Global Chinese Hamster Ovary Cho Clotting Factors Market

Market Size in USD Million

CAGR :

%

USD

14.39 Million

USD

25.13 Million

2024

2032

USD

14.39 Million

USD

25.13 Million

2024

2032

| 2025 –2032 | |

| USD 14.39 Million | |

| USD 25.13 Million | |

|

|

|

|

Chinese Hamster Ovary (CHO) Clotting Factors Market Size

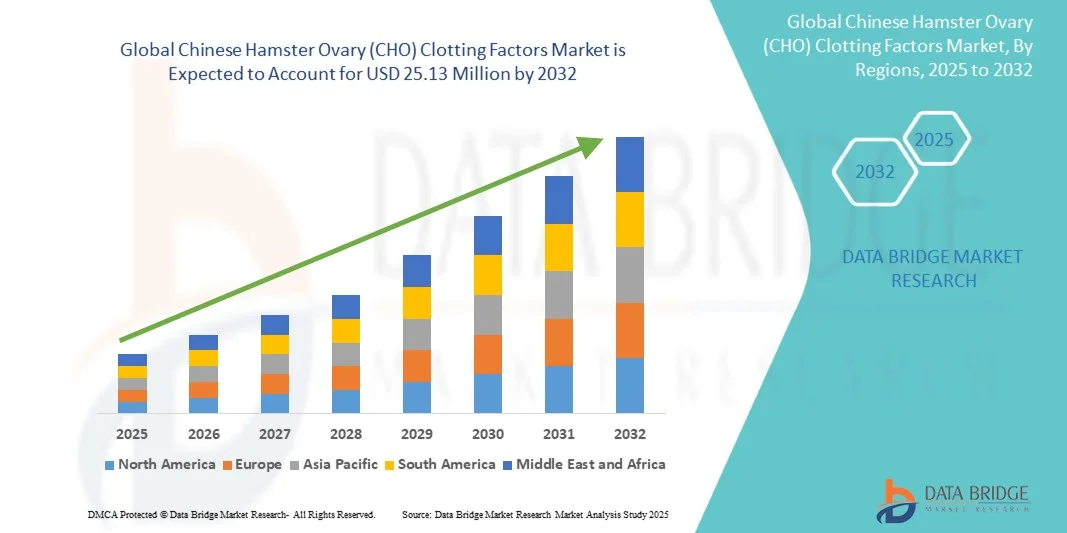

- The global Chinese Hamster Ovary (CHO) clotting factors market size was valued at USD 14.39 million in 2024 and is expected to reach USD 25.13 million by 2032, at a CAGR of 7.22% during the forecast period

- The market growth is largely driven by the increasing use of CHO cell lines in the large-scale production of recombinant coagulation factors, owing to their high productivity, post-translational modification capabilities, and regulatory acceptance in biopharmaceutical manufacturing

- Furthermore, rising prevalence of bleeding disorders such as hemophilia A and B, coupled with growing investments in biologics R&D and advancements in cell line engineering and bioprocess technologies, are accelerating the adoption of CHO-based production systems, thereby significantly boosting the industry's growth

Chinese Hamster Ovary (CHO) Clotting Factors Market Analysis

- Chinese Hamster Ovary (CHO) clotting factors market, centered on the production of recombinant coagulation proteins such as Factor VIII and Factor IX, is becoming increasingly vital in biopharmaceutical manufacturing due to CHO cells’ superior protein expression efficiency, human-compatible glycosylation, and proven safety in large-scale therapeutic production

- The rising demand for CHO-derived clotting factors is primarily fueled by the growing prevalence of hemophilia and other bleeding disorders, expanding adoption of recombinant therapies over plasma-derived products, and technological advancements in CHO cell line engineering and bioprocess optimization

- North America dominated the CHO clotting factors market with the largest revenue share of 42.2% in 2024, supported by strong biopharmaceutical infrastructure, favorable regulatory frameworks, and the presence of leading players investing in recombinant protein manufacturing and advanced biologics R&D

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, driven by increasing government initiatives to enhance biomanufacturing capacity, expanding patient access to biologics, and growing investments in biosimilar development across China, India, and South Korea

