Global Gaming Steering Wheels Market

Market Size in USD Billion

CAGR :

%

USD

22.86 Billion

USD

42.00 Billion

2024

2032

USD

22.86 Billion

USD

42.00 Billion

2024

2032

| 2025 –2032 | |

| USD 22.86 Billion | |

| USD 42.00 Billion | |

|

|

|

|

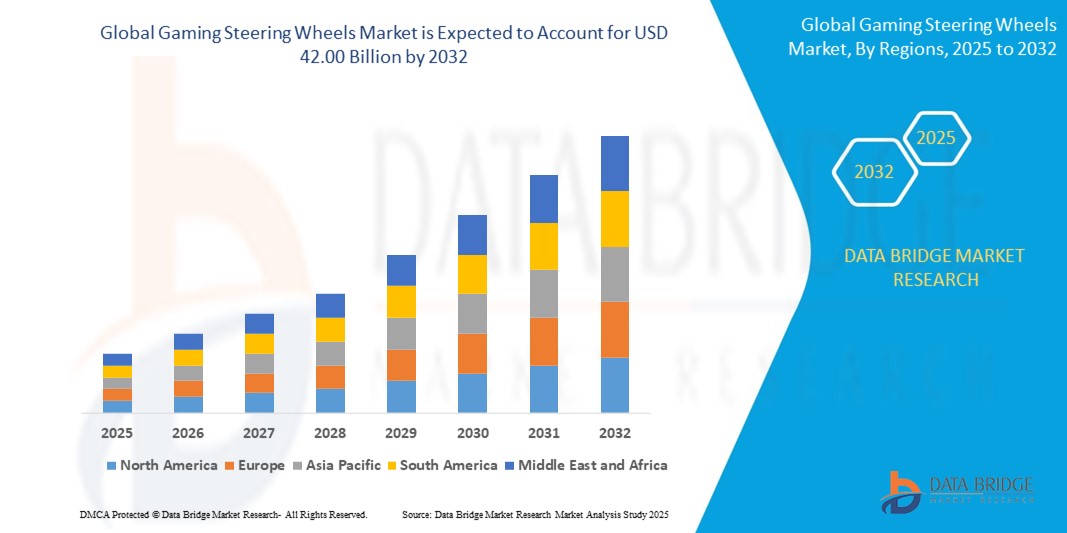

What is the Global Gaming Steering Wheels Market Size and Growth Rate?

- The global gaming steering wheels market size was valued at USD 22.86 billion in 2024 and is expected to reach USD 42.00 billion by 2032, at a CAGR of 7.90% during the forecast period

- In the gaming steering wheels market, the application of advanced force feedback technology enhances realism and immersion in driving simulation games. Recent launches include customizable steering wheels with adjustable sensitivity and compatibility with various gaming platforms, offering gamers an enhanced and immersive driving experience

What are the Major Takeaways of Gaming Steering Wheels Market?

- The rising popularity of simulation games, particularly racing and driving simulators, drives demand for realistic gaming peripherals such as steering wheels. Offering an immersive experience surpassing traditional controllers, gaming steering wheels appeal to gamers seeking heightened realism and immersion, contributing to their increasing adoption and prominence in the gaming market

- North America dominated the gaming steering wheels market with the largest revenue share of 33.81% in 2024, attributed to high consumer spending on gaming peripherals and a strong preference for immersive simulation experiences

- Asia-Pacific gaming steering wheels market is projected to grow at the fastest CAGR of 7.52% from 2025 to 2032, fueled by rapid growth in gaming populations in China, Japan, and India

- The Gear-Driven Wheel segment dominated the gaming steering wheels market with the largest market revenue share of 38.6% in 2024, driven by its affordability, reliability, and appeal to casual gamers and beginners

Report Scope and Gaming Steering Wheels Market Segmentation

|

Attributes |

Gaming Steering Wheels Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Gaming Steering Wheels Market?

