Global Green Cardamom Market

Market Size in USD Million

CAGR :

%

USD

899.20 Million

USD

1,422.41 Million

2024

2032

USD

899.20 Million

USD

1,422.41 Million

2024

2032

| 2025 –2032 | |

| USD 899.20 Million | |

| USD 1,422.41 Million | |

|

|

|

|

Green Cardamom Market Size

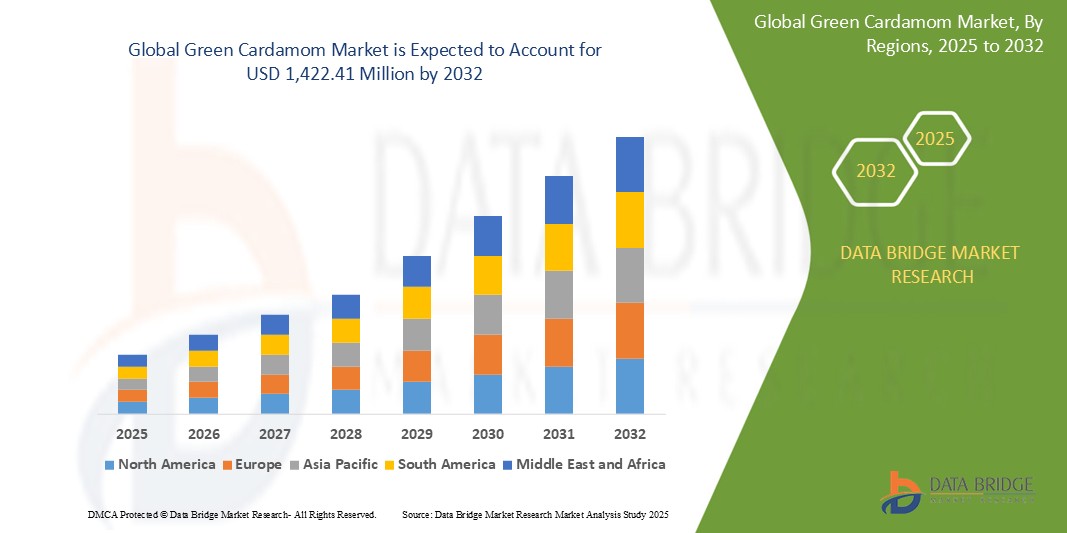

- The global green cardamom market size was valued at USD 899.2 million in 2024 and is expected to reach USD 1,422.41 million by 2032, at a CAGR of 5.9% during the forecast period

- This growth is driven by factors such as rising demand for natural and organic spices, increased awareness of cardamom’s health benefits, and expanding applications in food, beverages, and traditional medicine

Green Cardamom Market Analysis

- Green cardamom is a highly valued spice used extensively in culinary applications, traditional medicine, and personal care products due to its aromatic and therapeutic properties

- The market is significantly driven by increasing global demand for natural and organic ingredients, particularly in the food and beverage industry

- Asia-Pacific is expected to dominate the green cardamom market with largest market share of 54.3%, due to favorable climatic conditions and established agricultural practices

- Europe is expected to be the fastest growing region in the green cardamom market during the forecast period due to rising consumer interest in exotic and natural ingredients, particularly in premium food and beverage products

- Conventional segment is expected to dominate the market with a largest market share of 84.4% due to broad market acceptance and extensive use of conventional green cardamom across various industries, such as food and beverages, contribute to its consistent demand. Conventional farming methods typically involve lower production costs than organic practices, allowing for competitive pricing

Report Scope and Green Cardamom Market Segmentation

|

Attributes |

Green Cardamom Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Green Cardamom Market Trends

“Rising Popularity of Green Cardamom in Functional Foods and Beverages”

- One prominent trend in the global green cardamom market is the growing incorporation of cardamom into functional foods and health-oriented beverages due to its antioxidant, anti-inflammatory, and digestive properties

