Global Electrotherapy Market

Market Size in USD Million

CAGR :

%

USD

965.96 Million

USD

1,281.85 Million

2024

2032

USD

965.96 Million

USD

1,281.85 Million

2024

2032

| 2025 –2032 | |

| USD 965.96 Million | |

| USD 1,281.85 Million | |

|

|

|

|

Electrotherapy Market Size

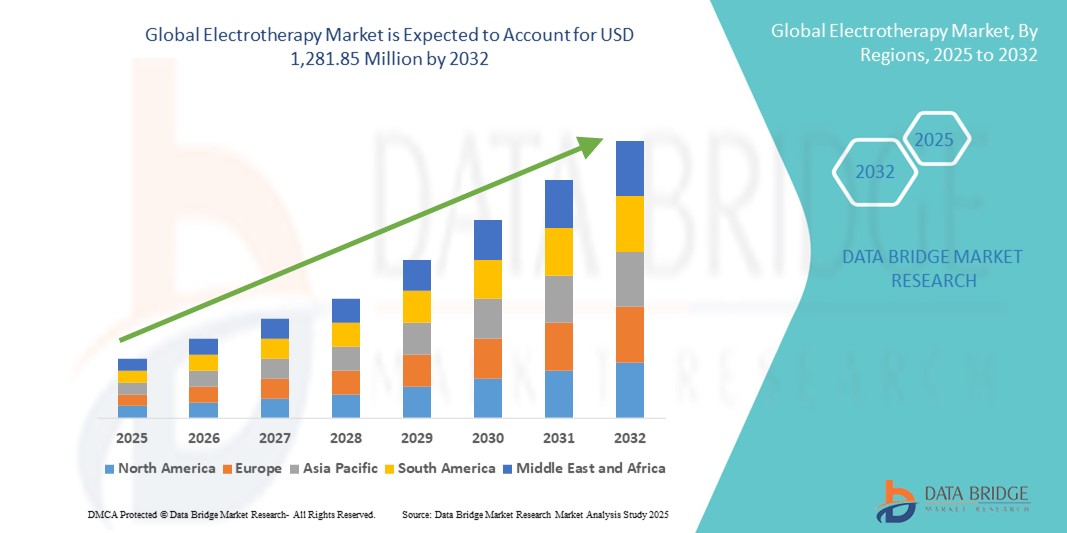

- The global electrotherapy market size was valued at USD 965.96 million in 2024 and is expected to reach USD 1,281.85 million by 2032, at a CAGR of 3.60% during the forecast period

- The market growth is largely driven by increasing prevalence of chronic pain, musculoskeletal disorders, and neurological conditions, coupled with growing awareness of non-invasive pain management therapies. Advancements in electrotherapy devices and integration with wearable technology are further supporting market expansion

- Moreover, rising demand from rehabilitation centers, physiotherapy clinics, and homecare settings for efficient, safe, and patient-friendly treatment solutions is positioning electrotherapy as a preferred choice for pain relief and functional recovery. These factors collectively are accelerating adoption, thereby substantially enhancing market growth

Electrotherapy Market Analysis

- Electrotherapy, involving the use of electrical energy for pain management, muscle stimulation, and rehabilitation, is increasingly recognized as an essential component in physical therapy, sports medicine, and neurological treatment due to its non-invasive nature, targeted therapy capabilities, and ease of integration with modern healthcare protocols

- The rising demand for electrotherapy is primarily driven by the growing prevalence of chronic pain, musculoskeletal disorders, and neurological conditions, alongside increased awareness of non-pharmacological pain management options and advancements in device technology

- North America dominated the electrotherapy market with the largest revenue share of 39.5% in 2024, supported by well-established healthcare infrastructure, high healthcare spending, and a strong presence of leading device manufacturers. The U.S. witnessed substantial growth in electrotherapy adoption, particularly in rehabilitation centers and homecare settings, driven by innovations in wearable and portable devices, as well as AI-enabled treatment monitoring systems

- Asia-Pacific is expected to be the fastest-growing region in the electrotherapy market during the forecast period, fueled by increasing healthcare access, rising geriatric population, and growing adoption of modern rehabilitation and physiotherapy solutions in emerging economies

- Transcutaneous Electrical Nerve Stimulation (TENUS) devices dominated the electrotherapy market with a market share of 42% in 2024, driven by their proven efficacy in pain relief, user-friendly design, and widespread availability for both clinical and home use

Report Scope and Electrotherapy Market Segmentation

|

Attributes |

Electrotherapy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Electrotherapy Market Trends

