Global Consumer Genomics Market

Market Size in USD Billion

CAGR :

%

USD

2.54 Billion

USD

21.23 Billion

2025

2033

USD

2.54 Billion

USD

21.23 Billion

2025

2033

| 2026 –2033 | |

| USD 2.54 Billion | |

| USD 21.23 Billion | |

|

|

|

|

Consumer Genomics Market Size

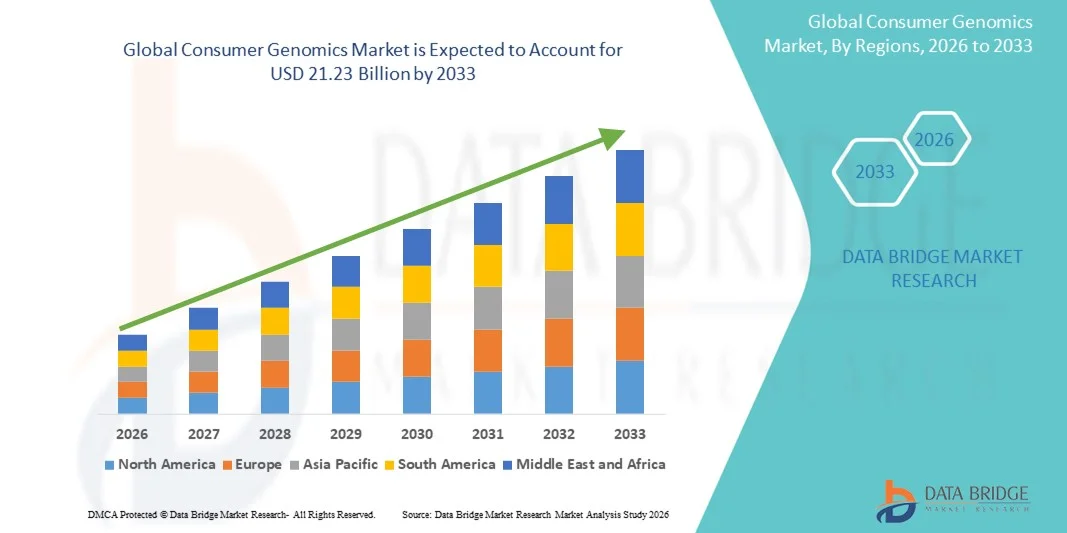

- The global consumer genomics market size was valued at USD 2.54 billion in 2025 and is expected to reach USD 21.23 billion by 2033, at a CAGR of 30.40% during the forecast period

- The market growth is largely fueled by increasing consumer interest in personalized health, ancestry insights, and predictive genomics, leading to higher adoption of at-home DNA testing and personalized genomics services

- Furthermore, rising awareness about preventive healthcare, coupled with the availability of affordable and user-friendly testing kits, is accelerating the uptake of Consumer Genomics solutions, thereby significantly boosting the industry's growth

Consumer Genomics Market Analysis

- Consumer genomics, offering insights into ancestry, health predispositions, and wellness traits, is increasingly becoming a vital tool for individuals seeking personalized healthcare, preventive medicine, and lifestyle guidance due to its accessibility, convenience, and integration with digital health platforms

- The escalating demand for consumer genomics is primarily fueled by growing awareness of personalized healthcare, increasing interest in ancestry and wellness testing, and the rising adoption of direct-to-consumer genetic testing services

- North America dominated the consumer genomics market with the largest revenue share of 45% in 2025, characterized by the presence of leading genomics service providers, strong healthcare infrastructure, high consumer awareness, and favorable regulatory support, with the U.S. contributing the majority of this share due to widespread adoption of direct-to-consumer genetic testing

- Asia-Pacific is expected to be the fastest-growing region in the consumer genomics market during the forecast period, registering a CAGR of 10% from 2026 to 2033, driven by increasing healthcare awareness, rising disposable incomes, and expanding access to genetic testing services in countries such as China, India, and Japan

- The Consumables segment dominated the largest market revenue share of 45.5% in 2025, owing to the recurring need for sample collection kits, reagents, and processing materials in direct-to-consumer testing and clinical genomics applications

Report Scope and Consumer Genomics Market Segmentation

|

Attributes |

Consumer Genomics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• AncestryDNA (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Consumer Genomics Market Trends

Rising Adoption of Personalized Healthcare and Preventive Medicine

- A key trend in the global consumer genomics market is the increasing adoption of personalized healthcare and preventive medicine. As consumers become more proactive about their health, there is growing interest in genomic testing to understand disease risk, ancestry, and lifestyle-related genetic traits

