Global Home Beer Brewing Machine Market

Market Size in USD Billion

CAGR :

%

USD

54.70 Billion

USD

126.07 Billion

2025

2033

USD

54.70 Billion

USD

126.07 Billion

2025

2033

| 2026 –2033 | |

| USD 54.70 Billion | |

| USD 126.07 Billion | |

|

|

|

|

What is the Global Home Beer Brewing Machine Market Size and Growth Rate?

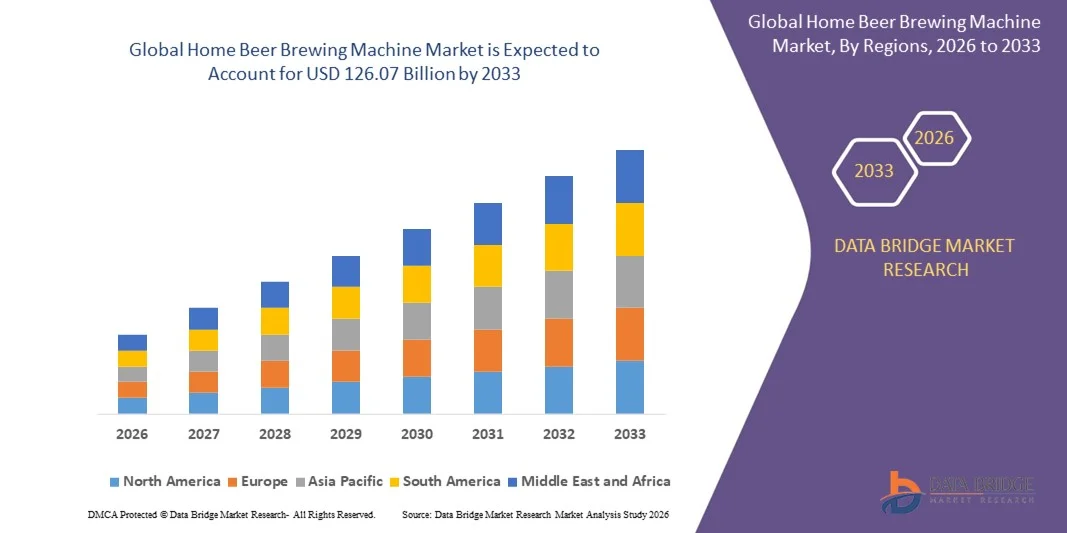

- The global home beer brewing machine market size was valued at USD 54.70 billion in 2025 and is expected to reach USD 126.07 billion by 2033, at a CAGR of 11.00% during the forecast period

- Growing popularity of craft beer among young consumers owing to the availability of a variety of flavors, including malted barley, chestnut, and honey is one of the major driving factors for the home beer brewing machine market. Increasing demand for home craft and draught beer is also a driver for the home beer brewing machine market.

What are the Major Takeaways of Home Beer Brewing Machine Market?

- Increasing beer consumption, rising popularity of customized beer, and the emergence of e-commerce platforms is an opportunity for the home beer brewing machine market

- Lack of popularity as well as cultural restrictions in Asian countries is a challenge for the growth of home beer brewing machine market. However, periodic maintenance of home beer brewing machine is the main restraint for home beer brewing machine market

- North America dominated the home beer brewing machine market with the largest revenue share of 42.8% in 2025, attributed to the presence of leading brewing equipment manufacturers, high consumer adoption of home brewing, and the popularity of craft beer culture across the U.S. and Canada

- Asia-Pacific is projected to witness the fastest growth rate of 10.2% during 2026–2033, driven by rising urbanization, growing middle-class income, and expanding interest in home brewing culture across China, Japan, India, and South Korea

- The Mini Brewer segment dominated the market with a revenue share of 57.3% in 2025, driven by its compact design, ease of use, and suitability for home kitchens and small living spaces

Report Scope and Home Beer Brewing Machine Market Segmentation

|

Attributes |

Home Beer Brewing Machine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Home Beer Brewing Machine Market?

