Global Gluten Free Jams Market

Market Size in USD Million

CAGR :

%

USD

168.20 Million

USD

264.06 Million

2024

2032

USD

168.20 Million

USD

264.06 Million

2024

2032

| 2025 –2032 | |

| USD 168.20 Million | |

| USD 264.06 Million | |

|

|

|

|

Gluten-Free Jams Market Size

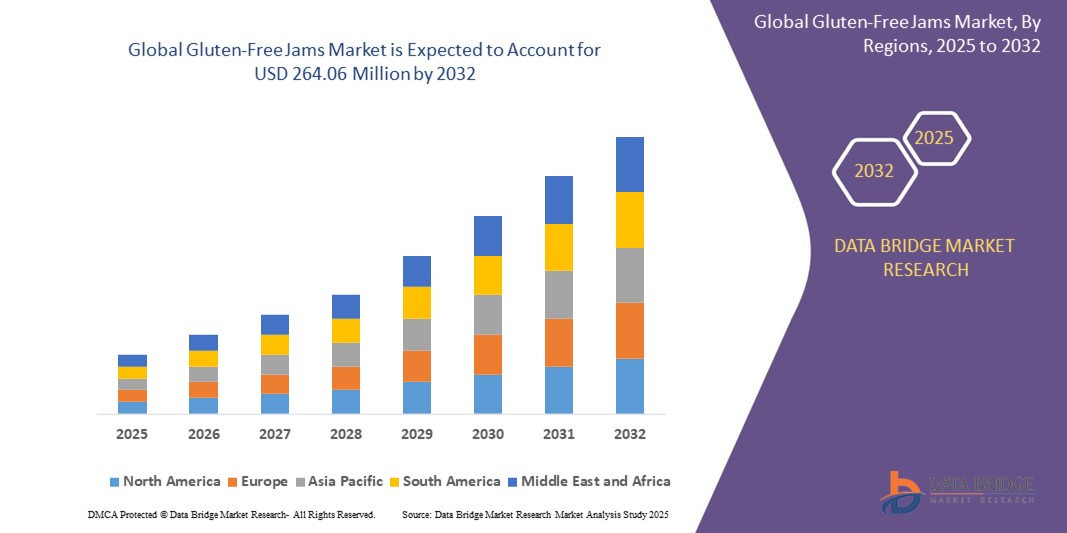

- The global gluten-free jams market size was valued at USD 168.2 million in 2024 and is expected to reach USD 264.06 million by 2032, at a CAGR of 5.80% during the forecast period

- The market growth is largely driven by the rising incidence of gluten intolerance and celiac disease, along with the increasing consumer shift toward healthy and natural food alternatives

- In addition, growing awareness about clean-label and allergen-free products is significantly propelling demand for gluten-free jams across health-conscious consumer segments globally

Gluten-Free Jams Market Analysis

- Gluten-Free Jams, made without any gluten-containing ingredients, are becoming increasingly popular among consumers seeking digestive wellness, organic ingredients, and lifestyle-based dietary choices

- The demand is fueled by a surge in gluten sensitivity cases, a rising trend of clean eating, and expanding availability of specialty food products across online and offline retail channels

- Manufacturers are innovating with fruit blends, reduced sugar options, and eco-friendly packaging, helping differentiate their products in an increasingly competitive market

- North America dominates the gluten-free jams market with the largest revenue share of 36.41% in 2024, driven by increasing health consciousness and growing demand for gluten-free food alternatives. The region’s robust food processing industry and heightened consumer preference for natural, preservative-free spreads have significantly supported market growth

- Asia-Pacific gluten-free jams market is poised to grow at the fastest CAGR of 12.25% during 2025 to 2032, driven by rising disposable incomes, urbanization, and Western dietary influences. Countries such as India, China, and Japan are witnessing surging awareness of gluten-free lifestyles, especially among younger and urban populations

- The Traditional Fruit Jams segment dominated the market with the largest revenue share of 47.6% in 2024, owing to their wide consumer acceptance, familiarity, and ease of pairing with multiple food products such as bread, pastries, and crackers

Report Scope and Gluten-Free Jams Market Segmentation

|

Attributes |

Gluten-Free Jams Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Gluten-Free Jams Market Trends

“Health-Driven Innovation and Clean Label Preferences”

