Global Sports Nutrition Market

Market Size in USD Billion

CAGR :

%

USD

21.71 Billion

USD

48.13 Billion

2024

2032

USD

21.71 Billion

USD

48.13 Billion

2024

2032

| 2025 –2032 | |

| USD 21.71 Billion | |

| USD 48.13 Billion | |

|

|

|

|

Sports Nutrition Market Size

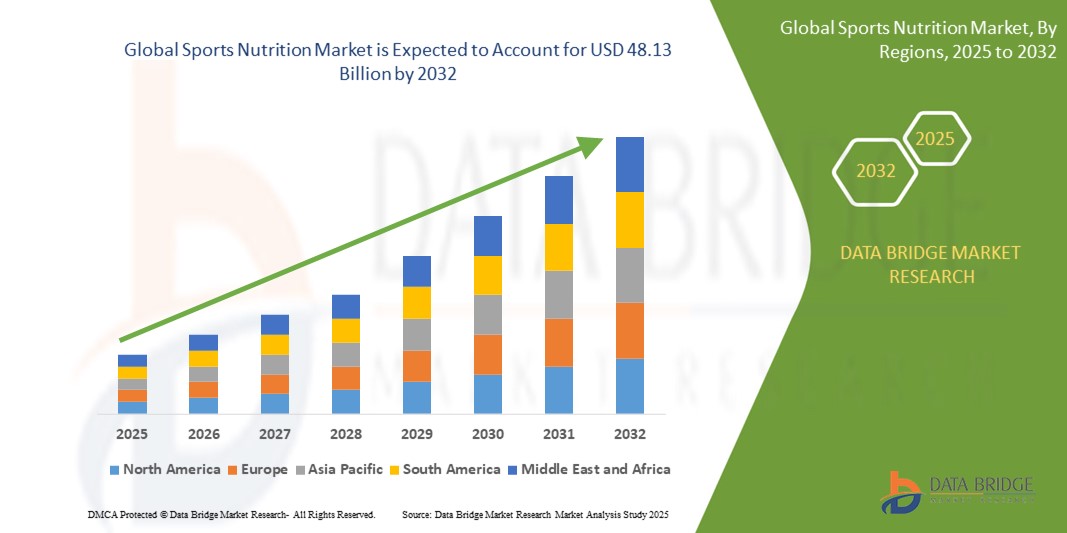

- The global sports nutrition market was valued at USD 21.71 billion in 2024 and is expected to reach USD 48.13 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 10.46%, primarily driven by increasing demand for performance-enhancing products and wellness trends

- This growth is fueled by rising fitness awareness, growing participation in sports and physical activities, and expanding consumer base beyond professional athletes to include recreational users and lifestyle consumers

Sports Nutrition Market Analysis

- Sports nutrition products play a crucial role in enhancing physical performance, recovery, and overall health by supplying essential nutrients such as proteins, amino acids, vitamins, and minerals. These products are widely consumed by professional athletes, fitness enthusiasts, and increasingly by lifestyle users

- The demand for sports nutrition is being significantly driven by rising health consciousness, the growing trend of active lifestyles, and the increasing penetration of fitness centers and gyms globally. A shift toward preventive healthcare and performance-driven nutrition further supports market expansion

- The North America region stands out as one of the dominant regions in the sports nutrition market, supported by its well-established fitness industry, high consumer awareness, and availability of advanced product formulations

- For instance, the U.S. has seen a surge in demand for protein supplements and plant-based sports nutrition, with innovation from major brands catering to both athletes and casual users. E-commerce platforms have also accelerated product accessibility and consumer engagement

- Globally, sports nutrition is evolving beyond traditional powders and bars into functional foods and beverages, personalized nutrition, and clean-label offerings—highlighting its growing role in mainstream health and wellness routines

Report Scope and Sports Nutrition Market Segmentation

|

Attributes |

Ophthalmic Operational Microscope Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sports Nutrition Market Trends

“Growing Demand for Clean-Label and Plant-Based Products”

- One prominent trend in the global sports nutrition market is the increasing demand for clean-label and plant-based products, as consumers prioritize transparency, health, and sustainability in their dietary choices

- Clean-label sports nutrition products, free from artificial additives, sweeteners, and preservatives, are gaining popularity, particularly among millennials and Gen Z consumers who seek natural and minimally processed ingredients

- For instance, major brands are launching plant-based protein powders made from peas, brown rice, and hemp to cater to vegan and lactose-intolerant consumers, expanding the reach of sports nutrition beyond traditional fitness users

- Digital integration also allows for the seamless capture of high-resolution images and videos during surgeries, facilitating better documentation and post-operative analysis

