Global Cartoning Machines Market

Market Size in USD Billion

CAGR :

%

USD

3.17 Billion

USD

4.61 Billion

2024

2032

USD

3.17 Billion

USD

4.61 Billion

2024

2032

| 2025 –2032 | |

| USD 3.17 Billion | |

| USD 4.61 Billion | |

|

|

|

|

Cartoning Machines Market Size

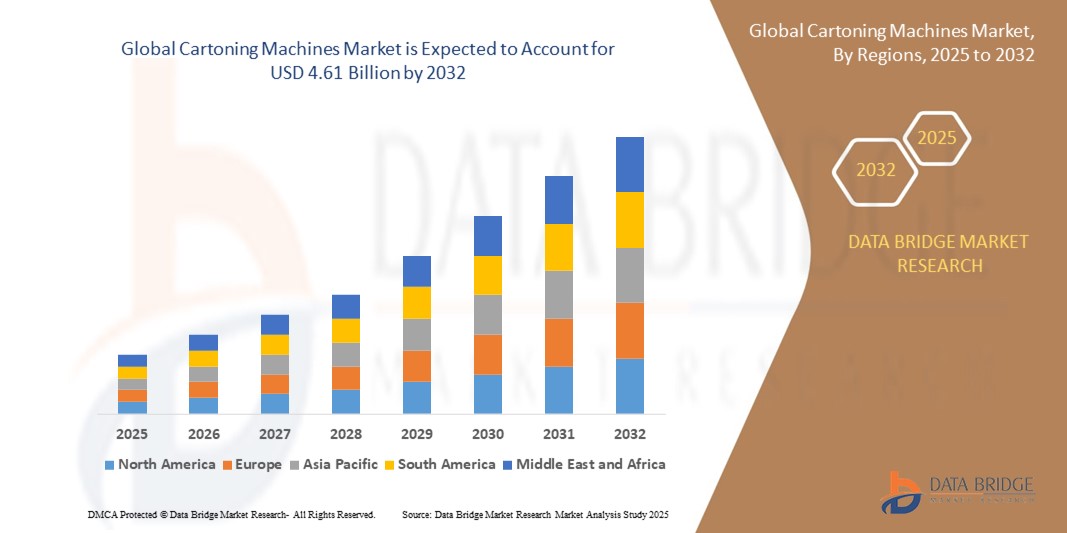

- The global cartoning machines market size was valued at USD 3.17 billion in 2024 and is expected to reach USD 4.61 billion by 2032, at a CAGR of 4.78% during the forecast period

- The market growth is primarily driven by the increasing demand for automated and efficient packaging solutions in the food, pharmaceutical, and personal care sectors, as manufacturers aim to improve productivity and reduce operational costs

- In addition, the rising adoption of sustainable and compact packaging formats, combined with advancements in machinery design and integration with smart factory technologies, is further fueling the growth of cartoning machines across global industries

Cartoning Machines Market Analysis

- Cartoning machines are becoming increasingly vital across various end-use industries, particularly in food & beverage, pharmaceuticals, personal care, and household products, due to their ability to automate packaging, enhance productivity, and reduce human error in high-volume production environments. Their role in improving packaging consistency and reducing waste is a key factor in their widespread adoption

- The rising demand for sustainable, compact, and tamper-evident packaging, combined with the trend toward smart manufacturing and Industry 4.0, is a primary driver of market growth. The integration of advanced control systems, robotic arms, and real-time data analytics in cartoning machines supports operational efficiency and traceability, fueling demand in both developed and developing economies

- Asia-Pacific dominates the cartoning machines market with the largest revenue share of over 40% in 2025, owing to rapid industrialization, growing e-commerce, and strong demand for packaged consumer goods, especially in China, India, and Southeast Asia. Manufacturers in the region are focusing on automation to address labor shortages and meet rising export requirements for precision-packed goods

- North America is expected to be the fastest-growing region in the cartoning machines market during the forecast period, driven by increasing adoption of high-speed, customized cartoning solutions in the pharmaceutical and food sectors. The U.S. leads the region with strong investments in automation, sustainability initiatives, and technological innovations by key players such as PMI KYOTO, Tetra Pak, and Bosch Packaging Technology

- The end-load cartoning segment is projected to dominate the market with a market share of around 38% in 2025, as it offers high-speed capabilities, efficient space utilization, and adaptability to a wide variety of product sizes and packaging styles, making it especially popular in food and household product packaging lines