- A major trend shaping the global gluten-free jams market is the surge in demand for clean-label, health-conscious, and allergen-free food products. Consumers are increasingly scrutinizing ingredient lists and opting for products that align with specific dietary needs, including gluten-free diets

- Manufacturers are responding with innovative formulations, using natural sweeteners (such as stevia or honey), organic fruits, and pectin from plant sources. The result is a new generation of gluten-free jams that offer better nutrition without sacrificing taste

- For instance, in 2024, Bonne Maman launched an organic gluten-free jam line that emphasizes traceable ingredients and reduced sugar content, which received a positive reception across North American and European markets

- This trend is further fueled by the growing vegan, keto, and paleo movements, pushing producers to develop more specialized jam varieties free of preservatives, artificial additives, and processed sugars

- The increasing visibility of certification labels, such as "Certified Gluten-Free" and "USDA Organic", on packaging is also boosting consumer confidence and accelerating purchasing decisions

- As health awareness deepens globally, the demand for natural, transparent, and functional gluten-free jam products is expected to drive innovation and competition in the industry

Gluten-Free Jams Market Dynamics

Driver

“Rising Prevalence of Celiac Disease and Gluten Sensitivity”

- A growing number of consumers are being diagnosed with celiac disease, gluten intolerance, or non-celiac gluten sensitivity, driving the demand for gluten-free alternatives, including jams

- According to the Celiac Disease Foundation, around 1% of the global population is affected by celiac disease, and many more remain undiagnosed or choose gluten-free diets for personal health reasons

- For instance, in 2023, The J.M. Smucker Company reported a significant rise in gluten-free product demand, leading to expanded distribution of its gluten-free fruit spreads and jams across major retail chains

- The demand extends beyond the diagnosed population, as many health-conscious consumers associate gluten-free products with better digestion and wellness, even without clinical conditions

- As food sensitivity awareness grows, gluten-free jams are becoming staple offerings in both mainstream supermarkets and specialty health stores, ensuring broader market reach

Restraint/Challenge

“Higher Production Costs and Limited Shelf Life for Natural Formulations”

- Despite rising demand, gluten-free jam production faces cost challenges. Sourcing high-quality, gluten-free-certified ingredients and maintaining separate production lines to avoid cross-contamination increases overall manufacturing expenses

- Natural and organic jams, which are typically free from synthetic preservatives, often have a shorter shelf life, posing logistics and inventory challenges, especially for smaller producers and exporters

- For instance, small-scale European brands such as Clearspring and Fiordifrutta have reported increased packaging and distribution costs due to their strict allergen-free policies and eco-conscious packaging commitments

- In addition, many gluten-free products remain priced at a premium, which may limit access among cost-sensitive consumers, particularly in developing regions

- Educating consumers about the value of gluten-free offerings, investing in cost-effective preservation techniques, and scaling up certified production lines will be key to overcoming these limitations and achieving wider adoption

Gluten-Free Jams Market Scope

The market is segmented on the basis of type, flavor, application, and distribution channel.

- By Type

On the basis of type, the gluten-free jams market is segmented into Traditional Fruit Jams, Marmalade, Chutneys, and Flavored Jams. The Traditional Fruit Jams segment dominated the market with the largest revenue share of 47.6% in 2024, owing to their wide consumer acceptance, familiarity, and ease of pairing with multiple food products such as bread, pastries, and crackers. The traditional appeal, combined with increased availability in gluten-free formats, sustains strong demand in both household and food service channels.

The Flavored Jams segment is projected to witness the fastest CAGR from 2025 to 2032, driven by rising experimentation with unique blends such as chili mango, lavender peach, and spiced berry, catering to the growing interest in gourmet and health-oriented jams.

- By Flavors

On the basis of flavor segmentation, the market is categorized into Berries, Fruits, and Others. The Berries segment accounted for the highest revenue share of 41.3% in 2024, due to high demand for gluten-free strawberry, blueberry, raspberry, and mixed berry jams, which are widely perceived as natural, antioxidant-rich, and flavorful.

The Fruits segment (excluding berries) is expected to grow at the highest CAGR from 2025 to 2032, supported by growing demand for tropical and exotic flavors such as mango, pineapple, and fig, which are being increasingly featured in gluten-free and artisanal jam lines.

