Global Fried Chicken Franchise Market

Market Size in USD Billion

CAGR :

%

USD

51.65 Billion

USD

77.48 Billion

2024

2032

USD

51.65 Billion

USD

77.48 Billion

2024

2032

| 2025 –2032 | |

| USD 51.65 Billion | |

| USD 77.48 Billion | |

|

|

|

|

Fried Chicken Franchise Market Size

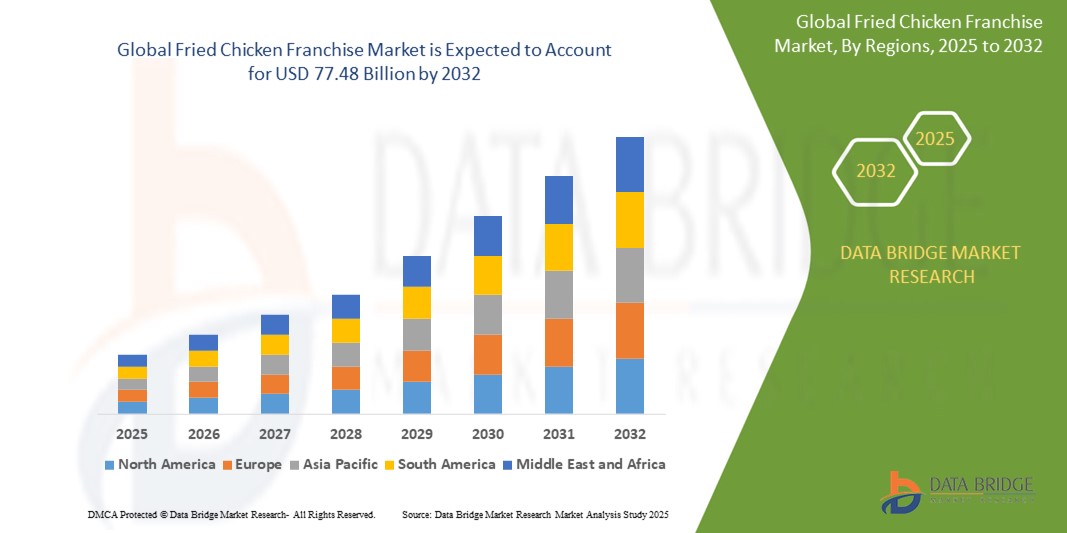

- The global fried chicken franchise market size was valued at USD 51.65 billion in 2024 and is expected to reach USD 77.48 billion by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely fueled by rising demand for convenient, ready-to-eat meals and the global expansion of quick-service restaurant (QSR) chains, which are capitalizing on evolving consumer preferences and busy urban lifestyles

- Furthermore, increasing disposable incomes, digital ordering platforms, and aggressive franchise strategies in emerging markets are establishing fried chicken franchises as a dominant force in the fast-food sector. These converging factors are accelerating franchise penetration and significantly boosting the industry's growth

Fried Chicken Franchise Market Analysis

- Fried chicken franchises, offering quick-service and indulgent meal options, are becoming increasingly popular across global foodservice markets due to their consistent taste, broad consumer appeal, and operational scalability across dine-in, takeout, and delivery formats

- The escalating demand for fried chicken franchises is primarily driven by rising urbanization, changing food consumption patterns favoring convenience foods, expanding middle-class populations, and the aggressive expansion strategies of major QSR brands in emerging and developed markets

- North America dominated the fried chicken franchise market with a share of 38.5% in 2024, due to the strong presence of established franchise chains, evolving consumer preferences, and high demand for convenient, indulgent meal options

- Asia-Pacific is expected to be the fastest growing region in the fried chicken franchise market during the forecast period due to rapid urbanization, a rising young population, and increasing disposable income in countries such as China, India, and the Philippines

- Takeout and delivery segment dominated the market with a market share of 49.4% due to consumer preference for convenience, especially during and post-pandemic. Strategic partnerships with third-party delivery platforms and the rise of dedicated mobile apps have expanded franchise reach while ensuring timely service and order tracking

