Global Cystatin C Assay Market

Market Size in USD Billion

CAGR :

%

USD

241.66 Billion

USD

430.99 Billion

2024

2032

USD

241.66 Billion

USD

430.99 Billion

2024

2032

| 2025 –2032 | |

| USD 241.66 Billion | |

| USD 430.99 Billion | |

|

|

|

|

Cystatin C Assay Market Size

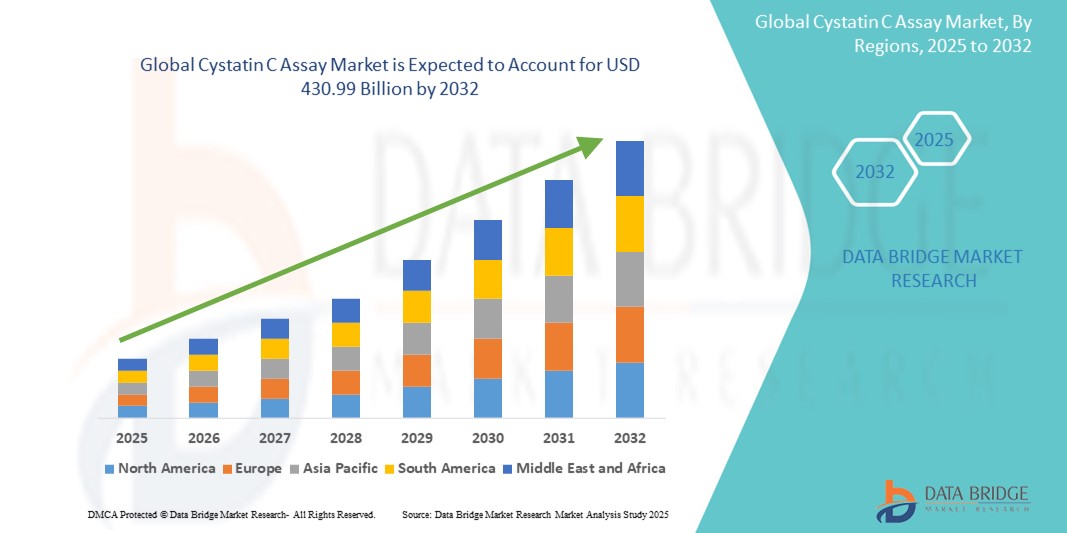

- The global Cystatin C Assay market size was valued at USD 241.66 billion in 2024 and is expected to reach USD 430.99 billion by 2032, at a CAGR of 7.50% during the forecast period

- The market growth is largely driven by the increasing prevalence of chronic kidney disease (CKD), diabetes, and cardiovascular conditions, which are fueling the demand for more precise renal function biomarkers over traditional creatinine-based methods

- Furthermore, rising clinical adoption of cystatin C assays due to their accuracy, standardization, and early detection capabilities is establishing them as a preferred diagnostic tool in nephrology and cardiology. These factors are collectively propelling the demand for cystatin C testing, thereby accelerating market expansion

Cystatin C Assay Market Analysis

- Cystatin C assays, used to evaluate kidney function by measuring the cystatin C protein in blood, are gaining prominence as a reliable alternative to traditional creatinine-based diagnostics due to their higher accuracy and independence from muscle mass variations

- The growing demand for cystatin C assays is primarily driven by the rising global burden of chronic kidney disease (CKD), diabetes, and cardiovascular disorders, along with increased clinical awareness about the limitations of existing renal biomarkers

- North America dominated the cystatin C assay market with the largest revenue share of 39.5% in 2024, attributed to advanced healthcare infrastructure, high adoption of novel diagnostic methods, and strong focus on early disease detection, particularly in the U.S., where clinical guidelines increasingly recommend cystatin C testing for enhanced GFR estimation

- Asia-Pacific is expected to be the fastest growing region in the cystatin C assay market during the forecast period due to expanding healthcare access, increasing prevalence of renal conditions, and growing investments in diagnostic technologies

- The ELISA segment dominated the cystatin C assay market with a market share of 46.5% in 2024, driven by its widespread clinical usage, cost-effectiveness, and compatibility with automated laboratory systems

Report Scope and Cystatin C Assay Market Segmentation

|

Attributes |

Cystatin C Assay Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cystatin C Assay Market Trends

“Growing Shift Toward More Accurate Renal Biomarkers”

- A significant and accelerating trend in the global cystatin C assay market is the transition toward more precise and reliable biomarkers for kidney function, particularly in populations where creatinine-based tests are less accurate, such as the elderly, children, and individuals with low muscle mass

