Global Cenospheres Market

Market Size in USD Million

CAGR :

%

USD

650.63 Million

USD

1,598.32 Million

2024

2032

USD

650.63 Million

USD

1,598.32 Million

2024

2032

| 2025 –2032 | |

| USD 650.63 Million | |

| USD 1,598.32 Million | |

|

|

|

|

Cenospheres Market Size

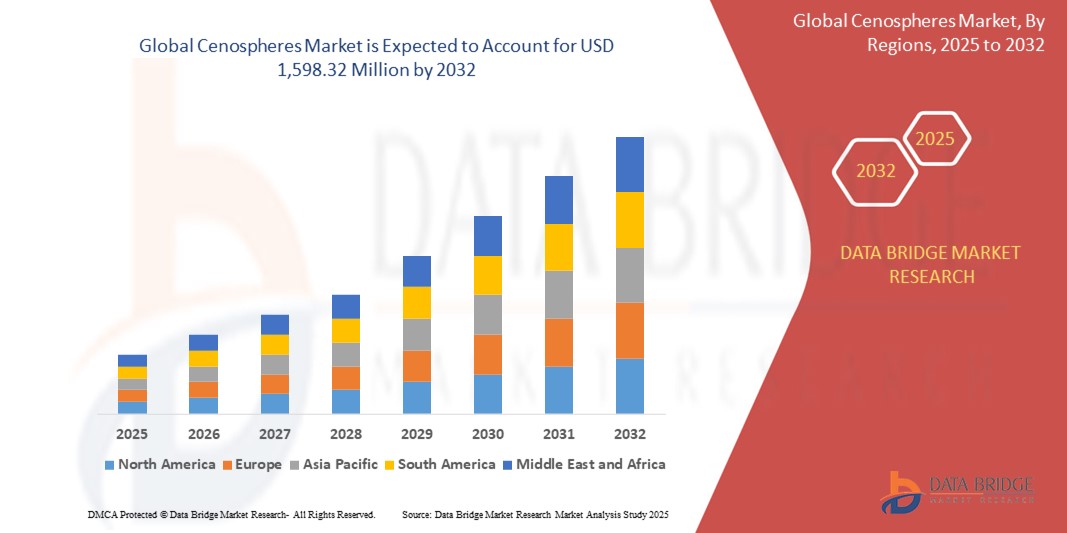

- The global cenospheres market size was valued at USD 650.63 million in 2024 and is expected to reach USD 1,598.32 million by 2032, at a CAGR of 11.89% during the forecast period

- This growth is driven by factors such as rising demand for lightweight construction materials, expanding applications in oil & gas and automotive industries, and increasing focus on sustainability and energy efficiency

Cenospheres Market Analysis

- Cenospheres are lightweight, hollow microspheres primarily composed of silica and alumina, formed as a byproduct of coal combustion in thermal power plants. They are widely used in construction, oil & gas, automotive, and aerospace sectors due to their high strength-to-weight ratio and insulating properties

- The demand for cenospheres is significantly driven by the increasing adoption of lightweight and durable materials in various end-use industries, particularly for reducing material weight and improving energy efficiency

- North America is expected to dominate the global cenospheres market with largest market share of 34.69%, due to established industrial sectors, growing demand in the oil & gas and automotive industries, and strong focus on sustainability initiatives

- Asia-Pacific is expected to be the fastest growing region in the cenospheres market during the forecast period due to rapid industrialization, infrastructure development, and the availability of abundant raw material (fly ash)

- The gray cenospheres segment is expected to dominate the market with a largest market share of 62.9% due to its widespread use in construction materials and composites, as well as lower production costs compared to white Cenospheres. The increasing oil & gas and construction industries in countries such as India, China, and Japan are expected to further bolster the segment's growth. Gray cenospheres are a byproduct of coal combustion in thermal power plants. These are lightweight, inert, hollow spheres composed primarily of silica and alumina and filled with air or inert gas

Report Scope and Cenospheres Market Segmentation

|

Attributes |

Cenospheres Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cenospheres Market Trends

“Growing Adoption of Cenospheres in High-Performance Composites and Sustainable Applications”

