Global Category Management Software Market

Market Size in USD Billion

CAGR :

%

USD

2.10 Billion

USD

4.84 Billion

2024

2032

USD

2.10 Billion

USD

4.84 Billion

2024

2032

| 2025 –2032 | |

| USD 2.10 Billion | |

| USD 4.84 Billion | |

|

|

|

|

What is the Global Category Management Software Market Size and Growth Rate?

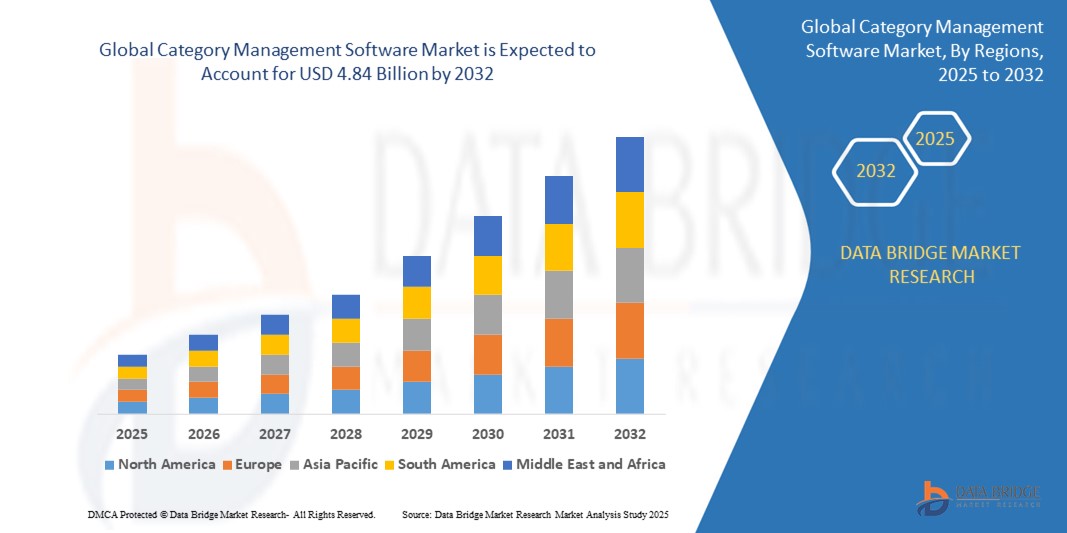

- The global category management software market size was valued at USD 2.10 billion in 2024 and is expected to reach USD 4.84 billion by 2032, at a CAGR of 11.00% during the forecast period

- The market expansion is primarily driven by the increasing need for data-driven retail planning, the surge in omnichannel retail strategies, and growing demand for personalized shopping experiences

- In addition, retailers and CPG companies are leveraging category management tools to streamline inventory, optimize shelf space, and boost collaboration with suppliers key factors that are fueling sustained market growth

What are the Major Takeaways of Category Management Software Market?

- Category Management Software, designed to enhance retail planning, product assortment, and performance analysis, has become essential for modern retailers aiming to improve efficiency, profitability, and customer satisfaction across channels

- Rising demand for real-time data analytics, AI-powered decision-making, and collaborative supplier-retailer platforms is significantly boosting adoption across industries such as FMCG, electronics, and fashion retail

- The software’s ability to align product categories with shopper behavior, optimize planograms, and enable agile merchandising strategies makes it a vital solution in the age of digital retail transformation

- Europe dominated the category management software market with the largest revenue share of 31.26% in 2024, driven by growing demand for advanced retail planning tools, rising digital transformation across the retail sector, and widespread adoption of AI-enabled merchandising solutions

- North America is projected to witness the fastest CAGR of 13.6% from 2025 to 2032, driven by the surge in data-centric retail strategies, increased competition among consumer brands, and rising demand for real-time category insights

- The Assortment Planning segment dominated the category management software market with the largest market revenue share of 38.9% in 2024, driven by growing demand for data-driven product assortment optimization across retail stores to maximize shelf efficiency and meet consumer preferences

Report Scope and Category Management Software Market Segmentation

|

Attributes |

Category Management Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Category Management Software Market?

