Global Chronic Kidney Disease Ckd Market

Market Size in USD Million

CAGR :

%

USD

13,220.00 Million

USD

18,800.17 Million

2022

2030

USD

13,220.00 Million

USD

18,800.17 Million

2022

2030

| 2023 –2030 | |

| USD 13,220.00 Million | |

| USD 18,800.17 Million | |

|

|

|

|

Chronic Kidney Disease (CKD) Market Analysis and Size

Chronic Kidney Disease (CKD) is a long-term condition in which the kidneys gradually lose function. The kidneys play a crucial role in filtering waste products, excess fluids, and toxins from the blood while also regulating blood pressure, electrolyte balance, and red blood cell production. CKD typically progresses slowly and may lead to kidney failure if left untreated. Diabetes, glomerulonephritis, polycystic kidney disease, and high blood pressure are the causes of CKD. If CKD is suspected, a healthcare provider may order several tests, including blood tests to measure kidney function (creatinine and blood urea nitrogen levels), urine tests, imaging studies (ultrasound and CT scan), and kidney biopsy in some cases.

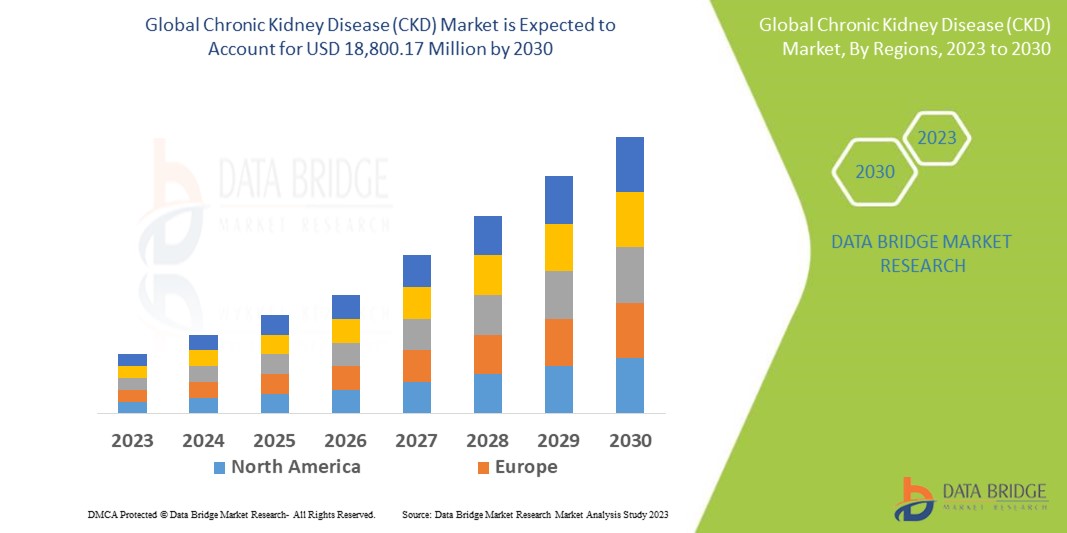

Data Bridge Market Research analyses that the Chronic Kidney Disease (CKD) market which was USD 13,220.00 million in 2022, would rocket up to USD 18,800.17 million by 2030, and is expected to undergo a CAGR of 4.5% during the forecast period. This indicates that the market value. Diagnosis dominates the product type segment of the Chronic Kidney Disease (CKD) market owing to the increasing prevalence of CKD. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Chronic Kidney Disease (CKD) Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product Type (Diagnosis, Treatment), Route of Administration (Oral, Intravenous, Subcutaneous), End Users (Hospitals, Diagnostic Laboratories, Homecare, Specialty Clinics, Others), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), South Africa, Saudi Arabia, UAE, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

Pfizer Inc. (U.S.), Amgen, Inc. (U.S.), F. Hoffmann-La Roche Ltd. (Switzerland), Abbott (U.S.), Bristol-Myers Squibb Company (U.S.), GlaxoSmithKline Plc (U.K.), Novartis AG (Switzerland), Sanofi (France), Teva Pharmaceutical Industries Ltd (Israel), Fresenius Medical Care AG & Co. KGaA (Germany), Kissei Pharmaceutical Co., Ltd. (Japan), AbbVie Inc. (U.S.), Merck KGaA (U.S.), Otsuka Pharmaceutical Co., Ltd. (Japan), AstraZeneca (U.K.), Johnson & Johnson Services, Inc. (U.S.), Akebia Therapeutics, Inc. (U.S.), FibroGen, Inc. (U.S.), and Siemens Healthcare GmbH (Germany) |

|

Market Opportunities |

|

Market Definition

Chronic Kidney Disease (CKD) is also termed chronic kidney failure characterized by gradual loss of kidney function. There are various types of medications available in the market. Medicines cannot reverse chronic kidney disease, but they treat complications and slow further kidney damage.

