Global Commercial Foodservice Market

Market Size in USD Billion

CAGR :

%

USD

1,056.11 Billion

USD

1,633.13 Billion

2024

2032

USD

1,056.11 Billion

USD

1,633.13 Billion

2024

2032

| 2025 –2032 | |

| USD 1,056.11 Billion | |

| USD 1,633.13 Billion | |

|

|

|

|

Commercial Foodservice Market Size

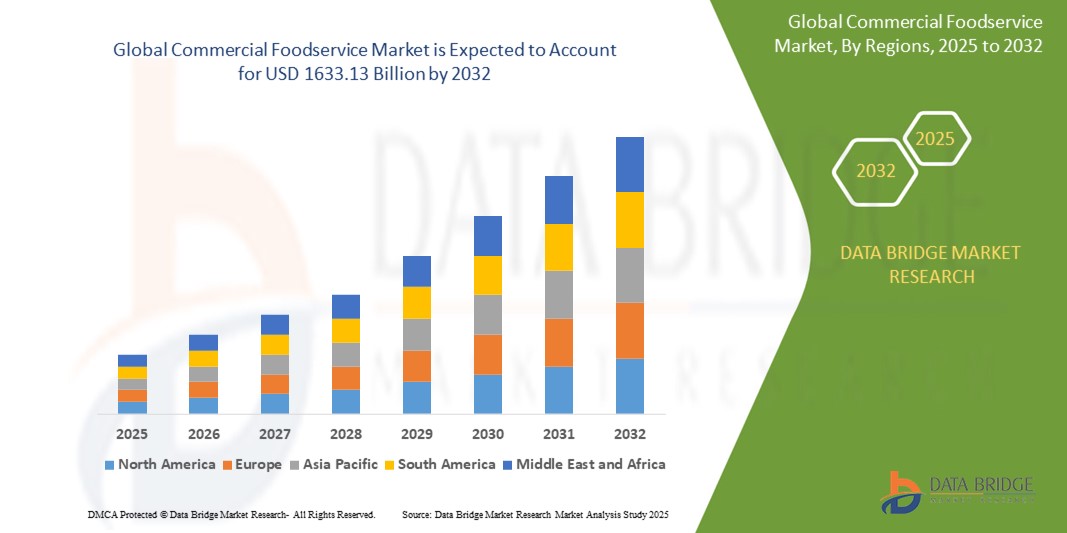

- The global commercial foodservice market was valued at USD 1056.11 billion in 2024 and is expected to reach USD 1633.13 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.60%, primarily driven by rising demand for convenient and ready-to-eat meals

- This growth is driven by rapid expansion of the tourism and hospitality sectors and the increasing influence of western dining habits, particularly in emerging economies

Commercial Foodservice Market Analysis

- The commercial foodservice market is experiencing strong growth driven by changing consumer lifestyles, increasing urbanization, and a rising preference for dining out. The expansion of global tourism and hospitality sectors, combined with the influence of western dining trends in emerging economies, has significantly contributed to the growth of restaurants, cafes, and catering services. Technological advancements in kitchen automation, cooking equipment, and food preparation processes are enhancing operational efficiency and service quality, thereby attracting more investments into the sector

- The market is also propelled by the rapid growth of quick service restaurants (QSRs), full service restaurants (FSRs), and institutional foodservice providers. Factors such as increasing disposable incomes, busy work schedules, and the growing millennial and Gen Z populations are fueling demand for fast, affordable, and quality meals. In addition, the integration of digital ordering platforms, AI-based kitchen systems, and cloud kitchens is streamlining operations and broadening customer reach, while sustainability initiatives such as energy-efficient appliances and eco-friendly packaging are gaining momentum

- For instance, in the Asia Pacific region, global and local QSR chains are expanding aggressively, driven by increasing consumer demand for convenient food solutions and growing awareness of international cuisines, further boosting the commercial foodservice sector

- Globally, the commercial foodservice industry is aligning with trends such as healthy eating, transparency in sourcing, and enhanced dining experiences. Innovations such as robotic kitchen assistants, smart POS systems, and personalized menu offerings based on data analytics are transforming the customer journey. These developments, along with favorable government policies and infrastructure investments, are reinforcing the sector’s long-term potential and establishing commercial foodservice as a key pillar of the global food economy

Report Scope and Commercial Foodservice Market Segmentation

|

Attributes |

Commercial Foodservice Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Commercial Foodservice Market Trends

“Adoption of Smart Kitchen Equipment and Automation Technologies”

- The growing popularity of quick service restaurants (QSRs) and cloud kitchens is a key driver for the expansion of the commercial foodservice market, driven by consumer demand for fast, affordable, and convenient meal options. Changing lifestyles, busy work schedules, and the rise of online food delivery apps are encouraging more consumers to choose QSRs and delivery-only food models over traditional dine-in experiences

- Foodservice operators are leveraging data-driven kitchen layouts, centralized cooking facilities, and optimized menus to increase efficiency and cater to a wider audience through minimal physical infrastructure. The reduced operational costs and scalability of cloud kitchens make them attractive for both startups and established brands

- The proliferation of online ordering platforms and aggregator apps such as Uber Eats, DoorDash, and Zomato is further accelerating the demand for QSR-style foodservice, allowing brands to quickly adapt to regional tastes and deliver consistent quality at scale

For instance,

- In 2023, Rebel Foods, the world’s largest cloud kitchen operator, expanded its multi-brand kitchen network across Southeast Asia and the Middle East, offering region-specific QSR-style menus.

