Global Coffee Premixes Market

Market Size in USD Billion

CAGR :

%

USD

79.92 Billion

USD

135.27 Billion

2024

2032

USD

79.92 Billion

USD

135.27 Billion

2024

2032

| 2025 –2032 | |

| USD 79.92 Billion | |

| USD 135.27 Billion | |

|

|

|

|

Coffee Premixes Market Size

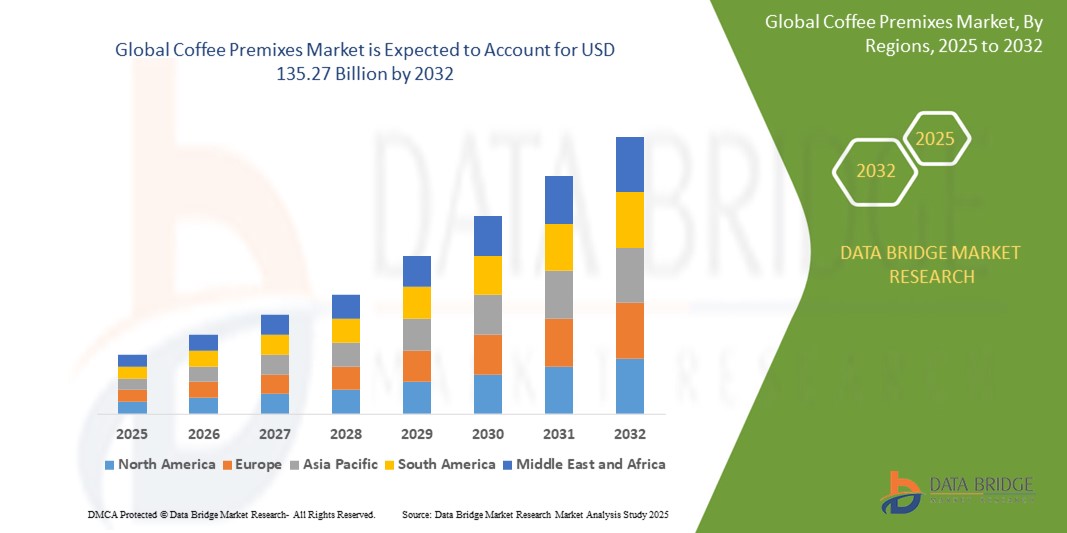

- The global coffee premixes market size was valued at USD 79.92 billion in 2024 and is expected to reach USD 135.27 billion by 2032, at a CAGR of 6.80% during the forecast period

- The market growth is primarily driven by the increasing demand for convenient, ready-to-drink coffee solutions, rising urbanization, and evolving consumer preferences for diverse coffee flavors and brewing styles

- In addition, the growing popularity of premium and specialty coffee premixes, coupled with the expansion of e-commerce platforms, is significantly contributing to the market's robust growth trajectory

Coffee Premixes Market Analysis

- Coffee premixes, offering pre-blended coffee formulations for quick and consistent preparation, are gaining traction as a convenient solution for consumers seeking quality coffee experiences at home, work, or on-the-go

- The surge in demand is fueled by busy lifestyles, the growing café culture, and increasing consumer interest in experimenting with unique flavors and brewing styles, particularly among younger demographics

- North America dominated the coffee premixes market with the largest revenue share of 38.5% in 2024, driven by high coffee consumption, a strong presence of key manufacturers, and widespread adoption of instant and specialty coffee premixes. The U.S. market is particularly strong due to innovations in flavored and premium coffee premixes

- Asia-Pacific is anticipated to be the fastest-growing region during the forecast period, propelled by rising disposable incomes, rapid urbanization, and a growing preference for convenient coffee solutions in countries such as China, India, and Japan

- The black coffee premix segment dominated the largest market revenue share of 38% in 2024, driven by its widespread popularity among consumers seeking bold flavors and convenience in preparation.

