Global Fortified Breakfast Cereals Market

Market Size in USD Billion

CAGR :

%

USD

17.71 Billion

USD

41.41 Billion

2024

2032

USD

17.71 Billion

USD

41.41 Billion

2024

2032

| 2025 –2032 | |

| USD 17.71 Billion | |

| USD 41.41 Billion | |

|

|

|

|

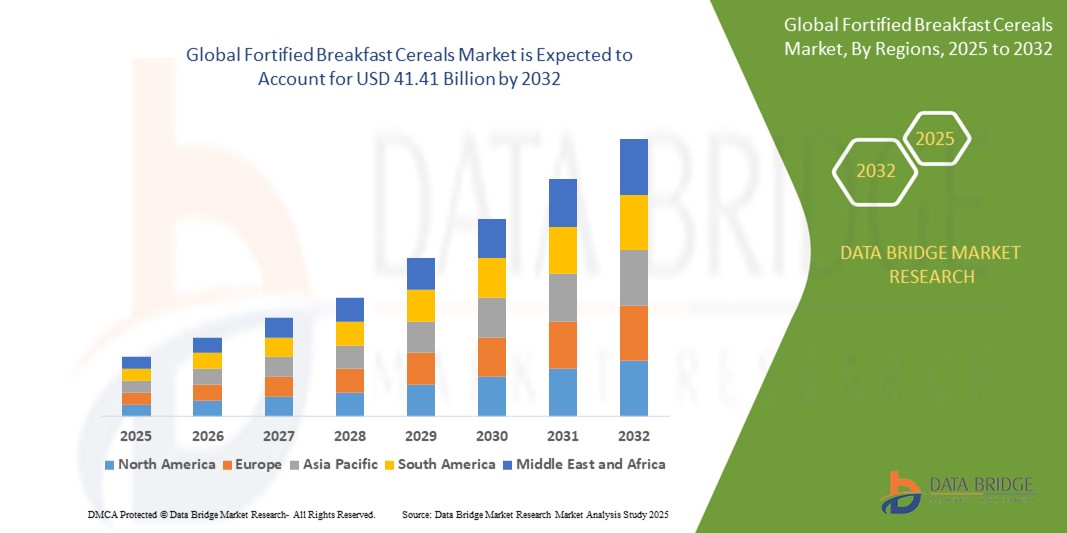

What is the Global Fortified Breakfast Cereals Market Size and Growth Rate?

- The global fortified breakfast cereals market size was valued at USD 17.71 billion in 2024 and is expected to reach USD 41.41 billion by 2032, at a CAGR of 11.20% during the forecast period

- The fortified breakfast cereals market lies in their demand for convenient and nutritious breakfast options. This suggests a growing demand for healthier alternatives, reflected in the popularity of low-calorie options

- With consumers increasingly conscious of calorie intake, manufacturers focus on offering low calories cereals with lower counts. For instance, "Special K" by Kellogg's, offers variants with reduced calorie counts while still providing essential nutrients through fortification

What are the Major Takeaways of Fortified Breakfast Cereals Market?

- The demand for convenient breakfast options continues to rise as consumers increasingly prioritize productivity in their daily routines. Ready to eat cereals exemplify this trend by providing quick, hassle-free morning meals packed with essential nutrients. In an era where busy lifestyles are omnipresent, consumers seek solutions that balance nutrition and convenience

- Ready to eat cereals perfectly align with this need, offering a simple yet nourishing breakfast choice that seamlessly integrates into fast-paced lifestyles. Their popularity in the fortified breakfast cereals reflects a growing demand for products that prioritize both convenience and health without compromising on taste or quality

- North America dominated the fortified breakfast cereals market with the largest revenue share of 38.3% in 2024, driven by increasing consumer demand for functional, high-fiber, and micronutrient-rich breakfast options

- Asia-Pacific fortified breakfast cereals market is projected to grow at the fastest CAGR of 10.1% from 2025 to 2032, spurred by increasing health awareness, rapid urbanization, and rising disposable incomes

- The oat segment dominated the market with the largest revenue share of 34.7% in 2024, primarily due to its rich fiber content, cholesterol-lowering benefits, and consumer perception as a heart-healthy ingredient

Report Scope and Fortified Breakfast Cereals Market Segmentation

|

Attributes |

Fortified Breakfast Cereals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Fortified Breakfast Cereals Market?

