Global Cat Litter Market

Market Size in USD Billion

CAGR :

%

USD

4.75 Billion

USD

6.56 Billion

2024

2032

USD

4.75 Billion

USD

6.56 Billion

2024

2032

| 2025 –2032 | |

| USD 4.75 Billion | |

| USD 6.56 Billion | |

|

|

|

|

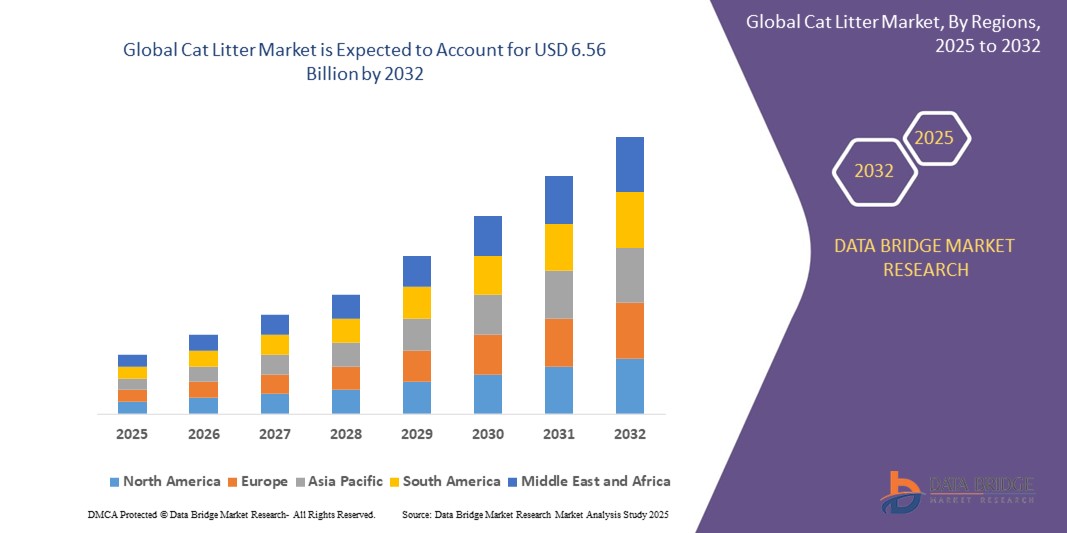

What is the Global Cat Litter Market Size and Growth Rate?

- The global cat litter market size was valued at USD 4.75 billion in 2024 and is expected to reach USD 6.56 billion by 2032, at a CAGR of 4.10% during the forecast period

- The cat litter market has witnessed significant growth, driven by advancements in technology and innovative methods. One notable trend is the development of biodegradable and eco-friendly litter options. Brands are increasingly utilizing materials such as corn, wheat, and recycled paper, appealing to environmentally conscious consumers. This shift has led to a surge in demand for sustainable products

- In addition, the introduction of clumping litters, which facilitate easier cleaning, has revolutionized the market. These products use advanced formulations that enhance absorbency and minimize odor, improving the overall user experience. Technologies such as odor-neutralizing agents and crystal litter are also gaining traction, offering superior performance compared to traditional clay-based litters

What are the Major Takeaways of Cat Litter Market?

- The rise of e-commerce has further fueled market expansion, enabling consumers to easily access a wider range of products. Online platforms are increasingly featuring subscription services, providing convenience and driving repeat purchases

- Overall, the cat litter market is evolving with a focus on sustainability and technological innovation, positioning itself for robust growth in the coming years. Brands that prioritize these advancements are probably to thrive amid changing consumer preferences

- North America dominated the cat litter market with the largest revenue share of 41.8% in 2024, driven by increasing pet ownership, rising awareness regarding pet hygiene, and strong demand for convenient, odor-controlling litter products

- Asia-Pacific cat litter market is set to grow at the fastest CAGR of 8.3% from 2025 to 2032, supported by rapid urbanization, increasing pet ownership, and rising disposable incomes in countries such as China, Japan, and India

- The clay segment dominated the market with the largest revenue share of 57.8% in 2024, attributed to its affordability, high absorbency, and excellent odor control, making it the most commonly used material in conventional cat litter products

Report Scope and Cat Litter Market Segmentation

|

Attributes |

Cat Litter Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Cat Litter Market?

