Global High Resolution Melting Analysis Market

Market Size in USD Million

CAGR :

%

USD

344.54 Million

USD

489.22 Million

2024

2032

USD

344.54 Million

USD

489.22 Million

2024

2032

| 2025 –2032 | |

| USD 344.54 Million | |

| USD 489.22 Million | |

|

|

|

|

High-Resolution Melting Analysis Market Size

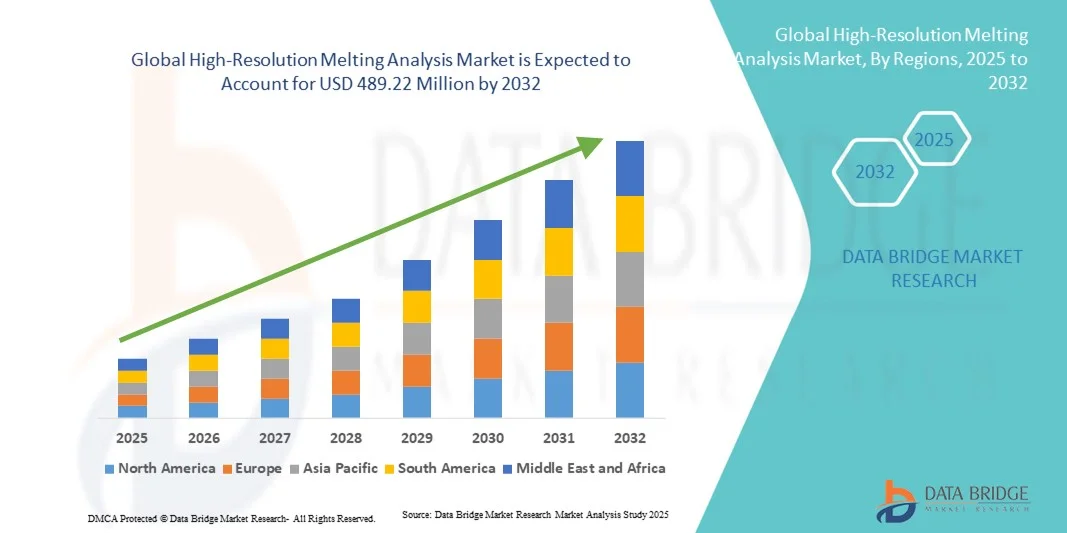

- The global high-resolution melting analysis market size was valued at USD 344.54 million in 2024 and is expected to reach USD 489.22 million by 2032, at a CAGR of 4.48% during the forecast period

- This growth is primarily driven by the increasing adoption of precision medicine, advancements in genetic analysis techniques, and the rising prevalence of chronic diseases

- In addition, the demand for cost-effective and rapid genotyping methods, along with the integration of HRM analysis with next-generation sequencing platforms, is further propelling market expansion

High-Resolution Melting Analysis Market Analysis

- High-resolution melting (HRM) analysis, a post-PCR technique used to detect genetic variations by monitoring DNA melting behavior, is increasingly vital in molecular diagnostics, genetic research, and personalized medicine. Its applications span mutation scanning, SNP genotyping, and epigenetic profiling

- The escalating demand for HRM analysis is primarily fueled by advancements in precision medicine, the growing prevalence of genetic disorders, and the need for cost-effective, rapid genotyping methods. In addition, the integration of HRM with next-generation sequencing platforms is enhancing its utility in clinical and research settings

- North America dominated the global high-resolution melting analysis market with the largest revenue share of 36.5% in 2024, characterized by robust healthcare infrastructure, significant R&D investments, and early adoption of genomic technologies. The U.S. led the North American market, driven by advancements in precision medicine and strong regulatory support

- Asia-Pacific is expected to be the fastest-growing region in the global high-resolution melting analysis market during the forecast period, due to increasing urbanization, rising disposable incomes, and expanding healthcare access. Countries such as Japan are leading in HRM adoption, supported by aging populations and government initiatives in genomic research

- The instrument segment dominated the global high-resolution melting analysis market with a market share of 40.5% in 2024, driven by the demand for high-throughput and accurate analysis tools in genetic research and diagnostics

Report Scope and High-Resolution Melting Analysis Market Segmentation

|

Attributes |

High-Resolution Melting Analysis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

High-Resolution Melting Analysis Market Trends

Enhanced Accuracy Through AI and Automation Integration

- A significant and accelerating trend in the global HRM analysis market is the integration of artificial intelligence (AI) and automation technologies, which is significantly enhancing accuracy, throughput, and operational efficiency across research and clinical laboratories

- For instance, HRM platforms equipped with AI can automatically interpret melting curve data, detect genetic mutations, and flag anomalies, reducing analysis time and manual intervention

