Global Cocoa And Chocolate Market

Market Size in USD Billion

CAGR :

%

USD

74.39 Billion

USD

115.91 Billion

2021

2029

USD

74.39 Billion

USD

115.91 Billion

2021

2029

| 2022 –2029 | |

| USD 74.39 Billion | |

| USD 115.91 Billion | |

|

|

|

|

Market Analysis and Size

Cocoa is a substance made from the seeds of the cocoa tree. Although it originated in Latin America, cocoa is now grown in nearly every tropical region, from West and Central Africa to Asia and Oceania. Cocoa seeds are used to produce a range of products such as cocoa liquor, cocoa butter, and cocoa powder.

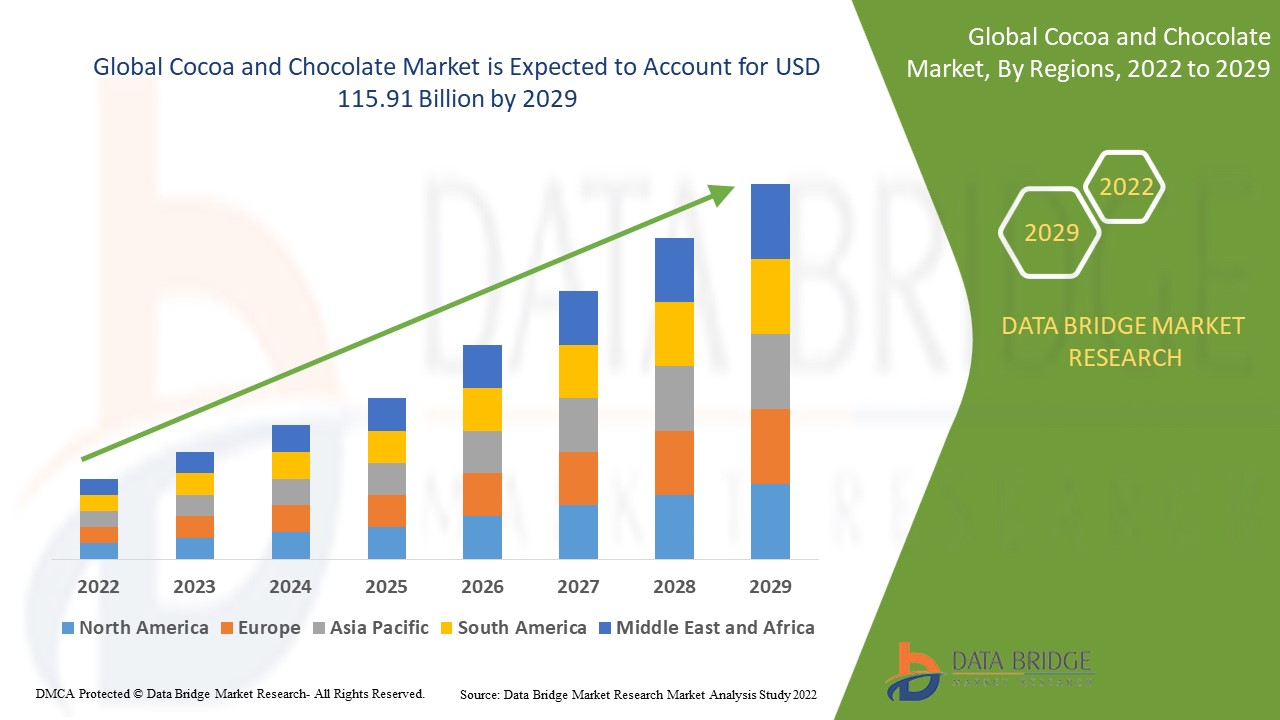

Data Bridge Market Research analyses that the cocoa and chocolate market was valued at USD 74.39 million in 2021 and is expected to reach the value of USD 115.91 billion by 2029, at a CAGR of 5.7% during the forecast period of 2022 to 2029.