Advancements in Wearable and AI-Enabled Electrotherapy Devices

- A prominent trend in the global electrotherapy market is the integration of wearable technology with AI-enabled monitoring systems, enhancing treatment personalization and real-time patient feedback. This combination is improving therapy effectiveness and patient engagement

- For instance, devices such as Compex Wireless TENS and Omron Pocket Pain Pro offer wearable electrotherapy solutions that can be controlled via mobile apps, allowing patients to adjust intensity, track sessions, and monitor progress remotely

- AI integration enables these devices to adapt stimulation patterns based on individual patient responses, detect abnormal usage, and provide predictive alerts to optimize treatment outcomes. Some NeuroMetrix and Quell devices employ AI to modify electrical impulses over time, enhancing pain relief efficacy and reducing the risk of overstimulation

- The seamless connectivity of electrotherapy devices with smartphones, tablets, and telehealth platforms allows centralized management of patient therapy schedules, enabling healthcare providers to monitor and adjust treatments remotely, thus improving adherence and outcomes

- This trend toward smarter, connected, and adaptive electrotherapy solutions is redefining patient expectations for non-invasive pain management, encouraging innovation in AI-enabled device features

- Consequently, companies such as Chattanooga (DJO Global) and BTL Industries are developing AI-integrated electrotherapy solutions capable of automatic adjustment based on patient activity and condition, enhancing convenience and effectiveness across clinical and homecare settings

- The demand for wearable and AI-enabled electrotherapy devices is growing rapidly across rehabilitation centers, physiotherapy clinics, and homecare markets, as patients and providers increasingly prioritize convenience, personalization, and data-driven treatment optimization

Electrotherapy Market Dynamics

Driver

Rising Prevalence of Chronic Pain and Demand for Non-Invasive Therapies

- The growing incidence of chronic pain, musculoskeletal disorders, and neurological conditions is a primary driver for the increasing adoption of electrotherapy devices

- For instance, in March 2024, Omron Healthcare launched an updated range of TENS and EMS devices aimed at home-based pain management, highlighting the rising consumer preference for non-pharmacological treatment solutions

- Electrotherapy provides advantages such as targeted pain relief, muscle stimulation, and rehabilitation support, making it a preferred alternative to invasive procedures or long-term medication use

- Furthermore, the increasing penetration of physiotherapy and rehabilitation services in developed and emerging markets is boosting electrotherapy adoption in both clinical and home settings

- Patient convenience, portability of devices, and integration with mobile apps for remote monitoring and therapy management are further driving market growth

Restraint/Challenge

Device Standardization, Safety Concerns, and Regulatory Barriers

- The variability in device quality, intensity settings, and application protocols poses a challenge to market adoption, as improper usage may lead to discomfort, skin irritation, or ineffective therapy

- For instance, reports of minor burns or skin reactions from improperly used TENS units have raised safety concerns among some consumers

- Ensuring compliance with regional medical device regulations, safety certifications, and standardized usage guidelines is essential to gain patient and provider trust. Companies such as Chattanooga and NeuroMetrix emphasize FDA approvals and rigorous testing in their marketing to reassure users

- In addition, the relatively high cost of advanced electrotherapy devices with AI and connectivity features can limit adoption in price-sensitive markets, particularly in developing regions

- Addressing these challenges through standardized protocols, enhanced safety features, regulatory compliance, and affordable device options will be crucial for sustained growth in the electrotherapy market

Electrotherapy Market Scope

The market is segmented on the basis of technology, application, therapy, and end-user.

- By Technology

On the basis of technology, the electrotherapy market is segmented into Transcutaneous Electrical Nerve Stimulation (TENS), Neuromuscular Electrical Stimulation (NMES), Inferential Current (IFC), Percutaneous Electrical Nerve Stimulation (PENS), Electronic Muscle Stimulator (EMS), Spinal Cord Stimulation (SCS), Electro-acupuncture (EA), and Others. The TENS segment dominated the market with the largest market revenue share of 42% in 2024. Its dominance is attributed to proven efficacy in managing chronic and acute pain, ease of use, and wide acceptance in both clinical and homecare settings. TENS devices are portable, non-invasive, and cost-effective, making them a preferred choice among patients and healthcare providers. In addition, the rise of app-controlled and wearable TENS devices has further strengthened its market position. The segment benefits from increasing patient awareness about non-pharmacological pain relief options and the growing prevalence of musculoskeletal disorders. Hospitals and homecare providers continue to adopt TENS for its simplicity and reliable results.