Chronic Kidney Disease (CKD) Market Dynamics

Drivers

- Increasing prevalence of CKD

The global prevalence of CKD is rising due to aging populations, sedentary lifestyles, unhealthy diets, and a higher prevalence of risk factors such as diabetes and hypertension. The growing number of CKD cases drives the demand for treatments and management solutions.

- Technological advancements in kidney disease management

Advances in medical technology have led to the development of innovative diagnostic tools, therapeutic options, and treatment modalities for CKD. These advancements include improved screening techniques, biomarkers for early detection, wearable devices for continuous monitoring, and telemedicine platforms for remote patient management.

- Growing awareness and screening initiatives

Increased awareness about kidney health and the importance of early detection has resulted in more people seeking screening for CKD. Public health campaigns, educational programs, and initiatives by healthcare organizations have contributed to the early identification of CKD cases, leading to timely intervention and treatment.

- Rising healthcare expenditure

Governments and private entities are allocating more resources to healthcare, including kidney disease management. Increased healthcare expenditure allows better access to diagnostics, treatment options, and specialized care for CKD patients, thereby driving the market growth.

Opportunities

- Precision medicine approaches

CKD is a heterogeneous condition with various underlying causes and disease trajectories. The application of precision medicine, including genetic profiling, molecular diagnostics, and tailored treatment approaches, can optimize therapeutic outcomes and improve patient care.

-

Digital health and remote monitoring

Integrating digital health technologies, such as wearable devices, remote monitoring systems, and telemedicine platforms, provides opportunities to enhance patient engagement, improve self-management, and enable remote care delivery for CKD patients. These technologies can facilitate real-time monitoring of vital signs, medication adherence, and lifestyle factors, leading to better disease management and reduced hospitalizations.

Restraints/Challenges

- Adverse effects and safety concerns

Some existing treatments for CKD, such as certain medications, can have side effects and safety concerns. Nephrotoxicity, drug interactions, and adverse reactions can limit the use of certain medications or require careful monitoring. Balancing the benefits and risks of treatments is a challenge in CKD management.

-

Limited awareness and early detection

Despite efforts to raise awareness, many cases of CKD remain undiagnosed until the disease has progressed to advanced stages. Late detection hampers the effectiveness of interventions and limits the opportunities for early preventive measures. Increasing awareness, promoting regular screenings, and improving diagnostic methods are essential to address this restraint.

This chronic kidney disease (CKD) market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the chronic kidney disease (CKD) market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In July 2021, Bayer’s KERENDIA (finerenone) received U.S. FDA Approval for Treatment of Patients with Chronic Kidney Disease Associated with Type 2 Diabetes

- In April 2021, AstraZeneca’s Farxiga (dapagliflozin), a sodium-glucose cotransporter 2 (SGLT2) inhibitor, has been approved in the US to reduce the risk of sustained estimated glomerular filtration rate (eGFR) decline, end-stage kidney disease (ESKD), cardiovascular (CV) death and hospitalization for heart failure (hHF) in adults with chronic kidney disease (CKD) at risk of progression.

Global Chronic Kidney Disease (CKD) Market Scope

The chronic kidney disease (CKD) market is segmented on the basis of product type, route of administration, end user, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product type

- Diagnosis

- Treatment

Route of administration

- Oral

- Intravenous

- Subcutaneous

End User

- Hospitals

- Diagnostic Laboratories

- Homecare

- Specialty Clinics

- Others)

Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Chronic Kidney Disease (CKD) Market Regional Analysis/Insights

The chronic kidney disease (CKD) market is analysed and market size insights and trends are provided by country, product type, route of administration, end user, and distribution channel, as referenced above.

The countries covered in the chronic kidney disease (CKD) market report are U.S., Canada and Mexico in North America, Germany, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), South Africa, Saudi Arabia, UAE, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the chronic kidney disease (CKD) market because of the rising prevalence of CKD in the region. Growing investment in healthcare infrastructure is also boosting the market's growth.

