Global Fermentation Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

38.46 Billion

USD

84.22 Billion

2024

2032

USD

38.46 Billion

USD

84.22 Billion

2024

2032

| 2025 –2032 | |

| USD 38.46 Billion | |

| USD 84.22 Billion | |

|

|

|

|

Fermentation Ingredients Market Size

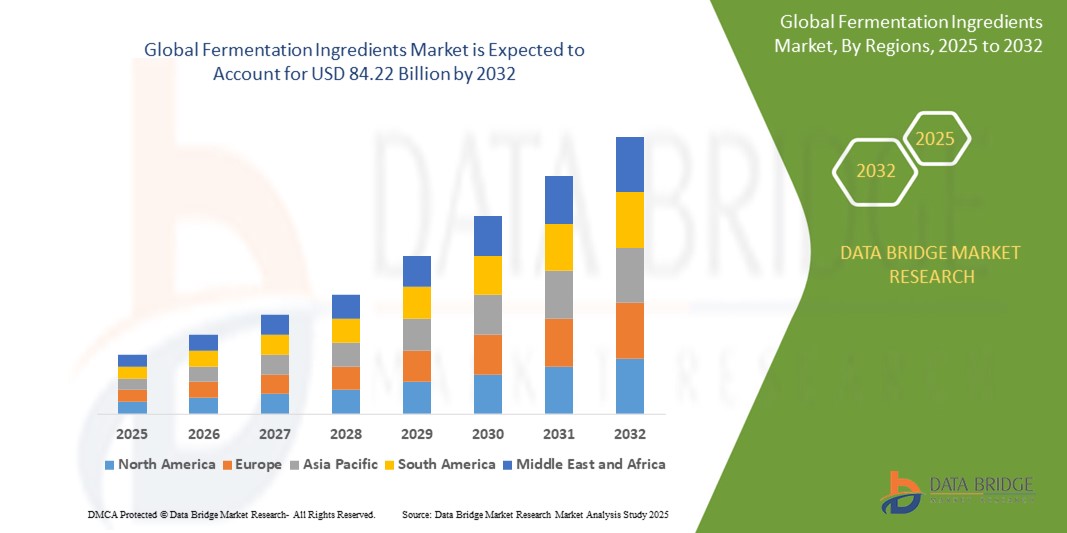

- The Global Fermentation Ingredients Market size was valued at USD 38.46 Billion in 2024 and is expected to reach USD 84.22 Billion by 2032, at a CAGR of 9.1% during the forecast period

- The market growth is largely fueled by growth of the global bioethanol industry, the growing alertness about the food preservation

- Furthermore, the need for antibiotics is high, the growing alertness about the functions of the fermentation ingredients in personal care and pharmaceutical products, are further anticipated to propel the growth of the fermentation ingredients market

Fermentation Ingredients Market Analysis

- A fermentation procedure is a biological procedure, and it has necessities of sterility and utilization of cellular enzyme reactions in its place of chemical reactions helped by inanimate catalyst at a specific temperature and pressure. The fermentation ingredients are added to the food, so that it preserved for longer period.

- The fermentation procedure can alter the quality and satisfactoriness of the product. This concludes in the enhancing the quality of the food, makes it simpler to digest, more nourishing, and better in taste.

- Fermentation ingredients are utilized in the industries for example the Food and beverages, pharmaceutical, and in others. Better productions, low price, and the structure of the ingredients are being steadily utilized at a large scale in numerous industries around the world.

- North America dominates the Fermentation Ingredients Market with the largest revenue share of 34.11% in 2024, characterized by increasing consumer demand for organic and healthy ingredients.

