Global High Purity Calcium Sulfate Market

Market Size in USD Billion

CAGR :

%

USD

12.00 Billion

USD

18.42 Billion

2024

2032

USD

12.00 Billion

USD

18.42 Billion

2024

2032

| 2025 –2032 | |

| USD 12.00 Billion | |

| USD 18.42 Billion | |

|

|

|

|

High Purity Calcium Sulfate Market Size

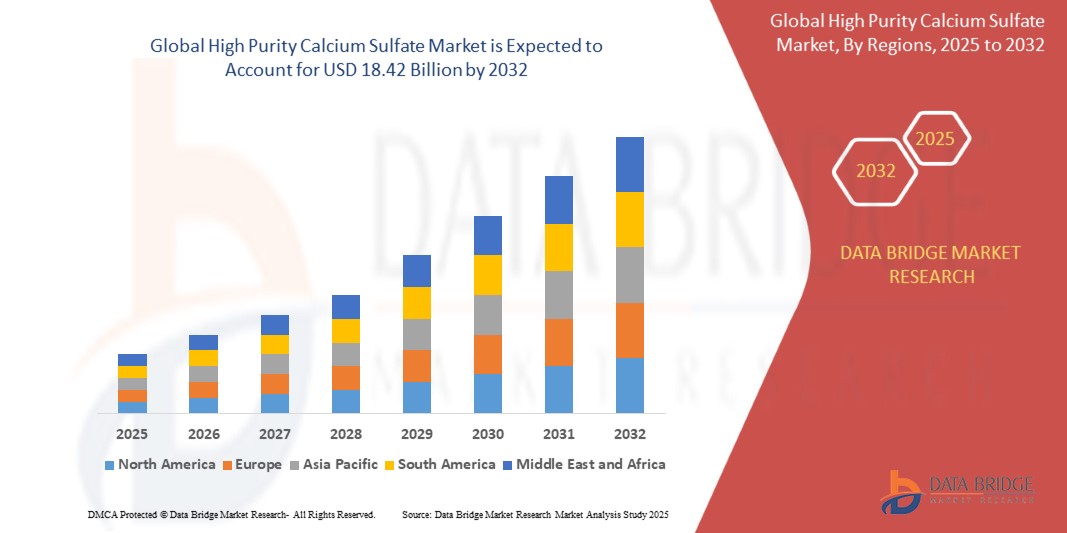

- The global high purity calcium sulfate market size was valued at USD 12.00 billion in 2024 and is expected to reach USD 18.42 billion by 2032, at a CAGR of 5.50% during the forecast period

- This growth is driven by growing trend toward sustainable building materials

High Purity Calcium Sulfate Market Analysis

- High Purity Calcium Sulfate is extensively used across industries due to its superior purity, chemical stability, and compatibility with pharmaceutical, food, and construction standards. Its role in moisture regulation, formulation enhancement, and structural integrity makes it a valuable additive in multiple high-performance applications

- Market expansion is driven by increasing demand in pharmaceuticals, where it is used as an excipient, and in food and beverages, where it acts as a firming agent and stabilizer

- Asia-Pacific is expected to dominate the global high purity calcium sulfate market with the largest market share of 49.22%, driven by rapid industrialization, strong manufacturing output in China and India, and rising consumption in construction, food, and pharmaceutical applications

- Middle East and Africa is expected to witness the highest compound annual growth rate (CAGR) in the high purity calcium sulfate market due to rapid urban development in GCC countries especially in cities such as Dubai, Riyadh, and Doha is significantly boosting demand for gypsum-based materials

- The powder segment is expected to dominate the high purity calcium sulfate market with the largest share of 54.88% in 2025, due to its outstanding biocompatibility and non-toxic nature, high-purity calcium sulfate powder is gaining traction

Report Scope and High Purity Calcium Sulfate Market Segmentation

|

Attributes |

High Purity Calcium Sulfate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

High Purity Calcium Sulfate Market Trends

“Sustainable Production Methods Gaining Momentum”

- Environmental regulations and sustainability goals are pushing manufacturers to adopt greener production methods for high purity calcium sulfate, focusing on reducing emissions and optimizing resource utilization

- Innovations in waste valorization and circular economy strategies such as utilizing industrial by-products are being explored to minimize raw material dependency and lower carbon footprints

- These eco-friendly practices are gaining traction across industries such as construction and pharmaceuticals, which are increasingly seeking sustainable additives that meet both performance and environmental standards

- For instance, in August 2023, Saint-Gobain launched a pilot project to recover and purify gypsum from construction waste, producing high-purity calcium sulfate for pharmaceutical and food-grade applications

- This trend reflects a broader shift toward sustainable manufacturing and is expected to reshape the market landscape, especially in regions with strict environmental policies

High Purity Calcium Sulfate Market Dynamics

Driver

“Rising Demand in Pharmaceutical Formulations”

- High Purity Calcium Sulfate is increasingly being used in tablet formulations and as an excipient due to its excellent biocompatibility, purity, and stability under various storage conditions

- With rising global health awareness and aging populations, pharmaceutical production has surged, driving the demand for safe and stable formulation agents such as high-purity calcium sulfate

- Regulatory emphasis on clean-label and non-toxic excipients further supports the material’s growth in pharmaceutical applications

- For instance, in February 2024, BASF reported a significant increase in demand for its pharmaceutical-grade calcium sulfate, mainly from manufacturers in the U.S. and Europe producing new oral solid dosage forms

- This driver underlines how pharmaceutical sector expansion is propelling demand for high-quality formulation materials

Opportunity

“Expansion in Cosmetic and Personal Care Applications”

