Global Flax Fiber Bottle Market

Market Size in USD Million

CAGR :

%

USD

239.14 Million

USD

375.84 Million

2024

2032

USD

239.14 Million

USD

375.84 Million

2024

2032

| 2025 –2032 | |

| USD 239.14 Million | |

| USD 375.84 Million | |

|

|

|

|

Flax Fiber Bottle Market Size

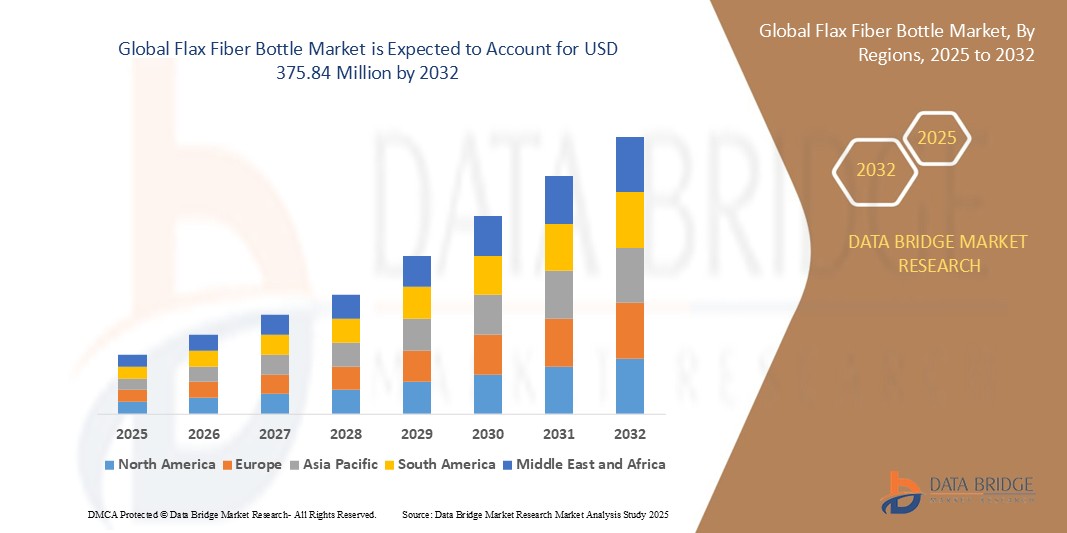

- The global flax fiber bottle market size was valued at USD 239.14 million in 2024 and is expected to reach USD 375.84 million by 2032, at a CAGR of 5.80% during the forecast period

- The market growth is significantly driven by increasing global awareness and understanding among consumers about the crucial link between packaging and environmental impact, leading to a higher demand for sustainable alternatives to traditional plastic bottles

- A rising prevalence of environmental concerns and stricter regulations against single-use plastics worldwide is propelling the demand for flax fiber bottles. Growing environmental consciousness and a proactive approach towards sustainability, with individuals taking greater responsibility for their ecological impact through their purchasing choices, are key factors

Flax Fiber Bottle Market Analysis

- Flax fiber bottles refer to packaging solutions made from flax fibers, often combined with other biodegradable materials, designed to hold various products. These bottles play an increasingly significant role in today's packaging industry due to their ability to address the rising consumer demand for more sustainable and environmentally friendly packaging options, manage the growing concern over plastic pollution, and drive innovation in packaging material development

- The expanding utilization of flax fiber bottles is primarily driven by greater consumer awareness of the critical role of packaging in environmental conservation and waste reduction, a rising demand for natural and eco-friendly packaging alternatives, and ongoing advancements in material science and manufacturing technologies that enable the effective production of durable and functional flax fiber bottles for a wide range of applications

- North America is expected to dominate the flax fiber bottle market due to a growing awareness of environmental issues and an increasing demand for sustainable packaging alternatives to traditional plastics

- Asia-Pacific is expected to be the fastest growing region in the flax fiber bottle market during the forecast period due to increasing environmental concerns, expanding manufacturing sectors, and rising consumer demand for sustainable packaging

- Reusable bottles segment is expected to dominate the market with a market share of 53.1% due to the increasing consumer focus on sustainability and the growing demand for durable and eco-friendly alternatives to conventional plastic bottles, aligning with global efforts to reduce plastic waste

