Global Fruit Concentrate Market

Market Size in USD Billion

CAGR :

%

USD

115.95 Billion

USD

159.91 Billion

2024

2032

USD

115.95 Billion

USD

159.91 Billion

2024

2032

| 2025 –2032 | |

| USD 115.95 Billion | |

| USD 159.91 Billion | |

|

|

|

|

Fruit Concentrate Market Size

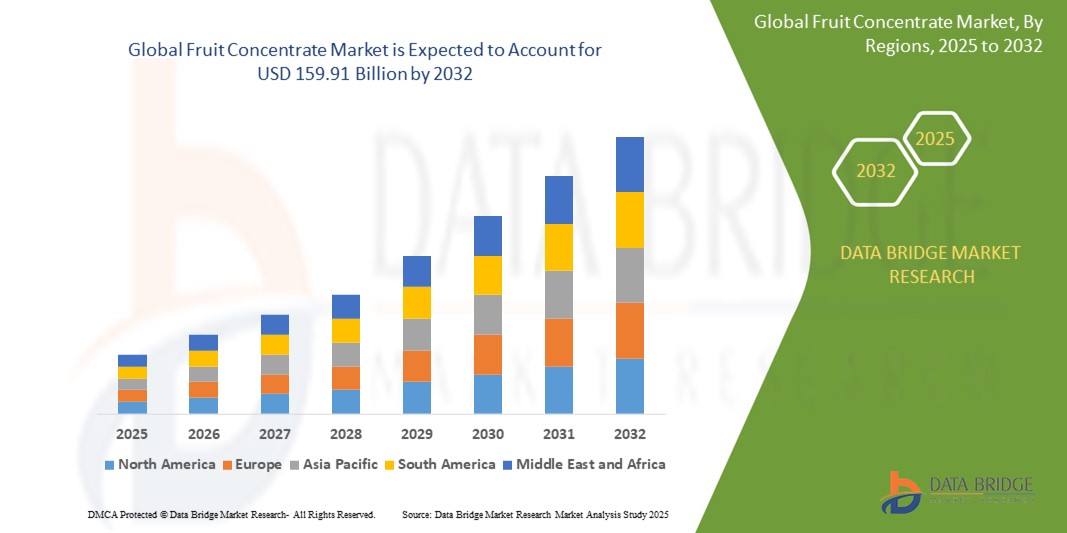

- The global fruit concentrate market size was valued at USD 115.95 billion in 2024 and is expected to reach USD 159.91 billion by 2032, at a CAGR of 4.10% during the forecast period

- The market growth is largely fueled by rising health consciousness and increasing demand for natural, clean-label ingredients in food and beverage products, leading to greater incorporation of fruit concentrates across functional beverages, snacks, and dietary supplements

- Furthermore, expanding food processing industries, coupled with advancements in concentration technologies and supply chain capabilities, are enabling manufacturers to meet evolving consumer preferences for convenience and nutrition, thereby significantly boosting the fruit concentrate market's growth

Fruit Concentrate Market Analysis

- Fruit concentrate is a product derived from the extraction and reduction of fruit juices, where the water content is removed to create a more concentrated form. This process preserves the flavor, color, and nutritional value of the original fruit while allowing for longer shelf life and easier transportation

- The escalating demand for fruit concentrates is primarily fueled by rising consumer preference for natural and clean-label ingredients, growing adoption of functional and health-oriented foods, and expanding usage in the production of reduced-sugar and plant-based products

- Asia-Pacific dominated the fruit concentrate market with a share of 47.1% in 2024, due to high fruit production volumes, expanding food processing industries, and rising demand for natural fruit-based products across densely populated countries

- North America is expected to be the fastest growing region in the fruit concentrate market with a share of during the forecast period due to

- Food segment dominated the market with a market share of 34.52% in 2024, due to the extensive use of fruit concentrates in bakery, confectionery, and dairy products for flavor enhancement, natural coloring, and nutritional enrichment

Report Scope and Fruit Concentrate Market Segmentation

|

Attributes |

Fruit Concentrate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analyss, and regulatory framework. |