Rising Adoption of Smart, Automated Brewing Systems for Personalized Home Brewing Experiences

- The home beer brewing machine market is witnessing a key trend toward smart, automated, and compact brewing systems that allow users to brew high-quality beer at home with minimal manual intervention. These systems integrate IoT connectivity, touch-screen interfaces, and automated temperature and fermentation control for precision brewing

- For instance, LG Electronics, MiniBrew B.V., and PicoBrew have introduced AI-enabled and fully automated home beer brewing machines that provide customizable recipes, real-time monitoring, and app-based controls to enhance the user experience

- The growing popularity of craft beers and personalized brewing at home is driving consumer interest in compact, user-friendly brewing solutions

- Home brewers are increasingly adopting IoT-enabled machines with recipe libraries, automated cleaning, and fermentation alerts for consistent and repeatable results

- Rising interest in DIY brewing, sustainability, and convenience is motivating manufacturers to develop modular, energy-efficient, and compact brewing solutions

- As home brewing continues to grow globally, smart and automated brewing systems will remain the defining trend shaping market evolution

What are the Key Drivers of Home Beer Brewing Machine Market?

- The rising popularity of craft beer and home brewing culture is one of the primary drivers of the home beer brewing machine market. Consumers increasingly seek convenience, customization, and quality in home brewing

- For instance, in 2024, MiniBrew B.V. launched fully automated home brewing machines with IoT-enabled apps for recipe customization and remote monitoring

- Technological advancements in automation, IoT integration, and sensor-based brewing controls are enabling precise fermentation, temperature regulation, and real-time monitoring.

- Increasing consumer inclination toward DIY activities, personalized beverages, and at-home entertainment is driving market adoption

- Compact and energy-efficient designs, coupled with ease of use, are encouraging households to invest in smart brewing machines

- As global interest in home-based craft brewing rises, the home beer brewing machine market is expected to grow steadily, supported by innovation, convenience, and sustainability trends

Which Factor is Challenging the Growth of the Home Beer Brewing Machine Market?

- High initial purchase costs, complex machine setup, and maintenance requirements pose challenges for home beer brewing machine adoption

- For instance, during 2023–2024, several consumers delayed purchasing advanced automated brewing systems due to price and complexity concerns

- Intense competition among global and regional manufacturers has led to price pressure and margin constraints

- Limited awareness about smart brewing technologies and the learning curve associated with recipe customization restricts widespread adoption

- Regulatory compliance for electrical and safety standards in different regions adds cost and complexity for manufacturers

- To address these challenges, market players are focusing on modular, user-friendly designs, subscription-based recipe services, and partnerships with retail and online channels to enhance accessibility and customer engagement

How is the Home Beer Brewing Machine Market Segmented?

The market is segmented on the basis of product, mechanism, capacity and distribution channel.

- By Product

On the basis of product, the home beer brewing machine market is segmented into Mini Brewer and Full-size Brewer. The Mini Brewer segment dominated the market with a revenue share of 57.3% in 2025, driven by its compact design, ease of use, and suitability for home kitchens and small living spaces. Mini brewers appeal to consumers seeking convenient, entry-level brewing solutions with customizable recipes and minimal maintenance.

The Full-size Brewer segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing demand for larger batch brewing, advanced automation, and commercial-quality beer production at home. Full-size brewers are gaining traction among craft beer enthusiasts and hobbyists who require higher capacity, integrated fermentation controls, and app-based monitoring for consistent results. The growing popularity of DIY brewing culture and interest in home-based craft beer experimentation is expected to sustain strong adoption of both product types globally.

- By Mechanism

Based on mechanism, the market is segmented into Automatic and Manual Home Beer Brewing Machines. The Automatic segment dominated the market with a share of 62.1% in 2025, owing to its user-friendly operations, pre-programmed brewing cycles, and minimal manual intervention. Automated machines allow precise control over temperature, fermentation, and timing, ensuring consistent beer quality and reducing the learning curve for home brewers.

The Manual segment is expected to grow at the fastest CAGR during 2026–2033, driven by craft enthusiasts who prefer hands-on control, customizable brewing techniques, and experimentation with ingredients and fermentation profiles. The rising interest in home brewing as a hobby, combined with DIY beer culture and educational brewing kits, is supporting growth across both mechanism types globally.

