Global Dentinogenesis Imperfecta Type 2 Market

Market Size in USD Billion

CAGR :

%

USD

6.54 Billion

USD

10.19 Billion

2024

2032

USD

6.54 Billion

USD

10.19 Billion

2024

2032

| 2025 –2032 | |

| USD 6.54 Billion | |

| USD 10.19 Billion | |

|

|

|

|

Dentinogenesis Imperfecta Type 2 Market Size

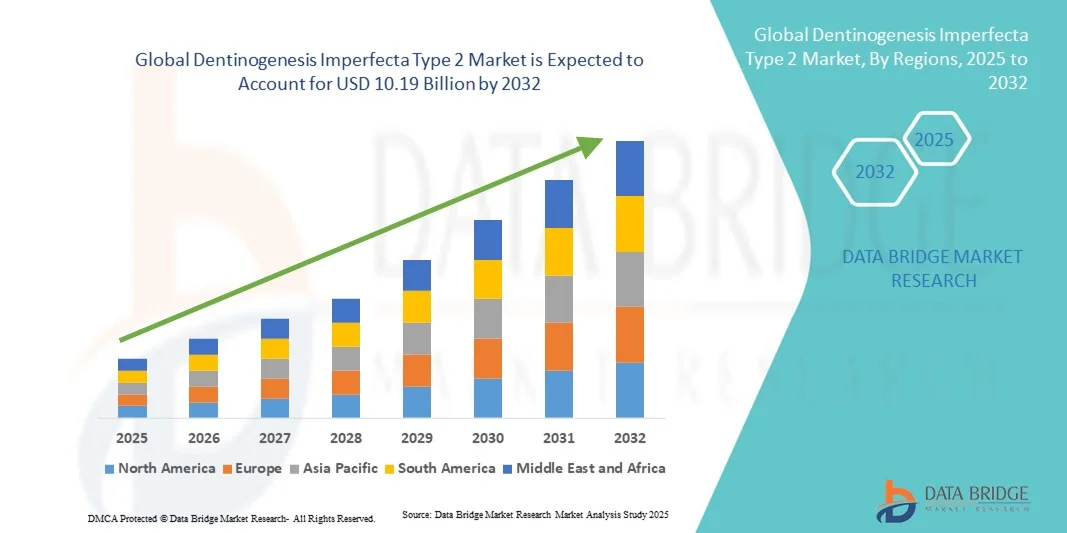

- The global Dentinogenesis Imperfecta Type 2 market size was valued at USD 6.54 billion in 2024 and is expected to reach USD 10.19 billion by 2032, at a CAGR of 5.70% during the forecast period

- The market growth is largely fueled by the increasing prevalence of rare genetic disorders, advancements in dental treatments, and rising awareness about oral health, leading to higher demand for specialized dental care solutions

- Furthermore, growing research and development efforts for innovative treatment options, combined with the adoption of advanced diagnostic tools, are establishing effective management strategies for DGI-II, thereby accelerating market uptake and significantly boosting the industry's growth

Dentinogenesis Imperfecta Type 2 Market Analysis

- Dentinogenesis Imperfecta Type 2 (DGI-II), a rare genetic disorder affecting tooth development and resulting in discolored, weak, and brittle teeth, is increasingly recognized as a critical area in dental health and rare disease management due to its impact on oral function, aesthetics, and patient quality of life

- The rising demand for effective treatment options is primarily driven by growing awareness of genetic dental disorders, advancements in dental care technologies, and increased access to specialized dental clinics capable of early diagnosis and intervention

- North America dominated the DGI-II market with the largest revenue share of 43% in 2024, supported by high healthcare expenditure, strong research and development activities, widespread access to dental specialists, and increased adoption of advanced dental restorative and orthodontic solutions

- Asia-Pacific is expected to witness significant market growth during the forecast period, due to improvements in healthcare infrastructure, rising awareness about oral health, and increasing investments in genetic diagnostics and dental treatment solutions

- The composite resin segment dominated the DGI-II treatment market with a market share of 45.8% in 2024, driven by its effectiveness in restoring tooth structure, improving aesthetics, and offering long-term durability in managing the clinical manifestations of the disorder

