Global Flight Data Monitoring Market

Market Size in USD Billion

CAGR :

%

USD

5.44 Billion

USD

10.10 Billion

2024

2032

USD

5.44 Billion

USD

10.10 Billion

2024

2032

| 2025 –2032 | |

| USD 5.44 Billion | |

| USD 10.10 Billion | |

|

|

|

|

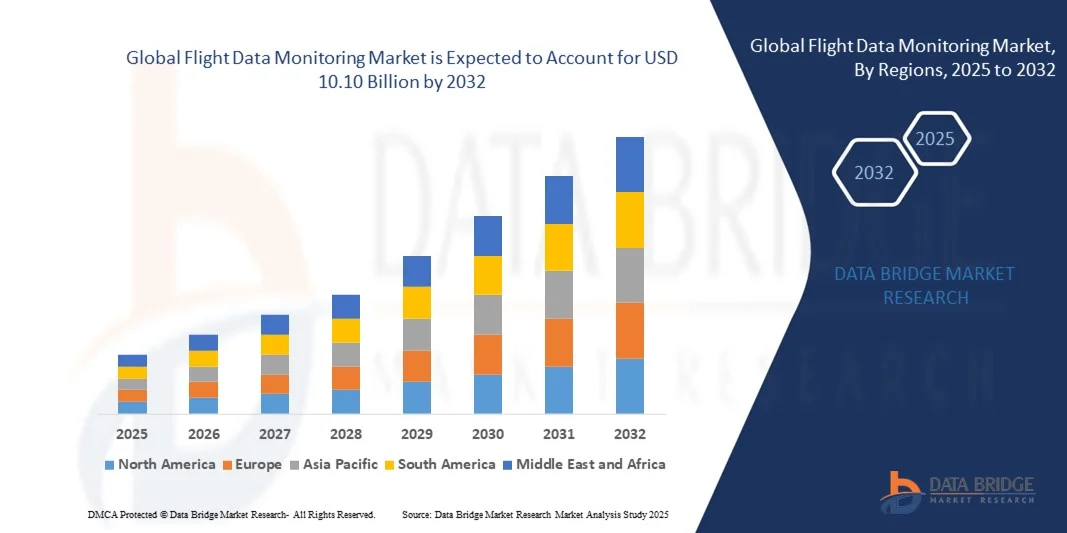

What is the Global Flight Data Monitoring Market Size and Growth Rate?

- The global flight data monitoring market size was valued at USD 5.44 billion in 2024 and is expected to reach USD 10.10 billion by 2032, at a CAGR of 8.03% during the forecast period

- The increasing demand for increased situational awareness for economical airline operations, have to be compelled to cut back the price of forced maintenance, increasing volume of information generated by the aviation trade, and rise in craft deliveries area unit factors that area unit expected to drive the flight knowledge observance market

- Furthermore, increasing demand for period of time situational awareness system, raise in craft deliveries, growing adoption of assorted security analytics techniques in aviation trade, growing domestic and international travel activities across the world and rising adoption of wireless sensors for flight knowledge observance area unit expected to witness quick growth throughout the forecast period

What are the Major Takeaways of Flight Data Monitoring Market?

- The increasing demand for increased situational awareness for economical airline operations, ought to cut back the value of special maintenance, increasing volume of knowledge generated by the aviation business, and rise in craft deliveries are factors that are expected to drive the flight information observance market

- However, high cost of investment associated, lack of technical skilled personnel’s, environmental parameters and ageing aircraft are major restraining factors that could hamper the growth of the flight data monitoring market

- North America dominated the flight data monitoring (FDM) market with the largest revenue share of 39.97% in 2024, driven by stringent aviation safety regulations, widespread adoption of digital aviation technologies, and strong airline focus on proactive risk management

- The Asia-Pacific flight data monitoring market is forecast to grow at the fastest CAGR of 8.65% from 2025 to 2032, driven by rapid aviation growth, urbanization, and regulatory initiatives in countries such as China, India, and Japan

- The Onboard Solution segment dominated the market with the largest revenue share of 61.4% in 2024, driven by its critical role in enabling real-time monitoring of flight parameters directly from aircraft systems

Report Scope and Flight Data Monitoring Market Segmentation

|

Attributes |

Flight Data Monitoring Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Flight Data Monitoring Market?

