Global Electrical Insulation Tape Market

Market Size in USD Billion

CAGR :

%

USD

14.86 Billion

USD

22.63 Billion

2024

2032

USD

14.86 Billion

USD

22.63 Billion

2024

2032

| 2025 –2032 | |

| USD 14.86 Billion | |

| USD 22.63 Billion | |

|

|

|

|

What is the Global Electrical Insulation Tape Market Size and Growth Rate?

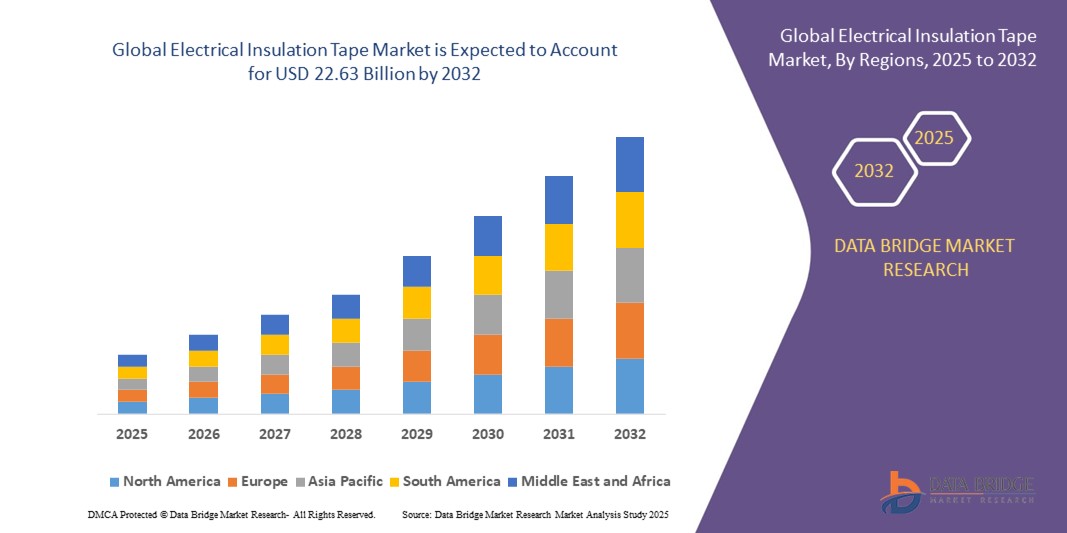

- The global electrical insulation tape market size was valued at USD 14.86 billion in 2024 and is expected to reach USD 22.63 billion by 2032, at a CAGR of5.40% during the forecast period

- As the global population grows and industrialization continues, electricity's constantly needed. This drives the demand for electrical insulation tapes to ensure safe and efficient electrical distribution driving the demand for electrical insulation tape. Ongoing infrastructure projects, such as the construction of buildings, bridges, roads, and power transmission lines, require extensive electrical wiring. Electrical insulation tapes are essential for protecting these installations from environmental factors and ensuring longevity, which is expected to fuel the growth of the market

What are the Major Takeaways of Electrical Insulation Tape Market?

- The rapid expansion of the electronics industry, propelled by the widespread integration of smartphones, laptops, tablets, and various electronic devices, generates a heightened need for electrical insulation tapes. These tapes play a pivotal role in circuitry and component insulation, safeguarding against electrical hazards and ensuring optimal performance and longevity of electronic gadgets. As the demand for electronic products continues to soar, so does the requirement for reliable insulation solutions, positioning electrical insulation tapes as indispensable components within the burgeoning electronics sector

- North America dominated the electrical insulation tape market with the largest revenue share of 32.51% in 2024, driven by increasing demand for home automation and advanced security solutions

- Asia-Pacific (APAC) market is poised to grow at the fastest CAGR of 11.58% during 2025–2032, driven by rapid urbanization, rising disposable incomes, and technological advancement in countries such as China, Japan, and India

- Deadbolt segment dominated the Electrical Insulation Tape market with a market share of 43.2% in 2024, driven by its established reputation for security and ease of retrofit into existing door setups

Report Scope and Electrical Insulation Tape Market Segmentation

|

Attributes |

Electrical Insulation Tape Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Electrical Insulation Tape Market?

