Global Colour Cosmetics Market

Market Size in USD Billion

CAGR :

%

USD

54.76 Billion

USD

94.79 Billion

2024

2032

USD

54.76 Billion

USD

94.79 Billion

2024

2032

| 2025 –2032 | |

| USD 54.76 Billion | |

| USD 94.79 Billion | |

|

|

|

|

Colour Cosmetics Market Size

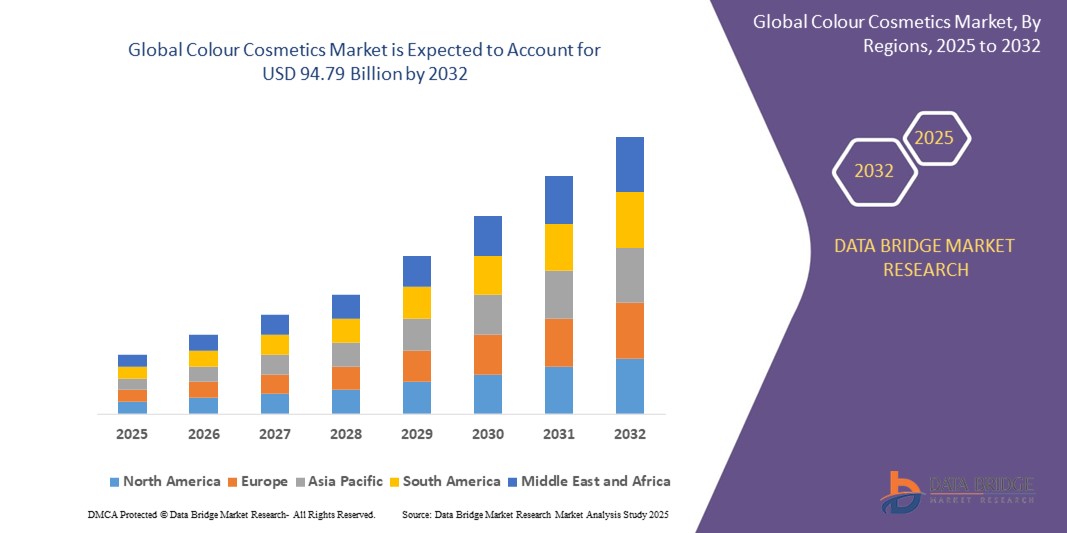

- The global Colour Cosmetics market was valued at USD 54.76 billion in 2024 and is expected to reach USD 94.79 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.10%, primarily driven by the increasing consumer demand for innovative, sustainable, and premium cosmetic products, along with rising awareness of beauty and personal care

- This growth is driven by factors such as increasing consumer demand for innovative, sustainable, and premium cosmetic products, along with rising awareness of beauty and personal care

Colour Cosmetics Market Analysis

- Rising interest in beauty and grooming routines across diverse age groups is a key factor driving the market

- Consumers are becoming more conscious of their appearance, leading to higher demand for makeup and skincare products

- The growing influence of social media influencers and beauty content creators has further fueled demand

- Consumers actively seek products that are featured by influencers and beauty experts on platforms such as Instagram and YouTube

- There is a noticeable shift toward natural and organic ingredients, increasing demand for cruelty-free and eco-friendly products

- For instance: Brands such as Drunk Elephant and Tata Harper are gaining popularity for their natural formulations

- Companies are heavily investing in research and development to create products that align with evolving consumer preferences

- Brands are focusing on maintaining quality and performance while meeting consumer expectations for sustainability

- Innovations in product formulations and packaging are appealing to consumers seeking convenience and functionality

- Long-lasting makeup and multi-functional products such as BB creams and tinted moisturizers are growing in popularity

- The market benefits from a wide variety of color options, textures, and finishes that cater to diverse preferences and skin types

- For instance: Fenty Beauty has revolutionized the market with its inclusive range of shades for all skin tones