- Asia-Pacific is expected to be the fastest growing region in the Fermentation Ingredients Market during the forecast period due to rapid industrialization, increasing health awareness, and supportive policies

- The wood segment is expected to dominate the Fermentation Ingredients Market with a market share of 38.7% in 2024, driven by widespread use in dietary supplements, animal feed, and pharmaceuticals

Report Scope and Fermentation Ingredients Market Segmentation

|

Attributes |

Fermentation Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fermentation Ingredients Market Trends

“Rise of Precision Fermentation and Clean-Label Demand”

- A significant trend in the global fermented ingredients market is the increasing adoption of precision fermentation to produce high-value ingredients such as alternative proteins, enzymes, and bioactive compounds.

- This technology enables the production of sustainable, animal-free ingredients, aligning with the growing consumer demand for clean-label and plant-based products.

- For instance, companies are leveraging precision fermentation to create fermented plant-based proteins, offering consumers nutritious and environmentally friendly alternatives to traditional animal-derived products.

- The trend towards artisanal and small-batch fermentation is also gaining momentum, catering to consumers seeking unique flavors and traditional preparation methods.

Fermentation Ingredients Market Dynamics

Driver

“Increasing Health Consciousness and Demand for Functional Foods”

- The rising awareness of the health benefits associated with fermented foods, such as improved digestion and enhanced immune function, is a major driver of market growth.

- Consumers are increasingly seeking functional foods that offer health benefits beyond basic nutrition, leading to a surge in demand for fermented ingredients rich in probiotics and other bioactive compounds.

- The trend towards natural and organic food products further propels the market, as fermentation is a natural process that enhances the nutritional profile and shelf life of foods.

Restraint/Challenge

“High Production Costs and Regulatory Hurdles”

- The production of fermented ingredients often involves high costs due to the need for specialized equipment, controlled fermentation conditions, and high-quality raw materials, which can limit market expansion, especially in developing regions.

- Additionally, stringent regulatory frameworks governing the use of fermented ingredients in food and pharmaceutical products can pose significant challenges for manufacturers, requiring compliance with various safety and quality standards.

- Addressing these challenges through technological advancements to reduce production costs and navigating regulatory landscapes effectively will be crucial for sustained market growth.

Fermentation Ingredients Market Scope

The market is segmented on the basis of type, application, form, and process.

- By Type

On the basis of type, the Fermentation Ingredients Market is segmented into amino acids, organic acids, biogas, polymers, vitamins, industrial enzymes, antibiotics, and others. The Amino Acids segment dominates the largest market revenue share of 38.7% in 2024, driven by widespread use in dietary supplements, animal feed, and pharmaceuticals. Their high nutritional value, ease of fermentation from renewable sources, and increasing demand for protein-rich food products support continued dominance. Additionally, rising consumer health awareness and functional food trends reinforce growth.

The Polymers segment is anticipated to witness the fastest growth rate of 9.4% from 2025 to 2032, driven by rising demand for biodegradable and sustainable packaging solutions. Fermentation-derived polymers offer eco-friendly alternatives to petrochemical plastics in industries such as food packaging, agriculture, and personal care. Regulatory pressure to reduce plastic waste and the push for circular economy models are accelerating adoption of bio-based polymers in global markets.

- By Application

On the basis of application, the fermentation ingredients market is segmented into food and beverages, feed, pharmaceuticals, paper, biofuel, textile and leather, and others. The Food and Beverages segment held the largest market revenue share in 2024, driven by increased use of fermentation ingredients as preservatives, flavor enhancers, and nutritional boosters. Consumers’ preference for natural and clean-label ingredients in bakery, dairy, and beverage products continues to stimulate market growth.

The pharmaceuticals segment is projected to record the fastest CAGR from 2025 to 2032, owing to fermentation’s critical role in producing antibiotics, enzymes, and therapeutic proteins. Biotech advancements and rising R&D investment are expanding the scope of microbial fermentation in drug discovery and production. Growing demand for efficient, scalable, and low-cost biologic manufacturing supports market expansion in both developed and emerging regions.

