Global Celiac Disease Testing Market

Market Size in USD Billion

CAGR :

%

USD

564.92 Billion

USD

1.00 Billion

2024

2032

USD

564.92 Billion

USD

1.00 Billion

2024

2032

| 2025 –2032 | |

| USD 564.92 Billion | |

| USD 1.00 Billion | |

|

|

|

|

Celiac Disease Testing Market Size

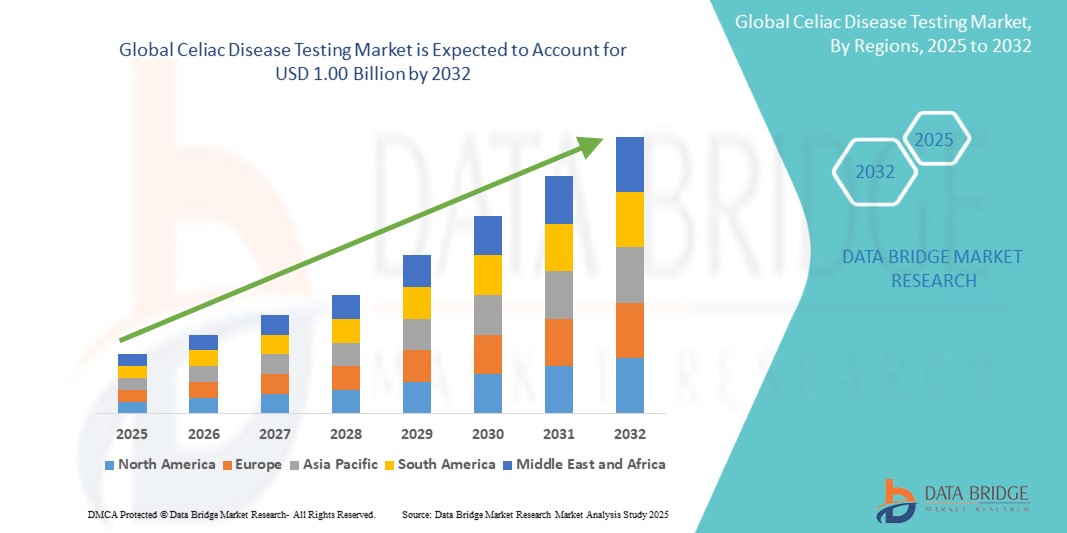

- The global celiac disease testing market size was valued at USD 564.92 million in 2024 and is expected to reach USD 1.00 billion by 2032, at a CAGR of 7.20% during the forecast period

- This growth is driven by factors such as the increasing awareness and diagnosis of celiac disease, and improvement in diagnostic technologies

Celiac Disease Testing Market Analysis

- Celiac disease testing is crucial for the diagnosis of celiac disease, an autoimmune disorder triggered by gluten consumption. These tests help detect the presence of antibodies in the blood, as well as genetic markers, to confirm the diagnosis

- The demand for celiac disease testing is significantly driven by the increasing awareness of the disease, better understanding of its symptoms, and rising prevalence across global populations

- North America is expected to dominate the celiac disease testing market due to advanced healthcare infrastructure, widespread awareness, and the high availability of diagnostic technologies

- Asia-Pacific is projected to be the fastest growing region in the celiac disease testing market due to increasing healthcare awareness, growing incidences of autoimmune disorders, and expanding access to diagnostic services

- Serology tests segment is expected to dominate the global celiac disease testing market with a market share of approximately 60.5%. This dominance is attributed to the high demand for precision in diagnosing celiac disease, along with the increasing use of serology rapid testing kits. These tests remain the most common and effective method for detecting celiac disease due to their ability to detect antibodies in the blood, contributing significantly to the market's growth

Report Scope and Celiac Disease Testing Market Segmentation

|

Attributes |

Celiac Disease Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Celiac Disease Testing Market Trends

“Increasing Adoption of Non-Invasive Diagnostic Methods”