“Premiumization and Demand for Eco-Friendly, Odor-Control Solutions”

- A significant and accelerating trend in the global cat litter market is the growing consumer preference for premium, eco-friendly, and odor-control cat litter products. Pet owners are increasingly opting for natural, biodegradable materials such as corn, wheat, paper, and wood-based litters that reduce environmental impact while ensuring superior odor absorption and hygiene

- For instance, companies such as Nestlé Purina and PrettyLitter have launched innovative cat litter products featuring lightweight formulas, health-monitoring capabilities, and advanced odor-neutralizing technologies to meet evolving consumer expectations for convenience and sustainability

- Furthermore, the shift toward dust-free, low-tracking, and hypoallergenic cat litter products is gaining traction, particularly among urban pet owners seeking cleaner, pet-safe indoor environments

- The rise in pet humanization and the willingness to spend on high-quality pet care products are further driving the adoption of premium cat litter solutions with added functionalities such as health indicators and multi-cat usage efficiency

- This trend toward eco-friendly, health-conscious, and technologically advanced cat litter is reshaping the market landscape, prompting manufacturers to innovate and diversify product portfolios to address varied consumer needs globally

What are the Key Drivers of Cat Litter Market?

- The increasing global pet population, particularly the rise in cat ownership among urban households, is a major driver for the cat litter market, as more consumers seek convenient, hygienic, and odor-controlling litter solutions for their pets

- For instance, in October 2023, Mars Petcare expanded its product range with plant-based, biodegradable cat litter options, addressing growing environmental concerns and consumer demand for sustainable pet products

- In addition, heightened awareness regarding pet hygiene and indoor air quality is encouraging the use of advanced cat litter solutions that minimize odor, dust, and mess, contributing to a cleaner, pet-friendly home environment

- The premiumization trend, coupled with rising disposable incomes, is also driving demand for specialized litter products, including clumping, scented, and health-monitoring litters that offer added convenience and functionality

- Furthermore, the expansion of e-commerce platforms and retail chains has improved product accessibility, enabling consumers to explore diverse cat litter options and make informed purchasing decisions, further fueling market growth

Which Factor is challenging the Growth of the Cat Litter Market?

- The relatively higher price point of premium, eco-friendly, and technologically advanced cat litter products presents a challenge to widespread adoption, particularly in price-sensitive markets and developing regions

- In addition, fluctuating raw material costs, especially for plant-based and biodegradable materials, can impact product pricing and profitability for manufacturers, posing a barrier to market expansion

- For instance, small pet owners in emerging economies may opt for lower-cost, conventional clay-based litter despite concerns over environmental impact and dust generation, limiting the penetration of sustainable alternatives

- Furthermore, disposal challenges and varying consumer awareness regarding proper waste management of biodegradable litters may hinder growth in certain market

- Overcoming these challenges requires industry players to invest in consumer education, offer competitively priced eco-friendly options, and improve product performance to drive adoption among environmentally conscious, budget-aware consumers worldwide

How is the Cat Litter Market Segmented?

The market is segmented on the basis of product, raw material, end-use, type, brand type, form type, and distribution channel.

- By Raw Material

On the basis of raw material, the cat litter market is segmented into clay, silica, plant fibers, pine, paper/wood, walnut, corn, and others. The clay segment dominated the market with the largest revenue share of 57.8% in 2024, attributed to its affordability, high absorbency, and excellent odor control, making it the most commonly used material in conventional cat litter products. Its wide availability and compatibility with both clumping and non-clumping formulations further strengthen its market position.

The plant fibers segment is anticipated to witness the fastest growth rate of 22.6% from 2025 to 2032, driven by increasing consumer preference for biodegradable, eco-friendly, and low-dust litter options. Plant-based litters, made from renewable resources such as corn, wheat, and recycled paper, align with growing sustainability trends and are gaining traction among environmentally conscious pet owners.

- By End-Use

On the basis of end-use, the cat litter market is segmented into cats, hamsters, and others. The cats segment accounted for the largest revenue share of 83.2% in 2024, reflecting the dominant pet ownership trends where domestic cats are the primary consumers of litter products. The need for odor control, hygiene, and convenience in urban households significantly contributes to the strong demand for cat litter products in this segment.

The hamsters segment is expected to register the fastest CAGR from 2025 to 2032, supported by the rising popularity of small pets such as hamsters, rabbits, and guinea pigs, especially among families and younger pet owners. Demand for safe, dust-free, and absorbent bedding and litter solutions for small animals is fueling growth in this niche but expanding market.