Report Scope and Cartoning Machines Market Segmentation

|

Attributes |

Cartoning Machines Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Cartoning Machines Market Trends

“Innovation-Driven Automation and Sustainable Packaging Demands”

- A significant trend shaping the global cartoning machines market is the increasing automation of end-of-line packaging processes, including integration with IoT-enabled systems and digital twin technology. This enables real-time optimization of machine performance, minimizes manual adjustments, and enhances operational efficiency in highly regulated industries such as pharmaceuticals and cosmetics

- For instance, in May 2024, Coesia S.p.A. announced the deployment of an AI-enhanced smart cartoning platform that automatically adjusts to packaging variations in size, weight, and material—reducing waste by 12% and boosting line flexibility for high-SKU environments

- Major manufacturers are investing in collaborative robotics (cobots) to assist with cartoning in compact factory layouts. In early 2024, SHIBUYA CORPORATION unveiled a dual-arm robotic cartoner with integrated vision sensors capable of safely working alongside human operators—especially useful for small and medium enterprises with hybrid workflows

- Demand for sustainable and minimalist packaging is prompting innovations in machine design that support biodegradable cartons, glue-free locking systems, and minimal material usage. LANGLEY HOLDINGS plc, through its MPac Group, launched a new series of glue-less cartoning machines in 2023, which use interlocking designs to reduce environmental impact and energy consumption

- Remote maintenance and service virtualization are becoming essential in the post-pandemic manufacturing environment. In August 2023, Körber AG introduced an AR-based remote maintenance tool that allows clients to visualize machine diagnostics, run virtual troubleshooting, and connect with service teams in real time—minimizing travel-related delays and improving uptime

- The shift toward customized packaging solutions, especially for e-commerce and direct-to-consumer models, is driving the development of adaptive cartoning machines. Cama 1 S.P.A. responded by launching an adjustable format cartoner capable of handling varied carton sizes without tool changeovers—perfect for agile packaging lines handling multiple product SKUs daily

- These developments underline the evolving dynamics of the cartoning machines market, where flexibility, sustainability, and smart automation are no longer optional but central to machine design. Industry leaders are focusing on modular machine architecture, recyclable packaging compatibility, and connected service ecosystems to deliver greater value, compliance, and performance in a highly competitive landscape

Cartoning Machines Market Dynamics

Driver

“Growing Demand from Automated Packaging and Sustainable Consumer Goods Sectors”

- The rising global demand for automated, high-speed packaging solutions in sectors such as food & beverage, pharmaceuticals, personal care, and household goods is a key driver for the cartoning machines market. These machines play a vital role in improving production throughput, product safety, and packaging consistency

- For instance, in March 2024, Douglas Machine Inc. expanded its smart cartoning systems line to meet growing U.S. demand from nutraceutical and functional food manufacturers seeking high-output, GMP-compliant packaging lines

- The global push toward sustainable packaging, particularly recyclable cartonboard and plastic-free secondary packaging, has accelerated the adoption of eco-friendly cartoning machines designed to handle biodegradable, compostable, and FSC-certified materials. Cartoners with glue-free locking and minimal material waste are gaining traction in Europe and North America

- As e-commerce and direct-to-consumer (DTC) retail models grow globally, there’s increasing demand for cartoning machines that can manage high SKU variability and rapid changeovers. Advanced machines are being deployed to accommodate flexible packaging requirements without compromising on speed or footprint efficiency

- The adoption of smart manufacturing technologies, including IoT-enabled sensors, predictive maintenance systems, and integrated control software, is further enhancing machine uptime, traceability, and real-time performance monitoring—key value drivers in high-volume and regulated production environments

- Overall, the demand for automation, sustainable materials handling, and digital packaging intelligence is fueling the global expansion of the cartoning machines market, with strong investment flows from both multinationals and regional contract packagers

Restraint/Challenge

“High Capital Costs and Customization Complexity in Diverse End-Use Applications”

- One of the primary restraints in the cartoning machines market is the high initial capital investment required for advanced, fully automated systems. These machines often involve custom engineering, servo technologies, and control systems, making them less accessible for small and medium-sized manufacturers in cost-sensitive markets

- For instance, the cost of installing a high-speed robotic cartoner with vision-guided automation and digital integration can exceed USD 500,000, which limits adoption among SMEs and start-up manufacturers, particularly in Latin America and parts of Southeast Asia

- Complexity in product shapes, sizes, and packaging materials across diverse end-use industries—such as pharmaceuticals vs. confectionery—poses design and integration challenges. Customization often requires prolonged development cycles, specialized tooling, and line validation, delaying implementation and increasing total cost of ownership

- Supply chain disruptions, particularly in sourcing precision components such as actuators, servos, and motion control modules from Europe and Asia, have caused lead time issues and pricing fluctuations, which affect machine delivery schedules and procurement decisions.