Asia-Pacific is expected to witness significant growth during the forecast period of 2023 to 2030 due to the increase in government initiatives to promote awareness, rise in medical tourism, growing research activities in the region, availability of massive untapped markets, large population pool, and the growing demand for quality healthcare in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure growth Installed base and New Technology Penetration

The chronic kidney disease (CKD) market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for chronic kidney disease (CKD) market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the chronic kidney disease (CKD) market. The data is available for historic period 2015-2020.

Competitive Landscape and Chronic Kidney Disease (CKD) Market Share Analysis

The chronic kidney disease (CKD) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the market.

Some of the major players operating in the Chronic Kidney Disease (CKD) market are:

- Pfizer Inc. (U.S.)

- Amgen, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Abbott (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- GlaxoSmithKline Plc (U.K.)

- Novartis AG (Switzerland)

- Sanofi (France)

- Teva Pharmaceutical Industries Ltd (Israel)

- Fresenius Medical Care AG & Co. KGaA (Germany)

- Kissei Pharmaceutical Co., Ltd. (Japan)

- AbbVie Inc. (U.S.)

- Merck KGaA (U.S.)

- Otsuka Pharmaceutical Co., Ltd. (Japan)

- AstraZeneca (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- Akebia Therapeutics, Inc. (U.S.)

- FibroGen, Inc. (U.S.)

- Siemens Healthcare GmbH (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CHRONIC KIDNEY DISEASE (CKD) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CHRONIC KIDNEY DISEASE (CKD) MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY MODELING

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL CHRONIC KIDNEY DISEASE (CKD) MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S 5 FORCES

4.2 PESTEL ANALYSIS

5 INDUSTRY INSIGHTS

5.1 PATENT ANALYSIS

5.1.1 PATENT LANDSCAPE

5.1.2 USPTO NUMBER

5.1.3 PATENT EXPIRY

5.1.4 EPIO NUMBER

5.1.5 PATENT STRENGTH AND QUALITY

5.1.6 PATENT CLAIMS

5.1.7 PATENT CITATIONS

5.1.8 PATENT LITIGATION AND LICENSING

5.1.9 FILE OF PATENT

5.1.10 PATENT RECEIVED CONTRIES

5.1.11 TECHNOLOGY BACKGROUND

5.2 DRUG TREATMENT RATE BY MATURED MARKETS

5.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

5.4 PATIENT FLOW DIAGRAM

5.5 KEY PRICING STRATEGIES

5.6 KEY PATIENT ENROLLMENT STRATEGIES

5.7 INTERVIEWS WITH SPECIALIST

5.8 OTHER KOL SNAPSHOTS

6 EPIDEMOLOGY

6.1 INCIDENCE RATE

6.2 TREATMENT RATE

6.3 MORTALITY RATE

6.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

6.5 PATIENT TREATMENT SUCCESS RATES

7 MERGERS AND ACQUISITION

7.1 LICENSING

7.2 COMMERCIALIZATION AGREEMENTS

8 REGULATORY FRAMEWORK

8.1 REGULATORY APPROVAL PROCESS

8.2 GEOGRAPHIES' EASE OF REGULATORY APPROVAL

8.3 REGULATORY APPROVAL PATHWAYS

8.4 LICENSING AND REGISTRATION

8.5 POST-MARKETING SURVEILLANCE

8.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

9 PIPELINE ANALYSIS

9.1 CLINICAL TRIALS AND PHASE ANALYSIS

9.2 DRUG THERAPY PIPELINE

9.3 PHASE III CANDIDATES

9.4 PHASE II CANDIDATES

9.5 PHASE I CANDIDATES

9.6 OTHERS (PRE-CLINICAL AND RESEARCH)

TABLE 1 GLOBAL CLINICAL TRIAL MARKET FOR XX

Company Name Therapeutic Area

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE

Phase Number of Projects

Preclinical/Research Projects XX

Clinical Development XX

Phase I XX

Phase II XX

Phase III XX

U.S. Filed/Approved But Not Yet Marketed XX

Total XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE

Therapeutic Area Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE

Technology Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

10 MARKETED DRUG ANALYSIS

10.1 DRUG

10.1.1 BRAND NAME

10.1.2 GENERICS NAME

10.2 THERAPEUTIC INDIACTION

10.3 PHARACOLOGICAL CLASS OD THE DRUG

10.4 DRUG PRIMARY INDICATION

10.5 MARKET STATUS

10.6 MEDICATION TYPE

10.7 DRUG DOSAGES FORM

10.8 DOSAGES AVAILABILITY

10.9 PACKAGING TYPE

10.1 DRUG ROUTE OF ADMINISTRATION

10.11 DOSING FREQUENCY

10.12 DRUG INSIGHT

10.13 AN OVERVIEW OF THE DRUG DEVELOPMENT ACTIVITIES SUCH AS REGULATORY MILSTONE, SAFETY DATA AND EFFICACY DATA, MARKET EXCLUSIVITY DATA.