Report Scope and Flax Fiber Bottle Market Segmentation

|

Attributes |

Flax Fiber Bottle Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Flax Fiber Bottle Market Trends

“Rising Shift Towards Non-Plastic Packaging Solutions”

- A significant and rapidly expanding trend in the global flax fiber bottle market is the increasing consumer preference and demand for non-plastic packaging solutions across various applications. This growing emphasis is driven by a greater awareness of the environmental benefits associated with non-plastic packaging, rising concerns about plastic pollution and its impact on health, and the increasing availability of innovative flax fiber-based bottle technologies

- For instance, major companies within the packaging industry and those exploring sustainable alternatives, such as Green Gen Technologies, which is actively producing flax fiber bottles, are heavily investing in and expanding their portfolios. Companies such as The Flax Company, another key player in the flax fiber market, are likely also involved in developing or promoting flax fiber-based packaging solutions

- This heightened focus on flax fiber bottles enables the development of packaging solutions that cater to a growing segment of environmentally conscious consumers and businesses seeking sustainable alternatives to traditional plastic bottles. It also fosters innovation in creating bottles with unique properties derived from flax fiber, such as potential for compostability and a reduced carbon footprint compared to conventional plastic

- The growing recognition among packaging manufacturers and end-users of the strong consumer demand for non-plastic options and the increasing technological advancements in processing flax fiber for bottle production further fuels the importance of this trend as a critical component of modern packaging strategies within various industries

- Organizations are increasingly acknowledging the potential of flax fiber bottles to tap into new market segments, improve their environmental credentials, and align with consumer values related to ethical and ecological considerations. This trend towards prioritizing flax fiber bottles within the packaging market is driving significant research, development, and investment in this area

- The demand for innovative and high-quality non-plastic packaging options such as flax fiber bottles is growing rapidly as the increasing awareness of their ecological and potential health benefits encourages packaging companies and brands to develop and adopt proactive and versatile strategies tailored to address the evolving preferences of their consumers. This direct and intentional approach to incorporating flax fiber into bottle manufacturing is vital for staying competitive in the modern market and significantly boosts the innovation and diversification within the sustainable packaging sector

Flax Fiber Bottle Market Dynamics

Driver

“Increasing Government Regulations and Environmental Policies”

- The increasing global implementation of stringent government regulations and proactive environmental policies is a significant driver for the heightened demand for sustainable and non-plastic packaging solutions, particularly within the flax fiber bottle market. This regulatory push is fueled by growing governmental and intergovernmental recognition of the detrimental effects of plastic pollution, the urgent need for a circular economy, and a broader commitment to achieving environmental sustainability goals

- For instance, leading companies in the packaging industry are responding to these regulations by exploring and adopting innovative materials such as flax fiber. Yajur Bast Fibers Limited, which is identified as a prominent player in the flax fiber market, is likely involved in developing sustainable applications for their fibers, including potential use in bottle manufacturing to meet stricter environmental standards

- As the understanding of the long-term environmental consequences of plastic waste expands, the flax fiber bottle market offers superior solutions compared to traditional plastic packaging. These bottles provide a biodegradable and renewable alternative, directly addressing regulations aimed at reducing plastic usage and promoting sustainable waste management practices, thereby fostering greater adoption and satisfaction among businesses seeking regulatory compliance and environmental responsibility

- The increasing implementation of supportive policies, such as tax incentives for using sustainable packaging and outright bans on certain single-use plastics, coupled with growing public and corporate awareness of environmental responsibilities, makes the flax fiber bottle market an attractive area for innovation and investment driven by regulatory tailwinds.

- The demand for sophisticated and environmentally friendly packaging solutions such as flax fiber bottles is growing rapidly as the increasing number and scope of government regulations and environmental policies encourage various industries to develop and adopt proactive and environmentally conscious strategies tailored to address these evolving legal and societal expectations. This direct and intentional shift towards sustainable packaging options such as flax fiber bottles is vital for ensuring long-term market viability and significantly boosts the growth and diversification of the sustainable packaging industry

Restraint/Challenge

“Navigating Scaling and Supply Chain Hurdles”

- Establishing efficient and reliable scaling of production along with robust supply chains presents a considerable challenge to the widespread adoption and market growth of flax fiber bottles within the broader packaging industry. The complexities involved in sourcing consistent and high-quality flax fiber, developing optimized manufacturing processes for bottle production at scale, and establishing efficient distribution networks can create significant hurdles for many companies