The NMES segment is expected to witness the fastest growth at a CAGR of 19.8% from 2025 to 2032. NMES is increasingly adopted in rehabilitation, sports medicine, and physiotherapy applications to enhance muscle strength, prevent atrophy, and aid post-surgical recovery. Integration with wearable and AI-enabled devices allows for real-time monitoring and personalized therapy, improving treatment outcomes. The segment’s growth is supported by rising demand for home-based rehabilitation and portable devices. Moreover, the expanding geriatric population and increasing incidence of neuromuscular disorders are fueling adoption in both developed and emerging markets.

- By Application

On the basis of application, the electrotherapy market is segmented into chronic wound healing, neuromuscular dysfunction, pain management, tissue repair, musculoskeletal disorder, physical therapy, iontophoresis, and others. The pain management segment dominated the market in 2024 due to the increasing prevalence of chronic conditions such as arthritis, back pain, and sports injuries. Electrotherapy provides a safe, non-invasive alternative to medications, reducing dependency on drugs while delivering targeted pain relief. The segment benefits from growing patient awareness and acceptance of electrotherapy in clinical and homecare settings. Its widespread adoption in hospitals, clinics, and rehabilitation centers further supports its market leadership. In addition, rising healthcare expenditure and advances in device technology, such as wearable and app-enabled solutions, are boosting segment growth.

The musculoskeletal disorder segment is expected to register the fastest growth during the forecast period. Increasing orthopedic injuries, sports-related conditions, and age-related degenerative disorders are driving demand. Electrotherapy is essential for rehabilitation, muscle strengthening, and functional recovery, making it popular in physiotherapy and sports medicine centers. The adoption of portable and home-use devices allows patients to continue therapy outside clinical settings, enhancing market penetration. In addition, awareness campaigns and professional endorsements by physiotherapists contribute to rapid growth in this segment.

- By Therapy

On the basis of therapy, the electrotherapy market is segmented into extracorporeal shock wave therapy, magnetic field therapy, ultrasound therapy, microcurrent therapy, interferential current therapy, and others. The Interferential Current (IFC) Therapy segment dominated the market in 2024 due to its effectiveness in treating deep tissue pain, improving circulation, and accelerating rehabilitation. Hospitals and clinics widely use IFC therapy for musculoskeletal and neurological conditions. Its non-invasive nature, ease of use, and ability to target specific muscle groups make it a preferred choice among healthcare providers. Increasing clinical adoption and patient preference for pain relief without medication further strengthen the segment’s market position.

The extracorporeal shock wave therapy segment is expected to grow the fastest during the forecast period. This therapy is increasingly applied in orthopedics, sports injury treatment, and chronic wound healing. Its non-invasive, high-efficacy approach attracts both patients and healthcare providers. Growing awareness of advanced therapies, technological advancements, and increasing investment in rehabilitation and sports medicine facilities contribute to rapid adoption. In addition, rising demand for faster recovery and improved patient outcomes supports segment growth globally.

- By End-User

On the basis of end-user, the electrotherapy market is segmented into hospitals, rehabilitation centers, and clinics. The hospitals segment dominated the market in 2024 due to the presence of advanced healthcare infrastructure, high patient inflow, and extensive adoption of electrotherapy for pain management and rehabilitation. Hospitals invest in multiple electrotherapy devices to offer comprehensive treatment solutions and improve patient outcomes. High awareness among healthcare professionals and patients further drives adoption in hospitals. Increasing prevalence of chronic pain, musculoskeletal disorders, and post-surgical rehabilitation cases supports segment dominance. Moreover, integration of AI-enabled and wearable electrotherapy devices enhances hospital-based therapy efficiency.

The rehabilitation centers segment is expected to witness the fastest growth during the forecast period. Rising focus on post-operative recovery, sports injury management, and physical therapy programs is fueling demand. Patients increasingly prefer continuous therapy sessions in rehabilitation centers with personalized care. Portable and connected devices allow real-time monitoring, improving treatment outcomes and convenience. Growing investments in specialized rehab facilities and increasing awareness about non-invasive therapies further accelerate segment growth. In addition, collaborations with hospitals and physiotherapy clinics help expand market reach for rehabilitation centers.