- The Recombinant Factor VIII segment dominated the CHO clotting factors market with a market share of 46% in 2024, owing to its extensive use in hemophilia A treatment and continuous innovation in extended half-life and fusion protein formulations

Report Scope and Chinese Hamster Ovary (CHO) Clotting Factors Market Segmentation

|

Attributes |

Chinese Hamster Ovary (CHO) Clotting Factors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Chinese Hamster Ovary (CHO) Clotting Factors Market Trends

“Advancements in CHO Cell Line Engineering and Bioprocessing”

- A significant and accelerating trend in the global CHO clotting factors market is the adoption of advanced gene-editing techniques and optimized CHO cell lines, enhancing protein yield, stability, and glycosylation fidelity for recombinant coagulation factors

- For instance, CRISPR/Cas9-based modifications in CHO-DG44 cells have enabled higher productivity and reduced immunogenicity of recombinant Factor VIII, supporting more efficient large-scale manufacturing

- Integration of automated bioprocessing platforms and single-use bioreactors allows manufacturers to achieve more consistent product quality and scalable production with reduced contamination risk. For instance, Perfusion-based CHO culture systems combined with automated monitoring are being used by leading biopharma firms to produce high-purity Factor IX for hemophilia B therapy

- This trend towards more precise and high-yield CHO production systems is reshaping expectations for biomanufacturing efficiency, driving investments in R&D and bioprocess optimization

- The demand for CHO cell line innovations and integrated bioprocess technologies is growing rapidly across both developed and emerging markets as manufacturers seek cost-effective and scalable recombinant coagulation factor production

Chinese Hamster Ovary (CHO) Clotting Factors Market Dynamics

Driver

“Increasing Prevalence of Hemophilia and Other Bleeding Disorders”

- The growing number of patients with hemophilia A, hemophilia B, and rare bleeding disorders is a significant driver of CHO-based clotting factor demand globally

- For instance, North America reported an estimated 20,000 hemophilia A patients in 2024, creating substantial demand for high-quality recombinant Factor VIII produced in CHO cells

- Rising awareness of recombinant therapies over plasma-derived products due to safety, consistency, and lower risk of viral transmission is further propelling market growth

- For instance, hospitals and hemophilia treatment centers are increasingly procuring CHO-derived Factor IX biosimilars to improve patient access while maintaining safety standards

- The expanding pipeline of biosimilars and long-acting recombinant coagulation factors enhances patient compliance and accessibility, further boosting adoption.

- Extended half-life rFVIII products manufactured in CHO cells are being launched in Europe and Asia-Pacific, increasing market penetration and uptake

Restraint/Challenge

“High Production Costs and Regulatory Compliance Hurdles”

- The high manufacturing costs associated with CHO-based recombinant proteins pose a major challenge for widespread market adoption, especially in price-sensitive regions

- For instance, the cost per gram of recombinant Factor VIII produced in CHO cells remains significantly higher than plasma-derived alternatives, affecting hospital procurement budgets

- Stringent regulatory requirements for biologics production, including GMP compliance, quality control, and clinical validation, further complicate market entry and expansion

- For instance, obtaining EMA and FDA approval for new CHO-derived coagulation factors requires extensive clinical trials and validation studies, delaying time-to-market

- The complexity of scale-up, purification, and maintaining consistent glycosylation profiles adds additional barriers for manufacturers aiming to expand production capacity.

- Mid-sized biotech companies often face challenges in replicating commercial-scale CHO processes without affecting product quality, limiting their competitive positioning

Chinese Hamster Ovary (CHO) Clotting Factors Market Scope

The market is segmented on the basis of product, CHO cell line, production technology, application, and end user.