Report Scope and Fried Chicken Franchise Market Segmentation

|

Attributes |

Fried Chicken Franchise Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fried Chicken Franchise Market Trends

“Rising Trend of Premiumization and Flavor Innovation”

- A significant and accelerating trend in the global fried chicken franchise market is the growing emphasis on premiumization and flavor innovation, driven by evolving consumer tastes, the desire for novelty, and demand for elevated fast-food experiences. This trend is boosting franchise competitiveness as brands diversify offerings with bold flavors, higher-quality ingredients, and unique menu items

- For instance, KFC has launched Korean-inspired crispy chicken, while Popeyes gained widespread popularity with its spicy chicken sandwich—both reflecting a strategic shift toward globally influenced, differentiated menu options that resonate with younger and more adventurous consumers

- The demand for gourmet-style fast food and fusion-inspired flavor combinations is reshaping franchise menus, with consumers willing to pay more for quality, variety, and originality. This pushes franchises to focus on limited-time offerings, regional specialties, and artisanal preparation to stand out in a saturated QSR market

- Flavor innovation aligns with regional consumer preferences, enabling market penetration in diverse geographies while encouraging customer loyalty through exclusivity and taste-driven differentiation. Brands such as Wingstop and Zaxby’s have also seen success by offering unique seasoning blends and heat levels, tapping into the hot and spicy flavor trend

- The seamless integration of global taste trends and localized menus makes flavor innovation an essential component of franchise growth. With consumers increasingly seeking culinary experiences over routine meals, franchises investing in R&D and menu experimentation are positioned for long-term success

- As the trend toward flavor exploration continues to grow across the globe, premiumization and innovation are becoming key differentiators in attracting new demographics, strengthening brand equity, and expanding market share for leading fried chicken franchises

Fried Chicken Franchise Market Dynamics

Driver

“Expanding Quick Service Restaurant (QSR) Footprint”

- The accelerating global expansion of quick service restaurant (QSR) networks, particularly in urban and emerging markets, is a major driver fueling the growth of the fried chicken franchise market. The rising demand for fast, affordable, and consistent meal options continues to support the rapid scaling of franchise outlets across regions

- For instance, Bojangles announced plans to open 20 new locations on the U.S. West Coast starting in Las Vegas, while international brands such as Cravy Chicken are entering the Indian market through franchise expos, signaling aggressive global expansion strategies

- As consumers increasingly turn to fast-casual dining options for convenience and value, the scalability of the franchise model enables brands to meet demand efficiently while maintaining operational consistency. Fried chicken, being a universally appealing comfort food, benefits significantly from this growth trajectory

- The streamlined setup, established brand equity, and proven business models associated with QSR franchises make them attractive for investors and entrepreneurs, further accelerating market penetration. In addition, strategic partnerships, co-branding, and location diversification—including drive-thrus, malls, and urban food courts—enhance accessibility and customer reach

- The global momentum of QSR growth, especially in Asia-Pacific, Latin America, and the Middle East, ensures continued demand for fried chicken franchise models as they adapt to local tastes and consumption patterns while maintaining core offerings

Restraint/Challenge

“Rising Operational and Supply Chain Costs”

- Concerns surrounding rising operational and supply chain costs pose a significant challenge to the competitiveness and profitability of fried chicken franchise businesses. Fluctuating prices of key inputs such as poultry, cooking oil, packaging materials, and labor are pressuring margins and impacting pricing strategies

- For instance, major franchises such as KFC and Popeyes have faced increased costs due to global supply chain disruptions, inflationary pressures, and sourcing constraints, particularly in logistics and raw material procurement, leading to revised menu pricing and profit margin compression

- Addressing these cost challenges requires franchises to enhance supply chain efficiency, renegotiate vendor contracts, and invest in automation or cost-saving technologies. Moreover, maintaining food quality and service standards while managing increased overheads remains a difficult balance for operators

- While efforts such as centralized procurement, local sourcing, and strategic partnerships can mitigate some risks, unpredictable spikes in fuel, labor, and commodity prices continue to affect profitability and expansion plans across the franchise landscape

- Overcoming these challenges will require adaptive strategies focused on operational resilience, diversified sourcing models, and lean cost structures to maintain long-term viability in an increasingly cost-sensitive and competitive market

Fried Chicken Franchise Market Scope

The market is segmented on the basis of product offering, consumer demographics, and distribution channel.

