Global Halal Skin Care Market

Market Size in USD Billion

CAGR :

%

USD

11.80 Billion

USD

16.92 Billion

2024

2032

USD

11.80 Billion

USD

16.92 Billion

2024

2032

| 2025 –2032 | |

| USD 11.80 Billion | |

| USD 16.92 Billion | |

|

|

|

|

Halal Skin Care Market Size

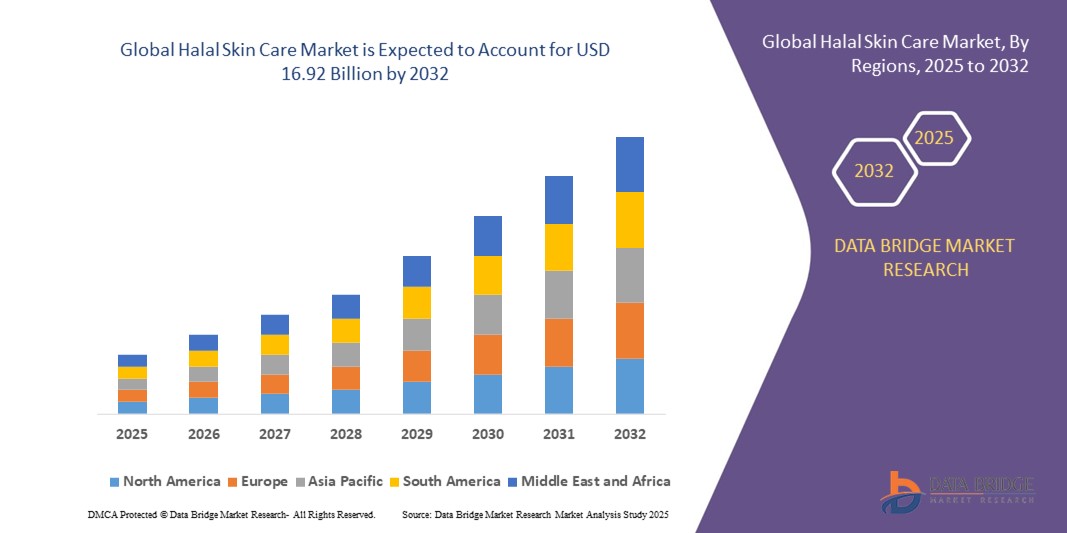

- The global halal skin care market size was valued at USD 11.80 billion in 2024 and is expected to reach USD 16.92 billion by 2032, at a CAGR of 4.6% during the forecast period

- The market growth is largely fueled by the rising consumer preference for ethical, natural, and religiously compliant beauty products, with halal certification emerging as a key differentiator in skincare and cosmetics. Increasing awareness regarding harmful chemicals, animal-derived ingredients, and cruelty-free practices has strengthened demand for halal-certified solutions across global markets

- Furthermore, the growing availability of halal-certified skincare through e-commerce platforms, specialty stores, and mainstream retail chains is accelerating adoption. The combination of health-conscious purchasing, cultural alignment, and regulatory support for halal certification is significantly boosting the industry’s expansion

Halal Skin Care Market Analysis

- Halal skincare products are certified formulations free from alcohol, animal by-products, and harsh chemicals, designed to align with both religious principles and modern clean beauty standards. These products include moisturizers, serums, cleansers, and cosmetics that appeal to both Muslim and non-Muslim consumers seeking safe and ethical options

- The escalating demand for halal skincare is primarily fueled by rising disposable incomes, growing urban populations, and an increasing shift toward sustainable and transparent beauty. The assurance of certification, coupled with the influence of social media, influencer marketing, and the expansion of global halal brands, is positioning halal skincare as a rapidly growing segment within the broader cosmetics industry

- Middle East and Africa dominated halal skin care market in 2024, due to high demand for certified Halal beauty and personal care products and increasing consumer preference for ethical and religiously compliant formulations

- Asia-Pacific is expected to be the fastest growing region in the halal skin care market during the forecast period due to rising urbanization, growing disposable incomes, and an increasing preference for certified Halal beauty products in countries such as Malaysia, Indonesia, and Singapore

- Skin care segment dominated the market with a market share of 39% in 2024, due to increasing consumer awareness about ethical and clean beauty products. Rising preference for natural, cruelty-free, and chemical-free ingredients in moisturizers, serums, and facial treatments has fueled demand. Skin care products adhering to Halal certification offer assurance of purity and compliance with Islamic principles, attracting both Muslim and conscious non-Muslim consumers. The surge in e-commerce platforms, combined with innovative product launches and influencer-led marketing, further propels the adoption of Halal skin care products globally

Report Scope and Halal Skin Care Market Segmentation

|

Attributes |

Halal Skin Care Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Halal Skin Care Market Trends

