Global Healthcare Interoperability Market

Market Size in USD Billion

CAGR :

%

USD

4.47 Billion

USD

11.69 Billion

2025

2033

USD

4.47 Billion

USD

11.69 Billion

2025

2033

| 2026 –2033 | |

| USD 4.47 Billion | |

| USD 11.69 Billion | |

|

|

|

|

Healthcare Interoperability Market Size

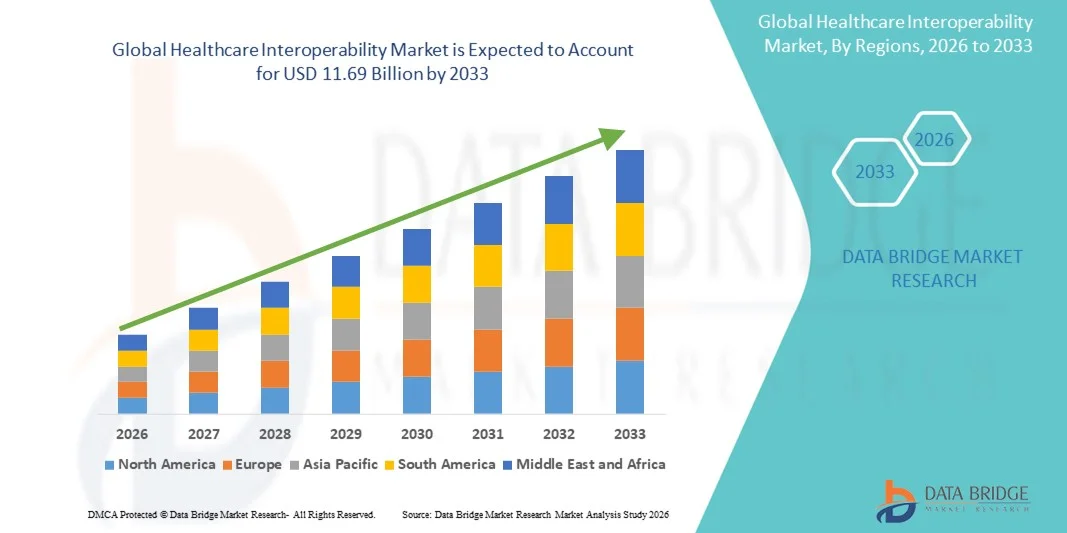

- The global healthcare interoperability market size was valued at USD 4.47 billion in 2025 and is expected to reach USD 11.69 billion by 2033, at a CAGR of 12.75% during the forecast period

- The market growth is largely fueled by the increasing adoption of electronic health records (EHRs), digital health platforms, and connected healthcare systems, leading to enhanced data exchange and operational efficiency across healthcare providers

- Furthermore, rising demand for seamless, secure, and real-time information sharing between hospitals, clinics, and patients is positioning interoperability solutions as a critical component of modern healthcare infrastructure. These converging factors are accelerating the adoption of healthcare interoperability solutions, thereby significantly boosting the industry's growth

Healthcare Interoperability Market Analysis

- Healthcare interoperability, enabling seamless electronic exchange of patient health information across systems and providers, is becoming a critical component of modern healthcare delivery due to its potential to improve care coordination, patient outcomes, and operational efficiency in both clinical and administrative settings

- The escalating demand for healthcare interoperability solutions is primarily fueled by the widespread adoption of electronic health records (EHRs), growing emphasis on value-based care, and rising need for real-time access to accurate patient data across hospitals, clinics, and other care facilities

- North America dominated the healthcare interoperability market with the largest revenue share of 39.5% in 2025, driven by advanced healthcare infrastructure, high adoption of digital health technologies, and a strong presence of key solution providers, with the U.S. witnessing substantial growth in interoperability initiatives, particularly in integrated delivery networks and hospital systems, supported by government regulations and innovations in AI-driven data exchange

- Asia-Pacific is expected to be the fastest growing region in the healthcare interoperability market during the forecast period due to increasing digitization of healthcare systems, government initiatives for national health information exchange, and rising investments in connected health technologies