Electrotherapy Market Regional Analysis

- North America dominated the electrotherapy market with the largest revenue share of 39.5% in 2024, supported by well-established healthcare infrastructure, high healthcare spending, and a strong presence of leading device manufacturers

- Patients and healthcare providers in the region increasingly prefer non-invasive and effective pain management solutions, making electrotherapy a popular choice in hospitals, rehabilitation centers, and homecare settings

- The widespread adoption is further supported by high healthcare spending, advanced medical technology, and strong presence of key market players investing in innovative and connected electrotherapy devices

U.S. Electrotherapy Market Insight

The U.S. electrotherapy market captured the largest revenue share of 42% in 2024 within North America, driven by the increasing prevalence of chronic pain, musculoskeletal disorders, and post-operative rehabilitation cases. Hospitals, rehabilitation centers, and homecare providers are increasingly adopting electrotherapy as a non-invasive and effective treatment solution. Growing awareness about pain management alternatives to medication, coupled with rising demand for wearable and AI-enabled electrotherapy devices, is significantly propelling the market. In addition, the expansion of telehealth services and home-based care is boosting the adoption of portable and app-controlled electrotherapy devices. The U.S. market also benefits from strong healthcare infrastructure, high healthcare expenditure, and active presence of key device manufacturers.

Europe Electrotherapy Market Insight

The Europe electrotherapy market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing geriatric population, rising incidence of musculoskeletal disorders, and the demand for advanced rehabilitation solutions. Hospitals and physiotherapy clinics are increasingly adopting electrotherapy devices due to their non-invasive nature and proven effectiveness. Moreover, regulatory support for medical devices and growing healthcare awareness are fostering adoption. The region is witnessing strong growth across hospitals, rehabilitation centers, and homecare segments, with both new facilities and established clinics incorporating electrotherapy into treatment protocols.

U.K. Electrotherapy Market Insight

The U.K. electrotherapy market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising prevalence of chronic pain and musculoskeletal conditions. Patient preference for non-invasive, drug-free therapies and home-based rehabilitation solutions is fueling demand. In addition, physiotherapy clinics and hospitals are increasingly integrating wearable and connected electrotherapy devices to improve patient outcomes. The U.K.’s well-established healthcare infrastructure and strong adoption of digital health solutions are expected to continue supporting market expansion. Government initiatives promoting innovative medical treatments also contribute to steady growth.

Germany Electrotherapy Market Insight

The Germany electrotherapy market is expected to expand at a considerable CAGR during the forecast period, fueled by high awareness of advanced pain management therapies and increasing adoption of rehabilitation technologies. Germany’s emphasis on healthcare innovation and strong medical infrastructure supports the integration of electrotherapy in hospitals and clinics. Growing focus on non-invasive, personalized therapies, alongside rising demand for wearable and AI-enabled devices, is driving market growth. Furthermore, patients are increasingly seeking home-based electrotherapy solutions for chronic pain and post-surgical recovery, supporting market adoption. The focus on evidence-based therapies and clinical efficacy strengthens the segment’s expansion potential.

Asia-Pacific Electrotherapy Market Insight

The Asia-Pacific electrotherapy market is poised to grow at the fastest CAGR of 23% during the forecast period of 2025 to 2032, driven by rising healthcare expenditure, increasing geriatric population, and rapid adoption of modern rehabilitation techniques in countries such as China, Japan, and India. The growing focus on non-invasive and cost-effective therapies, combined with government initiatives promoting digital health and telemedicine, is boosting market adoption. In addition, APAC’s emergence as a hub for affordable electrotherapy devices is expanding accessibility to a wider patient base. The rising prevalence of chronic pain, sports injuries, and post-operative rehabilitation needs are further accelerating demand.

Japan Electrotherapy Market Insight

The Japan electrotherapy market is gaining momentum due to the country’s aging population, high technological adoption, and increasing focus on non-invasive therapies. Hospitals, rehabilitation centers, and homecare settings are adopting wearable and connected electrotherapy devices to improve patient outcomes. The integration of electrotherapy with digital health platforms and telemedicine services is supporting market growth. In addition, rising awareness of musculoskeletal disorders and chronic pain management solutions is encouraging adoption across residential and clinical sectors. Japan’s culture of technological innovation also supports the development of AI-enabled electrotherapy devices.

India Electrotherapy Market Insight

The India electrotherapy market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by the expanding middle class, growing healthcare awareness, and rapid urbanization. Hospitals, rehabilitation centers, and clinics are increasingly adopting electrotherapy for pain management and rehabilitation purposes. The government’s push towards digital health initiatives and telemedicine, combined with affordable electrotherapy devices, is propelling market growth. Rising incidence of musculoskeletal disorders and post-operative rehabilitation needs further fuel adoption. In addition, strong domestic manufacturing and increasing availability of portable devices are making electrotherapy more accessible to a wider population.

Electrotherapy Market Share

The electrotherapy industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Zynex Medical (U.S.)

- Enovis Corporation (U.S.)

- BTL Group of Companies (Czech Republic)

- Omron Healthcare, Inc. (Japan)

- Stymco (U.S.)