Report Scope and Dentinogenesis Imperfecta Type 2 Market Segmentation

|

Attributes |

Dentinogenesis Imperfecta Type 2 Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Dentinogenesis Imperfecta Type 2 Market Trends

Advancements in Genetic Diagnostics and Personalized Dental Care

- A significant and accelerating trend in the global Dentinogenesis Imperfecta Type 2 (DGI-II) market is the increasing adoption of genetic testing and early diagnostic tools, allowing for precise identification of DSPP gene mutations responsible for the disorder

- For instance, next-generation sequencing (NGS) panels are being used in specialized dental clinics to diagnose DGI-II in children before clinical symptoms fully manifest, enabling early intervention

- Integration of personalized dental care plans with advanced restorative materials and orthodontic solutions enables clinicians to tailor treatment to individual patient needs, improving both functional and aesthetic outcomes

- This trend toward combining genetic insights with innovative dental procedures facilitates proactive disease management, minimizing tooth loss and enamel deterioration over the patient’s lifetime

- The development of advanced dental biomaterials and minimally invasive treatment techniques is fundamentally reshaping expectations for patient care, encouraging manufacturers to innovate solutions such as AI-assisted treatment planning

- The demand for integrated genetic diagnostics and personalized dental interventions is growing rapidly across specialized dental centers and research institutions, as patients and clinicians increasingly prioritize proactive and effective management of DGI-II

Dentinogenesis Imperfecta Type 2 Market Dynamics

Driver

Rising Awareness and Adoption of Specialized Dental Treatments

- The increasing awareness about rare genetic dental disorders, coupled with advancements in restorative and orthodontic treatments, is a significant driver for the growing demand for DGI-II management solutions

- For instance, dental clinics and hospitals in North America and Europe are implementing patient education programs to promote early screening and preventive care for DGI-II

- As patients and parents become more aware of potential dental complications associated with DGI-II, demand for advanced treatments such as composite resins, crowns, and implants is increasing

- Furthermore, rising investments in dental research and development are enabling the creation of more effective and long-lasting treatment modalities, supporting higher adoption rates in both pediatric and adult patients

- Early diagnosis and customized treatment planning, including orthodontic interventions and preventive care, provide improved functional and aesthetic outcomes, propelling market growth

- Expansion of insurance coverage and reimbursement policies for genetic testing and specialized dental treatments is facilitating wider adoption of DGI-II interventions

- Increased collaboration between dental associations and healthcare providers is promoting standardized treatment protocols, improving patient outcomes and encouraging market growth

Restraint/Challenge

Limited Access to Specialized Care and High Treatment Costs

- Constraints such as the scarcity of specialized dental professionals and limited access to advanced treatment facilities pose a significant challenge to broader market penetration

- For instance, patients in developing regions often face difficulties obtaining timely diagnosis and management due to a lack of trained clinicians and genetic testing capabilities

- High costs of advanced restorative and orthodontic treatments, coupled with long-term maintenance requirements, can restrict adoption among price-sensitive patients and families

- In addition, misdiagnosis or delayed detection of DGI-II may exacerbate dental complications, limiting the effectiveness of interventions and impacting patient outcomes

- Overcoming these challenges through training programs for dental specialists, expanded genetic testing availability, and cost-effective treatment solutions will be crucial for sustained market growth

- Regulatory hurdles related to approval of novel gene-based therapies and dental biomaterials can slow the introduction of innovative treatment options in certain regions

- Limited public awareness in rural and underserved areas continues to restrict early diagnosis and treatment adoption, necessitating targeted outreach and education programs

Dentinogenesis Imperfecta Type 2 Market Scope

The market is segmented on the basis of diagnosis, treatment, population type, end-users, and distribution channel.

- By Diagnosis

On the basis of diagnosis, the DGI-II market is segmented into radiography and others. The Radiography segment dominated the market in 2024, owing to its established use in clinical practice for identifying abnormal tooth structure and enamel defects characteristic of DGI-II. Radiographic imaging allows dentists to evaluate the extent of dentin and pulp involvement, aiding in accurate diagnosis and treatment planning. The segment benefits from widespread availability in hospitals and dental clinics, combined with familiarity among dental professionals. Radiography also supports monitoring of disease progression over time, making it a reliable diagnostic tool. Its cost-effectiveness and non-invasive nature further strengthen its market position. For instance, panoramic X-rays are routinely used to detect early signs of dentin abnormalities in pediatric patients.

