Global Fresh Food Market

Market Size in USD Billion

CAGR :

%

USD

3,532.05 Billion

USD

5,100.36 Billion

2024

2032

USD

3,532.05 Billion

USD

5,100.36 Billion

2024

2032

| 2025 –2032 | |

| USD 3,532.05 Billion | |

| USD 5,100.36 Billion | |

|

|

|

|

Fresh Food Market Size

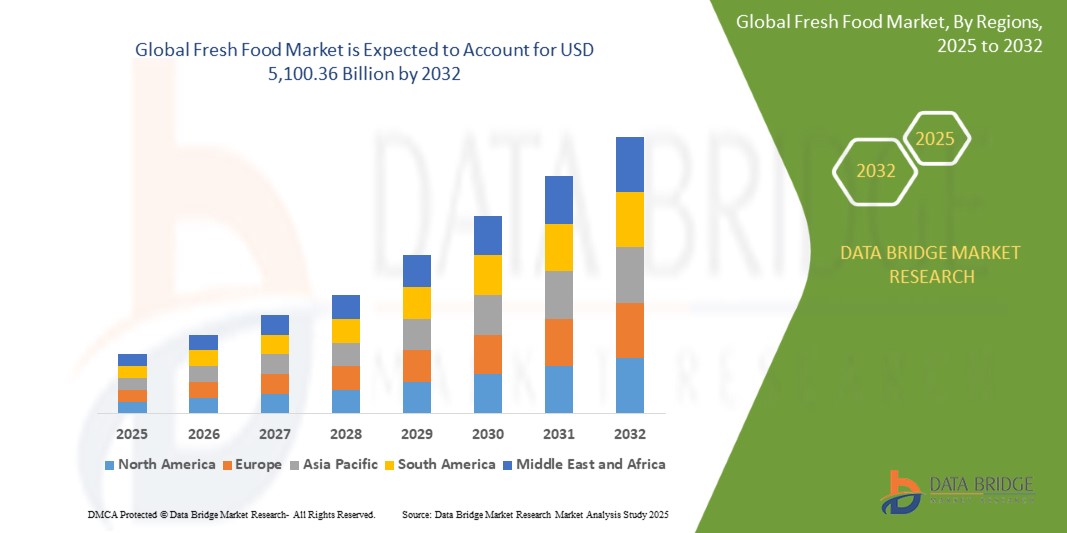

- The global fresh food market was valued at USD 3,532.05 billion in 2024 and is expected to reach USD 5,100.36 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.70%, primarily driven by increasing consumer awareness of health and wellness

- This growth is driven by rising disposable incomes and changing lifestyles are fueling demand for convenient, ready-to-eat, and fresh meal options

Fresh Food Market Analysis

- The fresh food market has witnessed substantial growth due to increasing consumer preference for organic, chemical-free, and minimally processed foods. The rising awareness of food safety, nutrition, and sustainability has driven demand for fresh fruits, vegetables, dairy, and meat products. In addition, growing concerns over preservatives and artificial additives are prompting consumers to shift towards fresh and naturally sourced ingredients. Advancements in cold storage, packaging, and supply chain technologies are further enhancing product quality and shelf life, making fresh food more accessible to a wider audience

- The market is primarily driven by the rising demand for ready-to-eat fresh food options, farm-to-table initiatives, and sustainable agricultural practices. Increasing investments in vertical farming, hydroponics, and organic food production are improving the availability and affordability of fresh produce. In addition, the expansion of direct-to-consumer sales models and the integration of AI-driven inventory management systems are optimizing distribution networks, reducing food waste, and ensuring year-round supply

- For instance, in the U.S., major grocery chains and online food delivery services are expanding their fresh food categories, offering farm-direct organic produce, dairy, and meats to meet growing consumer expectations for quality and transparency

- Globally, fresh food is becoming an integral part of dietary trends, with a significant shift towards healthier meal choices, functional nutrition, and environmentally responsible food sourcing. Innovations such as plant-based fresh protein alternatives, AI-driven precision farming, and smart packaging solutions are reshaping industry trends, enhancing food security, and driving long-term market expansion.