Market Definition

Cocoa is an unadulterated form of chocolate. Chocolate is made from cocoa beans and has gone through the same manufacturing process as cocoa. However, cocoa butter is not removed from chocolate. Cocoa butter contributes to chocolate's smoother and richer consistency.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Chocolate Type (Dark, White, Filled, Milk), Cocoa Type (Cocoa beans, Cocoa butter, Cocoa powder & cake, Cocoa liquor & paste, Cocoa nibs, Others), Application (Confectionary, Cosmetics, Pharmaceuticals, Food & Beverage), Distribution Channel (Sales Channel, Distributors, Traders, Dealers) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, Sweden, Poland, Denmark, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Cemoi Chocolatier (France), Republica del Cacao (Ecuador), Nestlé S.A. (Switzerland), Mars Incorporated (U.S.), Fuji Oil Holdings Inc. (Japan), Guittard Chocolate Co. (U.S.), Ghirardelli Chocolate Co. (U.S.),, Varihona Inc. (France), Barry Callebaut AG (Switzerland), Alpezzi Chocolate SA De CV (Mexico), Kerry Group Plc (Ireland), Olam International Ltd. (Singapore), Tcho Ventures Inc. (U.S.), The Hershey Company (U.S.), Cargill, Incorporated (U.S.), Blommer Chocolate Company (U.S.), Foley's Candies LP (Canada), Puratos Group Nv (Belgium), Ferrero International S.A. (Italy) |

|

Opportunities |

|

Cocoa and Chocolate Market Dynamics

Drivers

- Growing awareness about benefits of cocoa and chocolate

The growing awareness of the health benefits of consuming cocoa-rich products drives the growth of the cocoa and chocolate market. Cocoa helps reduce hypertension, chronic fatigue syndrome, protection against sunburn, and other health benefits to the human body. Cocoa also contains polyphenols, which serve to protect bodily tissues from oxidative stress and related diseases such as cancer and inflammation. These factors are also propelling the cocoa and chocolate markets forward.

Growing demand for cocoa based products

Increased demand for chocolate and related products such as milk chocolate, sweet chocolate, and dark chocolate, and advertising by manufacturers to increase brand recognition, are driving the growth of the cocoa and chocolate market. Progresses in commercial farming techniques are used to produce cocoa, which is expected to increase supply and thus improve growth prospects in the future.

Opportunity

Theo bromine, which is found in cocoa powder, helps to reduce inflammation and protects against serious diseases. As cocoa contains a high concentration of phytonutrients while being low in fat and sugar, the calories obtained from cocoa powder are rich in beneficial compounds. Raw products are often less processed and healthier because they are made from agitated, dried, unroasted cacao beans. Nonetheless, dark chocolate with at least 70% cacao is a good source of antioxidants and minerals, creating a huge market opportunity.

Restraints

The market's growth is hampered by volatile cocoa prices and limited cocoa production. Cacao products, such as unsweetened cocoa powder, nibs, and dark chocolate, are high in minerals. Raw cacao goods that have been minimally processed contain less or no added sugar and are higher in antioxidants than those that have been heavily processed, which is impeding market growth.

This cocoa and chocolate market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the cocoa and chocolate market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Cocoa and Chocolate Market

The cocoa market was impacted by low sales volumes caused by the COVID-19 pandemic, as well as supply-side issues related to quality and certification. In terms of exports, the Fine Cacao and Chocolate Institute (FCCI) conducted a survey on the impact of the COVID-19 pandemic, and the results were troubling. According to reports in the Dominican Republic, the harsh lockdown prevented producers and agricultural workers from visiting the plantations for several weeks until the authorities granted exceptions. As a result of the disruption in the raw material supply chain, followed by lockdown, an increasing number of specialty stores are remaining closed for an extended period of time, and volume consumption of premium chocolates is decreasing.

Global Cocoa and Chocolate Market Scope

The cocoa and chocolate market is segmented on the basis of chocolate type, cocoa type, application and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Chocolate type

- Dark

- White

- Filled

- Milk

Cocoa type

- Cocoa beans

- Cocoa butter

- Cocoa powder & cake

- Cocoa liquor & paste

- Cocoa nibs

- Others

Application

- Confectionary

- Cosmetics

- Pharmaceuticals

- Food & Beverage

Distribution channel

- Sales Channel

- Distributors

- Traders

- Dealers

Cocoa and Chocolate Market Regional Analysis/Insights

The cocoa and chocolate market is analysed and market size insights and trends are provided by country, type of chocolate type, cocoa type, application and distribution channel as referenced above.