Report Scope and Coffee Premixes Market Segmentation

|

Attributes |

Coffee Premixes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Coffee Premixes Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The global coffee premixes market is experiencing a notable trend toward the integration of Artificial Intelligence (AI) and Big Data analytics

- These technologies enable advanced consumer behavior analysis, supply chain optimization, and personalized product recommendations, providing deeper insights into market trends and preference

- AI-powered solutions allow for proactive inventory management, predicting demand fluctuations based on seasonal trends, regional preferences, or promotional campaigns

- For instance, companies are leveraging AI-driven platforms to analyze consumer purchasing patterns, tailoring flavor profiles or packaging sizes to specific demographics, or optimizing distribution routes to reduce costs and improve efficiency

- This trend enhances the value proposition of coffee premix products, making them more appealing to retailers, e-commerce platforms, and end consumers

- AI algorithms can analyze a wide range of consumer data, including flavor preferences, purchase frequency, and brewing habits, to support targeted marketing and product innovation

Coffee Premixes Market Dynamics

Driver

“Rising Demand for Convenient and Premium Coffee Experiences”

- Increasing consumer demand for convenient, high-quality coffee solutions, such as instant and specialty premixes, is a major driver for the global coffee premixes market

- Coffee premixes enhance consumer convenience by offering quick preparation options such as instant, cappuccino, latte, espresso, and regular brewing styles, catering to busy lifestyles

- Government and industry initiatives promoting sustainable sourcing and certifications, such as Fair Trade and Rainforest Alliance, are contributing to the adoption of premium coffee premixes

- The proliferation of e-commerce platforms and advancements in packaging technology are further enabling the expansion of coffee premix applications, offering greater accessibility and longer shelf life for diverse flavors and forms

- Manufacturers are increasingly offering innovative premix formulations, such as health-focused green coffee blends or unique flavors such as chocolate and honey cinnamon, to meet consumer expectations and enhance product value

Restraint/Challenge

“High Production Costs and Supply Chain Complexities”

- The substantial costs associated with sourcing high-quality coffee beans, flavor additives, and advanced packaging for premixes can be a significant barrier to market growth, particularly for smaller manufacturers or in price-sensitive markets

- Developing and blending specialized formulations, such as soluble or roasted/grounded premixes with unique flavors such as chicory or rosemary, can be complex and resource-intensive

- In addition, supply chain disruptions and sustainability concerns pose major challenges. Coffee premixes rely on globally sourced ingredients, making them vulnerable to fluctuations in raw material prices, climate change impacts, and logistical issues

- The fragmented regulatory landscape across different countries regarding food safety, labeling, and sustainability standards further complicates operations for international manufacturers and distributors

- These factors can deter market expansion, particularly in regions where cost sensitivity is high or where awareness of sustainable and ethical sourcing is growing

Coffee Premixes market Scope

The market is segmented on the basis of type, brewing style, flavors, forms, and end users.

- By Type

On the basis of type, the market is segmented into green, black, brown, and white. The black coffee premix segment dominated the largest market revenue share of 38% in 2024, driven by its widespread popularity among consumers seeking bold flavors and convenience in preparation. Its versatility in various brewing styles and strong consumer preference for traditional coffee taste contribute to its dominance.

The green coffee premix segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising health consciousness among consumers. Green coffee’s association with weight management, antioxidants, and natural properties is driving demand, particularly in health-focused markets.

- By Brewing Style

On the basis of brewing style, the market is segmented into instant, cappuccino, latte, espresso, and regular. The instant coffee premix segment dominated the largest market revenue share of 45% in 2024, owing to its convenience, affordability, and widespread use in both household and commercial settings. Its quick preparation time appeals to busy consumers globally.

The cappuccino segment is anticipated to experience the fastest growth rate of 8.5% from 2025 to 2032. The increasing popularity of café-style beverages, coupled with advancements in premix formulations that replicate barista-quality flavors, is driving consumer adoption in both urban and emerging markets.

- By Flavors

On the basis of flavors, the market is segmented into chicory, chocolate, maple walnut, honey cinnamon, and rosemary. The chocolate flavor segment dominated with a market revenue share of 32% in 2024, driven by its appeal to younger demographics and its versatility in enhancing coffee drinking experiences. The rich, indulgent taste aligns with consumer preferences for premium and flavored coffee options.

