Global Commercial Soft Serve Machines Market

Market Size in USD Billion

CAGR :

%

USD

1.37 Billion

USD

2.15 Billion

2024

2032

USD

1.37 Billion

USD

2.15 Billion

2024

2032

| 2025 –2032 | |

| USD 1.37 Billion | |

| USD 2.15 Billion | |

|

|

|

|

Commercial Soft-Serve Machines Market Size

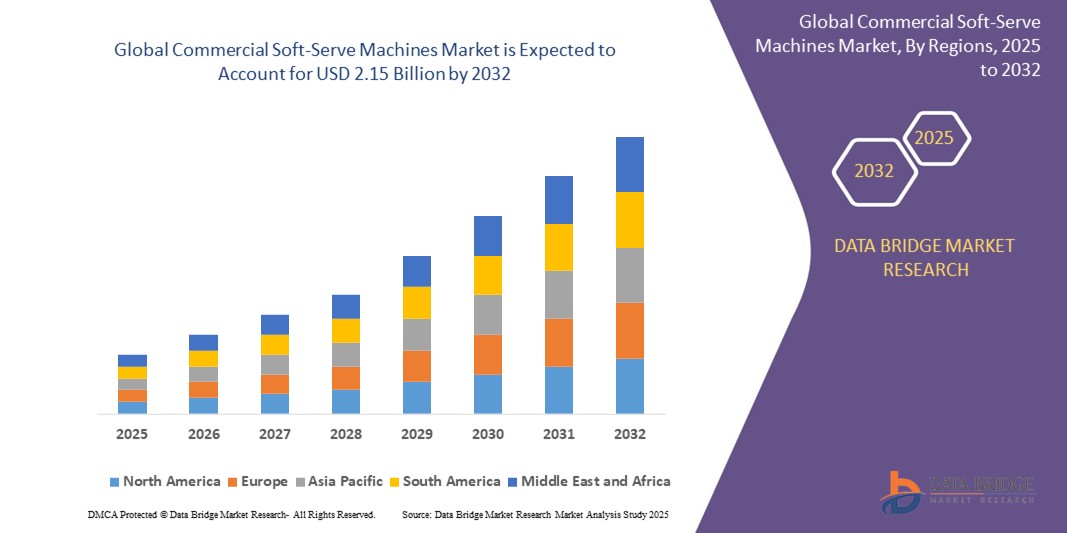

- The global commercial soft-serve machines market size was valued at USD 1.37 billion in 2024 and is expected to reach USD 2.15 billion by 2032, at a CAGR of 5.80% during the forecast period

- The market growth is largely fuelled by the increasing popularity of frozen desserts in quick-service restaurants, cafes, and convenience stores, along with advancements in machine automation, energy efficiency, and compact designs that meet the evolving needs of food service operators

Commercial Soft-Serve Machines Market Analysis

- The rising demand for customizable dessert offerings and low-fat frozen alternatives is contributing to the growing adoption of commercial soft-serve machines across multiple food service formats

- Technological improvements such as touch screen interfaces, energy-saving modes, and real-time monitoring capabilities are enhancing operational efficiency and customer engagement

- North America dominated the commercial soft-serve machines market with the largest revenue share of 37.9% in 2024, driven by the widespread presence of QSR chains, ice cream parlors, and convenience stores across the region

- Asia-Pacific region is expected to witness the highest growth rate in the global commercial soft-serve machines market, driven by increasing urbanization, a booming foodservice industry, and the rising popularity of frozen desserts among younger demographics across countries such as China, India, and Japan

- The floor model segment dominated the market with the largest market revenue share in 2024, attributed to its high output capacity and widespread adoption in large-scale food service establishments. Floor models are preferred in high-traffic locations such as quick-service restaurants and cafeterias where continuous dispensing is essential. Their robust construction and ability to accommodate dual flavors or mix-ins also make them an optimal choice for operators looking to diversify dessert offerings and serve a high volume of customers efficiently

Report Scope and Commercial Soft-Serve Machines Market Segmentation

|

Attributes |

Commercial Soft-Serve Machines Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion of Soft-Serve Offerings in Emerging Markets • Integration of Smart Technology in Dispensing Equipment |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Commercial Soft-Serve Machines Market Trends