- For instance, in 2023, 23andMe launched expanded health reports in the U.S., offering insights into over 50 genetic health risks, which enhanced consumer engagement in preventive healthcare strategies

- The integration of genomics into wellness programs and clinical decision-making is encouraging healthcare providers and insurers to support consumer testing

- With the surge in direct-to-consumer (DTC) genetic testing services, consumers are increasingly using genomic data to tailor nutrition, fitness, and lifestyle interventions

- Companies such as AncestryDNA, MyHeritage, and Nebula Genomics are expanding their offerings to include detailed carrier screening and wellness reports, reflecting the trend toward more personalized health insights

- The trend is reinforced by growing awareness about hereditary diseases, rising health literacy, and increasing accessibility of affordable testing kits across developed and developing regions

- Moreover, research partnerships and collaborations between genomics companies and healthcare institutions are boosting the adoption of genomics in preventive medicine, particularly for high-risk populations

Consumer Genomics Market Dynamics

Driver

Growing Health Awareness and Demand for Preventive Medicine

- The increasing health awareness among consumers and the desire to prevent hereditary diseases are significant drivers of the Consumer Genomics market

- For instance, in March 2024, Nebula Genomics partnered with a leading healthcare provider in the U.S. to offer subsidized whole-genome sequencing for high-risk patients, aimed at early detection of genetic conditions

- Consumers are seeking actionable health insights, such as disease predisposition, drug response, and nutritional needs, motivating the adoption of genetic testing. Expansion of government initiatives and public awareness campaigns about genetic health is encouraging more people to undertake testing

- The rise of chronic and lifestyle-related diseases, such as diabetes, cardiovascular conditions, and obesity, is pushing individuals and families toward genomics-based preventive strategies. Increasing availability of affordable and rapid testing solutions, along with online platforms for result interpretation, is simplifying access to genetic information for consumers worldwide

- Healthcare professionals are also advocating for genomics-guided preventive care, further supporting the market expansion

Restraint/Challenge

Privacy Concerns and Regulatory Barriers

- Concerns over genetic data privacy and potential misuse of personal information pose challenges to the widespread adoption of consumer genomics services

- For instance, in July 2023, the European Data Protection Board issued guidance highlighting privacy risks in DTC genetic testing, prompting stricter compliance requirements for service providers

- The lack of standardized regulations across countries regarding storage, sharing, and interpretation of genomic data can slow down market growth

- Consumers may hesitate to share sensitive genetic information due to fears of discrimination by insurers or employers

- High costs associated with comprehensive genomic testing, particularly whole-genome sequencing, can be prohibitive for price-sensitive consumers in emerging regions

- Addressing these challenges requires robust data protection policies, secure platforms for storing genomic data, and clear regulatory frameworks to build consumer trust

- Some companies, such as Invitae and Myriad Genetics, are investing in enhanced encryption and anonymization methods to protect consumer data and reassure users about privacy risks

Consumer Genomics Market Scope

The market is segmented on the basis of application, technology, and product & service.

- By Application

On the basis of application, the Consumer Genomics market is segmented into Genetic Relatedness, Diagnostics, Lifestyle, Wellness, and Nutrition, Ancestry, Reproductive Health, Personalized Medicine and Pharmacogenetic Testing, Sports Nutrition and Health, and Others. The Genetic Relatedness segment dominated the largest market revenue share of 38.6% in 2025, driven by growing consumer interest in ancestry insights, family lineage discovery, and paternity testing. Companies offering ancestry-focused tests are expanding their marketing campaigns globally, making these services accessible and appealing to a broad demographic. Consumers are increasingly engaging in direct-to-consumer (DTC) testing to uncover heritage, connect with distant relatives, and explore genealogical roots. Partnerships with healthcare providers and integration with lifestyle apps are further enhancing the value proposition of genetic relatedness testing. Additionally, ongoing product innovations, affordable kits, and online platforms for result interpretation continue to drive consumer adoption. The segment benefits from strong brand recognition of major ancestry testing providers, such as 23andMe and AncestryDNA, boosting market penetration across North America and Europe. Educational campaigns highlighting the accuracy and scientific credibility of these tests reinforce consumer confidence. Market growth is also supported by rising internet penetration, improved logistics for sample collection, and increasing interest among younger demographics. The Genetic Relatedness segment has established itself as a mainstream genomics offering, solidifying its leading position in the market.