- The global color cosmetics market is rapidly evolving, with increased competition and constant innovation, creating opportunities for both established brands and new entrants

Report Scope and Colour Cosmetics Market Segmentation

|

Attributes |

Colour Cosmetics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Colour Cosmetics Market Trends

“Rising Demand for Natural and Organic Products”

- Rising demand for natural and organic product consumers are increasingly seeking cosmetics with natural, plant-based, and organic ingredients. This trend reflects a growing concern for skin health and environmental impact

- For instance: popular brands such as Fenty Beauty and ILIA Beauty have seen success with their clean beauty lines, offering foundations and lip products free from synthetic chemicals and parabens

- Social media platforms such as Instagram, YouTube, and TikTok have become key drivers in the promotion of colour cosmetics. Beauty influencers, such as Huda Kattan and James Charles, have major sway in shaping consumer preferences. This has boosted online sales and led to collaborations between influencers and brands, driving new product launches and innovations.

- Technology is enhancing the performance of colour cosmetics, with long-lasting, waterproof, and smudge-proof products becoming increasingly popular

- For instance: The launch of Fenty Beauty's Pro Filt'r Soft Matte Foundation, known for its longevity and wide shade range, demonstrates how advancements in product formulation are meeting consumer demands for both coverage and skin benefits

- Consumers are looking for cosmetics tailored to their specific skin tones and personal preferences. Brands such as MAC Cosmetics and Estée Lauder offer personalized foundation shades through their online tools, while other brands, such as Bite Beauty, have provided custom lipstick-making services to allow consumers to create their perfect shade

- Sustainability has become a priority in the colour cosmetics market, with brands shifting toward eco-friendly packaging and cruelty-free products

- For instance: The initiative taken by brands such as Lush, which has pioneered naked cosmetics and the Body Shop’s commitment to 100% recycled packaging in some of their product lines

Colour Cosmetics Market Dynamics

Driver

“Increasing Awareness of Personal Grooming and Self-Expression”

- Increasing awareness of personal grooming and self-expression through social media platforms, particularly Instagram, TikTok, and YouTube, play a major role in shaping beauty standards and driving product sales. Beauty influencers and makeup artists regularly introduce new trends and products to millions of followers. For instance, the rise of "no-makeup" makeup looks and bold eye makeup trends during the COVID-19 lockdowns led to a surge in product demand for eyeshadows, mascaras, and brow pencils

- Consumers are increasingly using cosmetics as a tool for self-expression. Makeup has evolved beyond beauty enhancement, with individuals using it to reflect their personality, mood, or creativity. For instance, the rise of colorful eyeshadows and graphic eyeliner designs in 2020-2021 reflected a desire for more bold and personalized styles during the pandemic

- Consumers are demanding cosmetics that align with their values, leading to a significant rise in the popularity of cruelty-free, organic, and eco-friendly products

- For instance: Brands such as Fenty Beauty and Glossier are leading the way by offering vegan and cruelty-free options, and packaging made from recycled materials, catering to the increasing consumer awareness around environmental impact

- There is a growing demand for cosmetics that cater to all skin tones and types, with brands expanding their shade ranges to ensure inclusivity. Fenty Beauty, launched by Rihanna, revolutionized the market by offering 40 shades of foundation, pushing other brands such as MAC and Maybelline to follow suit with similar offerings, reflecting a shift towards more diverse representation in the industry

- The shift towards online shopping, accelerated by the COVID-19 pandemic, has reshaped how consumers purchase cosmetics. Virtual try-ons and augmented reality (AR) technology, introduced by brands such as L'Oréal and Sephora, allow consumers to experiment with products before purchasing. This trend continues to thrive as people seek convenience and safety, particularly in the wake of the global health crisis

Opportunity

“Growing Acceptance of Male Grooming”

