Global Craft Beer Market

Market Size in USD Billion

CAGR :

%

USD

3.49 Billion

USD

8.83 Billion

2024

2032

USD

3.49 Billion

USD

8.83 Billion

2024

2032

| 2025 –2032 | |

| USD 3.49 Billion | |

| USD 8.83 Billion | |

|

|

|

|

Craft Beer Market Size

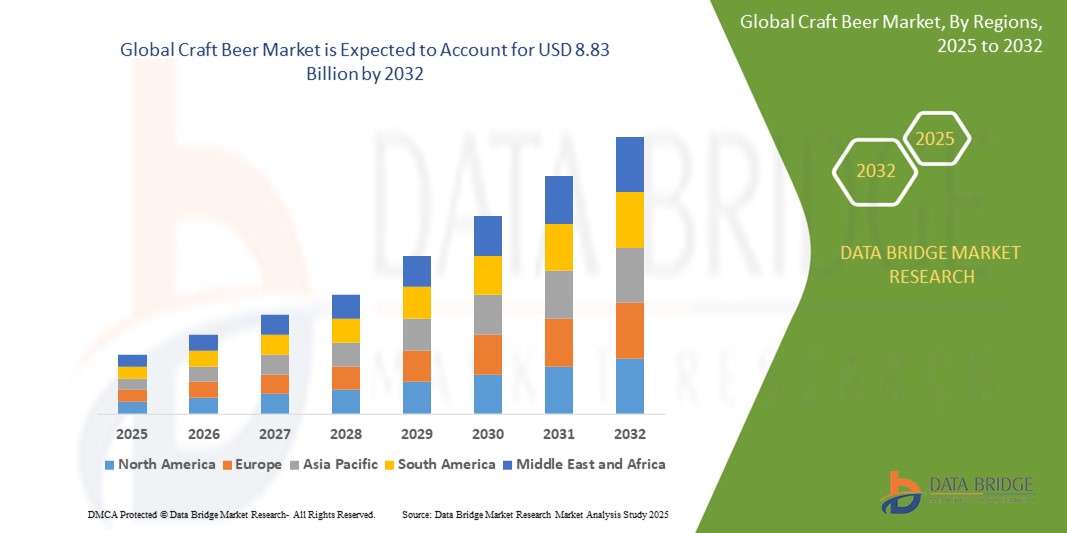

- The global craft beer market size was valued at USD 3.49 billion in 2024 and is expected to reach USD 8.83 billion by 2032, at a CAGR of 12.30% during the forecast period

- The market growth is largely fuelled by the increasing consumer demand for artisanal and premium beverages, rising interest in diverse beer flavors, and the growing culture of home brewing and local breweries

- The rise of taproom experiences, social drinking culture, and collaborations between brewers and restaurants are further enhancing craft beer visibility and contributing to its expanding global footprint

Craft Beer Market Analysis

- Craft beer continues to gain popularity among millennials and Gen Z consumers, driven by a strong preference for authentic and locally brewed products with unique taste profiles

- Microbreweries and brewpubs are expanding rapidly across key markets, offering consumers a personalized drinking experience, while fostering brand loyalty and community engagement through exclusive releases and events

- North America dominated the craft beer market with the largest revenue share of 38.7% in 2024, driven by a strong culture of microbrewing and consumer preference for unique, high-quality brews

- Asia-Pacific region is expected to witness the highest growth rate in the global craft beer market, driven by rising disposable incomes, a growing millennial population, and evolving taste preferences favoring premium and flavored alcoholic beverages

- The ale segment held the largest revenue share in 2024, driven by its rich flavor profile, traditional appeal, and popularity among seasoned craft beer enthusiasts. Ales, including IPAs and pale ales, are widely recognized for their bold taste and higher fermentation temperatures, making them the preferred choice in microbreweries and pubs across key regions. Their broad acceptance among millennials and consistent demand across on-trade channels have further strengthened their market presence

Report Scope and Craft Beer Market Segmentation

|

Attributes |

Craft Beer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand for Low- and No-Alcohol Craft Beer Options Among Health-Conscious Consumers • Expansion of Craft Beer Taprooms and Brewpubs in Emerging Markets |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Craft Beer Market Trends

“Surging Popularity of Low-ABV and Non-Alcoholic Craft Beers”

- Consumers are increasingly opting for low-alcohol and non-alcoholic craft beers due to rising health consciousness and a preference for mindful drinking

- These variants offer the experience of beer consumption without compromising on taste or causing intoxication, appealing to both casual and regular drinkers

- Breweries are using advanced techniques to retain flavor complexity while reducing alcohol content

- Brands such as BrewDog and Athletic Brewing Co. have launched successful low-ABV product lines that are gaining popularity among wellness-driven consumers

- The trend is expanding global accessibility and inclusivity within the craft beer category, driving market diversification

- For instance, athletic Brewing Co. in the U.S. specializes entirely in non-alcoholic craft beers and saw rapid growth with national distribution in under five years