- AI integration in HRM systems enables features such as predicting mutation patterns and generating intelligent alerts for unusual results. For instance, some advanced HRM software can refine analysis accuracy over time and provide automated quality control notifications

- The seamless integration of HRM platforms with laboratory information management systems (LIMS) and other molecular diagnostic tools facilitates centralized control over sample processing, data collection, and reporting, creating a unified workflow

- This trend towards more intelligent, automated, and interconnected HRM systems is fundamentally reshaping laboratory expectations for precision and efficiency. Consequently, companies such as Bio-Rad and Thermo Fisher are developing AI-enabled HRM platforms with automated analysis, predictive mutation detection, and LIMS compatibility

- The demand for HRM systems that offer seamless AI and automation integration is growing rapidly across clinical, research, and contract laboratory settings, as users increasingly prioritize accuracy, efficiency, and high-throughput capabilities

High-Resolution Melting Analysis Market Dynamics

Driver

Increasing Need for Precision Genotyping and Personalized Medicine

- The rising prevalence of genetic disorders, coupled with the accelerating adoption of precision medicine, is a significant driver for the heightened demand for HRM analysis

- For instance, in 2024, several clinical laboratories and research institutions deployed HRM systems for rapid SNP genotyping and mutation detection, aiming to support personalized treatment decisions

- As laboratories become more focused on early disease detection and therapy optimization, HRM analysis offers high-throughput, cost-effective, and accurate genotyping, providing a compelling upgrade over conventional methods

- Automation in sample handling, reaction setup, and data acquisition is increasing throughput and efficiency while ensuring consistent results across multiple analyses

- Furthermore, the growing adoption of genomic research and personalized medicine initiatives is making HRM analysis an integral tool in both clinical diagnostics and molecular biology laboratories

- The convenience of automated analysis, high sensitivity for variant detection, and the ability to integrate HRM with other molecular diagnostic platforms are key factors propelling its adoption in global healthcare and research sectors. The trend towards user-friendly HRM solutions and software further contributes to market growth

Restraint/Challenge

Standardization Issues and Sensitivity Limitations for Rare Variants

- Concerns surrounding standardization of HRM protocols and limited sensitivity for detecting rare mutations pose a significant challenge to broader market penetration

- For instance, inconsistencies in DNA sample quality or instrument calibration can affect HRM results, making some users hesitant to adopt the technology for critical applications

- Addressing these standardization and sensitivity challenges through validated protocols, robust software, and frequent quality checks is crucial for building user confidence. In addition, the relatively high initial cost of advanced HRM systems compared to conventional genotyping methods can be a barrier, particularly for smaller laboratories or budget-conscious institutions

- In addition, managing large datasets generated from HRM analysis can be challenging, requiring advanced software, infrastructure, and trained personnel

- While costs are gradually decreasing, the perceived premium for advanced HRM platforms can still hinder widespread adoption, especially in developing regions or for users who do not require high-throughput or automated capabilities

- Overcoming these challenges through enhanced protocol standardization, user training, and development of more cost-effective HRM platforms will be vital for sustained market growth

High-Resolution Melting Analysis Market Scope

The market is segmented on the basis of product and service, application, and end user.

- By Product and Service

On the basis of product and service, the global high-resolution melting analysis market is segmented into instruments, reagents and consumables, and software and services. The instruments segment dominated the HRM analysis market with a market share of 40.5% in 2024, driven by continuous technological advancements that improve sensitivity, automation, and throughput. Laboratories rely on these instruments for accurate genotyping, mutation detection, and pathogen identification. Integration with real-time PCR systems enables seamless workflow and faster results. Researchers and clinicians increasingly prefer instruments that combine high precision with ease of use. Manufacturers are developing compact, automated, and high-throughput instruments to cater to both developed and emerging markets. The instruments segment remains the backbone of HRM analysis due to its critical role in research and diagnostics.

The reagents and consumables segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for high-quality PCR reagents, intercalating dyes, and consumables that ensure reliable HRM results. These reagents are essential for standardization and reproducibility across laboratories. Continuous innovations in reagent formulation, multiplex compatibility, and improved stability contribute to market growth. Research and clinical labs are increasingly adopting these consumables for SNP genotyping, mutation discovery, and pathogen detection. Their indispensable role in assay accuracy makes this segment highly attractive. Expanding global molecular diagnostics and genomics research further accelerates growth in this segment.

- By Application

On the basis of application, the global high-resolution melting analysis market is segmented into SNP genotyping, mutation discovery, species identification, pathogen identification, epigenetics, and others. The SNP genotyping segment dominated the market in 2024, driven by extensive use in genetic research, personalized medicine, and pharmacogenomics. HRM enables rapid, high-throughput, and cost-effective detection of single nucleotide polymorphisms, critical for large-scale studies. Advanced software integration allows for automated data interpretation and increased analytical reliability. Academic institutions, research labs, and biotech companies extensively use SNP genotyping for genome-wide studies and mutation mapping. Its versatility in detecting genetic variations across multiple organisms strengthens its market position. Increasing global focus on precision medicine and targeted therapies reinforces SNP genotyping dominance.