- The cosmetic industry is increasingly adopting high purity calcium sulfate as a natural absorbent and texturizing agent in powders, creams, and exfoliators, especially in premium and clean-label product lines

- Consumers' rising preference for mineral-based and allergen-free ingredients is prompting formulators to explore alternative minerals such as calcium sulfate

- This shift is creating new revenue streams in the personal care industry, particularly in Asia-Pacific and North America, where demand for safe and innovative ingredients is high

- For instance, in June 2023, L’Oréal Group began using high-purity calcium sulfate in its newly launched mineral facial powder line under its sustainable product division

- This trend signals a growing non-industrial demand base, offering diversification for manufacturers and suppliers

Restraint/Challenge

“Regulatory Compliance and Certification Hurdles”

- High Purity Calcium Sulfate used in food and pharmaceutical applications must meet stringent purity and safety standards, including certifications such as USP, EP, or FCC, which pose barriers for new or regional producers

- Ensuring consistency in particle size, impurity levels, and trace element control requires advanced quality control systems, increasing production costs

- Cross-border regulations often vary, complicating market entry and supply chain logistics for companies looking to expand internationally

- For instance, in May 2023, a Southeast Asian producer faced export delays due to failing to meet EU’s REACH standards for trace contaminants in food-grade calcium sulfate

- These challenges emphasize the need for robust compliance infrastructure and regulatory foresight to sustain long-term growth in sensitive application areas

High Purity Calcium Sulfate Market Scope

The market is segmented on the basis of form and end use.

|

Segmentation |

Sub-Segmentation |

|

By Form |

|

|

By End Use |

|

In 2025, the powder is projected to dominate the market with a largest share in form segment

The powder segment is expected to dominate the high purity calcium sulfate market with the largest share of 54.88% in 2025, due to its outstanding biocompatibility and non-toxic nature, high-purity calcium sulfate powder is gaining traction.

The pharmaceuticals is expected to account for the largest share during the forecast period in end use segment

In 2025, the pharmaceuticals segment is expected to dominate the market with the largest market share of 31.42% due to its crucial role in the pharmaceutical industry, where it is used in applications such as excipients, stabilizers, and coatings for tablets and capsules. It is highly valued for its non-reactive nature, biocompatibility, and effectiveness in enabling controlled drug release.

High Purity Calcium Sulfate Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the High Purity Calcium Sulfate Market”

- Asia-Pacific is expected to dominate the global high purity calcium sulfate market with the market share of 49.22%, due to robust demand from pharmaceutical, construction, and food & beverage sectors, particularly in China, India, and Japan

- Rapid industrialization, growing population, and expanding infrastructure projects across emerging economies are driving higher consumption of high purity calcium sulfate as a filler, desiccant, and food additive

- Supportive regulatory frameworks and increasing domestic production of pharmaceutical excipients contribute to the region’s market dominance

“Middle East and Africa is projected to register the Highest CAGR in the High Purity Calcium Sulfate Market”

- Middle East and Africa is expected to witness the highest compound annual growth rate (CAGR) in the high purity calcium sulfate market due to rapid urban development in GCC countries especially in cities such as Dubai, Riyadh, and Doha is significantly boosting demand for gypsum-based materials

- This surge in infrastructure projects is driving the need for high-purity calcium sulfate, a key component in producing durable, high-quality construction products

- Large-scale government investments in residential and commercial infrastructure are further accelerating the consumption of premium building materials in the region

High Purity Calcium Sulfate Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Saint-Gobain (France)

- Georgia-Pacific (U.S.)

- Knauf Digital GmbH (Germany)

- Etex Group (Belgium)

- HOLCIM (Switzerland)

- Shanghai Huilong Chemical Co., Ltd. (China)

- Boral Limited (Australia)

- alahligypsum (Saudi Arabia)

- Global Gypsum Board Co LLC (Oman)

- W. R. Grace & Co.-Conn (U.S.)

- Arcosa, Inc. (U.S.)

- JK Cement Ltd. (India)

- Alpek Polyester USA, LLC (U.S.)

- The Chemours Company (U.S.)

- Ecolab (U.S.)

- Celanese Corporation (U.S.)

- Solvay (Belgium)

- BNBM (China)

- Celtic Chemicals (U.K.)

- Honeywell International Inc. (U.S.)

- Jonoub Gypsum (Iran)

- PABCO (U.S.)

- Penta Fine Ingredients, Inc. (U.S.)

- YOSHINO GYPSUM CO., LTD. (Japan)

Latest Developments in Global High Purity Calcium Sulfate Market

- In July 2024, the Saudi Water Authority (SWA), through its research division the Water Technologies Innovation Institute and Research Advancement (WTIIRA) launched a groundbreaking initiative to utilize cement plant by-products (fly ash) and desalination wastewater. This project aims to produce high-purity calcium carbonate (vaterite) with 97% purity, promoting environmental sustainability and advancing circular economy practices. This effort positions Saudi Arabia as a pioneer in industrial waste valorization for environmental conservation

- In June 2023, Healio released a video featuring Dr. Nishant Suneja, Director of Complicated Orthopaedic Trauma and Deformity Repair at Brigham and Women’s Hospital, discussing his latest research presented at the 2023 Annual Meeting of the American Academy of Orthopaedic Surgeons (AAOS). This media engagement highlighted key developments in orthopaedic trauma care and surgical innovation

- In October 2022, Saint-Gobain acquired Global Gypsum Company, a major gypsum wallboard producer in Sub-Saharan Africa, expanding its geographical presence across the African continent. This strategic acquisition strengthens Saint-Gobain’s position in the global building materials industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global High Purity Calcium Sulfate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global High Purity Calcium Sulfate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global High Purity Calcium Sulfate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.