Global Healthcare Reimbursement Market

Market Size in USD Billion

CAGR :

%

USD

23.10 Billion

USD

78.65 Billion

2024

2032

USD

23.10 Billion

USD

78.65 Billion

2024

2032

| 2025 –2032 | |

| USD 23.10 Billion | |

| USD 78.65 Billion | |

|

|

|

|

Healthcare Reimbursement Market Size

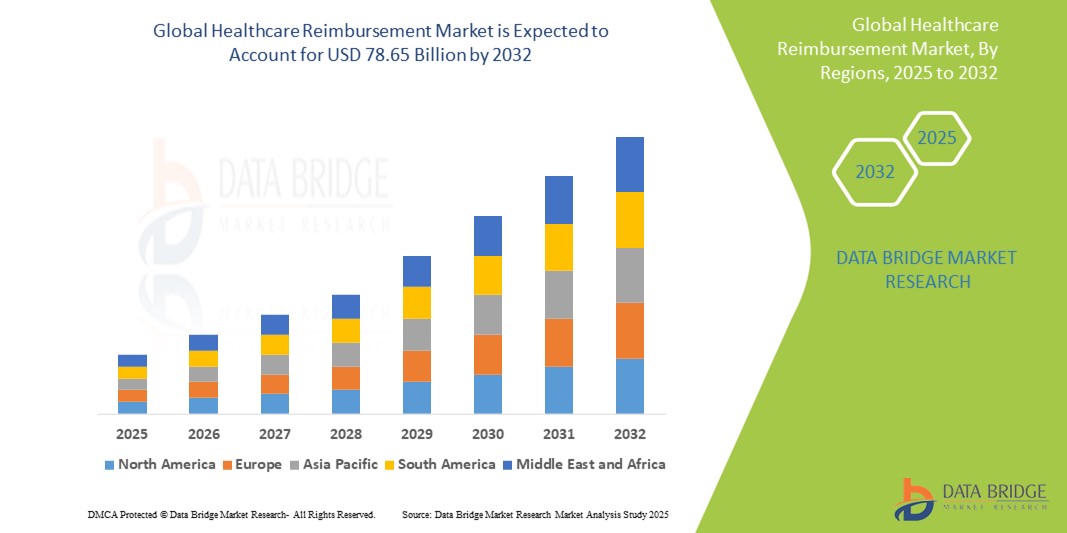

- The global healthcare reimbursement market size was valued at USD 23.10 billion in 2024 and is expected to reach USD 78.65 billion by 2032, at a CAGR of 16.55% during the forecast period

- The market growth is largely fueled by the increasing demand for efficient healthcare financing mechanisms, rising healthcare costs, and the growing burden of chronic diseases, which necessitate structured and scalable reimbursement systems globally

- Furthermore, the expansion of government-sponsored healthcare programs, value-based reimbursement models, and technological advancements in claims processing are driving the adoption of healthcare reimbursement systems. These converging factors are accelerating the shift towards transparent, timely, and accountable healthcare funding, thereby significantly boosting the industry's growth

Healthcare Reimbursement Market Analysis

- Healthcare reimbursement systems, facilitating the processing of payments between healthcare providers, payers, and patients, are increasingly critical in managing healthcare costs and ensuring timely compensation in both public and private healthcare settings due to their role in streamlining claims, reducing errors, and supporting compliance with regulatory requirements

- The escalating demand for advanced healthcare reimbursement solutions is primarily fueled by the increasing complexity of healthcare billing, the rising volume of claims driven by expanding healthcare services, and the growing emphasis on value-based care models that require accurate reimbursement tracking and reporting

- North America dominates the healthcare reimbursement market with the largest revenue share of 46.2% in 2024, characterized by mature healthcare infrastructure, widespread adoption of electronic health records (EHR), stringent regulatory frameworks, and the presence of major technology vendors offering integrated reimbursement platforms

- Asia-Pacific is expected to be the fastest growing region in the healthcare reimbursement market during the forecast period due to increasing healthcare expenditure, government reforms to expand insurance coverage, rising adoption of digital health technologies, and a growing emphasis on streamlining reimbursement processes to support expanding healthcare access