Rising Awareness of Skin Health and Safety Standards

- The halal skin care market is witnessing strong growth due to rising consumer awareness regarding skin health and higher safety standards. Consumers are increasingly opting for products that are free from harmful chemicals, alcohol, and animal-derived ingredients, aligning with regulatory benchmarks and religious compliance while meeting dermatological safety requirements

- For instance, Wardah and IBA Halal Care have positioned themselves strongly in the halal skin care space by offering safe, alcohol-free, and cruelty-free products that comply with Shariah principles and also appeal to broader consumers seeking toxin-free and ethically produced cosmetics. Similarly, multinational players such as Unilever are expanding their halal-certified product lines to serve growing demand in Asia-Pacific and the Middle East

- The trend toward clean-label skin care is reinforcing the appeal of halal certification as a mark of product purity, safety, and transparency. Increasing consumer scrutiny of labels and ingredients has directly boosted trust and preference for halal skin care brands in both Muslim and non-Muslim segments

- The rising incidence of skin conditions linked to pollution, hormonal imbalances, and lifestyle changes is also increasing demand for products that guarantee dermatological safety. Halal formulations are increasingly positioned as gentle, safer alternatives to chemical-intensive cosmetics, further extending their use in sensitive skin categories

- In conclusion, the heightened awareness of skin health and the importance of safety standards are directly influencing consumer choices, ensuring that halal-certified skin care continues to gain sustainable traction across demographic and regional boundaries

Halal Skin Care Market DynamicsDriver

Increasing Demand for Ethical and Halal-Certified Products

- The expanding consumer demand for ethical, transparent, and halal-certified products is a key driver of the halal skin care market. Certification ensures compliance with both religious values and global ethical standards, which appeals to diverse consumer bases seeking safe, cruelty-free, and environmentally conscious choices

- For instance, Amara Halal Cosmetics has gained prominence in North America by focusing on halal-certified, vegan, and toxin-free products that appeal to conscious consumers beyond the Muslim population. Similarly, Wardah and Safi have scaled their halal-certified offerings, integrating ethical sourcing and sustainable practices alongside religious compliance

- The broader ethical consumerism trend is pushing manufacturers to provide skin care products that align with sustainability practices such as cruelty-free testing, eco-friendly packaging, and natural organic formulations. Halal certification acts as an added assurance of quality, safety, and ethical responsibility

- This alignment of halal beauty with wider ethical consumption movements significantly broadens the addressable market

- It positions halal skin care as a niche religious product and as a mainstream ethical choice attracting health-conscious, sustainability-driven consumers worldwide

Restraint/Challenge

Competition from Established Brands

- A major challenge in the halal skin care market is the strong competition posed by established global beauty and personal care brands. Well-recognized multinational companies already dominate shelf space, distribution channels, and marketing budgets, making it challenging for smaller halal-specific brands to gain visibility and scale globally

- For instance, global giants such as L’Oréal and Procter & Gamble are increasingly integrating natural and “clean beauty” lines into their existing portfolios. While not always halal-certified, these offerings compete directly by addressing consumer demand for safe, cruelty-free, and chemical-free products, limiting halal brands’ differentiation in mainstream markets

- High competition also affects pricing strategies. Larger multinational firms benefit from economies of scale, enabling them to offer competitive pricing and widespread promotions that smaller halal-focused brands often cannot match. This reduces growth opportunities in non-traditional markets where halal awareness is still developing

- In addition, established international brands often enjoy stronger consumer trust, broad global retail networks, and advanced R&D investments. This creates entry barriers for emerging halal brands that must convince consumers of legitimacy, efficacy, and value while competing against established market leaders

- As a result, competition from established beauty and skin care brands remains a structural challenge. Halal players will need to emphasize strong certification, brand authenticity, targeted awareness campaigns, and product innovation to differentiate and secure long-term growth in competitive market environments

Halal Skin Care Market Scope

The market is segmented on the basis of product, application, and distribution channel.

- By Product

On the basis of product, the Halal Skin Care market is segmented into personal care, skin care, hair care, colour cosmetics, face, eyes, lips, nails, and fragrance. The skin care segment dominated the market with the largest revenue share of 39% in 2024, driven by increasing consumer awareness about ethical and clean beauty products. Rising preference for natural, cruelty-free, and chemical-free ingredients in moisturizers, serums, and facial treatments has fueled demand. Skin care products adhering to Halal certification offer assurance of purity and compliance with Islamic principles, attracting both Muslim and conscious non-Muslim consumers. The surge in e-commerce platforms, combined with innovative product launches and influencer-led marketing, further propels the adoption of Halal skin care products globally.