• By Product Offering

On the basis of product offering, the fried chicken franchise market is segmented into Traditional Fried Chicken, Spicy Fried Chicken, Boneless Chicken Options, Chicken Sandwiches, and Side Dishes. The traditional fried chicken segment dominates the largest market revenue share in 2024, driven by its timeless appeal and strong association with brand identity across major chains. Its popularity is rooted in its familiar taste, crispy texture, and cultural resonance in comfort food, making it a staple choice for a broad demographic. Many franchises continue to promote traditional fried chicken through family meals and combo offerings, reinforcing its position as a core revenue generator.

The chicken sandwiches segment is anticipated to witness the fastest growth rate from 2025 to 2032, spurred by the ongoing “chicken sandwich wars” and shifting consumer preferences toward portable, protein-rich meal options. Franchise brands are heavily investing in chicken sandwich innovation, leveraging social media trends and limited-time launches to drive consumer engagement. The versatility in flavors, customizable toppings, and premium bun options also appeal to younger consumers seeking both novelty and convenience.

• By Consumer Demographics

On the basis of consumer demographics, the market is segmented into Age Group, Income Level, and Lifestyle Preferences. The age group of 18–34 years holds the largest market share in 2024, driven by their frequent consumption of fast food and high engagement with digital ordering platforms. This group often values convenience, affordability, and new taste experiences, making them a key target audience for fried chicken promotions and limited-time offerings.

The lifestyle preference segment aligned with health-conscious but indulgent eaters is expected to grow fastest from 2025 to 2032. These consumers seek a balance between taste and perceived quality, leading franchises to offer boneless or air-fried alternatives, better-for-you sides, and transparency in sourcing. Growth in this segment is also fueled by rising disposable incomes and increased demand for customizable meal experiences.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into On-premise Dining, Takeout and Delivery, and Online Ordering. Takeout and delivery dominated the largest market share 49.4% in 2024, largely due to consumer preference for convenience, especially during and post-pandemic. Strategic partnerships with third-party delivery platforms and the rise of dedicated mobile apps have expanded franchise reach while ensuring timely service and order tracking.

Online ordering is projected to experience the fastest CAGR from 2025 to 2032, supported by technological advancements and increased smartphone penetration. Enhanced digital interfaces, loyalty programs, and personalized deals are encouraging more consumers to place orders online. Franchises are also leveraging data analytics to optimize menus and promotional strategies, driving the acceleration of digital sales channels.

Fried Chicken Franchise Market Regional Analysis

- North America dominated the fried chicken franchise market with the largest revenue share of 38.5% in 2024, driven by the strong presence of established franchise chains, evolving consumer preferences, and high demand for convenient, indulgent meal options

- The region’s consumer base highly favors fried chicken due to its cultural relevance, consistent product quality, and wide availability through dine-in, drive-thru, and delivery platforms

- North America’s market strength is further reinforced by aggressive marketing strategies, product innovation (such as chicken sandwiches and boneless variants), and a robust infrastructure supporting nationwide franchise scalability

U.S. Fried Chicken Franchise Market Insight

The U.S. fried chicken franchise market captured the largest revenue share in 2024 within North America, fueled by a deep-rooted fast-food culture, continuous menu innovation, and the dominance of national and regional franchise brands. Consumer demand for value meals, coupled with rising digital ordering and loyalty programs, supports sustained market growth. Moreover, the popularity of comfort food, especially among millennials and Gen Z, continues to boost sales across dine-in, drive-thru, and third-party delivery channels.

Europe Fried Chicken Franchise Market Insight

The Europe fried chicken franchise market is projected to grow at a steady CAGR throughout the forecast period, supported by increasing westernization of diets and the growing appeal of American-style fast food. Expansion of franchise outlets across urban centers and the rising preference for convenient, flavorful protein options are key contributors. The region is witnessing increased demand for spicy and boneless varieties, driven by shifting dietary habits and youth-centric marketing approaches.

