Global Grid Optimization And Management Market

Market Size in USD Billion

CAGR :

%

USD

13.20 Billion

USD

71.43 Billion

2024

2032

USD

13.20 Billion

USD

71.43 Billion

2024

2032

| 2025 –2032 | |

| USD 13.20 Billion | |

| USD 71.43 Billion | |

|

|

|

|

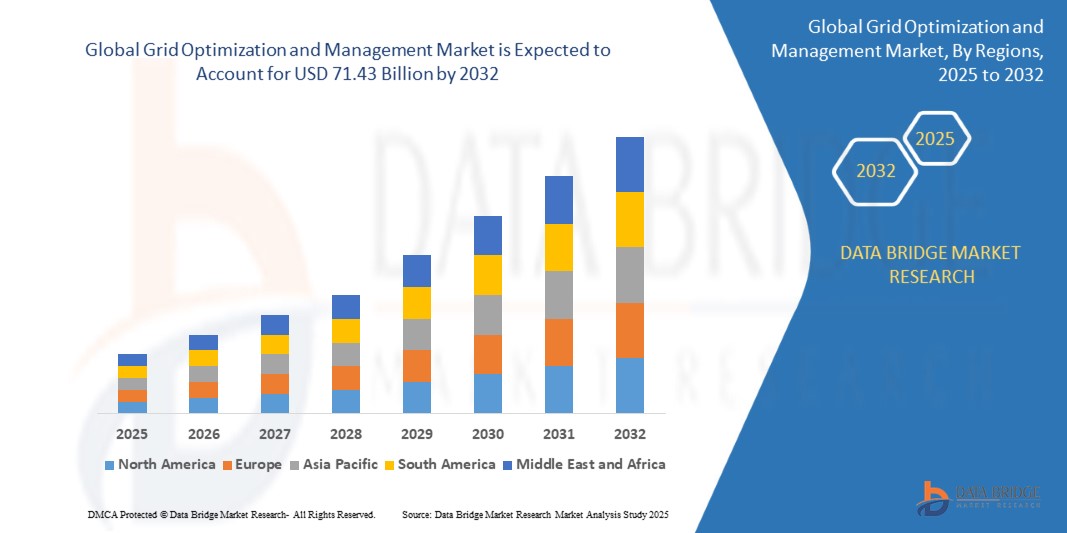

What is the Global Grid Optimization and Management Market Size and Growth Rate?

- The global grid optimization and management market size was valued at USD 13.20 billion in 2024 and is expected to reach USD 71.43 billion by 2032, at a CAGR of 23.50% during the forecast period

- Market expansion is driven by the increasing integration of renewable energy sources, rising demand for efficient electricity distribution, and growing emphasis on grid modernization across developed and emerging economies

- In addition, advancements in digital technologies such as AI, IoT, and real-time monitoring systems are enabling enhanced grid reliability and efficiency, positioning grid Optimization and management solutions as critical for future energy infrastructure. These factors collectively support rapid market growth globally

What are the Major Takeaways of Grid Optimization and Management Market?

- Grid optimization and management solutions, offering advanced monitoring, control, and automation capabilities, are becoming indispensable for utilities and industries to improve energy efficiency, reduce outages, and support the integration of distributed energy resources (DERs)

- The rising adoption of smart grids, increasing electricity demand, and growing need for real-time analytics to manage complex power flows are major drivers accelerating demand for these solutions

- As countries push toward decarbonization and renewable integration, grid Optimization and management systems are emerging as essential technologies to ensure sustainable, reliable, and resilient power networks

- North America dominated the grid optimization and management market with the largest revenue share of 32.56% in 2024, driven by the rapid digitalization of power infrastructure and rising investments in smart grid technologies

- Asia-Pacific grid optimization and management market is projected to grow at the fastest CAGR of 9.74% from 2025 to 2032, driven by urbanization, rapid industrialization, and strong government support for digital grid transformation

- The Cloud-Based segment dominated the market with the largest revenue share of 46.5% in 2024, driven by its scalability, cost-effectiveness, and seamless integration with advanced smart grid systems

Report Scope and Grid Optimization and Management Market Segmentation

|

Attributes |

Grid Optimization and Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Grid Optimization and Management Market?