Smart, Efficient, and Eco-Friendly Insulation Solutions

- A major trend in the global electrical insulation tape market is the growing adoption of advanced, eco-friendly materials combined with high-performance adhesive technologies. Manufacturers are focusing on tapes that provide better thermal resistance, electrical insulation, and durability while reducing environmental impact.

- For instance, 3M and Nitto Denko are introducing tapes with enhanced heat tolerance and sustainable backing materials, suitable for industrial, automotive, and electrical applications. These solutions help extend the life of electrical components and reduce maintenance requirements.

- Innovations include flame-retardant, UV-resistant, and silicone-based tapes that adapt to extreme conditions, providing higher safety and reliability. Some tapes are now engineered with thinner, more flexible substrates that maintain insulation while reducing material consumption.

- The integration of multifunctional tapes, such as those combining electrical insulation with vibration dampening or waterproofing properties, is gaining traction in automotive and renewable energy sectors.

- As industries increasingly prioritize energy efficiency, safety, and sustainability, Electrical Insulation Tapes are evolving from basic protective materials into high-tech, multifunctional solutions that meet regulatory standards and performance expectations.

- The demand for durable, high-performance, and eco-conscious Electrical Insulation Tapes is rising across automotive, construction, electronics, and renewable energy applications.

What are the Key Drivers of Electrical Insulation Tape Market?

- Rising adoption of electric vehicles, renewable energy installations, and advanced electronics is driving the need for high-quality, heat-resistant, and durable electrical insulation tapes

- For instance, in 2024, 3M introduced a line of flame-retardant and high-temperature tapes for electric vehicle battery assemblies, enhancing safety and longevity. Such initiatives are expected to drive market growth during the forecast period

- Growing industrialization in Asia-Pacific, coupled with increasing investments in construction, manufacturing, and electronics, is boosting demand for high-performance insulation solutions

- Stricter regulatory standards on electrical safety, flame resistance, and environmental compliance are prompting manufacturers to adopt advanced, certified tape products across sectors

- The convenience of versatile, pre-cut, and easy-to-apply tapes for industrial and residential wiring, coupled with improved availability via online and retail channels, is further propelling market adoption globally

Which Factor is Challenging the Growth of the Electrical Insulation Tape Market?

- High cost of advanced specialty tapes, particularly those made from silicone, PTFE, or eco-friendly composites, limits penetration in price-sensitive markets

- For instance, small and medium enterprises in emerging economies often continue to rely on conventional PVC or rubber tapes due to affordability concerns, slowing adoption of high-performance alternatives

- Technical limitations such as improper adhesion, reduced performance in extreme humidity or temperature, and limited shelf life can affect product reliability, posing challenges for manufacturers

- Availability of counterfeit or substandard tapes, especially in developing regions, undermines consumer confidence and brand reputation

- Addressing these challenges requires investment in R&D, awareness campaigns on performance benefits, and development of cost-effective, high-quality Electrical Insulation Tapes that meet both industrial standards and environmental regulations

How is the Electrical Insulation Tape Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Type of Material

On the basis of material, the electrical insulation tape market is segmented into PVC Electrical Tapes, Rubber Electrical Tapes, Silicone Electrical Tapes, and Others. The PVC Electrical Tape segment dominated the market with a revenue share of 46.8% in 2024, owing to its excellent insulating properties, cost-effectiveness, and widespread availability. PVC tapes are preferred in residential and commercial applications due to their durability, flame-retardant characteristics, and ease of handling. Rubber electrical tapes, while offering superior flexibility and elasticity, are primarily used in industrial and high-stress environments.