- By Type

On the basis of type, the cat litter market is segmented into scented/fragrance and unscented/without fragrance. The unscented segment held the largest revenue share of 61.4% in 2024, driven by growing concerns over artificial fragrances triggering allergic reactions in cats and pet owners. Unscented litters, particularly those with superior odor control and natural materials, are highly preferred for sensitive cats and multi-cat households.

The scented/fragrance segment is projected to witness the fastest growth from 2025 to 2032, fueled by increasing demand for odor-masking solutions in urban apartments and high-density living environments. Pet owners seeking enhanced freshness and long-lasting odor neutralization are contributing to the popularity of scented litter varieties.

- By Brand Type

On the basis of brand type, the cat litter market is segmented into prestige brands, mass brands, and private label. The mass brands segment dominated the market with the largest revenue share of 54.5% in 2024, owing to their widespread availability, affordability, and established consumer trust. Mass-market brands offer a variety of litter options, catering to a broad spectrum of pet owners across regions.

The prestige brands segment is expected to grow at the fastest CAGR from 2025 to 2032, supported by increasing pet humanization and consumer willingness to invest in premium, health-oriented, and eco-friendly litter products. Prestige brands often emphasize sustainability, advanced odor control, and innovative features, appealing to urban, health-conscious pet owners.

- By Form Type

On the basis of form type, the cat litter market is segmented into clay, fine litter, coarse litter, silica, fine litter, coarse litter, plant fibers, fine litter, and coarse litter. The clay fine litter segment dominated the market with the largest revenue share of 39.8% in 2024, due to its superior clumping ability, absorbency, and easy waste management. Fine clay litter offers enhanced comfort for cats and effective odor control, making it a preferred choice for many households.

The plant fibers fine litter segment is projected to experience the fastest growth from 2025 to 2032, as consumers increasingly seek eco-friendly, lightweight, and biodegradable options. Plant-based fine litters provide excellent moisture absorption and minimal dust, addressing both environmental and health concerns.

- By Distribution Channel

On the basis of distribution channel, the cat litter market is segmented into online and offline channels. The offline segment dominated the market with the largest revenue share of 67.9% in 2024, driven by consumer preference for purchasing litter products from pet specialty stores, supermarkets, and veterinary clinics where quality assurance and product evaluation are possible.

The online segment is anticipated to witness the fastest CAGR from 2025 to 2032, propelled by the convenience of doorstep delivery, subscription services, and the ability to compare product features and reviews. The rising penetration of e-commerce platforms and growing awareness of specialized litter products through online channels are accelerating market growth.

Which Region Holds the Largest Share of the Cat Litter Market?

- North America dominated the cat litter market with the largest revenue share of 41.8% in 2024, driven by increasing pet ownership, rising awareness regarding pet hygiene, and strong demand for convenient, odor-controlling litter products

- The region’s widespread preference for premium, clumping, and low-dust cat litter options, along with growing interest in eco-friendly alternatives, is further fueling market expansion

- North America’s advanced retail infrastructure and the popularity of both mass and private label brands position the region as the global leader in the cat litter market

U.S. Cat Litter Market Insight

The U.S. cat litter market accounted for the largest revenue share within North America in 2024, supported by high cat ownership rates, urbanization, and growing demand for innovative, health-focused litter solutions. Consumers increasingly favor clumping, low-tracking, and natural litter products to enhance cleanliness and reduce allergens at home. The U.S. market also benefits from the presence of leading brands offering diverse product options, including sustainable and scented variants.

Europe Cat Litter Market Insight

The Europe cat litter market is projected to witness steady growth over the forecast period, driven by increasing pet humanization trends and consumer demand for eco-friendly, biodegradable, and dust-free litter options. Heightened environmental awareness and stringent regulations on sustainable products are promoting the use of plant-based and silica gel litters. Europe’s established retail networks and growing adoption of premium pet care products are expected to sustain long-term market expansion.

U.K. Cat Litter Market Insight

The U.K. cat litter market is anticipated to grow at a notable CAGR during the forecast period, fueled by rising pet adoption, especially among urban households, and increasing consumer preference for convenient, odor-neutralizing litter solutions. Demand for lightweight, easy-to-handle products such as clumping and silica-based litters is expanding. The U.K.’s focus on sustainability and premium pet care contributes to the growth of eco-friendly litter alternatives.