- One prominent trend in the global cenospheres market is the increasing use of cenospheres in high-performance composite materials across construction, automotive, and aerospace sectors due to their lightweight and insulating properties

- This trend supports the global shift toward energy efficiency and material optimization, where cenospheres contribute to reducing overall product weight without compromising strength or durability

- For instance, in automotive applications, cenospheres are increasingly used in polymer composites to enhance fuel efficiency, while in construction, they are incorporated into lightweight concrete and insulation materials for sustainable building solutions

- This growing preference for cenospheres as functional fillers in eco-friendly and high-performance applications is shaping the market, encouraging innovation and expanding their industrial footprint

Cenospheres Market Dynamics

Driver

“Rising Demand for Lightweight and Durable Materials Across Key Industries”

- The growing need for lightweight, durable, and thermally insulating materials in industries such as construction, automotive, oil & gas, and aerospace is a major factor driving the demand for Cenospheres

- As companies increasingly seek to improve energy efficiency, reduce production costs, and meet regulatory standards, cenospheres offer an ideal solution due to their low density, high strength, and thermal resistance

- Incorporating cenospheres into composite materials, concrete, and drilling fluids leads to enhanced product performance and sustainability, further fueling market demand

For instance,

- In the construction sector, cenospheres are being widely used in lightweight concrete to reduce structural load and improve insulation. Similarly, in the automotive industry, they contribute to vehicle weight reduction, enhancing fuel efficiency and emissions compliance

- As a result, the shift toward lightweight and sustainable materials is a key driver accelerating the global demand for cenospheres across multiple high-growth sectors

Opportunity

“Rising Utilization of Cenospheres in Oil & Gas and Drilling Fluid Applications”

- The oil & gas industry presents a growing opportunity for cenospheres due to their use in lightweight drilling fluids, cementing slurries, and wellbore strengthening materials, especially for high-pressure and high-temperature (HPHT) environments

- These applications benefit from cenospheres’ hollow structure, which helps reduce fluid density without compromising strength, leading to enhanced drilling efficiency and reduced risk of formation damage

- With the increasing demand for energy and exploration of deeper reserves, oil & gas companies are actively seeking advanced materials that can improve operational safety and efficiency

For instance,

- Cenospheres are being incorporated into cementing formulations to minimize fluid loss and improve thermal insulation in deep wells. Their ability to improve slurry stability and decrease hydrostatic pressure makes them ideal for complex drilling conditions

- As global drilling activities continue to expand—especially in offshore and unconventional reservoirs—the demand for high-performance additives like cenospheres is expected to rise, creating lucrative market opportunities

Restraint/Challenge

“Inconsistent Quality and Limited Availability of Raw Materials”

- A major challenge facing the global cenospheres market is the inconsistent quality and limited availability of raw materials, primarily fly ash, which is a byproduct of coal combustion in thermal power plants

- The quality and yield of cenospheres depend heavily on the type of coal used, combustion conditions, and ash handling processes, leading to variability in product characteristics such as density, particle size, and chemical composition

- This inconsistency can pose significant challenges for manufacturers aiming to meet the strict quality requirements of advanced industrial applications, including aerospace and high-performance composites

For instance,

- In several regions, especially in North America and Europe, the shift toward cleaner energy sources and the decline of coal-fired power generation have reduced the availability of high-quality fly ash, thereby impacting cenospheres supply

- As a result, the limited and inconsistent raw material supply chain poses a barrier to scaling up production, increasing costs, and limiting market penetration—particularly in high-demand and quality-sensitive sectors

Cenospheres Market Scope

The market is segmented on the basis of type, material, form, distribution channel, and end users

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Material |

|

|

By Form |

|

|

By Distribution Channel |

|

|

By End Users |

|

In 2025, the gray cenospheres is projected to dominate the market with a largest share in type segment

The gray cenospheres segment is expected to dominate the cenospheres market with the largest share of 62.9% due to its widespread use in construction materials and composites, as well as lower production costs compared to white Cenospheres. The increasing oil & gas and construction industries in countries like India, China, and Japan are expected to further bolster the segment's growth. Gray cenospheres are a byproduct of coal combustion in thermal power plants. These are lightweight, inert, hollow spheres composed primarily of silica and alumina and filled with air or inert gas