- By Application

On the basis of application, the gluten-free jams market is segmented into Bakery Products, Confectionery, Nutrition Bars, Dressings, Beverages, Dairy Products, and Other Non-food Applications. The Bakery Products segment led the market with a dominant revenue share of 38.9% in 2024, as gluten-free jams are widely used as fillings, toppings, and flavor enhancers in baked goods such as muffins, cookies, and gluten-free bread.

The Nutrition Bars segment is expected to exhibit the fastest growth from 2025 to 2032, driven by the increasing popularity of functional snacks and the integration of clean-label jam fillings in protein and cereal bars targeted at health-conscious consumers.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Convenience Stores, Supermarkets & Hypermarkets, Specialty Stores, and Online. Supermarkets & Hypermarkets held the largest market share of 42.7% in 2024, attributed to their extensive product variety, in-store promotions, and increasing shelf space for health-oriented products such as gluten-free jams.

The Online segment is forecasted to grow at the fastest CAGR from 2025 to 2032, fueled by rising e-commerce adoption, consumer preference for home delivery, and availability of niche brands that focus on allergen-free and organic offerings through direct-to-consumer platforms.

Gluten-Free Jams Market Regional Analysis

- North America dominates the gluten-free jams market with the largest revenue share of 36.41% in 2024, driven by increasing health consciousness and growing demand for gluten-free food alternatives. The region’s robust food processing industry and heightened consumer preference for natural, preservative-free spreads have significantly supported market growth

- Consumers in the region are highly responsive to clean-label and allergen-free products, with gluten-free jams gaining strong traction among households, bakeries, and restaurants alike

- The availability of a wide product range across supermarkets, health stores, and online platforms further accelerates the adoption of gluten-free jams across the U.S. and Canada

U.S. Gluten-Free Jams Market Insight

The U.S. gluten-free jams market captured the largest revenue share within North America in 2024, owing to the country’s rising prevalence of gluten intolerance, celiac disease, and general wellness trends. American consumers are increasingly seeking healthier and additive-free alternatives, making gluten-free jams a preferred option across breakfast tables and snack recipes. In addition, the surge in small-batch and artisanal jam producers across the U.S. has introduced innovative flavors and organic varieties, boosting product visibility. The strong e-commerce presence of health food brands and subscription models is further contributing to the sustained expansion of the gluten-free jams segment in the U.S.

Europe Gluten-Free Jams Market Insight

The Europe gluten-free jams market is projected to expand at a substantial CAGR over the forecast period, driven by rising awareness of dietary restrictions, natural food movements, and regulatory support for allergen labeling. Countries across Europe are witnessing increasing demand for gluten-free breakfast and bakery spreads, with consumers prioritizing digestive health and clean ingredients. This trend is especially strong in Western Europe, where premium and organic jam varieties are performing well in specialty stores and gourmet food retailers. The growing number of vegan and gluten-free certified brands across the EU market is also enhancing accessibility and consumer trust.

U.K. Gluten-Free Jams Market Insight

The U.K. gluten-free jams market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by heightened consumer demand for “free-from” food products. A significant rise in gluten sensitivity and lifestyle choices promoting reduced gluten intake is creating fertile ground for gluten-free jam consumption. The nation’s leading supermarkets are expanding their free-from sections, including diverse jam flavors tailored for health-conscious buyers. In addition, the country’s dynamic online grocery landscape and food delivery services are expanding market reach, particularly among younger, digitally active consumers.

Germany Gluten-Free Jams Market Insight

The Germany gluten-free jams market is expected to expand at a considerable CAGR, fueled by the country's strong emphasis on organic, natural, and allergen-free foods. Germany’s proactive health and wellness culture has made gluten-free diets increasingly mainstream, with jams being a staple for both adults and children. The growing demand for locally produced, additive-free jams from artisan brands complements the popularity of gluten-free labeling. Germany’s robust organic retail channels, including health food stores and farmers’ markets, continue to play a vital role in market expansion.