“Adoption of Compact and Energy-Efficient Machines in Quick-Service Outlets”

- Compact and countertop soft-serve machines are gaining traction in quick-service restaurants (QSRs), food trucks, and small-format retail due to their space-saving designs

- Energy-efficient components such as variable-speed compressors, improved insulation, and low-GWP refrigerants are becoming standard in new models

- Rising electricity costs and increased awareness about carbon emissions are prompting operators to seek machines that lower utility expenses

- The integration of smart sensors and automated energy-saving modes allows businesses to reduce idle-time consumption without affecting output

- For instance, Carpigiani introduced its “191 Classic” model in 2023, a compact soft-serve machine with energy-saving standby features and low-noise operation, which has been widely adopted by urban QSR chains

Commercial Soft-Serve Machines Market Dynamics

Driver

“Rising Demand for Frozen Desserts Across Quick-Service Restaurants and Cafés”

- The global appetite for frozen treats is expanding rapidly, especially among millennials and Gen Z who favor customization and on-the-go formats

- QSRs and café chains are diversifying dessert menus with innovative flavors, vegan options, and seasonal offerings, driving demand for soft-serve equipment

- Soft-serve machines allow businesses to serve high-margin products such as sundaes, cones, and blended desserts with fast output and minimal staff training

- The machines are also increasingly used in self-service models, enabling customers to personalize their orders and reduce labor overhead

- For instance, McDonald’s introduced dessert kiosks across Southeast Asia, significantly increasing machine deployment across franchise locations to meet the surge in demand for customizable frozen offerings

Restraint/Challenge

“High Initial Investment and Maintenance Costs for Small Operators”

- Quality commercial soft-serve machines often range from USD 6,000 to USD 20,000, making them a significant investment for small businesses

- Regular maintenance is critical for hygiene, performance, and compliance with food safety standards, but often incurs high service fees and downtime

- Smaller businesses may lack access to skilled technicians, especially in emerging markets, which can lead to operational delays and equipment damage

- High power consumption and component wear-and-tear, such as beater motors and compressors, also increase the total cost of ownership over time

- For instance, a boutique café in the U.K. faced recurring breakdowns during summer 2023 due to lack of access to certified technicians, causing a 15% dip in monthly revenue

Commercial Soft-Serve Machines Market Scope

The market is segmented on the basis of type and application.

• By Type

On the basis of type, the commercial soft-serve machines market is segmented into countertop model and floor model. The floor model segment dominated the market with the largest market revenue share in 2024, attributed to its high output capacity and widespread adoption in large-scale food service establishments. Floor models are preferred in high-traffic locations such as quick-service restaurants and cafeterias where continuous dispensing is essential. Their robust construction and ability to accommodate dual flavors or mix-ins also make them an optimal choice for operators looking to diversify dessert offerings and serve a high volume of customers efficiently.

The countertop model segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption in small cafés, food trucks, and convenience stores. These machines are compact, cost-effective, and easy to install, which suits businesses with limited space or moderate customer flow. Their portability and plug-and-play features appeal especially to seasonal businesses and new market entrants looking for flexibility without significant infrastructure investments.

• By Application

On the basis of application, the commercial soft-serve machines market is segmented into catering industry, entertainment venue, and others. The catering industry segment held the largest market revenue share in 2024, fueled by rising demand for soft-serve desserts in institutional catering, hotels, and fast-casual dining. Catering businesses value the reliability, output speed, and customization options that commercial soft-serve machines offer, which are essential for large-scale food preparation and customer service.

The entertainment venue segment is expected to witness the fastest growth rate from 2025 to 2032, due to growing deployment of soft-serve equipment in amusement parks, cinemas, and event spaces. These machines enhance the on-site food and beverage experience, particularly during peak footfall seasons. Their integration with self-service kiosks and minimal operator involvement also contributes to improved customer satisfaction and operational efficiency in dynamic entertainment environments.

