Global Digital Freight Matching Market

Market Size in USD Billion

CAGR :

%

USD

47.87 Billion

USD

428.10 Billion

2024

2032

USD

47.87 Billion

USD

428.10 Billion

2024

2032

| 2025 –2032 | |

| USD 47.87 Billion | |

| USD 428.10 Billion | |

|

|

|

|

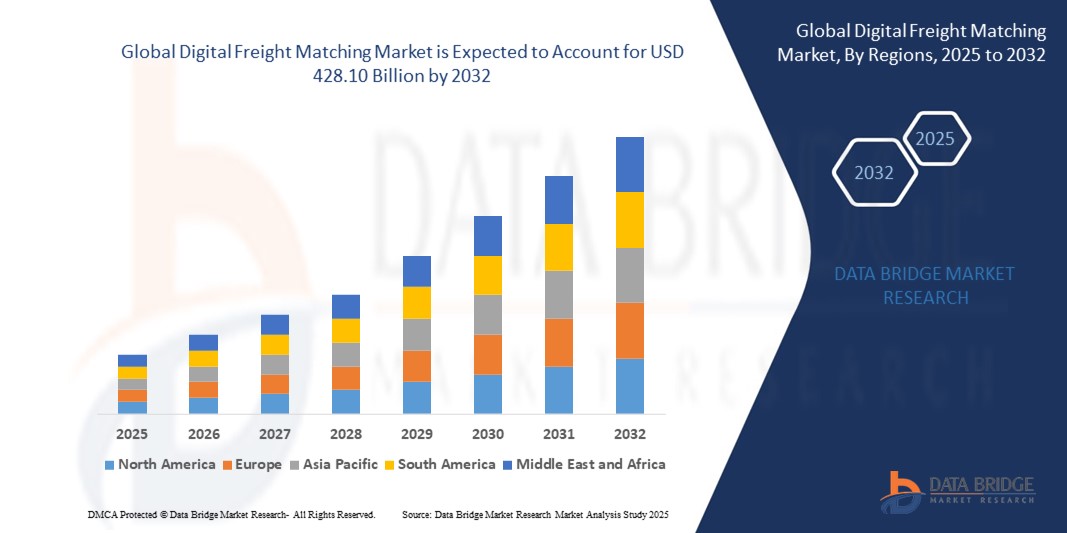

What is the Global Digital Freight Matching Market Size and Growth Rate?

- The global digital freight matching market size was valued at USD 47.87 billion in 2024 and is expected to reach USD 428.10 billion by 2032, at a CAGR of 31.50% during the forecast period

- The global digital freight matching market is experiencing robust growth driven by the increasing demand for efficient and transparent freight transportation solution

- Advancements in technology, such as AI and blockchain, are revolutionizing the logistics industry by enabling real-time matching of freight capacity with available shipments, thereby optimizing route planning, reducing empty miles, and enhancing overall supply chain efficiency

- With a growing emphasis on sustainability and cost-effectiveness, businesses are increasingly turning to digital freight matching platforms to streamline their logistics operations, driving further expansion of the market globally

What are the Major Takeaways of Digital Freight Matching Market?

- Increased demand for real-time visibility is indeed a driver for the global digital freight matching Market. Digital freight matching platforms provide real-time tracking and visibility of shipments throughout the transportation process

- Shippers and carriers can monitor the location, status, and condition of freight in real-time, allowing for better decision-making, proactive problem-solving, and improved customer service. This real-time visibility helps reduce delays, mitigate risks, enhance efficiency, and optimize resource allocation, making digital freight matching solutions increasingly valuable in meeting the demands of modern supply chains

- North America dominated the digital freight matching market with the largest revenue share of 30.01% in 2024, supported by the strong presence of logistics technology startups and widespread adoption of digital platforms by shippers and carriers

- Asia-Pacific market is set to grow at the fastest CAGR of 8.25% between 2025 and 2032, driven by rising freight volumes, urbanization, and expanding trade activities in China, Japan, and India

- The Brokerage-Based segment dominated the market with the largest revenue share of 58.4% in 2024, driven by the strong reliance of shippers and carriers on established digital freight brokers for trust, efficiency, and streamlined operations

Report Scope and Digital Freight Matching Market Segmentation

|

Attributes |

Digital Freight Matching Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Digital Freight Matching Market?