AI-Powered Predictive Analytics for Smarter Grid Operations

- A significant trend in the grid optimization and management market is the increasing use of artificial intelligence (AI) and machine learning (ML) for predictive analytics and real-time grid optimization. This integration enhances grid reliability, efficiency, and resilience

- For instance, in March 2024, Siemens Energy introduced an AI-powered grid software that predicts energy demand fluctuations, enabling utilities to prevent outages and optimize energy distribution

- AI-driven tools allow utilities to forecast power loads, detect anomalies, and automate demand-response strategies, ensuring smoother operations and reduced energy wastage

- The adoption of AI in grid management also facilitates renewable energy integration, helping utilities balance intermittent sources such as solar and wind with real-time demand

- This trend is reshaping the market by shifting from reactive grid management to proactive optimization, enabling utilities to cut costs while ensuring uninterrupted energy supply

- As energy transition accelerates, AI-enabled grid optimization will be a cornerstone of building future-ready smart grids globally

What are the Key Drivers of Grid Optimization and Management Market?

- The rising global electricity demand, coupled with the growing penetration of renewable energy sources, is a major driver fueling the adoption of grid Optimization solutions

- For instance, in June 2024, Hitachi Energy launched advanced grid automation systems to help utilities manage renewable-heavy power grids more efficiently

- The increasing need for reliable and resilient power infrastructure to prevent blackouts and ensure uninterrupted electricity supply is boosting demand

- Government initiatives supporting smart grid development and large-scale investments in digital grid infrastructure are accelerating adoption across regions

- In addition, the demand for real-time monitoring, predictive maintenance, and energy efficiency is pushing utilities and industries to embrace advanced Optimization tools

- These drivers collectively make grid Optimization an essential enabler of sustainable energy transition worldwide

Which Factor is Challenging the Growth of the Grid Optimization and Management Market?

- One of the biggest challenges is the high cost of grid modernisation and infrastructure upgrades, especially in developing regions where funding is limited

- For instance, several utilities in Southeast Asia have delayed the deployment of smart grid projects due to budget constraints and lack of financing models

- Cybersecurity risks also remain a critical concern, as digitalised grids are vulnerable to hacking, data breaches, and malicious cyberattacks, which can disrupt entire power networks

- The complexity of integrating advanced grid software with legacy infrastructure poses another hurdle, requiring significant technical expertise and long-term planning

- Moreover, the slow regulatory approvals in some regions hinder the pace of deployment, creating uncertainty for investors and technology providers

- Addressing these challenges through cost-efficient solutions, strong cybersecurity frameworks, and supportive policies will be vital for achieving large-scale adoption of grid Optimization systems

How is the Grid Optimization and Management Market Segmented?

The market is segmented on the basis of deployment type, application, end-user, functionality, and technology.

• By Deployment Type

On the basis of deployment type, the grid optimization and management market is segmented into On-Premise, Cloud-Based, and Hybrid. The Cloud-Based segment dominated the market with the largest revenue share of 46.5% in 2024, driven by its scalability, cost-effectiveness, and seamless integration with advanced smart grid systems. Cloud platforms enable utilities and energy providers to manage large volumes of real-time data, support remote monitoring, and ensure faster upgrades compared to traditional systems. Moreover, rising cybersecurity frameworks and compliance measures are boosting trust in cloud deployments.

The Hybrid segment is projected to witness the fastest CAGR from 2025 to 2032, supported by utilities adopting a balance of on-premise control and cloud flexibility. Hybrid deployments appeal to government agencies and large energy providers that seek data sovereignty while leveraging the analytical power of cloud platforms. This dual advantage is expected to fuel rapid adoption across diverse end-user industries.

• By Application

On the basis of application, the grid optimization and management market is segmented into Transmission Management, Distribution Management, Outage Management, Energy Management, and Load Forecasting. The Distribution Management segment accounted for the largest market share of 41.2% in 2024, driven by the urgent need for modernizing aging grid infrastructure, integrating renewable energy, and ensuring efficient power delivery. Distribution management systems (DMS) provide real-time visibility, outage restoration, and voltage optimization, making them indispensable for utilities.

The Outage Management segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by increasing consumer expectations for reliable electricity, rising extreme weather events, and regulatory mandates for faster service restoration. Utilities are increasingly investing in outage management systems integrated with AI-driven fault detection and predictive analytics, which significantly improve restoration times. As grids become more digitalized, outage management solutions will play a central role in achieving customer satisfaction and regulatory compliance.