Commercial Soft-Serve Machines Market Regional Analysis

• North America dominated the commercial soft-serve machines market with the largest revenue share of 37.9% in 2024, driven by the widespread presence of QSR chains, ice cream parlors, and convenience stores across the region

• The rising demand for frozen desserts, coupled with increasing consumer preferences for quick and personalized service, supports continued adoption of soft-serve machines

• Manufacturers in the region are introducing technologically advanced machines with energy efficiency, self-cleaning features, and touchscreen interfaces to meet evolving customer expectations

• The North American market benefits from strong distribution networks and brand loyalty among consumers, particularly in the U.S. and Canada

• The presence of major soft-serve machine manufacturers and a culture of food innovation further reinforce the region's market leadership

U.S. Commercial Soft-Serve Machines Market Insight

The U.S. commercial soft-serve machines market captured the largest revenue share of 83.5% in North America in 2024, driven by the thriving fast-food industry and increasing number of frozen yogurt and dessert outlets. Consumers in the U.S. increasingly demand customized soft-serve offerings, prompting establishments to invest in efficient, multi-flavor dispensing systems. Technological innovations, such as touchless dispensing and real-time maintenance alerts, are gaining traction in urban centers. In addition, favorable health trends have led to the launch of low-fat and dairy-free soft-serve options, expanding the customer base and spurring equipment upgrades in commercial outlets.

Europe Commercial Soft-Serve Machines Market Insight

The Europe commercial soft-serve machines market is expected to witness the fastest growth rate from 2025 to 2032, supported by the continent’s rich café culture and an expanding frozen dessert segment. Key countries such as Germany, Italy, and France are witnessing increased installations of compact, energy-efficient soft-serve machines in cafes, food trucks, and casual dining establishments. Local consumers are drawn to the artisanal dessert experience, encouraging businesses to offer innovative frozen treat options. Sustainability regulations and energy efficiency standards are also influencing equipment upgrades across the European foodservice sector.

U.K. Commercial Soft-Serve Machines Market Insight

The U.K. commercial soft-serve machines market is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising popularity of frozen desserts and the expansion of dessert parlors and kiosks. Businesses are investing in compact countertop models to accommodate space constraints and improve operational efficiency in high-footfall areas such as shopping centers and transportation hubs. Furthermore, the rise of vegan and health-conscious dessert trends is encouraging the adoption of machines capable of handling plant-based and low-calorie mixes.

Germany Commercial Soft-Serve Machines Market Insight

The Germany is expected to witness the fastest growth rate from 2025 to 2032, with growth supported by the country’s vibrant foodservice industry and increasing demand for high-quality frozen dessert offerings. German operators value reliability and energy efficiency in equipment, leading to a preference for advanced floor model soft-serve machines with built-in diagnostics and self-cleaning systems. In addition, the trend of seasonal pop-up shops and mobile food trucks offering premium frozen desserts is contributing to greater machine deployment across urban and suburban locations.

Asia-Pacific Commercial Soft-Serve Machines Market Insight

The Asia-Pacific commercial soft-serve machines market is expected to witness the fastest growth rate from 2025 to 2032, driven by a rising middle-class population, growing disposable incomes, and the westernization of dessert consumption habits in countries such as China, Japan, and South Korea. International and domestic dessert chains are rapidly expanding across the region, necessitating high-capacity, easy-to-operate machines. Government initiatives promoting tourism and food retail development also fuel demand for frozen dessert equipment in high-traffic commercial zones.

Japan Commercial Soft-Serve Machines Market Insight

The Japan commercial soft-serve machines market is expected to witness the fastest growth rate from 2025 to 2032, supported by a strong inclination towards product quality, hygiene, and technological precision. Japanese consumers value visually appealing and unique soft-serve presentations, which encourages equipment innovation focused on precision temperature control and advanced dispensing techniques. Compact machine models are particularly popular in urban foodservice setups, and demand is strong in convenience stores, which often offer soft-serve products as impulse buys.

China Commercial Soft-Serve Machines Market Insight

The China led the Asia-Pacific region in terms of revenue share in 2024, fueled by the proliferation of fast-food chains, dessert-focused cafes, and the popularity of customizable frozen treats among young consumers. Domestic manufacturers are producing affordable machines tailored to local tastes, while international brands continue to enter the market with technologically advanced offerings. The integration of soft-serve machines in mall food courts, theme parks, and roadside snack shops is becoming increasingly common, propelling market growth across both tier-1 and tier-2 cities.

Commercial Soft-Serve Machines Market Share

The Commercial Soft-Serve Machines industry is primarily led by well-established companies, including:

- Taylor Commercial Foodservice, LLC (U.S.)