- Software solutions segment dominated the healthcare interoperability market with a market share of 42.7% in 2025, driven by the growing need for integrated and standalone platforms that facilitate secure, standardized, and real-time exchange of patient data across healthcare ecosystems

Report Scope and Healthcare Interoperability Market Segmentation

|

Attributes |

Healthcare Interoperability Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Healthcare Interoperability Market Trends

Advancement Through AI-Driven Data Exchange

- A significant and accelerating trend in the global healthcare interoperability market is the integration of artificial intelligence (AI) with health information exchange platforms, enhancing data analysis, predictive insights, and real-time clinical decision-making

- For instance, cloud-based interoperability solutions such as InterSystems IRIS for Health utilize AI to aggregate and analyze patient data across multiple systems, helping providers detect patterns and optimize care workflows

- AI integration enables features such as predictive patient risk scoring, automated alerts for abnormal lab results, and identification of care gaps, improving clinical efficiency and patient outcomes

- The seamless connection of interoperable platforms with EHRs, laboratory systems, and patient monitoring devices facilitates centralized management of healthcare data, allowing clinicians to access comprehensive patient information from a single interface

- This trend towards smarter, AI-enabled, and interconnected healthcare systems is fundamentally transforming expectations for clinical decision-making, prompting companies such as Oracle Health to develop AI-powered interoperability platforms with predictive analytics and automated care alerts

- The demand for AI-enhanced interoperability solutions is growing rapidly across hospitals, clinics, and integrated delivery networks, as providers increasingly prioritize efficiency, accuracy, and coordinated patient care

- Growing focus on patient engagement is driving interoperability solutions that allow secure patient access to their health records, appointment scheduling, and telehealth integration, enhancing patient-centered care

- Expansion of cross-institutional and cross-border health data sharing is emerging as a trend, supporting medical research, clinical trials, and international care coordination

Healthcare Interoperability Market Dynamics

Driver

Rising Need Due to Digital Health Adoption and Regulatory Push

- The increasing adoption of digital health platforms, coupled with government mandates for health information exchange, is a significant driver for the heightened demand for healthcare interoperability solutions

- For instance, in March 2025, Epic Systems announced expanded interoperability capabilities to comply with U.S. federal information-blocking rules, enabling seamless patient data exchange across multiple providers

- As healthcare providers focus on improving care coordination and patient outcomes, interoperability solutions offer real-time access to accurate patient records, reducing duplication of tests and medical errors

- Furthermore, the growing implementation of value-based care models and population health management initiatives is making interoperable systems essential for performance tracking and reporting

- The integration of EHRs, cloud-based health platforms, and telehealth solutions facilitates unified data management, driving the adoption of healthcare interoperability across large hospital networks and small clinics

- Increasing collaborations between healthcare providers, payers, and technology vendors are fueling demand for interoperable platforms that streamline data exchange and analytics across the healthcare ecosystem

- Rising investments in healthcare IT infrastructure by emerging economies are creating new opportunities for deploying interoperability solutions, accelerating adoption across underpenetrated markets

Restraint/Challenge

Data Security Concerns and High Implementation Costs

- Concerns surrounding patient data privacy, cybersecurity vulnerabilities, and compliance with regulations such as HIPAA pose significant challenges to market growth

- For instance, high-profile healthcare data breaches have made some providers hesitant to adopt cloud-based interoperability solutions, fearing unauthorized access or ransomware attacks

- Addressing these security concerns through advanced encryption, secure authentication protocols, and regular system audits is crucial for building trust among healthcare organizations

- In addition, the high initial cost of implementing comprehensive interoperability platforms, including software, hardware, and training, can hinder adoption, especially in smaller clinics or resource-constrained regions

- While cloud-based solutions are gradually reducing upfront costs, advanced features such as AI analytics and real-time population health dashboards often come at a premium, limiting accessibility for some healthcare providers

- Overcoming these challenges through robust security measures, provider education, and cost-effective solutions will be critical for sustained growth in the healthcare interoperability market

- Resistance to change from healthcare staff and the complexity of integrating legacy systems with new interoperability platforms can slow adoption and require extensive training and support

- Variability in regional regulations, standards, and compliance requirements may create implementation challenges for global interoperability solutions, limiting scalability and cross-border adoption

Healthcare Interoperability Market Scope

The market is segmented on the basis of type, software type, model type, interoperability level, deployment, application, and end users.