• By End-User

On the basis of end-user, the grid optimization and management market is segmented into Utility Companies, Independent Power Producers (IPPs), Energy Aggregators, Government Agencies, Commercial, and Industrial Users. The Utility Companies segment dominated the market with the largest share of 49.6% in 2024, owing to their critical role in managing large-scale transmission and distribution networks. Utilities are at the forefront of adopting grid optimization solutions to enhance reliability, reduce operational costs, and meet renewable integration goals.

The Energy Aggregators segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by the proliferation of distributed energy resources (DERs) and demand-response programs. Aggregators are leveraging digital platforms to pool renewable generation, energy storage, and flexible loads, optimizing them for cost and efficiency. With increasing emphasis on decentralized energy systems, aggregators will gain momentum, creating new opportunities for advanced grid optimization solutions.

• By Functionality

On the basis of functionality, the grid optimization and management market is segmented into Real-time Monitoring, Data Analytics, Predictive Maintenance, Seamless Communication, Reporting, and Compliance. The Real-time Monitoring segment dominated with the largest share of 44.8% in 2024, driven by the need for instantaneous grid visibility, load balancing, and fault detection. Utilities rely heavily on real-time systems to prevent blackouts, optimize renewable integration, and ensure operational resilience. The proliferation of IoT-enabled devices and advanced communication networks has further strengthened this segment.

The Predictive Maintenance segment is projected to witness the fastest CAGR from 2025 to 2032, as utilities and industries shift towards proactive asset management. Predictive maintenance, powered by AI and machine learning, helps detect equipment anomalies before failure, reducing downtime and repair costs. With growing pressure to minimize outage durations and extend asset lifecycles, predictive maintenance is emerging as a key driver of operational efficiency and cost savings in modern grid management.

• By Technology

On the basis of technology, the grid optimization and management market is segmented into SCADA Systems, IoT and Smart Grid Technologies, Artificial Intelligence and Machine Learning, Advanced Metering Infrastructure (AMI), and Blockchain for Energy Transactions. The SCADA Systems segment dominated the market with a share of 39.7% in 2024, attributed to their long-standing role in grid monitoring, supervisory control, and operational efficiency. SCADA remains the backbone of utility operations, providing centralized control and integration with advanced technologies.

The Artificial Intelligence and Machine Learning (AI/ML) segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its ability to provide predictive insights, demand forecasting, and intelligent decision-making. AI/ML enhances outage prediction, optimizes load dispatch, and facilitates renewable integration, making it an indispensable technology for future-ready grids. As utilities worldwide accelerate digital transformation, AI/ML is poised to become the cornerstone of next-generation grid optimization.

Which Region Holds the Largest Share of the Grid Optimization and Management Market?

- North America dominated the grid optimization and management market with the largest revenue share of 32.56% in 2024, driven by the rapid digitalization of power infrastructure and rising investments in smart grid technologies

- The region benefits from strong government initiatives, advanced grid modernization programs, and increasing reliance on renewable energy integration

- High disposable incomes, technological expertise, and large-scale adoption across utilities and industries strengthen its leadership position in this market

U.S. Grid Optimization and Management Market Insight

U.S. grid optimization and management market captured the largest revenue share in 2024 within North America, fueled by investments in smart meters, demand response systems, and energy efficiency solutions. Increasing penetration of AI- and IoT-enabled monitoring systems, combined with federal funding for grid resilience, is propelling the industry. Moreover, collaborations with technology providers and renewable integration initiatives further reinforce U.S. market dominance.

Europe Grid Optimization and Management Market Insight

Europe grid optimization and management market is projected to grow at a strong CAGR during the forecast period, supported by stringent EU energy regulations and a rapid shift toward renewable power. Rising demand for grid stability, urban electrification, and smart distribution networks is fostering adoption. European governments’ push for sustainability and digital grid solutions is driving growth across utilities, commercial, and industrial sectors.

U.K. Grid Optimization and Management Market Insight

U.K. grid optimization and management market is anticipated to expand at a notable CAGR, driven by a growing need for energy efficiency and modernization of outdated grid infrastructure. Increasing focus on renewable energy integration, along with regulatory pressure to reduce carbon emissions, is creating opportunities. The country’s shift toward digital utilities and emphasis on reliable, secure electricity supply further fuel market demand.