- Spaceman Ice Systems Co., Ltd. (China)

- Stoelting Foodservice Equipment (U.S.)

- CARPIGIANI GROUP (Italy)

- Huangshi Dongbei Refrigeration Co., Ltd. (China)

- Electrolux Professional AB (Sweden)

- IREKS U.K. Ltd. ICD (U.K.)

- Guangdong Mike Cool Refrigeration Equipment Co., Ltd. (China)

- Shenzhen Oceanpower Food Equipment Tech Co., Ltd. (China)

- Electro Freeze (U.S.)

- SANISERV (U.S.)

- Ali Group S.r.l. a Socio Unico (Italy)

- Bravo North America (U.S.)

- Gram Equipment A/S (Denmark)

- Tetra Pak International S.A. (Switzerland)

- The Middleby Corporation (U.S.)

- The Vollrath Company, LLC (U.S.)

- ICETRO AMERICA, INC (U.S.)

- Donper USA (U.S.)

Latest Developments in Global Commercial Soft-Serve Machines Market

- In March 2024, Gourmia, a leader in cutting-edge countertop kitchen appliances, has announced the launch of its new SoftSnap 1-quart automatic soft-serve ice cream maker. This groundbreaking appliance will be showcased at The Inspired Home Show 2024 in booth #N8500. The SoftSnap is the world’s first all-in-one home soft-serve ice cream maker with a built-in cooling system, eliminating the need for pre-freezing bowls or adding salt and ice

- In January 2022, Carpigiani, part of the Ali Group and a global leader in equipment for fresh ice cream, gelato, and pastry, unveiled the UF920. This top-tier model is a versatile combination of soft-serve and shake machines, designed specifically for high-volume food service operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL COMMERCIAL SOFT-SERVE MACHINES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL COMMERCIAL SOFT-SERVE MACHINES MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 GLOBAL COMMERCIAL SOFT-SERVE MACHINES MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 CONSUMER BUYING BEHAVIOUR

