Global Farm Equipment Rental Market

Market Size in USD Billion

CAGR :

%

USD

89.60 Billion

USD

159.81 Billion

2024

2032

USD

89.60 Billion

USD

159.81 Billion

2024

2032

| 2025 –2032 | |

| USD 89.60 Billion | |

| USD 159.81 Billion | |

|

|

|

|

Farm Equipment Rental Market Size

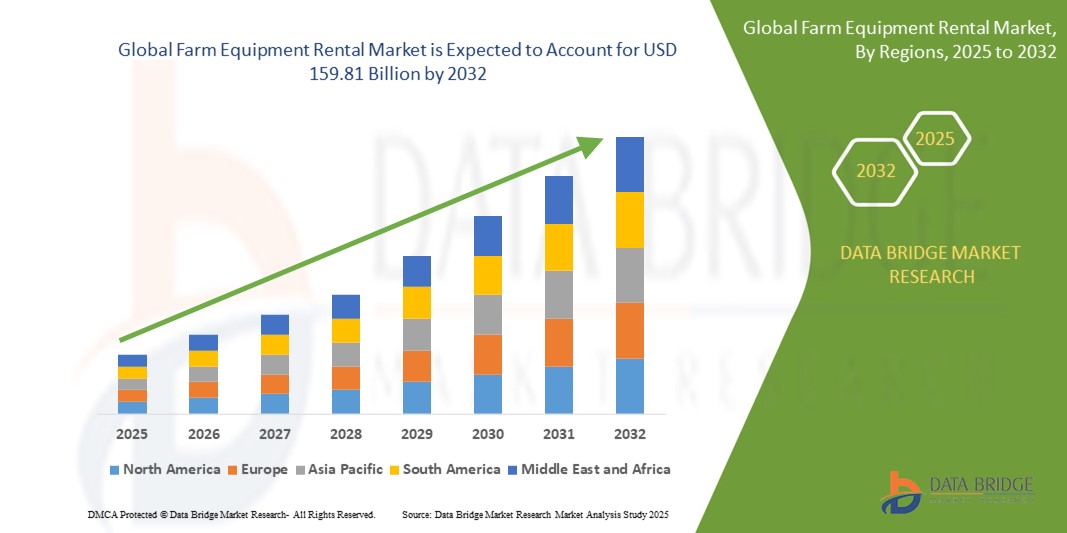

- The global farm equipment rental market was valued at USD 89.60 billion in 2024 and is expected to reach USD 159.81 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of7.50%, primarily driven by high upfront cost of purchasing new machinery

- This growth is driven by increasing demand for advanced agricultural technologies among small and medium-scale farmers is boosting the popularity of equipment rentals

Farm Equipment Rental Market Analysis

- The farm equipment rental market is experiencing significant growth, driven by the rising need for affordable access to modern farm machinery, the increasing adoption of mechanized farming practices, and the growing presence of organized rental platforms across rural areas

- The surge in awareness regarding cost savings, coupled with the rising trend of precision farming, is prompting rental companies to expand their fleets with technologically advanced tractors, harvesters, and implements, while flexible rental models and on-demand services are catering to evolving farmer needs

- For instance, in the U.S., companies such as Pacific Ag Rentals and Premier Equipment are expanding their rental fleets with autonomous and smart farming equipment to enhance farm productivity and efficiency

- Emerging trends such as app-based rental platforms, shared equipment services, and partnerships with agritech startups are reshaping the farm equipment rental landscape, offering both flexibility and scalability to meet the future demands of the agricultural sector

Report Scope and Farm Equipment Rental Market Segmentation

|

Attributes |

Farm Equipment Rental Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory |

Farm Equipment Rental Market Trends

“Adoption of Autonomous Farm Equipment in Rental Fleets”

- A major trend shaping the farm equipment rental market is the increasing adoption of autonomous farm equipment in rental fleets, driven by the rising demand for labor efficiency, precision farming, and operational cost reduction

- Rental companies are investing heavily in autonomous tractors, robotic harvesters, and GPS-enabled implements to offer farmers advanced solutions that maximize productivity and minimize human intervention

- For instance, in February 2024, Deere & Company introduced its latest range of autonomous-ready tractors under the 9RX series, empowering farmers to seamlessly transition toward fully autonomous operations through rental services

- Technological innovations such as AI-based route planning, remote monitoring systems, and autonomous fleet management software are being rapidly adopted to enhance equipment utilization and customer experience

- This trend is redefining the farm equipment rental industry by accelerating the shift towards smart farming practices, meeting labor shortage challenges, and positioning rental companies as pioneers of next-generation agricultural solutions

Farm Equipment Rental Market Dynamics

Driver

“Rising Financial Constraints among Small and Medium-Sized Farmers”

- The farm equipment rental market is experiencing significant growth fueled by the increasing financial constraints faced by small and medium-sized farmers, who are unable to afford the high upfront costs of purchasing new machinery

- Rental services provide a cost-effective alternative, allowing farmers to access modern and technologically advanced equipment on a pay-per-use basis, improving farm productivity without heavy capital investment

- For instance, in August 2022, Deere & Company invested in Hello Tractor, a Nigerian startup, to support a marketplace that allows farmers across Africa to rent tractors affordably, addressing financial barriers

- Governments and private players are launching rental platforms and subsidy programs to facilitate easier access to farm equipment, particularly in emerging economies where mechanization levels are still low

- This driver is expected to further propel the farm equipment rental market by democratizing access to technology, boosting agricultural efficiency, and empowering smallholder farmers toward sustainable farming practices

Opportunity

“Government Support for Agricultural Mechanization in Developing Countries”