The countries covered in the cocoa and chocolate market report are U.S., Canada and Mexico in North America, Germany, Sweden, Poland, Denmark, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

The European region has the largest market share in the global cocoa and chocolate market, followed by North America, Asia-Pacific, the Middle East and Africa, and South America. In Europe, Germany has the largest market share due to the widespread use of cocoa and chocolate in industrial applications. For example, Mondelez International, Nestle, and Lindt & Sprüngli, three of the world's largest confectionery companies, use cocoa and chocolate to make chocolates containing roasted cocoa beans. However, in North America, the United States has occupied the largest market share due to the consumption of cocoa beans and butter used in the food and beverage sector, as well as the preference of coffee flavour among American consumers.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Cocoa and Chocolate Market Share Analysis

The cocoa and chocolate market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to cocoa and chocolate market.

Some of the major players operating in the cocoa and chocolate market are:

- Cemoi Chocolatier (France)

- Republica del Cacao (Ecuador)

- Nestlé S.A. (Switzerland)

- Mars Incorporated (U.S.)

- Fuji Oil Holdings Inc. (Japan)

- Guittard Chocolate Co. (U.S.)

- Ghirardelli Chocolate Co. (U.S.)

- Varihona Inc. (France)

- Barry Callebaut AG (Switzerland)

- Alpezzi Chocolate SA De CV (Mexico)

- Kerry Group Plc (Ireland),

- Olam International Ltd. (Singapore)

- Tcho Ventures Inc. (U.S.)

- The Hershey Company (U.S.)

- Cargill, Incorporated (U.S.)

- Blommer Chocolate Company (U.S.)

- Foley's Candies LP (Canada)

- Puratos Group Nv (Belgium)

- Ferrero International S.A. (Italy)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL COCOA AND CHOCOLATE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL COCOA AND CHOCOLATE MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL COCOA AND CHOCOLATE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 SUPPLY CHAIN ANALYSIS

5.2 VALUE CHAIN ANALYISIS

5.3 FACTORS INFLUENCING PURCHASING DECISION OF END USER

5.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.5 INDUSTRY TRENDS AND FUTURE PERSPECTIBE