Enhanced Convenience Through AI and Voice Integration

- A major trend in the global digital freight matching market is the rapid integration of artificial intelligence (AI), machine learning, and automation to streamline freight brokerage operations. These technologies are optimizing load matching, improving route planning, and enhancing overall operational transparency

- AI-driven platforms help carriers and shippers minimize empty miles, reduce fuel consumption, and improve asset utilization. Machine learning models analyze historical freight data to predict demand fluctuations and offer real-time pricing strategies

- Automated systems also enable instant booking and digital contract generation, eliminating the time-consuming manual negotiations typical in traditional freight brokerage

- For instance, Uber Freight has deployed AI-driven algorithms that recommend optimal loads to carriers, reducing downtime and maximizing fleet efficiency. Similarly, Convoy’s automated reloads feature uses AI to bundle shipments, allowing carriers to line up multiple jobs seamlessly without manual intervention

- The integration of automation is transforming digital freight matching into a real-time, predictive, and highly efficient ecosystem, significantly enhancing convenience and profitability for both shippers and carriers

What are the Key Drivers of Digital Freight Matching Market?

- The increasing demand for real-time freight visibility and operational transparency is driving adoption, as shippers seek platforms that provide live tracking, automated updates, and predictive insights into delivery performance

- Rising e-commerce growth and the surge in on-demand logistics are amplifying the need for scalable freight solutions capable of handling high shipment volumes with speed and efficiency

- The growing shortage of truck drivers and inefficiencies in traditional freight brokerage are pushing both carriers and shippers towards automated platforms that reduce operational costs and optimize load utilization

- For instance, in March 2024, Flexport expanded its AI-powered freight platform to offer shippers real-time tracking and digital booking across multimodal transportation. Similarly, Loadsmart has partnered with The Home Depot to provide instant freight quotes and booking services, demonstrating the rising demand for automated solutions

- These drivers highlight how Digital Freight Matching platforms are becoming integral to modern logistics, offering efficiency, cost savings, and enhanced service reliability

Which Factor is Challenging the Growth of the Digital Freight Matching Market?

- A significant challenge in the digital freight matching market is market fragmentation and trust issues between shippers, carriers, and digital platforms. Many small and mid-sized carriers remain hesitant to fully transition to digital systems due to concerns about transparency and fair pricing

- Additionally, the lack of standardization across different platforms often results in compatibility issues, making it difficult for carriers and shippers to integrate seamlessly across multiple services

- High competition among DFM providers, coupled with narrow profit margins, is also limiting long-term scalability

- For instance, while Convoy and Transfix offer advanced AI-driven features, many smaller carriers still prefer traditional freight brokers due to the personalized relationship and negotiated pricing model. Similarly, DAT Solutions reported that many independent truckers remain skeptical of digital-only platforms due to inconsistent load availability in certain regions

- These challenges highlight the need for greater trust-building, platform standardization, and inclusive digital solutions to overcome adoption barriers and sustain growth in the digital freight matching market

How is the Digital Freight Matching Market Segmented?

The market is segmented on the basis of platform, deployment, end-user, and mode of transport.

- By Platform

On the basis of platform, the digital freight matching market is segmented into Brokerage-Based and Open Marketplace-Based. The Brokerage-Based segment dominated the market with the largest revenue share of 58.4% in 2024, driven by the strong reliance of shippers and carriers on established digital freight brokers for trust, efficiency, and streamlined operations. These platforms offer personalized support, contract freight solutions, and wider carrier networks, giving them a competitive advantage.

The Open Marketplace-Based segment is expected to witness the fastest growth from 2025 to 2032, fueled by increasing demand for transparency, real-time pricing, and flexibility for both shippers and carriers. Growing preference for digital-first freight models is further accelerating adoption.