The pathogen identification segment is expected to register the fastest growth rate from 2025 to 2032 due to rising demand for rapid and precise detection of infectious agents. HRM-based pathogen detection allows timely diagnosis and infection control. The method provides high sensitivity and specificity, crucial for detecting low-abundance pathogens. Growing emphasis on infectious disease surveillance, outbreak management, and rapid clinical interventions supports this growth. Hospitals, diagnostic labs, and research centers are increasingly adopting HRM assays for pathogen identification. Regulatory support and increasing awareness of molecular diagnostics further accelerate expansion of this segment.

- By End User

On the basis of end user, the global high-resolution melting analysis market is segmented into research laboratories and academic institutes, hospitals and diagnostic centers, pharmaceutical and biotechnology companies, and others. The research laboratories and academic institutes segment dominated the market in 2024, driven by extensive use of HRM analysis in education, genetic research, and molecular biology studies. HRM provides a cost-effective and versatile tool for studying genetic variations, supporting both teaching and research projects. Growing investments in genomics research and collaborations between academia and industry strengthen its position. Advanced instruments and reagents enable high-throughput experimentation and reproducibility. Accessibility, reliability, and integration with laboratory workflows contribute to its leading share. Adoption of HRM in emerging economies for research purposes also supports segment growth.

The hospitals and diagnostic centers segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising adoption of HRM assays for clinical diagnostics, genetic testing, and early disease detection. Rapid and reliable results enhance patient care and enable personalized treatment. Increasing prevalence of genetic disorders, infectious diseases, and cancer drives demand. Hospitals are investing in HRM instruments, training staff, and incorporating assays into routine diagnostic workflows. Regulatory approvals, clinical validation, and growing awareness of molecular diagnostics further boost this segment. The combination of clinical utility and technological advancement positions hospitals and diagnostic centers for strong growth.

High-Resolution Melting Analysis Market Regional Analysis

- North America dominated the global high-resolution melting analysis market with the largest revenue share of 36.5% in 2024, characterized by robust healthcare infrastructure, significant R&D investments, and early adoption of genomic technologies

- Researchers and clinicians in the region highly value the accuracy, high-throughput capabilities, and integration of HRM instruments with real-time PCR systems for SNP genotyping, mutation discovery, and pathogen identification

- The widespread adoption is further supported by substantial R&D funding, technologically advanced laboratory infrastructure, and strong regulatory frameworks for molecular diagnostics, establishing HRM analysis as a preferred tool in both research and clinical applications

U.S. HRM Analysis Market Insight

The U.S. high-resolution melting analysis market captured the largest revenue share in North America in 2024, fueled by extensive investments in genomics research, molecular diagnostics, and personalized medicine. Laboratories and diagnostic centers are increasingly adopting HRM instruments for SNP genotyping, mutation detection, and pathogen identification. The growing preference for rapid, high-throughput, and accurate genetic analysis is driving market expansion. Integration with real-time PCR systems and advanced software platforms enhances laboratory workflow efficiency. Moreover, the strong presence of leading biotechnology companies and research institutions supports continuous adoption. Government funding and favorable regulatory frameworks further contribute to the market’s growth.

Europe HRM Analysis Market Insight

The Europe high-resolution melting analysis market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by growing investments in molecular diagnostics and genomic research. Stringent regulatory standards and the increasing focus on precision medicine are fostering HRM adoption in hospitals, diagnostic centers, and research labs. Rising urbanization, coupled with increasing healthcare infrastructure development, supports the deployment of advanced instruments and reagents. European laboratories are leveraging HRM for SNP genotyping, pathogen identification, and mutation discovery, integrating it into both clinical and academic applications. The market growth is further supported by collaborations between pharmaceutical companies and academic institutes.

U.K. HRM Analysis Market Insight

The U.K. high-resolution melting analysis market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising investments in genomics and molecular diagnostic research. Increased awareness of genetic disorders and the adoption of high-throughput diagnostic techniques are fueling demand. Laboratories and research institutes prioritize HRM for accurate SNP genotyping and mutation detection. Integration with bioinformatics tools and real-time PCR systems enhances analytical capabilities and workflow efficiency. Government initiatives supporting precision medicine and genetic testing further encourage market growth. The U.K.’s strong healthcare infrastructure and research ecosystem continue to stimulate HRM adoption.

