Global Frac Sand Market

Market Size in USD Billion

CAGR :

%

USD

9.30 Billion

USD

28.35 Billion

2024

2032

USD

9.30 Billion

USD

28.35 Billion

2024

2032

| 2025 –2032 | |

| USD 9.30 Billion | |

| USD 28.35 Billion | |

|

|

|

|

Frac Sand Market Size

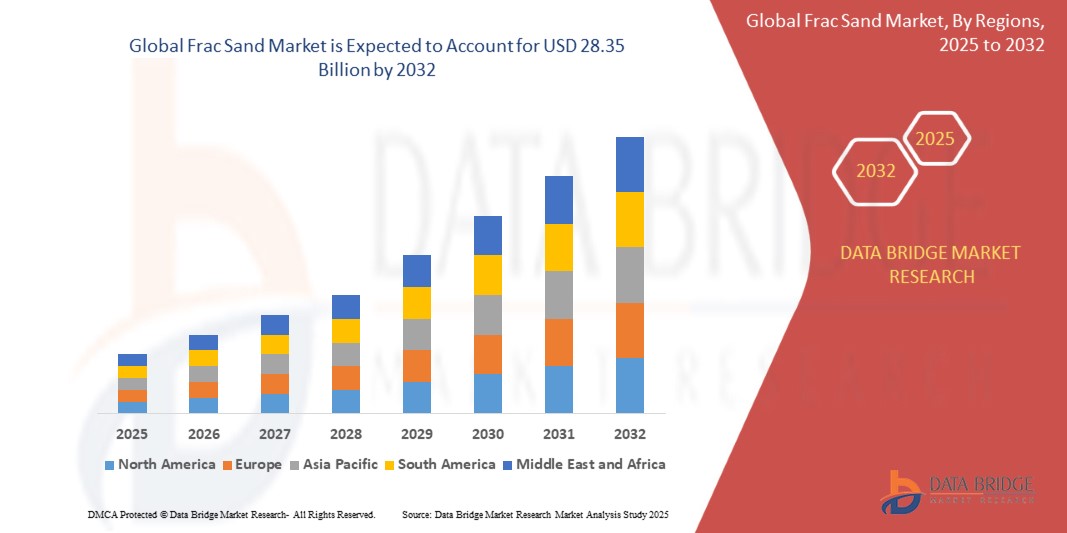

- The global ophthalmic operational microscope market was valued at USD 9.30 billion in 2024 and is expected to reach USD 28.35 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 14.95%, primarily driven by the increasing demand for hydraulic fracturing in oil and gas production

- This growth is driven by factors such as the expansion of shale oil and gas exploration, increased demand for energy, advancements in extraction technologies, and the need for high-quality sand for efficient fracking operations

Frac Sand Market Analysis

- Frac sand is a critical material used in hydraulic fracturing (fracking) processes to extract oil and natural gas from underground rock formations. The sand is injected into wells to create fractures, allowing oil and gas to flow more freely. It is an essential component in energy production, particularly in shale oil and gas extraction

- The demand for frac sand is primarily driven by the increasing production of unconventional oil and gas resources, particularly in North America. The need for high-quality, durable frac sand is growing due to advancements in hydraulic fracturing techniques and the expansion of shale drilling activities

- North America remains the dominant region for frac sand consumption, driven by the booming shale oil and gas sector in the U.S. The country has significant reserves of shale oil and gas, and as hydraulic fracturing technology advances, the need for frac sand has been rising. The increased drilling activity, along with ongoing investments in infrastructure to support the growing demand for frac sand, has bolstered the market in North America

- For instance, the Permian Basin, one of the largest shale oilfields in the U.S., is a major hub for frac sand usage. The demand for high-quality sand in this region is expected to continue growing due to its vast reserves and active fracking operations

- Globally, frac sand is ranked as one of the most critical materials in the oil and gas extraction process, alongside other proppants like ceramic beads. It plays a pivotal role in enhancing the efficiency and cost-effectiveness of hydraulic fracturing, making it indispensable to modern energy production

Report Scope and Frac Sand Market Segmentation

|

Attributes |

Frac Sand Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Frac Sand Market Trends

"Increasing Demand for High-Quality Frac Sand and Optimized Fracturing Techniques"

- One prominent trend in the global frac sand market is the increasing demand for high-quality frac sand, especially premium Northern White sand, which is known for its superior strength and conductivity properties

- High-quality frac sand enhances the efficiency of hydraulic fracturing by ensuring better permeability and higher fracture conductivity, which is essential for maximizing oil and gas extraction in shale formations

- For instance, high-quality frac sand improves the overall performance of wells in challenging geological formations, such as those in the Permian Basin and Bakken Shale, where the demand for durable, crush-resistant sand is growing