- By Deployment

On the basis of deployment, the digital freight matching market is segmented into Cloud-Based and On-Premises. The Cloud-Based segment held the largest market revenue share of 65.7% in 2024, owing to the scalability, cost-effectiveness, and remote accessibility offered by cloud solutions. Cloud deployment supports real-time freight visibility, predictive analytics, and seamless integration with IoT and AI-driven platforms, making it highly preferred across logistics companies.

The On-Premises segment is projected to grow steadily, mainly in organizations requiring stricter data control, regulatory compliance, and customized integration within existing enterprise systems.

- By End-User

On the basis of end-user, the digital freight matching market is segmented into Shippers, Carriers, and Logistics Companies. The Shippers segment dominated the market with the largest revenue share of 46.9% in 2024, driven by their need for efficient freight procurement, reduced transportation costs, and enhanced supply chain visibility. Shippers leverage digital freight platforms to gain access to broader carrier networks and real-time freight rate comparisons.

The Carriers segment is expected to record the fastest growth from 2025 to 2032, supported by increasing adoption of platforms that provide optimized load matching, route planning, and higher vehicle utilization rates.

- By Mode of Transport

On the basis of mode of transport, the digital freight matching market is segmented into Roadways, Railways, Airways, and Seaways. The Roadways segment accounted for the largest market revenue share of 72.3% in 2024, owing to the dominance of trucking in freight movement, flexibility of operations, and the widespread adoption of digital freight platforms across short- and long-haul routes. Road freight’s ability to provide door-to-door delivery strengthens its market position.

The Seaways segment is expected to grow significantly during the forecast period, driven by the rising global trade volumes, containerized shipping, and integration of digital freight solutions in maritime logistics for improved scheduling and capacity utilization.

Which Region Holds the Largest Share of the Digital Freight Matching Market?

- North America dominated the digital freight matching market with the largest revenue share of 30.01% in 2024, supported by the strong presence of logistics technology startups and widespread adoption of digital platforms by shippers and carriers

- The region’s growth is driven by the need for real-time freight visibility, route optimization, and cost efficiency in the transportation sector

- Widespread adoption is also supported by high e-commerce penetration, robust freight infrastructure, and the push for automation in logistics, positioning digital freight matching as a critical solution for reducing empty miles and enhancing supply chain performance

U.S. Digital Freight Matching Market Insight

U.S. dominated the North American revenue share in 2024, fueled by the rapid adoption of on-demand freight solutions and digital platforms connecting shippers with carriers. Key drivers include the growth of e-commerce deliveries, driver shortages, and increasing demand for dynamic freight pricing models. Strong integration with technologies such as AI, IoT-enabled tracking, and mobile-based load matching apps further accelerates adoption in the U.S. logistics industry.

Europe Digital Freight Matching Market Insight

Europe’s market is projected to grow at a substantial CAGR during the forecast period, supported by stringent emission regulations, digitalization of freight operations, and strong cross-border trade activity. The demand for sustainable and cost-efficient freight solutions is pushing adoption of digital platforms across the region. Significant growth is observed in FTL (Full Truckload), LTL (Less-than-Truckload), and intermodal freight, with both SMEs and large logistics providers shifting towards digital freight ecosystems.

U.K. Digital Freight Matching Market Insight

U.K. market is expected to expand at a noteworthy CAGR, driven by growing e-commerce shipments, last-mile delivery demand, and the need for streamlined freight visibility. Concerns around driver shortages, rising logistics costs, and sustainability targets are encouraging adoption of digital freight solutions. The U.K.’s strong retail and e-commerce infrastructure ensures continued growth for digital platforms enabling faster and more transparent freight movement.

Germany Digital Freight Matching Market Insight

Germany’s market is projected to grow at a considerable CAGR, fueled by its role as a European logistics hub and early adoption of digital freight solutions. Increasing demand for green logistics, connected truck fleets, and automated load optimization is accelerating adoption. Germany’s emphasis on technological innovation and sustainable supply chain solutions makes it one of the leading adopters of digital freight platforms in Europe.