- For instance, healthcare systems across the U.S., U.K., and parts of Europe are incorporating cystatin C into estimated glomerular filtration rate (eGFR) equations to improve diagnostic accuracy. The CKD-EPI 2021 guideline recommends cystatin C as a preferred alternative or supplement to creatinine for assessing kidney function

- Cystatin C assays are being increasingly adopted in clinical settings due to their ability to detect early-stage renal dysfunction before creatinine levels become elevated. This makes them especially valuable for high-risk patients with diabetes, cardiovascular disease, or post-transplant needs

- Automation of cystatin C testing platforms, such as those using immunoturbidimetric and ELISA technologies, is streamlining lab operations and improving turnaround times. For example, companies such as BioVendor and Gentian offer automated cystatin C assay kits compatible with major analyzers, increasing operational efficiency in diagnostic labs

- The rising demand for personalized medicine and risk stratification tools in nephrology is also fueling market interest in cystatin C as a marker for long-term cardiovascular and renal outcomes

- As clinicians increasingly seek biomarkers that improve diagnostic precision and risk prediction, cystatin C assays are expected to gain broader adoption, especially with supportive clinical guidelines and reimbursement policies taking hold across more countries

Cystatin C Assay Market Dynamics

Driver

“Rising Prevalence of Kidney Diseases and Demand for Early Diagnosis”

- The growing global burden of chronic kidney disease (CKD), diabetes, and hypertension is a major driver for the increasing demand for cystatin C assays as a tool for early and accurate diagnosis of renal impairment

- For instance, according to the Global Burden of Disease Study, CKD was ranked as the 10th leading cause of death globally in 2024. This has spurred public health agencies and healthcare providers to adopt more sensitive diagnostic tools such as cystatin C to detect kidney damage early and initiate timely intervention

- Compared to creatinine, cystatin C provides a more consistent and muscle-mass-independent measure of glomerular filtration rate (GFR), making it ideal for a wider range of patient populations

- The growing recognition of cystatin C's role in refining eGFR calculations has led to its inclusion in national guidelines in countries such as the U.S., Canada, and Japan, boosting clinical demand

- Increased availability of automated, high-throughput platforms for cystatin C testing is also supporting its wider adoption in both hospital and laboratory settings, reducing costs and improving efficiency

Restraint/Challenge

“High Cost and Limited Reimbursement in Emerging Markets”

- One of the key challenges facing the cystatin C assay market is the relatively higher cost of testing compared to traditional serum creatinine tests, which limits accessibility in resource-constrained settings

- While leading markets such as the U.S. and Western Europe have begun to incorporate cystatin C into standard renal function panels with supportive reimbursement, many developing countries lack widespread insurance coverage or clinical protocols that include cystatin C testing

- For instance, in several Asian and Latin American countries, healthcare providers often default to creatinine due to familiarity and lower costs, despite cystatin C's proven diagnostic advantages

- In addition, variability in assay standardization and calibration across manufacturers can affect the comparability of results, creating hesitancy among clinicians regarding universal implementation

- Overcoming these challenges will require broader education on the clinical value of cystatin C, stronger evidence to support cost-effectiveness, and efforts by assay developers to offer more affordable, standardized solutions for diverse healthcare markets

Cystatin C Assay Market Scope

The market is segmented on the basis of product, method, application, sample type, end user, and distribution channel.

- By Product

On the basis of product, the cystatin C assay market is segmented into analyzers and kits & reagents. The kits & reagents segment dominated the market with the largest market revenue share in 2024, driven by the recurring demand for consumables in routine testing and their compatibility with a wide range of analyzers. Diagnostic laboratories prefer these kits due to their ease of use, high sensitivity, and reliability in assessing renal function, particularly in early-stage kidney disease.

The analyzers segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the increasing adoption of automated diagnostic systems. Advanced analyzers are enabling faster turnaround times and improved efficiency in hospitals and clinical laboratories. The integration of analyzers with high-throughput platforms and laboratory information systems (LIS) is enhancing workflow optimization and driving demand for these instruments in medium- to large-scale facilities.

- By Method

On the basis of method, the cystatin C assay market is segmented into ELISA, PETIA, IFA, CLIA, and PENIA. The ELISA segment held the largest market revenue share of 46.5% in 2024, owing to its widespread usage, standardization, and cost-effectiveness in clinical diagnostics and research applications. ELISA kits are well-established in hospital labs and research institutions, providing accurate, reproducible results with minimal equipment requirements.

The PETIA (Particle Enhanced Turbidimetric Immunoassay) segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its compatibility with automated chemistry analyzers and suitability for high-throughput testing. PETIA offers faster results and greater precision in renal biomarker analysis, making it increasingly popular in centralized diagnostic laboratories.