Craft Beer Market Dynamics

Driver

“Expanding Consumer Preference for Unique and Localized Flavors”

- Consumers are seeking diverse flavor profiles and authentic, locally inspired brews not typically found in mainstream beer options

- Craft brewers use unique ingredients, seasonal recipes, and small-batch brewing to differentiate their offerings

- Younger demographics, particularly millennials and Gen Z, are drawn to the artisanal and community-driven nature of local breweries

- Taprooms and brewery events foster brand loyalty and enhance customer experience beyond just the product

- Brewers such as Stone Brewing in the U.S. have built strong consumer bases through innovative recipes and regional flavor emphasis

- For instance, stone Brewing regularly rotates its offerings and highlights local ingredients, contributing to its cult following and expansion into international markets

Restraint/Challenge

“High Competition and Regulatory Barriers”

- The growing number of microbreweries intensifies competition, making it harder for new entrants to gain visibility and customer loyalty

- Larger beverage corporations dominate retail shelf space and leverage economies of scale, putting pricing pressure on smaller craft brewers

- Regulatory complexity, including alcohol distribution laws and taxation, varies across countries and even local jurisdictions

- Craft brewers often face high operational costs due to licensing, compliance, and ingredient sourcing requirements

- In markets such as India, state-specific excise policies and licensing hurdles restrict national expansion for many local breweries

- For instance, in India, even established players such as Bira 91 face distribution limitations due to varying state-level regulations and high alcohol taxes

Craft Beer Market Scope

The market is segmented on the basis of product type, type, distribution channel, and age group.

• By Product Type

On the basis of product type, the craft beer market is segmented into ale, lagers, specialty beers, and others. The ale segment held the largest revenue share in 2024, driven by its rich flavor profile, traditional appeal, and popularity among seasoned craft beer enthusiasts. Ales, including IPAs and pale ales, are widely recognized for their bold taste and higher fermentation temperatures, making them the preferred choice in microbreweries and pubs across key regions. Their broad acceptance among millennials and consistent demand across on-trade channels have further strengthened their market presence.

The specialty beers segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by increasing consumer demand for unique and innovative brews. Specialty beers include seasonal, fruit-infused, barrel-aged, and experimental varieties that appeal to adventurous drinkers seeking novel experiences. Craft breweries continue to push creative boundaries in this segment to stand out in a competitive landscape.

• By Type

On the basis of type, the market is segmented into alcoholic and non-alcoholic craft beer. The alcoholic segment accounted for the highest revenue share in 2024, attributed to its deep-rooted popularity and vast availability across both on-trade and off-trade channels. A strong culture of social drinking and preference for high-quality brews continue to support this segment’s dominance globally.

The non-alcoholic segment is expected to witness the fastest growth rate from 2025 to 2032, due to rising health consciousness and the demand for mindful consumption. Consumers looking to enjoy the craft beer experience without the effects of alcohol are increasingly opting for flavorful, low-ABV or zero-alcohol alternatives.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into on-trade and off-trade. The on-trade segment led the market in 2024, primarily due to the high consumption of craft beer in bars, pubs, taprooms, and restaurants. The social nature of on-premise consumption and its ability to showcase local brews directly to customers support its strong performance.

The off-trade segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the expansion of retail channels and increasing availability of craft beer in supermarkets, liquor stores, and online platforms. This distribution method also gained momentum during and after the COVID-19 pandemic as at-home consumption surged.

• By Age Group

On the basis of age group, the market is segmented into 21–35 years old, 40–54 years old, and 55 years and above. The 21–35 age group dominated the market in 2024, owing to their higher disposable incomes, curiosity for new flavors, and greater inclination toward social drinking and craft culture. This demographic is highly influenced by branding, innovation, and sustainability, which aligns well with the ethos of many craft breweries.

The 40–54 years age group is expected to witness the fastest growth rate from 2025 to 2032, as this segment shows increasing interest in premium beverages, unique taste profiles, and health-conscious options such as non-alcoholic craft beers.

Craft Beer Market Regional Analysis

• North America dominated the craft beer market with the largest revenue share of 38.7% in 2024, driven by a strong culture of microbrewing and consumer preference for unique, high-quality brews

• The region’s craft beer landscape benefits from the presence of thousands of independent breweries, particularly in the U.S., which foster experimentation with diverse ingredients and brewing techniques

• A growing trend toward local sourcing, sustainable brewing, and premiumization has also fueled consumption, making craft beer a staple across both on-trade and off-trade channels

U.S. Craft Beer Market Insight

The U.S. craft beer market accounted for over 78% of the North American share in 2024, supported by a rich ecosystem of independent brewers and continuously evolving consumer tastes. With increasing demand for flavorful, artisanal beverages, the U.S. has become a global leader in innovation and diversity within the craft segment. Festivals, brewpubs, and community-supported breweries continue to drive engagement, while product experimentation with IPAs, stouts, and sours keeps the market dynamic and competitive.

