Global Enhanced Water Market

Market Size in USD Billion

CAGR :

%

USD

9.03 Billion

USD

19.51 Billion

2024

2032

USD

9.03 Billion

USD

19.51 Billion

2024

2032

| 2025 –2032 | |

| USD 9.03 Billion | |

| USD 19.51 Billion | |

|

|

|

|

Enhanced Water Market Size

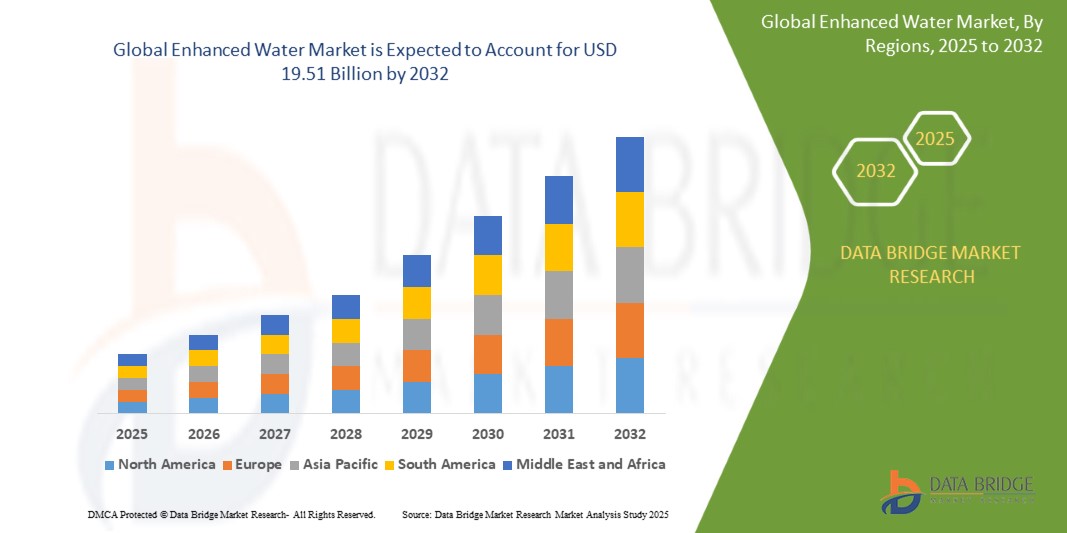

- The global enhanced water market size was valued at USD 9.03 billion in 2024 and is expected to reach USD 19.51 billion by 2032, at a CAGR of 10.1% during the forecast period

- This growth is driven by factors such as the rising demand for functional beverages, growing health consciousness among consumers, and increased product innovation with added vitamins, minerals, and electrolytes

Enhanced Water Market Analysis

- Enhanced water products are non-carbonated beverages infused with functional ingredients such as vitamins, minerals, antioxidants, electrolytes, and herbal extracts, catering to consumers seeking healthier alternatives to sugary drinks

- The demand for enhanced water is significantly driven by increasing health consciousness, a shift away from traditional sugary beverages, and the rising popularity of functional and performance-enhancing drinks

- North America is expected to dominate the enhanced water market, accounting for approximately 40% of the share, due to high consumer awareness, widespread availability of premium functional beverages, and strong marketing by leading brands such as Vitamin Water and Bai

- Asia-Pacific is expected to be the fastest-growing region in the enhanced water market during the forecast period, with a market share of around 30%, fueled by growing urbanization, increased disposable incomes, and a rising trend of fitness and wellness culture

- The vitamin-infused water segment is anticipated to lead the market, holding approximately 45% of the share, due to consumer preference for beverages that support immune function, hydration, and energy, along with continuous product innovations by companies like PepsiCo and Nestlé

Report Scope and Enhanced Water Market Segmentation

|

Attributes |

Enhanced Water Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Enhanced Water Market Trends

“Growth of Functional Ingredients and Eco-Friendly Packaging in Enhanced Water”

- One prominent trend in the enhanced water market is the increasing incorporation of functional ingredients such as electrolytes, vitamins, and minerals to cater to consumers seeking health benefits beyond basic hydration

- These innovations are enhancing the appeal of enhanced water, offering consumers drinks that support hydration, energy, and immunity while promoting overall wellness

- For instance, brands like Vitaminwater and Bai are increasingly infusing their products with antioxidants, electrolytes, and added vitamins to meet growing consumer demand for healthier alternatives to sugary sodas.