- By Application

On the basis of application, the cystatin C assay market is segmented into diagnostics and research. The diagnostics segment dominated the market with the largest revenue share in 2024, driven by the rising global burden of chronic kidney disease and increasing recognition of cystatin C as a more reliable biomarker than creatinine. Healthcare providers are incorporating cystatin C assays into regular diagnostic protocols for at-risk patients, including those with cardiovascular conditions and diabetes.

The research segment is anticipated to witness steady growth during the forecast period, supported by increased funding in academic and clinical research exploring new biomarkers and the broader role of cystatin C in metabolic and inflammatory conditions. As research institutions explore cystatin C beyond nephrology, demand for research-specific assay formats is expected to rise.

- By Sample Type

On the basis of sample type, the cystatin C assay market is segmented into blood and urine. The blood segment held the largest market revenue share in 2024, as serum and plasma samples remain the standard for accurate cystatin C testing in clinical settings. Blood-based cystatin C measurements are considered highly sensitive and are preferred for estimating glomerular filtration rate (GFR) in both general and specialized care.

The urine segment is projected to grow gradually from 2025 to 2032, as researchers investigate urinary cystatin C levels as a potential early indicator of renal tubular injury and transplant monitoring. Though not yet routine in clinical use, urine-based testing is gaining relevance in nephrology and academic studies.

- By End User

On the basis of end user, the cystatin C assay market is segmented into hospitals, clinical laboratories, and others. The hospitals segment dominated the market with the largest revenue share in 2024, supported by their central role in patient management and chronic disease diagnostics. Hospitals rely on cystatin C testing for early diagnosis of kidney disease and risk stratification in cardiac and diabetic patients, leading to higher test volumes.

The clinical laboratories segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the decentralization of diagnostic services and increasing automation in laboratory operations. The rise of independent diagnostic centers and their adoption of advanced renal function testing tools is accelerating the segment’s growth.

- By Distribution Channel

On the basis of distribution channel, the cystatin C assay market is segmented into direct tenders and retail sales. The direct tenders segment held the largest market revenue share in 2024, driven by institutional procurement by hospitals, diagnostic labs, and public healthcare systems. Bulk purchasing agreements and long-term supplier contracts contribute to consistent revenues in this segment.

The retail sales segment is expected to grow steadily from 2025 to 2032, driven by increased availability of assay kits through online platforms, e-commerce channels, and third-party distributors. Small clinics, academic research centers, and private labs are increasingly turning to retail sales for accessible and affordable cystatin C assay solutions.

Cystatin C Assay Market Regional Analysis

- North America dominated the cystatin C assay market with the largest revenue share of 39.5% in 2024, attributed to advanced healthcare infrastructure, high adoption of novel diagnostic methods, and strong focus on early disease detection

- Healthcare providers in the region are increasingly adopting cystatin C testing for more accurate renal function assessment, especially in at-risk populations such as elderly patients, diabetics, and those with cardiovascular conditions

- This widespread adoption is further supported by favorable clinical guidelines, insurance coverage, and the availability of automated testing platforms, positioning cystatin C assays as a critical component of routine diagnostic evaluations across hospitals and laboratories

U.S. Cystatin C Assay Market Insight

The U.S. cystatin C assay market captured the largest revenue share of 79% in 2024 within North America, driven by widespread clinical acceptance, strong reimbursement structures, and increasing awareness of chronic kidney disease (CKD) diagnostics. The country benefits from the presence of advanced diagnostic laboratories and a strong emphasis on early detection through precision biomarkers. Moreover, the integration of cystatin C testing into routine renal panels, supported by clinical guidelines such as those from the National Kidney Foundation, is significantly contributing to market expansion.

Europe Cystatin C Assay Market Insight

The Europe cystatin C assay market is projected to grow at a strong CAGR throughout the forecast period, propelled by government initiatives aimed at early CKD detection and increasing clinical validation of cystatin C as a superior renal biomarker. Regulatory support for improved diagnostic standards and an aging population facing rising kidney-related complications are major growth drivers. Cystatin C testing is being increasingly adopted in both public health systems and private healthcare settings across the region.

U.K. Cystatin C Assay Market Insight

The U.K. cystatin C assay market is expected to grow at a notable CAGR, supported by national healthcare programs emphasizing early-stage kidney function assessment and evidence-based diagnostics. The inclusion of cystatin C in updated eGFR guidelines by the NHS is accelerating adoption. Growing investments in laboratory automation and biomarker research further bolster the U.K.’s position in advancing renal diagnostics.