- The farm equipment rental market is set to benefit significantly from increasing government initiatives aimed at promoting agricultural mechanization in developing countries, where small and marginal farmers face challenges in accessing modern equipment

- Subsidies, low-interest loan programs, and public-private partnerships are being introduced to make rental services more accessible and affordable for rural farming communities

- For instance, in July 2022, the state government of Bihar in India launched a mobile app-based farm equipment rental service to help small farmers rent machinery easily and cost-effectively

- Agricultural development agencies and NGOs are collaborating with rental platforms to build awareness, offer training, and establish rural rental hubs equipped with essential farm machinery

- This opportunity is expected to accelerate the growth of the farm equipment rental market by enhancing farm productivity, supporting rural economies, and driving large-scale adoption of modern agricultural practices

Restraint/Challenge

“High Maintenance Costs and Downtime of Farm Equipment”

- The farm equipment rental market faces significant challenges due to the high maintenance costs and frequent downtime associated with heavy-duty agricultural machinery, which can impact profitability and customer satisfaction for rental service providers

- Tractors, harvesters, and other farm equipment require regular servicing, spare part replacements, and skilled labor for maintenance, leading to increased operational expenses and fleet management complexities

- For instance, in May 2024, a leading rental company in Brazil reported a 15% dip in quarterly revenue due to extended downtime of rented equipment caused by delays in obtaining specialized parts

- Equipment breakdowns during critical farming seasons disrupt rental schedules and strain customer relationships and lead to reputational risks for service providers.

- Effectively managing maintenance challenges will be essential for improving equipment uptime, ensuring consistent service delivery, and maintaining long-term customer trust in the farm equipment rental market

Farm Equipment Rental Market Scope

The market is segmented on the basis of type, power output, drive type, function, purpose, and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Power Output |

|

|

By Drive Type |

|

|

By Function

|

|

|

By Purpose |

|

|

By Application |

|

Farm Equipment Rental Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Farm Equipment Rental Market”

- High agricultural dependence and the presence of small and marginal farmers in Asia-Pacific drive strong demand for flexible and affordable farm equipment rental services

- Government initiatives supporting farm mechanization and subsidies for rental programs further encourage the adoption of rented machinery across rural areas

- Rapid technological advancements, coupled with the growing popularity of app-based and online farm equipment rental platforms, are streamlining access to modern machinery for farmers

- These combined factors firmly position Asia-Pacific as the leading region in the farm equipment rental Market, offering substantial opportunities for expansion, innovation, and rural development

“Europe is projected to register the Highest Growth Rate”

- Increasing labor shortages and rising operational costs in Europe are pushing farmers to adopt flexible farm equipment rental solutions to maintain profitability and operational efficiency

- Growing emphasis on sustainable agriculture and the rapid integration of smart farming technologies are fueling the demand for rented precision equipment across European farms

- Supportive government policies, subsidies for modernizing agricultural practices, and initiatives promoting shared farming resources are making rental options more attractive for farmers across the region

- These combined factors position Europe as the fastest-growing region in the farm equipment rental market, fostering technological advancement, resource optimization, and more accessible farming solutions

Farm Equipment Rental Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Deere & Company (U.S.)

- CNH Industrial N.V. (U.K.)

- KUBOTA Corporation (Japan)

- AGCO Corporation (U.S.)

- Engineering For Change (U.S.)

- J C Bamford Excavators Ltd. (U.K.)

- Escorts Kubota Limited (India)

- Tractors and Farm Equipment Limited (India)

- The Papé Group, Inc. (U.S.)

- Premier Equipment (Canada)

- Flaman (Canada)

- Pacific Ag Rentals (U.S.)

- Pacific Tractor & Implement (U.S.)

- Farmease (India)

- KWIPPED, Inc. (U.S.)

- Cedar St Companies (U.S.)

- EM3 Agriservices (India)

- Friesen Sales & Rentals (Canada)

- Messick's (U.S.)

Latest Developments in Global Farm Equipment Rental Market

- In February 2024, Deere & Company launched its latest range of four-track tractors with high horsepower, introducing top models such as the 9RX 710, 9RX 770, and 9RX 830, featuring enhanced engines, hydraulic systems, advanced technology packages, and updated cabs, along with an autonomous-ready option in the MY25 8 Series and 9 Series tractors to support seamless transitions to autonomous operations, which is expected to significantly modernize farm practices

- In July 2023, Pacific AG Rentals LLC partnered with Burro, a Philadelphia-based autonomous mobility company, to integrate Burro's autonomous robots into their rental fleet, aiming to boost agricultural productivity and address labor shortages, which is anticipated to expand Pacific AG Rentals LLC’s market reach across the U.S. and offer innovative solutions to farmers

- In August 2022, Deere and Company invested in Hello Tractor, a Nigerian startup providing marketplace and fleet management technology that enables African farmers to rent tractors, which is expected to enhance mechanization accessibility and improve farming efficiency across the African continent

- In July 2022, the state government of Bihar in India announced the launch of a mobile app-based farm equipment rental service designed to help small farmers access necessary machinery affordably, which is projected to empower farmers and promote agricultural growth in the region

- In May 2022, India-based agriculture equipment rental and agro e-commerce startup KhetiGaadi introduced its agro advisory services for farmers in Pune, aiming to offer expert guidance alongside equipment rentals, which is expected to strengthen farmers' productivity and decision-making capabilities

- In March 2022, eThekwini Municipality in South Africa acquired tractors to provide free rentals to farmers through its Agro-Ecology Unit's initiative, which is anticipated to support smallholder farmers and boost agricultural development in the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.