- By Form

On the basis of form, the fermentation ingredients market is segmented into dry and liquid. The Dry segment accounted for the largest market revenue share in 2025, supported by ease of storage, extended shelf life, and cost-effective distribution. Widely used in food, feed, and personal care industries, dry fermentation ingredients offer stable formulations suitable for varied processing conditions.

The Liquid segment is expected to register the fastest CAGR from 2025 to 2032, fueled by growing demand for active cultures and liquid enzymes in food and beverage processing. Liquid forms enable faster absorption and more efficient integration in production workflows. Their use in functional beverages, brewing, and pharmaceutical solutions is expanding, driven by formulation flexibility and real-time fermentation requirements.

- By Process

On the basis of process, the fermentation ingredients market is segmented into batch fermentation, continuous fermentation, aerobic fermentation, and anaerobic fermentation. The Batch Fermentation segment held the largest revenue share in 2025, owing to its process control, product consistency, and widespread use in food, enzyme, and antibiotic manufacturing. It remains ideal for low-volume, high-value production with customized yields.

The Continuous Fermentation segment is forecasted to exhibit the fastest growth from 2025 to 2032, supported by increased demand for high-throughput and cost-effective fermentation methods. It enables uninterrupted production, higher biomass productivity, and improved process scalability—particularly advantageous in biofuel and industrial enzyme production. Technological innovations in reactor design and monitoring are further enhancing its adoption.

Fermentation Ingredients Market Regional Analysis

- North America dominates the Fermentation Ingredients Market with the largest revenue share of 34.11% in 2024, driven by increasing consumer demand for organic and healthy ingredients. The region's focus on sustainable and functional foods, along with substantial investments in biotechnology and food tech research, has propelled market growth.

- Consumers and industries in North America prioritize eco-friendly and health-conscious alternatives, leading to a surge in demand for fermented ingredients in food and beverage applications. The region's robust technological infrastructure and supportive regulatory environment further facilitate this growth.

- This expansion is bolstered by advancements in fermentation technologies, favorable government policies promoting sustainable agriculture, and a strong emphasis on clean-label products among leading manufacturers and end-users.

U.S. Fermentation Ingredients Market Insight

The U.S. Fermentation Ingredients Market captured the largest revenue share of 81.27% in 2025 within Asia-Pacific, fueled by increasing health awareness, demand for natural and organic products, and significant investments in research and development. Federal initiatives supporting sustainable food production and biotechnology research play a crucial role in market expansion. Moreover, the U.S. food and beverage sector's shift toward clean-label and functional ingredients, coupled with consumer awareness around health and sustainability, is spurring demand for fermented ingredients.

Europe Fermentation Ingredients Market Insight

The European Fermentation Ingredients Market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by high consumption of cheese, yogurt, and alcohol, along with stringent regulations promoting natural and sustainable ingredients. Countries across the region are witnessing increased demand from the food and beverage sector, particularly for ingredients that enhance flavor and nutritional value. Industrial players are aligning their operations with circular economy principles, enhancing the attractiveness of fermented formulations, especially in Germany, France, and the Nordics.

U.K. Fermentation Ingredients Market Insight

The U.K. Fermentation Ingredients Market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by heightened focus on health and wellness, and the government's push for sustainable food systems. Adoption is also supported by consumer demand for natural and functional ingredients with minimal ecological footprint. The U.K.'s advanced food and beverage sector, along with its drive toward net-zero emissions, are expected to further stimulate demand for fermented ingredients.

Germany Fermentation Ingredients Market Insight

The German Fermentation Ingredients Market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s strong industrial base and long-standing commitment to sustainability. Germany’s stringent standards for natural and organic products, along with support for renewable raw material innovations, have positioned the country as a key hub for fermented ingredient R&D and adoption. Applications in dairy, beverages, and functional foods are expanding, further accelerating the growth trajectory.