- Growing acceptance of male grooming as societal perceptions of masculinity evolve, more men are embracing grooming products, including colour cosmetics. Traditionally targeted at women, the cosmetics industry is now seeing an increasing demand from men for products such as concealers, foundations, and eyebrow pencils to enhance their appearance and cover imperfections. This shift is a direct result of changing cultural attitudes around beauty and self-care for men

- The growing trend of male grooming presents a significant market opportunity for cosmetic brands to cater to this previously underserved demographic. Brands such as MAC Cosmetics and Tom Ford have already launched product lines specifically designed for men, such as MAC's "Studio Fix" foundation and Tom Ford for Men collection, tapping into this emerging market segment

- Social media platforms, especially Instagram, YouTube, and TikTok, have been instrumental in normalizing makeup for men.

- For instance: Influencers such as James Charles and Patrick Starr, who openly discuss makeup and beauty for men, are leading the charge in reducing the stigma surrounding male cosmetic use, further expanding the reach of colour cosmetics in the male market

- As more men embrace colour cosmetics, brands are recognizing the need for inclusivity. This growing acceptance of male grooming and beauty routines extends beyond skincare to incorporate makeup products, opening up new product development avenues, such as male-specific highlighting, contouring, and foundation products

- By investing in gender-neutral or male-specific cosmetic lines, brands can build loyalty among male consumers and enhance their customer base.

- For instance: Fenty Beauty’s inclusive approach to beauty products for all skin tones has contributed to the growing demand for gender-neutral cosmetic offerings, paving the way for a larger male consumer segment

Restraint/Challenge

“High Cost of Research and Development”

- High cost of research and development increases investment in innovation shift towards more innovative and sustainable products requires cosmetic brands to heavily invest in research and development (R&D).

- For instance: Companies such as Fenty Beauty have set high standards by developing new formulas for diverse skin tones, which involves extensive R&D to ensure compatibility and effectiveness for a broad range of consumers

- As consumers demand clean beauty products, brands must invest in R&D to create formulations free from synthetic chemicals, parabens, and other harmful ingredients. This shift towards more natural products, such as those from ILIA Beauty, demands a significant amount of testing and regulatory compliance to ensure safety and effectiveness, driving up costs

- The rise in demand for personalized beauty products tailored to individual needs—such as specific skin types, tones, or concerns—requires advanced R&D capabilities.

For instance: Sephora's customization tools, which recommend personalized products based on skin tests, illustrate the growing trend of tailored cosmetic solutions that require extensive technological investment

- As competition intensifies in the cosmetics market, brands are pushed to constantly innovate and offer unique product features, such as combining skincare benefits with makeup. Companies such as Estée Lauder have incorporated skincare ingredients such as hyaluronic acid into their foundations, but this integration involves significant R&D to ensure both performance and safety

- The high cost of innovation in the cosmetics industry can particularly impact smaller brands with limited resources. Developing new products and staying ahead of trends can strain their budgets, making it harder for them to expand their product offerings. This challenge limits their ability to compete with larger brands that have more financial flexibility to invest in continuous product development

Colour Cosmetics Market Scope

The market is segmented on the basis pigment type, product, packaging, target market, form, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Pigment Type |

|

|

By Product |

|

|

By Packaging |

|

|

By Target Market |

|

|

By Form |

|

|

By End User |

|

|

By Distribution Channel

|

|

Colour Cosmetics Market Regional Analysis

“North America is the Dominant Region in the Colour Cosmetics Market”

- North America currently holds a dominant position in the global colour cosmetics market due to high consumer spending and a robust demand for premium and innovative beauty products

- The U.S. market is the largest contributor, with established players such as L'Oréal, Estée Lauder, and Revlon driving market expansion through product innovation and targeted marketing

- Increasing awareness of clean beauty trends and natural formulations has further propelled growth, particularly in the organic cosmetics sector

- E-commerce platforms are a major distribution channel in North America, with more consumers opting for online shopping for convenience and product variety

