Global Covid 19 Drug Delivery Devices Market

Market Size in USD Billion

CAGR :

%

USD

1.93 Billion

USD

3.37 Billion

2025

2033

USD

1.93 Billion

USD

3.37 Billion

2025

2033

| 2026 –2033 | |

| USD 1.93 Billion | |

| USD 3.37 Billion | |

|

|

|

|

COVID-19 Drug Delivery Devices Market Size

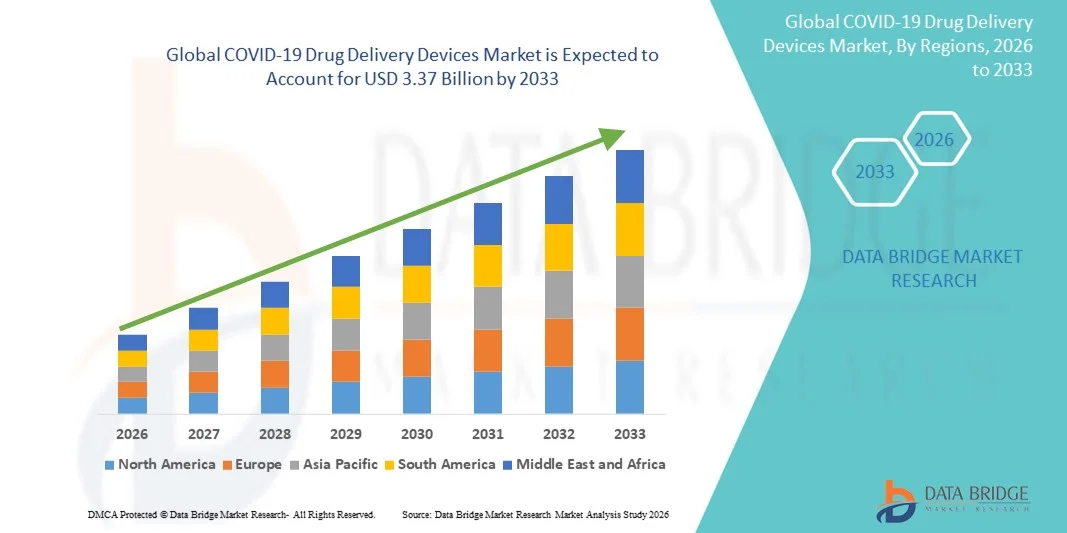

- The global COVID-19 drug delivery devices market size was valued at USD 1.93 billion in 2025 and is expected to reach USD 3.37 billion by 2033, at a CAGR of 7.22% during the forecast period

- The market growth is primarily driven by the sustained demand for efficient, accurate, and rapid drug administration methods for COVID-19 treatment and management, alongside continued investments in respiratory care and infectious disease preparedness across healthcare systems

- In addition, increasing adoption of advanced delivery technologies such as inhalers, nebulizers, injectors, and infusion systems combined with the need for improved patient safety, dosing precision, and home-based care positions COVID-19 drug delivery devices as a critical component of modern therapeutic infrastructure, thereby supporting steady market expansion

COVID-19 Drug Delivery Devices Market Analysis

- COVID-19 drug delivery devices, used for the administration of antiviral drugs, vaccines, and supportive COVID-19 therapies, play a critical role in ensuring safe, accurate, and efficient treatment across hospital, pharmacy, and homecare settings, particularly during large-scale public health emergencies

- The increasing demand for COVID-19 drug delivery devices is primarily driven by the continued need for pandemic preparedness, mass immunization programs, and the shift toward user-friendly, minimally invasive, and self-administrable delivery solutions

- North America dominated the COVID-19 drug delivery devices market with the largest revenue share of 53.2% in 2025, supported by advanced healthcare infrastructure, high adoption of prefilled syringes and inhalers, strong government procurement programs, and the presence of major medical device manufacturers, with the U.S. maintaining steady demand across hospital and retail pharmacy channels

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by expanding vaccination coverage, rising healthcare expenditure, large patient populations, and increasing adoption of innovative delivery formats such as needle-free injectors and nasal delivery systems

- The prefilled syringe segment dominated the COVID-19 drug delivery devices market with a market share of 43.8% in 2025, driven by its dosing accuracy, ease of use, reduced contamination risk, and widespread utilization in vaccination and parenteral drug administration programs

Report Scope and COVID-19 Drug Delivery Devices Market Segmentation

|

Attributes |

COVID-19 Drug Delivery Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

COVID-19 Drug Delivery Devices Market Trends

Shift Toward Self-Administration and Home-Based Drug Delivery

- A significant and accelerating trend in the global COVID-19 drug delivery devices market is the increasing shift toward self-administrable and home-based delivery systems, including prefilled syringes, inhalers, and patches, aimed at reducing hospital visits and easing the burden on healthcare infrastructure