Fruit Concentrate Market Trends

“Growing Demand for Natural Ingredient”

- A significant and accelerating trend in the global fruit concentrate market is the increasing consumer shift toward natural, clean-label ingredients in food, beverage, and dietary applications. This demand stems from growing health awareness and the preference for minimally processed products

- For instance, in January 2024, ADM launched fruit concentrate blends featuring elderberry, cranberry, and acai to meet the rising demand for immunity-boosting, natural ingredients in functional beverages

- Manufacturers are increasingly using fruit concentrates in reduced-sugar and plant-based products, as they offer natural sweetness and nutritional benefits. Grape and citrus concentrates, for instance, are valued for their antioxidant content and suitability for clean-label formulations

- The popularity of fruit concentrates in health-focused applications such as smoothies, fortified waters, and sports nutrition drinks reflects the trend toward wellness-oriented consumer choices

- This trend is also influencing the formulation of bakery and dairy products. For instance, Sudzucker’s organic strawberry concentrate launched in March 2024 supports the growing clean-label movement in Europe, where consumers actively seek preservative-free, traceable ingredients

- As consumer expectations evolve, companies such as Kerry Group and Dohler are investing in R&D to create customized blends that cater to functionality, taste, and nutritional value—further driving market expansion for fruit concentrates

Fruit Concentrate Market Dynamics

Driver

“Increasing Health Consciousness Among Consumers”

- The global rise in health consciousness is a major driver for the fruit concentrate market, with consumers actively seeking foods and beverages that offer natural nutrients, functional benefits, and lower sugar content

- For instance, a 2023 report showed a 29% increase in consumer preference for natural fruit-based ingredients in beverages, leading to greater use of concentrates in ready-to-drink formulations and wellness drinks

- Fruit concentrates are gaining traction as alternatives to artificial flavorings and synthetic additives, offering manufacturers a natural solution to meet health-conscious product positioning

- The growing demand for clean-label and plant-based food products has led to a surge in fruit concentrate applications in baby food, dairy alternatives, and health supplements

- Consumers are increasingly drawn to ingredients that support immunity, digestion, and energy, driving the adoption of high-nutrient fruit concentrates such as berries, citrus, and tropical fruits across various industries

Restraint/Challenge

“High Costs Associated with Production of Fruit Concentrate”

- High production and processing costs, driven by seasonal availability, perishability of raw fruits, and energy-intensive concentration methods, present a key challenge to market growth

- For instance, fruit crop volatility caused by climate change—such as droughts in India or frost in Europe—often disrupts supply chains and elevates input prices for concentrate manufacturers

- The additional cost of maintaining quality, especially in organic and clean-label variants, increases the final product price, limiting adoption in price-sensitive markets

- Storage, transportation, and refrigeration requirements for liquid concentrates further add to operational costs, especially in global supply chains

- To overcome these challenges, companies are exploring freeze-drying and aseptic technologies to improve shelf life and reduce wastage, although such advancements also require significant capital investment, which may deter smaller players in the market

Fruit Concentrate Market Scope

The market is segmented on the basis of concentrates type, product type, form, and application.

• By Concentrates Type

On the basis of concentrates type, the fruit concentrate market is segmented into orange, apples, grapes, grapefruit, pineapple, peaches, pears, apricots, cherries, prunes, dates, and others. The orange segment dominated the largest market revenue share in 2024, primarily due to its widespread use in beverages, bakery, and confectionery products. Orange concentrate is favored for its strong consumer acceptance, high vitamin C content, and versatility in both foodservice and retail products. Its cost-effectiveness and extended shelf life make it an attractive option for manufacturers aiming to balance quality and pricing.

The grape segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for natural sweeteners and antioxidants. Grape concentrate is increasingly adopted in health-oriented products, including functional beverages and dietary supplements, owing to its rich polyphenol and resveratrol content. Its growing usage in wine production, especially in regions with emerging winery industries, further accelerates segment expansion.