Asia-Pacific Gluten-Free Jams Market Insight

The Asia-Pacific gluten-free jams market is poised to grow at the fastest CAGR of 12.25% during 2025 to 2032, driven by rising disposable incomes, urbanization, and Western dietary influences. Countries such as India, China, and Japan are witnessing surging awareness of gluten-free lifestyles, especially among younger and urban populations. The expansion of health-oriented retail chains, as well as a growing e-commerce presence, is improving accessibility to gluten-free products. In addition, regional jam manufacturers are increasingly investing in clean-label production and tapping into export opportunities in Western markets.

Japan Gluten-Free Jams Market Insight

The Japan gluten-free jams market is gaining momentum due to the country’s expanding focus on functional and allergen-free foods. Japanese consumers, known for their demand for high-quality and convenient products, are showing a strong preference for jams that are organic, low in sugar, and free from gluten. Health trends, combined with a growing aging population, are driving interest in digestive wellness and dietary sensitivity solutions, including gluten-free jam offerings. Domestic brands are increasingly highlighting “no additives” and “clean nutrition” to attract conscious buyers in retail and online channels.

China Gluten-Free Jams Market Insight

The China gluten-free jams market accounted for the largest revenue share in Asia-Pacific in 2024, supported by the country’s rapid urbanization, expanding middle class, and increased awareness of Western-style health trends. With gluten intolerance and celiac disease slowly gaining attention, Chinese consumers are exploring gluten-free options across more food categories, including jams. Domestic manufacturers are launching innovative fruit-based spreads with gluten-free certification, targeting both domestic and export markets. Government-backed food safety regulations and an expanding health food segment in China further strengthen prospects for gluten-free jam adoption.

Gluten-Free Jams Market Share

The Gluten-Free Jams industry is primarily led by well-established companies, including:

- Amy's Kitchen, Inc (U.S.)

- Kelkin Ltd. (Ireland)

- Bob's Red Mill Natural Foods (U.S.)

- Seitz glutenfrei (Germany)

- Silly Yaks- For Real Taste (Australia)

- Warburtons (U.K.)

- Dun & Bradstreet, Inc. (U.S.)

- Big OZ (U.K.)

- Farmo S.P.A. (Italy)

- Enjoy Life Foods (U.S.)

- Dr. Schär AG / SPA (Italy)

- Raisio Plc (Finland)

- Ecotone (France)

- FREEDOM FOODS GROUP LIMITED (Australia)

- Quinoa Corporation (U.S.)

- Barilla G. e R., Fratelli S.p.A (Italy)

- Hero AG (Switzerland)

- Conagra Brands, Inc. (U.S.)

- Kellogg Co. (U.S.)

- The Kraft Heinz Company (U.S.)

Latest Developments in Global Gluten-Free Jams Market

-

In March 2025, Quiznos, a well-known sandwich chain recognized for its premium meats and cheeses sliced fresh in-house daily and perfectly toasted, introduced new gluten-smart options across all its U.S. locations. The launch featured a limited-time Buffalo Chicken Club sandwich made with spicy mayonnaise blended with Frank’s RedHot sauce, bacon, provolone cheese, tomatoes, and lettuce. Gluten-free bread became available for all sandwiches in both regular and large sizes, with location-based additional charges

- In December 2024, Revyve and Lallemand Bio-Ingredients Savory entered a strategic partnership focused on the North American market. Under this collaboration, Lallemand became Revyve’s exclusive distributor across the U.S., Canada, and Mexico, while Revyve continued sourcing a vital raw material from Lallemand. Together, they aim to pioneer sustainable food innovations that are gluten-free, animal-free, GMO-free, and natural

- In October 2024, Dr. Schär unveiled three new gluten-free snack offerings, including Peanut Butter Blondie Bites, Chocolate Brownie Bites, and Mini Honeygrams. The Blondie Bites deliver a creamy yet crunchy experience, the Brownie Bites offer a rich chocolate flavor with a crisp wafer center, and the Mini Honeygrams serve as bite-sized versions of Schär’s honey-sweetened graham-style cookies. These snacks cater to various on-the-go snacking occasions and are available through the Schär Shop online

- In August 2024, Lancaster Colony Corp. launched its first gluten-free line under the New York Bakery frozen bread range, introducing Garlic Texas Toast and Five Cheese Texas Toast. These products are crafted using a patent-pending dough recipe that replicates the texture and taste of traditional bread, addressing common limitations found in gluten-free alternatives. The company intends to use this breakthrough formulation to expand its gluten-free portfolio in the future

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.