Report Scope and Fresh Food Market Segmentation

|

Attributes |

Fresh Food Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Fresh Food Market Trends

“Expansion of E-Commerce and Direct-to-Consumer Fresh Food Sales”

- The growing preference for online grocery shopping and direct-to-consumer (DTC) food delivery services is fueling the expansion of fresh food sales through digital platforms, offering consumers convenience, transparency, and farm-fresh quality

- Major food retailers, startups, and farm cooperatives are launching online marketplaces, subscription-based fresh food boxes, and farm-to-door delivery services to meet the rising demand for organic, locally sourced, and minimally processed food products

- Advancements in cold chain logistics, smart packaging, and AI-driven inventory management are improving the efficiency of online fresh food distribution, reducing spoilage, and ensuring timely delivery of perishable goods

For instance,

- In February 2024, Fresh Harvest launched a DTC online marketplace offering consumers access to organic fruits, vegetables, dairy, and meat, sourced directly from local farms

- Companies such as Thrive Market offer subscription-based grocery delivery services, providing organic and non-GMO foods tailored to various dietary needs

- Startups such as Guac specialize in AI-driven demand forecasting and replenishment solutions for grocery stores, aiming to reduce food waste and increase product availability

- As digital transformation in the food industry accelerates, e-commerce and DTC models will continue reshaping the fresh food market, offering consumers greater accessibility, freshness, and sustainable sourcing options while driving market growth and innovation

Fresh Food Market Dynamics

Driver

“Rising Demand for Farm-to-Table and Locally Sourced Fresh Food”

- Increasing consumer preference for transparency, traceability, and sustainable food sourcing is driving demand for farm-to-table and locally grown fresh food products, ensuring higher nutritional value, freshness, and minimal processing

- Restaurants, grocery stores, and online retailers are actively partnering with local farms and producers to offer seasonal, organic, and pesticide-free fresh food options, catering to the growing demand for clean-label and ethically sourced products

- The rise of farmers' markets, community-supported agriculture (CSA) programs, and direct farm-to-consumer sales is further accelerating fresh food consumption, as consumers seek fresher, healthier, and more eco-friendly food choices

For instance,

- Stores such as Seed to Table in Naples, Florida, have emphasized offering fresh, locally sourced produce to consumers

- Organizations such as Agricultural Connections offer Community Supported Agriculture (CSA) subscription boxes, providing customers with weekly fresh produce directly from local farms

- As consumer demand for fresh, sustainable, and locally sourced food continues to rise, the farm-to-table movement will play a crucial role in shaping the fresh food market, fostering healthier eating habits and environmentally responsible food choices

Opportunity

“Growing Adoption of Fresh Food in Sustainable Packaging Solutions”

- The rising demand for eco-friendly and biodegradable packaging is creating new opportunities for fresh food brands to enhance product appeal through sustainable and innovative packaging solutions that reduce environmental impact

- Food manufacturers and retailers are investing in compostable, recyclable, and plant-based packaging materials, ensuring longer shelf life, minimal plastic usage, and improved freshness of fresh food products

- Increasing government regulations and consumer awareness regarding plastic waste reduction and carbon footprint minimization are further driving the transition toward green packaging alternatives in the fresh food market

For instance,

- In November 2024, Bolthouse Fresh Foods unveiled compostable packaging for their baby carrots, which won the Best Sustainable Packaging Award at the International Fresh Produce Association’s Global Produce and Floral Show

- Upfield, in collaboration with Footprint, introduced an oil-proof, plastic-free, recyclable paper solution for its plant butters and spreads, aiming to replace up to two billion plastic tubs by 2030

- Researchers from Chungnam National University developed an edible, recyclable coating made of chitosan and gallic acid, designed to protect fruits from post-harvest degradation by preventing water loss and gas exchange

- As sustainability becomes a key industry focus, fresh food brands adopting eco-friendly packaging solutions will gain a competitive edge, enhancing consumer trust, reducing environmental impact, and supporting long-term market growth

Restraint/Challenge

“Limited Cold Chain Infrastructure Affecting Fresh Food Distribution”

- The lack of efficient cold chain logistics and temperature-controlled storage remains a major challenge in the fresh food market, leading to higher spoilage rates, reduced product quality, and increased supply chain inefficiencies