The Personalized Medicine and Pharmacogenetic Testing segment is expected to witness the fastest CAGR of 22.4% from 2026 to 2033, driven by rising adoption of genomics-guided treatment planning, drug response prediction, and individualized healthcare strategies. Increased awareness of pharmacogenomics in therapeutic decision-making is prompting both consumers and healthcare providers to invest in testing solutions that optimize treatment efficacy. For instance, collaborations between genomics companies and hospitals are facilitating access to personalized treatment plans based on genetic profiles. Governments and insurance providers in developed regions are gradually recognizing the benefits of genomics-based personalized care, supporting reimbursement frameworks. Technological advancements in sequencing and data analytics reduce turnaround times and costs, making pharmacogenetic testing increasingly attractive. Consumers seeking to minimize adverse drug reactions and improve treatment outcomes are further fueling demand. The segment’s growth is bolstered by rising prevalence of chronic and complex diseases, which require individualized therapeutic interventions. Furthermore, integration of pharmacogenetic insights into electronic health records enhances clinical decision-making, creating a robust market ecosystem. Expansion of awareness campaigns and direct-to-consumer access options also contribute to the accelerating adoption rate in both developed and emerging markets.

- By Technology

On the basis of technology, the Consumer Genomics market is segmented into PCR, Sequencing, Microarray, Nucleic Acid Extraction and Purification, and Other Technologies. The Sequencing segment dominated the largest market revenue share of 41.8% in 2025, primarily due to its ability to provide comprehensive genome-wide insights, high accuracy, and applications across diagnostics, personalized medicine, and ancestry. Sequencing platforms enable both whole-genome and targeted analyses, offering valuable insights for disease risk assessment and trait discovery. Leading providers have expanded sequencing services through user-friendly kits and cloud-based data interpretation platforms. The segment’s popularity is reinforced by decreasing costs of next-generation sequencing, robust bioinformatics support, and growing collaborations between genomics companies and research institutions. Major market players continue to enhance sequencing throughput and precision, enabling faster and more scalable testing solutions. Consumers are increasingly adopting sequencing for preventive healthcare and clinical decision-making. Ongoing innovations, such as ultra-low-cost sequencing and portable devices, expand the reach of sequencing technologies globally. Market growth is further stimulated by rising awareness of genomic applications in wellness, nutrition, and reproductive health. Sequencing’s flexibility across diverse genomics applications ensures its continued dominance.

The PCR segment is expected to witness the fastest CAGR of 20.7% from 2026 to 2033, driven by its widespread use in rapid diagnostics, mutation detection, and consumer-friendly genetic tests. PCR-based solutions are highly sensitive, cost-effective, and suitable for small-scale or point-of-care testing. Adoption is particularly strong in clinical diagnostics, pharmacogenetics, and consumer wellness applications. Companies are introducing multiplex PCR kits capable of detecting multiple genetic markers simultaneously, further expanding their usability. Growth is also supported by advancements in automated and portable PCR platforms, making testing more convenient and accessible. PCR remains a preferred choice for targeted testing due to its speed, reliability, and scalability. Increasing demand for at-home genetic testing kits and rapid reporting of results contributes to segment acceleration. Regional expansion in Asia-Pacific and Latin America is driving additional adoption, as healthcare infrastructure and awareness improve. Regulatory approvals for PCR-based consumer testing have further solidified market confidence, enhancing its growth trajectory over the forecast period.

- By Product & Service

On the basis of product & service, the Consumer Genomics market is segmented into Consumables, Systems and Software, and Services. The Consumables segment dominated the largest market revenue share of 45.5% in 2025, owing to the recurring need for sample collection kits, reagents, and processing materials in direct-to-consumer testing and clinical genomics applications. Consumables form the backbone of genomics operations, ensuring reliable sample quality and accurate testing outcomes. Companies are expanding the availability of ready-to-use kits for at-home or clinical settings, supporting rapid adoption. Subscription-based models and kit bundles contribute to consistent revenue streams. High demand for diagnostic, wellness, and ancestry testing further reinforces consumables as the primary revenue driver. Ongoing product innovations, such as easier sample collection and stabilization technologies, enhance user experience. The segment benefits from global logistics networks that enable delivery and return of kits efficiently. Strategic partnerships between genomics companies and e-commerce platforms facilitate accessibility in remote regions. Market growth is additionally supported by education campaigns and increased consumer health literacy, solidifying the dominance of consumables.

The Services segment is expected to witness the fastest CAGR of 21.3% from 2026 to 2033, fueled by rising demand for genetic counseling, data interpretation, and analytical services. Service offerings include personalized reports, clinical interpretation of genetic findings, and wellness recommendations. Expansion of online platforms offering comprehensive genomics services has made professional support more accessible to consumers. Companies are leveraging AI-driven analytics (internally for interpretation) to provide insights without mentioning AI to the user, increasing efficiency. Collaborations with healthcare providers and insurance firms for guided genomic insights are boosting adoption. Growth is further supported by increasing consumer reliance on professional recommendations to understand complex genetic results. Regional growth in North America, Europe, and Asia-Pacific reflects a combination of awareness, infrastructure, and affordability. Emerging markets are also witnessing rapid uptake as service providers localize offerings and enhance accessibility.