Germany Cat Litter Market Insight

The Germany cat litter market is expected to witness considerable growth, driven by the country’s emphasis on high-quality, sustainable, and health-oriented pet care products. German consumers show strong demand for natural, plant-based, and dust-free cat litters that align with environmental values. The availability of both mass-market and premium litter options, coupled with rising awareness about pet hygiene, is reinforcing the adoption of advanced litter solutions across the country.

Which Region is the Fastest Growing Region in the Cat Litter Market?

Asia-Pacific cat litter market is set to grow at the fastest CAGR of 8.3% from 2025 to 2032, supported by rapid urbanization, increasing pet ownership, and rising disposable incomes in countries such as China, Japan, and India. Growing demand for convenient, odor-control, and affordable cat litter products, combined with expanding e-commerce penetration, is accelerating market adoption. The region’s evolving pet care industry and rising preference for innovative litter solutions are key contributors to growth.

Japan Cat Litter Market Insight

The Japan cat litter market is experiencing significant growth, driven by increasing pet adoption in urban areas and a strong preference for high-quality, low-dust, and odor-controlling litter options. Japanese consumers prioritize hygiene, convenience, and eco-friendly litter solutions, especially in small living spaces. The market is also witnessing rising demand for plant-based and silica gel litters that offer enhanced performance and sustainability.

China Cat Litter Market Insight

The China cat litter market held the largest revenue share within Asia-Pacific in 2024, supported by rapid urbanization, rising disposable incomes, and growing pet ownership, especially in major cities. Strong demand for clumping, odor-control, and affordable cat litter products is driving market growth. The increasing availability of domestic and international litter brands through online and offline channels, along with growing awareness about pet hygiene, positions China as a key contributor to regional market expansion.

Which are the Top Companies in Cat Litter Market?

The cat litter industry is primarily led by well-established companies, including:

- Mars, Incorporated (U.S.)

- Yantai China Pet Foods Co., Ltd. (China)

- Luscious Labels (U.S.)

- IRIS USA, Inc. (U.S.)

- Lucy Pet Products (U.S.)

- Dollar General Corporation (U.S.)

- Paws & Claws Oakland (U.S.)

- PrettyLitter, Inc. (U.S.)

- Nestlé S.A. (Switzerland)

- Church & Dwight Co., Inc. (U.S.)

- The Clorox Company (U.S.)

- Dr. Elsey's (U.S.)

- Oil-Dri Corporation of America (U.S.)

- ZOLUX S.A.S. (France)

- Pestell Pet Products (Canada)

- Cat Litter Company (U.S.)

- Healthy Pet (U.S.)

- Pettex Limited (U.K.)

What are the Recent Developments in Global Cat Litter Market?

- In May 2024, Oil-Dri Corporation of America successfully finalized its USD 46 million acquisition of Ultra Pet, a prominent player in the crystal cat litter market. The merger is expected to enhance both companies’ operational capabilities as they focus on seamless integration. By combining their expertise and shared values, they aim to deliver superior products, broaden their customer base, and solidify their market position in the pet care industry

- In February 2024, Kent Corporation’s brand, World's Best Cat Litter, collaborated with Little Big Brands to revamp its branding. The new logo and packaging feature a softer color scheme, highlighting the natural and sustainable aspects of its cat litter products. This strategic partnership aims to enhance brand visibility and resonate with environmentally conscious consumers, thereby strengthening the company's position in the competitive pet care market

- In April 2023, Kent Corporation initiated the construction of a state-of-the-art manufacturing plant in Muscatine, Iowa, covering 113,000 square feet on a 70-acre site next to the KENT Distribution Center. The facility will feature cutting-edge manufacturing equipment, dedicated research and development spaces, and ample room for future expansion initiatives. This strategic investment reflects Kent’s commitment to enhancing production capabilities and meeting the growing demand for its cat litter products

- In January 2023, Dr. Elsey's unveiled its new Smart Scoop litter box, designed to improve litter maintenance for pet parents. This innovative box is equipped with a built-in litter sensor that alerts users when it needs to be scooped. Furthermore, the device can be conveniently managed through a mobile application, allowing cat owners to stay on top of litter maintenance and ensure a clean environment for their feline friends

- In December 2022, Church & Dwight Co., Inc. announced a significant expansion of its manufacturing facility in Ohio, aimed at increasing production capacity for cat litter. This expansion involves a substantial investment in new machinery, processing equipment, and rail enhancements to optimize operations. Set for completion in 2024, the project is expected to create approximately 80 new job opportunities, bolstering the local economy and reinforcing the company's market presence

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.