- Additionally, advancements in fracturing techniques, such as multi-stage and extended reach drilling, are driving the demand for higher volumes of frac sand in order to achieve optimal results from longer and more complex wells

- This trend is transforming the dynamics of the frac sand market, with operators seeking sand that not only meets the physical demands of fracking but also integrates well with the evolving technology in hydraulic fracturing

Frac Sand Market Dynamics

Driver

"Growing Demand Due to Expansion of Shale Oil and Gas Production"

- The increasing global demand for energy, particularly from shale oil and gas, is significantly driving the demand for frac sand, which is essential in hydraulic fracturing (fracking) processes

- As the exploration and production of unconventional oil and gas reserves continue to rise, particularly in North America, the need for high-quality frac sand to optimize well productivity and efficiency is becoming more pronounced

- In particular, the expansion of hydraulic fracturing technology is making deeper and more complex wells viable, increasing the amount of frac sand required per well

- The ongoing advancements in fracking technologies, such as longer horizontal wells and multi-stage fracking, further underline the need for superior frac sand that can withstand the high pressure and provide better conductivity

- For instance, according to the U.S. Energy Information Administration (EIA), the U.S. oil production is expected to increase significantly over the coming years, driving further demand for frac sand to support more extensive fracking operations

- In conclusion the U.S. Energy Information Administration (EIA) projects significant growth in U.S. oil production, which is expected to drive increased demand for frac sand to support expanding fracking operations

Opportunity

"Leveraging Technological Advancements in Fracturing Techniques and Automation"

- The integration of advanced technologies, such as automation and real-time data analytics, into the hydraulic fracturing process presents significant opportunities for the frac sand market. These innovations can improve the efficiency of sand delivery systems, reducing operational costs and enhancing overall well performance

- Automated systems, including smart proppant delivery and optimization software, allow operators to monitor and control the flow of frac sand in real-time, ensuring a more precise application and reducing the amount of sand wasted during the fracking process

- Additionally, the use of artificial intelligence (AI) and machine learning in hydraulic fracturing can enhance decision-making by analyzing large volumes of data, helping operators optimize sand usage, monitor well performance, and predict maintenance needs

For instance,

- In August 2024, an article published in Oil & Gas Journal noted that AI-driven models are helping operators predict the ideal sand type and amount to use for specific well conditions, improving the productivity of shale wells

- The implementation of these technological advancements boosts the demand for frac sand and also improves the efficiency and sustainability of fracking operations, creating significant growth opportunities for frac sand suppliers and producers globally

Restraint/Challenge

"Growing Environmental Concerns and Stringent Regulatory Challenges"

- The environmental impact of frac sand mining, particularly related to land degradation, water usage, and dust emissions, poses a significant challenge for the market, especially as regulatory frameworks around environmental sustainability become more stringent

- The process of extracting and processing frac sand often involves the use of large amounts of water and energy, and the creation of dust can negatively affect local ecosystems and communities. These environmental concerns are increasingly leading to stricter regulations in key mining regions

- Additionally, regulatory hurdles around sand mining and transportation, including restrictions on mining operations and transportation routes, can increase operational costs and lead to delays in sand supply, affecting the overall efficiency of fracking operations

For instance,

- In March 2024, an article published by Reuters reported that new state-level regulations in the U.S. could limit the expansion of frac sand mining in certain regions due to concerns about water usage and air quality, potentially leading to higher costs and supply shortages

- As a result, these environmental and regulatory challenges could limit the expansion of frac sand production, increase operational costs for producers, and create supply chain disruptions, ultimately hindering the growth of the global frac sand market

Frac Sand Market Scope

The market is segmented on the basis type, mesh size, and application

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Mesh Size |

|

|

By Application |

|

Frac Sand Market Regional Analysis

“North America is the Dominant Region in the Frac Sand Market"

- North America holds a dominant position in the global frac sand market, driven by the vast shale oil and gas reserves in the U.S., particularly in regions such as the Permian Basin and Bakken Formation, which are highly dependent on hydraulic fracturing

- The U.S. is the largest consumer of frac sand, driven by the increasing demand for energy, extensive hydraulic fracturing operations, and technological advancements in drilling techniques

- The availability of well-established infrastructure for sand extraction, processing, and transportation further strengthens the market in North America. Additionally, investments in domestic sand production and the development of new sand mines in the region reduce reliance on imported sand, enhancing market growth

- The growing trend toward longer horizontal wells and multi-stage hydraulic fracturing techniques in North America continues to drive demand for higher volumes of frac sand, ensuring steady market expansion

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the global frac sand market, driven by increasing investments in the oil and gas industry, particularly in countries like China, India, and Australia

