Global Financial Detection And Prevention Market

Market Size in USD Billion

CAGR :

%

USD

29.20 Billion

USD

74.38 Billion

2024

2032

USD

29.20 Billion

USD

74.38 Billion

2024

2032

| 2025 –2032 | |

| USD 29.20 Billion | |

| USD 74.38 Billion | |

|

|

|

|

Financial Detection and Prevention Market Analysis

The financial detection and prevention market is experiencing significant growth as organizations and financial institutions face increasing challenges from fraudulent activities, cyberattacks, and data breaches. Rising digitalization, the expansion of online financial transactions, and the adoption of mobile payment technologies are driving the demand for advanced fraud detection technologies. Machine learning, artificial intelligence (AI), and predictive analytics are leading innovations in fraud detection, enabling real-time threat detection, improved accuracy, and reduced false positives. In addition, biometric authentication and multi-factor authentication (MFA) systems are being integrated into security protocols, further strengthening financial systems. For instance, AI algorithms can analyze transaction patterns and identify unusual behaviors, allowing financial institutions to mitigate fraud before it occurs. Moreover, regulatory frameworks, such as GDPR and PSD2, are pushing companies to implement robust fraud detection mechanisms to ensure compliance and protect consumers' personal data. As financial institutions and e-commerce businesses continue to invest in these advanced solutions, the market is poised for further expansion, providing greater protection for digital financial transactions across various sectors, including banking, insurance, retail, and government.

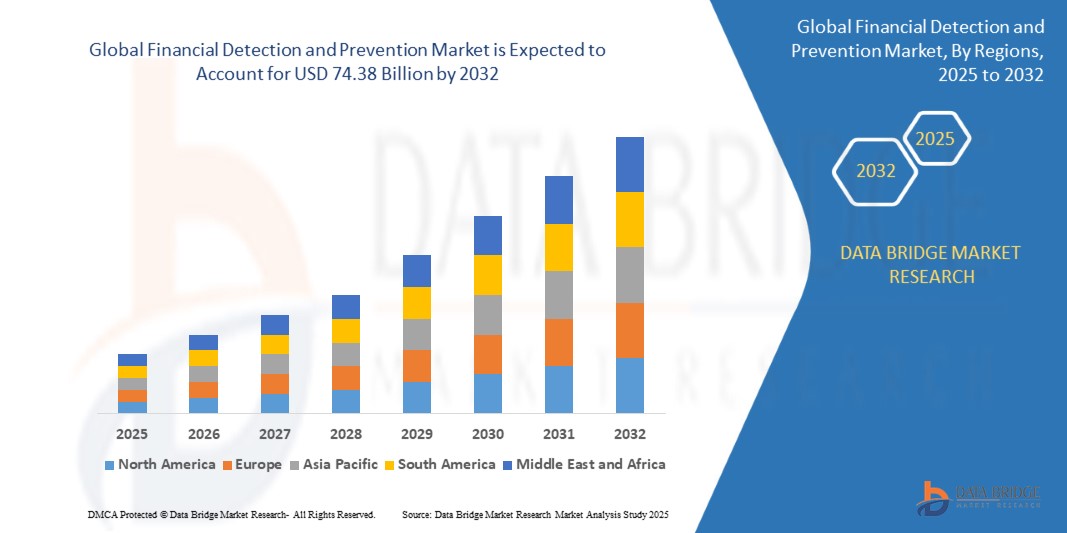

Financial Detection and Prevention Market Size

The global financial detection and prevention market size was valued at USD 29.20 billion in 2024 and is projected to reach USD 74.38 billion by 2032, with a CAGR of 12.40 % during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Financial detection and Prevention Market Trends

“Increasing Integration of Artificial Intelligence (AI) and Machine Learning (ML)”

One prominent trend in the financial detection and prevention market is the increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies for real-time fraud detection. As online transactions and digital payments grow, AI and ML are becoming essential for identifying and mitigating fraudulent activities quickly and accurately. For instance, AI-powered fraud detection systems analyze historical transaction data, customer behavior, and other patterns to predict and flag suspicious activity before it escalates. Companies such as FIS Global and FICO are implementing these technologies to help financial institutions and businesses reduce losses due to fraud. These advanced solutions improve detection accuracy and reduce false positives, ensuring legitimate transactions are not wrongly blocked. In addition, these tools adapt and learn from new fraud patterns, constantly evolving to tackle emerging threats. This shift toward AI-driven fraud prevention highlights the increasing importance of innovative, intelligent systems in securing digital financial ecosystems.