- By Type

On the basis of type, the healthcare interoperability market is segmented into software solutions, services, and others. The software solutions segment dominated the market with the largest revenue share of 42.7% in 2025, driven by the increasing demand for integrated and standalone platforms that facilitate secure, standardized, and real-time exchange of patient data across healthcare ecosystems. Providers are prioritizing software solutions for their ability to seamlessly connect EHRs, laboratory systems, and patient monitoring devices, which enhances clinical workflows. The market sees strong growth in this segment due to government regulations and initiatives promoting electronic health record adoption and interoperability standards. In addition, software solutions allow scalable integration across hospital networks and smaller clinics, making them highly versatile and critical to modern healthcare infrastructure. Companies offering cloud-based, AI-enabled software are further driving the adoption of this segment. Software solutions also support analytics, reporting, and decision support features, making them indispensable for value-based care and population health management.

The services segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for consulting, implementation, training, and maintenance services related to interoperability platforms. Healthcare organizations, especially smaller providers, rely on professional services to deploy complex interoperability systems efficiently and ensure regulatory compliance. Managed services and technical support enhance the performance, security, and adoption rate of interoperable platforms. Rising investments in IT outsourcing for healthcare interoperability are further supporting the expansion of this services segment. The growing complexity of healthcare IT ecosystems and the need for ongoing system optimization are also driving demand for service providers. In addition, services facilitate customization, integration, and continuous upgrades, making them essential for sustained interoperability performance.

- By Software Type

On the basis of software type, the market is segmented into integrated and standalone software. The integrated software segment dominated the market in 2025 due to its ability to provide seamless access to patient data across multiple systems and care settings. Integrated platforms allow healthcare providers to consolidate information from EHRs, laboratory systems, and imaging devices into a unified interface, enhancing care coordination and reducing redundancy. The growing emphasis on value-based care models and population health management is driving adoption of integrated software as it supports analytics and reporting across the patient lifecycle. Integration with telehealth, AI analytics, and clinical decision support systems further strengthens this segment. Providers prefer integrated solutions for large-scale networks and hospital systems that require standardized, interoperable workflows. Integrated platforms also simplify compliance with government-mandated data sharing standards and reduce operational complexity.

The standalone software segment is expected to witness the fastest growth during the forecast period due to its flexibility and lower implementation complexity. Standalone solutions allow smaller hospitals, clinics, and specialized providers to adopt interoperability platforms without overhauling existing systems. The segment benefits from demand for cost-effective, modular solutions that can be deployed quickly to achieve compliance with interoperability standards. Rising adoption of cloud-hosted standalone platforms and AI-enabled analytics tools is contributing to rapid growth in this subsegment. In addition, standalone software offers easier customization and can target specific departmental needs, such as lab or pharmacy integration. Healthcare organizations in developing regions also prefer standalone solutions due to lower upfront costs and simpler maintenance.

- By Model Type

On the basis of model type, the market is segmented into centralized, hybrid, and decentralized models. The centralized model dominated the market in 2025 due to its structured approach for aggregating patient data from multiple sources into a single repository, allowing secure access and analysis across healthcare networks. Centralized models reduce data duplication, improve patient record accuracy, and simplify compliance with regulatory frameworks. Large hospitals and integrated delivery networks prefer centralized solutions for enterprise-wide interoperability and standardized workflows. Centralized systems also facilitate reporting, population health management, and AI-driven analytics. The segment benefits from government incentives promoting unified health information exchange. Centralized models remain the preferred choice for large-scale healthcare networks due to their operational efficiency and data security capabilities.