“Enhanced Immersion through Haptic Feedback and Adaptive Force Technology”

- A key trend reshaping the gaming steering wheels market is the rapid advancement of haptic feedback and adaptive force response systems, designed to simulate real-life driving sensations. These innovations are enhancing realism and immersion in racing simulators, offering users an experience closer to actual motorsports

- For instance, FANATEC's Direct Drive technology delivers precise, high-torque feedback that replicates every detail of the road, while Logitech’s G923 TrueForce system dynamically adjusts force output based on real-time in-game physics

- The integration of multi-directional haptics, tunable resistance, and motorized gear shifts allows users to feel tire grip loss, engine rumble, terrain texture, and cornering forces, thereby boosting both competitive edge and entertainment value

- These immersive enhancements are being widely adopted across eSports platforms and training simulators, offering users nuanced control and tactile feedback that was previously limited to professional-grade equipment

- Manufacturers are now embedding these technologies in mid-range products, democratizing access to high-fidelity simulation. Thrustmaster and SimXperience, for instance, are launching mid-tier wheels with motorsport-grade force feedback for console and PC gamers

- This trend toward hyper-realistic and responsive gaming hardware is redefining user expectations and accelerating innovation, positioning gaming steering wheels as essential gear for both casual players and competitive sim racers

What are the Key Drivers of Gaming Steering Wheels Market?

- The rising popularity of racing simulation games and the growth of eSports are significant factors driving the gaming steering wheels market. Titles such as Gran Turismo, F1, and Assetto Corsa have cultivated dedicated communities demanding more immersive and realistic control systems

- For instance, in November 2023, Playseat partnered with Sony Interactive Entertainment to launch a next-gen racing cockpit compatible with PlayStation 5, boosting the demand for professional-grade steering wheels

- Technological advancements, such as plug-and-play USB compatibility, Bluetooth connectivity, and cross-platform support, are making these devices more accessible to gamers on multiple consoles and PCs

- In addition, the rise in home-based gaming setups post-pandemic has led to a surge in consumer investment in gaming hardware, with steering wheels becoming a high-value add-on for enhancing realism

- Growth in streaming and content creation is also encouraging gamers to upgrade their peripherals, with steering wheels offering a tangible performance and engagement boost on platforms such as Twitch and YouTube

Which Factor is challenging the Growth of the Gaming Steering Wheels Market?

- One of the primary challenges facing the market is the high cost associated with quality steering wheel systems. Advanced models with direct drive motors, hydraulic pedals, and modular accessories often exceed the price range of average gamers

- For instance, FANATEC and SimXperience offer high-end wheels that can cost over USD 1,000, limiting access for entry-level users or casual gamers not looking for competitive play

- Furthermore, limited compatibility across gaming platforms can be a barrier many devices are optimized for specific consoles, forcing consumers to buy separate wheels for Xbox, PlayStation, or PC, thereby increasing the total cost of ownership

- Lack of space in compact home environments and the requirement of additional hardware such as racing seats or frames for a complete experience can also deter potential buyers

- To counter this, brands such as Logitech and Hori are releasing affordable and compact models targeting casual users and console gamers. However, the gap between entry-level and high-end experience remains noticeable

- Bridging this gap through affordable innovations, multi-platform support, and space-saving designs will be essential to overcoming market resistance and expanding adoption across user segments

How is the Gaming Steering Wheels Market Segmented?

The market is segmented on the basis of type, application, weight, clutch pedal, and distribution channel.

- By Type

On the basis of type, the gaming steering wheels market is segmented into Gear-Driven Wheel, Belt-Driven Wheel, Direct Drive Wheel, and Hybrid Wheel. The Gear-Driven Wheel segment dominated the gaming steering wheels market with the largest market revenue share of 38.6% in 2024, driven by its affordability, reliability, and appeal to casual gamers and beginners. These wheels offer tactile feedback through interlocking gears and are widely compatible with mainstream gaming consoles, making them a popular entry-level option.

The Direct Drive Wheel segment is anticipated to witness the fastest CAGR of 20.3% from 2025 to 2032, fueled by rising demand among sim racing enthusiasts and professional gamers. Direct drive systems provide unmatched realism and responsiveness by connecting the steering wheel directly to the motor, delivering precise feedback without mechanical lag. Their premium build and performance are gaining traction across high-end gaming setups and eSports tournaments.

