Global Edible Films Coatings Market

Market Size in USD Billion

CAGR :

%

USD

3.20 Billion

USD

5.30 Billion

2024

2032

USD

3.20 Billion

USD

5.30 Billion

2024

2032

| 2025 –2032 | |

| USD 3.20 Billion | |

| USD 5.30 Billion | |

|

|

|

|

Edible Films and Coatings Market Size

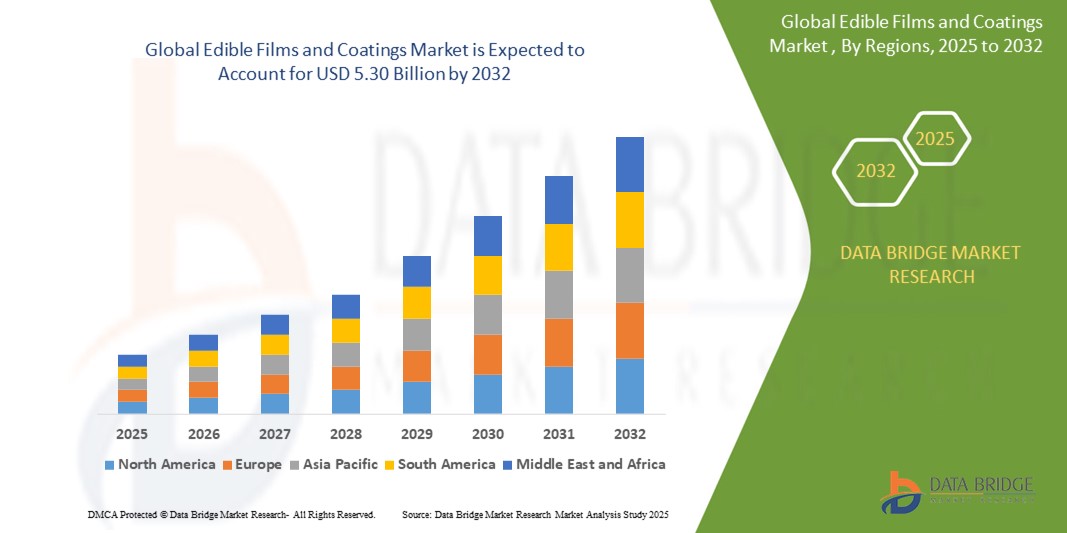

- The global edible films and coatings market size was valued at USD 3.20 billion in 2024 and is expected to reach USD 5.30 billion by 2032, at a CAGR of 6.50% during the forecast period

- This growth is driven by rising adoption of sustainable packaging to reduce carbon footprints

Edible Films and Coatings Market Analysis

- The edible films and coatings market has been experiencing substantial growth, driven by the rising demand for sustainable packaging and increasing concerns about plastic waste in the food industry

- As consumers and food manufacturers prioritize eco-friendly and biodegradable alternatives, the adoption of edible films and coatings across fresh produce, bakery, and confectionery sectors is expanding rapidly

- Technological innovations in bio-based materials, such as polysaccharides, proteins, and lipids, have significantly enhanced the functionality and shelf-life extension capabilities of edible coatings

- North America is expected to dominate the global edible films and coatings market with the largest market share of 37.36%, driven by increasing consumer demand for sustainable packaging solutions and innovations in food preservation technologies across the U.S. and Canada

- Asia-Pacific is expected to witness the highest compound annual growth rate (CAGR) in the edible films and coatings market, fueled by rising environmental awareness, population growth, and the expansion of the food processing industry

- The polysaccharides segment is expected to dominate the edible films and coatings market with the largest market share of 41.15% in 2025, due to the high availability, cost-effectiveness, and excellent film-forming properties of polysaccharide-based materials such as starch, cellulose, pectin, and alginate

Report Scope and Edible Films and Coatings Market Segmentation

|

Attributes |

Edible Films and Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Edible Films and Coatings Market Trends

“Growing Shift towards Sustainable and Eco-Friendly Packaging”

- A major trend in the edible films and coatings market is the rising global demand for sustainable packaging solutions, driven by environmental concerns and government regulations against single-use plastics