- A key trend in the celiac disease testing market is the increasing adoption of non-invasive diagnostic methods, such as serology tests and rapid detection kits, which have made it easier and more efficient for patients to undergo testing. These advancements in testing technologies are improving the speed and accuracy of diagnosis, helping to detect celiac disease earlier and more reliably

- Personalized Medicine is another emerging trend, with an increasing focus on genetic tests for diagnosing celiac disease. These tests enable healthcare providers to identify individuals at risk for the condition based on genetic predispositions, further enhancing early detection and prevention strategies

- For instance, rapid serology tests are gaining popularity for their convenience and quick results, making it easier for patients to get tested in home care settings or specialty clinics

- In addition, increased awareness about the prevalence of celiac disease, especially in non-traditional markets, is driving demand for better testing solutions. Health campaigns and educational programs are prompting people to seek diagnostic tests, leading to a rise in both serology and genetic testing

Celiac Disease Testing Market Dynamics

Driver

“Growing Need Due to Increasing Awareness and Prevalence of Celiac Disease”

- The rising awareness of celiac disease, along with an increase in the number of diagnosed cases, is significantly contributing to the growing demand for celiac disease testing

- With more individuals being diagnosed, especially among populations that were previously underdiagnosed, the demand for reliable and efficient testing solutions such as serology tests and genetic tests has seen a steady rise

- The growing trend of early screening for celiac disease, particularly among at-risk populations such as those with a family history of the condition or individuals with unexplained gastrointestinal symptoms, is further boosting the demand for these diagnostic tests

For instance,

- According to a report published by the World Health Organization (WHO), the global prevalence of celiac disease is increasing due to improved awareness and diagnostic methods, contributing to higher demand for testing

- The increasing focus on early diagnosis and the need for accurate testing methods continue to drive market growth

Opportunity

“Advancements in Testing Technologies and Personalized Medicine”

- Technological advancements in celiac disease testing are creating new opportunities for more effective and non-invasive diagnostic methods, such as rapid serology tests and at-home test kits. These innovations offer quicker results and higher convenience for patients, driving demand across different end-users, including hospitals, diagnostic laboratories, and home care settings

- The integration of personalized medicine and genetic testing is an opportunity for the market to offer tailored diagnostic solutions for celiac disease, helping to identify individuals at risk based on genetic predisposition, enabling early intervention and better management of the condition

For instance,

- In a 2025 study published in the Journal of Clinical Gastroenterology, genetic tests were found to help identify individuals at higher risk of celiac disease, making it easier to screen high-risk populations early and offer more personalized treatment

- The shift towards personalized care and advanced testing methods is expected to enhance diagnosis and improve treatment outcomes for individuals living with celiac disease

Restraint/Challenge

“High Cost of Diagnostic Tests and Limited Accessibility in Low-Resource Settings”

- The high cost of comprehensive testing, including genetic tests and biopsies, can be a significant challenge in certain markets, particularly in developing regions with limited access to healthcare and diagnostic services

- These tests, although accurate, can be expensive, which can deter individuals and healthcare providers, especially in low-income settings, from seeking diagnosis or early intervention

For instance,

- In an article published by the Celiac Disease Foundation in 2024, the high costs of diagnostic tests were cited as one of the major barriers for widespread screening, particularly in rural and underserved areas

- This financial constraint on access to diagnostic services can delay diagnoses, contributing to untreated or mismanaged celiac disease, thus impacting overall market growth

- In addition, the need for increased awareness and availability of affordable testing in resource-limited regions remains a significant challenge to achieving broader market penetration

Celiac Disease Testing Market Scope

The market is segmented on the basis of test type, product type and End User.

|

Segmentation |

Sub-Segmentation |

|

By Test Type |

|

|

By Product Type |

|

|

By End User |

|

In 2025, the serology tests is projected to dominate the market with a largest share in test type segment

The serology test segment is expected to dominate the celiac disease testing market with the largest share of 60.5% in 2025 due to increasing adoption of serology rapid testing kits. As it remains the most common and effective method for detecting celiac disease, as they can efficiently detect antibodies in the blood, contributing significantly to the market's growth.