Germany HRM Analysis Market Insight

The Germany high-resolution melting analysis market is expected to expand at a considerable CAGR during the forecast period, fueled by rising awareness of molecular diagnostics and technological advancements in laboratories. Germany’s emphasis on innovation, research, and high-quality healthcare infrastructure promotes HRM adoption. Both research institutes and hospitals increasingly leverage HRM instruments for mutation discovery, SNP genotyping, and pathogen identification. Integration with automated systems enhances efficiency and reproducibility. The growing focus on personalized medicine and clinical genomics further supports market growth. In addition, strong collaborations between biotech firms and academic institutions strengthen the adoption of HRM technologies in the country.

Asia-Pacific HRM Analysis Market Insight

The Asia-Pacific high-resolution melting analysis market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing investments in biotechnology, healthcare infrastructure, and genomics research. Countries such as China, Japan, and India are witnessing rapid adoption of HRM instruments for pathogen identification, SNP genotyping, and mutation screening. Government initiatives promoting digital healthcare and genomic research are accelerating market uptake. The availability of affordable instruments and reagents further supports widespread adoption. Expanding clinical research, growing molecular diagnostics awareness, and a rising number of hospitals and research institutes are fueling growth. In addition, Asia-Pacific is emerging as a manufacturing hub for HRM instruments and consumables, increasing accessibility and affordability.

Japan HRM Analysis Market Insight

The Japan high-resolution melting analysis market is gaining momentum due to the country’s advanced biotechnology sector, strong focus on research, and increasing demand for molecular diagnostics. HRM instruments are widely used for SNP genotyping, mutation detection, and pathogen identification in hospitals and research laboratories. Integration with real-time PCR platforms and automated systems enhances precision and reduces turnaround times. Government funding for genomics and precision medicine projects supports the market. The growing emphasis on infectious disease detection and clinical diagnostics further drives adoption. Japan’s well-developed healthcare infrastructure and high technological capability encourage rapid market expansion.

India HRM Analysis Market Insight

The India high-resolution melting analysis market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding biotechnology sector, increasing healthcare infrastructure, and rising investments in molecular diagnostics. Research laboratories, hospitals, and diagnostic centers are increasingly adopting HRM for SNP genotyping, mutation detection, and pathogen identification. The government’s push towards smart healthcare and genomics initiatives further accelerates market growth. Affordable instruments and reagents, alongside domestic manufacturing capabilities, improve accessibility. Rising prevalence of infectious diseases and genetic disorders is creating additional demand. India’s growing focus on clinical research, diagnostics, and academic applications positions the market for strong growth.

High-Resolution Melting Analysis Market Share

The High-Resolution Melting Analysis industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- QIAGEN (Germany)

- Agilent Technologies, Inc. (U.S.)

- Illumina, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- BIOMÉRIEUX (France)

- Meridian Bioscience, Inc. (U.S.)

- Novacyt S.A. (France)

- Azura Genomics (U.S.)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- PREMIER Biosoft (U.S.)

- LGC Biosearch Technologies (U.K.)

- Takara Bio Inc. (Japan)

- Cepheid (U.S.)

- Analytik Jena GmbH+Co. KG (Germany)

- PacBio. (U.S.)

- Sysmex Corporation (Japan)

- Bio-Techne (U.S.)

What are the Recent Developments in Global High-Resolution Melting Analysis Market?

- In December 2024, researchers developed a single-tube, multiplex molecular assay using high-resolution melting (HRM) analysis to predict the four chemotypes of Fusarium graminearum, a fungal pathogen affecting crops. This assay targets conserved functional regions of trichothecene biosynthetic genes, providing a rapid and efficient method for chemotype identification, which is crucial for managing fungal diseases in agriculture

- In September 2024, QIAGEN launched the QIAcuityDx digital PCR system, specifically designed for clinical testing in oncology. This system enhances the capabilities of HRM analysis by providing precise and multiplexed quantification results for mutation detection and gene expression studies, facilitating advanced cancer diagnostics. The QIAcuityDx system integrates seamlessly into clinical laboratories, offering a walk-away automated platform with minimal hands-on time

- In June 2024, QIAGEN launched 35 new digital PCR assays for pathogens causing tropical diseases, sexually transmitted infections (STIs), and urinary tract infections (UTIs), including Dengue, Monkeypox, and Malaria. This expansion enhances the utility of HRM analysis in infectious disease research and surveillance, providing researchers with more tools to study and monitor various pathogens

- In May 2024, a pilot study suggested that Universal Digital High-Resolution Melting (U-dHRM) analysis could address challenges in quickly and accurately diagnosing bloodstream infections. This method shows promise for enhancing clinical diagnostics by enabling rapid and robust detection of infections, potentially improving patient outcomes

- In April 2024, a study introduced a high-resolution melting (HRM) PCR assay designed for the rapid and efficient detection and identification of Leishmania species in cutaneous leishmaniasis (CL) diagnosis. This development highlights the growing application of HRM in clinical diagnostics, offering a cost-effective and sensitive alternative to traditional sequencing methods

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.