“Functional Fortification and Clean Label Preferences Shaping Innovation”

- A significant trend driving the fortified breakfast cereals market is the convergence of functional health benefits with clean-label positioning. Consumers are increasingly opting for cereals fortified with basic vitamins and minerals and with probiotics, plant proteins, antioxidants, and superfoods such as chia, flaxseed, and quinoa

- For instance, Nestlé partnered with Danone in 2024 to co-develop probiotic-enriched breakfast cereals under its Wellness+ line, targeting gut health and immunity-conscious consumers

- Clean label demands are steering formulations away from artificial colors, flavors, and high sugar content. Natural sweeteners such as monk fruit and date syrup are being incorporated, along with gluten-free grains to appeal to allergen-sensitive buyers

- The rise of plant-based and organic preferences is pushing manufacturers to fortify cereals using plant-derived nutrients such as vitamin B12 from algae or iron from moringa

- In addition, innovations in extrusion technology are enabling enhanced nutrient retention and texture profiles in high-fiber, low-GI cereals designed for diabetic and heart-health-focused demographics

- These clean-label and function-driven cereals are increasingly dominating retail shelves, especially across North America and Europe, fueling market growth and regulatory interest in health-forward breakfast choices

What are the Key Drivers of Fortified Breakfast Cereals Market?

- Rising awareness of preventive healthcare, coupled with busy lifestyles, is propelling demand for nutrient-dense, ready-to-eat cereals enriched with vitamins, minerals, and prebiotics to support immunity, digestion, and mental focus

- For instance, in February 2025, General Mills launched its “Brain Boost” line fortified with omega-3s, zinc, and vitamin D3 to promote cognitive health in children and seniors asuch as

- Government initiatives encouraging micronutrient fortification to combat deficiencies—especially iron, folate, and vitamin A are catalyzing adoption in both developed and emerging economies

- Growing vegan and flexitarian populations are pushing demand for plant-based fortified cereals that align with ethical consumption patterns without compromising nutritional value

- E-commerce and D2C cereal brands such as purelyelizabeth and Magic Spoon are disrupting traditional distribution with customizable, subscription-based offerings catering to niche dietary goals

- Increasing R&D investment by major players in encapsulation technologies, bioavailability enhancers, and grain diversification (e.g., millet, sorghum, amaranth) is expanding the fortified cereal landscape globally

Which Factor is challenging the Growth of the Fortified Breakfast Cereals Market?

- A primary challenge is the perception of processed cereals as unhealthy, despite fortification. High sugar levels, refined grains, and synthetic additives in legacy products have eroded consumer trust

- For instance, The Hain Celestial Group faced backlash in 2023 for using cane sugar and artificial flavors in its children’s cereal line despite promoting fortified claims, leading to reformulation pressures

- The cost of fortification, especially using bioavailable or plant-based sources of nutrients, can strain profit margins particularly for startups or companies operating in price-sensitive markets

- Regulatory variations across regions regarding permissible nutrient levels, labeling claims, and health certifications complicate international expansion for fortified cereal brands

- Moreover, supply chain volatility for superfood ingredients and micronutrient additives—such as organic quinoa or vitamin D from lichen can disrupt production timelines and inventory reliability

- Lastly, consumer confusion around fortification vs. natural nutrition remains a barrier; many health-conscious buyers still prefer whole, unprocessed foods, believing them to be superior to fortified options, despite scientific evidence to the contrary

How is the Fortified Breakfast Cereals Market Segmented?

The market is segmented on the basis of cereal type, nutrients type, and distribution channel.