The hybrid model is expected to witness the fastest growth rate during forecast period, driven by the increasing need for flexible interoperability platforms that combine centralized control with localized data storage. Hybrid models are gaining popularity in multi-site hospitals and cross-institutional collaborations, offering both scalability and security. Providers adopting hybrid solutions can maintain control over sensitive data while leveraging cloud-based analytics and remote access capabilities. Hybrid models also support phased adoption, allowing healthcare organizations to integrate new systems without disrupting existing workflows. Government-backed initiatives promoting health information exchange contribute to their adoption. Hybrid models are particularly attractive for regions with strict data privacy regulations, balancing compliance with accessibility.

- By Interoperability Level

On the basis of interoperability level, the market is segmented into foundational interoperability, structural interoperability, and semantic interoperability. The structural interoperability segment dominated the market in 2025 due to its ability to standardize the format and organization of data for consistent and usable exchange across EHRs and other systems. Structural interoperability ensures patient information can be accurately shared, displayed, and interpreted across multiple platforms, improving clinical decision-making and reducing errors. It is widely adopted in hospitals and large healthcare networks to support care coordination and reporting requirements. Structural interoperability also facilitates integration with clinical decision support and analytics platforms. The segment benefits from government initiatives mandating standardized healthcare data exchange. Hospitals and health systems prioritize structural interoperability to streamline workflows and improve patient safety.

The semantic interoperability segment is expected to witness the fastest growth rate during the forecast period, fueled by the rising need to enable machines and providers to interpret and utilize exchanged data meaningfully. Semantic interoperability allows advanced analytics, AI-driven decision support, and personalized care by translating clinical information into actionable insights. Its adoption is accelerating due to the growing focus on precision medicine, predictive analytics, and population health initiatives. Semantic interoperability ensures that complex medical concepts are consistently understood across systems. Providers implementing semantic interoperability can enhance care coordination and clinical outcomes. Its growth is supported by international standards and emerging AI healthcare platforms.

- By Deployment

On the basis of deployment, the market is segmented into cloud-based and on-premise. The cloud-based deployment segment dominated the market in 2025 due to its scalability, lower upfront investment, and ease of integration with multiple healthcare systems. Cloud solutions enable real-time access to patient data across hospitals, clinics, and remote care settings while supporting AI analytics, telehealth integration, and disaster recovery. Cloud deployment facilitates rapid compliance with interoperability standards and secure data sharing. The segment also benefits from the growing trend of hospital networks outsourcing IT infrastructure management. Cloud-based platforms reduce maintenance costs and simplify system upgrades. Scalability and multi-site access are key advantages driving adoption of cloud deployment.

The on-premise deployment segment is expected to witness the fastest growth rate during forecast period, driven by concerns around data privacy, regulatory compliance, and control over sensitive patient information. On-premise systems are preferred by hospitals and specialty clinics in regions with strict healthcare data regulations, as they allow local management of infrastructure and data security policies. On-premise platforms enable complete control over data storage, backup, and access management. The segment is supported by organizations requiring offline access to patient records in remote or low-connectivity areas. On-premise systems are often combined with hybrid deployments for greater flexibility. Rising investments in cybersecurity and IT infrastructure are accelerating on-premise adoption.

- By Application

On the basis of application, the market is segmented into diagnosis, treatment, and others. The diagnosis segment dominated the market in 2025 due to the critical need for accurate, real-time patient information to inform diagnostic decisions. Interoperable systems enable clinicians to access lab results, imaging, and historical health data efficiently, reducing diagnostic errors and delays. Integration with AI diagnostic tools and decision support systems enhances clinical outcomes. The segment benefits from rising demand for telehealth and remote monitoring integration. Hospitals and clinics prioritize interoperability in diagnostics to improve efficiency and patient satisfaction. Adoption is also driven by value-based care initiatives requiring timely, accurate diagnostic information.

The treatment segment is expected to witness the fastest growth rate during the forecast period, driven by the adoption of precision medicine, personalized treatment plans, and care coordination across multiple providers. Interoperable platforms allow treatment data to be shared seamlessly with specialists, pharmacies, and care teams, improving patient outcomes and supporting value-based care initiatives. Telemedicine and remote monitoring integration also contribute to rising demand in treatment applications. AI-enabled analytics and predictive tools further accelerate adoption in treatment workflows. The segment benefits from growing patient-centered care models and chronic disease management programs. Hospitals and clinics are increasingly deploying interoperability platforms to enhance treatment planning and follow-up care.