The personal care segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing consumer inclination toward comprehensive Halal-certified grooming routines. Products such as body washes, deodorants, and lotions are gaining popularity due to their ethical formulations and compatibility with sensitive skin. The growing influence of social media, along with rising demand for products that align with ethical, sustainable, and wellness-focused lifestyles, is accelerating market penetration. Personal care items are also becoming a key focus for brands expanding their Halal-certified portfolios to capture wider demographics.

- By Application

On the basis of application, the Halal Skin Care market is segmented into hair care, skin care, beauty care, face care, and others. The skin care application segment held the largest market revenue share in 2024, attributed to the increasing consumer emphasis on daily skincare routines that comply with Halal standards. Growing concerns regarding harmful chemicals and synthetic ingredients in conventional skincare have strengthened the preference for certified Halal alternatives. Rising urbanization, disposable income, and the influence of wellness trends are also driving adoption, particularly among millennials and Gen Z consumers. Halal-certified face masks, creams, and serums are increasingly recognized for their ethical sourcing and gentle formulations, further consolidating their market dominance.

The beauty care segment is projected to register the fastest CAGR from 2025 to 2032, driven by the rising integration of Halal products in makeup, exfoliants, and spa treatments. Consumers are seeking products that enhance appearance and also meet religious, ethical, and clean-label standards. The surge in online beauty platforms, social media promotions, and influencer-driven awareness campaigns is accelerating the uptake of Halal beauty care products. In addition, the growing focus on inclusive and diverse formulations is encouraging brands to expand their Halal-certified offerings across this application segment.

- By Distribution Channel

On the basis of distribution channel, the Halal Skin Care market is segmented into hypermarkets & supermarkets, specialty stores, online retail, and others. The online retail segment dominated the market in 2024, driven by the convenience of home delivery, extensive product variety, and access to verified Halal-certified brands. The surge in e-commerce adoption, particularly in emerging markets, has made online platforms the preferred choice for tech-savvy and conscious consumers. Detailed product information, reviews, and easy comparison of Halal certifications on these platforms further enhance consumer confidence and drive purchases.

The specialty stores segment is expected to witness the fastest growth from 2025 to 2032, fueled by rising demand for curated Halal skincare collections and expert-led recommendations. Specialty stores offer personalized experiences, professional guidance, and exclusive access to niche Halal-certified products. Increasing brand collaborations, pop-up events, and in-store campaigns are contributing to growth, while consumer preference for tangible product trials before purchase continues to strengthen this channel. The combination of expertise, authenticity, and curated offerings positions specialty stores as a high-growth distribution avenue.

Halal Skin Care Market Regional Analysis

- Middle East and Africa dominated the halal skin care market with the largest revenue share in 2024, driven by high demand for certified Halal beauty and personal care products and increasing consumer preference for ethical and religiously compliant formulations

- Consumers in the region highly value the assurance of Halal certification, natural and cruelty-free ingredients, and the availability of products tailored to sensitive skin

- This widespread adoption is further supported by rising disposable incomes, growing awareness of Halal lifestyle products, and strong retail and e-commerce infrastructure, establishing Halal skin care as a preferred choice across the region

U.A.E. Halal Skin Care Market Insight

The U.A.E. captured the largest revenue share within the Middle East & Africa region in 2024, fueled by a robust retail sector, high disposable incomes, and a large population actively seeking Halal-certified skincare and personal care products. Consumers prioritize premium, ethical, and natural formulations, while the presence of international Halal-certified brands enhances market diversity. The adoption of online platforms, combined with influencer-led marketing and luxury beauty trends, is further accelerating the uptake of Halal skincare products across both personal and professional segments.

Europe Halal Skin Care Market Insight

The Europe Halal Skin Care market is expected to expand at a substantial CAGR during the forecast period, driven by a growing multicultural population and increasing demand for ethical and clean beauty products. Countries such as the U.K. and Germany are witnessing strong adoption of Halal-certified skincare and personal care due to rising awareness about ingredient safety, sustainability, and cruelty-free standards. Retailers and specialty stores are increasingly offering certified Halal products, and the expansion of e-commerce platforms further enhances accessibility to a diverse consumer base.

U.K. Halal Skin Care Market Insight

The U.K. Halal Skin Care market is projected to grow at a noteworthy CAGR during the forecast period, driven by consumer demand for ethical, transparent, and religion-compliant personal care products. Increasing awareness about Halal certification and the rising influence of health, wellness, and beauty trends are encouraging both retailers and brands to expand their Halal product offerings. The robust e-commerce infrastructure and growing adoption of online beauty marketplaces are expected to continue supporting market growth.

Germany Halal Skin Care Market Insight

The Germany Halal Skin Care market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing consumer awareness of clean, natural, and Halal-certified products. Germany’s well-developed retail network, combined with rising demand for ethical, sustainable, and vegan beauty products, promotes market adoption. The growing popularity of specialty stores, organic shops, and online platforms contributes to the penetration of Halal skincare solutions across both personal and professional care segments.