Asia-Pacific Fermentation Ingredients Market Insight

The Asia-Pacific Fermentation Ingredients Market is poised to grow at the fastest CAGR of over 17.3% during the forecast period of 2025 to 2032, driven by rapid industrialization, increasing health awareness, and supportive policies in emerging economies such as China, India, and Southeast Asia. Government efforts to promote healthy diets and local production of fermented foods are facilitating cost-effective and widespread adoption. APAC’s growing food and beverage sectors also present significant opportunities for fermented ingredient suppliers.

Japan Fermentation Ingredients Market Insight

The Japan Fermentation Ingredients Market is gaining momentum due to stringent food safety regulations, technological innovation, and a strong culture of health consciousness. Japan’s food and beverage industries are turning to high-quality fermented ingredients for improved flavor, nutrition, and shelf life. The aging population is also prompting a shift toward functional foods with health benefits. Integration of fermented ingredients in traditional and modern food applications is accelerating across various sectors.

China Fermentation Ingredients Market Insight

China Fermentation Ingredients Market accounted for the largest market revenue share in Asia Pacific in 2025, driven by massive industrial output, rising consumer awareness, and supportive health and nutrition policies. The government's focus on improving public health and the availability of local raw materials are boosting domestic production. China's food, beverage, and nutraceutical sectors are rapidly incorporating fermented ingredients, aided by state support and a strong manufacturing ecosystem.

Fermentation Ingredients Market Share

The Fermentation Ingredients Industry is primarily led by well-established companies, including:

- Hi-Pro Feeds LP (Canada)

- Kent Corporation (U.S.)

- Alltech (U.S.)

- Prestage Farms (U.S.)

- Mercer Milling Company, Inc. (U.S.)

- Kalmbach Media Co. (U.S.)

- Tyson Foods, Inc. (U.S.)

- LMF FEEDS, INCORPORATED (U.S.)

- STAR MILLING CO (U.S.)

- White Oak Mills (U.S.)

- The Wenger Group (U.S.)

- Orangeburg Milling Company (U.S.)

- Cargill, Incorporated (U.S.)

- Purina Animal Nutrition LLC (U.S.)

- DuPont (U.S.)

- ADM (U.S.)

- Evonik Industries AG (Germany)

- BASF SE (Germany)

- DSM (Netherlands)

- Solvay (Belgium)

- AJINOMOTO CO., INC. (Japan)

- Novozymes (Denmark)

- Chr. Hansen Holding A/S (Denmark)

- INVIVO THERAPEUTICS (U.S.)

- Nutreco N.V. (Netherlands)

- Kemin Industries, Inc. (U.S.)

- Adisseo (France)

Latest Developments in Global Fermentation Ingredients Market

- In February 2024, Evonik entered into a strategic alliance with Jland Biotech to bring to market a new vegan collagen designed for the cosmetics and personal care sector. Utilizing Jland Biotech's advanced fermentation technology, the partnership aims to provide high-purity, animal-free collagen for use in skincare formulations.

- In February 2024, Lesaffre and DSM-Firmenich launched a broad collaboration focused on creating yeast-based solutions for the savory ingredients sector. As part of the deal, Lesaffre will take over DSM-Firmenich's yeast extract processing technologies, boosting its ability to offer innovative products and services for savory and other fermentation-driven applications.

- In October 2023, New Culture revealed its intention to release a vegan mozzarella cheese made through precision fermentation by early 2024. Backed by USD 25 million in Series A funding, the company is advancing its dairy-free innovations in partnership with ADM, aiming to develop mozzarella that mimics the flavor and texture of traditional cheese using animal-free casein.

- Also in October 2023, De Novo Foodlabs announced the commercial launch of its flagship product, NanoFerrin—a nature-identical substitute for bovine lactoferrin known for its health benefits. With new funding secured, the company is accelerating NanoFerrin's rollout, promoting it as a cost-effective and sustainable alternative to animal-derived lactoferrin.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fermentation Ingredients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fermentation Ingredients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fermentation Ingredients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.