- By Capacity

On the basis of capacity, the home beer brewing machine market is segmented into Less than 5 liters, 5–10 liters, and 10 liters and above. The Less than 5 liters segment dominated the market with a revenue share of 51.6% in 2025, attributed to its suitability for casual home brewers, compact kitchens, and easy storage. This segment is popular for single-batch experimentation and small-scale craft beer production.

The 10 liters and above segment is projected to register the fastest CAGR from 2026 to 2033, supported by increasing demand among dedicated home brewers and craft beer hobbyists for higher-volume production, integrated fermentation controls, and automated monitoring systems. The trend toward personalized brewing experiences, larger batch experimentation, and home-based microbrewery setups continues to drive capacity-based adoption worldwide.

- By Distribution Channel

Based on distribution channel, the market is segmented into Online and Offline. The Offline segment dominated the market with a share of 59.2% in 2025, driven by established retail networks, appliance stores, and specialty brewing equipment outlets that allow consumers to explore products firsthand and seek expert guidance. Offline channels also provide immediate delivery and installation services, enhancing consumer confidence.

The Online segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by the surge in e-commerce platforms, digital marketing, and growing consumer preference for home delivery. The convenience of online ordering, coupled with access to detailed product information, reviews, and subscription-based recipe kits, is boosting adoption of home brewing machines across emerging and developed markets.

Which Region Holds the Largest Share of the Home Beer Brewing Machine Market?

- North America dominated the home beer brewing machine market with the largest revenue share of 42.8% in 2025, attributed to the presence of leading brewing equipment manufacturers, high consumer adoption of home brewing, and the popularity of craft beer culture across the U.S. and Canada. Rising disposable income, premiumization trends, and increasing interest in DIY brewing have fueled demand across both OEM and retail channels

- The region’s well-established distribution networks, advanced manufacturing capabilities, and strong online and offline retail infrastructure further reinforce North America’s dominance in the global market

- Favorable government regulations, brewing safety standards, and technological innovation in smart brewing systems continue to position North America as the leading market globally

U.S. Home Beer Brewing Machine Market Insight

The U.S. represents the largest contributor to the North American home beer brewing machine market, driven by a strong home brewing culture, high consumer spending on leisure appliances, and presence of key manufacturers such as PicoBrew Inc. and Blichmann Engineering. Increasing adoption of automated and connected brewing machines enhances convenience and consistency for home brewers. Rising interest in craft beer experimentation, recipe customization, and smart device integration continues to support the market’s growth. The growing trend of gifting brewing kits and subscription-based beer recipes further strengthens consumer adoption across the U.S.

Canada Home Beer Brewing Machine Market Insight

Canada contributes steadily to the North American home beer brewing machine market, supported by rising disposable income, craft beer popularity, and the expansion of specialty brewing retailers. Consumers are increasingly adopting compact, automated brewing machines for home use, supported by online retail availability and growing e-commerce penetration. Government initiatives promoting entrepreneurship and small-scale food & beverage manufacturing are further encouraging local adoption. Collaborations between distributors and smart brewing system manufacturers are enhancing innovation, convenience, and accessibility for Canadian consumers.

Asia-Pacific Home Beer Brewing Machine Market Insight

Asia-Pacific is projected to witness the fastest growth rate of 10.2% during 2026–2033, driven by rising urbanization, growing middle-class income, and expanding interest in home brewing culture across China, Japan, India, and South Korea. Increasing awareness of craft beer, growing cafe and microbrewery culture, and adoption of compact and automated home brewing machines are fueling market expansion. Rapid digitalization and e-commerce adoption also support sales of mini brewers and connected systems.

China Home Beer Brewing Machine Market Insight

China represents the largest contributor to the Asia-Pacific market, driven by growing urban middle-class populations, rising interest in DIY craft beer, and expanding online retail penetration. Local manufacturers and international brands are increasingly offering compact and automated brewers to cater to home consumers. Government initiatives supporting entrepreneurship and specialty food and beverage equipment manufacturing further strengthen China’s growth trajectory.