Consumer Genomics Market Regional Analysis

- North America dominated the consumer genomics market with the largest revenue share of 45% in 2025

- Characterized by the presence of leading genomics service providers, strong healthcare infrastructure, high consumer awareness, and favorable regulatory support

- The market contributed the majority of this share due to widespread adoption of direct-to-consumer genetic testing and increasing interest in personalized health, ancestry, and wellness insights

U.S. Consumer Genomics Market Insight

The U.S. consumer genomics market captured the largest revenue share within North America in 2025, supported by high adoption of direct-to-consumer genetic tests, advanced laboratory infrastructure, and favorable reimbursement policies. Consumers are increasingly seeking ancestry, lifestyle, wellness, and personalized medicine insights, which is driving growth in testing services and associated software platforms.

Europe Consumer Genomics Market Insight

The Europe consumer genomics market is projected to grow steadily during the forecast period, fueled by increasing awareness about preventive healthcare, rising interest in ancestry and lifestyle genomics, and supportive government initiatives promoting genetic research. The market is seeing notable adoption in countries such as the U.K., Germany, and France, where private and public genetic testing services are expanding.

U.K. Consumer Genomics Market Insight

The U.K. consumer genomics market is anticipated to grow at a strong CAGR during the forecast period, driven by increasing consumer interest in ancestry and wellness testing, advancements in genomics technologies, and the availability of user-friendly testing kits. Rising online platforms for direct-to-consumer testing also contribute to market expansion.

Germany Consumer Genomics Market Insight

The Germany consumer genomics market is expected to expand significantly, supported by high healthcare awareness, well-established genetic laboratories, and growing consumer interest in personalized health and wellness solutions. Germany’s robust infrastructure and adoption of advanced genomics technologies facilitate the development of the market.

Asia-Pacific Consumer Genomics Market Insight

The Asia-Pacific consumer genomics market is poised to grow at the fastest rate, with a CAGR of 10% from 2026 to 2033, driven by increasing awareness about personalized healthcare, expanding middle-class population, rising disposable incomes, and growing availability of genetic testing services in countries such as China, India, and Japan.

Japan Consumer Genomics Market Insight

The Japan consumer genomics market is gaining momentum due to high healthcare awareness, a tech-savvy population, and increasing interest in ancestry, lifestyle, and wellness testing. The market is supported by advanced laboratory infrastructure and government initiatives promoting precision medicine.

China Consumer Genomics Market Insight

The China consumer genomics market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rising consumer awareness, rapid urbanization, growing disposable incomes, and increasing adoption of direct-to-consumer genetic testing. Expanding private and public genomics service providers are driving the availability of personalized health and ancestry solutions across the country.

Consumer Genomics Market Share

The Consumer Genomics industry is primarily led by well-established companies, including:

• AncestryDNA (U.S.)

• MyHeritage (Israel)

• Veritas Genetics (U.S.)

• Color Genomics (U.S.)

• Fitgenes (U.S.)

• Invitae (U.S.)

• Helix (U.S.)

• Orig3n (U.S.)

• Illumina (U.S.)

• BGI Genomics (China)

• Gene by Gene (U.S.)

• Full Genomes Corporation (U.S.)

• FamilyTreeDNA (U.S.)

• Dante Labs (Italy)

• Genomelink (U.S.)

• Nutrigenomix (Canada)

• EasyDNA (U.K.)

• Verogen (U.S.)

Latest Developments in Global Consumer Genomics Market

- In 2023, Nebula Genomics — known for its whole‑genome sequencing (WGS) offerings — significantly reduced the price of its full‑genome sequencing service to under US$ 200, making advanced genome sequencing more accessible and expanding the reach of high-resolution genetic testing

- In January 2024, a leading company in the space, 23andMe, announced a strategic partnership with Pfizer to leverage consumer genomics data for research and drug discovery, marking a shift where consumer genetic data begins to feed into broader biomedical research beyond simple ancestry or wellness tests

- In February 2025, the market research tracker SNS Insider reported that the global direct‑to‑consumer genetic testing market is on track to reach US$ 7.59 billion by 2032, driven by increased consumer interest in predictive health, ancestry insights, and affordable online genetic test kits

- In May 2025, Regeneron Pharmaceuticals agreed to acquire 23andMe Holding Co. for US$ 256 million via bankruptcy auction, securing access to 23andMe’s database of over 15 million customer DNA profiles — a major event underscoring both the immense data value and the shifting business models in consumer genomics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.