- The lack of skilled technical personnel for machine operation, maintenance, and programming, especially in emerging markets, is another challenge. Advanced cartoning systems require highly trained operators and service engineers, and downtime due to skill gaps can impact production continuity

- In addition, the growing focus on green packaging regulations, including bans on plastic coatings or glue usage in cartons, is forcing machine makers to re-engineer traditional systems—often at a high R&D cost and with uncertain ROI for niche applications

- Addressing these challenges will require modular system designs, operator-friendly interfaces, and investment in training and support infrastructure, alongside cost-efficient automation platforms that offer scalability and adaptability for changing packaging needs

Cartoning Machines Market Scope

The market is segmented on the basis of machine type, carton type, capacity, dimension, process, distribution channel and application.

• By Machine Type

On the basis of machine type, the Cartoning Machines market is segmented into vertical cartoning machines/top load and horizontal cartoning machines/end load. The Horizontal Cartoning machines/end load segment dominates the largest market revenue share in 2025, driven by its superior throughput capacity, compact footprint, and compatibility with a wide range of carton styles. Manufacturers often prioritize end-load machines for their ease of integration into existing production lines and high-speed performance, especially in food and pharmaceutical sectors. The market also witnesses strong demand for horizontal cartoners due to their efficient handling of pre-glued cartons and minimal manual intervention requirements

The Vertical Cartoning Machines/Top Load segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its increasing adoption in fragile or irregularly shaped product packaging, where top-load mechanisms offer better orientation control and product protection. Vertical machines also find growing usage in small-batch, personalized packaging applications, offering operational flexibility and ergonomic advantages

• By Carton Type

On the basis of carton type, the Cartoning Machines market is segmented into stand up straight, closed, folded, bag-in-box, side-seamed, and others. The Closed carton segment held the largest market revenue share in 2025, driven by its widespread application in secondary packaging for pharmaceuticals, personal care, and consumer electronics. Closed cartons offer high tamper-resistance, structural integrity, and branding opportunities, making them the preferred format across regulated and retail-driven industries

The Bag-In-Box segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising demand in beverage and bulk food packaging. Bag-in-box formats support efficient liquid handling, extend shelf life, and reduce packaging waste, prompting equipment investments for this carton type in dairy, wine, and industrial food sectors

• By Capacity

On the basis of capacity, the Cartoning Machines market is segmented into Up to 70 CPM, 70 to 150 CPM, 150 to 400 CPM, and Above 400 CPM. The 150 to 400 CPM segment dominates the largest market revenue share in 2025, as this range provides an optimal balance between speed and flexibility for mid- to large-scale production lines in food and pharma industries. These machines support semi-automated workflows and variable carton sizes, making them ideal for contract packagers and multinational CPG manufacturers

The Above 400 CPM segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for ultra-high-speed packaging in large-volume operations, particularly in e-commerce-ready SKUs and high-turnover personal care products. These machines enable rapid throughput and integration with robotic picking and palletizing systems for end-to-end automation

• By Dimension

On the basis of dimension, the Cartoning Machines market is segmented into Up to 200 cm³, 200 to 1000 cm³, 1000 to 5000 cm³, and above 5000 cm³. The 200 to 1000 cm³ segment held the largest market revenue share in 2025, driven by the dominance of small and medium-sized consumer goods packaging that requires efficient cartonization with minimal material usage. Products such as medications, cosmetics, and snack foods fall within this volume range, ensuring steady equipment demand

The Up to 200 cm³ segment is expected to witness the fastest CAGR from 2025 to 2032, supported by the miniaturization trend in healthcare, personal electronics, and luxury cosmetics. Small-format cartoning machines are gaining traction in urban fulfillment centers and boutique manufacturing environments, where space and agility are critical

• By Process

On the basis of process, the Cartoning Machines market is segmented into online cartoning machine and offline cartoning machine. The Online Cartoning Machine segment dominates the largest market revenue share in 2025, as it enables seamless integration into continuous production lines, reducing handling time and increasing operational efficiency. Online systems support real-time data capture and in-line inspection, making them vital for regulated environments such as pharmaceuticals and food