5.2 FACTORS AFFECTING BUYING DECISION

5.3 PRODUCT ADOPTION SCENARIO

5.4 PORTER’S FIVE FORCES

5.5 REGULATION COVERAGE

5.6 RAW MATERIAL SOURCING ANALYSIS

5.7 IMPORT EXPORT SCENARIO

6 PRODUCTION CAPACITY OUTLOOK

7 PRICING ANALYSIS

8 BRAND OUTLOOK

8.1 BRAND COMPARATIVE ANALYSIS

8.2 PRODUCT VS BRAND OVERVIEW

9 IMPACT OF ECONOMIC SLOWDOWN

9.1 IMPACT ON PRICES

9.2 IMPACT ON SUPPLY CHAIN

9.3 IMPACT ON SHIPMENT

9.4 IMPACT ON DEMAND

9.5 IMPACT ON STRATEGIC DECISIONS

10 SUPPLY CHAIN ANALYSIS

10.1 OVERVIEW

10.2 LOGISTIC COST SCENARIO

10.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

11 GLOBAL COMMERCIAL SOFT-SERVE MACHINES MARKET, BY PRODUCT, 2018-2032 (USD MILLION) (UNITS)

11.1 OVERVIEW

11.2 FLOOR STANDING

11.3 COUNTERTOP

12 GLOBAL COMMERCIAL SOFT-SERVE MACHINES MARKET, BY VOLUME, 2018-2032 (USD MILLION)

12.1 OVERVIEW

12.2 LOW VOLUME SOFT SERVE MACHINES

12.3 HIGH VOLUME SOFT SERVE MACHINES

13 GLOBAL COMMERCIAL SOFT-SERVE MACHINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

13.1 OVERVIEW

13.2 SINGLE FLAVOR SOFT SERVE MACHINES

13.3 DUAL FLAVOR SOFT SERVE MACHINES

13.4 MULTI-FLAVOR SOFT SERVE MACHINES

14 GLOBAL COMMERCIAL SOFT-SERVE MACHINES MARKET, BY AUTOMATION, 2022-2031(USD MILLION)

14.1 OVERVIEW

14.2 AUTOMATIC

14.3 SEMI-AUTOMATIC

15 GLOBAL COMMERCIAL SOFT-SERVE MACHINES MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

15.1 OVERVIEW

15.2 GRAVITY-FED SOFT SERVE MACHINES

15.3 PRESSURIZED SOFT SERVE MACHINES

16 GLOBAL COMMERCIAL SOFT-SERVE MACHINES MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

16.1 OVERVIEW

16.2 LOW CAPACITY (UP TO 20 LITERS/HOUR)

16.3 MEDIUM CAPACITY (20-40 LITERS/HOUR)

16.4 HIGH CAPACITY (ABOVE 40 LITERS/HOUR)

17 GLOBAL COMMERCIAL SOFT-SERVE MACHINES MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

17.1 OVERVIEW

17.2 QUICK SERVICE RESTAURANTS (QCRS)

17.2.1 FLOOR STANDING

17.2.2 COUNTERTOP

17.3 FULL SERVICE RESTAURANTS

17.3.1 FLOOR STANDING

17.3.2 COUNTERTOP

17.4 FOOD JUNCTIONS

17.4.1 FLOOR STANDING

17.4.2 COUNTERTOP

17.5 BAKERIES

17.5.1 FLOOR STANDING

17.5.2 COUNTERTOP

17.6 ICE-CREAM PARLORS

17.6.1 FLOOR STANDING

17.6.2 COUNTERTOP

17.7 OTHERS

18 GLOBAL COMMERCIAL SOFT-SERVE MACHINES MARKET, BY GEOGRAPHY, 2018-2032 (USD MILLION) (UNITS)

Global COMMERCIAL SOFT-SERVING MACHINE market, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