- Many developing regions face insufficient refrigerated transport, inadequate storage facilities, and power reliability issues, making it difficult to maintain the freshness and safety of perishable food products throughout the supply chain

- The high costs associated with cold storage investments, energy consumption, and advanced preservation technologies further limit the ability of small and mid-sized producers to expand their fresh food distribution networks

For instance,

- In February 2025, Nigeria's horticulture sector faced challenges from high freight costs and inadequate cold chain infrastructure, making it difficult for exporters to compete globally and resulting in potential losses of perishable goods

- To overcome these challenges, industry players must invest in advanced refrigeration technologies, improve cold storage capacity, and collaborate with logistics providers to ensure efficient and cost-effective fresh food distribution worldwide

Fresh Food Market Scope

The market is segmented on the basis of product type and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Distribution Channel |

|

Fresh Food Market Regional Analysis

“North America is the Dominant Region in the Fresh Food Market”

- North America is expected to lead the fresh food market in revenue and market share, driven by increasing consumer awareness of healthy lifestyles

- Higher disposable income levels are fueling demand for convenient food products, supporting market expansion

- There is a significant shift towards healthier and more convenient food choices, reflecting evolving consumer behavior

- With these trends, North America will remain a dominant force in the global fresh food market in the foreseeable future

“Asia-Pacific is projected to register the Highest Growth Rate”

- Asia-Pacific is projected to be the fastest-growing region due to changing consumer eating habits and rapid urbanization, especially in India and China

- The expanding middle-class population is driving higher spending on household groceries, boosting market demand

- The region's dynamic and evolving market landscape is expected to fuel continued industry growth

- With these factors in play, Asia-Pacific is set to emerge as a key driver of global market expansion in the coming years

Fresh Food Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Del Monte Foods Corporation II Inc (U.S.)

- Dole Plc (U.S.)

- Greenyard (Belgium)

- NatureSweet Tomatoes (U.S.)

- Cargill, Incorporated (U.S.)

- Hain Celestial (U.S.)

- Dairy Farmers of America, Inc. (U.S.)

- General Mills Inc. (U.S.)

- Danone (France)

- UNFI (U.S.)

- GCMMF (India)

- Organic Valley (U.S.)

- Conagra Brands, Inc. (U.S.)

- Eden Foods (U.S.)

- SunOpta (Canada)

- Organic Store (U.S.)

- Taylor Farms (U.S.)

Latest Developments in Global Fresh Food Market

- In June 2023, FreshPoint Inc. acquired BIX Produce to expand its customer base, introduce freshly cut items, and enhance its specialty offerings in new markets. This strategic move is set to strengthen FreshPoint’s market presence and drive growth in untapped regions

- In January 2023, Dole plc sold its Fresh Vegetables Division to Fresh Express Incorporated to drive innovation, efficiency, and food safety while enhancing future product offerings and services. This acquisition is expected to boost Fresh Express’s position in the fresh produce sector

- In December 2022, Keelings partnered with the charitable organization FareShare to combat food waste and alleviate hunger by providing nutritious and fresh food to families and children. This collaboration aims to promote sustainability and support vulnerable communities

- In July 2022, Wayne Farms and Sanderson Farms merged to establish Wayne-Sanderson Farms, consolidating their presence in the poultry industry. This merger is set to enhance operational efficiency and strengthen their market footprint

- In June 2021, iD Fresh Food, headquartered in Bengaluru, announced plans to expand its workforce by hiring 500 individuals across different sectors to support its operations in India and the Gulf Cooperation Council (GCC) region. Despite pandemic challenges, this hiring initiative demonstrates iD Fresh Food’s resilience and commitment to growth

- In March 2021, iD Fresh Food launched its first online store, introducing iD Instant Filter Coffee Liquid as part of its shift toward direct consumer engagement and adaptation to e-commerce trends. This initiative is expected to strengthen its digital presence and broaden its customer reach

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL FRESH FOOD MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 ARRIVING AT THE GLOBAL FRESH FOOD MARKET