- For instance, smaller or emerging companies in the flax fiber bottle market, much such as established players such as Green Gen Technologies or The Flax Company as they expand their operations, might find the difficulties associated with securing a stable supply of raw flax fiber that meets specific quality requirements or implementing large-scale production techniques for bottle manufacturing to be substantial and potentially restrictive to their growth

- Addressing these scaling and supply chain challenges requires the development of reliable and geographically diverse flax fiber sourcing networks, the optimization of manufacturing technologies to achieve economies of scale, and the establishment of efficient logistics and transportation infrastructure to ensure consistent product delivery. Collaboration across the supply chain, from farmers to manufacturers to distributors, will be crucial

- While the potential long-term benefits of overcoming these limitations, such as increased availability of flax fiber bottles for various industries and wider adoption as a sustainable alternative, are substantial, the current realities of scaling production and managing the supply chain can impede the rapid growth and universal integration of flax fiber bottles

- Overcoming these challenges through advancements in agricultural practices for flax cultivation, optimization of fiber processing and bottle manufacturing processes, and the strategic development of resilient supply chain partnerships will be vital for ensuring the continued growth and broader accessibility of the flax fiber bottle market as a viable alternative to traditional plastic packaging

Flax Fiber Bottle Market Scope

The market is segmented on the basis of product type, capacity, sales channel, and end user.

- By Product Type

On the basis of product type, the market is segmented into single-use bottles, reusable bottles, and customized bottles. The reusable bottles segment dominates the largest market revenue share of 53.1% in 2025, driven by the increasing consumer focus on sustainability and the growing demand for durable and eco-friendly alternatives to conventional plastic bottles, aligning with global efforts to reduce plastic waste.

The customized bottles segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising demand for unique and brand-specific packaging solutions that resonate with consumers who value personalization and eco-conscious products.

- By Capacity

On the basis of capacity, the market is segmented into 50 to 250 ml, 250 to 500 ml, 500 to 750 ml, and above 750 ml. The 250 to 500 ml segment dominates the largest market revenue share of 41.7% in 2025, driven by its suitability for single-serving beverages and standard-sized personal care products, catering to a broad consumer base seeking convenient and sustainable options.

The 500 to 750 ml segment is expected to witness the fastest CAGR from 2025 to 2032, driven by an increasing consumer preference for slightly larger, more economical sizes for both beverages and personal care products, aligning with the trend of reducing packaging waste by purchasing larger volumes.

- By Sales Channel

On the basis of sales channel, the market is segmented into online and offline. The offline segment dominates the largest market revenue share in 2025, driven by established distribution networks, the prevalence of brick-and-mortar stores, and consumer preference for tangible product interaction before purchase, especially in certain regions.

The online segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing internet penetration, the convenience of e-commerce, a wider product selection, and the growing trend of direct-to-consumer sales facilitated by online platforms.

- By End User

On the basis of end user, the market is segmented into food and beverage, pharmaceuticals, cosmetics and personal care, and others. The food and beverage segment dominates the largest market revenue share in 2025, driven by the increasing adoption of sustainable packaging solutions by beverage and food manufacturers to meet consumer demand for eco-friendly alternatives.

The cosmetics and personal care segment is expected to witness the fastest CAGR from 2025 to 2032, driven by a growing consumer awareness and preference for sustainable and natural packaging options in the beauty and personal care industry, coupled with increasing pressure on brands to reduce their environmental impact.

Flax Fiber Bottle Market Regional Analysis

- North America dominates the flax fiber bottle market with the largest revenue share in 2024, driven by a growing awareness of environmental issues and an increasing demand for sustainable packaging alternatives to traditional plastics

- Organizations in this region are progressively adopting eco-friendly packaging solutions such as flax fiber bottles to meet consumer preferences and comply with emerging environmental regulations

- This is further supported by a rising consumer inclination towards natural and biodegradable products, pushing major industries to integrate such options

Canada Flax Fiber Bottle Market Insight

Canada flax fiber bottle market is experiencing strong growth, through forecast period, driven by increasing environmental consciousness among consumers and a significant push to reduce plastic waste. This demand for sustainable packaging is particularly evident in the food and beverage industry, where the wine segment is a major adopter of flax fiber bottles as an eco-friendly alternative. The biodegradable and renewable nature of flax fibers, coupled with potential government initiatives supporting green alternatives, positions Canada as a leading market for this sustainable packaging solution in North America.