- For instance, prefilled syringe and inhaler-based COVID-19 therapies have gained traction for outpatient and homecare use, enabling patients to safely administer prescribed treatments without direct clinical supervision

- Technological advancements in drug delivery devices are enhancing ease of use, dosing accuracy, and patient compliance. For instance, modern prefilled syringes are designed with safety mechanisms such as needle guards and ergonomic grips to minimize dosing errors and needlestick injuries

- The growing preference for non-invasive or minimally invasive routes of administration, such as nasal and dermal delivery, is further shaping product development, as these methods improve patient comfort and acceptance during repeated dosing schedules

- This trend toward simplified, patient-centric drug delivery solutions is reshaping expectations around infectious disease treatment, prompting manufacturers to prioritize portability, stability, and ease of storage in device design

- Consequently, companies are increasingly focusing on scalable, ready-to-use COVID-19 drug delivery platforms that support rapid deployment during outbreaks while enabling continuity of care beyond hospital settings

- The demand for compact, portable, and shelf-stable drug delivery devices is rising, as healthcare systems prioritize rapid stockpiling and easy distribution during sudden infection surges or emergency response scenarios

COVID-19 Drug Delivery Devices Market Dynamics

Driver

Rising Demand Driven by Pandemic Preparedness and Mass Treatment Program

- The ongoing need for pandemic preparedness and rapid response capabilities is a major driver fueling demand for COVID-19 drug delivery devices across global healthcare systems

- For instance, large-scale vaccination and antiviral distribution programs have relied heavily on prefilled syringes and parenteral delivery devices to ensure speed, accuracy, and safety during mass administration efforts

- As governments and healthcare providers strengthen their infectious disease response frameworks, the demand for reliable and standardized drug delivery devices continues to rise

- In addition, the growing emphasis on decentralized care models, including retail and online pharmacies, is increasing the adoption of easy-to-dispense and ready-to-use COVID-19 drug delivery formats

- The ability of these devices to support rapid scaling, reduce administration errors, and improve treatment accessibility is a key factor propelling sustained market growth

- Increasing investments by governments and international health organizations in emergency medical stockpiles are driving steady demand for standardized COVID-19 drug delivery devices

- The growing role of hospital, retail, and online pharmacies in distributing COVID-19 therapies is further supporting the adoption of ready-to-use delivery formats that simplify dispensing and administration

Restraint/Challenge

Supply Chain Constraints and Regulatory Compliance Hurdles

- Disruptions in global supply chains for medical-grade materials and components present a significant challenge to the consistent production and availability of COVID-19 drug delivery devices

- For instance, shortages of syringes, medical plastics, and specialized components during peak pandemic periods highlighted vulnerabilities in device manufacturing and distribution networks

- Strict regulatory requirements for drug–device combination products can also slow product approvals, particularly when rapid deployment is required during public health emergencies

- Compliance with varying regulatory standards across regions adds complexity and cost for manufacturers, potentially delaying market entry in emerging economies

- Addressing these challenges through diversified supply sourcing, streamlined regulatory pathways, and improved coordination between governments and manufacturers will be critical for long-term market stability and growth

- Limited manufacturing capacity in low- and middle-income countries restricts local availability of advanced COVID-19 drug delivery devices, increasing reliance on imports and extending lead times

- The need for continuous post-market surveillance and compliance reporting for drug delivery devices adds operational burden for manufacturers, particularly during periods of rapid product rollout

COVID-19 Drug Delivery Devices Market Scope

The market is segmented on the basis of product type, route of administration, and end user

- By Product Type

On the basis of product type, the global COVID-19 drug delivery devices market is segmented into prefilled syringe, needle-free injectors, inhalers, and patch. The prefilled syringe segment dominated the market with the largest market revenue share of 43.8% in 2025, driven by its widespread use in COVID-19 vaccination programs and parenteral antiviral therapies. Prefilled syringes provide accurate dosing, reduced risk of contamination, and faster administration, making them highly suitable for mass immunization and emergency response settings. Their ease of handling and compatibility with existing healthcare infrastructure further supported strong adoption across hospital and pharmacy channels. In addition, large-scale government procurement and standardized regulatory approvals reinforced the dominance of this segment globally.

The needle-free injectors segment is anticipated to witness the fastest growth during the forecast period, fueled by increasing demand for pain-free, safe, and patient-friendly drug delivery solutions. These devices minimize needle-stick injuries and improve patient compliance, particularly among needle-averse populations. Growing emphasis on self-administration and home-based care has accelerated interest in needle-free technologies. Technological advancements improving delivery efficiency and precision are also contributing to rapid adoption in both developed and emerging markets.