2.3 VENDOR POSITIONING GRID

2.4 TECHNOLOGY LIFE LINE CURVE

2.5 MARKET GUIDE

2.6 COMPANY POSITIONING GRID

2.7 COMAPANY MARKET SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 DEMAND AND SUPPLY-SIDE VARIABLES

2.1 CONSUMPTION TREND OF END PRODUCTS

2.11 TOP TO BOTTOM ANALYSIS

2.12 STANDARDS OF MEASUREMENT

2.13 VENDOR SHARE ANALYSIS

2.14 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.15 DATA POINTS FROM KEY SECONDARY DATABASES

2.16 GLOBAL FRESH FOOD MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 SUPPLY CHAIN ANALYSIS

5.2 IMPORT-EXPORT SCENARIO

5.3 PRIVATE LABEL VS BRAND ANALYSIS

5.4 SHOPPING BEHAVIOUR AND DYNAMICS

5.4.1 RECOMMENDATION FROM FAMILY & FRIENDS

5.4.2 RESEARCH

5.4.3 IMPULSIVE

5.4.4 ADVERTISEMENT

5.4.4.1. TELEVISION ADVERTISEMENT

5.4.4.2. ONLINE ADVERTISEMENT

5.4.4.3. IN-STORE ADVERTISEMENT

5.4.4.4. OUTDOOR ADVERTISEMENT

5.5 PROMOTIONAL ACTIVITIES

5.6 NEW PRODUCT LAUNCH STRATEGY

5.6.1 NUMBER OF NEW PRODUCT LAUNCH

5.6.1.1. LINE EXTENSTION

5.6.1.2. NEW PACKAGING

5.6.1.3. RE-LAUNCHED

5.6.1.4. NEW FORMULATION

5.6.2 DIFFERNTIAL PRODUCT OFFERING

5.6.3 MEETING CONSUMER REQUIREMENT

5.6.4 PACKAGE DESIGNING

5.6.5 PRICING ANALYSIS

5.6.6 PRODUCT POSITIONING

5.7 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMERS

5.8 MARKETING STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 NEW PRODUCT LAUNCHES

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING ANALYSIS

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 BRAND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 SUPPLY CHAIN ANALYSIS

