Global Chicken Wings Market

Market Size in USD Billion

CAGR :

%

USD

1.62 Billion

USD

2.36 Billion

2024

2032

USD

1.62 Billion

USD

2.36 Billion

2024

2032

| 2025 –2032 | |

| USD 1.62 Billion | |

| USD 2.36 Billion | |

|

|

|

|

Chicken Wings Market Size

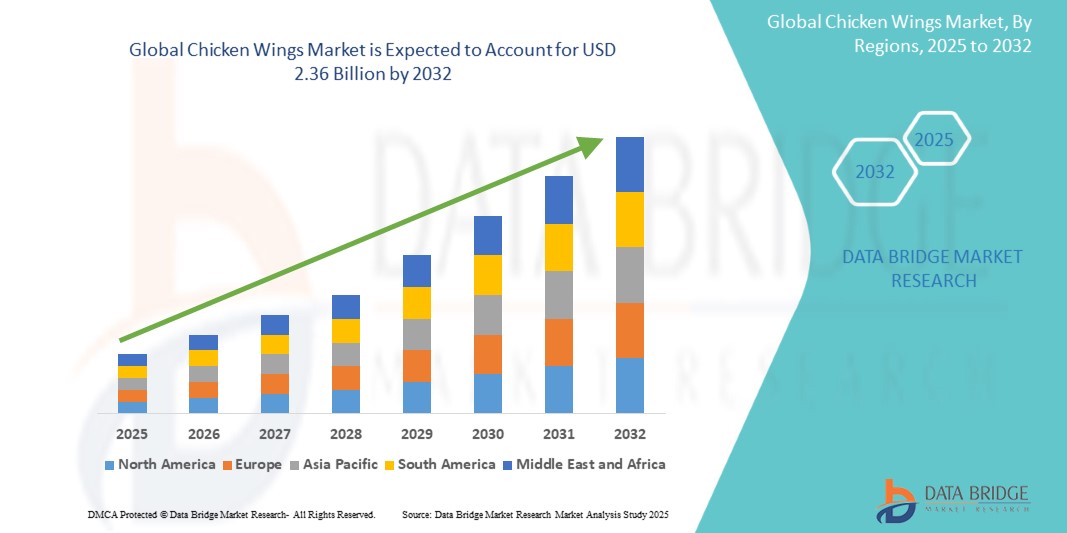

- The global chicken wings market was valued at USD 1.62 billion in 2024 and is expected to reach USD 2.36 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.80%, primarily driven by increasing consumer demand for convenient and protein-rich foods

- This growth is driven by growing popularity of sports events and social gatherings, where chicken wings are a staple, further fuels market growth

Chicken Wings Market Analysis

- The chicken wings market has gained significant traction due to rising consumer demand for high-protein, convenient, and flavorful food options, particularly in fast-food chains, casual dining, and home-cooked meals. The increasing popularity of chicken wings as a go-to snack for social gatherings and sporting events, combined with the introduction of new flavors and cooking styles, is attracting a diverse consumer base seeking taste, variety, and convenience

- The market is primarily driven by growing demand for ready-to-eat and frozen chicken wings, expanding availability in quick-service restaurants (QSRs) and delivery platforms, and advancements in poultry farming and processing technologies. In addition, the rise of spicy, smoky, and international-inspired flavors continues to fuel market growth, along with the increasing presence of plant-based and alternative protein wings

- North America dominates the chicken wings market, with countries such as the U.S. and Canada leading due to high consumption rates, strong poultry production, and well-established foodservice industries. The region’s dominance is further supported by seasonal demand spikes, especially during events such as the Super Bowl and March Madness, which significantly boost chicken wing sales

- For instance, in the U.S., the demand for chicken wings peaks annually around the Super Bowl, with major food chains and delivery services reporting record-high sales during this period

- Globally, chicken wings are becoming a staple in premium casual dining, fast food, and frozen meal categories. Innovations such as air-fried wings, boneless varieties, and premium organic or ethically sourced wings are driving industry transformation and supporting the shift toward higher-quality, sustainable poultry products

Report Scope and Chicken Wings Market Segmentation

|

Attributes |

Chicken Wings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Chicken Wings Market Trends

“Innovation in Flavors and Cooking Techniques Driving Consumer Demand”

- The growing consumer interest in bold, unique, and globally inspired flavors is driving demand for chicken wings, with brands introducing spicy, smoky, and fusion-style options to cater to diverse palates