Europe Flax Fiber Bottle Market Insight

Europe is anticipated to experience substantial growth in the flax fiber bottle market, propelled by stringent government regulations against single-use plastics and the promotion of sustainable practices. The European Union's Single-Use Plastics Directive and similar national policies are encouraging manufacturers and consumers to switch to biodegradable materials such as flax fiber. Furthermore, increasing environmental awareness and the availability of incentives for adopting green packaging solutions are significantly boosting market growth in this region.

U.K. Flax Fiber Bottle Market Insight

U.K. flax fiber bottle market is anticipated to experience steady growth, demonstrating a CAGR of 4.3% through the forecast period. This growth is fueled by increasing consumer awareness regarding sustainable and environmentally friendly packaging solutions, aligning with the broader global trend towards reducing plastic waste. The adoption of flax fiber bottles is expected to rise as consumers and brands seek biodegradable and compostable alternatives to conventional plastic, particularly for beverages and cosmetics.

Germany Flax Fiber Bottle Market Insight

Germany's flax fiber bottle market is anticipated to experience growth, aligning with the increasing global demand for sustainable packaging alternatives. This adoption is supported by Germany's strong emphasis on environmental sustainability and the implementation of regulations favoring eco-friendly packaging across various industries. The food and beverage industry's increasing interest in eco-friendly packaging solutions such as flax fiber, particularly in the wine segment, is also contributing to this trend.

Asia-Pacific Flax Fiber Bottle Market Insight

Asia-Pacific is poised to witness rapid growth in the flax fiber bottle market, driven by increasing environmental concerns, expanding manufacturing sectors, and rising consumer demand for sustainable packaging. In rapidly growing economies such as China, the expanding manufacturing sector is creating a higher demand for eco-friendly packaging solutions such as flax fiber bottles, with the country expected to see a lucrative growth. This growth is also supported by a general trend towards reusable and sustainable products across the Asia Pacific region.

Japan Flax Fiber Bottle Market Insight

Japan's flax fiber bottle market is expected to gain traction, aligning with the country's growing focus on sustainability and the development of natural fiber composites. While specific data on flax fiber bottles is limited, the broader trend towards natural fiber materials in various applications indicates a positive outlook for flax fiber bottle adoption as an eco-conscious packaging choice.

China Flax Fiber Bottle Market Insight

China is projected to hold a considerable market revenue share in the Asia Pacific flax fiber bottle market. The country's large manufacturing base and increasing focus on sustainable industrial practices are driving the adoption of biodegradable packaging materials. The expanding manufacturing sector is specifically contributing to the demand for flax fiber bottles, positioning China as a key growth area in the global market

Flax Fiber Bottle Market Share

The flax fiber bottle industry is primarily led by well-established companies, including:

- Green Gen Technologies (France)

- Yajur Bast Fibers Limited (India)

- Bcomp (Switzerland)

- Toray Industries, Inc. (Japan)

- Solvay (Belgium)

- BASF (Germany)

- UPM (Finland)

- Carlsberg Breweries A/S (Denmark)

- Alpla Group (Austria)

- Berry Global Inc. (U.S.)

- O-I Glass, Inc. (U.S.)

- Mondi AG (Austria)

- TEIJIN LIMITED (Japan)

- The Flax Company (France)

Latest Developments in Global Flax Fiber Bottle Market

- In August 2024, French start-up Green Gen Technologies proudly unveiled its latest advancements in sustainable packaging for the premium wine and spirits sector with the launch of two groundbreaking products. The company introduced a novel cardboard-based bottle, offering a new alternative to traditional glass, alongside the highly anticipated second-generation version of its pioneering flax fiber vessel. This enhanced flax fiber bottle had previously garnered recognition through its adoption by the esteemed cognac brand A. de Fussigny in 2022. This dual product launch underscores Green Gen Technologies' commitment to driving innovation and providing high-end, eco-conscious packaging solutions that meet the evolving demands of the wine and spirits market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Flax Fiber Bottle Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Flax Fiber Bottle Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Flax Fiber Bottle Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.