18.1 NORTH AMERICA

18.1.1 U.S.

18.1.2 CANADA

18.1.3 MEXICO

18.2 EUROPE

18.2.1 GERMANY

18.2.2 U.K.

18.2.3 ITALY

18.2.4 FRANCE

18.2.5 SPAIN

18.2.6 RUSSIA

18.2.7 SWITZERLAND

18.2.8 TURKEY

18.2.9 BELGIUM

18.2.10 NETHERLANDS

18.2.11 LUXEMBURG

18.2.12 REST OF EUROPE

18.3 ASIA-PACIFIC

18.3.1 JAPAN

18.3.2 CHINA

18.3.3 SOUTH KOREA

18.3.4 INDIA

18.3.5 SINGAPORE

18.3.6 THAILAND

18.3.7 INDONESIA

18.3.8 MALAYSIA

18.3.9 PHILIPPINES

18.3.10 AUSTRALIA & NEW ZEALAND

18.3.11 REST OF ASIA-PACIFIC

18.4 SOUTH AMERICA

18.4.1 BRAZIL

18.4.2 ARGENTINA

18.4.3 REST OF SOUTH AMERICA

18.5 MIDDLE EAST AND AFRICA

18.5.1 SOUTH AFRICA

18.5.2 EGYPT

18.5.3 SAUDI ARABIA

18.5.4 UNITED ARAB EMIRATES

18.5.5 ISRAEL

18.5.6 REST OF MIDDLE EAST AND AFRICA

19 GLOBAL COMMERCIAL SOFT-SERVE MACHINES MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: GLOBAL

19.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

19.3 COMPANY SHARE ANALYSIS: EUROPE

19.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

19.5 MERGERS AND ACQUISITIONS

19.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

19.7 EXPANSIONS

19.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTSS

20 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

21 GLOBAL COMMERCIAL SOFT-SERVE MACHINES MARKET - COMPANY PROFILES

21.1 STOELTING FOODSERVICE EQUIPMENT

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 PRODUCT PORTFOLIO

21.1.4 RECENT UPDATES

21.2 DONPER

21.2.1 COMPANY SNAPSHOT

21.2.2 REVENUE ANALYSIS

21.2.3 PRODUCT PORTFOLIO

21.2.4 RECENT UPDATES

21.3 GRINDMASTER-CECILWARE

21.3.1 COMPANY SNAPSHOT

21.3.2 REVENUE ANALYSIS

21.3.3 PRODUCT PORTFOLIO

21.3.4 RECENT UPDATES

21.4 KLIMAGEL

21.4.1 COMPANY SNAPSHOT

21.4.2 REVENUE ANALYSIS

21.4.3 PRODUCT PORTFOLIO

21.4.4 RECENT UPDATES

21.5 LUNA

21.5.1 COMPANY SNAPSHOT

21.5.2 REVENUE ANALYSIS

21.5.3 PRODUCT PORTFOLIO

21.5.4 RECENT UPDATES

21.6 MKK

21.6.1 COMPANY SNAPSHOT

21.6.2 REVENUE ANALYSIS

21.6.3 PRODUCT PORTFOLIO

21.6.4 RECENT UPDATES

21.7 OCEANPOWER

21.7.1 COMPANY SNAPSHOT

21.7.2 REVENUE ANALYSIS

21.7.3 PRODUCT PORTFOLIO

21.7.4 RECENT UPDATES

21.8 ELECTRO FREEZE

21.8.1 COMPANY SNAPSHOT

21.8.2 REVENUE ANALYSIS

21.8.3 PRODUCT PORTFOLIO

21.8.4 RECENT UPDATES

21.9 GEPPETTO EIS GMBH..

21.9.1 COMPANY SNAPSHOT

21.9.2 REVENUE ANALYSIS

21.9.3 PRODUCT PORTFOLIO

21.9.4 RECENT UPDATES

21.1 TAYLOR COMMERCIAL FOODSERVICE, LLC

21.10.1 COMPANY SNAPSHOT

21.10.2 REVENUE ANALYSIS

21.10.3 PRODUCT PORTFOLIO

21.10.4 RECENT UPDATES

21.11 CARPIGIANI

21.11.1 COMPANY SNAPSHOT

21.11.2 REVENUE ANALYSIS

21.11.3 PRODUCT PORTFOLIO

21.11.4 RECENT UPDATES

21.12 SPACEMAN ICE SYSTEMS CO. LTD

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 PRODUCT PORTFOLIO

21.12.4 RECENT UPDATES

21.13 THE VOLLRATH COMPANY, LLC

21.13.1 COMPANY SNAPSHOT

21.13.2 REVENUE ANALYSIS

21.13.3 PRODUCT PORTFOLIO

21.13.4 RECENT UPDATES

21.14 ELECTROLUX PROFESSIONAL GROUP

21.14.1 COMPANY SNAPSHOT

21.14.2 REVENUE ANALYSIS

21.14.3 PRODUCT PORTFOLIO

21.14.4 RECENT UPDATES

21.15 TECHNOGEL

21.15.1 COMPANY SNAPSHOT

21.15.2 REVENUE ANALYSIS

21.15.3 PRODUCT PORTFOLIO

21.15.4 RECENT UPDATES

21.16 NISSEI

21.16.1 COMPANY SNAPSHOT

21.16.2 REVENUE ANALYSIS

21.16.3 PRODUCT PORTFOLIO

21.16.4 RECENT UPDATES

21.17 PASMO

21.17.1 COMPANY SNAPSHOT

21.17.2 REVENUE ANALYSIS

21.17.3 PRODUCT PORTFOLIO

21.17.4 RECENT UPDATES

21.18 BAVARIAN BUREAU FOR INTERNATIONAL

21.18.1 COMPANY SNAPSHOT

21.18.2 REVENUE ANALYSIS

21.18.3 PRODUCT PORTFOLIO

21.18.4 RECENT UPDATES

21.19 INNOVA

21.19.1 COMPANY SNAPSHOT

21.19.2 REVENUE ANALYSIS

21.19.3 PRODUCT PORTFOLIO

21.19.4 RECENT UPDATES

21.2 GEL MATIC.

21.20.1 COMPANY SNAPSHOT

21.20.2 REVENUE ANALYSIS

21.20.3 PRODUCT PORTFOLIO

21.20.4 RECENT UPDATES

21.21 NEMOX INTERNATIONAL S.R.L

21.21.1 COMPANY SNAPSHOT

21.21.2 REVENUE ANALYSIS

21.21.3 PRODUCT PORTFOLIO

21.21.4 RECENT UPDATES

21.22 SEAFORTH GROUP

21.23 FIZZ BANG

21.23.1 COMPANY SNAPSHOT

21.23.2 REVENUE ANALYSIS

21.23.3 PRODUCT PORTFOLIO

21.23.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

22 RELATED REPORTS

23 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.