Global Halal Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

61.30 Billion

USD

98.08 Billion

2024

2032

USD

61.30 Billion

USD

98.08 Billion

2024

2032

| 2025 –2032 | |

| USD 61.30 Billion | |

| USD 98.08 Billion | |

|

|

|

|

Halal Ingredients Market Size

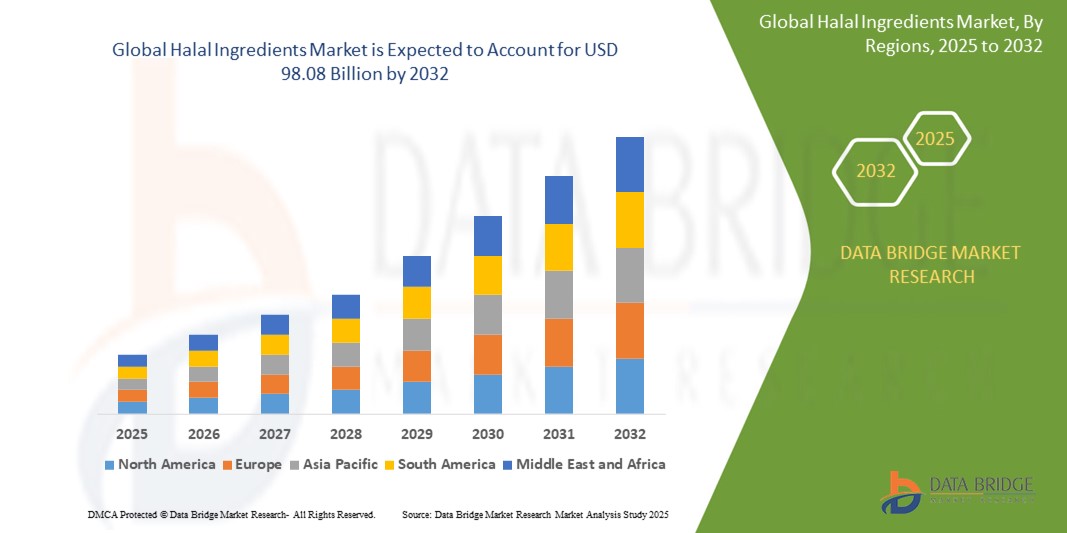

- The global halal ingredients market size was valued at USD 61.30 billion in 2024 and is expected to reach USD 98.08 billion by 2032, at a CAGR of 6.05% during the forecast period

- The market growth is largely fuelled by the increasing Muslim population, rising demand for ethically sourced products, and growing consumer awareness regarding halal-certified ingredients across food, pharmaceuticals, and cosmetics industries

- The market is also witnessing expansion due to supportive government regulations and certification standards that ensure product authenticity and build consumer trust in halal-labelled offerings

Halal Ingredients Market Analysis

- The halal ingredients market is experiencing steady growth as food, cosmetic, and pharmaceutical companies are expanding their product lines to cater to the rising demand for halal-certified offerings among global consumers

- Manufacturers are focusing on transparency and traceability by investing in certification processes and clean-label ingredients to strengthen consumer trust and brand reputation

- Asia-Pacific dominates the halal ingredients market with the largest revenue share in 2024, driven by the region’s substantial Muslim population and growing demand for halal-certified food, pharmaceuticals, and personal care products

- Middle East region is expected to witness the highest growth rate in the global halal ingredients market, driven by rising consumer awareness, strong Islamic dietary adherence, and increasing investments in halal-certified production facilities

- The personal care products segment holds the largest market revenue share in 2024, driven by increasing demand for halal-certified skincare and hygiene products that meet strict ethical and quality standards. Consumers are drawn to these products due to their compliance with religious guidelines and perceived safety benefits

Report Scope and Halal Ingredients Market Segmentation

|

Attributes |

Halal Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Halal Ingredients Market Trends

“Rising Demand for Plant-Based Halal Ingredients”

- The halal ingredients market is shifting toward plant-based halal-certified options due to rising demand for healthier and more ethical products

- Younger consumers and health-conscious individuals are driving the popularity of clean-label, allergen-free, and naturally sourced halal items

- Food and beverage manufacturers are developing halal-certified plant-based proteins, oils, and flavorings to expand their product offerings

- Cosmetic brands are using halal-certified botanical extracts to attract vegan and Muslim consumers looking for natural skincare solutions

- This trend is shaping how companies approach product development, marketing, and labeling for halal-certified goods

- For instance, Halal-certified soy protein is increasingly used in plant-based ready meals to cater to ethical and dietary preferences

Halal Ingredients Market Dynamics

Driver

“Rising Demand for Halal-Certified Products across Multiple Sectors”

- Rising global Muslim population is increasing the demand for halal-certified products across food, pharmaceutical, and personal care sectors