- Brands such as McDonald’s and KFC are increasingly investing in digital kiosks, app-based ordering, and kitchen automation to streamline service and improve customer experience

- Kitopi, a U.A.E.-based cloud kitchen platform, has partnered with global food brands to serve multiple cuisines under one roof, powered by smart kitchen tech and real-time data insights

- As urbanization continues and digital adoption rises, the penetration of QSRs and cloud kitchens is expected to reshape the commercial foodservice landscape, offering scalability, operational efficiency, and broader access to diverse food choices

Commercial Foodservice Market Dynamics

Driver

“Increasing Penetration of Quick Service Restaurants (QSRs) and Cloud Kitchens”

- The growing popularity of quick service restaurants (QSRs) and cloud kitchens is a key driver for the expansion of the commercial foodservice market, driven by consumer demand for fast, affordable, and convenient meal options. Changing lifestyles, busy work schedules, and the rise of food delivery apps are encouraging more consumers to choose QSRs and delivery-only food models over traditional dine-in experiences

- Foodservice operators are leveraging data-driven kitchen layouts, centralized cooking facilities, and optimized menus to increase efficiency and cater to a wider audience through minimal physical infrastructure. The reduced operational costs and scalability of cloud kitchens make them attractive for both startups and established brands

- The proliferation of online ordering platforms and aggregator apps such as Uber Eats, DoorDash, and Zomato is further accelerating the demand for QSR-style foodservice, allowing brands to quickly adapt to regional tastes and deliver consistent quality at scale

For instance,

- In 2023, Rebel Foods, the world’s largest cloud kitchen operator, expanded its multi-brand kitchen network across Southeast Asia and the Middle East, offering region-specific QSR-style menus

- Brands such as McDonald’s and KFC are increasingly investing in digital kiosks, app-based ordering, and kitchen automation to streamline service and improve customer experience

- Kitopi, a U.A.E.-based cloud kitchen platform, has partnered with global food brands to serve multiple cuisines under one roof, powered by smart kitchen tech and real-time data insights

- As urbanization continues and digital adoption rises, the penetration of QSRs and cloud kitchens is expected to reshape the commercial foodservice landscape, offering scalability, operational efficiency, and broader access to diverse food choices

Opportunity

“Expansion of Commercial Foodservice in Healthcare and Institutional Sectors”

- The growing emphasis on nutrition, hygiene, and efficient food delivery in hospitals, schools, and corporate offices is opening up new opportunities for commercial foodservice providers. The demand for balanced meals tailored to specific dietary needs is driving partnerships between foodservice operators and healthcare institutions to deliver nutritious, safe, and cost-effective food options

- Government initiatives promoting health-focused meal programs and food safety regulations are encouraging institutions to collaborate with professional foodservice companies for meal planning, portion control, and standardized nutrition delivery. In addition, the rise of wellness trends is pushing institutions to seek customized foodservice offerings that align with health objectives

- Advancements in centralized kitchen systems, automated meal prep, and digital dietary tracking tools are helping foodservice providers scale operations while maintaining consistency, hygiene, and compliance across institutional settings

For instance,

- In 2023, Compass Group PLC expanded its healthcare foodservice operations across multiple hospital networks in the U.K., delivering patient-specific meals and clinical nutrition services

- Sodexo partnered with U.S.-based universities to enhance campus dining services, integrating healthy meal options and tech-enabled food management systems

- Aramark introduced customized meal plans for corporate clients, including wellness-driven menus and eco-friendly meal delivery programs in North America

- As public institutions and healthcare facilities increasingly focus on health, wellness, and operational efficiency, the commercial foodservice market will benefit from robust demand, long-term contracts, and a stable revenue stream, positioning it as a critical component in institutional food delivery

Restraint/Challenge

“Labor Shortages and High Employee Turnover in the Commercial Foodservice Industry”

- A persistent shortage of skilled labor and rising employee turnover rates pose significant operational challenges for commercial foodservice providers. From chefs and kitchen staff to delivery personnel and front-of-house workers, the industry struggles to attract and retain qualified talent, leading to service disruptions and reduced productivity