- Foodservice chains and quick-service restaurants (QSRs) are continuously launching new wing varieties, including Korean-style, Nashville hot, garlic parmesan, and plant-based alternatives, to attract both traditional and health-conscious consumers

- The rise of air-fried, baked, and grilled chicken wings is gaining popularity as consumers seek healthier cooking methods without compromising taste and texture

For instance,

- In February 2024, Wingstop introduced a limited-time line of globally inspired chicken wing flavors, featuring Korean Gochujang, Jamaican Jerk, and Spicy Mango Habanero to appeal to adventurous eaters

- In October 2023, KFC expanded its Hot & Spicy Wings offering across North America, responding to increasing consumer demand for bolder, crunchier, and spicier wing options

- In July 2023, Pilgrim’s launched its Garlic Parmesan "Mega Meaty" Chicken Wings, designed for larger portion sizes and enhanced flavor retention, exclusively available at Costco locations

- As global flavors continue to influence food trends, the innovation in marinades, sauces, and cooking techniques will shape the chicken wings market, meeting evolving consumer preferences for bold, premium, and convenient wing experiences

Chicken Wings Market Dynamics

Driver

“Growth of Online Food Delivery and E-Commerce Channel”

- The rise of online food delivery platforms and e-commerce channels is significantly boosting the chicken wings market, as consumers increasingly prefer the convenience of ordering ready-to-eat wings from restaurants or purchasing frozen wings for home cooking

- Third-party delivery services such as Uber Eats, DoorDash, and Grubhub are partnering with quick-service restaurants (QSRs) and cloud kitchens to expand their chicken wings offerings, making wings more accessible to a wider audience

- Companies are leveraging digital marketing, AI-driven recommendations, and data analytics to personalize promotions and enhance consumer engagement, driving higher sales for both fresh and processed chicken wings

For instance,

- In 2024, Wingstop expanded its digital-first strategy, launching a direct-to-consumer platform that allows customers to order wings directly from their website and app, bypassing third-party fees

- In 2023, KFC partnered with major delivery services across North America, introducing exclusive online-only wing deals, driving significant growth in off-premise sales

- As e-commerce and food delivery platforms continue to grow, brands that optimize their online presence, enhance delivery speed, and offer exclusive digital deals will strengthen their position in the expanding chicken wings market

Opportunity

“Expansion of Plant-Based and Alternative Protein Chicken Wings”

- With the increasing shift toward health-conscious and environmentally friendly diets, plant-based chicken wings alternatives are gaining traction among vegetarians, flexitarians, and health-conscious consumers looking for meat-free yet flavorful options

- Food manufacturers are innovating soy, pea protein, and mycelium-based chicken wing alternatives, offering a realistic texture and taste to appeal to both traditional meat-eaters and plant-based consumers

- Restaurants and fast-food chains are introducing plant-based wing options, responding to the growing demand for sustainable, cruelty-free, and high-protein alternatives in the foodservice sector

For instance,

- In 2024, THIS launched vegan Chicken Wings, made from soy and fava bean protein, catering to the growing plant-based and flexitarian market

- In 2023, Beyond Meat partnered with major QSR chains, introducing plant-based boneless wings as a limited-time menu item to test consumer interest

- As the demand for alternative proteins continues to grow, brands that invest in plant-based innovations, sustainability, and texture-enhancing food technology will unlock new revenue streams and expand their market reach in the chicken wings industry

Restraint/Challenge

“Supply Chain Disruptions Impacting Chicken Wings Availability”

- The chicken wings market faces challenges due to fluctuations in poultry supply, rising feed costs, and transportation disruptions, which impact the availability and pricing of chicken wings in both retail and foodservice sectors

- Labor shortages in poultry processing plants, disease outbreaks such as avian influenza, and global trade restrictions have created bottlenecks in production, leading to higher costs and inconsistent supply for restaurants and distributors

- The growing dependence on cold chain logistics and efficient storage facilities adds further complexity, making it difficult for suppliers to maintain fresh and frozen wing inventories without supply delays

For instance,

- In February 2024, U.S. poultry producers faced supply chain disruptions due to severe winter storms, causing delays in chicken wing shipments ahead of the Super Bowl, impacting restaurant stocks

- In October 2023, a major poultry processor in Brazil reduced exports due to an outbreak of avian influenza, leading to higher global prices and limited supply for international buyers