“AI-Driven Automation and Predictive Analytics in Retail Planning”

- A significant and accelerating trend in the global category management software market is the adoption of artificial intelligence (AI) and predictive analytics to optimize assortment planning, shelf space allocation, and pricing strategies. These technologies enable retailers to make real-time, data-backed decisions, resulting in improved efficiency and increased profitability

- For instance, Oracle Retail and SAP SE have integrated machine learning into their category management platforms to analyze purchasing behavior and forecast demand more accurately, allowing retailers to align product offerings with shopper preferences across channels

- AI-enabled software can automate traditionally manual processes such as clustering, planogramming, and markdown planning, significantly reducing operational time while improving accuracy. Predictive models also help retailers respond to seasonal demand, competitive pricing changes, and regional preferences in near real-time

- Integration with POS systems, inventory management tools, and e-commerce platforms further enhances decision-making by creating a 360-degree view of product performance across the supply chain. This holistic insight allows businesses to enhance personalization and responsiveness to market trends

- Companies such as JAGGAER and GEP are also embedding advanced analytics into their platforms, helping businesses streamline supplier collaboration and sourcing strategies within their category planning workflows

- The demand for intelligent, automated, and highly adaptive retail planning tools is rapidly growing, especially as retailers seek to enhance omnichannel strategies, improve inventory turnover, and maximize space efficiency in competitive environments

What are the Key Drivers of Category Management Software Market?

- The growing complexity of retail supply chains, rising consumer expectations for personalized shopping experiences, and the need for data-driven decision-making are major forces propelling the adoption of category management software solutions

- For instance, in March 2024, Board International partnered with a leading retail chain to deploy an integrated planning platform using real-time analytics to boost shelf efficiency and optimize in-store assortments, demonstrating the increasing reliance on tech-driven solutions in modern merchandising

- The shift toward omnichannel retailing, with consumers shopping both online and offline, requires dynamic product assortment and inventory synchronization tasks efficiently managed by category management software

- In addition, retail businesses are prioritizing customer-centricity, driving the demand for solutions that track purchase behavior, loyalty metrics, and regional preferences to create targeted assortments

- Cloud-based deployments, scalable architectures, and AI-powered automation have made these tools accessible even to mid-sized retailers, further accelerating market penetration

- The need for collaborative platforms between retailers and suppliers is also encouraging the adoption of category management tools to enhance transparency, streamline joint business planning, and boost profitability across the supply chain

Which Factor is challenging the Growth of the Category Management Software Market?

- One of the key challenges limiting the growth of the category management software market is the high initial cost and complexity associated with implementing and customizing enterprise-level solutions. For many small and medium-sized businesses, the cost of deployment, integration, and employee training can be prohibitive

- For instance, reports from mid-market retailers show delays in adoption due to the perceived complexity and lack of in-house technical expertise required to maintain advanced platforms such as SAP’s Retail Suite or Oracle Category Management Cloud Service

- Moreover, data silos within organizations can limit the effectiveness of these solutions. If customer, product, and sales data are not properly integrated, the output of category management tools may lack the necessary depth for informed decision-making

- Data privacy concerns, particularly with GDPR and CCPA regulations, can also hinder the collection and analysis of detailed consumer data—an essential component of predictive category planning

- In addition, resistance to change within traditional retail environments, where manual planning or outdated legacy systems are still used, can delay adoption timelines. The learning curve associated with migrating to AI-based platforms remains a deterrent for some operators

- To overcome these challenges, vendors are investing in user-friendly interfaces, modular pricing models, and comprehensive training programs to support broader adoption across retail tiers and geographies

How is the Category Management Software Market Segmented?

The market is segmented on the basis of solution, service, deployment, enterprise size, and application.

- By Solution

On the basis of solution, the category management software market is segmented into Planogram Software, Floor Planning Software, Assortment Planning, and Others. The Assortment Planning segment dominated the Category Management Software market with the largest market revenue share of 38.9% in 2024, driven by growing demand for data-driven product assortment optimization across retail stores to maximize shelf efficiency and meet consumer preferences. Retailers increasingly rely on advanced assortment planning tools to analyze sales patterns, forecast demand, and enhance product availability, improving overall profitability.