- By Route of Administration

On the basis of route of administration, the global COVID-19 drug delivery devices market is segmented into parenteral, nasal, and dermal. The parenteral segment held the largest market revenue share in 2025, primarily due to its critical role in COVID-19 vaccination and injectable antiviral treatments. Parenteral administration enables rapid systemic drug delivery and precise dosing, which is essential in managing moderate to severe COVID-19 cases. Hospitals and healthcare providers rely heavily on injectable routes for controlled and supervised treatment. Established clinical practices and strong regulatory support further strengthened the dominance of this segment.

The nasal route of administration is expected to witness the fastest growth from 2026 to 2033, driven by rising demand for non-invasive and easy-to-administer treatment options. Nasal delivery offers faster onset of action and improved patient comfort compared to injectable methods. Increasing development of nasal sprays for antiviral and supportive COVID-19 therapies is supporting segment growth. Its suitability for outpatient and homecare use further enhances adoption, particularly in decentralized healthcare models.

- By End Users

On the basis of end users, the global COVID-19 drug delivery devices market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment dominated the market in 2025, driven by high patient volumes during peak infection periods and the concentration of severe cases requiring institutional care. Hospitals serve as primary centers for vaccination, injectable antiviral administration, and emergency COVID-19 treatment. The availability of trained healthcare professionals and controlled storage facilities supports extensive utilization of advanced drug delivery devices. Government-led procurement and bulk purchasing further reinforced hospital pharmacy dominance.

The online pharmacies segment is anticipated to register the fastest growth during the forecast period, supported by the rapid expansion of digital healthcare platforms and increasing adoption of home-based treatment. Online pharmacies enable convenient access to COVID-19 therapies and associated drug delivery devices for patients under home isolation or outpatient care. Rising consumer preference for contactless services, doorstep delivery, and telemedicine integration is accelerating segment growth. Improved regulatory clarity and growing trust in e-pharmacy models are further contributing to this trend.

COVID-19 Drug Delivery Devices Market Regional Analysis

- North America dominated the COVID-19 drug delivery devices market with the largest revenue share of 53.2% in 2025, supported by advanced healthcare infrastructure, high adoption of prefilled syringes and inhalers, strong government procurement programs, and the presence of major medical device manufacturers, with the U.S. maintaining steady demand across hospital and retail pharmacy channels

- Healthcare providers in the region place strong emphasis on dosing accuracy, patient safety, and rapid treatment delivery, supporting widespread use of prefilled syringes, injectors, and inhalation-based devices across hospital and pharmacy settings

- This broad adoption is further supported by substantial healthcare spending, proactive government procurement programs, and a well-established network of hospital, retail, and online pharmacies, positioning COVID-19 drug delivery devices as a critical component of infectious disease management in both acute and outpatient care

U.S. COVID-19 Drug Delivery Devices Market Insight

The U.S. COVID-19 drug delivery devices market captured the largest revenue share within North America in 2025, driven by strong pandemic preparedness measures, large-scale vaccination programs, and high adoption of advanced drug delivery technologies. Healthcare providers in the U.S. prioritize accurate dosing, patient safety, and rapid administration, supporting widespread use of prefilled syringes, injectors, and inhalation-based devices. The growing emphasis on home-based care, supported by robust retail and online pharmacy networks, further accelerates market expansion. Moreover, continued government funding and strategic stockpiling initiatives significantly contribute to sustained demand for COVID-19 drug delivery devices.

Europe COVID-19 Drug Delivery Devices Market Insight

The Europe COVID-19 drug delivery devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strong public healthcare systems and coordinated pandemic response frameworks. Increasing focus on vaccination readiness, infection control, and standardized treatment protocols is fostering adoption of reliable drug delivery devices. European healthcare providers emphasize safety, regulatory compliance, and efficiency, supporting demand across hospital and retail pharmacy channels. The region is also witnessing growth in homecare and outpatient treatment, further supporting market expansion.

U.K. COVID-19 Drug Delivery Devices Market Insight

The U.K. COVID-19 drug delivery devices market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by sustained government investment in infectious disease management and healthcare resilience. The National Health Service’s focus on rapid vaccine rollout and accessible antiviral treatment has driven consistent demand for prefilled syringes and parenteral delivery systems. Increasing adoption of digital health services and online pharmacies is also improving patient access to COVID-19 therapies. These factors collectively support steady market growth across institutional and homecare settings.