11.1 OVERVIEW

11.2 LOGISTIC COST SCENARIO

11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

12 CLIMATE CHANGE SCENARIO

12.1 ENVIRONMENTAL CONCERNS

12.2 INDUSTRY RESPONSE

12.3 GOVERNMENT’S ROLE

12.4 ANALYST RECOMMENDATIONS

13 GLOBAL FRESH FOOD MARKET , BY PRODUCT TYPE, 2018-2032 (USD MILLION) (MARKET VOLUME)

13.1 OVERVIEW

13.2 BAKERY PRODUCTS

13.2.1 BREADS AND ROLLS

13.2.2 PUFFS & PIES (PREPACKED)

13.2.3 DONUTS AND MUFFINS (PREPACKED)

13.2.4 CAKES, PASTRIES & TRUFFLE

13.2.5 BISCUIT

13.2.6 TART & PIES

13.2.7 BROWNIES

13.2.8 COOKIES & CRACKERS

13.2.9 TORTILLA

13.2.10 OTHERS

13.3 PLANT BASED MEAT PRODUCTS

13.3.1 PLANT BASED MEAT PRODUCTS, BY TYPE

13.3.1.1. PLANT BASED MEAT PATTIES

13.3.1.2. PLANT BASED SAUSAGES

13.3.1.3. PLANT BASED STRIPS & NUGGETS

13.3.1.4. PLANT BASED MEATBALLS

13.3.1.5. PLANT BASED MEAT JERKY

13.3.1.6. OTHERS

13.3.2 PLANT BASED MEAT PRODUCTS BY SOURCE

13.3.2.1. SOY

13.3.2.2. ALMOND

13.3.2.3. HEMP

13.3.2.4. COCONUT

13.3.2.5. RICE

13.3.2.6. CASHEW

13.3.2.7. PEA

13.3.2.8. OATS

13.3.2.9. POTATO

13.3.2.10. SEITAN

13.3.2.11. MUSHROOM

13.3.2.12. QUORN

13.3.2.13. NATTO

13.3.2.14. LEGUMES

13.3.2.15. OTHERS

13.4 SEAFOOD

13.5 SPECIALTY CHEESE

13.5.1 ANIMAL BASED CHEESE

13.5.1.1. COW

13.5.1.2. BUFFALO

13.5.1.3. GOAT

13.5.1.4. SHEEP

13.5.1.5. OTHERS

13.5.2 PLANT BASED CHEESE

13.5.2.1. SOY

13.5.2.2. ALMOND

13.5.2.3. HEMP

13.5.2.4. COCONUT

13.5.2.5. RICE

13.5.2.6. CASHEW

13.5.2.7. PEA

13.5.2.8. OATS

13.5.2.9. POTATO

13.5.2.10. SEITAN

13.5.2.11. MUSHROOMS

13.5.2.12. QUORN

13.5.2.13. NATTO

13.5.2.14. LEGUMES

13.5.2.15. OTHERS

13.6 SAVORY SNACKS

13.6.1 WAFERS& CHIPS

13.6.2 PRETZELS

13.6.3 CRACKERS & CRISPBREADS

13.6.4 BISCUITS & COOKIES

13.6.5 OTHERS

13.7 CEREALS

13.7.1 COLD CEREALS

13.7.2 HOT CEREALS

13.8 SAUCES, CONDIMENTS, DRESSINGS, AND MARINADES

13.9 FRUIT SPREADS, JAMS, JELLY AND PRESERVES

13.1 FRUITS & VEGETABLES

13.10.1 FRUITS

13.10.1.1. FRUITS, BY TYPE

13.10.1.1.1. ORANGE

13.10.1.1.2. GRAPE

13.10.1.1.3. PLUM

13.10.1.1.4. POMEGRANTE

13.10.1.1.5. MELON

13.10.1.1.6. APPLE

13.10.1.1.7. MANGO

13.10.1.1.8. LEMON

13.10.1.1.9. PINEAPPLE

13.10.1.1.10. PEACH

13.10.1.1.11. KIWI

13.10.1.1.12. PASSION FRUIT

13.10.1.1.13. BANANA

13.10.1.1.13.1 CHERRY

13.10.1.1.13.2 BERRY

13.10.1.1.13.3 STRAWBERRY

13.10.1.1.13.4 BLUEBERRY

13.10.1.1.13.5 RASPBERRY

13.10.1.1.13.6 WILD BERRY

13.10.1.1.13.7 GRAPES

13.10.1.1.13.8 ACAI BERRY

13.10.1.1.13.9 GOJI BERRY

13.10.1.1.13.10 JUNIPER BERRY

13.10.1.1.13.11 MARIONBERRY

13.10.1.1.13.12 GOOSEBERRY

13.10.1.1.14. OTHERS

13.10.2 VEGETABLES

13.10.2.1. LEAFY VEGETABLES, BY TYPES

13.10.2.1.1. LEAFY GREEN

13.10.2.1.2. CRUCIFEROUS VEGETABLES