Europe Craft Beer Market Insight

The Europe craft beer market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing consumer inclination toward premium and artisanal beverages. Countries such as the U.K., Germany, and Belgium, known for their beer heritage, are witnessing a surge in small-scale craft operations. The market’s growth is further propelled by rising demand in supermarkets and specialty retail stores, along with growing participation in food and beverage pairings.

U.K. Craft Beer Market Insight

The U.K. craft beer market is expected to witness the fastest growth rate from 2025 to 2032, driven by a rising preference for premium alcoholic beverages and innovation in beer styles. The proliferation of craft breweries across the country, especially in urban centers, contributes to local economic development and diversified offerings. Increased availability of canned and bottled craft beers in retail chains and e-commerce platforms is also boosting consumer access and adoption.

Germany Craft Beer Market Insight

The Germany's craft beer market is expected to witness the fastest growth rate from 2025 to 2032, albeit at a moderate pace, with consumers showing increasing interest in new beer styles beyond traditional lagers. While the country remains deeply rooted in beer tradition, younger demographics are exploring IPAs, pale ales, and mixed fermentation styles. Growth is also supported by the emergence of craft-focused bars and events that celebrate modern brewing culture alongside heritage.

Asia-Pacific Craft Beer Market Insight

The Asia-Pacific craft beer market is expected to witness the fastest growth rate from 2025 to 2032, owing to rising disposable incomes, shifting consumer preferences, and urbanization across countries such as China, India, and Japan. The rise of local breweries and growing influence of Western drinking culture are key growth enablers. The region is also experiencing strong demand for flavored and lower-alcohol craft beer variants.

Japan Craft Beer Market Insight

The Japan’s craft beer market is expected to witness the fastest growth rate from 2025 to 2032, as domestic brewers innovate with local ingredients such as yuzu, matcha, and rice. Rising interest in pairing craft beer with traditional Japanese cuisine and a supportive regulatory environment for microbreweries are enhancing market presence. Japan’s growing beer tourism and retail expansion are also contributing to increased awareness and consumption.

China Craft Beer Market Insight

The China leads the Asia-Pacific region in craft beer consumption by value, thanks to a booming middle class and rising demand for premium alcoholic beverages. Urban consumers, especially millennials, are driving the shift toward high-quality, niche beers. Breweries such as Boxing Cat and Great Leap are spearheading the trend, while international brands continue to invest in China’s expanding beer culture.

Craft Beer Market Share

The Craft Beer industry is primarily led by well-established companies, including:

- Davide Campari-Milano N.V. (Italy)

- Diageo (U.K.)

- Halewood Sales (U.K.)

- ASAHI GROUP HOLDINGS, LTD. (Japan)

- Accolade Wines (Australia)

- Bacardi & Company Limited (Bermuda)

- Mike's Hard Lemonade (U.S.)

- Castel Group (France)

- SUNTORY HOLDINGS LIMITED (Japan)

- Anheuser-Busch Companies, LLC (Belgium)

- Brown‑Forman (U.S.)

- United Brands LLC (U.S.)

- Pernod Ricard (France)

- Molson Coors Beverage Company (U.S.)

Latest Developments in Global Craft Beer Market

- In April 2023, Bell's Brewery Inc. announced its plans to expand distribution into Alaska, Idaho, Oregon, Utah, and Washington, among five additional states. This strategic move aims to broaden the brewery's market reach and enhance brand visibility in these regions. By entering these new markets, Bell's Brewery seeks to connect with a wider audience of craft beer enthusiasts and capitalize on the growing demand for its products

- In March 2023, New Belgium Brewing Company Inc. announced its agreement to acquire a 259,000-square-foot brewing facility located in Daleville, Virginia, previously owned by Constellation Brands. This strategic acquisition is expected to enhance New Belgium's production capabilities and expand its operational footprint. By securing this state-of-the-art plant, New Belgium aims to bolster its capacity to meet growing consumer demand for its craft beer offerings

- In December 2023, Sierra Nevada Brewing Co. launched its inaugural line of non-alcoholic brews, featuring Trail Pass IPA and Trail Pass Golden, which are now available on shelves across the U.S. This introduction marks a significant step for the brewery as it expands its offerings to include non-alcoholic options. In addition, to complement this new portfolio, Sierra Nevada is releasing Hop Splash Citrus, a line extension of its popular Hop Splash sparkling water, further enhancing its product range for consumers seeking refreshing alternatives

- In April 2021, B9 Beverages Pvt. Ltd., operating under the brand Bira91, revealed plans to introduce a limited edition of craft beers featuring a variety of bold flavors in India. This initiative responds to the rising consumer demand for unique and exquisite taste experiences. By expanding their product line, Bira91 aims to capture the attention of adventurous beer enthusiasts seeking innovative flavor profiles

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Craft Beer Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Craft Beer Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Craft Beer Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.