- By End Users

On the basis of end users, the market is segmented into healthcare providers, healthcare payers, pharmacies, and others. The healthcare providers segment dominated the market in 2025 due to the high reliance on interoperable systems for hospital networks, clinics, and specialty care centers. Providers leverage interoperability solutions to consolidate patient information, improve clinical workflows, and ensure compliance with healthcare regulations. The segment benefits from growing adoption of EHRs, telehealth, and value-based care models. Integrated platforms allow seamless communication across departments and with external specialists. Large healthcare networks prioritize provider adoption to optimize operational efficiency. The segment also supports population health management and predictive analytics initiatives.

The healthcare payers segment is expected to witness the fastest growth rate during the forecast period, fueled by increasing demand for efficient claims processing, population health management, and predictive analytics. Payers are adopting interoperability platforms to gain insights from clinical and administrative data, reduce costs, and improve policyholder outcomes. Integration with provider networks and EHRs enhances operational efficiency. The segment is further supported by government incentives promoting health information exchange. Payers are increasingly leveraging interoperable data for fraud detection and utilization management. Rising focus on patient outcomes and cost-effective care drives adoption of advanced interoperability solutions.

Healthcare Interoperability Market Regional Analysis

- North America dominated the healthcare interoperability market with the largest revenue share of 39.5% in 2025, driven by advanced healthcare infrastructure, high adoption of digital health technologies, and a strong presence of key solution providers

- Providers in the region prioritize seamless, real-time access to patient data, enabling improved care coordination, reduced duplication of tests, and enhanced clinical decision-making across hospitals, clinics, and specialty centers

- This widespread adoption is further supported by advanced healthcare infrastructure, high investment in healthcare IT, and a strong presence of key interoperability solution providers, establishing the region as a leader in deploying integrated and AI-enabled healthcare data platforms

U.S. Healthcare Interoperability Market Insight

The U.S. healthcare interoperability market captured the largest revenue share of 82% in 2025 within North America, fueled by rapid adoption of electronic health records (EHRs), digital health platforms, and telehealth solutions. Providers are increasingly prioritizing seamless data exchange to improve care coordination, reduce duplication of tests, and enhance clinical decision-making. The growing trend of value-based care models and government mandates for health information exchange further propels market growth. Moreover, integration with AI-driven analytics and predictive tools is significantly contributing to the expansion of interoperability solutions. Strong healthcare IT infrastructure and high investments by private and public stakeholders continue to drive adoption across hospitals and clinics.

Europe Healthcare Interoperability Market Insight

The Europe healthcare interoperability market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent data-sharing regulations, such as GDPR, and the rising need for efficient patient care coordination. Increasing digitalization in hospitals and clinics, coupled with government initiatives promoting national health information exchange, is fostering adoption. European healthcare providers are also drawn to the operational efficiency, reduced errors, and real-time analytics offered by interoperable platforms. The region is witnessing growth across public and private healthcare facilities, with interoperability solutions being implemented in both new and existing healthcare IT infrastructures.

U.K. Healthcare Interoperability Market Insight

The U.K. healthcare interoperability market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the national emphasis on digital healthcare and enhanced patient safety. Concerns regarding medical errors, data fragmentation, and the need for comprehensive electronic health records are encouraging providers to adopt interoperable systems. The U.K.’s well-established healthcare IT infrastructure, combined with strong government support for health information exchange and telehealth services, is expected to continue stimulating market growth. Integration of AI analytics, patient engagement portals, and clinical decision support tools further enhances adoption.

Germany Healthcare Interoperability Market Insight

The Germany healthcare interoperability market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing digital health initiatives, stringent compliance standards, and the demand for efficient patient care coordination. Germany’s advanced healthcare infrastructure, emphasis on innovation, and focus on secure, privacy-compliant solutions promote the adoption of interoperable platforms in hospitals and specialty clinics. Integration with national health networks, EHRs, and telemedicine solutions is becoming increasingly prevalent, supporting real-time clinical decision-making. Local providers prioritize interoperability solutions that align with regulatory requirements and patient safety standards.