Germany COVID-19 Drug Delivery Devices Market Insight

The Germany COVID-19 drug delivery devices market is expected to expand at a considerable CAGR, fueled by the country’s strong medical infrastructure and emphasis on high-quality healthcare delivery. Germany’s focus on precision medicine, safety standards, and regulatory compliance supports the adoption of advanced drug delivery devices. Hospitals and pharmacies play a central role in vaccine and antiviral distribution, reinforcing steady demand. In addition, increasing attention to decentralized care and outpatient treatment models is further encouraging market growth.

Asia-Pacific COVID-19 Drug Delivery Devices Market Insight

The Asia-Pacific COVID-19 drug delivery devices market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by large patient populations, expanding healthcare access, and rising government investments in pandemic response infrastructure. Countries such as China, Japan, and India are strengthening vaccination and treatment programs, increasing demand for efficient and scalable drug delivery solutions. The region’s growing pharmaceutical manufacturing base is also improving affordability and availability of delivery devices. These factors collectively position Asia-Pacific as a key growth region for the market.

Japan COVID-19 Drug Delivery Devices Market Insight

The Japan COVID-19 drug delivery devices market is gaining momentum due to the country’s advanced healthcare system, strong emphasis on patient safety, and aging population. Japan’s focus on efficient vaccination and treatment delivery supports adoption of prefilled syringes and minimally invasive drug delivery solutions. The integration of homecare services and digital health platforms is improving access to COVID-19 therapies. In addition, the demand for easy-to-use and reliable delivery devices is expected to remain strong across both hospital and outpatient settings.

India COVID-19 Drug Delivery Devices Market Insight

The India COVID-19 drug delivery devices market accounted for a significant revenue share within Asia-Pacific in 2025, supported by large-scale immunization programs and expanding healthcare infrastructure. Rapid urbanization, increasing healthcare awareness, and strong government-led vaccination initiatives have driven demand for cost-effective and scalable drug delivery devices. India’s growing pharmaceutical manufacturing capabilities further support domestic availability of prefilled syringes and injectors. The expansion of retail and online pharmacy networks is also enhancing access to COVID-19 therapies, sustaining market growth.

COVID-19 Drug Delivery Devices Market Share

The COVID-19 Drug Delivery Devices industry is primarily led by well-established companies, including:

- BD (U.S.)

- AstraZeneca (U.K.)

- Moderna, Inc. (U.S.)

- Pfizer Inc. (U.S.)

- GSK plc (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- Novavax, Inc. (U.S.)

- Serum Institute of India Pvt. Ltd. (India)

- Bharat Biotech (India)

- Hindustan Syringes & Medical Devices Ltd. (India)

- Terumo Corporation (Japan)

- NIPRO CORPORATION (Japan)

- SCHOTT AG (Germany)

- Gerresheimer AG (Germany)

- Cardinal Health (U.S.)

- CanSino Biologics Inc. (China)

- Croda International Plc (U.K.)

- ApiJect Systems Corp. (U.S.)

- PharmaJet Inc. (U.S.)

- Inovio Pharmaceuticals, Inc. (U.S.)

What are the Recent Developments in Global COVID-19 Drug Delivery Devices Market?

- In July 2025, the FDA granted full approval to Moderna’s Spikevax COVID‑19 vaccine for children aged six months through 11 years at increased risk of severe COVID‑19, transitioning its status from emergency use to full licensure and reinforcing broader pediatric access to a licensed vaccine delivery format

- In June 2025, the U.S. Food and Drug Administration (FDA approved Moderna’s new lower‑dose COVID‑19 vaccine, mNEXSPIKE, designed to elicit a focused immune response with approximately one‑fifth the dose of the original vaccine, offering a potentially safer and more efficient delivery option for high‑risk adults and supporting updated immunization strategies

- In April 2024, a Nature‑published study highlighted that intradermal delivery of a self‑amplifying mRNA COVID‑19 vaccine booster using the Tropis system significantly boosts immune response and is well tolerated, underscoring the potential advantages of needle‑free, dermal delivery in improving immunogenicity and real‑world vaccine uptake

- In June 2023, PharmaJet’s Tropis intradermal needle‑free delivery system was authorized as the exclusive delivery platform for two novel COVID‑19 vaccines in India, including the DNA vaccine ZyCoV‑D and a self‑amplifying mRNA booster, highlighting the adoption of needle‑free precision delivery technology to enhance immunogenicity and patient acceptance in mass vaccination campaigns

- In August 2021, India’s Drug Controller General granted Emergency Use Authorization (EUA) to ZyCoV‑D, the world’s first plasmid DNA COVID‑19 vaccine, administered via a spring‑powered needle‑free jet injector, marking a significant milestone in alternative delivery modalities beyond traditional needles and expanding delivery technology options for pandemic response

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.