- The physically demanding nature of foodservice jobs, combined with long hours, low wages, and limited career advancement opportunities, contributes to burnout and job dissatisfaction, especially among younger workers. This challenge is amplified in fast-paced environments such as QSRs and catering services where operational efficiency is critical

- The cost of recruitment, onboarding, and training new staff adds financial pressure on businesses, particularly small and mid-sized operators, making it difficult to scale operations or maintain service quality consistently

For instance,

- In late 2024, restaurant associations in the U.S. and Canada reported that over 60% of foodservice establishments were understaffed, leading to reduced working hours and menu limitations

- Hospitality industry surveys in Australia indicated a sharp decline in new kitchen apprenticeships, prompting calls for immigration policy reforms to fill critical labor gaps

- Companies such as McDonald’s and Domino’s have accelerated investments in automated ordering kiosks and robotic kitchen systems to reduce dependency on human labor amid staffing shortages

- As labor availability continues to impact service delivery, the Commercial Foodservice industry must prioritize employee retention strategies, workforce training programs, and technology adoption to overcome labor-related challenges and sustain long-term operational efficiency

Commercial Foodservice Market Scope

The market is segmented on the basis of product and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By End User |

|

Commercial Foodservice Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Commercial Foodservice Market”

- Increasing adoption of western-style dining customs is transforming food preferences and restaurant formats across Asia Pacific

- The expansion of the tourism sector is driving demand for diverse and high-capacity foodservice establishments

- Rapid development of hotels, resorts, and food courts is supporting the commercial foodservice ecosystem in the region

- These trends reinforce Asia Pacific's leading position in the global commercial foodservice market throughout the forecast period

“North America is projected to register the Highest Growth Rate”

- Presence of major key players in the region is contributing to strong innovation and expansion in the commercial foodservice market

- Government initiatives to boost the tourism sector are creating more opportunities for foodservice establishments

- Rising immigration is increasing cultural diversity, leading to higher demand for varied dining options across North America

- These factors are expected to drive significant growth in North America's commercial foodservice market in the coming years.

Commercial Foodservice Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Sysco Corporation (U.S.)

- Foodbuy (U.S.)

- Brinker International (U.S.)

- Compass Group PLC (U.K.)

- Tech24 (U.S.)

- The Vollrath Company, LLC (U.S.)

- Standex International Corporation (U.S.)

- Taylor Commercial Foodservice, LLC (U.S.)

- BAKERS PRIDE (U.S.)

- Hobart (U.S.)

- ZoomInfo Technologies LLC (U.S.)

- Master-Bilt Products, LLC (U.S.)

- Greenfield World Trade (U.S.)

- Carlisle FoodService Products (U.S.)

- Boelter, Inc. (U.S.)

- Falcon Foodservice Equipment (U.K.)

- The Middleby Corporation (U.S.)

- B. United Art Trading (U.S.)

- Zink Foodservice (U.S.)

Latest Developments in Global Commercial Foodservice Market

- In January 2024, Restaurant Brands International revealed its plan to acquire all outstanding shares of Carrols Restaurant Group in a cash-only deal. Carrols, being the largest Burger King franchisee in the U.S., manages over 1,000 Burger King locations and more than 50 Popeyes restaurants across 23 states. This acquisition is expected to significantly strengthen Restaurant Brands International's position in the fast-food sector. This strategic move marks a major step in expanding the company’s market footprint in the U.S. foodservice industry

- In September 2023, Fat Brands, a recognized name in the polished dining segment, completed the acquisition of Smokey Bones Bar & Fire Grill from Sun Capital Partners for USD 30 million. The deal is anticipated to improve Fat Brands’ financial standing, with projected EBITDA growth of approximately USD 10 million. This acquisition is expected to significantly boost Fat Brands’ profitability and market presence

- In June 2023, Pizza Hut launched a new single-serving pizza named “Pizza Hut Melts,” which is cheese-loaded and features a crispy texture. The product is tailored for individual consumption, ideal for snacking and eating on the go. This innovation reflects Pizza Hut’s efforts to tap into the growing demand for convenient, personal-sized food options

- In March 2023, Starbucks announced plans to open around 100 new stores in the U.K. over the following year, as part of its broader investment strategy across Europe. With over 1,000 existing outlets in the U.K., the company also allocated approximately USD 35 million to refurbish its stores over the next three years. This expansion plan is set to reinforce Starbucks' market leadership and enhance customer experience in the U.K.

- In February 2022, White Castle expanded its partnership with Miso Robotics by implementing the “Flippy 2” burger-making robot in an additional 100 locations. The decision followed successful testing in the Chicagoland Area, where the robot showed improvements in operational efficiency and staff productivity. This technological adoption underlines White Castle’s commitment to innovation and automation in foodservice operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Commercial Foodservice Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Commercial Foodservice Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Commercial Foodservice Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.