- Eco-friendly packaging is another emerging trend, with many brands transitioning to sustainable materials such as recycled plastic or plant-based bottles to reduce their environmental impact

- These trends are transforming the enhanced water market by aligning with consumer preferences for health-conscious and environmentally responsible products, thus driving demand for functional, eco-friendly beverage option

Enhanced Water Market Dynamics

Driver

“Growing Health Consciousness and Shift Towards Hydration with Functional Beverages”

- The rising health consciousness among consumers, coupled with the growing demand for functional beverages, is significantly contributing to the increased demand for enhanced water

- With an increasing focus on wellness, consumers are shifting away from sugary sodas and artificial drinks toward products that offer added benefits like hydration, energy, immune support, and overall well-being

- As the global population becomes more aware of the health risks associated with sugary drinks, including obesity, diabetes, and heart disease, the preference for low-calorie, functional beverages like enhanced water is rising

For instance,

- In March 2023, Nestlé launched a new line of vitamin-infused enhanced water targeting health-conscious consumers looking for a refreshing way to boost their hydration and immune system

- This shift toward functional beverages is not only driven by health-conscious millennials but also by older generations seeking to maintain hydration and health in a convenient, healthy form, further fueling the demand for enhanced water

Opportunity

“Integration of Digital and Smart Technology in Enhanced Water Products”

- The increasing use of smart technology in everyday products offers an opportunity for enhanced water brands to incorporate digital features into their offerings, such as smart water bottles that track hydration levels, monitor water intake, or remind users to stay hydrated throughout the day

- By integrating technology with water products, brands can create more interactive and personalized hydration experiences, encouraging consumers to adopt healthier hydration habits and ensuring better engagement with the brand

- Smart water bottles and connected hydration systems are gaining traction, especially among fitness enthusiasts and tech-savvy consumers who are seeking data-driven insights to improve their health and wellness routines

For instance,

- In March 2024, HydrationTech, an emerging company in the enhanced water sector, launched a smart water bottle that syncs with a mobile app to track hydration goals and provide personalized hydration reminders based on the user’s activity level and health metrics

- The combination of hydration and technology not only enhances the consumer experience but also opens opportunities for partnerships with fitness apps, health tracking devices, and wellness platforms to further expand the customer base and foster customer loyalty

Restraint/Challenge

“High Production and Distribution Costs Impacting Market Accessibility”

- The high cost of production and distribution for enhanced water products is a significant challenge, especially for smaller brands aiming to compete with established market leaders

- Enhanced water requires premium ingredients like electrolytes, vitamins, and minerals, along with specialized packaging to maintain product integrity and appeal to eco-conscious consumers. These factors contribute to higher production costs, making the final retail price more expensive

- These costs can limit the accessibility of enhanced water, particularly in price-sensitive markets, where consumers may prioritize more affordable beverage options, such as regular bottled water or soda

For instance,

- In January 2024, an article published by the Beverage Industry Journal highlighted that some brands in the enhanced water space, such as Essentia Water and Core Hydration, face rising production costs due to ingredient sourcing and eco-friendly packaging, which ultimately translates to higher retail prices for consumers

- As a result, smaller companies or new entrants in the market may struggle to compete, and the overall market penetration of enhanced water could be hindered in regions with lower disposable incomes, limiting overall market growth

Enhanced Water Market Scope

The market is segmented on the basis of product, distribution channel, infusions, packaging, end-users, and price range.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Distribution Channel |

|

|

By Infusions |

|

|

By Packaging |

|

|

By End-users |

|

|

By Price Range |

|

In 2025, the flavored enhanced wateris projected to dominate the market with a largest share in application segment

The flavored enhanced water segment is projected to hold the largest market share in 2025, driven by the increasing consumer demand for healthy, refreshing alternatives to sugary drinks. Flavored enhanced waters are popular due to their added benefits, such as vitamins, electrolytes, and minerals, which cater to the growing trend of functional beverages. This segment is expected to reach a 59.3% market share in 2025.

The vitamin-infused wateris expected to account for the largest share during the forecast period in technology segment

The vitamin-infused water segment is projected to hold the largest market share in 2025, driven by increasing consumer demand for functional beverages that offer both hydration and health benefits. These waters provide essential nutrients like vitamins A, C, D, and B complex, appealing to consumers focused on immunity, energy, and overall wellness.The vitamin water segment held a 14% market share in 2024 and is expected to continue its dominance in 2025. The rise in health consciousness, along with the demand for low-calorie, sugar-free options, fuels this growth, with brands like Vitaminwater and Bai leading the market.