5.6 CONSUMER LEVEL TRENDS

5.7 TECHNOCOGICAL ADVANCEMENTS

5.8 RAW MATERIAL IMPORT EXPORT ANALYSIS

5.9 RAW MATERIAL PRODUCTION AND CONSUMPTION ANALYSIS

5.1 NEW PRODUCT LAUNCHES

6 REGULATORY FRAMEWORK AND GUIDELINES

7 POST COVID-19 IMPACT ANALYSIS

8 GLOBAL COCOA AND CHOCOLATE MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 COCOA

8.2.1 COCOA, BY COCOA PRODUCT TYPE

8.2.1.1. COCOA BUTTER

8.2.1.1.1. COCOA BUTTER, BY TYPE

8.2.1.1.2. PARTIALLY DEODORISED

8.2.1.1.3. FULLY DEODORISED

8.2.1.2. COCOA POWDER

8.2.1.2.1. COCOA POWDER, BY TYPE

8.2.1.2.2. NATURALLY PROCESSED COCOA POWDER

8.2.1.2.3. BENSDROP DUTCH PROCESS COCOA POWDER

8.2.1.2.4. BROWN ALKALIZED COCOA POWDER

8.2.1.2.5. REDDISH BROWN ALKALIZED COCOA POWDER

8.2.1.2.6. RED ALKALIZED COCOA POWDER

8.2.1.2.7. BLACK ALKALIZED COCOA POWDER

8.2.1.2.8. DOUBLE DUTCH COCOA BLEND

8.2.1.2.9. COCOA ROUGE POWDER

8.2.1.3. COCOA LIQUOR & PASTE

8.2.1.3.1. COCOA LIQUOR & PASTE, BY FORM

8.2.1.3.2. BLOCKS

8.2.1.3.3. INGOTS

8.2.1.3.4. EASY-TO-MELT LIQUOR THINS

8.2.1.4. COCOA NIBS

8.2.1.5. COCOA LIQUID EXTRACTS

8.2.1.6. OTHERS

8.2.2 COCOA, BY COCOA BEAN TYPE

8.2.2.1. FORASTERO COCOA

8.2.2.2. CRIOLLO COCOA

8.2.2.3. TRINITARIO COCOA

8.2.2.4. OTHERS

8.2.3 COCOA, BY COCOA COLOR

8.2.3.1. BROWN

8.2.3.1.1. LIGHT BROWN

8.2.3.1.2. DARK BROWN

8.2.3.2. RED

8.2.3.2.1. LIGHT RED

8.2.3.2.2. DARK RED

8.3 CHOCOLATE

8.3.1 CHOCOLATE, BY TYPE

8.3.1.1. MILK CHOCOLATE

8.3.1.2. DARK CHOCLATE

8.3.1.2.1. DARK CHOCLATE, BY TYPE

8.3.1.2.2. BITTERSWEET

8.3.1.2.3. SEMI-SWEET

8.3.1.2.4. SWEET DARK

8.3.1.3. WHITE CHOCLATE

8.3.2 CHOCOLATE, BY GRADE

8.3.2.1. GRADE I

8.3.2.2. GRADE II

8.3.2.3. GRADE III

8.3.3 CHOCOLATE, BY FROM

8.3.3.1. CHOCOLATE BLOCK

8.3.3.2. CHOCLATE CHUNKS

8.3.3.3. LIQUID CHOCOLATE

8.3.3.4. OTHERS (IF ANY)

8.3.4 CHOCOLATE, BY COCOA CONTENT

8.3.4.1. LESS THAN 50%

8.3.4.2. 50-60%

8.3.4.3. 61-70%

8.3.4.4. 71-80%

8.3.4.5. 81-90%

8.3.4.6. 91-100%

8.3.5 CHOCOLATE, BY FLAVOR

8.3.5.1. CLASSIC/ORIGINAL

8.3.5.2. INFUSED FLAVOR

8.3.5.2.1. CARAMEL

8.3.5.2.2. BUTTERSCOTCH

8.3.5.2.3. PEPPERMINT

8.3.5.2.4. VANILLA

8.3.5.2.5. SEA SALT

8.3.5.2.6. MOCHA

8.3.5.2.7. NUT

8.3.5.2.8. FRUIT

8.3.5.2.9. OTHERS

9 GLOBAL COCOA AND CHOCOLATE MARKET, BY NATURE

9.1 OVERVIEW

9.2 CONVENTIONAL

9.2.1 CONVENTIONAL, BY PRODUCT TYPE

9.2.1.1. COCOA

9.2.1.2. CHOCOLATE

9.3 ORGANIC

9.3.1 ORGANIC, BY PRODUCT TYPE

9.3.1.1. COCOA

9.3.1.2. CHOCOLATE

10 GLOBAL COCOA AND CHOCOLATE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FOOD