- Manufacturers are increasingly adopting bio-based materials such as starch, cellulose, proteins, and lipids to develop edible coatings that reduce packaging waste and carbon footprint

- Consumer interest in eco-conscious consumption is pushing food producers to invest in innovative compostable and edible film technologies, particularly in fresh produce and ready-to-eat segments

- For instance, in February 2024, edible packaging startup DisSolves was acquired by Generation Food Rural Partners I, LP to scale its patented, fast-dissolving edible films for beverages and CPG applications

- This sustainable packaging trend is expected to gain stronger momentum as both consumers and regulators emphasize waste reduction and circular economy principles

Edible Films and Coatings Market Dynamics

Driver

“Increased Focus on Food Waste Reduction and Shelf Life Extension”

- The need to minimize food spoilage and enhance shelf life is a strong driver for the adoption of edible films and coatings, especially in perishable categories such as fruits, vegetables, and bakery products

- These coatings provide a protective layer that retains moisture, prevents microbial contamination, and reduces oxidative damage, thereby improving product longevity

- Food processors and retailers are investing in edible coatings to cut down on cold chain losses, reduce returns, and maintain product quality during transportation

- For instance, in January 2022, U.S.-based Akorn Technology launched multi-functional edible coatings that doubled the shelf life of fresh produce while enhancing flavor and appearance

- The continued focus on reducing food loss across the value chain is expected to bolster market growth for edible film technologies globally

Opportunity

“Innovations in Functional and Multi-Layered Coating Solutions”

- Ongoing R&D in multi-functional edible coatings is opening new opportunities, such as combining antimicrobial, antioxidant, and flavor-enhancing properties into a single layer

- This technological evolution allows companies to tailor coatings for specific applications such as extended preservation of high-value fruits or enhancement of nutritional value in snacks

- Functional coatings that serve both packaging and dietary enrichment purposes (e.g., with vitamins or probiotics) present a compelling proposition for health-focused consumers

- For instance, in 2021, Agrofresh’s subsidiary Vita Fresh launched plant-based coatings using ISO14001-certified environmental standards to reduce moisture loss and extend shelf life

- Such innovation-driven approaches are expected to significantly expand product offerings and application areas for edible films in the coming years

Restraint/Challenge

“Cost Constraints and Limited Industrial Scalability”

- High production and material costs for edible coatings especially those using advanced or multi-layer formulations remain a key barrier to large-scale industrial adoption

- In regions where packaging budgets are limited or where traditional plastic remains more economical, cost-effectiveness and price sensitivity hinder market penetration

- Moreover, challenges related to machinery compatibility, storage, and humidity sensitivity can affect the usability of edible films in high-volume processing environment

- For instance, in 2023, industry reports indicated that despite strong interest in edible coatings in Latin America, many small and mid-sized manufacturers struggled with cost and equipment compatibility

- To overcome these challenges, future market growth will rely on cost optimization, education, and cross-industry collaboration to standardize and scale edible film technologies efficiently

Edible Films and Coatings Market Scope

The market is segmented on the basis of ingredient type and application.

|

Segmentation |

Sub-Segmentation |

|

By Ingredient Type |

|

|

By Application |

|

In 2025, the polysaccharides is projected to dominate the market with a largest share in ingredient type segment

The polysaccharides segment is expected to dominate the edible films and coatings market with the largest market share of 41.15% in 2025, due to the high availability, cost-effectiveness, and excellent film-forming properties of polysaccharide-based materials such as starch, cellulose, pectin, and alginate.

The fruits and vegetables is expected to account for the largest share during the forecast period in application segment

In 2025, the fruits and vegetables segment is expected to dominate the market with the largest market share of 36.56%, due to the abundant availability, high fiber content, and increasing demand for clean-label, plant-based ingredients derived from natural sources.