- Halal products are gaining traction among non-Muslim consumers who associate them with higher safety and hygiene standards

- The food industry is witnessing strong growth in halal-certified meat, dairy, and snack products due to strict quality and ethical sourcing norms

- Halal-certified supplements, creams, and pharmaceutical products made without alcohol or animal derivatives are becoming more popular

- For instance, several global cosmetic brands have launched halal-certified skincare lines to cater to both Muslim and non-Muslim ethical consumers

Restraint/Challenge

“Complex and Diverse Halal Certification Standards”

- The lack of uniform global halal certification standards creates confusion and complicates international product approvals

- Different Islamic authorities have varying criteria, inspection protocols, and labelling requirements, making it hard for brands to streamline processes

- For instance, a product halal-certified in Malaysia may require re-certification in the Middle East due to differing regulatory expectations

- Small and medium-sized companies often face high certification costs and logistical burdens, limiting their ability to expand globally

- These inconsistencies affect market entry timelines, raise compliance expenses, and challenge consumer trust in cross-border halal product authenticity

Halal Ingredients Market Scope

The halal ingredients market is segmented on the basis of product type, ingredient type, application, and distribution channels.

- By Product Type

On the basis of product type, the halal ingredients market is segmented into personal care products and color cosmetics. The personal care products segment holds the largest market revenue share in 2024, driven by increasing demand for halal-certified skincare and hygiene products that meet strict ethical and quality standards. Consumers are drawn to these products due to their compliance with religious guidelines and perceived safety benefits.

The color cosmetics segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by rising awareness and preference for halal-certified makeup items, especially among younger consumers seeking clean-label and cruelty-free options.

- By Ingredient Type

On the basis of ingredient type, the halal ingredients market is segmented into ingredients for the food and beverage industry, ingredients for the pharmaceutical industry, and ingredients for the cosmetic industry. Ingredients for the food and beverage industry dominate the market revenue share in 2024, supported by the expanding demand for halal-certified food products worldwide.

The pharmaceutical ingredients segment is expected to witness the fastest growth rate from 2025 to 2032, during the forecast period, as there is growing adoption of halal-certified medicines and supplements that exclude non-permissible substances.

- By Application

On the basis of application, the halal ingredients market is segmented into food and beverage, cosmetics, and pharmaceuticals. The food and beverage application segment accounts for the largest revenue share in 2024, driven by the rising consumption of halal-certified processed foods and beverages across various global markets.

The cosmetics application segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by increasing demand for halal-certified beauty and personal care products.

- By Distribution Channels

On the basis of distribution channels, the halal ingredients market is segmented into online and offline. The offline distribution channel holds the largest market share in 2024 due to well-established retail networks and consumer preference for in-store purchases.

The online segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing penetration of e-commerce platforms and convenience of purchasing halal-certified products digitally.

Halal Ingredients Market Regional Analysis

- Asia-Pacific dominates the halal ingredients market with the largest revenue share in 2024, driven by the region’s substantial Muslim population and growing demand for halal-certified food, pharmaceuticals, and personal care products

- Increasing consumer awareness about halal compliance and rising disposable incomes in countries such as China, India, and Indonesia are boosting market growth

- The region benefits from supportive government regulations and expanding halal certification infrastructure, encouraging manufacturers to introduce a wider variety of halal-certified products

India Halal Ingredients Market Insight

The India dominates the Asia-Pacific halal ingredients market, supported by its significant Muslim population, expanding food processing industry, and rising demand for halal-certified products across various sectors. The country’s strong agricultural base and growing pharmaceutical and cosmetics manufacturing capabilities further contribute to its leadership. With increasing consumer preference for safe, ethical, and quality ingredients, domestic and international brands are focusing on halal compliance. In addition, robust export potential and supportive government policies are strengthening India's role as a leading supplier of halal ingredients in the region.

China Halal Ingredients Market Insight

The China halal ingredients market is expected to witness the fastest growth rate from 2025 to 2032, supported by rapid urbanization, increasing Muslim consumer base, and the country’s growing e-commerce penetration. The rising demand for halal-certified food and beverage products, along with pharmaceutical and cosmetic ingredients, is driving market expansion. China’s efforts to promote halal standards and certification are also strengthening consumer confidence and industry growth.

Japan Halal Ingredients Market Insight

The Japan’s halal ingredients market is expected to witness the fastest growth rate from 2025 to 2032, due to increasing Muslim tourism, rising interest in halal lifestyles, and government initiatives promoting halal food exports. The growing number of halal-certified restaurants and retail outlets is encouraging manufacturers to offer halal-compliant ingredients, especially in the food and cosmetic sectors. In addition, Japan’s emphasis on quality and safety standards complements halal certification demands.