- By Product

On the basis of product, the market is segmented into Recombinant Factor VIII, Recombinant Factor IX, Von Willebrand Factor, Factor VII and other coagulation proteins, and Fusion and extended half-life clotting factors. Recombinant Factor VIII (rFVIII) dominated the market with the largest revenue share of 46% in 2024, driven by its extensive use in the treatment of hemophilia A, which represents the majority of bleeding disorder cases globally. CHO cell production ensures proper glycosylation and safety, making rFVIII the therapy of choice for hospitals and hemophilia treatment centers. Continuous innovation in long-acting and fusion rFVIII variants further consolidates its dominance. Additionally, the well-established clinical history and wide reimbursement coverage enhance its adoption in developed regions. rFVIII’s robust pipeline and patient preference for recombinant over plasma-derived products also contribute to its leading position. Manufacturers prioritize rFVIII in both commercial and biosimilar production pipelines due to consistent high demand.

Fusion and extended half-life clotting factors are expected to witness the fastest growth from 2025 to 2032, fueled by the rising preference for therapies with reduced dosing frequency and improved patient compliance. These advanced formulations, often produced using CHO cell engineering, enhance circulation time in the bloodstream. For instance, PEGylated or Fc-fusion rFVIII and rFIX products allow less frequent infusions, appealing to both patients and healthcare providers. Emerging markets with increasing access to modern biologics are driving adoption of these innovative therapies. The segment also benefits from ongoing R&D investments in gene fusion and protein stabilization technologies.

- By CHO Cell Line

On the basis of cell line, the market is segmented into CHO-K1, CHO-DG44, CHO-S, CHO-DXB11, and Other engineered CHO variants. CHO-K1 dominated the market in 2024 due to its long-standing use in commercial biologics production, proven stability, and high adaptability for expressing complex glycoproteins such as coagulation factors. It offers reliable yields and is widely accepted by regulatory authorities, making it the preferred choice for large-scale manufacturing. Pharmaceutical companies often select CHO-K1 for both originator biologics and biosimilar production. Its extensive historical data and reproducibility in bioprocessing further reinforce its dominance. CHO-K1 cell lines also benefit from well-established upstream and downstream protocols. Continuous process optimization ensures consistent quality, supporting ongoing market leadership.

CHO-DG44 is expected to be the fastest-growing subsegment from 2025 to 2032, driven by its use in high-yield recombinant protein expression, particularly for newer biosimilar clotting factors. Its gene amplification capabilities allow efficient production of both rFVIII and rFIX. For instance, DG44 is increasingly adopted in emerging markets for cost-effective and scalable manufacturing. Advances in genetic engineering and perfusion bioreactor compatibility boost its growth potential. The cell line is particularly favored for producing extended half-life clotting factors and novel fusion proteins.

- By Production Technology

On the basis of production technology, the market is segmented into stable expression systems, transient expression systems, fed-batch bioreactors, perfusion bioreactors, and single-use bioreactor systems. Fed-batch bioreactors dominated the market in 2024, offering controlled growth conditions, high cell density, and scalability for large-volume CHO-derived clotting factor production. This method allows manufacturers to optimize yield, minimize contamination risk, and maintain consistent protein quality. Fed-batch processes are widely preferred for commercial manufacturing of both rFVIII and rFIX. The technology integrates seamlessly with CHO-K1 and CHO-DG44 systems. Established biopharma companies rely on fed-batch bioreactors for regulatory-compliant production. Their cost-efficiency and process stability further reinforce their market dominance.

Perfusion bioreactors are anticipated to witness the fastest growth during the forecast period due to their ability to maintain continuous production and achieve higher protein yields. Perfusion allows constant media replacement, reducing toxic byproducts and supporting long-term cell viability. For instance, many extended half-life rFVIII products are being developed using perfusion systems to meet rising demand. The technology is particularly attractive for high-value recombinant coagulation factors and biosimilars. Advances in automation and single-use perfusion systems support faster adoption.

- By Application

On the basis of application, the market is segmented into Hemophilia A, Hemophilia B, Von Willebrand disease, and Other bleeding disorders. Hemophilia A dominated the market with the largest revenue share in 2024 due to its high prevalence relative to other bleeding disorders and the widespread use of recombinant Factor VIII therapies. CHO-based production ensures high-quality rFVIII that meets clinical and regulatory standards. Hospitals and treatment centers prioritize recombinant products for safety, consistency, and patient compliance. Continuous innovation in long-acting and fusion rFVIII enhances market penetration. Developed regions such as North America and Europe show strong demand due to established treatment infrastructure. Biosimilar rFVIII adoption is also contributing to revenue growth.