• By Product Type

On the basis of product type, the market is divided into conventional and organic. The conventional segment held the largest market share in 2024, driven by its long-standing dominance in large-scale food processing and cost-effective production. Conventional fruit concentrates offer a broad selection, consistent quality, and compatibility with mass manufacturing, making them the go-to choice for mainstream beverage and food brands.

The organic segment is anticipated to grow at the highest CAGR from 2025 to 2032, propelled by rising consumer preference for clean-label and pesticide-free products. Increasing awareness around food safety, sustainability, and health is prompting both producers and consumers to shift toward organic concentrates, especially in the dietary supplement and premium beverage categories.

• By Form

On the basis of form, the fruit concentrate market is bifurcated into powder and liquid. The liquid segment led the market in 2024, attributed to its widespread application in juices, smoothies, and syrups. Liquid fruit concentrates are preferred by beverage manufacturers for their ease of blending, strong flavor retention, and immediate usability in large-scale production setups.

The powder segment is expected to witness the fastest growth from 2025 to 2032, owing to its longer shelf life, easier storage, and increasing usage in powdered drink mixes, infant nutrition, and health supplements. The surge in demand for portable, instant food and drink solutions is further bolstering interest in powder-based fruit concentrates, especially among health-conscious and on-the-go consumers.

• By Application

On the basis of application, the market is segmented into food, dietary supplements, pharmaceuticals, sports nutrition, and personal care & cosmetics. The food segment dominated the market revenue share of 34.52% in 2024, driven by the extensive use of fruit concentrates in bakery, confectionery, and dairy products for flavor enhancement, natural coloring, and nutritional enrichment.

The dietary supplements segment is poised to grow at the fastest rate between 2025 and 2032, as consumers increasingly seek plant-based and natural ingredients for health improvement. Fruit concentrates, especially from berries, grapes, and citrus fruits, are gaining traction in nutraceuticals due to their antioxidant, anti-inflammatory, and immunity-boosting properties, supporting the demand surge in this space.

Fruit Concentrate Market Regional Analysis

- Asia-Pacific dominated the fruit concentrate market with the largest revenue share of 47.1% in 2024, driven by high fruit production volumes, expanding food processing industries, and rising demand for natural fruit-based products across densely populated countries

- The region’s increasing consumer shift toward nutritious and clean-label food and beverages, coupled with the rise of health-conscious urban populations, is fueling market expansion

- Government support for agri-processing infrastructure, coupled with competitive pricing and export-oriented manufacturing, is further propelling the growth of fruit concentrates across diverse applications

Japan Fruit Concentrate Market Insight

The Japan market is growing due to increasing demand for natural, low-calorie fruit ingredients in beverages and functional foods. The aging population and strong preference for health-boosting formulations are driving the use of concentrated fruits such as apples and grapes in nutritional supplements and ready-to-drink products. Local producers are focusing on premium quality and traceability to meet consumer expectations and regulatory standards.

China Fruit Concentrate Market Insight

The China fruit concentrate market held the largest share in Asia-Pacific in 2024, supported by vast domestic fruit production and growing consumption of packaged beverages and processed food. Rapid urbanization, rising disposable incomes, and the popularity of fruit-flavored dairy and snack items are contributing to demand. Investments in cold chain logistics and food processing facilities are further enhancing the export potential of Chinese fruit concentrates.

Europe Fruit Concentrate Market Insight

The Europe fruit concentrate market is projected to grow at a notable CAGR over the forecast period, driven by demand for organic, natural, and sustainably sourced ingredients in health foods and beverages. Strict food labeling laws, consumer emphasis on clean-label products, and advancements in fruit concentration technologies are bolstering regional growth. The use of fruit concentrates in plant-based foods, nutraceuticals, and premium beverages is also rising steadily.

U.K. Fruit Concentrate Market Insight

The U.K. market is expected to grow steadily due to rising preference for reduced-sugar and naturally sourced fruit ingredients in juices, smoothies, and snack bars. Government campaigns promoting healthier diets and sugar reduction are increasing demand for apple, berry, and citrus concentrates as natural flavoring and sweetening alternatives. Innovations in fruit-based blends targeting wellness-conscious consumers are further driving market interest.