- By Cereal Type

On the basis of cereal type, the fortified breakfast cereals market is segmented into Wheat, Rice, Barley, Oat, Corn, and Others. The Oat segment dominated the market with the largest revenue share of 34.7% in 2024, primarily due to its rich fiber content, cholesterol-lowering benefits, and consumer perception as a heart-healthy ingredient. Oat-based cereals are favored in both developed and developing regions due to their satiety, digestive benefits, and suitability for clean-label formulations.

The Rice segment is projected to witness the fastest CAGR from 2025 to 2032, supported by rising demand for gluten-free and allergen-free breakfast alternatives, especially in Asia-Pacific and health-conscious Western markets.

- By Nutrients Type

On the basis of nutrients type, the fortified breakfast cereals market is segmented into Minerals and Vitamins. The Vitamins segment held the largest market share of 56.3% in 2024, driven by the widespread inclusion of vitamins such as A, B-complex, D, and E in breakfast cereals to support immunity, energy metabolism, and cognitive health. Vitamin-fortified products are popular among both adults and children, enhancing product positioning as daily wellness staples.

The Minerals segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by increasing awareness of micronutrient deficiencies and the inclusion of iron, calcium, and zinc in cereals to address conditions such as anemia and bone health.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Supermarkets and Hypermarkets, Convenience Stores, Online Stores, and Others. The Supermarkets and Hypermarkets segment led the market with a revenue share of 44.9% in 2024, owing to the strong in-store presence, promotional displays, and the availability of a wide range of fortified cereal brands under one roof. Consumers prefer these retail formats for bulk purchases and trusted brand access.

The Online Stores segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by digital convenience, expanding e-commerce penetration, and growing consumer preference for home delivery and direct-to-consumer health food platforms.

Which Region Holds the Largest Share of the Fortified Breakfast Cereals Market?

- North America dominated the fortified breakfast cereals market with the largest revenue share of 38.3% in 2024, driven by increasing consumer demand for functional, high-fiber, and micronutrient-rich breakfast options. The region benefits from a well-established cereal culture, high health awareness, and strong brand presence across supermarket and online retail channels

- U.S. consumers are showing growing interest in fortified cereals with added vitamins (A, D, B12) and minerals (iron, calcium) for immunity and energy support, fueling innovation and product launches by leading brands

- Furthermore, favorable regulations by the FDA regarding nutrient enrichment and label transparency, along with aggressive marketing by health-focused companies, are supporting sustained market leadership in the region

U.S. Fortified Breakfast Cereals Market Insight

The U.S. accounted for the dominant share of the North America market in 2024, attributed to its large health-conscious population and long-standing cereal consumption habits. Rapid adoption of gluten-free, organic, and high-protein cereals especially among millennials and Gen Z—is boosting sales. Strong R&D investments by brands such as General Mills, Kellogg’s, and Nestlé are further diversifying the fortified cereal portfolio with plant-based and superfood-infused options.

Canada Fortified Breakfast Cereals Market Insight

Canada is witnessing steady growth, supported by consumer preference for natural and whole-grain cereals enriched with essential nutrients. Government nutrition guidelines, such as Canada’s Food Guide promoting healthy breakfast habits, are contributing to increased demand. Canadian startups and private-label brands are actively launching allergen-free and clean-label fortified cereals, strengthening domestic market momentum.

Mexico Fortified Breakfast Cereals Market Insight

The Mexican market is gaining traction due to rising awareness around childhood nutrition and government initiatives promoting fortified food to combat malnutrition. Local and global brands are investing in affordable, iron- and vitamin-fortified cereal products tailored for low-income populations. The growing middle class and rapid urbanization are also accelerating demand across supermarkets and convenience stores.

Which Region is the Fastest Growing in the Fortified Breakfast Cereals Market?

Asia-Pacific fortified breakfast cereals market is projected to grow at the fastest CAGR of 10.1% from 2025 to 2032, spurred by increasing health awareness, rapid urbanization, and rising disposable incomes. Countries such as China, India, Japan, and South Korea are seeing a shift toward nutrient-dense, ready-to-eat breakfasts as consumers seek convenience without compromising on health. Government-led nutrition programs, dietary diversification, and growing e-commerce access to international health brands are fueling growth across both urban and rural regions.