- Eme (Italy)

- Alrad Instruments (U.K.)

- Astar (Poland)

- Avazzia, Inc. (U.S.)

- BioMedical Life Systems (U.S.)

- GymnaUniphy (Belgium)

- Dynatronics Corporation (U.S.)

- Chattanooga Group (U.S.)

- NeuroMetrix (U.S.)

- Mettler Electronics (U.S.)

- Pepin Manufacturing (U.S.)

- RS Medical (U.S.)

- Orthofix Medical (U.S.)

- Haifu (China)

What are the Recent Developments in Global Electrotherapy Market?

- In April 2025, Stanford University launched the eWEAR-X initiative, aiming to advance wearable electrotherapy devices through collaboration between researchers in engineering and medicine. This initiative seeks to push the boundaries of wearable technology's clinical and health applications

- In March 2025, the U.S. FDA granted Breakthrough Device Designation to a non-invasive brain stimulation device developed by the University of North Carolina. This device aims to treat major depressive disorder by using targeted electrical stimulation, marking a significant advancement in psychiatric care

- In February 2025, Medtronic received U.S. FDA approval for the world's first adaptive deep brain stimulation system designed for individuals with Parkinson's disease. This system utilizes a surgically implanted neurostimulator to transmit electrical signals to specific parts of the brain, offering a transformative approach to managing neurological disorders

- In September 2024, Zynex Medical received FDA clearance for its TensWave device, a prescription-only transcutaneous electrical nerve stimulation (TENS) device designed for pain management and rehabilitation. The device aims to provide effective pain relief through TENS therapy, which has been clinically proven to reduce chronic and acute pain without the need for medication

- In May 2024, Lionheart Health and ElectroMedical Technologies (EMED) announced a strategic partnership aimed at accelerating the market growth of their bioelectric regeneration platform. This collaboration combines Lionheart Health's expertise in regenerative medicine with EMED's advanced electrotherapy technologies to develop innovative treatments for chronic pain and tissue repair

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ELECTROTHERAPY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL XX SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL ELECTROTHERAPY MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 INSTALLED BASE DATA