13.10.2.1.3. MARROW

13.10.2.1.4. PEPPER

13.10.2.1.5. ROOT

13.10.2.1.6. EDIBLE PLANT STEM

13.10.2.1.7. OTHERS

13.11 CONFECTIONERY

13.11.1 HARD-BOILED SWEETS

13.11.2 MINTS

13.11.3 GUMS & JELLIES

13.11.4 CHOCOLATE

13.11.5 CHOCOLATE SYRUPS

13.11.6 CARAMELS & TOFFEES

13.11.7 OTHERS

13.12 PROCESSED FOOD

13.12.1 READY MEALS

13.12.2 SAUCES, DRESSINGS AND CONDIMENTS

13.12.3 SOUPS

13.12.4 JAMS, PRESERVES & MARMALADES

13.12.5 CANNED FRUITS & VEGETABLES

13.12.6 FRUIT & VEGETABLE PUREE

13.12.7 OTHERS

13.13 NUTS & SEED BUTTER

13.13.1 ALMOND

13.13.2 CASHEW

13.13.3 PISTACHIO

13.13.4 OTHERS

13.14 PICKLES

13.15 DAIRY PRODUCTS

13.15.1 YOGURT

13.15.2 ICE CREAM

13.15.3 CHEESE

13.15.4 OTHERS

13.16 NUTRITIONAL BARS

13.16.1 CEREAL BARS

13.16.1.1. GRANOLA BARS

13.16.1.2. OAT BARS

13.16.1.3. RICE BARS

13.16.1.4. MIXED CEREAL BARS

13.16.1.5. OTHERS

13.16.2 NUT BARS

13.16.2.1. ALMOND

13.16.2.2. CASHEW

13.16.2.3. PEANUT

13.16.2.4. DATES

13.16.2.5. HAZELNUTS

13.16.2.6. OTHERS

13.17 CONVENIENCE FOOD

13.17.1 NOODLES

13.17.1.1. NOODLES, BY TYPE

13.17.1.1.1. REGULAR NOODLES

13.17.1.1.2. INSTANT NOODLES

13.17.2 PIZZA & PASTA

13.17.3 SANCKS & EXTRUDED SNACKS

13.17.4 BITES

13.17.5 WEDGES

13.17.6 NUGGETS

13.17.7 OTHERS

13.18 OTHERS

14 GLOBAL FRESH FOOD MARKET, BY NATURE, 2018-2032 (USD MILLION)

14.1 OVERVIEW

14.2 ORGANIC

14.3 CONVENTIONAL

15 GLOBAL FRESH FOOD MARKET, BY BRAND CATEGORY, 2018-2032 (USD MILLION)

15.1 OVERVIEW

15.2 BRANDED

15.3 PRIVATE LABEL

16 GLOBAL FRESH FOOD MARKET, BY PACKAGING, 2018-2032 (USD MILLION)

16.1 OVERVIEW

16.2 POUCHES/SACHETS

16.3 BOTTLES

16.3.1 GLASS BOTTLES

16.3.2 PLASTIC BOTTLES

16.4 TRAYS

16.5 CANS

16.6 BOXES

16.7 JARS AND CONTAINERS

16.8 OTHERS

17 GLOBAL FRESH FOOD MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

17.1 OVERVIEW

17.2 MASS

17.3 PREMIUM

17.4 LUXURY

18 GLOBAL FRESH FOOD MARKET, BY END USER, 2018-2032 (USD MILLION)

18.1 OVERVIEW

18.2 HOUSEHOLD/ RETAIL

18.3 FOOD SERVICE SECTOR

18.3.1 HOTEL

18.3.2 RESTAURANTS

18.3.3 CAFÉ

18.3.4 BARS / CLUBS

18.3.5 OTHERS

19 GLOBAL FRESH FOOD MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

19.1 OVERVIEW

19.2 STORE-BASED RETAILERS

19.2.1 GROCERY RETAILERS

19.2.2 MODERN GROCERY RETAILERS

19.2.3 CONVENIENCE STORES

19.2.4 DISCOUNTERS STORES

19.2.5 FORECOURT RETAILERS

19.2.6 HYPERMARKETS/ SUPERMARKETS

19.2.7 TRADITIONAL GROCERY STORES

19.2.8 INDEPENDENT SMALL GROCERS’ STORES

19.2.9 OTHERS

19.3 NON-STORE RETAILERS

19.3.1 VENDING

19.3.2 COMPANY OWNED WEBSITE

19.3.3 E-COMMERCE WEBSITES

20 GLOBAL FRESH FOOD MARKET, BY REGION, 2018-2032 (USD MILLION) (MARKET VOLUME)

20.1 GLOBAL FRESH FOOD MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