Germany Grid Optimization and Management Market Insight

Germany grid optimization and management market is expected to expand at a considerable CAGR, supported by its advanced energy transition policies and growing renewable penetration. Strong government backing for smart grid pilot projects, combined with a robust industrial base, is accelerating adoption. Rising focus on data-driven grid monitoring, automation, and sustainable energy management strengthens Germany’s role as a key European growth hub.

Which Region is the Fastest Growing in the Grid Optimization and Management Market?

Asia-Pacific grid optimization and management market is projected to grow at the fastest CAGR of 9.74% from 2025 to 2032, driven by urbanization, rapid industrialization, and strong government support for digital grid transformation. Increasing renewable adoption, coupled with cost-effective solutions from regional manufacturers, is making these systems more accessible.

Japan Grid Optimization and Management Market Insight

Japan grid optimization and management market is gaining momentum due to rapid digitalization of utilities, energy efficiency initiatives, and strong consumer adoption of smart technologies. The country’s focus on stable electricity supply, integration of renewable sources, and IoT-based monitoring solutions supports growth. Japan’s aging infrastructure and demand for reliable energy management further accelerate market expansion.

China Grid Optimization and Management Market Insight

China grid optimization and management market captured the largest revenue share in Asia-Pacific in 2024, fueled by strong government backing for smart city development and renewable integration. With rising electricity consumption, rapid urbanization, and domestic production of advanced grid technologies, China remains a global leader. The country’s push for large-scale smart grid deployment positions it as a dominant force in the regional market.

Which are the Top Companies in Grid Optimization and Management Market?

The grid optimization and management industry is primarily led by well-established companies, including:

- Accenture (Ireland)

- Capgemini (France)

- Networked Energy Services (NES) (U.S.)

- IBM (U.S.)

- Oracle (U.S.)

- SAP (Germany)

- SAS (U.S.)

- Schneider Electric (France)

- Siemens (Germany)

- Hitachi (Japan)

- ABB (Switzerland)

- Aclara Technologies LLC (U.S.)

- Eaton (Ireland)

- FirstEnergy Corp. (U.S.)

- Green Mountain Power (U.S.)

- Doble Engineering (U.S.)

- EKM Metering Inc. (U.S.)

- CGI Inc. (Canada)

- TotalEnergies (France)

What are the Recent Developments in Global Grid Optimization and Management Market?

- In February 2025, Cisco Systems, Inc. launched a new family of Smart Switches, integrating networking and security within a compact design. Powered by AMD Pensando DPUs, these switches streamline data center operations and enhance efficiency. The Smart Switch with Cisco Hypershield embeds security into the network fabric, addressing the rising complexity of AI workloads through automated and predictive operations. This innovation positions Cisco as a leader in securing next-generation AI-driven data centers

- In January 2025, Siemens was selected as the technology partner for two large EV charging projects in Italy, collaborating with Autolinee Toscane. The company is contributing to the electrification of public transport while transforming petrol stations into advanced service hubs. This initiative directly supports Italy’s push toward sustainable mobility and EV infrastructure expansion. This project reinforces Siemens’ pivotal role in advancing Europe’s transition to clean transportation solutions

- In April 2024, GE Vernova’s Grid Solutions division, in partnership with Algeria’s national electricity and gas provider Sonelgaz, enhanced the capabilities of GE Algeria Turbines (GEAT). This was achieved by amending their joint venture to deploy advanced grid solutions. The agreement reflects a shared commitment to sustainable energy progress, strengthening Algeria’s industrial base, and driving local economic growth. This collaboration highlights GE Vernova’s strong influence in shaping Algeria’s energy future

- In January 2023, ABB joined hands with Danish startup OKTO GRID to develop a solution that prolongs the lifespan of aging electrical equipment. This strategic investment accelerates the digitalization of power systems, helping meet the growing demand for stable and reliable energy supply. The partnership aims to enhance sustainability while ensuring safer and more efficient grid operations. This step underlines ABB’s commitment to supporting the global energy transition

- In August 2022, Hitachi Energy introduced network optimization and management solutions designed to reduce load in South Africa. These solutions aim to address the challenge of ensuring sufficient generation capacity amid ongoing supply constraints. By enabling IPPs as well as commercial and industrial users to expand power generation from 1MW to 100MW without permits, the initiative opens new opportunities for energy resilience. This move strengthens Hitachi Energy’s role in tackling South Africa’s energy supply challenges

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.