China Fortified Breakfast Cereals Market Insight

China held the largest share of the Asia-Pacific market in 2024, fueled by rising middle-class spending, modernization of food retail, and heightened demand for children’s and elderly nutrition. Fortified cereal products targeting bone health, immunity, and brain function are rapidly gaining popularity. In addition, collaborations between domestic producers and global brands are expanding fortified cereal availability across all age groups.

India Fortified Breakfast Cereals Market Insight

India is emerging as a key growth market, propelled by the expansion of modern trade channels and increasing consumer interest in protein- and vitamin-enriched breakfast options. The Indian government’s support for micronutrient fortification in food to address deficiencies, especially in school children, is further stimulating demand. Regional cereal variants with localized flavors and nutrients are gaining popularity in metro and tier-2 cities asuch as.

Japan Fortified Breakfast Cereals Market Insight

Japan’s market continues to grow steadily, driven by an aging population seeking digestive-friendly and functional food products. Consumer trust in quality, traceability, and nutrient-rich cereals is high, favoring brands that offer low-sugar, fortified, and additive-free options. Technological advances in food processing and packaging are also enabling longer shelf life and higher nutrient retention, supporting ongoing demand.

Which are the Top Companies in Fortified Breakfast Cereals Market?

The fortified breakfast cereals industry is primarily led by well-established companies, including:

- General Mills Inc. (U.S.)

- Kellogg's Co. (U.S.)

- Nestlé SA (Switzerland)

- Bob’s Red Mill Natural Foods (U.S.)

- Nature's Path Foods (Canada)

- Hometown Food Company (U.S.)

- purelyelizabeth (U.S.)

- The Quaker Oats Company (U.S.)

- BARBARA’S (U.S.)

- Northen Quinoa Production Corporation (Canada)

- Gluten-Free Prairie (U.S.)

- Avena Foods, Limited (Canada)

- Conagra Brands, Inc. (U.S.)

- The Kraft Heinz Company (U.S.)

- The Hain Celestial Group (U.S.)

What are the Recent Developments in Global Fortified Breakfast Cereals Market?

- In January 2025, Kellogg's unveiled Oaties, a high-fiber, oat-based cereal available in Original Crunch and Choco Crunch variants. Designed to retain its crispiness in milk, the cereal catered to health-conscious consumers by being non-HFSS and enriched with B vitamins, iron, and vitamin D. Each bowl offered a distinctive multilayered texture for enhanced mouthfeel. This launch reflects Kellogg’s commitment to functional, wholesome breakfasts tailored to evolving consumer needs

- In December 2024, General Mills, Inc. broadened its breakfast offerings with the launch of Wheaties Protein and Cheerios Protein, delivering 8 grams of protein per serving. Offered in Cinnamon and Strawberry flavors, both cereals featured a textured multilayer profile aimed at health-focused individuals. This initiative underscores the brand’s effort to boost its nutritional portfolio and respond to demand for protein-rich cereals

- In March 2024, the Sidemen collaborated with Mornflake to debut Best Cereal in the U.K., introducing Choco Crunch and Caramel Gold variants. These HFSS-compliant cereals, made from wheat and oat puffs, were fortified with vitamins B12, D, and E. Initially launched exclusively at Tesco, expansion to Morrisons and Iceland was also planned. This partnership exemplifies the merging of influencer branding with fortified food innovation

- In January 2024, WK Kellogg Co. introduced a protein-rich cereal brand named Eat Your Mouth Off, aimed at Millennials and Gen Z. The puffed cereal offered 22 grams of protein and contained zero sugar per serving, aligning with emerging nutritional trends. This product launch showcases Kellogg’s strategic pivot toward high-protein, sugar-free alternatives for younger, health-conscious demographics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fortified Breakfast Cereals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fortified Breakfast Cereals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fortified Breakfast Cereals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.