- This trend is revolutionizing the way ophthalmic surgeries are performed, improving patient outcomes and increasing the demand for technologically advanced microscopes in This trend is revolutionizing product development in the sports nutrition market, pushing manufacturers to innovate with functional ingredients, ensure sustainability, and align with consumer values—ultimately driving market growth and reshaping product offerings globally

Sports Nutrition Market Dynamics

Driver

“Growing Demand Due to Increased Health Awareness and Fitness Trends”

- The rising awareness around health, fitness, and active lifestyles is significantly contributing to the increased demand for sports nutrition products

- As more individuals engage in fitness routines and pursue health goals, the need for supplements like protein powders, energy bars, and hydration solutions is growing rapidly

- Protein supplements, in particular, are among the most popular, driven by their use in muscle building, recovery, and weight management

- The ongoing growth of the fitness industry, coupled with increasing interest in bodybuilding and sports performance, highlights the need for high-quality sports nutrition products that support various fitness goals

- As more consumers seek effective nutrition solutions to enhance performance and recovery, the demand for sports nutrition products continues to rise, driving innovation and new product development

For instance,

- In anuary 2024, Nestlé Health Science launched a new line of plant-based protein products aimed at athletes and fitness enthusiasts, responding to the rising demand for plant-based nutrition solutions. This launch targets the growing segment of health-conscious consumers who prefer plant-based alternatives to animal protein

- In July 2023, Glanbia Performance Nutrition introduced a new whey protein isolate product designed to enhance post-workout recovery. This product was developed in response to the increasing popularity of sports and fitness-related nutrition, with a focus on improving muscle protein synthesis

- The demand for sports nutrition products is closely tied to the increasing number of individuals participating in fitness activities and professional sports, further fueling market growth

Opportunity

“Leveraging Technology for Personalized Sports Nutrition”

- Advanced technologies, including artificial intelligence (AI) and data analytics, are enhancing the personalization of sports nutrition products, allowing for tailored solutions to meet individual needs

- AI-powered platforms are being developed to analyze users' fitness levels, nutritional requirements, and performance goals, providing customized recommendations for supplements, diet plans, and workout routines

- These personalized solutions not only optimize athletic performance but also support recovery, energy management, and overall well-being, attracting more consumers who want specific and measurable results from their sports nutrition

- With the growing demand for personalized health and fitness services, sports nutrition companies are increasingly integrating AI and machine learning into their product offerings to provide more accurate, data-driven insights into consumer needs

For instance,

- In March 2024, Myprotein, a leading sports nutrition brand, launched an AI-powered app that helps users create personalized nutrition plans based on their individual fitness goals, dietary preferences, and performance metrics

- In February 2023, Klean Athlete partnered with a tech firm to create a platform that analyzes users’ activity levels, recovery data, and overall fitness to recommend the ideal sports nutrition products for optimal results. This AI-driven system uses data from wearables to fine-tune recommendations for athletes of all levels

- The increasing focus on personalized sports nutrition represents a significant growth opportunity in the market, as consumers seek products that align with their specific goals and fitness profiles

Restraint/Challenge

“High Product Costs and Accessibility Barriers”

- The high cost of premium sports nutrition products, including specialized protein powders, supplements, and recovery drinks, presents a significant challenge for broader market penetration, especially in price-sensitive regions

- High-quality sports nutrition products often come at a premium price, which can limit their accessibility to individuals in lower-income brackets or developing markets, where consumers may not prioritize or afford advanced nutritional solutions

- While there is an increasing demand for sports nutrition, affordability remains a barrier for mass adoption, particularly in markets where disposable income is lower or where cost-conscious consumers are reluctant to invest in premium sports nutrition products

- These cost barriers can also affect the growth of the online sports nutrition market, where price comparisons and discounts are a major driver of consumer purchasing decisions

For instance

- In January 2024, GNC introduced a new range of affordable sports nutrition supplements in emerging markets like Southeast Asia and India, aimed at making sports nutrition accessible to a broader population despite the price sensitivity of these regions

- In October 2023, a report by Euromonitor indicated that the high cost of high-end protein and recovery supplements is limiting the growth potential of the sports nutrition market in some parts of Latin America and Africa, where consumers are often priced out of purchasing premium options

- Such affordability challenges can significantly limit market expansion and the ability of sports nutrition brands to capture a larger share of the global market

Sports Nutrition Market Scope

The market is segmented on the basis of product type, end user, distribution channel and consumer group.

|

Segmentation |

Sub-Segmentation |

|

By Product type |

|

|

By End User |

|

|

By Distribution channel |

|

|

By Consumer Group |

|

Sports Nutrition Market Regional Analysis

“North America is the Dominant Region in the Sports Nutrition Market”