15 VALUE CHAIN ANALYSIS

16 HEALTHCARE ECONOMY

16.1 HEALTHCARE EXPENDITURE

16.2 CAPITAL EXPENDITURE

16.3 CAPEX TRENDS

16.4 CAPEX ALLOCATION

16.5 FUNDING SOURCES

16.6 INDUSTRY BENCHMARKS

16.7 GDP RATION IN OVERALL GDP

16.8 HEALTHCARE SYSTEM STRUCTURE

16.9 GOVERNMENT POLICIES

16.1 ECONOMIC DEVELOPMENT

17 GLOBAL ELECTROTHERAPY MARKET, BY THERAPY TYPE

17.1 OVERVIEW

17.2 TRANSCUTANEOUS ELECTRICAL NERVE STIMULATION (TENS)

17.2.1 BY FREQUENCY

17.2.1.1. HIGH FREQUENCY (90 – 130 HZ)

17.2.1.2. LOWER FREQUENCY (2 – 5 HZ)

17.2.2 BY INDICATION

17.2.2.1. ARTHRITIS

17.2.2.2. FIBROMYALGIA

17.2.2.3. KNEE PAIN

17.2.2.4. BACK PAIN

17.2.2.5. NECK PAIN

17.2.2.6. DIABETIC NEUROPATHY

17.2.2.7. PELVIC PAIN FROM PERIODS OR ENDOMETRIOSIS

17.2.2.8. OTERS

17.3 HIGH VOLTAGE ELECTRICAL STIMULATION

17.3.1 BY INDICATION

17.3.1.1. ADHESIVE BURSITIS

17.3.1.2. WOUND HEALING

17.3.1.3. CERVICAL SPRAIN

17.3.1.4. DEGENERATIVE DISC

17.3.1.5. EPICONDYLITIS

17.3.1.6. SPRAIN

17.3.1.7. POST-OPERATIVE PAIN

17.3.1.8. OTHERS

17.4 THERAPEUTIC ULTRASOUND

17.4.1 BY TYPE

17.4.1.1. THERMAL

17.4.1.2. MECHANICAL

17.4.2 BY INDICATION

17.4.2.1. ACUTE INJURIES

17.4.2.2. CHRONIC INJURIES

17.5 NEUROMUSCULAR ELECTRICAL STIMULATION (NMES)

17.5.1 BY INDICATION

17.5.1.1. INCONTINENCE

17.5.1.2. MUSCLE REHABILITATION

17.5.1.3. MUSCLE WEAKNESS

17.5.1.4. OTHERS

17.6 INFERENTIAL CURRENT (IFC)

17.6.1 BY INDICATION

17.6.1.1. MUSCLE SPASM

17.6.1.2. EDEMA

17.6.1.3. HEMATOMA

17.6.1.4. CHRONIC LIGAMENT LESION

17.6.1.5. RADICULOPATHY

17.6.1.6. STRESS INCONTINENCE

17.6.1.7. CHRONIC LIGAMENT LESION

17.6.1.8. OTHERS

17.7 SHOCK WAVE THERAPY

17.7.1 BY INDICATION

17.7.1.1. PAIN MANAGEMENT

17.7.1.2. ORTHOPEDICS

17.7.1.3. SPORTS MEDICINE

17.7.1.4. OTHERS

17.8 ELECTROACUPUNCTURE

17.8.1 BY TYPE

17.8.1.1. LOW FREQUENCY

17.8.1.2. HIGH FREQUENCY

17.8.2 BY INDICATION

17.8.2.1. ARTHRITIS

17.8.2.2. PAIN

17.8.2.3. STRESS

17.8.2.4. ADDICTION

17.8.2.5. TINNITUS

17.8.2.6. OTHERS

17.9 ELECTRICAL MUSCLE STIMULATION (EMS)

17.9.1 BY INDICATION

17.9.1.1. PHYSICAL REHABILITATION

17.9.1.2. WEIGHT LOSS

17.9.1.3. MUSCLE SPASM RELAXATION

17.9.1.4. ATROPHY

17.9.1.5. OTHERS

17.1 OTHERS

18 GLOBAL ELECTROTHERAPY MARKET, BY APPLICATION

18.1 OVERVIEW

18.2 ARTHRITIS

18.3 FIBROMYALGIA

18.4 PAIN MANAGEMENT

18.4.1 KNEE PAIN

18.4.2 BACK PAIN

18.4.3 NECK PAIN

18.4.4 OTHERS

18.5 DIABETIC NEUROPATHY

18.6 ADHESIVE BURSITIS

18.7 WOUND HEALING

18.8 CERVICAL SPRAIN

18.9 DEGENERATIVE DISC

18.1 EPICONDYLITIS

18.11 INCONTINENCE

18.12 MUSCLE REHABILITATION

18.13 MUSCLE WEAKNESS

18.14 ADDICTION

18.15 TINNITUS

18.16 OTHERS

19 GLOBAL ELECTROTHERAPY MARKET, BY END USER

19.1 OVERVIEW

19.2 HOSPITALS

19.2.1 TRANSCUTANEOUS ELECTRICAL NERVE STIMULATION (TENS)

19.2.2 HIGH VOLTAGE ELECTRICAL STIMULATION

19.2.3 THERAPEUTIC ULTRASOUND

19.2.4 NEUROMUSCULAR ELECTRICAL STIMULATION (NMES)

19.2.5 INFERENTIAL CURRENT (IFC)

19.2.6 SHOCK WAVE THERAPY