20.2 NORTH AMERICA

20.2.1 U.S.

20.2.2 CANADA

20.2.3 MEXICO

20.3 EUROPE

20.3.1 GERMANY

20.3.2 U.K.

20.3.3 ITALY

20.3.4 FRANCE

20.3.5 SPAIN

20.3.6 SWITZERLAND

20.3.7 NETHERLANDS

20.3.8 BELGIUM

20.3.9 RUSSIA

20.3.10 DENMARK

20.3.11 SWEDEN

20.3.12 POLAND

20.3.13 TURKEY

20.3.14 REST OF EUROPE

20.4 ASIA-PACIFIC

20.4.1 JAPAN

20.4.2 CHINA

20.4.3 SOUTH KOREA

20.4.4 INDIA

20.4.5 AUSTRALIA

20.4.6 SINGAPORE

20.4.7 THAILAND

20.4.8 INDONESIA

20.4.9 MALAYSIA

20.4.10 PHILIPPINES

20.4.11 NEW ZEALAND

20.4.12 VIETNAM

20.4.13 REST OF ASIA-PACIFIC

20.5 SOUTH AMERICA

20.5.1 BRAZIL

20.5.2 ARGENTINA

20.5.3 REST OF SOUTH AMERICA

20.6 MIDDLE EAST AND AFRICA

20.6.1 SOUTH AFRICA

20.6.2 UAE

20.6.3 SAUDI ARABIA

20.6.4 OMAN

20.6.5 QATAR

20.6.6 KUWAIT

20.6.7 REST OF MIDDLE EAST AND AFRICA

21 GLOBAL FRESH FOOD MARKET, COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: GLOBAL

21.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

21.3 COMPANY SHARE ANALYSIS: EUROPE

21.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

21.5 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

21.6 MERGERS & ACQUISITIONS

21.7 NEW PRODUCT DEVELOPMENT & APPROVALS

21.8 EXPANSIONS & PARTNERSHIP

21.9 REGULATORY CHANGES

22 GLOBAL FRESH FOOD MARKET - SWOT AND DBMR ANALYSIS

23 GLOBAL FRESH FOOD MARKET, COMPANY PROFILES

23.1 GENERAL MILLS, INC.

23.1.1 COMPANY OVERVIEW

23.1.2 REVENUE ANALYSIS

23.1.3 PRODUCT PORTFOLIO

23.1.4 RECENT DEVELOPMENTS

23.2 DANONE

23.2.1 COMPANY OVERVIEW

23.2.2 REVENUE ANALYSIS

23.2.3 PRODUCT PORTFOLIO

23.2.4 RECENT DEVELOPMENTS

23.3 UNITED NATURAL FOODS, INC.

23.3.1 COMPANY OVERVIEW

23.3.2 REVENUE ANALYSIS

23.3.3 PRODUCT PORTFOLIO

23.3.4 RECENT DEVELOPMENTS

23.4 AMY’S KITCHEN

23.4.1 COMPANY OVERVIEW

23.4.2 REVENUE ANALYSIS

23.4.3 PRODUCT PORTFOLIO

23.4.4 RECENT DEVELOPMENTS

23.5 ORGANIC VALLEY

23.5.1 COMPANY OVERVIEW

23.5.2 REVENUE ANALYSIS

23.5.3 PRODUCT PORTFOLIO

23.5.4 RECENT DEVELOPMENTS

23.6 DOLE FOOD COMPANY, INC.

23.6.1 COMPANY OVERVIEW

23.6.2 REVENUE ANALYSIS

23.6.3 PRODUCT PORTFOLIO

23.6.4 RECENT DEVELOPMENTS

23.7 PEPSICO INC.

23.7.1 COMPANY OVERVIEW

23.7.2 REVENUE ANALYSIS

23.7.3 PRODUCT PORTFOLIO

23.7.4 RECENT DEVELOPMENTS

23.8 THE KROGER CO.

23.8.1 COMPANY OVERVIEW

23.8.2 REVENUE ANALYSIS

23.8.3 PRODUCT PORTFOLIO

23.8.4 RECENT DEVELOPMENTS

23.9 CLIF BAR & COMPANY

23.9.1 COMPANY OVERVIEW

23.9.2 REVENUE ANALYSIS

23.9.3 PRODUCT PORTFOLIO

23.9.4 RECENT DEVELOPMENTS

23.1 THE KRAFT HEINZ COMPANY

23.10.1 COMPANY OVERVIEW

23.10.2 REVENUE ANALYSIS

23.10.3 PRODUCT PORTFOLIO

23.10.4 RECENT DEVELOPMENTS

23.11 HAIN CELESTIAL

23.11.1 COMPANY OVERVIEW

23.11.2 REVENUE ANALYSIS

23.11.3 PRODUCT PORTFOLIO