The honey cinnamon segment is projected to witness significant growth from 2025 to 2032, as consumers increasingly seek unique and natural flavor profiles. The combination of health benefits associated with honey and cinnamon, along with rising demand for artisanal coffee experiences, fuels this segment’s growth.

- By Forms

On the basis of forms, the market is segmented into roasted/grounded, blended, and soluble. The soluble coffee premix segment dominated the largest market revenue share of 50% in 2024, attributed to its ease of use, long shelf life, and widespread availability across retail channels. Soluble premixes are particularly popular in regions with high demand for instant coffee.

The blended coffee premix segment is expected to grow rapidly from 2025 to 2032, driven by the rising trend of gourmet coffee consumption. Blended premixes offer a balance of flavors and textures, appealing to consumers seeking premium and customized coffee experiences at home.

- By End Users

On the basis of end users, the market is segmented into retail stores, department stores, supermarkets, hypermarkets, specialty stores, and e-commerce. The supermarket segment dominated with a market revenue share of 40% in 2024, due to its extensive reach, availability of diverse coffee premix brands, and competitive pricing, making it a preferred shopping channel for consumers.

The e-commerce segment is anticipated to witness the fastest growth rate of 12.3% from 2025 to 2032. The rise in online shopping, coupled with the convenience of home delivery and access to a wide range of premium and niche coffee premixes, is driving significant adoption. Subscription models and personalized offerings further enhance growth in this segment.

Coffee Premixes Market Regional Analysis

- North America dominated the coffee premixes market with the largest revenue share of 38.5% in 2024, driven by high coffee consumption, a strong presence of key manufacturers, and widespread adoption of instant and specialty coffee premixes

- Consumers prioritize premixes for their ease of preparation, consistent flavor, and variety, particularly in urban areas with fast-paced lifestyles

- Growth is supported by advancements in premix formulations, such as flavored and health-enhanced blends, alongside rising adoption in both retail and foodservice sectors

U.S. Coffee Premixes Market Insight

The U.S. coffee premixes market captured the largest revenue share of 70% in 2024 within North America, fueled by robust demand for instant and specialty premixes and growing consumer awareness of convenience and flavor customization. The trend toward at-home coffee consumption and increasing e-commerce penetration further boosts market expansion. Major brands’ focus on innovative flavors and single-serve sachets complements both retail and office coffee solutions, creating a dynamic market ecosystem.

Europe Coffee Premixes Market Insight

The Europe coffee premixes market is expected to witness significant growth, supported by a rising café culture and consumer preference for premium, convenient coffee options. Consumers seek premixes that offer café-style experiences with minimal effort, particularly in countries such as Germany, France, and Italy. The growth is prominent in both household and commercial applications, driven by increasing demand for flavored premixes and sustainable packaging.

U.K. Coffee Premixes Market Insight

The U.K. market for coffee premixes is projected to experience rapid growth, driven by demand for quick-preparation coffee solutions in urban and suburban settings. Increased interest in diverse flavors, such as chocolate and caramel, and growing awareness of health-oriented options, such as sugar-free premixes, encourage adoption. Evolving consumer preferences for convenience and quality, alongside improved e-commerce channels, support market growth.

Germany Coffee Premixes Market Insight

Germany is expected to witness strong growth in the coffee premixes market, attributed to its advanced coffee culture and high consumer focus on convenience and premium quality. German consumers prefer technologically advanced premixes, such as those with enhanced flavors or functional ingredients, that cater to busy lifestyles. The integration of premixes in vending machines and office settings, along with aftermarket demand, drives sustained market expansion.

Asia-Pacific Coffee Premixes Market Insight

The Asia-Pacific region is projected to experience the fastest growth rate, driven by expanding coffee consumption and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of convenience, flavor variety, and health benefits is boosting demand. Government initiatives promoting sustainable packaging and the growing popularity of café-style beverages further encourage the adoption of advanced coffee premixes.