- By Application

On the basis of application, the gaming steering wheels market is segmented into PC, PS3, PS4, and XBOX. The PC segment held the largest market revenue share of 42.7% in 2024, attributed to the platform’s widespread usage among sim racing communities and the flexibility it offers for customization and peripheral integration. Gamers using PCs often invest in high-performance wheels, pedals, and racing seats for an immersive experience.

The PS4 segment is expected to register the fastest CAGR from 2025 to 2032, driven by a vast user base and continued support for popular racing titles. Compatibility with plug-and-play steering wheels and the growing popularity of console-based sim racing are further fueling segment growth.

- By Weight

On the basis of weight, the gaming steering wheels market is segmented into 0–2.0 kg, 2.1–4.0 kg, 4.1–6.0 kg, 6.1–8.0 kg, and More Than 8.0 kg. The 2.1–4.0 kg segment dominated the market with the largest revenue share of 34.2% in 2024, as products in this range strike a balance between performance and portability. These models are popular among casual to mid-tier gamers who prioritize ease of setup, desk compatibility, and affordability.

The More Than 8.0 kg segment is projected to witness the fastest CAGR from 2025 to 2032, reflecting rising demand for heavy-duty, professional-grade wheels with metal housing, direct drive motors, and advanced features tailored for sim racing rigs.

- By Clutch Pedal

On the basis of clutch pedal configuration, the market is segmented into With Clutch Pedal and Without Clutch Pedal. The Without Clutch Pedal segment captured the largest market revenue share of 56.1% in 2024, mainly due to the entry-level and mid-range wheels catering to casual gamers and beginners, where simplified two-pedal configurations (brake and accelerator) are more common.

However, the With Clutch Pedal segment is expected to register the fastest growth rate from 2025 to 2032, as racing purists and competitive gamers seek more realistic, manual transmission experiences. Demand for this configuration is increasing alongside the growing popularity of racing simulators and eSports competitions.

- By Distribution Channel

On the basis of distribution channel, the gaming steering wheels market is segmented into Online and Offline. The Online segment held the largest market revenue share of 61.5% in 2024, driven by the convenience of e-commerce platforms, wide product availability, and access to customer reviews. Online channels such as Amazon, Newegg, and company websites offer frequent discounts, broad assortments, and doorstep delivery, which appeal especially to tech-savvy gamers.

The Offline segment is expected to witness the fastest CAGR from 2025 to 2032, supported by in-store demos, after-sales support, and the ability to physically evaluate products before purchase. Specialty electronics retailers and gaming stores are investing in immersive displays and customer education to boost sales.

Which Region Holds the Largest Share of the Gaming Steering Wheels Market?

- North America dominated the gaming steering wheels market with the largest revenue share of 33.81% in 2024, attributed to high consumer spending on gaming peripherals and a strong preference for immersive simulation experiences

- The presence of established gaming companies and a growing e-sports culture contribute significantly to regional demand, especially in the U.S. and Canada

- This dominance is supported by a technologically savvy population, robust gaming infrastructure, and early adoption of racing simulators in professional and casual setups

U.S. Gaming Steering Wheels Market Insight

The U.S. gaming steering wheels market held the largest revenue share in 2024 within North America, driven by the booming e-sports sector and growing popularity of racing simulation games. A surge in sim-racing events, along with collaborations between gaming brands and car manufacturers, has amplified consumer interest. The rise of DIY sim-rig setups, advanced force feedback systems, and console/PC compatibility are further accelerating demand across the country.

Europe Gaming Steering Wheels Market Insight

The Europe gaming steering wheels market is projected to expand at a strong CAGR during the forecast period, propelled by increasing gaming participation, especially in countries such as Germany, France, and the U.K. European gamers value realism and quality, prompting high demand for premium simulation equipment. The market is also benefiting from sim-racing leagues and a trend toward professional-grade gaming setups in both homes and commercial gaming lounges.