10.3 CONFECTIONERY

10.3.1 CONFECTIONERY, BY TYPE

10.3.1.1. CHOCOLATE

10.3.1.1.1. WHITE CHOCOLATES

10.3.1.1.2. DARK CHOCOLATES

10.3.1.1.3. MILK CHOCOLATES

10.3.1.1.3.1 HARD-BOILED SWEETS

10.3.1.1.3.2 MINTS

10.3.1.1.3.3 GUMS & JELLIES

10.3.1.1.3.4 CHOCOLATE

10.3.1.1.3.5 CHOCOLATE SYRUPS

10.3.1.1.3.6 CARAMELS & TOFFEES

10.3.1.1.3.7 SUGAR CONFECTIONERY CONTAINING CHOCOLATE

10.3.1.1.3.8 OTHERS

10.3.1.2. CONFECTIONERY, BY PRODUCT TYPE

10.3.1.2.1. COCOA

10.3.1.2.2. CHOCOLATE

10.4 BAKERY PRODUCTS

10.4.1 BAKERY PRODUCT, BY TYPE

10.4.1.1. BREAD & ROLLS

10.4.1.2. CAKES, PASTRIES & TRUFFLE

10.4.1.3. BISCUIT

10.4.1.4. TART & PIES

10.4.1.5. BROWNIES

10.4.1.6. COOKIES & CRACKERS

10.4.1.7. OTHERS

10.4.2 BAKERY PRODUCTS, BY PRODUCT TYPE

10.4.2.1. COCOA

10.4.2.2. CHOCOLATE

10.5 DAIRY PRODUCTS

10.5.1 SDAIRY PRODUCTS, BY TYPE

10.5.2 YOGURT

10.5.3 ICE CREAM

10.5.4 DAIRY DESSERTS

10.5.5 OTHERS

10.5.5.1. DAIRY PRODUCTS, BY PRODUCT TYPE

10.5.5.1.1. COCOA

10.5.5.1.2. CHOCOLATE

10.6 PROCESSED FOODS

10.6.1 PROCESSED FOOD, BY PRODUCT TYPE

10.6.1.1. COCOA

10.6.1.2. CHOCOLATE

10.7 FUNCTIONAL FOODS

10.7.1 FUNCTIONAL FOODS, BY PRODUCT TYPE

10.7.1.1. COCOA

10.7.1.2. CHOCOLATE

10.7.2 BABY FOOD

10.7.2.1. BABY FOOD, BY PRODUCT TYPE

10.7.2.1.1. COCOA

10.7.2.1.2. CHOCOLATE

10.8 DRESSINGS

10.8.1 DRESSINGS, BY PRODUCT TYPE

10.8.1.1. COCOA

10.8.1.2. CHOCOLATE

10.9 SPORTS NUTRITION

10.9.1 SPORTS NUTRITION, BY PRODUCT TYPE

10.9.1.1. COCOA

10.9.1.2. CHOCOLATE

10.1 DAIRY ALTERNATIVE

10.10.1 DAIRY ALTERNATIVE, BY TYPE

10.10.1.1. DAIRY MILK ALTERNATIVE

10.10.1.2. DAIRY YOGURT ALTERNATIVE

10.10.1.3. DAIRY ICE CREAM ALTERNATIVE

10.10.1.4. OTHERS

10.10.2 DAIRY ALTERNATIVE, BY PRODUCT TYPE

10.10.2.1. COCOA

10.10.2.2. CHOCOLATE

10.11 BEVERAGES

10.11.1 BEVERAGES, BY TYPE

10.11.1.1. ALCOHOLIC

10.11.1.1.1. ALCOHOLIC, BY TYPE

10.11.1.1.1.1 RUM

10.11.1.1.1.2 WHIISKEY

10.11.1.1.1.3 BEER

10.11.1.1.1.4 VODKA

10.11.1.1.1.5 WINE

10.11.1.1.1.6 OTHERS

10.11.1.2. NON-ALCOHOLIC

10.11.1.2.1. NON-ALCOHOLIC, BY TYPE

10.11.1.2.1.1 RTD COFFEE

10.11.1.2.1.2 FLAVOURED DAIRY MILK

10.11.1.2.1.3 FLAVORED PLANT-BASED MILK

10.11.1.2.1.4 SPORTS DRINKS

10.11.1.2.1.5 SMOOTHIES

10.11.1.2.1.6 OTHERS

10.11.2 BEVERAGES, BY PRODUCT TYPE

10.11.2.1. COCOA

10.11.2.2. CHOCOLATE

10.12 PERSONAL CARE

10.12.1 PERSONAL CARE, BY TYPE

10.12.1.1. SKIN CARE

10.12.1.1.1. MOISTURIZER & LOTIN

10.12.1.1.2. SERUM

10.12.1.1.3. CREAM

10.12.1.1.4. MASSAGE OIL

10.12.1.1.5. SCRUB

10.12.1.1.6. SOAP & BODYWASH