10.13.1 FORECAST MARKET OUTLOOK

10.13.2 CROSS COMPETITION

10.13.3 THERAPEUTIC PORTFOLIO

10.14 CURRENT DEVELOPMENT SCENARIO

11 MARKET OVERVIEW

11.1 DRIVERS

11.2 RESTRAINS

11.3 OPPURTUNITY

11.4 CHALLENGES

12 MARKET ACCESS

12.1 10-YEAR MARKET FORECAST

12.2 CLINICAL TRIAL RECENT UPDATES

12.3 ANNUAL NEW FDA APPROVED DRUGS

12.4 DRUGS MANUFACTURER AND DEALS

12.5 MAJOR DRUG UPTAKE

12.6 CURRENT TREATMENT PRACTICES

12.7 IMPACT OF UPCOMING THERAPY

13 R & D ANALYSIS

13.1 COMPARATIVE ANALYSIS

13.2 DRUG DEVELOPMENTAL LANDSCAPE

13.3 IN-DEPTH INSIGHTS ON REGULATORY MILESTONES

13.4 THERAPEUTIC ASSESSMENT

13.5 ASSET-BASED COLLABORATIONS AND PARTNERSHIPS

14 GLOBAL CHRONIC KIDNEY DISEASE (CKD) MARKET, BY DIAGNOSIS AND TREATMENT

(NOTE: MARKET VALUE, VOLUME AND ASP ANALYSIS WOULD BE PROVIDED FOR ALL SEGMENTS AND SUB-SEGMENTS OF PRODUCT)