U.K. Gaming Steering Wheels Market Insight

The U.K. gaming steering wheels market is expected to witness notable growth, driven by rising disposable income, growing console ownership, and strong engagement in online multiplayer racing titles. The expansion of local e-sports tournaments and streaming culture is boosting demand for immersive gaming peripherals. In addition, U.K.-based retailers and distributors are increasingly offering bundled sim-racing kits, catering to both amateurs and professionals.

Germany Gaming Steering Wheels Market Insight

The Germany gaming steering wheels market is projected to grow at a steady pace, owing to a robust PC gaming community and a strong focus on quality engineering. The popularity of motorsports such as Formula 1 and DTM further boosts sim-racing interest. German consumers show a preference for high-end, durable steering wheel setups with customizable features and force feedback technology, reinforcing the country’s status as a key European gaming hardware market.

Which Region is the Fastest Growing in the Gaming Steering Wheels Market?

Asia-Pacific gaming steering wheels market is projected to grow at the fastest CAGR of 7.52% from 2025 to 2032, fueled by rapid growth in gaming populations in China, Japan, and India. The increase in console and PC penetration, along with the rise of mobile-based racing games, is enhancing awareness and demand for steering wheels. Moreover, regional price competitiveness and the emergence of local manufacturers are making Gaming Steering Wheels more accessible to new gamers.

Japan Gaming Steering Wheels Market Insight

The Japan gaming steering wheels market is thriving, supported by a tech-savvy audience and a culture that embraces simulation and arcade-style gaming. High interest in racing titles such as Gran Turismo, combined with a strong console user base, is propelling demand. Japanese gamers appreciate compact, precise, and high-performance steering wheels suited to limited space environments, making it a dynamic market for innovation.

China Gaming Steering Wheels Market Insight

The China gaming steering wheels market captured the largest revenue share in Asia Pacific in 2024, driven by a vast gaming community, rapid urbanization, and government-backed e-sports development. Affordable PC builds, console accessibility, and smart device integration are spurring sales. In addition, domestic brands are rising in prominence, offering competitive alternatives to international brands at accessible price points, accelerating adoption across urban and tier-2 cities asuch as.

Which are the Top Companies in Gaming Steering Wheels Market?

The gaming steering wheels industry is primarily led by well-established companies, including:

- Logitech (Switzerland)

- Guillemot Corporation S.A. (France)

- FANATEC (Germany)

- Hori (Japan)

- SteelSeries (U.S.)

- Mad Catz Global Limited (Hong Kong)

- Razer Inc. (Singapore)

- Thrustmaster (Netherlands)

- Next Level Racing (Australia)

- Guillemot Corporation (France)

- SimXperience (U.S.)

- VRX Simulators (U.S.)

- Playseat (Netherlands)

- GTR Simulator (U.S.)

- OpenWheeler (U.S.)

What are the Recent Developments in Global Gaming Steering Wheels Market?

- In May 2021, Thrustmaster launched the licensed Ferrari SF1000 Wheel, closely resembling the Ferrari SF1000 steering wheel. This product provided professionals with an authentic experience akin to the original Ferrari SF1000 steering wheel, bolstering the company's racing wheel portfolio

- In September 2020, HORI CO., LTD. launched a range of accessories for the Xbox Series X|S, encompassing controllers, racing wheels, and controller chargers, among others. This product lineup expansion is poised to fortify the company's Xbox platform portfolio, catering to the diverse needs of gamers on the latest Xbox consoles

- In March 2021, MG Motor launched the Cyberster, an electric sports car featuring a futuristic interior with a gaming cockpit and console-style steering wheel. Integrating virtual reality (VR) technology, the gaming cockpit offers a unique experience, aligning with the gaming theme of the cabin and reinforcing MG Motor's innovative approach

- In August 2020, Logitech launched the G923, featuring interoperability between PC and Xbox One. With true force feedback and ultra-realistic racing capabilities, this wheel caters to both PC and Xbox gamers, contributing to Logitech's enhanced racing wheel lineup

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gaming Steering Wheels Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gaming Steering Wheels Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gaming Steering Wheels Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.