10.12.1.1.7. LIP CARE PRODUCTS

10.12.1.1.8. OTHERS

10.12.1.2. HAIR CARE

10.12.1.2.1. SERUM & OINTMENTS

10.12.1.2.2. CONDITIONER

10.12.1.2.3. SHAMPOO

10.12.1.2.4. OTHERS

10.12.2 PERSONAL CARE PRODUCTS, BY PRODUCT TYPE

10.12.2.1. COCOA

10.12.2.1.1. CHOCOLATE

10.13 PHARMACEUTICALS

10.13.1 PHARMACEUTICALS , BY TYPE

10.13.1.1. SYRUPS

10.13.1.2. CHEWABLE TABLETS

10.13.1.3. SUSPENSIONS OR GUMS

10.13.1.4. OTHERS

10.13.2 PHARMACEUTICALS , BY PRODUCT TYPE

10.13.2.1. COCOA

10.13.2.2. CHOCOLATE

10.14 ANIMAL FEED

10.14.1 ANIMAL FEED, BY TYPE

10.14.1.1. RUMINANT FEED

10.14.1.2. POULTRY FEED

10.14.1.3. SWINE FEED

10.14.1.4. AQUAFEED

10.14.2 ANIMAL FEED, BY PRODUCT TYPE

10.14.2.1. COCOA

10.14.2.2. CHOCOLATE

11 GLOBAL COCOA AND CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT

11.3 INDIRECT

12 GLOBAL COCOA AND CHOCOLATE MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12.5 MERGERS & ACQUISITIONS

12.6 NEW PRODUCT DEVELOPMENT & APPROVALS

12.7 EXPANSIONS & PARTNERSHIP

12.8 REGULATORY CHANGES

13 GLOBAL COCOA AND CHOCOLATE MARKET, BY GEOGRAPHY

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

13.2 EUROPE

13.2.1 GERMANY

13.2.2 U.K.

13.2.3 ITALY

13.2.4 FRANCE

13.2.5 SPAIN

13.2.6 SWITZERLAND

13.2.7 NETHERLANDS

13.2.8 BELGIUM

13.2.9 RUSSIA

13.2.10 TURKEY

13.2.11 REST OF EUROPE

13.3 ASIA-PACIFIC

13.3.1 JAPAN

13.3.2 CHINA

13.3.3 SOUTH KOREA

13.3.4 INDIA

13.3.5 AUSTRALIA

13.3.6 SINGAPORE

13.3.7 THAILAND

13.3.8 INDONESIA

13.3.9 MALAYSIA

13.3.10 PHILIPPINES

13.3.11 REST OF ASIA-PACIFIC

13.4 SOUTH AMERICA

13.4.1 BRAZIL

13.4.2 ARGENTINA

13.4.3 REST OF SOUTH AMERICA

13.5 MIDDLE EAST AND AFRICA

13.5.1 SOUTH AFRICA

13.5.2 UAE

13.5.3 SAUDI ARABIA

13.5.4 KUWAIT

13.5.5 REST OF MIDDLE EAST AND AFRICA

14 GLOBAL COCOA AND CHOCOLATE MARKET, SWOT & DBMR ANALYSIS

15 GLOBAL COCOA AND CHOCOLATE MARKET, COMPANY PROFILE

15.1 THE HERSHEYS COMPANY

15.1.1 COMPANY OVERVIEW

15.1.2 REVENUE ANALYSIS

15.1.3 GEOGRAPHIC PRESENCE

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 ARCHER DANIELS MIDLAND (ADM)

15.2.1 COMPANY OVERVIEW

15.2.2 REVENUE ANALYSIS

15.2.3 GEOGRAPHIC PRESENCE

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 PURATOS GROUPS

15.3.1 COMPANY OVERVIEW

15.3.2 REVENUE ANALYSIS

15.3.3 GEOGRAPHIC PRESENCE

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 GHIRARDELLI CHOCOLATE COMPANY

15.4.1 COMPANY OVERVIEW

15.4.2 REVENUE ANALYSIS

15.4.3 GEOGRAPHIC PRESENCE

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 JIANGSU WUXI TAIHU COCOA FOOD CO