Enhanced Water Market Regional Analysis

“North America Holds the Largest Share in the Enhanced Water Market”

- North America dominates the enhanced water market, driven by rising health consciousness among consumers, a high demand for functional beverages, and the region's advanced distribution networks

- The U.S. holds a significant share, supported by the growing consumer preference for health-enhancing beverages that offer added benefits like electrolytes, vitamins, and minerals. The trend toward healthier hydration options is further supported by increasing awareness of wellness and fitness

- The availability of well-established retail channels, coupled with continuous innovation by leading brands in terms of flavor profiles and added benefits, enhances market penetration and adoption in North America. Major companies have increased investments in product differentiation to appeal to health-conscious consumers

- In addition, growing environmental concerns and sustainability initiatives among both companies and consumers are contributing to the popularity of eco-friendly packaging and plant-based ingredients, helping to drive the market’s expansion in the region. The increase in on-the-go consumption due to busy lifestyles further fuels the demand for enhanced water products

“Asia-Pacific is Projected to Register the Highest CAGR in the Enhanced Water Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the enhanced water market, driven by rapid urbanization, increasing health awareness, and rising disposable incomes across the region

- Countries such as China, India, and Japan are emerging as key markets due to the growing demand for functional beverages that cater to health-conscious consumers. The increasing middle-class population, along with rising interest in fitness and wellness, is significantly boosting the adoption of enhanced water products

- Japan, with its advanced health and wellness trends, remains a crucial market for enhanced water, driven by a focus on functional beverages that provide health benefits like hydration and improved immunity. The country continues to lead in the adoption of innovative beverage products, including those with specific health claims such as detoxifying or boosting energy levels

- China and India, with their large populations and increasing awareness of healthy lifestyles, are witnessing a surge in demand for beverages that offer added health benefits. Both countries are seeing increasing investments from global beverage companies and local startups offering enhanced water products. The expansion of modern retail outlets and the rise in online sales further contribute to market growth in the region

Enhanced Water Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Nestlé S.A. (Switzerland)

- Groupe Danone (France)

- PepsiCo, Inc. (U.S.)

- The Coca-Cola Company (U.S.)

- Karma Culture LLC (U.S.)

- Hint Water Inc. (U.S.)

- Kraft Foods (U.S.)

- New York Spring Water Inc. (U.S.)

- Sunny Delight Beverages Company (U.S.)

- Danone Waters (France)

- Energy Brands (Glacéau) (U.S.)

- Xylem Inc. (U.S.)

- Ovivo Inc. (Canada)

- ELGA LabWater (U.K.)

- Ozonia (Switzerland)Ocular Instruments (U.S.)

Latest Developments in Global Enhanced Water Market

- In July 2024, Essentia Water, LLC collaborated with Canadian basketball player Natalie Achonwa for its ‘Stop for Nothing’ campaign, originally launched in 2021. This campaign highlights how Essentia's ionized alkaline water supports athletes by providing hydration to maintain peak performance and achieve their goals. Achonwa, known for her resilience and determination, embodies the campaign's spirit of perseverance and ambition. The partnership also marked Essentia's expansion into Canada, showcasing its commitment to empowering individuals through hydration

- In June 2023, Nestlé S.A. expanded its premium ionized alkaline water brand, Essentia Water, into Canada. Known for its unique ionization process, Essentia delivers water with a pH of 9.5 or higher, offering a smooth and pure taste. After achieving significant success in the U.S. as the leading alkaline water brand and top-selling bottled water in the natural channel, Essentia is now available at various retailers across Ontario, including Loblaws, Longo’s, Metro, Circle K, and online platforms like Amazon.ca and Well.ca.

- In February 2023, Keurig Dr Pepper Inc. introduced its premium enhanced water, Core Hydration, featuring a ‘perfectly pH balanced’ formula. The launch expanded the Core Hydration+ range, offering nutrient-enriched waters designed to promote overall health. The lineup includes Core Hydration+ Immunity with Zinc and Vitamin C and a hint of lemon, Core Hydration+ Calm with L-Theanine and a cucumber essence, and Core Hydration+ Vibrancy infused with Zinc, Biotin, and Vitamin C, flavored with grapefruit. Packaged in 23.9 oz bottles made from 100% recycled plastic, these beverages combine functionality with sustainability

- In September 2021, Glucose Health, Inc. introduced GLUCODOWN, a line of enhanced water drink mixes now available on Amazon. These mixes are designed to support healthy blood sugar levels while offering a refreshing and convenient beverage option. GLUCODOWN combines functional benefits with great taste, catering to health-conscious consumers seeking alternatives to traditional sugary drinks. The launch highlights Glucose Health's commitment to providing innovative nutritional solutions that align with modern wellness trends

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Enhanced Water Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Enhanced Water Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Enhanced Water Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.