Von Willebrand disease (vWD) therapies are expected to witness the fastest growth from 2025 to 2032 due to increasing diagnosis rates and expansion of recombinant treatment options. CHO-derived vWF products provide safer alternatives to plasma-derived concentrates. Emerging markets with expanding healthcare access are driving adoption. Novel therapies targeting both prophylaxis and acute bleeding management support growth. Manufacturers are focusing on R&D for stable CHO expression of vWF. The segment benefits from increasing patient awareness and guideline recommendations favoring recombinant products.

- By End User

On the basis of end user, the market is segmented into hospitals & clinics, hemophilia treatment centers, biopharmaceutical companies, contract manufacturing organizations (CMOs), and research & academic institutes. Hospitals & Clinics dominated the market in 2024, representing the largest revenue share due to the direct administration of recombinant clotting factors to patients. They prefer CHO-derived therapies for their established safety, clinical efficacy, and regulatory approval history. Large hospital networks in North America and Europe drive significant demand. Integration with treatment protocols and patient monitoring systems enhances usage. Hospitals often maintain long-term supply contracts with manufacturers. The reliability of CHO-produced products supports sustained market dominance.

Contract Manufacturing Organizations (CMOs) are expected to witness the fastest growth during 2025–2032, driven by rising outsourcing of biologics production by biopharmaceutical companies to reduce capital expenditure and scale-up risks. For instance, many mid-sized biotech firms are partnering with CMOs specializing in CHO-based rFVIII and rFIX production. Advanced capabilities in perfusion and single-use systems make CMOs attractive partners. Expansion of biosimilars and global supply chain requirements further accelerate growth. Emerging markets with limited in-house production capacity are increasingly adopting CMO services.

Chinese Hamster Ovary (CHO) Clotting Factors Market Regional Analysis

- North America dominated the CHO clotting factors market with the largest revenue share of 42.2% in 2024, supported by strong biopharmaceutical infrastructure, favorable regulatory frameworks, and the presence of leading players investing in recombinant protein manufacturing and advanced biologics R&D

- Healthcare providers and hemophilia treatment centers in the region highly value CHO-derived recombinant clotting factors for their proven safety, consistent efficacy, and regulatory compliance, making them the preferred choice over plasma-derived therapies

- This widespread adoption is further supported by strong R&D investments, advanced manufacturing capabilities, and favorable reimbursement policies, establishing CHO-based clotting factors as the standard treatment solution for both hospital and specialty care settings

U.S. Chinese Hamster Ovary (CHO) Clotting Factors Market Insight

The U.S. CHO clotting factors market captured the largest revenue share of 82% in 2024 within North America, fueled by the high prevalence of hemophilia A and B, along with advanced biopharmaceutical infrastructure. Patients and healthcare providers increasingly prioritize recombinant clotting factors produced in CHO cells due to their proven safety, consistent efficacy, and regulatory compliance. The growing adoption of long-acting and extended half-life therapies, combined with strong R&D investment and favorable reimbursement policies, further propels the market. Moreover, the presence of leading biopharmaceutical companies and specialized hemophilia treatment centers is significantly contributing to the market’s expansion.

Europe Chinese Hamster Ovary (CHO) Clotting Factors Market Insight

The Europe CHO clotting factors market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising hemophilia diagnosis rates and increasing access to recombinant therapies. Growing healthcare infrastructure, coupled with government support for biologics and rare disease management, is fostering the adoption of CHO-derived clotting factors. European patients and hospitals are also drawn to the safety and consistency offered by recombinant therapies over plasma-derived products. The region is experiencing significant growth across both hospital and specialty treatment center applications, with CHO-based clotting factors being integrated into standard treatment protocols.

U.K. Chinese Hamster Ovary (CHO) Clotting Factors Market Insight

The U.K. CHO clotting factors market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing awareness of bleeding disorders and the demand for safe, effective recombinant therapies. Additionally, healthcare initiatives supporting rare disease management are encouraging hospitals and treatment centers to adopt CHO-derived clotting factors. The U.K.’s advanced healthcare infrastructure, along with strong clinical research and biopharma presence, is expected to continue stimulating market growth.