14.1 OVERVIEW

14.2 DIAGNOSIS

14.2.1 BLOOD TESTS

14.2.1.1. CREATININE

14.2.1.2. OTHER BIOMARKERS

14.2.2 URINE TESTS

14.2.2.1. DIPSTICK TEST FOR ALBUMIN

14.2.2.2. URINE ALBUMIN-TO-CREATININE RATIO (UACR)

14.2.3 IMAGING TESTS

14.2.3.1. X-RAYS

14.2.3.2. PYELOGRAPHY

14.2.3.3. ULTRASONOGRAPHY

14.2.3.4. COMPUTED TOMOGRAPHY

14.2.3.5. OTHERS

14.2.4 BIOPSY

14.2.4.1. OPEN KIDNEY BIOPSY

14.2.4.2. PERCUTANEOUS KIDNEY BIOPSY

14.2.4.3. LAPAROSCOPIC KIDNEY BIOPSY

14.2.4.4. TRANSJUGULAR KIDNEY BIOPSY

14.3 TREATMENT

14.3.1 MEDICATION

14.3.1.1. MEDICATION, BY TYPE

14.3.1.1.1. SGLT2 INHIBITORS

14.3.1.1.1.1 DAPAGLIFLOZIN

14.3.1.1.1.2 OTHERS

14.3.1.1.2. ACE INHIBITORS

14.3.1.1.2.1 BENAZEPRIL

14.3.1.1.2.2 CAPTOPRIL

14.3.1.1.2.3 ENALAPRIL

14.3.1.1.2.4 CAPTOPRIL

14.3.1.1.2.5 LISINOPRIL

14.3.1.1.2.6 CAPTOPRIL

14.3.1.1.2.7 CAPTOPRIL

14.3.1.1.2.8 OTHERS

14.3.1.1.3. BETA BLOCKERS

14.3.1.1.3.1 ACEBUTOLOL

14.3.1.1.3.2 ATENOLOL

14.3.1.1.3.3 BISOPROLOL

14.3.1.1.3.4 NADOLOL

14.3.1.1.4. NADOLOL

14.3.1.1.4.1 AMILORIDE

14.3.1.1.4.2 BUMETANIDE

14.3.1.1.4.3 FUROSEMIDE

14.3.1.1.4.4 METOLAZONE

14.3.1.1.4.5 SPIRONOLACTONE

14.3.1.1.4.6 THIAZIDES

14.3.1.1.4.7 TORSEMIDE

14.3.1.1.4.8 TRIAMTERENE

14.3.1.1.5. ERYTHROPOIESIS-STIMULATING AGENTS (ESAS)

14.3.1.1.5.1 EPOETIN ALFA

14.3.1.1.5.2 EPOETIN BETA

14.3.1.1.5.3 DARBEPOETIN ALFA

14.3.1.1.5.4 OTHERS

14.3.1.1.6. ANTIBIOTICS

14.3.1.1.6.1 CEFTRIAXONE

14.3.1.1.6.2 CLINDAMYCIN

14.3.1.1.6.3 DOXYCYCLINE

14.3.1.1.6.4 MOXIFLOXACIN

14.3.1.1.6.5 AZITHROMYCIN

14.3.1.1.6.6 CIPROFLOXACIN

14.3.1.1.6.7 LEVOFLOXACIN

14.3.1.1.6.8 OTHERS

14.3.1.1.7. DIURETICS

14.3.1.1.8. PHOSPHATE BINDERS

14.3.1.1.9. OTHERS

14.3.1.2. MEDICATION, BY ROUTE OF ADMINISTRATION

14.3.1.2.1. ORAL

14.3.1.2.1.1 TABLETS

14.3.1.2.1.2 CAPSULES

14.3.1.2.2. PARENTERAL

14.3.1.2.2.1 INTRAVENOUS

14.3.1.2.2.2 SUBCUTANEOUS

14.3.1.2.2.3 OTHER

14.3.1.2.3. OTHERS

14.3.1.3. MEDICATION, BY PRODUCT TYPE

14.3.1.3.1. BRANDED/ REFERENCE DRUG

14.3.1.3.1.1 KARENDIA

14.3.1.3.1.2 CAPOTEN

14.3.1.3.1.3 PRINIVIL

14.3.1.3.1.4 DAPRUDUSTAT

14.3.1.3.1.5 DIOVAN

14.3.1.3.1.6 SECTRAL

14.3.1.3.1.7 JARDIANCE

14.3.1.3.1.8 BYSTOLIC

14.3.1.3.1.9 COREG

14.3.1.3.1.10 CRESTOR

14.3.1.3.1.11 FARXIGA

14.3.1.3.1.12 OTHERS

14.3.1.3.2. GENERIC/ BIOSIMILAR DRUG

14.3.1.3.2.1 QUINAPRIL

14.3.1.3.2.2 CANDESARTAN

14.3.1.3.2.3 NEBIVOLOL

14.3.1.3.2.4 ROSUVASTATIN

14.3.1.3.2.5 OTHERS

14.3.1.4. MEDICATION, BY PRESCRIPTION TYPE

14.3.1.4.1. PRESCRIPTION DRUG

14.3.1.4.2. OTC DRUG

14.3.2 DIALYSIS

14.3.2.1. HEMODIALYSIS

14.3.2.1.1. CENTER-USE HEMODIALYSIS

14.3.2.1.2. HOME-USE HEMODIALYSIS

14.3.2.2. PERITONEAL DIALYSIS

14.3.2.2.1. CENTER-USE HEMODIALYSIS