15.5.1 COMPANY OVERVIEW

15.5.2 REVENUE ANALYSIS

15.5.3 GEOGRAPHICAL PRESENCE

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 UCP

15.6.1 COMPANY OVERVIEW

15.6.2 REVENUE ANALYSIS

15.6.3 GEOGRAPHICAL PRESENCE

15.6.4 PRODUCT PORTFOLIO

15.6.5 RECENT DEVELOPMENTS

15.7 COCOABEAN

15.7.1 COMPANY OVERVIEW

15.7.2 REVENUE ANALYSIS

15.7.3 GEOGRAPHICAL PRESENCE

15.7.4 PRODUCT PORTFOLIO

15.7.5 RECENT DEVELOPMENTS

15.8 MONER COCOA S.A.

15.8.1 COMPANY OVERVIEW

15.8.2 REVENUE ANALYSIS

15.8.3 GEOGRAPHICAL PRESENCE

15.8.4 PRODUCT PORTFOLIO

15.8.5 RECENT DEVELOPMENTS

15.9 CARGILL INCORPORATED

15.9.1 COMPANY OVERVIEW

15.9.2 REVENUE ANALYSIS

15.9.3 GEOGRAPHICAL PRESENCE

15.9.4 PRODUCT PORTFOLIO

15.9.5 RECENT DEVELOPMENTS

15.1 INDCRE S.A.

15.10.1 COMPANY OVERVIEW

15.10.2 REVENUE ANALYSIS

15.10.3 GEOGRAPHICAL PRESENCE

15.10.4 PRODUCT PORTFOLIO

15.10.5 RECENT DEVELOPMENTS

15.11 AVI NATURALS

15.11.1 COMPANY OVERVIEW

15.11.2 REVENUE ANALYSIS

15.11.3 GEOGRAPHICAL PRESENCE

15.11.4 PRODUCT PORTFOLIO

15.11.5 RECENT DEVELOPMENTS

15.12 OLAM INTERNATIONAL LIMITED

15.12.1 COMPANY OVERVIEW

15.12.2 REVENUE ANALYSIS

15.12.3 GEOGRAPHICAL PRESENCE

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPMENTS

15.13 AGRO PRODUCTS & AGENCIES

15.13.1 COMPANY OVERVIEW

15.13.2 REVENUE ANALYSIS

15.13.3 GEOGRAPHICAL PRESENCE

15.13.4 PRODUCT PORTFOLIO

15.13.5 RECENT DEVELOPMENTS

15.14 GRASSE INTERNATIONAL

15.14.1 COMPANY OVERVIEW

15.14.2 REVENUE ANALYSIS

15.14.3 GEOGRAPHICAL PRESENCE

15.14.4 PRODUCT PORTFOLIO

15.14.5 RECENT DEVELOPMENTS

15.15 JUREMONT PTY LTD

15.15.1 COMPANY OVERVIEW

15.15.2 REVENUE ANALYSIS

15.15.3 GEOGRAPHICAL PRESENCE

15.15.4 PRODUCT PORTFOLIO

15.15.5 RECENT DEVELOPMENTS

15.16 HEALTHY VALLEY ORGANICS

15.16.1 COMPANY OVERVIEW

15.16.2 REVENUE ANALYSIS

15.16.3 GEOGRAPHICAL PRESENCE

15.16.4 PRODUCT PORTFOLIO

15.16.5 RECENT DEVELOPMENTS

15.17 MALTRA FOODS

15.17.1 COMPANY OVERVIEW

15.17.2 REVENUE ANALYSIS

15.17.3 GEOGRAPHICAL PRESENCE

15.17.4 PRODUCT PORTFOLIO

15.17.5 RECENT DEVELOPMENTS

15.18 MACHU PICCHU FOODS

15.18.1 COMPANY OVERVIEW

15.18.2 REVENUE ANALYSIS

15.18.3 GEOGRAPHICAL PRESENCE

15.18.4 PRODUCT PORTFOLIO

15.18.5 RECENT DEVELOPMENTS

15.19 BARRY CALLEBAUT

15.19.1 COMPANY OVERVIEW

15.19.2 REVENUE ANALYSIS

15.19.3 GEOGRAPHICAL PRESENCE

15.19.4 PRODUCT PORTFOLIO

15.19.5 RECENT DEVELOPMENTS

15.2 JBCOCOA SDN. BHD.

15.20.1 COMPANY OVERVIEW

15.20.2 REVENUE ANALYSIS

15.20.3 GEOGRAPHICAL PRESENCE

15.20.4 PRODUCT PORTFOLIO

15.20.5 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 RELATED REPORTS

17 CONCLUSION

18 QUESTIONNAIRE

19 ABOUT DATA BRIDGE MARKET RESEARCH

Global Cocoa And Chocolate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cocoa And Chocolate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cocoa And Chocolate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.