- Underpaid segment dominates the healthcare reimbursement market with a market share of 81.7% in 2024, driven by its critical role in addressing reimbursement gaps and financial shortfalls faced by healthcare providers, ensuring timely adjustments and accurate compensation for services rendered

Report Scope and Healthcare Reimbursement Market Segmentation

|

Attributes |

Healthcare Reimbursement Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Healthcare Reimbursement Market Trends

“Advancements in Automation and AI-Driven Claims Processing”

- A significant and accelerating trend in the global healthcare reimbursement market is the growing adoption of automation and artificial intelligence (AI) technologies to streamline claims processing, reduce manual errors, and enhance reimbursement accuracy. This shift is transforming traditional reimbursement workflows into more efficient, data-driven processes

- For instance, AI-powered platforms such as Change Healthcare and Optum leverage machine learning algorithms to analyze vast datasets, detect fraudulent claims, and optimize reimbursement decisions. Similarly, cloud-based solutions such as IBM Watson Health integrate predictive analytics to improve claims adjudication speed and accuracy

- AI integration in healthcare reimbursement enables features such as automated claims scrubbing, real-time eligibility verification, and intelligent denial management, reducing delays and improving provider cash flow. For instance, some platforms use natural language processing (NLP) to interpret complex medical codes and documentation, minimizing claim rejections. In addition, robotic process automation (RPA) helps to expedite routine billing tasks, allowing staff to focus on higher-value activities

- The seamless integration of reimbursement systems with electronic health records (EHR) and healthcare provider portals facilitates centralized management of billing, claims, and payments. Through unified platforms, stakeholders can monitor reimbursement status, resolve issues promptly, and ensure regulatory compliance

- The demand for healthcare reimbursement platforms with advanced AI and automation capabilities is growing rapidly across hospitals, insurance providers, and government agencies, as stakeholders increasingly prioritize efficiency, accuracy, and compliance in managing complex healthcare billing processes

Healthcare Reimbursement Market Dynamics

Driver

“Rising Healthcare Costs and Increasing Demand for Efficient Reimbursement Systems”

- The escalating healthcare costs worldwide, coupled with growing complexities in medical billing and insurance claims, are significant drivers fueling the demand for advanced healthcare reimbursement solutions

- For instance, in 2024, major players such as Change Healthcare introduced enhanced AI-powered reimbursement platforms designed to automate claims processing and reduce payment delays, addressing the pressing need for cost-efficient healthcare finance management. Such innovations by leading companies are expected to accelerate market growth during the forecast period

- As healthcare providers and payers face increasing pressure to control expenses while ensuring timely payments, reimbursement systems offering automation, real-time claims tracking, and error detection provide critical improvements over traditional manual processes

- Furthermore, the rising adoption of value-based care models and government initiatives aimed at healthcare transparency are pushing stakeholders to implement more robust reimbursement frameworks that support compliance and optimize revenue cycles

- The growing integration of reimbursement solutions with electronic health records (EHRs) and health information exchanges (HIEs) enables seamless data sharing and improves operational efficiency. The demand for scalable, user-friendly platforms that simplify claims management and support diverse payer-provider interactions is also driving adoption across hospitals, clinics, and insurance companies globally

Restraint/Challenge

“Concerns Regarding Data Security and High Implementation Costs”

- Concerns surrounding data security and privacy vulnerabilities in healthcare reimbursement systems pose a significant challenge to broader market adoption. As these platforms handle sensitive patient and financial information, they are prime targets for cyberattacks, raising apprehensions among providers and payers about potential data breaches and compliance risks

- For instance, high-profile incidents of healthcare data breaches and ransomware attacks have made some organizations cautious about fully digitizing their reimbursement workflows without robust security measures in place

- Addressing these concerns through advanced encryption, multi-factor authentication, and strict regulatory compliance (such as HIPAA in the U.S. and GDPR in Europe) is critical to gaining stakeholder trust. Companies such as Optum and Cerner emphasize their strong security frameworks and regular system audits to assure clients of data safety. In addition, the relatively high initial costs associated with deploying sophisticated reimbursement platforms including software licensing, integration with existing health IT systems, and staff training can act as barriers to adoption, especially for smaller healthcare providers and organizations in developing regions

- While cloud-based and modular reimbursement solutions are helping reduce upfront expenses, the perceived financial burden and complexity of implementation continue to challenge widespread market penetration

- Overcoming these obstacles through enhanced cybersecurity protocols, education on best practices, and development of scalable, cost-effective reimbursement platforms will be essential for sustained growth in the healthcare reimbursement market

Healthcare Reimbursement Market Scope

The market is segmented on the basis of claim, payer, and service provider.