14.3.2.2.2. HOME-USE HEMODIALYSIS

14.3.3 KIDNEY TRANSPLANTATION

14.3.3.1. DECEASED-DONOR KIDNEY TRANSPLANTS

14.3.3.2. LIVING-DONOR KIDNEY TRANSPLANTS

15 GLOBAL CHRONIC KIDNEY DISEASE (CKD) MARKET, BY STAGE

15.1 OVERVIEW

15.2 STAGE 1

15.2.1 DIAGNOSIS

15.2.2 TREATMENT

15.3 STAGE 2

15.3.1 DIAGNOSIS

15.3.2 TREATMENT

15.4 STAGE 3

15.4.1 DIAGNOSIS

15.4.2 TREATMENT

15.5 STAGE 4

15.5.1 DIAGNOSIS

15.5.2 TREATMENT

15.6 STAGE 5

15.6.1 DIAGNOSIS

15.6.2 TREATMENT

16 GLOBAL CHRONIC KIDNEY DISEASE (CKD) MARKET, BY AGE GROUP

16.1 OVERVIEW

16.2 PEDIATRIC

16.3 ADULT

16.4 GERIATRIC

17 GLOBAL CHRONIC KIDNEY DISEASE (CKD) MARKET, BY GENDER

17.1 OVERVIEW

17.2 MALE

17.3 FEMALE

18 GLOBAL CHRONIC KIDNEY DISEASE (CKD) MARKET, BY END USER

18.1 OVERVIEW

18.2 HOSPITALS

18.2.1 PRIVATE

18.2.1.1. TIER 1

18.2.1.2. TIER 2

18.2.1.3. TIER 3

18.2.2 PUBLIC

18.2.2.1. TIER 1

18.2.2.2. TIER 2

18.2.2.3. TIER 3CLINICS

18.3 DIAGNOSTIC CENTERS

18.4 DIALYSIS CENTERS

18.5 HOMECARE SETTINGS

18.6 OTHERS

19 GLOBAL CHRONIC KIDNEY DISEASE (CKD) MARKET, BY DISTRIBUTION CHANNEL

19.1 OVERVIEW

19.2 DIRECT TENDER

19.2.1 HOSPITAL PHARMACY

19.2.2 ONLINE PHARMACY

19.2.3 RETAIL PHARMACY

19.3 OTHERS

20 GLOBAL CHRONIC KIDNEY DISEASE (CKD) MARKET, SWOT AND DBMR ANALYSIS

21 GLOBAL CHRONIC KIDNEY DISEASE (CKD) MARKET, COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

21.2 COMPANY SHARE ANALYSIS: EUROPE

21.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

21.4 MERGERS & ACQUISITIONS

21.5 NEW PRODUCT DEVELOPMENT & APPROVALS

21.6 EXPANSIONS

21.7 REGULATORY CHANGES

21.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

22 GLOBAL CHRONIC KIDNEY DISEASE (CKD) MARKET, BY GEOGRAPHY

22.1 GLOBAL CHRONIC KIDNEY DISEASE (CKD) MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

22.2 NORTH AMERICA

22.2.1 U.S.

22.2.1.1. U.S. CHRONIC KIDNEY DISEASE (CKD) MARKET, BY DIAGNOSIS AND TREATMENT

22.2.1.2. U.S. CHRONIC KIDNEY DISEASE (CKD) MARKET, BY STAGE

22.2.1.3. U.S. CHRONIC KIDNEY DISEASE (CKD) MARKET, BY AGE GROUP

22.2.1.4. U.S. CHRONIC KIDNEY DISEASE (CKD) MARKET, BY GENDER

22.2.1.5. U.S. CHRONIC KIDNEY DISEASE (CKD) MARKET, BY END USER

22.2.1.6. U.S. CHRONIC KIDNEY DISEASE (CKD) MARKET, BY DISTRUBUTION CHANNEL

22.2.2 CANADA

22.2.3 MEXICO

22.3 EUROPE

22.3.1 GERMANY

22.3.2 FRANCE

22.3.3 U.K.

22.3.4 HUNGARY

22.3.5 LITHUANIA

22.3.6 AUSTRIA

22.3.7 IRELAND

22.3.8 NORWAY

22.3.9 POLAND

22.3.10 ITALY

22.3.11 SPAIN

22.3.12 RUSSIA

22.3.13 TURKEY

22.3.14 NETHERLANDS

22.3.15 SWITZERLAND

22.3.16 REST OF EUROPE

22.4 ASIA-PACIFIC

22.4.1 JAPAN

22.4.2 CHINA

22.4.3 SOUTH KOREA

22.4.4 INDIA

22.4.5 AUSTRALIA

22.4.6 SINGAPORE

22.4.7 THAILAND

22.4.8 MALAYSIA