19.2.7 ELECTROACUPUNCTURE

19.2.8 ELECTRICAL MUSCLE STIMULATION (EMS)

19.2.9 OTHERS

19.3 REHABILITATION CENTRES

19.3.1 TRANSCUTANEOUS ELECTRICAL NERVE STIMULATION (TENS)

19.3.2 HIGH VOLTAGE ELECTRICAL STIMULATION

19.3.3 THERAPEUTIC ULTRASOUND

19.3.4 NEUROMUSCULAR ELECTRICAL STIMULATION (NMES)

19.3.5 INFERENTIAL CURRENT (IFC)

19.3.6 SHOCK WAVE THERAPY

19.3.7 ELECTROACUPUNCTURE

19.3.8 ELECTRICAL MUSCLE STIMULATION (EMS)

19.3.9 OTHERS

19.4 PHYSICAL THERAPY CLINICS

19.4.1 TRANSCUTANEOUS ELECTRICAL NERVE STIMULATION (TENS)

19.4.2 HIGH VOLTAGE ELECTRICAL STIMULATION

19.4.3 THERAPEUTIC ULTRASOUND

19.4.4 NEUROMUSCULAR ELECTRICAL STIMULATION (NMES)

19.4.5 INFERENTIAL CURRENT (IFC)

19.4.6 SHOCK WAVE THERAPY

19.4.7 ELECTROACUPUNCTURE

19.4.8 ELECTRICAL MUSCLE STIMULATION (EMS)

19.4.9 OTHERS

19.5 SPECIALTY CLINICS

19.5.1 TRANSCUTANEOUS ELECTRICAL NERVE STIMULATION (TENS)

19.5.2 HIGH VOLTAGE ELECTRICAL STIMULATION

19.5.3 THERAPEUTIC ULTRASOUND

19.5.4 NEUROMUSCULAR ELECTRICAL STIMULATION (NMES)

19.5.5 INFERENTIAL CURRENT (IFC)

19.5.6 SHOCK WAVE THERAPY

19.5.7 ELECTROACUPUNCTURE

19.5.8 ELECTRICAL MUSCLE STIMULATION (EMS)

19.5.9 OTHERS

19.6 SPA AND WELLNESS CENTERS

19.6.1 TRANSCUTANEOUS ELECTRICAL NERVE STIMULATION (TENS)

19.6.2 HIGH VOLTAGE ELECTRICAL STIMULATION

19.6.3 THERAPEUTIC ULTRASOUND

19.6.4 NEUROMUSCULAR ELECTRICAL STIMULATION (NMES)

19.6.5 INFERENTIAL CURRENT (IFC)

19.6.6 SHOCK WAVE THERAPY

19.6.7 ELECTROACUPUNCTURE

19.6.8 ELECTRICAL MUSCLE STIMULATION (EMS)

19.6.9 OTHERS

19.7 SPORTS MEDICINE CLINICS

19.7.1 TRANSCUTANEOUS ELECTRICAL NERVE STIMULATION (TENS)

19.7.2 HIGH VOLTAGE ELECTRICAL STIMULATION

19.7.3 THERAPEUTIC ULTRASOUND

19.7.4 NEUROMUSCULAR ELECTRICAL STIMULATION (NMES)

19.7.5 INFERENTIAL CURRENT (IFC)

19.7.6 SHOCK WAVE THERAPY

19.7.7 ELECTROACUPUNCTURE

19.7.8 ELECTRICAL MUSCLE STIMULATION (EMS)

19.7.9 OTHERS

19.8 AMBULATORY CENTERS

19.8.1 TRANSCUTANEOUS ELECTRICAL NERVE STIMULATION (TENS)

19.8.2 HIGH VOLTAGE ELECTRICAL STIMULATION

19.8.3 THERAPEUTIC ULTRASOUND

19.8.4 NEUROMUSCULAR ELECTRICAL STIMULATION (NMES)

19.8.5 INFERENTIAL CURRENT (IFC)

19.8.6 SHOCK WAVE THERAPY

19.8.7 ELECTROACUPUNCTURE

19.8.8 ELECTRICAL MUSCLE STIMULATION (EMS)

19.8.9 OTHERS

19.9 OTHERS

20 GLOBAL ELECTROTHERAPY MARKET, BY DISTRIBUTION CHANNEL

20.1 OVERVIEW

20.2 DIRECT TENDER

20.3 RETAIL SALES

20.4 OTHERS

21 GLOBAL ELECTROTHERAPY MARKET, SWOT AND DBMR ANALYSIS

22 GLOBAL ELECTROTHERAPY MARKET, COMPANY LANDSCAPE

22.1 COMPANY SHARE ANALYSIS: GLOBAL

22.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

22.3 COMPANY SHARE ANALYSIS: EUROPE

22.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

22.5 MERGERS & ACQUISITIONS

22.6 NEW PRODUCT DEVELOPMENT & APPROVALS

22.7 EXPANSIONS

22.8 REGULATORY CHANGES

22.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

23 GLOBAL ELECTROTHERAPY MARKET, BY REGION

23.1 GLOBAL ELECTROTHERAPY MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

