Global Mobile Payment Technologies Market

Market Size in USD Billion

CAGR :

%

USD

33.00 Billion

USD

89.00 Billion

2022

2030

USD

33.00 Billion

USD

89.00 Billion

2022

2030

| 2023 –2030 | |

| USD 33.00 Billion | |

| USD 89.00 Billion | |

|

|

|

|

Mobile Payment Technologies Market Analysis and Size

The global mobile payment technologies market refers to the industry that provides services related to integrating various hardware, software, and networking components into a unified system for organizations. Mobile payment technologies are responsible for designing, implementing, and managing complex IT systems that meet the specific needs and requirements of businesses.

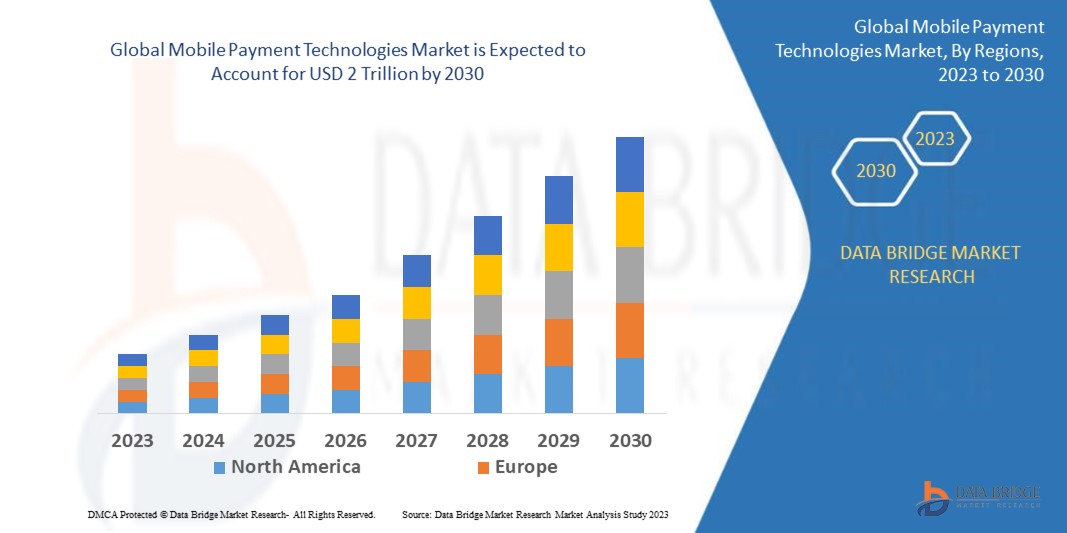

Data Bridge Market Research analyses that the global mobile payment technologies market which was USD 33 billion in 2022, would rocket up to USD 2 trillion by 2030, and is expected to undergo a CAGR of 37% during the forecast period. By payment mode, the segment is expected to dominate the market because the mode to transfer payment largely depends on its mode for instance, how the money is exchanged. Mobile payment technologies are the type of services where the users can transact with individuals and organizations with the help of their smart devices, in the financial sense for the exchange of products and services availed by the user. The incorporation of these technologies with smart devices transforms them into a mode of payment operations, helping in safe fiscal transactions. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Mobile Payment Technologies Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable into 2015-2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Payment Mode (Proximity Payment, Remote Payment), Purchase Type (Airtime Transfers and Top-Ups, Merchandise, and Coupons, Money Transfers and Payments, Travel and Ticketing, Others), End User (BFSI, Retail, Media and Entertainment, Hospitality and Tourism, Education, Healthcare, IT and Telecommunications, Others) |

|

Countries Covered |

U.S., Canada, and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of the Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

Google (Alphabet Inc.) (U.S.), Alibaba Group Holdings Limited (China), Amazon.com Inc. (U.S.), Apple Inc. (U.S.), American Express Company (U.S.), M Pesa (India), Money Gram International (U.S.), PayPal Holdings Inc. (U.S.), Samsung Electronics Co. Ltd. (South Korea), Visa Inc. (U.S.), WeChat (Tencent Holdings Limited) (China) |

|

Market Opportunities |

|

Market Definition

Mobile payment technologies refer to the market for various technologies and solutions that enable consumers to make financial transactions using their mobile devices. It encompasses a wide range of payment methods, including mobile wallets, mobile banking apps, contactless payments, and other mobile-based payment applications.