22.4.9 INDONESIA

22.4.10 PHILIPPINES

22.4.11 VIETNAM

22.4.12 REST OF ASIA-PACIFIC

22.5 SOUTH AMERICA

22.5.1 BRAZIL

22.5.2 ARGENTINA

22.5.3 PERU

22.5.4 COLOMBIA

22.5.5 VENEZUELA

22.5.6 REST OF SOUTH AMERICA

22.6 MIDDLE EAST AND AFRICA

22.6.1 SOUTH AFRICA

22.6.2 SAUDI ARABIA

22.6.3 UAE

22.6.4 EGYPT

22.6.5 KUWAIT

22.6.6 ISRAEL

22.6.7 REST OF MIDDLE EAST AND AFRICA

22.7 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

23 GLOBAL CHRONIC KIDNEY DISEASE (CKD) MARKET, COMPANY PROFILE

23.1 PFIZER INC.

23.1.1 COMPANY OVERVIEW

23.1.2 REVENUE ANALYSIS

23.1.3 GEOGRAPHIC PRESENCE

23.1.4 PRODUCT PORTFOLIO

23.1.5 RECENT DEVELOPMENTS

23.2 AMGEN INC.

23.2.1 COMPANY OVERVIEW

23.2.2 REVENUE ANALYSIS

23.2.3 GEOGRAPHIC PRESENCE

23.2.4 PRODUCT PORTFOLIO

23.2.5 RECENT DEVELOPMENTS

23.3 F. HOFFMANN-LA ROCHE LTD.

23.3.1 COMPANY OVERVIEW

23.3.2 REVENUE ANALYSIS

23.3.3 GEOGRAPHIC PRESENCE

23.3.4 PRODUCT PORTFOLIO

23.3.5 RECENT DEVELOPMENTS

23.4 ABBOTT.

23.4.1 COMPANY OVERVIEW

23.4.2 REVENUE ANALYSIS

23.4.3 GEOGRAPHIC PRESENCE

23.4.4 PRODUCT PORTFOLIO

23.4.5 RECENT DEVELOPMENTS

23.5 BRISTOL-MYERS SQUIBB COMPANY

23.5.1 COMPANY OVERVIEW

23.5.2 REVENUE ANALYSIS

23.5.3 GEOGRAPHIC PRESENCE

23.5.4 PRODUCT PORTFOLIO

23.5.5 RECENT DEVELOPMENTS

23.6 GSK PLC.

23.6.1 COMPANY OVERVIEW

23.6.2 REVENUE ANALYSIS

23.6.3 GEOGRAPHIC PRESENCE

23.6.4 PRODUCT PORTFOLIO

23.6.5 RECENT DEVELOPMENTS

23.7 FRESENIUS MEDICAL CARE

23.7.1 COMPANY OVERVIEW

23.7.2 REVENUE ANALYSIS

23.7.3 GEOGRAPHIC PRESENCE

23.7.4 PRODUCT PORTFOLIO

23.7.5 RECENT DEVELOPMENTS

23.8 KISSEI PHARMACEUTICAL CO., LTD.

23.8.1 COMPANY OVERVIEW

23.8.2 REVENUE ANALYSIS

23.8.3 GEOGRAPHIC PRESENCE

23.8.4 PRODUCT PORTFOLIO

23.8.5 RECENT DEVELOPMENTS

23.9 ASTRAZENECA

23.9.1 COMPANY OVERVIEW

23.9.2 REVENUE ANALYSIS

23.9.3 GEOGRAPHIC PRESENCE

23.9.4 PRODUCT PORTFOLIO

23.9.5 RECENT DEVELOPMENTS

23.1 MERCK & CO., INC.

23.10.1 COMPANY OVERVIEW

23.10.2 REVENUE ANALYSIS

23.10.3 GEOGRAPHIC PRESENCE

23.10.4 PRODUCT PORTFOLIO

23.10.5 RECENT DEVELOPMENTS

23.11 OTSUKA PHARMACEUTICAL CO., LTD.

23.11.1 COMPANY OVERVIEW

23.11.2 REVENUE ANALYSIS

23.11.3 GEOGRAPHIC PRESENCE

23.11.4 PRODUCT PORTFOLIO

23.11.5 RECENT DEVELOPMENTS

23.12 JOHNSON & JOHNSON

23.12.1 COMPANY OVERVIEW

23.12.2 REVENUE ANALYSIS

23.12.3 GEOGRAPHIC PRESENCE

23.12.4 PRODUCT PORTFOLIO

23.12.5 RECENT DEVELOPMENTS

23.13 FIBROGEN, INC.

23.13.1 COMPANY OVERVIEW

23.13.2 REVENUE ANALYSIS

23.13.3 GEOGRAPHIC PRESENCE

23.13.4 PRODUCT PORTFOLIO

23.13.5 RECENT DEVELOPMENTS

23.14 SIEMENS HEALTHCARE PRIVATE LIMITED

23.14.1 COMPANY OVERVIEW

23.14.2 REVENUE ANALYSIS

23.14.3 GEOGRAPHIC PRESENCE

23.14.4 PRODUCT PORTFOLIO