The Offline Cartoning Machine segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the growing need for flexible, stand-alone packaging systems in seasonal and short-run manufacturing. These machines offer manufacturers the ability to execute packaging independently of production lines, enabling cost-effective customization and rework operations

• By Distribution Channel

On the basis of distribution channel, the cartoning machines market is segmented into b2b, distributor/broker, and others. The B2B segment held the largest market revenue share in 2025, as direct sales enable end users to engage with OEMs for machine customization, maintenance services, and turnkey packaging solutions. B2B channels also support long-term equipment lifecycle management and performance monitoring

The Distributor/Broker segment is expected to witness the fastest CAGR from 2025 to 2032, as regional players and SMEs increasingly rely on third-party agents to access a variety of cartoning equipment with flexible financing and post-sale support. Distributors often offer faster delivery timelines and local service availability, making them an appealing option for small-scale buyers

• By Application

On the basis of application, the Cartoning Machines market is segmented into food, beverages, healthcare, personal care, homecare, chemical, and others. The Food segment dominates the largest market revenue share in 2025, driven by the widespread use of cartoning machines for shelf-ready packaging, snack boxes, and frozen goods. The segment benefits from high SKU volumes, rapid product turnover, and strong demand for branded secondary packaging

The Healthcare segment is expected to witness the fastest CAGR from 2025 to 2032, favored for its stringent packaging requirements related to product protection, serialization, and regulatory compliance. Cartoning machines in this sector are tailored to accommodate blister packs, vials, and medical devices, ensuring high-speed output with error-proofing technologies and traceability features

Cartoning Machines Market Regional Analysis

- Asia-Pacific dominates the global Cartoning Machines market, accounting for the largest revenue share of 41.7% in 2025, driven by the rapid growth of the food, pharmaceutical, and consumer goods packaging sectors in key economies such as China, India, and Japan. The region benefits from high manufacturing output, cost-effective labor, and a rising middle class fueling demand for packaged and convenience products across urban and semi-urban areas

- In addition, significant investments in automated packaging lines, coupled with a growing focus on smart factories and Industry 4.0 integration, are accelerating the adoption of cartoning machines. Regional players and global OEMs such as ACG (India) and Omori Machinery Co., Ltd. (Japan) are expanding product lines and enhancing machine efficiency to cater to diverse industry needs ranging from fast-moving consumer goods to pharmaceuticals

- The market also benefits from supportive government policies promoting industrial automation and local equipment manufacturing. Initiatives such as “Make in India” and China’s Smart Manufacturing Strategy are encouraging capital investment in packaging infrastructure. Furthermore, rising demand for sustainable and recyclable packaging formats is pushing manufacturers to deploy eco-friendly cartoning solutions, particularly in South Korea, Japan, and Australia, aligning with regional sustainability and waste reduction goals

Japan Cartoning Machines Market Insight

The Japan Cartoning Machines market is driven by the country’s advanced manufacturing sector, precision engineering standards, and high demand for automated packaging solutions in pharmaceuticals, electronics, and food industries. Japanese manufacturers are focusing on innovation in machine design and integration of robotics to enhance packaging speed, flexibility, and reliability. In addition, Japan’s emphasis on sustainability and space-efficient packaging is pushing the adoption of compact, energy-efficient cartoning machines tailored for eco-friendly packaging formats

China Cartoning Machines Market Insight

The China Cartoning Machines market is expected to dominate the Asia-Pacific region, fueled by rapid industrialization, large-scale packaging demand, and robust infrastructure supporting automation in food, beverage, and personal care sectors. Chinese manufacturers are investing heavily in upgrading production facilities with smart and modular cartoning systems to improve operational efficiency and meet stringent quality standards. Growing exports of packaged goods further stimulate demand for versatile and high-speed cartoning solutions in both domestic and international markets

North America Cartoning Machines Market Insight

The North America Cartoning Machines market is witnessing strong growth, driven by rising demand in pharmaceutical, healthcare, and consumer packaged goods industries. Increasing focus on product safety, tamper-evident packaging, and compliance with regulatory standards is accelerating adoption of advanced cartoning machines with integrated vision systems and automated quality control. The presence of leading OEMs and growing emphasis on Industry 4.0 technologies such as IoT-enabled packaging lines are enhancing market expansion across the U.S. and Canada

U.S. Cartoning Machines Market Insight

The U.S. Cartoning Machines market holds the largest share in North America, supported by a mature packaging industry and strong innovation ecosystem. Rising demand for sustainable and flexible packaging formats is encouraging the development of high-speed, multi-format cartoning machines capable of handling a variety of carton types. Investments in automation, robotics, and data-driven production monitoring systems by key players are strengthening domestic manufacturing capabilities and boosting exports