- North American consumers show a growing preference for sustainable and cruelty-free cosmetics, aligning with global trends toward eco-conscious purchasing decisions

“Asia-Pacific is expected to witness the highest growth rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the global colour cosmetics market, driven by changing beauty standards and the increasing influence of social media

- Countries such as China, India, and South Korea are seeing rapid expansion due to a burgeoning middle class, rising disposable incomes, and increased demand for high-quality beauty products

- The growing trend of personalized cosmetics and the acceptance of makeup among men are key factors contributing to this growth

- Additionally, the rise of online shopping platforms and beauty influencers in the region has made beauty products more accessible and popular among young, tech-savvy consumers.

- Local brands such as Shiseido and Amorepacific are gaining ground, offering products tailored to Asian skin tones and preferences, further boosting market development

Colour Cosmetics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- L’Oréal GROUPE (France)

- Unilever PLC (U.K.)

- Henkel AG & Co. KGaA (Germany)

- Shiseido Company, Limited (Japan)

- The Estée Lauder Companies Inc. (U.S.)

- Coty Inc. (U.S.)

- Mary Kay Inc. (U.S.)

- Revlon (U.S.), KOSÉ Corporation (Japan)

- CHANEL (U.K.)

- Oriflame Cosmetics AG (Switzerland)

- Natura & Co (Brazil)

- AMOREPACIFIC US, INC. (U.S.)

- Clarins (France)

- LVMH Moët Hennessy Louis Vuitton (France)

- Vestige Marketing Pvt. Ltd. (India)

- CHANTECAILLE BEAUTE (U.S.)

- Kryolan (Germany)

- Brand Agency London (U.K.)

Latest Developments in Global Colour Cosmetics Market

- In January, 2025 Born16, a new colour cosmetics brand by Kushmanda Cosmetics Pvt. Ltd., aims to empower women across India by addressing beauty challenges specific to the country. The brand offers two collections, Moon Duchess and Tamaraa, designed for various skin tones and India's tropical climate. With products that are 100% sweat-proof and free from harmful chemicals, Born16 promises long-lasting makeup solutions, while also promoting self-love and individual beauty

- In August, 2024 the Indian beauty market saw several exciting launches. Yves Saint Laurent made its debut with a range of iconic products such as the Touche Éclat highlighter and Rouge Pur Couture lipstick, exclusively available on Nykaa. NARS Cosmetics introduced new shades in its Afterglow lipstick collection, while Anastasia Beverly Hills launched the Blurring Serum Blush, a hydrating liquid blush. Additionally, Kay Beauty unveiled its Hydra Crème Lipsticks, and Max Factor, under Priyanka Chopra's influence, made a major comeback with new products such as the vegan foundation. These launches highlight the growing vibrancy of India's beauty landscape

- In April, 2024 Honasa Consumer has launched a new colour cosmetics line called Staze, designed to offer high-performance, long-lasting makeup. The brand targets Gen-Z consumers with products featuring innovative C-Lock technology for 12-hour wearability, including multi-purpose items such as a three-in-one bullet lipstick. Staze is priced affordably with products starting at Rs 449 and is available on various e-commerce platforms such as Nykaa, Amazon, and Flipkart. The brand aims to fill a gap in the market for innovative, accessible cosmetics, targeting Indian women

- In December 2023, Amorepacific Corporation introduced Dr. Amore, an AI-powered skin diagnosis system documented in the International Journal of Cosmetic Science. Utilizing advanced AI algorithms, it offers accurate and personalized skin analyses, enhancing product development for tailored skincare solutions, and reflecting Amorepacific's commitment to skincare R&D

- In November 2023, The Estée Lauder Companies Inc. announced Beauty & You incubator awards for Indian beauty businesses, in collaboration with Nykaa. Recognizing outstanding achievements in various beauty sectors, this initiative fosters collaboration and innovation, spotlighting Indian beauty brands and creators, and nurturing the Indian beauty business ecosystem

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.