23.2 NORTH AMERICA

23.2.1 U.S.

23.2.2 CANADA

23.2.3 MEXICO

23.3 EUROPE

23.3.1 GERMANY

23.3.2 U.K.

23.3.3 ITALY

23.3.4 FRANCE

23.3.5 SPAIN

23.3.6 RUSSIA

23.3.7 SWITZERLAND

23.3.8 TURKEY

23.3.9 BELGIUM

23.3.10 NETHERLANDS

23.3.11 DENMARK

23.3.12 SWEDEN

23.3.13 POLAND

23.3.14 NORWAY

23.3.15 FINLAND

23.3.16 REST OF EUROPE

23.4 ASIA-PACIFIC

23.4.1 JAPAN

23.4.2 CHINA

23.4.3 SOUTH KOREA

23.4.4 INDIA

23.4.5 SINGAPORE

23.4.6 THAILAND

23.4.7 INDONESIA

23.4.8 MALAYSIA

23.4.9 PHILIPPINES

23.4.10 AUSTRALIA

23.4.11 NEW ZEALAND

23.4.12 VIETNAM

23.4.13 TAIWAN

23.4.14 REST OF ASIA-PACIFIC

23.5 SOUTH AMERICA

23.5.1 BRAZIL

23.5.2 ARGENTINA

23.5.3 REST OF SOUTH AMERICA

23.6 MIDDLE EAST AND AFRICA

23.6.1 SOUTH AFRICA

23.6.2 EGYPT

23.6.3 BAHRAIN

23.6.4 UNITED ARAB EMIRATES

23.6.5 KUWAIT

23.6.6 OMAN

23.6.7 QATAR

23.6.8 SAUDI ARABIA

23.6.9 REST OF MEA

23.7 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

24 GLOBAL ELECTROTHERAPY MARKET, COMPANY PROFILE

24.1 MEDTRONIC

24.1.1 COMPANY OVERVIEW

24.1.2 REVENUE ANALYSIS

24.1.3 GEOGRAPHIC PRESENCE

24.1.4 PRODUCT PORTFOLIO

24.1.5 RECENT DEVELOPMENTS

24.2 ABBOTT

24.2.1 COMPANY OVERVIEW

24.2.2 REVENUE ANALYSIS

24.2.3 GEOGRAPHIC PRESENCE

24.2.4 PRODUCT PORTFOLIO

24.2.5 RECENT DEVELOPMENTS

24.3 ZYNEX MEDICAL

24.3.1 COMPANY OVERVIEW

24.3.2 REVENUE ANALYSIS

24.3.3 GEOGRAPHIC PRESENCE

24.3.4 PRODUCT PORTFOLIO

24.3.5 RECENT DEVELOPMENTS

24.4 NEUROMETRIX, INC.

24.4.1 COMPANY OVERVIEW

24.4.2 REVENUE ANALYSIS

24.4.3 GEOGRAPHIC PRESENCE

24.4.4 PRODUCT PORTFOLIO

24.4.5 RECENT DEVELOPMENTS

24.5 DJO, LLC

24.5.1 COMPANY OVERVIEW

24.5.2 REVENUE ANALYSIS

24.5.3 GEOGRAPHIC PRESENCE

24.5.4 PRODUCT PORTFOLIO

24.5.5 RECENT DEVELOPMENTS

24.6 NEVRO CORP.

24.6.1 COMPANY OVERVIEW

24.6.2 REVENUE ANALYSIS

24.6.3 GEOGRAPHIC PRESENCE

24.6.4 PRODUCT PORTFOLIO

24.6.5 RECENT DEVELOPMENTS

24.7 OMRON HEALTHCARE, INC.

24.7.1 COMPANY OVERVIEW

24.7.2 REVENUE ANALYSIS

24.7.3 GEOGRAPHIC PRESENCE

24.7.4 PRODUCT PORTFOLIO

24.7.5 RECENT DEVELOPMENTS

24.8 WALGREEN CO

24.8.1 COMPANY OVERVIEW

24.8.2 REVENUE ANALYSIS

24.8.3 GEOGRAPHIC PRESENCE

24.8.4 PRODUCT PORTFOLIO

24.8.5 RECENT DEVELOPMENTS

24.9 BTL

24.9.1 COMPANY OVERVIEW

24.9.2 REVENUE ANALYSIS

24.9.3 GEOGRAPHIC PRESENCE

24.9.4 PRODUCT PORTFOLIO

24.9.5 RECENT DEVELOPMENTS

24.1 CHIRAG ELECTRONICS PVT. LTD

24.10.1 COMPANY OVERVIEW

24.10.2 REVENUE ANALYSIS

24.10.3 GEOGRAPHIC PRESENCE

24.10.4 PRODUCT PORTFOLIO

24.10.5 RECENT DEVELOPMENTS

24.11 EMS PHYSIO LTD.

24.11.1 COMPANY OVERVIEW

24.11.2 REVENUE ANALYSIS

24.11.3 GEOGRAPHIC PRESENCE

24.11.4 PRODUCT PORTFOLIO

24.11.5 RECENT DEVELOPMENTS

24.12 HMS MEDICAL SYSTEMS

24.12.1 COMPANY OVERVIEW

24.12.2 REVENUE ANALYSIS

24.12.3 GEOGRAPHIC PRESENCE

24.12.4 PRODUCT PORTFOLIO

24.12.5 RECENT DEVELOPMENTS

25 RELATED REPORTS

26 CONCLUSION

27 QUESTIONNAIRE

28 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.