- By Claim

On the basis of claim, the healthcare reimbursement market is segmented into fully paid and underpaid. The underpaid segment dominated the market with the largest revenue share of 81.7% in 2024, driven by the increasing complexity of billing systems, coding errors, and insurance denials that necessitate claim resubmissions or appeals. These challenges make underpaid claims a significant focus area for providers seeking to recover lost revenue and improve billing accuracy.

The fully paid segment is projected to be the fastest-growing during the forecast period due to enhanced claim processing technologies, AI-enabled billing systems, and improved payer-provider collaborations that are reducing errors and increasing claim approval rates on the first submission.

- By Payer

On the basis of payer, the market is segmented into private payers and public payers. The private payers segment dominates the market in 2024, attributed to the wide penetration of commercial insurance plans, particularly in developed regions, where employers and private insurers play a central role in healthcare financing. These payers are early adopters of digital reimbursement systems and are focused on reducing operational costs through automation and data analytics.

The public payers segment is expected to be the fastest-growing during the forecast period, owing to expanding government healthcare programs, aging populations, and efforts to streamline public insurance reimbursement processes across developing countries and emerging economies.

- By Service Provider

On the basis of service provider, the market is segmented into physician offices, hospitals, diagnostic laboratories, and others. The hospital segment dominated the market in terms of revenue in 2024, driven by the vast volume of inpatient and outpatient services, surgeries, and long-term care that generate complex, high-value claims requiring robust reimbursement management.

The diagnostic laboratories segment is anticipated to be the fastest-growing during the forecast period, propelled by the rise in preventive health screenings, chronic disease diagnostics, and the increased need for streamlined, accurate billing for a high volume of low-margin tests. The growing reliance on lab services during and after the COVID-19 pandemic has also contributed to this segment's accelerated growth.

Healthcare Reimbursement Market Regional Analysis

- North America dominates the healthcare reimbursement market with the largest revenue share of 46.2% in 2024, driven by mature healthcare infrastructure, widespread adoption of electronic health records (EHR), stringent regulatory frameworks, and the presence of major technology vendors offering integrated reimbursement platforms

- The region also benefits from early adoption of advanced digital billing and reimbursement systems, alongside robust regulatory frameworks that support claims transparency and standardization

- In addition, the growing prevalence of chronic diseases and a large aging population in the U.S. and Canada have significantly increased the volume of healthcare services, thereby driving demand for efficient and accurate reimbursement processes. The presence of major healthcare providers, payers, and health tech companies further reinforces North America’s leadership in the market

U.S. Healthcare Reimbursement Market Insight

The U.S. healthcare reimbursement market accounted for the largest revenue share of 89% in North America in 2024, driven by the country's robust public and private insurance frameworks including Medicare, Medicaid, and a wide network of employer-sponsored health plans. The market benefits from comprehensive healthcare coverage policies, a high rate of medical procedure utilization, and advanced digital claims processing systems. In addition, reforms such as value-based reimbursement models and bundled payments are reinforcing efficiency and transparency in healthcare reimbursements, further accelerating market growth.

Europe Healthcare Reimbursement Market Insight

The Europe healthcare reimbursement market is poised for consistent expansion over the forecast period, fueled by universal healthcare systems across countries such as Germany, the U.K., and France. The presence of strong public payers, such as the NHS in the U.K. and statutory health insurance in Germany, ensures wide access to reimbursable healthcare services. The increasing adoption of electronic claims management systems, along with efforts to standardize reimbursement frameworks across EU nations, supports streamlined processes and cross-border care reimbursements.

U.K. Healthcare Reimbursement Market Insight

The U.K. healthcare reimbursement market is expected to grow steadily, driven by continued support for the National Health Service (NHS), which covers nearly the entire population. Emphasis on patient-centric reimbursement strategies and funding for preventative and community-based care has expanded. The government's push toward digitization, including the use of e-health platforms for claim submissions and real-time payment tracking, enhances operational efficiency, thereby strengthening the reimbursement framework.