U.K. Fried Chicken Franchise Market Insight

The U.K. fried chicken franchise market is anticipated to grow at a notable CAGR during the forecast period, driven by the popularity of quick-service meals, rising multicultural food influence, and the strong performance of chicken-centric brands. A surge in demand for portable options such as chicken wraps and sandwiches, along with strategic high street and delivery platform presence, is expected to fuel expansion. The ongoing trend toward halal-certified and diverse flavor profiles further enhances market penetration.

Germany Fried Chicken Franchise Market Insight

The Germany fried chicken franchise market is expected to expand consistently over the forecast period, driven by urbanization, growing interest in American fast-food formats, and increased adoption of digital ordering. The market is benefiting from expanding franchise locations in metro areas and the growing demand for high-protein, handheld food items. German consumers are increasingly attracted to crispy, seasoned options as an alternative to traditional fast-food burgers.

Asia-Pacific Fried Chicken Franchise Market Insight

The Asia-Pacific fried chicken franchise market is projected to grow at the fastest CAGR from 2025 to 2032, fueled by rapid urbanization, a rising young population, and increasing disposable income in countries such as China, India, and the Philippines. The adoption of Western-style fast food is accelerating, especially in tier-1 and tier-2 cities, where franchises are leveraging localization strategies, mobile app ordering, and promotional pricing to attract a broader customer base.

Japan Fried Chicken Franchise Market Insight

The Japan fried chicken franchise market is gaining traction due to the country’s affinity for convenience food and high standards for food quality. Seasonal menu offerings, such as festive buckets and localized flavor profiles, contribute to steady sales growth. The integration of efficient ordering systems and loyalty programs, combined with a strong emphasis on cleanliness and service, supports the expanding footprint of franchise outlets.

China Fried Chicken Franchise Market Insight

The China fried chicken franchise market held the largest revenue share in Asia-Pacific in 2024, supported by the rapid expansion of QSR chains, a tech-savvy consumer base, and rising urban food demand. Franchises are scaling rapidly through aggressive expansion strategies and extensive digital integration. The market benefits from a strong domestic supply chain, increasing popularity of spicy and crispy chicken variants, and partnerships with leading delivery platforms, enabling broad customer reach across urban and suburban areas.

Fried Chicken Franchise Market Share

The fried chicken franchise industry is primarily led by well-established companies, including:

- KFC (U.S.)

- Popeyes Louisiana Kitchen (U.S.)

- Church's Chicken (U.S.)

- Chick-fil-A (U.S.)

- Raising Cane's Chicken Fingers (U.S.)

- Zaxby's (U.S.)

- Bojangles' Famous Chicken 'n Biscuits (U.S.)

- Wingstop (U.S.)

- El Pollo Loco (U.S.)

- GUS'S World Famous Fried Chicken (U.S.)

Latest Developments in Global Fried Chicken Franchise Market

- In November 2024, Korean crispy chicken brand Cravy Chicken announced its entry into the Indian hospitality and retail space at the Franchise India Expo 2024, scheduled for November 29–30 at the Jio World Convention Centre in Mumbai. This move is expected to intensify market competition and diversify consumer offerings in India’s rapidly growing quick-service restaurant (QSR) sector, further accelerating market expansion in the Asia-Pacific region

- In July 2024, KFC launched a branded merchandise shop in partnership with Ink Branded, reflecting the brand’s strategy to strengthen consumer engagement and brand loyalty. Such initiatives enhance market visibility and contribute to sustained customer retention beyond traditional food offerings

- In March 2021, Bojangles announced its entry into Columbus, Ohio—marking its debut in the state—on the same day other major QSR players such as Taco John’s, Sheetz, and Del Taco declared plans to expand in Central Ohio. This clustered expansion trend signifies intensified regional competition and increased consumer access

- In July 2023, Bojangles announced the opening of 20 restaurants on the West Coast, beginning in Las Vegas, indicating the brand’s ambition to solidify its presence in high-growth urban centers, thereby contributing to the overall expansion of the U.S. fried chicken franchise market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fried Chicken Franchise Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fried Chicken Franchise Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fried Chicken Franchise Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.