Report Scope and Financial detection and Prevention Market Segmentation

|

Attributes |

Financial detection and Prevention Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Fiserv, Inc. (U.S.), FIS Global (U.S.), LexisNexis Risk Solutions (U.S.), TransUnion LLC. (U.S.), Experian Information Solutions, Inc. (Ireland), NICE Actimize (U.S.), ACI Worldwide (U.S.), SAS Institute Inc. (U.S.), RSA Security LLC (U.S.), SAP (Germany), FICO (U.S.), Software GmbH (Germany), Microsoft (U.S.), F5, Inc. (U.S.), Amazon Web Services, Inc. (U.S.), Bottomline Technologies, Inc. (U.S.), ClearSale (Brazil), Genpact (U.S.), Securonix (U.S.), Accertify, Inc. (U.S.), Feedzai (Portugal), Caseware International Inc. (U.S.), LexisNexis Risk Solutions (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Financial detection and Prevention Market Definition

Financial detection and prevention refers to the practices, technologies, and solutions designed to identify and mitigate fraudulent activities within financial systems, transactions, and institutions. This process involves detecting suspicious patterns, behaviors, and anomalies in financial data to prevent fraud, money laundering, identity theft, and other illicit activities.

Financial detection and Prevention Market Dynamics

Drivers

- Rising Cybercrime and Fraudulent Activities

The rise in cybercrime and fraudulent activities has become a significant market driver for the financial detection and prevention sector. According to a report by the Federal Trade Commission (FTC), in 2020, U.S. consumers reported losing nearly USD 3.3 billion due to fraud, with online scams and identity theft being among the top culprits. As the financial sector increasingly adopts digital platforms, cyberattacks are becoming more frequent and sophisticated, with cybercriminals leveraging advanced techniques such as phishing, malware, and ransomware to breach financial systems. In fact, the number of global data breaches increased by 17% in 2020, with many of these breaches targeting financial institutions. This has led to an urgent need for more robust and advanced fraud detection and prevention solutions that can safeguard financial transactions, protect sensitive customer data, and mitigate financial losses. Consequently, the financial detection and prevention market has seen an uptick in demand for innovative solutions such as AI-powered fraud detection systems, real-time monitoring tools, and biometric authentication methods to combat rising cybercrime and enhance security.

- Rapid Growth in Online and Mobile Payments

The rapid growth in online and mobile payments has significantly expanded the opportunities for fraudulent activities, making fraud prevention tools more critical than ever. According to Statista, the number of mobile payment users worldwide is projected to surpass 1.31 billion by 2023, indicating the widespread adoption of digital finance and mobile transactions. However, this growth also comes with a rise in fraud risks, with e-commerce fraud alone expected to reach USD 20 billion by 2024, as reported by Juniper Research. Common fraud techniques in online transactions include credit card fraud, account takeovers, and synthetic identity fraud. As more consumers shift to mobile banking, digital wallets, and online shopping platforms, fraud prevention solutions, such as real-time transaction monitoring, AI-driven fraud detection, and multi-factor authentication, are increasingly essential. This surge in digital financial activity is driving demand for sophisticated fraud prevention tools that ensure secure transactions, protect consumer data, and build trust in e-commerce and mobile payment systems, making it a key market driver.