- This trend is fueled by increasing consumer demand for natural ingredients that offer both flavor and health benefits, driving innovation in product formulations across the food and wellness industries

- For instance, green cardamom is now commonly featured in herbal teas, health drinks, and fortified snacks marketed for digestive health and detoxification

- The rising health-conscious population and preference for plant-based, clean-label ingredients are expected to sustain this trend, opening new avenues for product development and market expansion

Green Cardamom Market Dynamics

Driver

“Increasing Demand for Natural Spices with Health Benefits”

- The rising global preference for natural, chemical-free ingredients is a major factor driving the demand for green cardamom, which is prized not only for its distinct aroma and flavor but also for its therapeutic properties

- Consumers are increasingly turning to spices like cardamom for their digestive, antioxidant, and anti-inflammatory benefits, aligning with broader trends in health and wellness

- The shift toward plant-based and clean-label food products has encouraged manufacturers to incorporate green cardamom into health foods, herbal teas, and nutraceuticals

For instance,

- In recent years, major F&B brands have introduced cardamom-infused products such as functional beverages and organic spice blends, targeting health-conscious consumers seeking both flavor and wellness benefits

- As a result, the increasing awareness of cardamom’s health advantages is playing a critical role in driving its global market demand across multiple sectors, including food, beverages, and traditional medicine

Opportunity

“Expanding Use of Green Cardamom in Nutraceuticals and Wellness Products”

- The growing global focus on preventive health and natural remedies presents a major opportunity for the expansion of green cardamom into the nutraceutical and wellness product segments

- Rich in essential oils and bioactive compounds, green cardamom is increasingly being recognized for its potential to support digestive health, reduce inflammation, and provide antioxidant protection

- These properties make it an attractive ingredient for use in dietary supplements, herbal capsules, detox teas, and functional foods aimed at health-conscious consumers

For instance,

- In 2024, several nutraceutical companies in Europe and North America began launching cardamom-based capsules and blends marketed for gut health, metabolism enhancement, and anti-bloating effects, tapping into the clean-label and natural product movement

- The expanding consumer preference for plant-based wellness solutions is opening up new market segments for green cardamom, offering significant opportunities for value-added product innovation and global market penetration

Restraint/Challenge

“Price Volatility and Supply Chain Dependency on Key Producing Regions”

- The global green cardamom market faces significant challenges due to price volatility, largely driven by fluctuations in production output from major growing regions such as India and Guatemala

- Being a labor-intensive crop, cardamom production is highly susceptible to climatic changes, pest outbreaks, and shifts in agricultural policy, all of which can severely impact yield and global supply

- This dependency on a few key countries for the majority of global exports can create supply bottlenecks and sudden price surges, making it difficult for manufacturers and distributors to maintain stable pricing

For instance,

- In 2023, unfavorable weather conditions in Guatemala led to a notable decline in cardamom output, causing international prices to spike and disrupting supply chains across the Middle East and Europe, key importing regions

- As a result, this volatility poses a major challenge for businesses involved in sourcing, processing, and retailing green cardamom, especially for small and medium enterprises that may lack the resources to absorb such price shocks

Green Cardamom Market Scope

The market is segmented on the basis of product, end-use, and nature.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By End-use |

|

|

By Nature |

|

In 2025, the conventional is projected to dominate the market with a largest share in nature segment

The conventional segment is expected to dominate the green cardamom market with the largest share of 84.4% due to broad market acceptance and extensive use of conventional green cardamom across various industries, such as food and beverages, contribute to its consistent demand. Conventional farming methods typically involve lower production costs than organic practices, allowing for competitive pricing

The small is expected to account for the largest share during the forecast period in product segment

In 2025, the small segment is expected to dominate the market with the largest market share of 61.5% due to its intense flavor and aromatic properties, making it a preferred choice in culinary applications worldwide. Its unique taste is essential in various traditional dishes, desserts, and beverages, particularly in South Asian and Middle Eastern cuisines. As global cuisine trends embrace these flavors, the demand for small green cardamom has grown significantly