Integration of AI and Advanced Analytics for Proactive Safety Insights

- A major trend in the global flight data monitoring (FDM) market is the increasing adoption of artificial intelligence (AI), machine learning (ML), and predictive analytics to enhance aviation safety and operational efficiency. Airlines and operators are leveraging AI-driven insights to detect anomalies, forecast potential risks, and optimize flight performance

- For instance, Airbus Flight Data Monitoring solutions utilize advanced algorithms to analyze massive volumes of in-flight data, helping identify operational risks before they escalate into safety incidents. Similarly, Honeywell is deploying AI-powered flight data monitoring tools for real-time aircraft health monitoring

- AI integration in flight data monitoring enables early fault detection, predictive maintenance, and proactive safety measures, reducing unplanned downtime and ensuring compliance with global aviation safety standards. Airlines can now receive intelligent alerts on unusual flight patterns, engine performance, or pilot deviations, improving decision-making

- The trend of digitally integrated flight data monitoring platforms is reshaping aviation operations, as airlines increasingly demand systems that provide real-time analysis and seamless integration with existing safety and operational frameworks

- Companies such as FLYHT Aerospace Solutions and Curtiss-Wright Corporation are developing cloud-enabled, AI-driven flight data monitoring platforms to enhance predictive capabilities and regulatory compliance

- This shift towards intelligent, data-driven monitoring systems is redefining aviation safety management, ensuring that airlines and regulators can act on insights with greater speed and precision

What are the Key Drivers of Flight Data Monitoring Market?

- The growing emphasis on aviation safety compliance and regulatory mandates from bodies such as ICAO and EASA is a primary driver for the adoption of flight data monitoring systems

- For example, in March 2024, the European Union Aviation Safety Agency (EASA) mandated extended flight data monitoring reporting requirements for regional and charter operators, pushing the demand for advanced monitoring solutions

- Rising concerns about flight efficiency, fuel optimization, and operational cost reduction are propelling airlines to invest in flight data monitoring technologies. flight data monitoring allows carriers to track deviations in flight paths, optimize fuel burn, and reduce maintenance costs through predictive insights

- The increasing digitalization of aviation and growing reliance on IoT-based aircraft systems make flight data monitoring an integral component of modern fleets. Integration with real-time communication systems ensures operators can monitor aircraft data instantly

- The expansion of commercial aviation fleets in emerging regions, combined with the need for safety assurance in private and business aviation, further supports market growth. As global passenger traffic continues to rise, airlines are prioritizing flight data monitoring to improve safety, compliance, and operational efficiency

Which Factor is Challenging the Growth of the Flight Data Monitoring Market?

- A key challenge to the growth of the flight data monitoring market is the concern over data privacy, cybersecurity, and cost of implementation. Since FDM relies on continuous collection and transmission of sensitive aircraft data, it is vulnerable to cybersecurity threats and data breaches, raising concerns for airlines and regulators

- For instance, reported vulnerabilities in aviation IoT systems have led to heightened concerns about the secure handling of sensitive flight and crew data. Such issues make some operators cautious about adopting fully connected flight data monitoring solutions

- The high upfront cost of advanced flight data monitoring systems also poses a challenge, particularly for small airlines and operators in developing markets. While leading carriers can absorb costs, smaller operators may struggle with investment and ongoing maintenance expenses

- Additionally, the complexity of integrating flight data monitoring with existing aviation IT ecosystems can slow adoption, as airlines must balance new technology with legacy systems

- Overcoming these challenges requires strong cybersecurity frameworks, cost-efficient solutions, and simplified integration processes. Companies such as FLYHT and Flight Data Systems Pty. Ltd. are increasingly emphasizing secure, scalable, and affordable solutions to reassure airlines

- Addressing these barriers will be crucial for ensuring wider adoption of flight data monitoring systems and sustaining long-term market growth

How is the Flight Data Monitoring Market Segmented?

The market is segmented on the basis of solutions, end-users, and components.

- By Solution

On the basis of solution, the flight data monitoring market is segmented into Onboard Solution and On Ground Solution. The Onboard Solution segment dominated the market with the largest revenue share of 61.4% in 2024, driven by its critical role in enabling real-time monitoring of flight parameters directly from aircraft systems. Airlines and operators rely heavily on onboard solutions for proactive safety management, continuous performance evaluation, and compliance with regulatory standards. The ability to record and transmit high-fidelity data during flights enhances operational efficiency and safety, making it a preferred choice across both commercial and defense aviation.

The On Ground Solution segment is projected to witness the fastest CAGR from 2025 to 2032, fueled by increasing adoption of cloud-based analytics and AI-driven platforms for post-flight data assessment. Ground solutions offer enhanced data storage, trend analysis, and predictive maintenance, enabling operators to optimize fleet performance cost-effectively.