Opportunities

- Growing Identity Theft and Payment Fraud

The rise in identity theft and payment fraud is driving the demand for advanced fraud detection systems, as both businesses and consumers seek ways to mitigate financial losses. According to a 2020 report by Javelin Strategy & Research, identity fraud affected over 14.7 million U.S. consumers, leading to losses of nearly USD 16.9 billion. Payment fraud, particularly in the form of card-not-present fraud, continues to surge due to the rapid growth of e-commerce and mobile payments. For instance, in 2022, card-not-present fraud was projected to reach USD 7.2 billion in the U.S. alone, according to the Nilson Report. This surge in fraud cases highlights the urgent need for stronger prevention measures. As a result, companies are increasingly investing in advanced fraud detection technologies, including machine learning algorithms, biometric authentication, and real-time fraud monitoring, to safeguard consumer data and secure payment transactions. The escalating risk of identity theft and payment fraud presents a significant market opportunity for the development and implementation of these sophisticated detection and prevention systems, helping businesses protect their revenue and consumers from financial harm.

- Increasing Stringency of Regulatory Compliance Requirements

The increasing stringency of regulatory compliance requirements is becoming a significant market opportunity for fraud detection and prevention solutions. For instance, the implementation of the General Data Protection Regulation (GDPR) in the European Union has set high standards for data protection, demanding that organizations handle customer data securely and ensure that breaches are detected and reported swiftly. Similarly, the U.S. has introduced the Financial Industry Regulatory Authority (FINRA) regulations and the Bank Secrecy Act (BSA), which mandate financial institutions to adopt effective fraud detection measures. In response to such regulations, financial institutions are investing in advanced fraud detection solutions to avoid hefty fines and maintain customer trust. The growing focus on regulatory compliance means that companies must equip themselves with the necessary tools to detect suspicious activities, comply with reporting requirements, and protect customer data. As regulatory frameworks continue to tighten globally, the demand for fraud detection systems is expected to rise, presenting a lucrative opportunity for businesses providing compliance-driven fraud prevention solutions.

Restraints/Challenges

- False Positives in Financial Fraud Detection

False positives in financial fraud detection represent a significant market challenge, as they can lead to unnecessary operational costs, customer dissatisfaction, and even reputational damage. False positives occur when legitimate transactions are flagged as fraudulent, requiring time and resources to investigate and resolve the issue. For instance, if a customer travels abroad and attempts to make an international purchase, the transaction might be flagged as suspicious due to an unexpected location or transaction type, even though it's legitimate. This can result in the customer’s account being temporarily frozen or their transaction being blocked, leading to frustration and a potential loss of business. In addition to customer dissatisfaction, handling these false alarms often involves significant administrative overhead for the financial institution, including manual review of flagged transactions, which can delay genuine fraud detection. Furthermore, repeated false positives could erode customer trust in the system, causing them to seek services elsewhere. Therefore, managing and reducing false positives is crucial in balancing security with customer experience, making it a significant challenge in the fraud detection and prevention market.

- Volume and Complexity of Data

The volume and complexity of data in the financial detection and prevention market present significant challenges for organizations attempting to detect and prevent fraud. Financial institutions process enormous amounts of transaction data daily, including millions of payment and transfer records, user behavior logs, and customer profiles, all of which need to be analyzed for suspicious activities. The sheer volume of this data can overwhelm traditional systems, making it difficult to extract meaningful insights in real-time. For instance, a large bank might process thousands of transactions per second, each with varying levels of risk depending on factors such as geographical location, transaction history, and payment method. As data becomes more complex, with the addition of multi-channel transactions, real-time payments, and integration with digital currencies or decentralized finance platforms, detecting fraudulent patterns becomes more intricate. Financial institutions are often challenged to create robust algorithms capable of analyzing such large-scale data efficiently, leading to the risk of fraud being missed or false positives overwhelming the system. This volume and complexity, coupled with the need for advanced tools and techniques, create a significant market challenge for financial organizations trying to ensure accurate and swift fraud detection.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Financial detection and Prevention Market Scope

The market is segmented on the basis of component, fraud type, application, organization type, and organization size. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Solution

- Fraud Analytics

- Predictive Analytics

- Descriptive Analytics

- Prescriptive Analytics

- SNA

- Text Analytics

- Behavioral analytics

- Authentication

- Single-factor Authentication (SFA)