Green Cardamom Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Green Cardamom Market”

- The Asia-Pacific region dominates the green cardamom market with largest market share of 54.3%, driven by key producing countries like India and Guatemala, which account for a significant portion of the global supply

- India is the largest producer and exporter of green cardamom with largest market share of approximately 29%, benefiting from favorable climatic conditions and a well-established agricultural sector that supports both local consumption and international trade

- The growing demand for natural and organic ingredients in both food and wellness products within the region also contributes to the high market share in Asia-Pacific

- Countries like Indonesia and Sri Lanka are increasing their production capacities, further strengthening the region’s role as a global leader in the green cardamom market

“Europe is Projected to Register the Highest CAGR in the Green Cardamom Market”

- Europe is expected to witness the highest growth rate in the green cardamom market, driven by rising consumer demand for exotic spices, health-conscious food products, and the growing popularity of ethnic cuisines

- The demand for cardamom in European countries is growing due to its use in premium food and beverage items, including organic and clean-label products

- The increasing awareness of the health benefits of green cardamom, such as its digestive and antioxidant properties, is fueling its consumption in the wellness sector

- The UK, Germany, and France are the key markets in Europe, with an expanding range of cardamom-based products being introduced by food and beverage brands to cater to the region’s growing interest in natural ingredients and functional foods

Green Cardamom Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Vandanmedu Green Gold Cardamom Producer Company Limited (India)

- Adrianna Springs Impex Pvt Ltd. (India)

- Cardex S.A. (India)

- MAS Enterprises Ltd. (India)

- Nani Agro Foods (India)

- Royal Spices (India)

- Sunlite India Agro Producer Company Ltd. (India)

- Synthite Industries (India)

- VLC Spices (India)

- Vora Spice Mills LLP (India)

- Olam International (Singapore)

- McCormick & Company, Inc. (U.S.)

- Kerry Group (Ireland)

- Cargill (U.S.)

- Associated British Foods (UK)

- Firmenich (Switzerland)

- Archer Daniels Midland Company (ADM) (U.S.)

- D.D. Williamson (U.S.)

- International Flavors & Fragrances (IFF) (U.S.)

- Sensient Technologies Corporation (U.S.)

Latest Developments in Global Green Cardamom Market

- In August 2024, the Prime Minister of India, Narendra Modi, launched two new cardamom varieties, IISR Manushree and IISR Kaveri, developed by the Indian Council of Agricultural Research (ICAR). These new varieties are expected to enhance the yield and quality of cardamom production in India, which is the world’s largest producer and exporter of the spice. The introduction of these varieties further strengthens India’s dominance in the sector

- In October 2024, Fedecovera, a prominent Guatemalan cooperative, presented its organic green cardamom offerings at the Anuga trade fair. Since 2006, Fedecovera has been certified organic, and the cooperative continues to prioritize sustainability and superior quality in its product range. This development is increasing consumer preference for organic and sustainably sourced ingredients is driving demand

- In October 2024, Brighton Gin unveiled the launch of its limited-edition Spice Circuit Gin, created in collaboration with Brighton-based chef Kanthi Thamma. This exclusive gin features a blend of botanicals and spices, including black pepper, curry leaf, green cardamom, and mace. The introduction of Spice Circuit Gin highlights the growing trend of incorporating exotic spices like green cardamom into premium beverages, reflecting the increasing consumer preference for unique, flavor-rich products

- In September 2024, the Spices Board India, under the Ministry of Commerce and Industry, Government of India, launched a mobile application called CardsApp, aimed at enhancing cardamom production by providing farmers with evidence-based insights. The app was unveiled during the Spices Conclave and Buyer-Seller Meet at the Indian Cardamom Research Institute in Myladumpara, Idukki. The launch of CardsApp empowers farmers with data-driven tools to optimize cultivation practices and improve crop yield

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Green Cardamom Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Green Cardamom Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Green Cardamom Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.