The Others segment is expected to witness the fastest growth rate during the forecast period, driven by the increasing adoption of genetic testing, advanced imaging techniques such as CBCT, and AI-assisted diagnostics. Genetic and molecular tests allow early detection of DSPP gene mutations, offering opportunities for proactive interventions. Non-traditional diagnostics are becoming more popular in specialty clinics and research hospitals, particularly in developed regions. Integration of digital diagnostic tools with patient management software enhances accuracy and reduces misdiagnosis. For instance, next-generation sequencing panels are increasingly being utilized in pediatric dental care centers. The rising awareness of rare genetic disorders and personalized treatment approaches fuels the growth of this segment.

- By Treatment

On the basis of treatment, the market is segmented into composite resins, orthodontic implants, and others. The Composite Resins segment dominated the market in 2024 with a market share of 45.8%, owing to its widespread clinical use for restoring discolored and structurally weak teeth in DGI-II patients. Composite resins provide an effective combination of aesthetics and durability, making them the preferred choice among dentists. The segment benefits from compatibility with both adult and pediatric dental care, enabling minimally invasive procedures. Composite resins allow incremental restoration, preserving natural tooth structure while improving functional outcomes. For instance, patients often receive layered composite resin restorations to rebuild enamel and dentin affected by the disorder. Ease of application, availability of advanced resin materials, and affordability contribute to strong market demand.

The Orthodontic Implants segment is expected to witness the fastest growth during the forecast period, fueled by increasing awareness of long-term treatment strategies that combine structural reinforcement and functional correction. Implants help stabilize affected teeth and improve oral function, particularly in adult patients with severe tooth fragility. The rising adoption of orthodontic implants in specialty dental clinics and hospitals, supported by technological advancements and better patient education, drives market expansion. For instance, dental implants are increasingly used in combination with composite resins to achieve optimal restorative outcomes. Growth in this segment is further supported by research into biomimetic materials and personalized implant solutions for DGI-II patients.

- By Population Type

On the basis of population type, the market is segmented into adult and children. The Children segment dominated the market in 2024, driven by early diagnosis initiatives and the need for preventive interventions to minimize tooth damage during formative years. Pediatric dental care programs increasingly focus on early screening for DGI-II, which allows timely treatment and reduces long-term complications. Children benefit from less invasive treatments such as composite resin restorations and preventive orthodontic approaches. For instance, pediatric dental clinics routinely implement radiographic screening to detect early enamel and dentin defects. The segment also benefits from parental awareness and insurance coverage for pediatric dental care.

The Adult segment is expected to witness the fastest growth during the forecast period, driven by increasing demand for aesthetic and restorative treatments among adults with delayed diagnosis or residual dental complications. Adults are seeking advanced restorative solutions such as orthodontic implants and prosthetic rehabilitation to improve functionality and appearance. For instance, adults may undergo combined restorative and implant therapy to correct long-standing structural damage caused by DGI-II. Rising disposable incomes and awareness of cosmetic dental solutions in emerging markets further propel this segment.

- By End-Users

On the basis of end-users, the market is segmented into hospitals, specialty clinics, and others. The Hospitals segment dominated the market in 2024 due to the availability of comprehensive diagnostic and treatment facilities, including advanced imaging, genetic testing, and multidisciplinary dental care. Hospitals offer integrated services for both pediatric and adult patients, making them preferred care centers for DGI-II management. For instance, hospital-based dental units often collaborate with genetic testing labs for early diagnosis. Hospitals also play a key role in clinical trials and research initiatives, further supporting the adoption of advanced treatments. Availability of insurance coverage and structured care pathways reinforces hospital dominance.