Germany Chinese Hamster Ovary (CHO) Clotting Factors Market Insight

The Germany CHO clotting factors market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of hemophilia and other bleeding disorders and the increasing adoption of recombinant coagulation therapies. Germany’s well-established biopharmaceutical sector, combined with emphasis on advanced manufacturing and quality standards, promotes the uptake of CHO-derived products. Integration of biologics into national treatment guidelines and a preference for safe, clinically validated recombinant therapies align with local healthcare expectations.

Asia-Pacific CHO Clotting Factors Market Insight

The Asia-Pacific CHO clotting factors market is poised to grow at the fastest CAGR of 25% during 2025–2032, driven by rising awareness of hemophilia, improving healthcare access, and increasing biologics adoption in countries such as China, Japan, and India. The region's growing inclination towards advanced therapies, supported by government initiatives for rare disease treatment and healthcare digitalization, is driving CHO-based clotting factor adoption. Furthermore, as APAC emerges as a manufacturing hub for recombinant biologics, the affordability and accessibility of CHO-derived therapies are expanding across a wider patient base.

Japan Chinese Hamster Ovary (CHO) Clotting Factors Market Insight

The Japan CHO clotting factors market is gaining momentum due to high healthcare standards, technological advancement in biologics, and rising hemophilia prevalence. The Japanese market emphasizes safe, high-quality recombinant therapies, and the adoption of CHO-derived clotting factors is driven by increasing patient access through hospitals and specialty treatment centers. Moreover, government programs supporting rare diseases and aging population needs are fueling demand for easier-to-administer, long-acting clotting factor therapies in both residential and clinical settings.

India Chinese Hamster Ovary (CHO) Clotting Factors Market Insight

The India CHO clotting factors market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to increasing hemophilia diagnosis, growing healthcare infrastructure, and rising patient awareness. India stands as a key emerging market for recombinant biologics, with CHO-derived clotting factors becoming increasingly accessible in hospitals, specialty clinics, and treatment centers. Government initiatives supporting rare disease care, along with affordable biosimilar production and strong domestic biopharma presence, are key factors propelling market growth in India.

Chinese Hamster Ovary (CHO) Clotting Factors Market Share

The Chinese Hamster Ovary (CHO) Clotting Factors industry is primarily led by well-established companies, including:

- Sartorius AG (Germany)

- Lonza. (Switzerland)

- WuXi AppTec, Inc. (U.S.)

- Samsung Biologics Co., Ltd. (South Korea)

- Celltrion, Inc. (South Korea)

- Biogen Inc. (U.S.)

- Amgen Inc. (U.S.)

- Genentech, Inc. (U.S.)

- BASF SE (Germany)

- Bayer AG (Germany)

- Merck Group (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- Sanofi (France)

- Novartis AG (Switzerland)

- Eli Lilly and Company (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- AbbVie Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

What are the Recent Developments in Global Chinese Hamster Ovary (CHO) Clotting Factors Market?

- In September 2025, the U.S. FDA approved an expanded indication for VONVENDI® (recombinant von Willebrand factor) for both adults and children with von Willebrand disease (VWD). This approval supports its use for routine prophylaxis and treatment of bleeding episodes, enhancing treatment options for VWD patients

- In August 2025, researchers developed a highly productive CHO cell line capable of secreting human blood clotting factor IX. This development enhances the efficiency and scalability of recombinant factor IX production, crucial for treating hemophilia B

- In July 2025, advancements in recombinant clotting factor therapies led to the introduction of extended half-life (EHL) products. These innovations allow for less frequent dosing and improved patient compliance, contributing to better quality of life for those with bleeding disorders

- In February 2025, the adoption of recombinant Coagulation Factor VIII therapies accelerated, driven by technological advances in cell line development and manufacturing processes. These advancements improve the safety and efficacy of treatments for hemophilia A patients

- In January 2025, UC San Diego Health began offering a novel FDA-approved gene therapy for hemophilia B. This one-time infusion therapy leads to reduced bleeding and elevated levels of clotting factors in the blood, providing a long-term treatment option for patients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.