23.14.5 RECENT DEVELOPMENTS

23.15 NOVA BIOMEDICAL

23.15.1 COMPANY OVERVIEW

23.15.2 REVENUE ANALYSIS

23.15.3 GEOGRAPHIC PRESENCE

23.15.4 PRODUCT PORTFOLIO

23.15.5 RECENT DEVELOPMENTS

23.16 LUPIN

23.16.1 COMPANY OVERVIEW

23.16.2 REVENUE ANALYSIS

23.16.3 GEOGRAPHIC PRESENCE

23.16.4 PRODUCT PORTFOLIO

23.16.5 RECENT DEVELOPMENTS

23.17 ZYDUS GROUP

23.17.1 COMPANY OVERVIEW

23.17.2 REVENUE ANALYSIS

23.17.3 GEOGRAPHIC PRESENCE

23.17.4 PRODUCT PORTFOLIO

23.17.5 RECENT DEVELOPMENTS

23.18 BAYER AG

23.18.1 COMPANY OVERVIEW

23.18.2 REVENUE ANALYSIS

23.18.3 GEOGRAPHIC PRESENCE

23.18.4 PRODUCT PORTFOLIO

23.18.5 RECENT DEVELOPMENTS

23.19 AKEBIA THERAPEUTICS, INC.

23.19.1 COMPANY OVERVIEW

23.19.2 REVENUE ANALYSIS

23.19.3 GEOGRAPHIC PRESENCE

23.19.4 PRODUCT PORTFOLIO

23.19.5 RECENT DEVELOPMENTS

23.2 CSL VIFOR

23.20.1 COMPANY OVERVIEW

23.20.2 REVENUE ANALYSIS

23.20.3 GEOGRAPHIC PRESENCE

23.20.4 PRODUCT PORTFOLIO

23.20.5 RECENT DEVELOPMENTS

23.21 NOVARTIS

23.21.1 COMPANY OVERVIEW

23.21.2 REVENUE ANALYSIS

23.21.3 GEOGRAPHIC PRESENCE

23.21.4 PRODUCT PORTFOLIO

23.21.5 RECENT DEVELOPMENTS

23.22 SANOFI

23.22.1 COMPANY OVERVIEW

23.22.2 REVENUE ANALYSIS

23.22.3 GEOGRAPHIC PRESENCE

23.22.4 PRODUCT PORTFOLIO

23.22.5 RECENT DEVELOPMENTS

23.23 REATA PHARMACEUTICALS

23.23.1 COMPANY OVERVIEW

23.23.2 REVENUE ANALYSIS

23.23.3 GEOGRAPHIC PRESENCE

23.23.4 PRODUCT PORTFOLIO

23.23.5 RECENT DEVELOPMENTS

23.24 TRICIDA, INC.

23.24.1 COMPANY OVERVIEW

23.24.2 REVENUE ANALYSIS

23.24.3 GEOGRAPHIC PRESENCE

23.24.4 PRODUCT PORTFOLIO

23.24.5 RECENT DEVELOPMENTS

23.25 BOEHRINGER INGELHEIM INTERNATIONAL GMBH.

23.25.1 COMPANY OVERVIEW

23.25.2 REVENUE ANALYSIS

23.25.3 GEOGRAPHIC PRESENCE

23.25.4 PRODUCT PORTFOLIO

23.25.5 RECENT DEVELOPMENTS

23.26 ARDELYX

23.26.1 COMPANY OVERVIEW

23.26.2 REVENUE ANALYSIS

23.26.3 GEOGRAPHIC PRESENCE

23.26.4 PRODUCT PORTFOLIO

23.26.5 RECENT DEVELOPMENTS

23.27 CARA THERAPEUTICS.

23.27.1 COMPANY OVERVIEW

23.27.2 REVENUE ANALYSIS

23.27.3 GEOGRAPHIC PRESENCE

23.27.4 PRODUCT PORTFOLIO

23.27.5 RECENT DEVELOPMENTS

23.28 CALLIDITAS THERAPEUTICS AB.

23.28.1 COMPANY OVERVIEW

23.28.2 REVENUE ANALYSIS

23.28.3 GEOGRAPHIC PRESENCE

23.28.4 PRODUCT PORTFOLIO

23.28.5 RECENT DEVELOPMENTS

23.29 TRAVERE THERAPEUTICS

23.29.1 COMPANY OVERVIEW

23.29.2 REVENUE ANALYSIS

23.29.3 GEOGRAPHIC PRESENCE

23.29.4 PRODUCT PORTFOLIO

23.29.5 RECENT DEVELOPMENTS

23.3 OMEROS CORPORATION

23.30.1 COMPANY OVERVIEW

23.30.2 REVENUE ANALYSIS

23.30.3 GEOGRAPHIC PRESENCE

23.30.4 PRODUCT PORTFOLIO

23.30.5 RECENT DEVELOPMENTS

24 RELATED REPORTS

25 CONCLUSION

26 QUESTIONNAIRE

27 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.