Japan Coffee Premixes Market Insight

Japan’s coffee premixes market is expected to witness rapid growth due to strong consumer preference for high-quality, innovative premixes that enhance convenience and taste. The presence of major coffee brands and the integration of premixes in vending machines and OEM products accelerate market penetration. Rising interest in aftermarket customization, particularly for flavored premixes such as maple walnut and honey cinnamon, also contributes to growth.

China Coffee Premixes Market Insight

China holds the largest share of the Asia-Pacific coffee premixes market, propelled by rapid urbanization, rising coffee consumption, and increasing demand for convenient coffee solutions. The country’s growing middle class and focus on on-the-go lifestyles support the adoption of instant and flavored premixes. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility, particularly in e-commerce and retail channels.

Coffee Premixes Market Share

The coffee premixes industry is primarily led by well-established companies, including:

- Nestlé India (India)

- Unilever (U.K.)

- Lavazza (Italy)

- Veebha Beverages Private Limited (India)

- Kartin (India)

- Chai Kapi (India)

- Ken Global Flavours Pvt. Ltd. (India)

- Senso Foods (India)

- The Coca Cola Company (U.S.)

- R. V. Industries (India)

- Starbucks Corporation (U.S.)

- Tata Consumer Products (India)

- Mondelez International (U.S.)

- The Kraft Heinz Company (U.S.)

- Cafe Coffee Day (India)

What are the Recent Developments in Global Coffee Premixes Market?

- In May 2024, Patrick Mahomes introduced Throne SPORTS COFFEE, a ready-to-drink iced coffee developed in partnership with beverage industry veteran Michael Fedele. As the lead investor, Mahomes helped craft a functional coffee formula that blends natural caffeine, flavors, and sweeteners with B vitamins, electrolytes, and BCAAs. Designed for active individuals, this beverage supports energy, hydration, and muscle recovery while maintaining low sugar and calorie content. Throne SPORTS COFFEE quickly gained traction, becoming a top-selling product on Amazon

- In January 2024, Melitta introduced eco-friendly packaging for its cone coffee filters, reinforcing its commitment to sustainability and environmental stewardship. The new packaging, made from 100% recycled paperboard, carries Forest Stewardship Council (FSC) and Biodegradable Products Institute (BPI) certifications, ensuring responsible sourcing and compostability. This initiative addresses consumer concerns about packaging waste, promoting a greener coffee experience. Melitta’s long-standing dedication to sustainable practices is further highlighted by its solar-powered roasting facility and partnerships with environmental organizations

- In February 2023, Jollibee Foods Corporation expanded its global footprint by acquiring South Korea’s Compose Coffee chain, a fast-growing value coffee brand. This strategic move aligns with Jollibee’s commitment to the coffee and tea segment, leveraging Compose Coffee’s 2,600+ franchised stores and high profitability margins. The acquisition strengthens Jollibee’s presence in Asia’s thriving coffee market, particularly in South Korea, which ranks third globally in coffee consumption per capita. The deal, valued enhances Jollibee’s international business revenue and store count

- In January 2023, Tata Consumer Products introduced Tata Coffee Grand Premium, a 100% coffee blend featuring flavour-locked decoction crystals that enhance taste and aroma. This premium instant coffee caters to non-South Indian markets, where consumers prefer pure coffee over chicory blends. The launch was accompanied by a captivating ASMR film, showcasing the sensory journey from bean to cup, emphasizing the signature ‘Shik Shik Shik’ sound of the decoction crystals. Tata Consumer aims to strengthen its coffee portfolio and expand its market presence

- In June 2022, Continental Coffee (CCL Products India Ltd.) introduced Continental THIS Turmeric Coffee Latte, a 3-in-1 premix combining premium coffee with the health benefits of turmeric. As the first branded player to offer this unique blend, Continental Coffee aimed to redefine functional beverages by integrating anti-inflammatory properties into a ready-to-drink format. Sourced from high-grade Indian coffee plantations, this premix delivers a bold flavor, rich aroma, and therapeutic benefits. Designed for modern consumers seeking wellness-focused options, it aligns with growing health-conscious trends

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Coffee Premixes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Coffee Premixes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Coffee Premixes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.