Middle East Halal Ingredients Market Insight

The Middle East is the fastest-growing region in the halal ingredients market, fuelled by a large Muslim population and high demand for halal-certified products across food, pharmaceuticals, and personal care sectors. Countries such as Saudi Arabia lead the market growth with increasing investments in halal manufacturing and certification infrastructure. Rising health awareness and consumer preference for authentic halal products are further accelerating demand.

Saudi Arabia Halal Ingredients Market Insight

The Saudi Arabia’s halal ingredients market is expected to witness the fastest growth rate from 2025 to 2032, driven by government support for the halal economy and rising consumer spending on halal foods and cosmetics. The country’s strategic position as a global halal hub and ongoing infrastructure development for halal certification are attracting international players and boosting local production capabilities.

U.A.E Halal Ingredients Market Insight

The U.A.E. halal ingredients market is experiencing notable growth, driven by the country’s strategic vision to become a global halal hub and rising domestic demand. Government initiatives promoting halal certification and regulation have strengthened consumer trust and product quality. The country’s robust logistics infrastructure and favorable trade policies make it an ideal export base for halal-certified goods. Demand is rising across food, cosmetics, and pharmaceutical sectors, with local and international brands launching diverse halal-compliant products. Additionally, the growing influx of tourists and expatriates is boosting consumption of halal ingredients in personal care and dietary applications.

North America Halal Ingredients Market Insight

The North America holds a significant share of the halal ingredients market, driven by rising Muslim populations in the U.S. and Canada and growing consumer interest in halal-certified and ethically produced goods. Increasing availability of halal products through retail and online channels supports market growth. The region also benefits from innovation in product formulations and expanding certification programs.

U.S. Halal Ingredients Market Insight

The U.S. halal ingredients market is expected to witness the fastest growth rate from 2025 to 2032, due to the increasing demand for halal food, pharmaceuticals, and personal care products among both Muslim and non-Muslim consumers. Rising health consciousness and preference for ethically sourced ingredients contribute to market growth. The growing presence of halal certification bodies and expanding distribution networks further facilitate market penetration.

Europe Halal Ingredients Market Insight

The Europe’s halal ingredients market is expected to witness the fastest growth rate from 2025 to 2032, supported by a rising Muslim population and increasing demand for halal-certified food and personal care products. Countries such as Germany and the U.K. are key markets, driven by consumer awareness, expanding halal certification schemes, and the presence of large halal retail and foodservice sectors.

Germany Halal Ingredients Market Insight

The Germany’s halal ingredients market is expected to witness the fastest growth rate from 2025 to 2032, backed by its multicultural population and increasing halal food and cosmetic product launches. The country’s strong regulatory framework and emphasis on quality assurance encourage manufacturers to comply with halal standards, strengthening market confidence.

U.K. Halal Ingredients Market Insight

The U.K. halal ingredients market is expected to witness the fastest growth rate from 2025 to 2032, due to increasing Muslim demographics and heightened demand for halal-certified food and personal care products. The country’s well-established halal certification bodies, combined with growing consumer education on halal benefits, support market expansion. In addition, the U.K.’s vibrant retail and e-commerce sectors facilitate greater accessibility of halal ingredients.

Halal Ingredients Market Share

The Halal Ingredients industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- Solvay (Belgium)

- Archer Daniels Midland Company (U.S.)

- DSM (Netherlands)

- Del Monte Philippines, Inc. (Philippines)

- Unilever Food Solutions (U.K.)

- Tesco (U.K.)

- INIKA Organic Australia (Australia)

- Martha Tilaar Group (Indonesia)

- IVY Beauty Corporation (Malaysia)

- CLARA INTERNATIONAL BEAUTY GROUP (Malaysia)

- INGLOT Cosmetics (Poland)

- Iba (South Korea)

- Tuesday in Love (Canada)

- Wardah (Indonesia)

- Wipro Unza Holdings Ltd. (Singapore)

- Sirehemas Marketing Sdn Bhd (Malaysia)

- PROLAB COSMETICS (Brazil)

Latest Developments in Global Halal Ingredients Market

- In February 2024, CJ Foods, a South Korean company, launched its first halal bibigo Mandu products, marking a strategic move to enter the Malaysian market. This launch leverages the brand’s strong presence in Vietnam, Korea, and the U.S., aiming to cater to growing demand for authentic Korean halal food. By expanding into Malaysia, CJ Foods is expected to strengthen its position in the halal food segment and tap into new consumer bases, enhancing market diversity and driving growth in the region

- In November 2023, McCook commenced production at its new facility in Eustis, Nebraska, focusing on halal-certified beef bacon. This development targets the underserved halal meat market in the U.S., providing consumers with more diverse options in this niche. The move is anticipated to boost McCook’s market share while addressing rising consumer demand for halal protein products, fostering expansion in the specialized halal meat sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Halal Ingredients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Halal Ingredients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Halal Ingredients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.