Europe Cartoning Machines Market Insight

The Europe Cartoning Machines market is poised for steady growth, underpinned by strict regulatory frameworks on packaging waste and sustainability. Countries such as Germany, France, and the Netherlands lead in adopting eco-friendly and recyclable carton solutions, driving demand for cartoning machines with minimal material wastage and energy-efficient operation. Collaborations between packaging machinery manufacturers and FMCG companies are fostering innovation in smart packaging lines tailored to meet evolving consumer preferences

U.K. Cartoning Machines Market Insight

The U.K. Cartoning Machines market is gaining traction due to rising demand from the food and beverage, pharmaceutical, and personal care sectors. Manufacturers are adopting advanced cartoning systems that offer high flexibility, rapid changeover, and integration with downstream packaging processes. Government initiatives focusing on reducing plastic use and promoting sustainable packaging are accelerating the adoption of cartoning solutions that support paperboard and biodegradable cartons

Germany Cartoning Machines Market Insight

The Germany Cartoning Machines market is expanding robustly, driven by a strong industrial base in automotive, pharmaceuticals, and consumer goods packaging. German manufacturers emphasize precision engineering, durability, and automation capabilities in cartoning machines to meet strict quality and environmental standards. The growing preference for lightweight, recyclable packaging and investment in Industry 4.0 technologies, including machine learning for predictive maintenance, are key factors fueling market growth

Cartoning Machines Market Share

The cartoning machines industry is primarily led by well-established companies, including:

- ECONOCORP Inc. (U.S.)

- I.M.A. INDUSTRIA MACCHINE AUTOMATICHE S.P.A. (Italy)

- Omori Machinery Co., Ltd. (Japan)

- Marchesini Group S.p.A. (Italy)

- OPTIMA packaging group GmbH (Germany)

- ATS Automation Tooling Systems Inc. (Canada)

- Douglas Machine Inc. (U.S.)

- ACG (India)

- Kyoto Seisakusho Co., Ltd. (Japan)

- Senzani Brevetti S.p.A. (Italy)

- Körber AG (Germany)

- Langley Holdings plc (U.K.)

- Coesia S.p.A. (Italy)

- Mpac Group plc (U.K.)

- Robert Bosch GmbH (Germany)

- ROVEMA GmbH (Germany)

- SHIBUYA CORPORATION (Japan)

- Cama 1 S.P.A. (Italy)

- Jacob White Packaging Ltd. (U.K.)

- ADCO Manufacturing (U.S.)

- BERGAMI Packaging Solutions Srl (Italy)

Latest Developments in Global Cartoning Machines Market

- In April 2024, IWK Packaging Systems introduced the CH 4 Cartoner, a high-speed modular cartoning machine designed for pharmaceutical packaging. This innovative system supports continuous or intermittent motion, ensuring gentle product handling for pre-filled syringes, vials, and delicate containers. Powered by advanced servo motors, the CH 4 achieves up to 120 cartons per minute, with quick 10-minute format changeovers and easy cleaning. Its energy recuperation system reduces energy consumption by 21%, enhancing cost efficiency

- In January 2024, JASA Packaging Solutions unveiled the NXXT vertical packaging machine at Fruit Logistica in Berlin. This innovative machine is designed with a modular concept, enhancing packaging efficiency, versatility, and sustainability. The NXXT features energy-efficient servomotors, optimized airflow for sealing, and JASA-connect™ hybrid system for real-time monitoring. Its user-friendly design ensures easy cleaning and minimal heavy handling

- In March 2023, Optima played a key role in developing a sustainable travel set for daily personal hygiene, utilizing renewable, fiber-based raw materials. The project, named Trific, was a collaboration with Holmen Iggesund, Yangi®, and FutureLab & Partners, aiming to accelerate the adoption of eco-friendly packaging solutions. This innovation supports circular economy principles, combining low-energy manufacturing with user convenience

- In February 2021, Syntegon expanded its secondary packaging portfolio with the Sigpack TTMD, integrating Delta robot cells into the TTM platform for enhanced flexibility in secondary packaging. The system features camera-based vision control, enabling Delta robots to detect items on the infeed belt and efficiently organize and pack them into cartons, trays, or other containers. The tool-less format changeover allows vertical restarts, ensuring seamless operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cartoning Machines Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cartoning Machines Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cartoning Machines Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.