- North America holds a dominant share in the global sports nutrition market, driven by increasing awareness of fitness and health, a well-established fitness culture, and a strong presence of leading sports nutrition brands

- The U.S. is the key player, contributing significantly to market growth due to high consumer demand for sports supplements, protein powders, and energy drinks, fueled by the growing fitness and wellness trends

- The rise in professional and amateur sports participation, along with a growing focus on health and fitness, further propels demand for sports nutrition products in the region

- Well-established distribution channels, including online platforms and fitness centers, as well as an emphasis on product innovation and quality, continue to strengthen North America's position in the global market

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is projected to experience the highest growth rate in the global sports nutrition market, driven by a growing focus on fitness, increased disposable incomes, and rapid urbanization

- Countries such as China, India, and Japan are emerging as key markets due to increasing awareness of health and wellness, rising fitness trends, and growing sports participation

- China, with its large population and booming sports industry, is expected to see a significant rise in demand for protein supplements, energy drinks, and post-workout recovery products

- India, witnessing rapid growth in the fitness sector, especially among the youth, is experiencing a surge in demand for nutrition products tailored for active lifestyles. The expansion of fitness centers and gyms further supports the market

- Japan, with its advanced sports science and technology, continues to play a vital role in driving innovation in sports nutrition products, focusing on premium and scientifically-backed supplements to enhance athletic performance

Sports Nutrition Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Glanbia plc. (Ireland)

- Now Health Group, Inc. (U.S.)

- Nutiva Inc (U.S.)

- The Simply Good Food Co (U.S.)

- Iovate Health Sciences International Inc. (Canada)

- MusclePharm Corporation (U.S.)

- Kerry Group Plc (Ireland)

- CytoSport, Inc. (U.S.)

- The Nature's Bounty Co. (U.S.)

- Reliance Vitamin Company, Inc. (U.S.)

- Herbalife Nutrition, Inc. (U.S.)

- Danone SA (France)

- General Nutrition Centers (GNC) Holdings, Inc. (U.S.)

- Orgain Inc. (U.S.)

- True Nutrition (U.S.)

Latest Developments in Global Sports Nutrition Market

- In March 2024, PepsiCo’s Gatorade introduced a new line of plant-based sports drinks, tapping into the rising popularity of plant-based diets in North America. This innovative launch reflects Gatorade's commitment to catering to evolving consumer preferences while reinforcing its position in the competitive sports drink market. By offering plant-based options, Gatorade aims to attract health-conscious individuals seeking sustainable and nutrient-rich beverages. This strategic move highlights PepsiCo's dedication to expanding its portfolio and strengthening its foothold in the North American market

- In October 2023, Herbalife Nutrition introduced a new range of plant-based protein powders in India, addressing the rising demand for plant-based sports supplements. These products are designed for health-conscious consumers seeking nutritious and sustainable alternatives. The launch highlights Herbalife's commitment to innovation and meeting evolving consumer preferences. By offering plant-based options, the company aims to strengthen its presence in the Indian market and cater to the growing trend of healthier lifestyles

- In April 2023, Sirio Europe revealed plans to introduce two innovative collagen-based gummies at the Vitafoods Europe trade show. Specifically designed for sports nutrition, these gummies aim to support joint health and enhance athletic performance. Featuring advanced formulations, they incorporate high-quality collagen to cater to the growing demand for functional and convenient supplements. This launch highlights Sirio Europe's commitment to innovation and addressing the needs of health-conscious consumers. The Vitafoods Europe trade show served as the perfect platform to showcase these groundbreaking products

- In February 2023, Olly expanded its product lineup with the launch of two innovative offerings: Post-Game Recovery Gummy Rings and Pre-Game Energize Gummy Rings. Designed to cater to the fitness community, these gummies provide targeted benefits for workout enthusiasts. The Pre-Game Energize Gummy Rings boost energy and stamina with ingredients like the S7 Plant-Based Blend and B vitamins, while the Post-Game Recovery Gummy Rings aid muscle recovery with vitamin D, turmeric, and electrolytes. This launch underscores Olly's commitment to supporting active lifestyles

- In April 2022, Abbott, with approval from the U.S. FDA, released limited quantities of metabolic nutrition formulas to address specific nutritional needs. These formulas, previously on hold, were made available under medical supervision to ensure proper use. This strategic release is expected to drive demand for nutritional supplements, contributing to market growth. Abbott's initiative highlights its commitment to addressing specialized dietary requirements while adhering to regulatory standards. The move also underscores the growing importance of tailored nutrition solutions in the healthcare industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sports Nutrition Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sports Nutrition Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sports Nutrition Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.