The Planogram Software segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising adoption of visual merchandising tools that help retailers design optimal shelf layouts and product placements. These solutions improve in-store execution, customer experience, and sales performance, driving rapid market growth.

- By Service

On the basis of service, the category management software market is segmented into Managed Services and Professional Services. The Professional Services segment held the largest market revenue share of 56.1% in 2024, fueled by the need for consulting, implementation, and customization support, especially among large retailers deploying advanced category management platforms. Professional services are crucial for ensuring seamless integration with existing systems and tailoring solutions to specific business needs.

The Managed Services segment is projected to witness the fastest CAGR from 2025 to 2032, driven by growing demand for outsourced monitoring, maintenance, and technical support. As retailers seek cost-effective, scalable solutions, managed services are gaining popularity for offering ongoing system optimization without the need for extensive in-house resources.

- By Deployment

On the basis of deployment, the category management software market is segmented into On-premise and Cloud-based. The Cloud-based segment dominated the market with the largest revenue share of 63.4% in 2024, driven by increasing preference for flexible, scalable, and cost-efficient solutions accessible from any location. Cloud-based deployments enable seamless updates, easier collaboration, and faster implementation, making them ideal for modern, multi-location retail operations.

The On-premise segment is expected to experience slower but steady growth, primarily among organizations with strict data security requirements or those operating in regions with limited cloud infrastructure.

- By Enterprise Size

On the basis of enterprise size, the category management software market is segmented into Large Enterprises and Small & Medium Enterprises (SMEs). The Large Enterprises segment accounted for the largest revenue share of 58.7% in 2024, supported by significant investments in advanced planning tools, AI-driven analytics, and integrated retail management solutions. Large retailers require comprehensive, scalable platforms to manage complex operations and multi-channel environments.

The Small & Medium Enterprises (SMEs) segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing accessibility of cloud-based, affordable, and user-friendly category management solutions tailored to smaller retailers seeking to enhance competitiveness.

- By Application

On the basis of application, the category management software market is segmented into Retail, Distribution, and Consumer Packaged Goods (CPG). The Retail segment dominated the market with the largest revenue share of 49.6% in 2024, driven by the growing need for optimized product assortment, space planning, and data-driven decision-making to improve in-store performance and customer satisfaction. The retail sector increasingly adopts category management solutions to enhance operational efficiency and sales effectiveness.

The Consumer Packaged Goods (CPG) segment is projected to witness the fastest CAGR from 2025 to 2032, fueled by rising demand for collaboration between manufacturers and retailers, efficient product placement, and alignment of promotions with consumer behavior insights. CPG companies leverage these tools to drive category growth, brand visibility, and profitability.

Which Region Holds the Largest Share of the Category Management Software Maret?

- Europe dominated the category management software market with the largest revenue share of 31.26% in 2024, driven by growing demand for advanced retail planning tools, rising digital transformation across the retail sector, and widespread adoption of AI-enabled merchandising solutions

- The region’s mature retail infrastructure, focus on precision in shelf and assortment planning, and strong demand for localized consumer insights are significantly contributing to the widespread implementation of category management platforms

- Moreover, rising investments in omnichannel strategies, along with compliance with evolving regulatory frameworks around product labeling and sustainability, are further propelling the market's growth across the region

Germany Category Management Software Market Insight

The Germany category management software market accounted for the largest revenue share in Europe in 2024, supported by the presence of leading retail chains and a robust focus on store efficiency and data-driven decision-making. German retailers increasingly rely on intelligent planogramming and assortment planning software to enhance product visibility and reduce stockouts. In addition, the country's strong emphasis on digital infrastructure and AI integration positions it as a leader in software-driven retail optimization.

U.K. Category Management Software Market Insight

The U.K. category management software market is projected to grow steadily, driven by the increasing adoption of cloud-based retail solutions and a highly competitive retail landscape. U.K. retailers are leveraging category management tools to deliver more personalized in-store experiences and optimize space utilization. The shift toward agile supply chain planning and e-commerce-aligned inventory management is also fueling software adoption across the country.