Silicone tapes are expected to witness the highest growth due to its high-temperature applications, particularly in electronics and aerospace sectors. The growing need for reliable insulation solutions across diverse sectors and ongoing innovations in PVC tape adhesives and thickness variations continue to reinforce its leading position, ensuring broad adoption across multiple applications.

- By Voltage Rating

On the basis of voltage rating, the electrical insulation tape market is segmented into Low Voltage, Medium Voltage, and High Voltage. The Low Voltage segment held the largest market revenue share of 52.3% in 2024, driven by the expanding residential, commercial, and consumer electronics sectors. Low-voltage electrical tapes are widely used for household wiring, small motors, and cable insulation due to their affordability and ease of installation.

Medium-voltage tapes are expected to witness the highest growth due to its use in industrial machinery and commercial infrastructures, while high-voltage tapes are critical in energy transmission and heavy industrial setups, offering superior dielectric strength. The growth in renewable energy projects, smart homes, and electronic appliances continues to boost low-voltage tape demand, solidifying its dominance in the market. Increasing safety and regulatory standards for low-voltage wiring further contribute to sustained adoption.

- By End-Use Industry

On the basis of end-use industry, the electrical insulation tape market is segmented into Construction, Automotive, Electronics and Electrical, Aerospace and Defense, Telecommunication, Energy and Utilities, and Others. The Electronics and Electrical industry segment dominated the market with a market share of 41.7% in 2024, driven by the rapid growth of consumer electronics, home appliances, and industrial electrical equipment. Electrical tapes are essential for insulation, protection, and bundling of wires and components.

The automotive sector is witnessing strong growth due to increasing EV adoption and complex electrical systems. Aerospace and defense applications require high-performance insulation tapes capable of withstanding extreme conditions. Telecommunication and energy sectors are driving demand for specialized tapes suitable for cables, transformers, and control panels. The widespread use of electrical and electronic devices globally ensures the electronics and electrical segment remains the largest contributor to market revenue.

- By Application

On the basis of application, the electrical insulation tape market is segmented into Electrical Wires and Cables, Motors and Generators, Transformers, Switchgear and Control Panels, Communication Cables, and Others. The Electrical Wires and Cables segment dominated the market with a market share of 49.5% in 2024, due to the essential role of insulation tapes in protecting wiring systems and ensuring safety. Motors, generators, and transformers require high-performance tapes to prevent electrical faults and overheating. Switchgear and control panels use tapes for bundling and insulation, enhancing operational efficiency.

Communication cables, particularly fiber optic and coaxial types, are expected to witness the highest growth due to growth in construction, industrial automation, renewable energy, and telecom infrastructure projects drives demand for tapes across all applications, yet wiring and cabling remain the largest and most consistent application segment, given their fundamental role in nearly all electrical systems.

Which Region Holds the Largest Share of the Electrical Insulation Tape Market?

- North America dominated the electrical insulation tape market with the largest revenue share of 32.51% in 2024, driven by increasing demand for home automation and advanced security solutions

- Consumers in the region prioritize convenience, seamless integration with smart devices such as lighting systems and thermostats, and advanced safety features

- The widespread adoption is further fueled by high disposable incomes, a technology-oriented population, and the growing preference for remote monitoring and control. Both residential and commercial sectors benefit from these trends, making Electrical Insulation Tapes a widely preferred solution

U.S. Electrical Insulation Tape Market Insight

U.S. market captured a dominant revenue share in North America in 2024, supported by the rapid uptake of connected devices and home automation trends. Smart, keyless entry systems are increasingly used to enhance home security, while DIY smart home solutions and mobile app integrations further drive adoption. The integration of Electrical Insulation Tapes with platforms such as Alexa, Google Assistant, and Apple HomeKit continues to expand the market.

Europe Electrical Insulation Tape Market Insight

Europe market is projected to grow at a substantial CAGR during the forecast period, fueled by strict security regulations and the rising need for advanced home and office security. Urbanization and increasing demand for connected devices are encouraging adoption. Consumers in Europe also value energy efficiency and convenience offered by Electrical Insulation Tapes. Growth is observed across residential, commercial, and multi-family housing applications, with widespread use in both new construction and renovation projects.