Asia-Pacific Healthcare Interoperability Market Insight

The Asia-Pacific healthcare interoperability market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by increasing digitalization, government initiatives for national health information exchange, and rising adoption of telemedicine solutions in countries such as China, Japan, and India. The region’s growing focus on improving care quality and operational efficiency is driving the adoption of interoperability platforms. Moreover, emerging investments in healthcare IT infrastructure and AI-enabled analytics are facilitating real-time data access across hospitals and clinics. APAC’s expanding healthcare services market and increasing patient awareness of digital health tools are further supporting growth.

Japan Healthcare Interoperability Market Insight

The Japan healthcare interoperability market is gaining momentum due to the country’s technologically advanced healthcare system, aging population, and demand for seamless data access. Providers are increasingly adopting interoperable solutions to enhance patient care, integrate EHRs, and connect with telehealth and remote monitoring systems. The integration of interoperability platforms with AI and analytics tools is fueling growth. Japan’s emphasis on preventive care and coordinated healthcare networks is driving adoption across hospitals, clinics, and specialty care centers. Furthermore, regulatory support and government incentives for digital health initiatives contribute to market expansion.

India Healthcare Interoperability Market Insight

The India healthcare interoperability market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid digitalization, expanding hospital networks, and rising adoption of EHRs and telemedicine platforms. India is emerging as a key market for interoperability solutions, driven by government initiatives for national health data exchange and smart healthcare systems. Providers are leveraging interoperability platforms to improve care coordination, reduce errors, and enable real-time patient data access. The growing middle class, increasing healthcare IT investment, and rising awareness of digital health benefits are key factors propelling market growth in India. Affordable solutions from domestic and international providers further support adoption across hospitals, clinics, and rural healthcare centers.

Healthcare Interoperability Market Share

The Healthcare Interoperability industry is primarily led by well-established companies, including:

- Epic Systems Corporation (U.S.)

- InterSystems Corporation (U.S.)

- Oracle Health (U.S.)

- Allscripts Healthcare Solutions (U.S.)

- NextGen Healthcare, Inc. (U.S.)

- Medical Information Technology, Inc. (U.S.)

- Orion Health Group (New Zealand)

- eClinicalWorks (U.S.)

- IBM (U.S.)

- Infor, Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Change Healthcare (U.S.)

- Redox, Inc. (U.S.)

- Lyniate (U.S.)

- Rhapsody International, Inc. (U.S.)

- iNTERFACEWARE Inc. (Canada)

- Optum (U.S.)

- Health Catalyst (U.S.)

- ViSolve, Inc. (U.S.)

- GE Healthcare (U.S.)

What are the Recent Developments in Global Healthcare Interoperability Market?

- In November 2025, InterSystems launched HealthShare AI Assistant a generative‑AI capability built on its Unified Care Record platform enabling clinicians and administrators to query and summarize complex longitudinal patient data using natural‑language prompts, improving accessibility and efficiency of health data retrieval

- In October 2025, Epic Systems unveiled new interoperability features (including “MyChart Central” for unified record access), expanded its developer ecosystem (Open.Epic), and introduced APIs for prior authorization and staff‑safety alerts simplifying cross‑institution data sharing for providers and patients

- In October 2025, InterSystems also announced a strategic integration of its HealthShare platform with Google Cloud Healthcare API, enabling real‑time, harmonized data foundations for AI-enabled analytics a move that seeks to address fragmented healthcare data and enable scalable, secure, unified data infrastructure

- In September 2025, NextGen Healthcare partnered with Kno2 (a federally designated QHIN) to enable over 100,000 providers across specialties to connect under the national Trusted Exchange Framework and Common Agreement (TEFCA), significantly expanding the reach of nationwide data exchange infrastructure

- In December 2024, networks using Epic as their EHR system connected 625 hospitals to TEFCA within a year a milestone that significantly improved interoperability across U.S. health systems, particularly helping rural and underserved hospitals previously unable to exchange electronic health information

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.