France Category Management Software Market Insight

The France category management software market is witnessing notable growth due to increased deployment of analytics-based solutions in hypermarkets and supermarkets. French retailers prioritize visual merchandising and strategic product placement, supported by software tools that automate shelf layout design and improve shelf compliance. In addition, sustainability concerns and consumer demand for transparency are influencing software features related to product traceability and assortment efficiency.

Which Region is the Fastest Growing Region in the Category Management Software Market?

North America is projected to witness the fastest CAGR of 13.6% from 2025 to 2032, driven by the surge in data-centric retail strategies, increased competition among consumer brands, and rising demand for real-time category insights. Retailers in the region are rapidly shifting toward AI-powered shelf and assortment planning software to streamline product performance analysis, enhance planogram compliance, and improve customer engagement across omnichannel platforms. In addition, the region’s strong ecosystem of retail analytics providers and growing investments in digital shelf solutions are accelerating market expansion in both the U.S. and Canada.

U.S. Category Management Software Market Insight

The U.S. category management software market held the largest share in North America in 2024, fueled by widespread adoption of automation, rising e-commerce integration, and high demand for shelf optimization across brick-and-mortar retailers. U.S.-based companies are leveraging SaaS-based category management tools to gain a competitive edge in product visibility and consumer targeting. The availability of customized solutions for different retail formats is further strengthening the U.S. market position.

Canada Category Management Software Market Insight

The Canada category management software market is growing rapidly, supported by digitalization in retail and increasing interest in consumer behavior analytics. Canadian retailers are adopting these tools to improve store layout planning, boost operational efficiency, and align merchandising strategies with changing customer expectations. The expansion of cloud-based retail solutions and government support for digital innovation are enhancing software adoption in the country.

Which are the Top Companies in Category Management Software Market?

The category management software industry is primarily led by well-established companies, including:

- Oracle (U.S.)

- Aptos, LLC (U.S.)

- Board International S.A. (Switzerland)

- INTERACTIVE EDGE (U.S.)

- 42 Technologies, Inc. (Canada)

- Epicor Software Corp. (U.S.)

- Softvision (Cognizant) (U.S.)

- GEP (U.S.)

- JAGGAER (U.S.)

- DotActiv (Pty) Ltd. (South Africa)

- Quant Retail (Czech Republic)

- Oracle Retail (U.S.)

- SAS Institute (Retail Analytics Suite) (U.S.)

- Galleria RTS (U.K.)

- Intactix (legacy systems) (U.S.)

- One Door (U.S.)

- ShelfIQ (U.S.)

- Smart Shelf (U.S.)

- Space Planning Plus (U.S.)

- IBM (U.S.)

- SAP SE (Germany)

- Mi9 Retail (U.S.)

What are the Recent Developments in Global Category Management Software Market?

- In June 2023, Unicommerce, a leading SaaS-based e-commerce enablement platform, introduced an advanced inventory management solution that enables automated rerouting of unfulfilled orders based on real-time inventory visibility across warehouses and stores. This upgrade enhances order allocation accuracy and overall fulfillment efficiency, offering significant operational advantages to users of the Unicommerce platform. This development strengthens Unicommerce's position in the inventory and order management solutions market

- In July 2022, JAGGAER released version 22.2 of its JAGGAER ONE suite, featuring comprehensive source-to-pay enhancements aimed at simplifying transactions between buyers and suppliers. The new release focuses on automation, user experience, and end-to-end procurement efficiency. This update reinforces JAGGAER’s commitment to streamlining procurement operations and improving supplier collaboration

- In May 2021, Epicor acquired KBMax, a provider of configure-price-quote (CPQ) and visualization software, integrating it into Epicor’s ERP ecosystem. The move provides customers with improved touchpoints for managing inventory, pricing, costs, and customer data, particularly in complex sales processes. This acquisition has expanded Epicor’s capabilities in delivering customized and responsive enterprise resource planning solutions

- In February 2021, Aptos completed the acquisition of LS Retail, a developer of unified software systems for retail, pharmacy, hospitality, and restaurant operations. The integration aimed to create a robust retail technology platform capable of supporting businesses of all sizes with end-to-end solutions. This strategic move bolstered Aptos’ market presence and enhanced its ability to serve omnichannel retail needs globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.