U.K. Electrical Insulation Tape Market Insight

U.K. market is expected to expand at a notable CAGR, driven by rising adoption of home automation and the desire for convenient, secure access solutions. Concerns about burglary and safety motivate homeowners and businesses to adopt keyless entry systems. The country’s strong retail and e-commerce infrastructure, along with widespread integration of connected devices, supports market growth.

Germany Electrical Insulation Tape Market Insight

Germany market is forecasted to grow at a considerable CAGR, fueled by awareness of digital security and demand for eco-friendly, technologically advanced solutions. Well-developed infrastructure and emphasis on innovation and sustainability encourage adoption in residential and commercial spaces. Integration with home automation systems is increasing, with secure, privacy-focused solutions aligning with consumer expectations.

Which Region is the Fastest Growing in the Electrical Insulation Tape Market?

Asia-Pacific (APAC) market is poised to grow at the fastest CAGR of 11.58% during 2025–2032, driven by rapid urbanization, rising disposable incomes, and technological advancement in countries such as China, Japan, and India. Government initiatives promoting digitalization and smart homes are boosting adoption. APAC’s emergence as a manufacturing hub for electrical insulation tape components improves affordability and accessibility, expanding the consumer base.

Japan Electrical Insulation Tape Market Insight

Japan’s market growth is supported by its high-tech culture, urbanization, and demand for convenience. Security-focused consumers and the rise of smart homes and connected buildings are driving adoption. Integration with IoT devices, such as cameras and lighting systems, further fuels growth. The aging population is such asly to increase demand for secure, easy-to-use access solutions.

China Electrical Insulation Tape Market Insight

China accounted for the largest revenue share in APAC in 2024, driven by rapid urbanization, expanding middle class, and high adoption of smart home devices. Electrical Insulation Tapes are increasingly used in residential, commercial, and rental properties, supported by smart city initiatives and strong domestic manufacturing. Affordability and availability of advanced solutions further propel the market.

Which are the Top Companies in Electrical Insulation Tape Market?

The electrical insulation tape industry is primarily led by well-established companies, including:

- 3M Company (U.S.)

- Avery Dennison Corporation (U.S.)

- Nitto Denko Corporation (Japan)

- Scapa Group plc (U.K.)

- Shurtape Technologies, LLC (U.S.)

- Plymouth Rubber Europa S.A. (France)

- Saint-Gobain Performance Plastics (France)

- Denka Company Limited (Japan)

- Four Pillars Enterprise Co., Ltd. (Taiwan)

What are the Recent Developments in Global Electrical Insulation Tape Market?

- In September 2023, Avery Dennison Performance Tapes announced the launch of its newly developed Volt Tough portfolio of electrical insulation tape solutions, designed as electrically insulative, single-sided filmic tapes to tackle the challenges of inadequate insulation in EV battery packs, enhancing safety and performance in electric vehicles.

- In July 2023, Tesa (Beiersdorf AG) introduced its new high-performance electrical insulation tape, Tesa 61395, made from an advanced high-tech material that offers superior insulation, adhesion, flexibility, and durability compared to conventional tapes, strengthening its position in the premium insulation market

- In June 2023, Nitto Denko Corporation expanded its electrical insulation tape manufacturing facility in China, increasing production capacity by 50%, reflecting the company’s commitment to meeting rising global demand for high-quality insulation solutions.

- In May 2023, Achem (YC Group) launched a new line of high-temperature electrical insulation tapes capable of withstanding temperatures up to 250°C, providing a reliable solution for demanding industrial and electronic applications, and reinforcing its focus on specialized tape products

- In December 2022, Shurtape Technologies, LLC completed the acquisition of Pro Tapes & Specialties, Inc., a manufacturer serving multiple markets such as graphic arts, precision die-cutting, library supplies, retail, and industrial applications, strengthening Shurtape’s market reach and product portfolio

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.