The Specialty Clinics segment is expected to witness the fastest growth during the forecast period, driven by the rising number of dedicated dental clinics focusing on rare genetic disorders and advanced restorative treatments. These clinics provide personalized care, shorter waiting times, and access to novel treatments such as orthodontic implants and biomimetic restorations. For instance, specialty pediatric dental clinics are increasingly integrating AI-assisted diagnostics and customized treatment plans. Growth is further supported by patient preference for specialized care and increasing investments in dental technologies.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, hospital pharmacy, retail pharmacy, online pharmacy, and others. The Direct Tender segment dominated the market in 2024 due to bulk procurement of dental materials, equipment, and treatment solutions by hospitals and specialty clinics. Direct tender agreements allow healthcare providers to access high-quality restorative materials and diagnostic tools at negotiated prices. For instance, hospitals often procure composite resins and orthodontic implants directly from manufacturers for large-scale pediatric programs. Strong relationships between manufacturers and institutional buyers reinforce dominance in this channel.

The Online Pharmacy segment is expected to witness the fastest growth during the forecast period, fueled by increasing e-commerce adoption for dental products, patient awareness programs, and home delivery of supportive care items. Online platforms provide easy access to dental materials, oral care products, and patient-specific treatment kits. For instance, parents of children with DGI-II can order preventive dental kits and specialized resins online. The segment benefits from convenience, wider reach, and rapid fulfillment, particularly in regions with limited access to physical pharmacies or specialty suppliers.

Dentinogenesis Imperfecta Type 2 Market Regional Analysis

- North America dominated the DGI-II market with the largest revenue share of 43% in 2024, supported by high healthcare expenditure, strong research and development activities, widespread access to dental specialists, and increased adoption of advanced dental restorative and orthodontic solutions

- Patients and healthcare providers in the region highly value early diagnosis, specialized dental care, and the availability of advanced restorative and orthodontic treatment options, which improve both functional and aesthetic outcomes for DGI-II patients

- This widespread adoption is further supported by strong research and development activities, high healthcare expenditure, and a technologically adept population, establishing North America as the leading region for DGI-II diagnosis, treatment, and management across both pediatric and adult patient populations

U.S. Dentinogenesis Imperfecta Type 2 Market Insight

The U.S. Dentinogenesis Imperfecta Type 2 (DGI-II) market captured the largest revenue share of 79% in 2024 within North America, driven by widespread awareness of genetic dental disorders and advanced healthcare infrastructure. Patients increasingly prioritize early diagnosis and access to specialized dental care, including restorative and orthodontic treatments. The prevalence of pediatric screening programs and multidisciplinary dental centers further propels market growth. Moreover, high healthcare expenditure, insurance coverage for genetic testing, and the availability of innovative treatment solutions contribute to the expansion of the DGI-II market in the U.S.

Europe Dentinogenesis Imperfecta Type 2 Market Insight

The Europe DGI-II market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing awareness of rare genetic dental disorders and the rising demand for specialized dental care. Growing urbanization, coupled with advancements in diagnostic and restorative technologies, is fostering adoption of effective DGI-II management strategies. European patients also value early intervention and long-term treatment outcomes, which is encouraging the integration of advanced diagnostic tools and personalized treatment plans in both hospitals and specialty clinics.

U.K. Dentinogenesis Imperfecta Type 2 Market Insight

The U.K. DGI-II market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of oral genetic disorders and the desire for effective preventive and restorative dental care. Concerns regarding long-term dental complications are motivating patients and caregivers to seek timely diagnosis and intervention. The U.K.’s well-established healthcare infrastructure and growing adoption of advanced dental technologies, alongside supportive insurance coverage, are expected to continue stimulating market growth.

Germany Dentinogenesis Imperfecta Type 2 Market Insight

The Germany DGI-II market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of rare genetic dental conditions and the adoption of innovative diagnostic and treatment solutions. Germany’s strong healthcare system, emphasis on research and development, and focus on high-quality dental care promote adoption of advanced restorative and orthodontic treatments. Integration of genetic testing and personalized care plans is becoming more prevalent, aligning with patient expectations for effective management of DGI-II.