- By End User

On the basis of end user, the flight data monitoring market is segmented into Fleet Operators, Drone Operators, flight data monitoring Service Providers, and Investigation Agencies. The Fleet Operators segment accounted for the largest market share of 47.6% in 2024, owing to the widespread deployment of flight data monitoring solutions by commercial airlines and charter services to ensure flight safety, reduce operational risks, and comply with aviation safety mandates. Fleet operators leverage FDM insights to optimize fuel efficiency, enhance crew training, and minimize incidents.

The Drone Operators segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rapid growth of UAV applications in logistics, surveillance, and defense. As drones become more advanced and widely used, the need for accurate monitoring, regulatory compliance, and accident investigation is fueling demand for specialized flight data monitoring solutions tailored to unmanned platforms. This trend positions drone operators as a high-potential growth driver for the overall market.

- By Component

On the basis of component, the flight data monitoring market is segmented into FDM Services, FDM Software, and FDM Systems. The flight data monitoring Services segment held the largest market revenue share of 52.3% in 2024, owing to the rising outsourcing of data monitoring and analysis to specialized service providers. Airlines and operators increasingly prefer managed services to avoid high upfront costs, benefit from expert analytics, and ensure compliance with evolving aviation regulations. These services also offer scalability, making them attractive for both large carriers and smaller operators.

The flight data monitoring Software segment is anticipated to register the fastest CAGR from 2025 to 2032, propelled by advancements in big data analytics, AI, and machine learning. Modern flight data monitoring software enables real-time visualization, anomaly detection, and predictive maintenance insights. As aviation stakeholders increasingly adopt digital transformation, demand for intelligent, customizable, and cloud-based software platforms will significantly accelerate growth in this segment.

Which Region Holds the Largest Share of the Flight Data Monitoring Maret?

- North America dominated the flight data monitoring (FDM) market with the largest revenue share of 39.97% in 2024, driven by stringent aviation safety regulations, widespread adoption of digital aviation technologies, and strong airline focus on proactive risk management

- Airlines and helicopter operators across the region increasingly implement flight data monitoring solutions to improve operational safety, fuel efficiency, and maintenance planning

- This growth is further supported by the presence of major aviation OEMs, robust regulatory oversight from authorities such as the FAA, and investments in digital aviation infrastructure, making North America the global leader in flight data monitoring adoption

U.S. Flight Data Monitoring Market Insight

The U.S. flight data monitoring market captured 81% of the North America revenue share in 2024, supported by a strong commercial aviation sector, stringent safety mandates, and rapid adoption of advanced monitoring systems. U.S. airlines and operators prioritize flight data monitoring systems to comply with FAA mandates and reduce operational risks, fueling steady market growth. Additionally, the strong presence of leading aerospace and software companies accelerates innovation in data analytics and cloud-based solutions for flight monitoring. The increasing use of flight data monitoring for predictive maintenance, safety audits, and pilot performance evaluation further strengthens its adoption across both commercial airlines and business aviation in the U.S.

Europe Flight Data Monitoring Market Insight

The Europe flight data monitoring market is projected to grow at a significant CAGR during the forecast period, fueled by strict EASA regulations, rising fleet sizes, and the push toward digitization in aviation safety. European airlines, charter operators, and investigation agencies are actively deploying FDM solutions to improve compliance and reduce accident risks. Growth is also driven by modernization of fleets, expanding air mobility services, and demand for real-time analytics in both commercial and general aviation. Furthermore, flight data monitoring adoption is increasing in helicopter operations for offshore oil & gas and emergency services, boosting the region’s market presence across multiple aviation segments.

U.K. Flight Data Monitoring Market Insight

The U.K. flight data monitoring market is expected to expand at a notable CAGR, driven by strong regulatory enforcement, demand for improved aviation safety, and digital transformation initiatives. Airlines and fleet operators are leveraging flight data monitoring solutions to gain deeper insights into flight performance, crew behavior, and maintenance planning. Rising adoption in regional airlines and charter services, combined with integration into new-generation aircraft, is further propelling growth. Additionally, the U.K.’s growing UAV and drone sector is creating opportunities for specialized FDM solutions to ensure regulatory compliance and enhance operational safety in unmanned platforms, contributing to the market’s overall expansion.