This market includes both hardware and software components necessary for facilitating mobile payments. It involves the use of smartphones, tablets, smartwatches, and other mobile devices as payment tools. The technologies involved in mobile payments can vary but typically involve near-field communication (NFC), QR codes, mobile apps, and secure encryption methods.

Global Mobile Payment Technologies Market Dynamics

Drivers

- Increasing Smartphone Penetration

The widespread adoption of smartphones across the globe has been a significant driver of the mobile payment technologies market. As more people own smartphones, the potential user base for mobile payment solutions expands, leading to increased demand for mobile payment services.

- Rising E-commerce and M-commerce Transactions

The growth of e-commerce and m-commerce has fueled the demand for mobile payment technologies. Consumers are increasingly using their smartphones to make purchases online, and mobile payments provide a convenient and secure way to complete these transactions.

- Shift Toward Cashless Payments

Mobile payment technologies are seen as a more convenient and secure alternative to cash transactions. With the increasing focus on digital payments and the decline of cash usage in many countries, consumers are adopting mobile payment solutions for their everyday transactions.

Opportunities

- Enhanced Security Measures

Mobile payment technologies have improved security features, including encryption, tokenization, biometric authentication, and two-factor authentication. These measures instill trust in consumers, addressing their concerns about the security of their financial information and further driving the adoption of mobile payments.

- Contactless Payments and NFC Technology

Near Field Communication (NFC) technology enables contactless payments using smartphones or wearable devices. The convenience and speed of contactless payments have gained popularity, especially in retail environments, leading to increased adoption of mobile payment technologies.

Restraints/Challenges

- Infrastructure Limitations

The widespread adoption of mobile payment technologies relies on the availability of robust and reliable telecommunications infrastructure. In regions with inadequate network coverage or slow internet speeds, the growth of mobile payments may be hindered.

- Security Concerns

Security is a critical factor in mobile payments, as consumers need to trust that their financial information is secure. Any breaches or instances of fraud can erode consumer confidence in mobile payment technologies, limiting their adoption.

Recent Developments

- In April 2023, PayPal announced the launch of "Pay in 4", a new short-term installment offering for customers in the U.S. Pay in 4 allows customers to split their purchases into four equal payments over six weeks, with no interest or fees

- In March 2020, PhonePe, a leading digital payments platform in India, has become the first to introduce one-click payment functionality with Visa. This collaboration allows PhonePe users to make seamless and secure transactions using Visa cards, enhancing the overall payment experience. The partnership aims to simplify and accelerate digital payments for millions of PhonePe users across the country.

Global Mobile Payment Technologies Market Scope

The global mobile payment technologies market is segmented on the basis of payment mode, purchase type, and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Payment Mode

- Proximity Payment

- Remote Payment

Purchase Type

- Airtime Transfers and Top-Ups

- Merchandise and Coupons

- Money Transfers and Payments

- Travel and Ticketing

- Others

End-User

- BFSI

- Retail

- Media and Entertainment

- Hospitality and Tourism

- Education

- Healthcare

- IT and Telecommunications

- Others

Global Mobile Payment Technologies Market Regional Analysis/Insights

The global mobile payment technologies market is analyzed and market size insights and trends are provided by type and applications as referenced above.

The countries covered in the global mobile payment technologies market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America is expected to dominate the mobile payment technologies market because the U.S. has a strong reputation for technological innovation and advancement. North American companies often invest heavily in research and development, leading to the creation of cutting-edge mobile payment technologies. These advancements can give them a competitive edge in the market. This combination of factors positions the U.S. as a dominant player in the mobile payment technologies market. The Asia Pacific region is the fastest-growing market for mobile payment technology activities. This is due to the increasing demand for contactless payments in the region. Countries such as China, India, and South Korea are leading the growth of the mobile payment technologies market in the Asia Pacific.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and the challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Mobile Payment Technologies Market Share Analysis

The Global mobile payment technologies market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to mobile payment technologies market.

Some of the major players operating in the Global mobile payment technologies market are:

- Google (Alphabet Inc.) (U.S.)

- Alibaba Group Holdings Limited (China)

- Amazon.com Inc. (U.S.)

- Apple Inc. (U.S.)

- American Express Company (U.S.)

- M Pesa (India)

- Money Gram International (U.S.)

- PayPal Holdings Inc. (U.S.)

- Samsung Electronics Co. Ltd. (South Korea)

- Visa Inc. (U.S.)

- WeChat (Tencent Holdings Limited) (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.