Edible Films and Coatings Market Regional Analysis

“North America Holds the Largest Share in the Edible Films and Coatings Market”

- North America is expected to dominate the global edible films and coatings market with the largest market share of 37.36%, driven by increasing consumer demand for sustainable packaging solutions and innovations in food preservation technologies across the U.S. and Canada

- The U.S. dominates the region, supported by a well-developed food processing industry, rising adoption of biodegradable and edible packaging alternatives, and strong R&D investments in food-grade film materials

- Continued growth in the convenience food sector, coupled with increased focus on reducing plastic waste, will enable North America to retain its leading position in the edible films and coatings market during the forecast period

“Asia-Pacific is Projected to Register the Highest CAGR in the Edible Films and Coatings Market”

- Asia-Pacific is expected to witness the highest compound annual growth rate (CAGR) in the edible films and coatings market, fueled by rising environmental awareness, population growth, and the expansion of the food processing industry

- India and China are major contributors, driven by increasing demand for packaged and ready-to-eat foods, government support for sustainable packaging, and a growing urban middle class

- Japan and Australia are experiencing steady market growth due to consumer preference for clean-label products and advancements in food safety and packaging standards

- Increasing emphasis on reducing plastic waste, along with growing acceptance of edible coatings in bakery, confectionery, and fresh produce sectors, will accelerate market expansion across Asia-Pacific

- Government initiatives promoting eco-friendly packaging solutions and investments in biodegradable film technologies are expected to further strengthen the region’s market potential

Edible Films and Coatings Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Bayer AG (Germany)

- H.C. Starck GmbH (Germany)

- AGC SEIMI CHEMICAL CO., LTD. (Japan)

- BASF SE (Germany)

- DuPont (U.S.)

- Merck & Co., Inc. (U.S.)

- Evonik Industries AG (Germany)

- Sumitomo Chemical Co., Ltd. (Japan)

- Heliatek GmbH (Germany)

- Novaled GmbH (Germany)

- AU Optronics Corp. (Taiwan)

- Graphic Packaging International, LLC (U.S.)

- WestRock Company (U.S.)

- Smurfit Kappa (Ireland)

- Krones AG (Germany)

- Amcor plc (Switzerland)

- Graham Packaging Company (U.S.)

- Sonoco Products Company (U.S.)

- Parker Hannifin Corp. (U.S.)

- Berry Global Inc. (U.S.)

Latest Developments in Global Edible Films and Coatings Market

- In February 2024, Generation Food Rural Partners I, LP (GFRP), a fund created by early-stage investor Big Idea Ventures, acquired edible packaging startup DisSolves as it prepared to conduct pilot programs with leading CPG brands. Based in Pittsburgh and founded in 2018 by chemical engineer Jared Raszewski, DisSolves has developed patented edible films that dissolve quickly and leave no residue in milk, juice, or hot and cold water. This acquisition marks a strategic move toward scaling sustainable edible packaging in collaboration with large food brands

- In January 2024, a research paper titled “Sustainable Bio-Based Edible Films and Coatings for Fruit and Vegetable Applications” was published on ResearchGate. The paper explores progress in developing sustainable, bio-based edible coatings for produce, emphasizing materials, application techniques, and their effectiveness in reducing food waste and extending shelf life. This publication highlights growing academic and industry focus on biodegradable solutions for produce preservation

- In January 2022, U.S.-based Akorn Technology announced the commercial launch of its multifunctional edible coatings for fresh produce. These smart coatings help double the shelf life of fruits and vegetables, cut cold chain losses by over 30%, and enhance the flavor, texture, and appearance of the produce. This product launch signifies a key innovation in post-harvest food preservation technology

- In November 2021, Agri-Tech startup Sufresca introduced a biodegradable, water-based edible coating made entirely of natural food ingredients. The solution includes advanced modified atmosphere properties that help maintain product freshness. This innovation underscores the shift toward fully natural and functional packaging alternatives

- In February 2021, Vita Fresh, a subsidiary of AgroFresh Solutions Inc., launched plant-based edible coatings designed specifically for fresh produce. Developed under ISO14001 “Environmental Management System” standards, the coatings are eco-friendly and help reduce dehydration and moisture loss while prolonging freshness. This launch marked a milestone in environmentally certified, plant-based preservation technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Edible Films Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Edible Films Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Edible Films Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.