23.11.4 RECENT DEVELOPMENTS

23.12 DAIRY FARMERS OF AMERICA, INC.

23.12.1 COMPANY OVERVIEW

23.12.2 REVENUE ANALYSIS

23.12.3 PRODUCT PORTFOLIO

23.12.4 RECENT DEVELOPMENTS

23.13 THE HERSHEY COMPANY

23.13.1 COMPANY OVERVIEW

23.13.2 REVENUE ANALYSIS

23.13.3 PRODUCT PORTFOLIO

23.13.4 RECENT DEVELOPMENTS

23.14 CONAGRA BRANDS, INC.

23.14.1 COMPANY OVERVIEW

23.14.2 REVENUE ANALYSIS

23.14.3 PRODUCT PORTFOLIO

23.14.4 RECENT DEVELOPMENTS

23.15 NESTLÉ

23.15.1 COMPANY OVERVIEW

23.15.2 REVENUE ANALYSIS

23.15.3 PRODUCT PORTFOLIO

23.15.4 RECENT DEVELOPMENTS

23.16 EDEN FOODS

23.16.1 COMPANY OVERVIEW

23.16.2 REVENUE ANALYSIS

23.16.3 PRODUCT PORTFOLIO

23.16.4 RECENT DEVELOPMENTS

23.17 SUNOPTA

23.17.1 COMPANY OVERVIEW

23.17.2 REVENUE ANALYSIS

23.17.3 PRODUCT PORTFOLIO

23.17.4 RECENT DEVELOPMENTS

23.18 UNCLE MATT'S ORGANIC

23.18.1 COMPANY OVERVIEW

23.18.2 REVENUE ANALYSIS

23.18.3 PRODUCT PORTFOLIO

23.18.4 RECENT DEVELOPMENTS

23.19 THE COCA-COLA COMPANY

23.19.1 COMPANY OVERVIEW

23.19.2 REVENUE ANALYSIS

23.19.3 PRODUCT PORTFOLIO

23.19.4 RECENT DEVELOPMENTS

23.2 LOUIS DREYFUS COMPANY

23.20.1 COMPANY OVERVIEW

23.20.2 REVENUE ANALYSIS

23.20.3 PRODUCT PORTFOLIO

23.20.4 RECENT DEVELOPMENTS

23.21 LUNDBERG FAMILY FARMS

23.21.1 COMPANY OVERVIEW

23.21.2 REVENUE ANALYSIS

23.21.3 PRODUCT PORTFOLIO

23.21.4 RECENT DEVELOPMENTS

23.22 NATURE'S PATH

23.22.1 COMPANY OVERVIEW

23.22.2 REVENUE ANALYSIS

23.22.3 PRODUCT PORTFOLIO

23.22.4 RECENT DEVELOPMENTS

23.23 STONYFIELD

23.23.1 COMPANY OVERVIEW

23.23.2 REVENUE ANALYSIS

23.23.3 PRODUCT PORTFOLIO

23.23.4 RECENT DEVELOPMENTS

23.24 BARNANA

23.24.1 COMPANY OVERVIEW

23.24.2 REVENUE ANALYSIS

23.24.3 PRODUCT PORTFOLIO

23.24.4 RECENT DEVELOPMENTS

23.25 PATAGONIA PROVISIONS

23.25.1 COMPANY OVERVIEW

23.25.2 REVENUE ANALYSIS

23.25.3 PRODUCT PORTFOLIO

23.25.4 RECENT DEVELOPMENTS

23.26 ONE DEGREE ORGANICS

23.26.1 COMPANY OVERVIEW

23.26.2 REVENUE ANALYSIS

23.26.3 PRODUCT PORTFOLIO

23.26.4 RECENT DEVELOPMENTS

23.27 FRONTIER CO-OP

23.27.1 COMPANY OVERVIEW

23.27.2 REVENUE ANALYSIS

23.27.3 PRODUCT PORTFOLIO

23.27.4 RECENT DEVELOPMENTS

23.28 NOW FOODS

23.28.1 COMPANY OVERVIEW

23.28.2 REVENUE ANALYSIS

23.28.3 PRODUCT PORTFOLIO

23.28.4 RECENT DEVELOPMENTS

23.29 PLUM ORGANICS

23.29.1 COMPANY OVERVIEW

23.29.2 REVENUE ANALYSIS

23.29.3 PRODUCT PORTFOLIO

23.29.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

24 CONCLUSION

25 REFERENCE

26 QUESTIONNAIRE

27 RELATED REPORTS

28 ABOUT DATA BRIDGE MARKET RESEARCH

Global Fresh Food Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fresh Food Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fresh Food Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.