The serology rapid testing kits segment is expected to account for the largest share during the forecast period in Product Type market

In 2025, the serology rapid testing segment is expected to dominate the market with the largest market share of 72.9% due to the increasing demand and adoption of serology rapid testing kits for celiac disease and other conditions indicating the importance of accessible and efficient diagnostic tools.

Celiac Disease Testing Market Regional Analysis

“North America Holds the Largest Share in the Celiac Disease Testing Market”

- North America leads the celiac disease testing market, driven by its well-established healthcare infrastructure, the widespread adoption of advanced diagnostic technologies, and the presence of key market players

- U.S. holds a significant market share due to increasing awareness about celiac disease, a high prevalence of autoimmune diseases, and a robust healthcare system supporting early detection and testing

- The availability of comprehensive health insurance policies and government-backed initiatives aimed at improving disease awareness and screening also contribute to the growth of the market in the region.

- In addition, the ongoing research and development efforts by prominent medical institutions and diagnostic companies to enhance the precision and accessibility of testing further strengthen market expansion across North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Celiac Disease Testing Market”

- Asia-Pacific is expected to experience the highest growth rate in the celiac disease testing market due to the rapid expansion of healthcare infrastructure, increasing awareness about the disease, and rising diagnostic testing volume

- Countries such as China, India, and Japan are becoming key players in the market, as these regions experience a growing incidence of autoimmune diseases and a rising understanding of celiac disease

- Japan, with its advanced healthcare system and medical technologies, is emerging as an important market for celiac disease testing, with growing adoption of diagnostic tools that offer quicker and more accurate results

- China and India, with their large populations and rising health awareness, are investing heavily in healthcare infrastructure, which includes modern diagnostic services for autoimmune diseases such as celiac disease. The growing presence of global diagnostic companies and increasing government and private sector support are driving the expansion of the celiac disease testing market across the region

Celiac Disease Testing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Thermo Fisher Scientific Inc. (U.S.)

- Abbott (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- LabCorp (U.S.)

- Prometheus Laboratories (U.S.)

- Biomerica (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- The University of Chicago Medical Center (U.S.)

- Everlywell (U.S.)

- Genova Diagnostics (GDX) (U.S.)

- Eurofins Viracor, LLC (U.S.)

- NYU Langone Hospitals (U.S.)

- R-Biopharm AG (Germany)

- Eurofins Scientific (Luxembourg)

Latest Developments in Global Celiac Disease Testing Market

- In January 2025, Thermo Fisher Scientific, announced the launch of its Celiac Disease Testing Kits in the European Union, following the receipt of CE marking. The kits are designed to provide quick and accurate serological testing for individuals suspected of having celiac disease, utilizing advanced technology to improve diagnostic accuracy. These tests are optimized for high throughput and deliver results that assist clinicians in making timely treatment decisions, thus addressing the increasing demand for effective celiac disease diagnostics

- In October 2024, at the American Association of Clinical Chemistry (AACC) Annual Meeting, Abbott Laboratories showcased its advancements in molecular diagnostics, introducing a new Celiac Disease Genetic Test designed to identify genetic markers associated with an increased risk of celiac disease. This new test is aimed at improving early detection and preventive strategies, especially in at-risk populations, with a focus on non-invasive methods that enhance diagnostic efficiency

- In September 2024, at the 42nd European Society for Paediatric Gastroenterology, Hepatology, and Nutrition (ESPGHAN) Congress, Bio-Rad Laboratories presented new data supporting the integration of rapid serology tests for the diagnosis of celiac disease, demonstrating their effectiveness in providing accurate results within minutes. The company highlighted its portfolio of diagnostic tools for celiac disease, emphasizing the importance of early screening and monitoring in pediatric and adult populations

- In September 2024, Medtronic announced the upcoming launch of Celiac Disease Monitoring Systems, which provide continuous monitoring of antibody levels in patients with known celiac disease. This system, expected to be available in Q1 2025, is designed to aid in ongoing disease management by tracking patient response to dietary interventions and ensuring better compliance with gluten-free diets. It features advanced analytics and a user-friendly interface for healthcare providers and patients alike

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.