Which Region is the Fastest Growing Region in the Digital Freight Matching Market?

Asia-Pacific market is set to grow at the fastest CAGR of 8.25% between 2025 and 2032, driven by rising freight volumes, urbanization, and expanding trade activities in China, Japan, and India. Growth is supported by government digitalization initiatives, increasing cross-border e-commerce, and investments in smart logistics infrastructure. APAC’s emergence as a manufacturing and export hub further boosts affordability and adoption of digital freight matching solutions.

Japan Digital Freight Matching Market Insight

Japan’s market is gaining traction due to rapid urban freight demand, labor shortages in trucking, and the need for efficient freight scheduling. Adoption is driven by integration of digital freight platforms with IoT-enabled tracking and telematics solutions. Japan’s aging workforce and increasing automation in logistics are key factors accelerating the use of Digital Freight Matching in both domestic and regional freight transport.

China Digital Freight Matching Market Insight

China accounted for the largest share in APAC in 2024, supported by its large freight ecosystem, expanding middle class, and rapid digitalization of logistics networks. Growth is driven by government-led smart city initiatives, e-commerce dominance, and strong presence of domestic digital freight startups. The availability of cost-effective, scalable freight platforms and advanced AI-driven matching algorithms further propels adoption in China’s logistics sector.

Which are the Top Companies in Digital Freight Matching Market?

The digital freight matching industry is primarily led by well-established companies, including:

- Uber Freight (U.S.)

- Convoy (U.S.)

- Transfix (U.S.)

- Loadsmart (U.S.)

- Flexport (U.S.)

- Freightos (Israel)

- NEXT Trucking (U.S.)

- Trucker Path (U.S.)

- Cargomatic (U.S.)

- 10-4 Systems (U.S.)

- LaneAxis (U.S.)

- Shipwell (U.S.)

- DAT Solutions (U.S.)

- KeepTruckin (U.S.)

- Freightera (Canada)

- CargoX (Brazil)

- Quicargo (Netherlands)

- Sennder (Germany)

- uShip (U.S.)

- ShipChain (U.S.)

What are the Recent Developments in Global Digital Freight Matching Market?

- In August 2024, Uber Freight (Uber Technologies, Inc.) introduced Uber Freight Shipping, an advanced platform built on the Shipper Platform, offering free and easy-to-use services for quoting, booking, and tracking shipments. With real-time tracking, 24/7 live support, and expanded ERP integration, the platform enhances efficiency and visibility for businesses of all sizes. This launch highlights Uber Freight’s commitment to leveraging technology for seamless logistics operations

- In August 2024, Freight Technologies, Inc. announced its integration with Tecnomotum, a leading data transmission company in Mexico, to upgrade its AI-driven freight-matching platform, Fr8App. The collaboration boosts fleet connectivity, optimizes logistics workflows, and delivers real-time data for better decision-making. This integration strengthens Fr8App’s role as a leader in cross-border shipping across the USMCA region

- In August 2023, Uber Freight introduced AI-powered tools to its platform, significantly enhancing load matching accuracy and operational efficiency for both shippers and carriers. These innovations aim to streamline freight management processes and improve service reliability. This development reflects Uber Freight’s focus on driving efficiency through artificial intelligence

- In June 2023, Convoy announced a strategic alliance with a leading blockchain provider to pilot blockchain-enabled freight tracking and payment systems. The initiative aims to improve trust, transparency, and accountability within the freight industry. This partnership marks Convoy’s step toward integrating blockchain technology into logistics operations

- In November 2021, Uber Freight (Uber Technologies, Inc.) completed the acquisition of Transplace, a USD 2.25 billion deal to strengthen its transportation and logistics network offerings. The move was designed to combine Uber Freight’s digital expertise with Transplace’s established solutions for shippers and carriers. This acquisition positioned Uber Freight as a stronger player in the global logistics market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.