- Multi-factor Authentication (MFA)

- GRC

- Fraud Analytics

- Services

- Professional

- Risk Assessment

- Consulting and Training

- Implementation and Support

- Managed

- Professional

Fraud Type

- Check Fraud

- Identity Fraud

- Insider Fraud

- Investment Fraud

- Payment Fraud

- Insurance Fraud

- Friendly Fraud

- Others

Application

- Identity Theft

- Money Laundering

- Payment Fraud

- Others

Organization Size

- SMEs

- Large Enterprises

Organization Type

- BFSI

- Government and Defense

- Healthcare

- IT and Telecom

- Industrial and Manufacturing

- Retail and E-commerce

- Others

Financial Detection and Prevention Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, component, fraud type, application, organization type, and organization size. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America dominates the financial detection and Prevention market, driven by advanced technological infrastructure and the region’s focus on cybersecurity. The U.S. and Canada have been quick to adopt AI-driven fraud prevention solutions across various sectors, including banking, retail, and e-commerce. Increased investment in fraud management technologies has led to a strong market presence, with organizations prioritizing consumer data protection and secure transactions. In addition, stringent regulations and heightened awareness around data breaches have further fueled the growth of this market in North America.

Asia Pacific is the fastest growing region in the forecast period, driven by digitalization and the growing penetration of the internet. The rapid expansion of the e-commerce sector has led to an increase in online transactions, opening up opportunities for fraud, including payment fraud and identity theft. China is leading this growth, with businesses investing significantly in advanced fraud detection technologies to safeguard consumer data and improve transaction security. The widespread adoption of mobile payment systems is further accelerating this trend, as companies work to implement strong defenses against potential cyber threats.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Financial Detection and Prevention Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Financial detection and Prevention Market Leaders Operating in the Market Are:

- Fiserv, Inc. (U.S.)

- FIS Global (U.S.)

- LexisNexis Risk Solutions (U.S.)

- TransUnion LLC. (U.S.)

- Experian Information Solutions, Inc. (Ireland)

- NICE Actimize (U.S.)

- ACI Worldwide (U.S.)

- SAS Institute Inc. (U.S.)

- RSA Security LLC (U.S.)

- SAP (Germany)

- FICO (U.S.)

- Software GmbH (Germany)

- Microsoft (U.S.)

- F5, Inc. (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Bottomline Technologies, Inc. (U.S.)

- ClearSale (Brazil)

- Genpact (U.S.)

- Securonix (U.S.)

- Accertify, Inc. (U.S.)

- Feedzai (Portugal)

- Caseware International Inc. (U.S.)

- LexisNexis Risk Solutions (U.S.)

Latest Developments in Financial detection and Prevention Market

- In August 2024, CPI Card Group joined forces with Rippleshot, a platform specializing in fraud prevention, to integrate Rippleshot’s advanced services into its offerings. This partnership aims to enhance CPI’s fraud management capabilities, allowing customers to proactively address fraudulent activities, lower associated costs, and improve customer retention and satisfaction

- In March 2024, Visa introduced three new AI-driven solutions to its Visa Protect suite to bolster fraud prevention. One of the key solutions focuses on addressing immediate payment fraud, with expanded capabilities designed to combat fraud across various payment networks

- In October 2023, Nymcard, a major card issuer in the MENA region, formed a partnership with ACI Worldwide, the leading provider of real-time POS payment solutions. This collaboration is set to enhance Nymcard’s fraud platform, helping safeguard its clients from the growing threat of financial fraud

- In September 2023, Mastercard and Oracle collaborated to automate B2B payments, aiming to tackle challenges such as fragmented data, systems, and processes. Through Mastercard’s virtual card technology, Oracle will help organizations securely share information and streamline financial transactions for corporate clients

- In October 2023, Oscilar introduced the industry’s first AI-powered platform for fraud prevention. The platform uses generative AI to automatically detect potential fraud patterns, conduct root cause analysis, and offer real-time risk recommendations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.