- China, with its rapidly growing energy demands and ongoing investments in shale oil and gas exploration, is emerging as a significant market for frac sand. The country's expanding energy sector and its push to boost domestic oil and gas production are fueling the demand for hydraulic fracturing technologies and proppants like frac sand

- India, with its rising energy consumption and exploration of domestic shale gas reserves, is also seeing a growing need for frac sand to support fracking operations in emerging shale fields

- Australia’s increasing exploration of unconventional oil and gas reserves, coupled with government initiatives to expand energy production, is contributing to the rising demand for frac sand in the region. Furthermore, the growing awareness of efficient fracking practices and the need for advanced technology in Asia-Pacific are key drivers of market growth

- The Asia-Pacific region’s rapid development of oil and gas infrastructure and rising adoption of hydraulic fracturing are expected to drive significant demand for frac sand over the coming years

Frac Sand Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- U.S. Silica Holdings, Inc. (U.S.)

- Hi-Crush Inc. (U.S.)

- Carbo Ceramics Inc. (U.S.)

- Smart Sand Inc. (U.S.)

- Emerge Energy Services LP (U.S.)

- Vista Proppants and Logistics (U.S.)

- Unimin Corporation (U.S.)

- Northern White Sand Company (U.S.)

- Sibelco (Belgium)

- Minerals Technologies Inc. (U.S.)

- Badger Mining Corporation (U.S.)

- Preferred Sands (U.S.)

- Foresight Energy (U.S.)

- Atlas Sand (U.S.)

- U.S. Silica Holdings Inc. (U.S.)

- Riverside Resources Inc. (U.S.)

- Smart Sand, Inc. (U.S.)

- Pioneer Natural Resources Co. (U.S.)

- Winchester Intermediary, Inc. (U.S.)

- Texas Frac Sands LLC (U.S.)

Latest Developments in Global Frac Sand Market

- In July 2024, Apollo Funds successfully completed the acquisition of U.S. Silica Holdings, a leading provider of diversified minerals and logistics solutions to the oil and gas industry. U.S. Silica expressed confidence in the strategic partnership, noting that Apollo’s vision for long-term growth aligns with the company’s objectives. The company underscored the strength of its solid foundation and committed team as pivotal elements for driving continued success in the future. Apollo Funds' acquisition of U.S. Silica in July 2024 strengthens its position in the global frac sand market, boosting growth and innovation in the oil and gas sector

- In November 2024, Covia Energy and Black Mountain Sand merged to create Iron Oak Energy Solutions, a prominent proppant supplier in North America. The newly formed company has an annual production capacity of 30 million tons, with operations strategically located in key shale basins. Headquartered in Houston, Texas, Iron Oak Energy is well-positioned to address the increasing market demand and pursue additional acquisitions. The merger of Covia Energy and Black Mountain Sand to form Iron Oak Energy Solutions in November 2024 strengthens its position as a leading proppant supplier, meeting the rising demand in the global frac sand market

- In October 2023, ProFrac Holding Corp. announced ongoing strategic evaluations for its wholly-owned subsidiary, Alpine Silica. These assessments involve considering options such as an initial public offering (IPO), potential sale or merger of Alpine Silica, and potential restructuring measures, aiming to optimize the subsidiary's value. ProFrac Holding Corp.'s strategic evaluations for its subsidiary Alpine Silica, including potential IPO or merger, highlight efforts to optimize its position in the global frac sand market

- In January 2023, U.S. Silica Holdings, Inc., a leading proppant sand manufacturer, announced significant expansion plans in the Permian Basin. This expansion includes the establishment of a new frac sand processing facility in Andrews County, Texas, slated for early 2024 launch with an annual production capacity of 2 million tons. Additionally, the company plans to augment railway infrastructure at its existing Kermit facility, boosting its yearly capacity by an additional 1 million tons. U.S. Silica Holdings' expansion in the Permian Basin, including a new frac sand processing facility and increased capacity, strengthens its position in the growing global frac sand market

- In March 2020, CARBO Ceramics entered into an agreement with Wilks Brothers, LLC and Equify Financial, LLC (collectively, the "Wilks Brothers") for the acquisition of the company through a debt-for-equity exchange under a Chapter 11 bankruptcy reorganization plan. To facilitate the transaction, CARBO voluntarily initiated a Chapter 11 proceeding in the U.S. Bankruptcy Court for the Southern District of Texas, Houston Division. The company expects to maintain normal operations throughout the bankruptcy process. CARBO Ceramics' acquisition under a Chapter 11 bankruptcy reorganization plan highlights industry consolidation efforts within the global frac sand market during challenging financial conditions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Frac Sand Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Frac Sand Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Frac Sand Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.