Germany Fruit Concentrate Market Insight

The Germany fruit concentrate market is expanding rapidly, supported by strong demand for sustainable and traceable fruit sourcing in food and beverage applications. Germany’s leadership in organic food consumption and robust processing capabilities are boosting the use of concentrates in both domestic and export-oriented product lines. The popularity of functional drinks and dietary supplements is also fueling demand for high-antioxidant concentrates such as cherries and berries.

North America Fruit Concentrate Market Insight

North America is projected to witness the fastest CAGR from 2025 to 2032, driven by the rising use of fruit concentrates in plant-based beverages, clean-label products, and natural sweetener formulations. Growing consumer interest in immunity-boosting and antioxidant-rich diets is prompting increased use of concentrates from blueberries, grapes, and citrus fruits. Market growth is also supported by technological advancements in flavor retention and government backing for healthier food options.

U.S. Fruit Concentrate Market Insight

The U.S. fruit concentrate market accounted for the largest revenue share in North America in 2024, fueled by high demand from the beverage, sports nutrition, and health food sectors. The surge in plant-based and functional beverages is encouraging manufacturers to use fruit concentrates for color, flavor, and nutritional benefits. Consumer demand for reduced sugar and additive-free products is also shifting the market toward natural fruit-derived ingredients with enhanced functional appeal.

Fruit Concentrate Market Share

The fruit concentrate industry is primarily led by well-established companies, including:

- Kerry Group plc (Ireland)

- ADM (Canada)

- International Flavors & Fragrances Inc. (U.S.)

- Firmenich SA (Switzerland)

- Symrise (Germany)

- ROBERTET (France)

- SAS SICA SICODIS (France)

- Nestlé (Switzerland)

- Dohler (Germany)

- Invertec Foods (U.S.)

- AGRANA Beteiligungs-AG (Austria)

- Ingredion (U.S.)

- SunOpta (Canada)

- China Haisheng Fresh Fruit Juice Co., Ltd (China)

- The Coca-Cola Company (U.S.)

- Capricorn Food Products India Ltd. (India)

Latest Developments in Global Fruit Concentrate Market

- In March 2024, Louis Dreyfus Company (LDC) announced the exclusive introduction of its new fresh fruit juice brand, Montebelo Brasil, to the French market. This launch is in collaboration with Laiterie de Saint-Denis-de-l’Hôtel (LSDH), which will handle commercialization, bottling, and distribution

- In March 2024, Sudzucker introduced a new organic strawberry concentrate line in Europe, tailored for bakery and yogurt applications. This development addresses a 31% increase in demand for organic fruit products and caters to the growing clean-label trend influencing 46% of new product formulations. By offering a preservative-free and sustainable solution, Sudzucker is contributing to the expansion of the organic segment within the European fruit concentrate market

- In January 2024, ADM launched a new line of plant-based fruit concentrate blends featuring acai, elderberry, and cranberry, aimed at the functional beverage sector. This initiative is expected to significantly influence market dynamics by tapping into the 41% rise in demand for natural immunity-boosting ingredients. By supporting reduced sugar formulations, the product aligns with the preferences of over 39% of consumers seeking healthier drink alternatives, thereby accelerating innovation and growth in the health-focused beverage segment

- In November 2023, Kerry Group completed the expansion of its fruit concentrate facility in Southeast Asia, increasing production capacity by 28%. This expansion enhances the company’s ability to meet rising regional demand for dairy-alternative drinks and functional beverages. It directly supports the 34% surge in plant-based product launches across emerging Asian markets, reinforcing Asia-Pacific’s position as a key driver of global fruit concentrate market growth

- In February 2023, Austria Juice proudly showcased its latest innovations in organic juice concentrates and compounds at BioFach 2023, a premier event for organic products. Among the highlights were a new pomegranate berry mix and a refreshing lime guava drink

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fruit Concentrate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fruit Concentrate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fruit Concentrate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.