Germany Flight Data Monitoring Market Insight

The Germany flight data monitoring market is set to grow considerably, supported by the country’s focus on aviation innovation, sustainability, and safety. German operators are adopting flight data monitoring systems for efficient fuel usage, emissions tracking, and compliance with strict EU safety standards. The presence of a robust aerospace manufacturing sector and collaboration with global aviation software companies accelerates adoption. Additionally, helicopter operators in offshore wind energy and emergency medical services are increasingly deploying flight data monitoring solutions to enhance safety and efficiency. Germany’s growing demand for eco-conscious and digital aviation tools positions it as a key market within Europe for long-term flight data monitoring adoption.

Which Region is the Fastest Growing Region in the Flight Data Monitoring Market?

The Asia-Pacific flight data monitoring market is forecast to grow at the fastest CAGR of 8.65% from 2025 to 2032, driven by rapid aviation growth, urbanization, and regulatory initiatives in countries such as China, India, and Japan. Expanding airline fleets, rising safety awareness, and government mandates for flight data monitoring implementation are key growth factors. The region’s strong manufacturing base for aviation electronics and increasing adoption of digital aviation solutions make flight data monitoring systems more affordable and accessible. With the boom in both commercial and general aviation, Asia-Pacific is emerging as a critical growth hub for global flight data monitoring adoption.

Japan Flight Data Monitoring Market Insight

The Japan flight data monitoring market is gaining strong momentum, driven by the country’s advanced technological ecosystem, rising passenger air traffic, and regulatory focus on safety. Airlines and operators are implementing flight data monitoring solutions to optimize flight efficiency, enhance safety oversight, and reduce operational costs. The integration of flight data monitoring with other IoT-enabled systems such as predictive maintenance and smart airport solutions is accelerating adoption. Moreover, Japan’s aging pilot population and high focus on automation are encouraging the use of digital monitoring tools, making flight data monitoring a vital component of the country’s modern aviation infrastructure.

China Flight Data Monitoring Market Insight

The China flight data monitoring market accounted for the largest share within Asia-Pacific in 2024, fueled by rapid growth in commercial aviation, strong government support for safety compliance, and rising urban air mobility initiatives. Chinese airlines are aggressively expanding fleets, creating a strong demand for onboard and ground-based flight data monitoring solutions. The push towards smart aviation, supported by domestic aerospace manufacturing, is enhancing affordability and accessibility of flight data monitoring systems. Furthermore, the increasing use of flight data monitoring in helicopter operations, regional airlines, and UAV platforms positions China as a major contributor to the Asia-Pacific FDM market’s long-term growth trajectory.

Which are the Top Companies in Flight Data Monitoring Market?

The flight data monitoring industry is primarily led by well-established companies, including:

- Curtiss-Wright Corporation (U.S.)

- FLYHT Aerospace Solutions Ltd (Canada)

- Teledrum (U.K.)

- SKYTRAC SYSTEMS LTD (Canada)

- Scaled Analytics, Inc (U.S.)

- Flight Data Services Ltd (U.K.)

- Flight Data People (U.K.)

- Metro Aviation (U.S.)

- French Flight Safety (France)

- Aerosight (Country not clearly listed)

- AeroVision International (U.S.)

- FlightSafety International (U.S.)

- ERGOSS LOGICIELS (France)

- Aerobytes Ltd (U.K.)

- Helinalysis (U.K.)

- NeST Aerospace Pvt. Ltd (India)

- Flight Data Systems Pty. Ltd (Australia)

What are the Recent Developments in Global Flight Data Monitoring Market?

- In June 2025, Acron Aviation entered a multi-year partnership with Air Cairo to deliver Flight Data Monitoring services using its FDC platform. The patented system leverages statistical modeling and machine learning for rapid data processing, while the Astra pilot app ensures detailed operational insights. This collaboration is expected to strengthen Air Cairo’s operational safety and efficiency

- In June 2025, Textron Inc. launched a Flight Data Monitoring service for its Cessna Citation and SkyCourier aircraft, integrated with an Aircraft Recording System. The solution enables operators to seamlessly transfer data through GE Aerospace’s C-FOQA service, supported by Textron’s LinxUs system. This development highlights Textron’s commitment to advancing digital monitoring in business and regional aviation

- In October 2022, Safran announced that the Swedish Space Corporation selected Safran Data Systems to expand its global network of Lunar Exploration Ground Sites (LEGS). This expansion aims to support growing communication requirements for lunar missions. The initiative reinforces Safran’s leadership in providing advanced space communication solutions

- In September 2022, Safran Data Systems and Contec entered into an agreement for the 2023 deployment of an optical ground station in Western Australia. Safran was chosen to deliver the station, enhancing Contec’s satellite communication infrastructure. This partnership marks a significant step in strengthening global space connectivity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.