Germany Cystatin C Assay Market Insight

The Germany cystatin C assay market is projected to expand at a considerable CAGR, driven by the country’s emphasis on preventive healthcare and diagnostic accuracy. Germany’s advanced healthcare infrastructure and high public awareness of kidney health are encouraging broader use of cystatin C in routine screening and chronic disease monitoring. Increasing demand for automated platforms and standardized assays also supports market growth in clinical settings.

Asia-Pacific Cystatin C Assay Market Insight

The Asia-Pacific cystatin C assay market is set to grow at the fastest CAGR of 23.8% during the forecast period of 2025 to 2032, fueled by the rising burden of kidney diseases, improving healthcare access, and expanding diagnostic infrastructure in countries such as China, India, and Japan. Government initiatives aimed at enhancing non-communicable disease screening and the push for healthcare modernization are promoting the adoption of cystatin C as a key biomarker for renal function.

Japan Cystatin C Assay Market Insight

The Japan cystatin C assay market is gaining traction due to the country’s aging population, increasing incidence of CKD, and strong emphasis on technological innovation in diagnostics. Japanese clinicians are turning to cystatin C as a reliable indicator for early renal impairment, particularly in elderly and pediatric populations. The integration of cystatin C testing into hospital diagnostic routines is further supported by Japan’s universal healthcare system and medical research initiatives.

India Cystatin C Assay Market Insight

The India cystatin C assay market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by a high prevalence of diabetes and hypertension, growing awareness of kidney health, and increasing investments in diagnostic infrastructure. As public and private healthcare institutions adopt more accurate biomarkers for kidney function, cystatin C is emerging as a preferred alternative to creatinine. Local manufacturing of test kits and the expansion of private laboratories are further accelerating market penetration in both urban and semi-urban areas.

Cystatin C Assay Market Share

The Cystatin C Assay industry is primarily led by well-established companies, including:

- Siemens Healthineers AG (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Beckman Coulter, Inc. (U.S.)

- Abbott (U.S.)

- Gentian Diagnostics ASA (Norway)

- Randox Laboratories Ltd. (U.K.)

- Thermo Fisher Scientific Inc. (U.S.)

- BioVendor – Laboratorní medicína a.s. (Czech Republic)

- Boster Biological Technology (U.S.)

- Merck KGaA (Germany)

- Enzo Life Sciences, Inc. (U.S.)

- Aviva Systems Biology Corporation (U.S.)

- Cusabio Technology LLC (U.S.)

- Assay Genie (Ireland)

- Abcam plc (U.K.)

- R&D Systems, Inc. (U.S.)

- RayBiotech, Inc. (U.S.)

- Elabscience Biotechnology Inc. (China)

- Kamiya Biomedical Company (U.S.)

- Cloud-Clone Corp. (China)

What are the Recent Developments in Global Cystatin C Assay Market?

- In April 2023, Siemens Healthineers launched an enhanced version of its cystatin C assay kit designed for improved accuracy and compatibility with high-throughput chemistry analyzers. This development supports the growing demand for reliable renal biomarkers in early-stage kidney disease diagnosis and underscores the company’s commitment to innovation in laboratory diagnostics. The new assay enables faster processing and higher precision, making it suitable for both hospital and reference laboratory use

- In March 2023, Gentian Diagnostics ASA expanded the availability of its CE-marked cystatin C immunoassay across additional global markets. The assay, optimized for automated platforms, aims to meet the increasing clinical need for standardized renal function testing. Gentian’s strategic expansion highlights its focus on addressing global health challenges through biomarker innovation and boosting access to high-quality diagnostic tools in emerging and developed regions

- In March 2023, Roche Diagnostics collaborated with multiple academic institutions to support ongoing research into the use of cystatin C as a predictive biomarker for cardiovascular and renal complications in diabetic patients. The partnership is part of Roche’s broader strategy to advance personalized medicine and improve outcomes through data-driven diagnostics, emphasizing the clinical versatility of cystatin C beyond traditional kidney function testing

- In February 2023, BioVendor Group introduced a fully automated ELISA processing system tailored for renal biomarkers, including cystatin C. The system is designed to streamline workflow in clinical laboratories by minimizing manual intervention and enhancing result consistency. This innovation reflects BioVendor’s ongoing efforts to optimize diagnostic efficiency and address the operational challenges faced by modern laboratories

- In January 2023, Randox Laboratories launched a new range of cystatin C control and calibration solutions aimed at ensuring assay accuracy and compliance with international quality standards. These products are intended to support clinical labs in maintaining the precision of cystatin C testing, which is increasingly being adopted for early detection of kidney dysfunction. The launch highlights Randox’s role in strengthening the diagnostic ecosystem through reliable quality assurance solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.