- To overcome these challenges, companies must invest in supply chain resilience, diversify sourcing strategies, and adopt advanced logistics solutions to ensure a steady and cost-effective supply of chicken wings to meet rising consumer demand

Chicken Wings Market Scope

The market is segmented on the basis of type, application, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By Distribution Channel |

|

Chicken Wings Market Regional Analysis

“North America is the Dominant Region in the Chicken Wings Market”

- Chicken Wings are a staple in American cuisine, particularly in sports bars, fast-food chains, and casual dining restaurants

- The increasing popularity of ready-to-eat and frozen chicken wings is driving market expansion across retail and food service sectors

- Major producers such as the U.S. and Canada ensure a steady supply of chicken wings for domestic consumption and international exports

For Instance,

- In 2023, the U.S. poultry industry reported record-high chicken wing production to meet rising demand during major sporting events, including the Super Bowl

- In 2022, leading fast-food brands such as KFC and McDonald’s expanded their chicken wing offerings, introducing new flavors and limited-time promotions

- In 2021, Canada’s poultry sector increased exports of chicken wings to Asian markets, capitalizing on growing consumption trends in China and South Korea

- North America will continue to dominate the chicken wings market, driven by high consumer demand, innovative flavor trends, and expanding food service channels

Chicken Wings Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- JBS S.A. (Brazil)

- Tyson Foods (U.S.)

- BRF (Brazil)

- New Hope Liuhe (China)

- Wen's Food Group (China)

- CP Group (Thailand)

- Perdue Farms Inc (U.S.)

- Koch Foods LLC (U.S.)

- Industrias Bachoco (Mexico)

- The Arab Company for Livestock Development (Saudi Arabia)

- Sanderson Farms Inc (U.S.)

- Louis Dreyfus Company (Netherlands)

- Suguna Foods (India)

- Plukon Food Group (Netherlands)

- Cargill, Incorporated (U.S.)

- Henan Doyoo Group (China)

- OSI Group LLC (U.S.)

- Fujian Sunner Group (China)

- PRIOSKOLYE (Russia)

- Wayne Farms LLC (U.S.)

- Gruppo Veronesi SpA (Italy)

- LOHMANN & Co. Aktiengesellschaft (Germany)

- Mountaire Farms Inc (U.S.)

- San Miguel Pure Foods (Philippines)

- JAPFA (Indonesia)

- 2 Sisters Food Group (U.K.),

- Huaying Agricultural (China)

Latest Developments in Global Chicken Wings Market

- In December 2024, THIS introduced Vegan Chicken Wings and Kyiv for Veganuary, featuring high-protein and fiber-rich products fortified with iron and vitamin B12. The Kyiv is crafted from soy and fava bean protein, filled with wild garlic butter, and coated in sourdough breadcrumbs. This launch reflects the increasing demand for plant-based alternatives, especially during the Veganuary period, aligning with the growing trend towards healthier, more sustainable eating options

- In August 2024, Bojangles unveiled Chicken Wings with House-made Ranch for a limited time, featuring marinated wings cooked to perfection and served with a choice of three sauces, including Creamy Buffalo, BBQ, and Classic. Bojangles' innovation with limited-time offerings emphasizes their commitment to providing new and exciting flavors that drive customer interest and enhance their menu’s appeal

- In October 2023, BurgerFi, owned by BurgerFi International, Inc., expanded its menu with fresh, never-frozen jumbo chicken wings in three flavors and four varieties of BurgerFi Bowls, available as permanent additions starting November 1, 2023. This menu expansion highlights BurgerFi’s focus on diversifying its offerings and meeting consumer demands for high-quality, flavorful chicken wings and healthy bowl options

- In September 2023, KFC launched Hot & Spicy Wings in the U.S. for the first time, marinated and double hand-breaded in its Extra Crispy coating, offering a crunchy texture with a fiery kick. KFC’s introduction of Hot & Spicy Wings showcases its ability to innovate within its established menu, catering to the growing consumer preference for bold, spicy flavors

- In July 2023, Pilgrim’s introduced Garlic Parm Chicken Wings, marketed as "mega meaty" wings, just in time for National Wing Day on July 29, with availability at Costco locations throughout the Northeast United States. Pilgrim’s strategic timing and product positioning for National Wing Day demonstrate their focus on capitalizing on popular events to boost sales and consumer engagement

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.