Asia-Pacific Halal Skin Care Market Insight

The Asia-Pacific Halal Skin Care market is poised to grow at the fastest CAGR during the forecast period, driven by rising urbanization, growing disposable incomes, and an increasing preference for certified Halal beauty products in countries such as Malaysia, Indonesia, and Singapore. The region’s strong Halal certification frameworks, coupled with rising awareness of clean and ethical formulations, are accelerating adoption. Government initiatives promoting Halal industries, along with the growth of e-commerce and social media marketing, are enhancing product visibility and accessibility across a broader consumer base.

Japan Halal Skin Care Market Insight

The Japan Halal Skin Care market is witnessing steady growth due to rising consumer interest in natural, ethical, and clean beauty products. Halal-certified skin care is increasingly sought after by health-conscious and Muslim consumers. The integration of Halal products into premium skincare lines, along with the influence of wellness trends and the availability of online shopping platforms, is driving market expansion. Japanese consumers’ preference for high-quality, safe, and effective formulations further supports the adoption of Halal skincare.

China Halal Skin Care Market Insight

The China Halal Skin Care market accounted for the largest revenue share in the Asia-Pacific region in 2024, attributed to rising urbanization, increasing disposable incomes, and strong adoption of clean and ethical beauty products. The growing middle-class population, coupled with rising awareness of Halal-certified products, is driving demand across skincare, personal care, and beauty segments. The expansion of online retail platforms and influencer-led marketing campaigns further accelerates the visibility and uptake of Halal skincare products throughout the country.

Halal Skin Care Market Share

The halal skin care industry is primarily led by well-established companies, including:

- Wardah (Indonesia)

- TNS Skin Lab (Malaysia)

- Misk Al Fawz (Saudi Arabia)

- Al Haramain Perfumes (U.A.E.)

- Suna Natural SL (Turkey)

- Nourish London (U.K.)

- Ibtissam Beauty (U.S.)

- Sudsatorium (Australia)

- Herbs & Essence (Bangladesh)

- Juicy Chemistry Powered by Shopify (India)

Latest Developments in Global Halal Skin Care Market

- In November 2022, Iba Cosmetics partnered with Singapore-based Believe Company to strengthen its distribution network and expand market presence across the Middle East, Europe, and South Asia. With a USD 10 billion investment commitment, this collaboration is expected to accelerate Iba Cosmetics’ global footprint, enabling wider accessibility of halal-certified products in key growth markets. The partnership enhances Iba’s logistical and retail capabilities and also reinforces consumer confidence in certified halal offerings, supporting long-term growth in regions with high demand for ethical and religiously compliant beauty solutions

- In April 2022, Inika Organic launched its new cosmetics line, Pure with Purpose, which includes Lash & Brow Serum, Hydrating Toning Mist, Eyeshadow Quads, and Brow Palette. Marketed as 100% natural, vegan-certified, halal-certified, and cruelty-free, the line responds to the growing global trend of clean, sustainable, and ethical beauty. This launch strengthens Inika Organic’s positioning in the premium halal skincare and cosmetics segment while addressing consumer demand for transparency, safety, and multifunctional beauty solutions. The initiative also highlights how brands are leveraging certifications to expand their appeal beyond Muslim consumers to a broader ethically conscious audience

- In September 2022, Kolmar Korea Co., a South Korean halal cosmetics manufacturer, announced plans to expand operations in the UAE by supplying halal-certified products. This strategic expansion aims to tap into the Middle East’s rapidly growing halal beauty market, which is characterized by a high concentration of consumers actively seeking certified, safe, and high-quality products. By establishing a presence in the UAE, Kolmar Korea enhances its visibility, strengthens brand recognition in the region, and aligns with global trends of halal certification as a key differentiator in competitive international markets

- In October 2021, Dubai-based cosmetics brand Mikyajy introduced a halal-certified cosmetics line, including lipsticks, in response to the COVID-19 pandemic, which heightened consumer focus on hygiene and product safety. The launch of sustainable and hygienic halal products allowed Mikyajy to meet growing consumer expectations for ethical and reliable beauty solutions. This development solidified Mikyajy’s position in the Middle Eastern halal cosmetics sector and also emphasized the importance of integrating health, sustainability, and certification standards to gain consumer trust

- In August 2021, Japan-based Kao Corporation collaborated with Lion Corporation to develop recyclable packaging for its halal-certified cosmetics, aiming to reduce environmental impact and minimize plastic waste. This initiative highlights the convergence of sustainability and halal compliance, appealing to environmentally conscious consumers globally. By combining ethical beauty standards with eco-friendly practices, Kao Corporation positions itself as a leader in responsible cosmetics manufacturing, enhancing brand value and supporting long-term adoption of halal-certified products in both domestic and international markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.