Asia-Pacific Dentinogenesis Imperfecta Type 2 Market Insight

The Asia-Pacific DGI-II market is poised to grow at the fastest CAGR of 22% during the forecast period of 2025 to 2032, driven by rising awareness of genetic dental disorders, improving healthcare infrastructure, and growing access to specialized dental clinics in countries such as China, Japan, and India. The region’s increasing focus on early screening programs, preventive care, and advanced treatment technologies is driving adoption. Furthermore, government initiatives promoting healthcare accessibility and the expansion of private specialty dental centers are enhancing diagnosis and treatment coverage for DGI-II across the region.

Japan Dentinogenesis Imperfecta Type 2 Market Insight

The Japan DGI-II market is gaining momentum due to high awareness of rare genetic dental conditions, a technologically advanced healthcare system, and increasing demand for specialized pediatric and adult dental care. Integration of genetic diagnostics and advanced restorative treatments, alongside government-supported screening programs, is fueling growth. Moreover, Japan’s aging population and focus on preventive oral healthcare are such asly to drive demand for early diagnosis and tailored treatment strategies for DGI-II patients.

India Dentinogenesis Imperfecta Type 2 Market Insight

The India DGI-II market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to growing awareness of genetic dental disorders, rapid urbanization, and expanding healthcare infrastructure. India is witnessing increasing adoption of specialized dental care for children and adults, supported by affordable diagnostic and treatment options. The expansion of private dental clinics, government initiatives for rare disease awareness, and improved access to advanced restorative treatments are key factors propelling market growth in India.

Dentinogenesis Imperfecta Type 2 Market Share

The Dentinogenesis Imperfecta Type 2 industry is primarily led by well-established companies, including:

- Institut Straumann AG (Switzerland)

- Dentsply Sirona (U.S.)

- Zimmer Biomet (U.S.)

- 3M (U.S.)

- Avinent Science and Technology (Spain)

- CAMLOG Biotechnologies GmbH (Switzerland)

- Biohorizons. (U.S.)

- OSSTEM IMPLANT India Pvt Ltd. (South Korea)

- Bicon (U.S.)

- Sweden & Martina S.p.A (Italy)

- MegaGen (South Korea)

- Anatomage (U.S.)

- Henry Schein, Inc. (U.S.)

- Nobel Biocare Services AG (Switzerland)

- Planmeca Oy (Finland)

- Carestream Dental LLC (U.S.)

- GC Corporation (Japan)

- Ivoclar Vivadent (Liechtenstein)

- Vatech Co., Ltd. (South Korea)

- Dentium Co., Ltd. (South Korea)

What are the Recent Developments in Global Dentinogenesis Imperfecta Type 2 Market?

- In August 2025, HysensBio unveiled KH001, a groundbreaking topical bioactive peptide therapy aimed at regenerating dentin by reactivating odontoblasts. This first-in-class treatment offers a novel approach to restoring natural tooth structure with minimal drilling or synthetic materials, presenting a significant advancement in dental care for conditions such as DGI-II

- In July 2025, a clinical case report published in the Journal of Clinical Pediatric Dentistry detailed the use of nanoceramic resin crowns fabricated with Computer-Aided Design/Computer-Aided Manufacturing (CAD/CAM) technology for the oral rehabilitation of a 12-year-old patient with DGI-II. The study highlighted the effectiveness of this approach in restoring both functional and aesthetic aspects of the patient's dentition over an eight-year follow-up period

- In April 2025, a family study published in Orphanet Journal of Rare Diseases analyzed the clinical features and genetic mutation characteristics of a family with DGI-II. The study identified a novel mutation in the dentin sialophosphoprotein (DSPP) gene, contributing to the understanding of the genetic basis of DGI-II

- In February 2025, a case report published in Journal of Oral and Maxillofacial Pathology presented the diagnosis, functional, and esthetic rehabilitation of a 7-year-old child with DGI-II. The report highlighted a systematic and conservative dental approach in managing the condition, focusing on restoring oral health and improving esthetics and masticatory functions

- In September 2023, Grand Rapids Oral Surgery embarked on a collaborative treatment approach for a young patient with DGI-II. The team, including Dr. Rosie Noordhoek and Dr. Meachum, utilized virtual consultations with a laboratory technician to develop a comprehensive treatment plan. This multidisciplinary collaboration aimed to address the patient's rapid tooth deterioration and malocclusion, demonstrating a holistic approach to managing DGI-II

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.