The construction is expected to account for the largest share during the forecast period in end user segment

In 2025, the construction segment is expected to dominate the market with the largest market share of 25.3% due to the gray variety produced from coal combustion, are increasingly incorporated into the construction industry due to their unique properties. Their low density makes them an ideal additive for lightweight concrete, reducing the overall weight of structures while maintaining strength. The intrinsic thermal insulation and fire resistance of cenospheres enhance buildings' energy efficiency and safety

Cenospheres Market Regional Analysis

“North America Holds the Largest Share in the Cenospheres Market”

- North America dominates the global cenospheres market with largest market share of 34.69%, driven by a mature industrial base, growing adoption of lightweight materials, and robust demand from the oil & gas, automotive, and construction sectors.

- The U.S. holds a largest share of 64.87%, due to advanced R&D capabilities, strong environmental regulations promoting sustainable materials, and an established infrastructure for fly ash collection and processing

- Increased investment in composite materials, along with the presence of leading manufacturers and material science companies, further supports market growth

- Government initiatives focused on energy efficiency, infrastructure modernization, and green building standards are accelerating the use of cenospheres in various applications across the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Cenospheres Market”

- The Asia-Pacific region is expected to witness the fastest growth in the cenospheres market, fueled by rapid industrialization, urbanization, and infrastructure development across emerging economies such as China, India, and Southeast Asian countries

- China and India are key growth drivers due to the abundant availability of fly ash from coal-fired power plants, increasing demand for cost-effective construction materials, and expansion of the automotive and oil & gas sectors

- Japan and South Korea, with their advanced manufacturing capabilities and focus on lightweight and high-performance materials, are also contributing to regional market expansion

- The growing presence of domestic and international composite manufacturers, government initiatives promoting sustainable building materials, and rising exports of low-cost cenospheres from the region further support its high growth trajectory

Cenospheres Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- KAREVA (EN) (Germany)

- Delamin Ltd. (U.K.)

- Qingdao Eastchem Inc. (China)

- American Elements. (U.S.)

- BPN International (Austria)

- CenoStar (U.S.)

- Eko Export (Poland)

- Envirospheres (Australia)

- LKAB Minerals AB (Sweden)

- Omya AG (Switzerland)

- Reslab Microfiller (Australia)

- Tarmac (U.K.)

- UAB SUEK Baltic (Switzerland)

- uralsfera (Russia)

- Petraindia. (India)

- PR Group (Australia)

- 3M (U.S.)

Latest Developments in Global Cenospheres Market

- In March 2022, Omya AG announced the acquisition of Prima Inter-Chem, a leading specialty chemical distributor based in Malaysia. This strategic move aligns with Omya’s objective to strengthen its presence in Southeast Asia by expanding its regional distribution network and diversifying its product portfolio. This acquisition supports the growing demand for advanced material solutions, including cenospheres, in emerging economies

- In May 2021, Omya International AG, a key player in the cenosphere manufacturing industry, launched a new line of functionalized calcium carbonate products tailored for PET applications. This innovative, cost-effective opacifier is specifically designed to produce white, opaque PET bottles. Omya’s expansion into functionalized materials aligns with the growing demand for high-performance additives in manufacturing sectors. The innovation in PET applications highlights the broader trend of utilizing lightweight, durable materials like cenospheres in packaging, automotive, and construction

- In August 2023, Cenospheres Trade & Engineering S.A., a prominent cenosphere distributor, forged a strategic partnership with a leading construction materials supplier in North America. This collaboration aims to enhance the supply and delivery of cenospheres for use in lightweight concrete applications, with the potential to accelerate adoption within the construction industry. This partnership underscores the growing demand for cenospheres as an essential material in sustainable and high-performance construction

- In April 2022, American Iodine Company Inc., a leading producer of industrial minerals, announced plans to double its cenosphere production capacity. This expansion is driven by the growing demand for cenospheres, particularly from key sectors such as oil and gas, where their unique properties are increasingly valued for specialized applications. The planned increase in production capacity highlights the significant rise in demand for cenospheres, driven by their widespread use in industries like oil & gas, construction, and automotive

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cenospheres Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cenospheres Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cenospheres Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.