India Home Beer Brewing Machine Market Insight

India is emerging as one of the fastest-growing markets in Asia-Pacific, supported by rising disposable incomes, growing urban youth population, and increasing adoption of home leisure activities such as DIY brewing. Online retail platforms and subscription-based recipe kits are boosting consumer convenience and adoption. The rising popularity of craft beer, along with brewing education workshops and hobbyist communities, is expected to drive strong demand growth over the coming years.

Europe Home Beer Brewing Machine Market Insight

Europe holds a significant share in the global Home Beer Brewing Machine market, led by countries such as Germany, U.K., and France, where craft beer culture is well-established. The demand for smart, automated, and full-size brewers continues to grow among home brewing enthusiasts. Stricter hygiene and safety regulations, coupled with premium appliance adoption, support high market penetration across both offline and online channels.

Germany Home Beer Brewing Machine Market Insight

Germany leads the European market, driven by a strong home brewing tradition, high disposable incomes, and well-established appliance retail networks. Consumers increasingly prefer automated brewers with integrated fermentation and recipe management systems. The country’s emphasis on innovation, quality, and sustainable brewing practices further strengthens its market leadership.

U.K. Home Beer Brewing Machine Market Insight

The U.K. market continues to expand, fueled by rising craft beer consumption, hobbyist brewing communities, and growing awareness of home brewing kits and smart brewing machines. Online retail adoption, subscription recipe models, and educational initiatives in home brewing are supporting market growth. Demand for automated, compact, and connected brewing machines continues to rise, ensuring the U.K.’s continued influence within the European Home Beer Brewing Machine market.

Which are the Top Companies in Home Beer Brewing Machine Market?

The home beer brewing machine industry is primarily led by well-established companies, including:

- LG Electronics (South Korea)

- MiniBrew B.V. (Netherlands)

- PicoBrew Inc. (U.S.)

- The Middleby Corporation (U.S.)

- Blichmann Engineering (U.S.)

- Speidel Tank und Behälterbau GmbH (Germany)

- WilliamsWarn Ltd. (U.K.)

- Home Brew West (U.S.)

- Kickstarter (U.S.)

- PBC (U.S.)

- BrewJacket LLC (U.S.)

- AIBrew Corp. (U.S.)

- ABE Beverage Equipment (U.S.)

- Jinan Zhuoda Machinery Equipment Co., Ltd. (China)

- Hypro Engineers Pvt. Ltd. (India)

- Rohit Jafa Brewing Solutions (India)

- Czech Brewery System (Czech Republic)

- Craft A Brew (U.S.)

- The Home Brewery (U.S.)

- Smart Machine Technologies, Inc. (U.S.)

- BLONDER BEER (U.S.)

- Altitude Brewing & Supply (U.S.)

What are the Recent Developments in Global Home Beer Brewing Machine Market?

- In September 2024, Brew Bomb Cold Brew Equipment partnered with TORR Industries Inc., following TORR’s acquisition of a controlling stake in Brew Bomb’s parent company, Gunga LLC, strengthening operations by combining cold brew expertise with advanced manufacturing capabilities, ultimately driving innovation and supporting next-generation cold coffee technology development

- In March 2024, the Texas Craft Brewers Guild, representing over 300 small and independent breweries in the state, launched the Brew City, Texas program to unite municipalities and promote craft beer tourism, fostering economic growth and positioning Texas as a leading craft beer destination in the coming years

- In February 2024, Bwanaz, an online fusion marketplace merging wholesale and retail, unveiled the highly anticipated iGulu F1 Automated Smart Home Brewer in collaboration with iGulu, offering consumers an advanced solution for specialty lager blending at home, marking a milestone in convenient home brewing experiences

- In November 2023, Carabao introduced five new beer variants developed by Tawandang German Brewery, expanding its craft beer portfolio and enhancing consumer choice across local and international markets

- In October 2023, Brooklyn Brewery launched Fonio Rising, a unique craft beer made from fonio, an ancient West African grain known for its resilience and versatility, highlighting innovation in sustainable brewing ingredients and enriching craft beer diversity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.