Germany Healthcare Reimbursement Market Insight

The Germany healthcare reimbursement market is projected to grow at a robust CAGR, supported by a highly structured dual-payer system consisting of statutory and private health insurance providers. High healthcare expenditure, aging demographics, and the push for value-based care are driving reimbursement claims, particularly for chronic and long-term care services. Furthermore, integration of electronic patient records and DRG-based hospital reimbursement is fostering a more data-driven and transparent reimbursement environment.

Asia-Pacific Healthcare Reimbursement Market Insight

The Asia-Pacific healthcare reimbursement market is expected to register the fastest CAGR during the forecast period (2025–2032), propelled by expanding healthcare access and insurance penetration across developing economies. Government initiatives in countries such as China, India, and Indonesia to implement or strengthen national health insurance schemes are transforming reimbursement systems. Increased digital health adoption and telemedicine services are also fueling claim volumes and necessitating modernized reimbursement models across the region.

Japan Healthcare Reimbursement Market Insight

The Japan healthcare reimbursement market is driven by its universal health coverage model and the nation’s aging population, which increases the demand for reimbursed medical services, especially in chronic and elder care. The government’s periodic fee revisions, integration of AI into claims review, and high digital health infrastructure are contributing to efficient reimbursement cycles. In addition, innovations in value-based reimbursement for advanced therapies are gaining traction.

India Healthcare Reimbursement Market Insight

The India healthcare reimbursement market captured a significant share of the Asia-Pacific region in 2024, propelled by the expansion of government-funded schemes such as Ayushman Bharat and rising private insurance penetration. Rapid urbanization, growing middle-class income, and healthcare digitization are driving higher volumes of claims in both public and private sectors. The increasing collaboration between health tech startups and insurers is also improving claim processing speeds and transparency.

Healthcare Reimbursement Market Share

The healthcare reimbursement industry is primarily led by well-established companies, including:

- UnitedHealth Group (U.S.)

- Aetna Inc. (U.S.)

- Cigna Healthcare (U.S.)

- Anthem Insurance Companies, Inc. (U.S.)

- Humana (U.S.)

- Centene Corporation (U.S.)

- Kaiser Foundation Health Plan, Inc. (U.S.)

- Molina Healthcare, Inc. (U.S.)

- WellCare Health Plans, Inc. (U.S.)

- CVS Health (U.S.)

- Bupa (U.K.)

- AXA (France)

- Allianz (Germany)

- Aviva (U.K.)

- AOK – Die Gesundheitskasse (Germany)

- DKV (Germany)

- Nippon Life Insurance Company Limited (Japan)

- Ping An Insurance (Group) Company of China, Ltd. (China)

- Manulife (Canada)

Latest Developments in Global Healthcare Reimbursement Market

- In January 2024, Mastercard announced a medical claims payment partnership in India, leveraging its virtual card technology. This initiative aims to streamline payment processes within the healthcare sector

- In January 2024, The General Insurance Council in India announced that hospitals with 15 beds and registered under the Clinical Establishment Act can now offer cashless hospitalization. This move aims to make healthcare more accessible for policyholders

- In April 2024, In a collaborative effort to promote the adoption of value-based care, the American's Health Insurance Plans (AHIP), the American Medical Association (AMA), and the National Association of Accountable Care Organizations (NAACOS) released a playbook outlining voluntary best practices. This initiative specifically targets the private sector, aiming to accelerate the shift from traditional fee-for-service models to those that prioritize patient outcomes and quality of care

- In December 2023, The Centers for Medicare and Medicaid Services (CMS) in the US aimed to have all traditional Medicare beneficiaries under a value-based care model by December 2023, emphasizing the successful use of electronic health records for documentation and reporting. This highlights the ongoing shift towards outcomes-based reimbursement

- In August 2023, Codoxo, a US-based company specializing in AI, launched ClaimPilot, a generative AI product designed to enhance healthcare cost containment and payment integrity programs. This innovation aims to improve efficiency and reduce workforce constraints by automating in-patient and facility claim audits

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.