Global Hospital Staffing Market

Market Size in USD Billion

CAGR :

%

USD

40.50 Billion

USD

65.68 Billion

2024

2032

USD

40.50 Billion

USD

65.68 Billion

2024

2032

| 2025 –2032 | |

| USD 40.50 Billion | |

| USD 65.68 Billion | |

|

|

|

|

Hospital Staffing Market Size

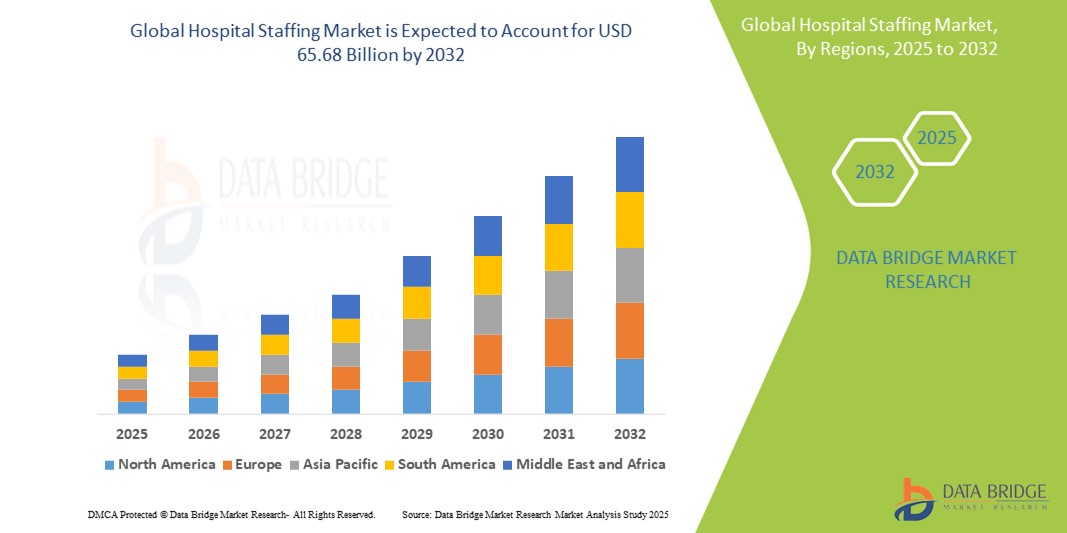

- The global hospital staffing market size was valued at USD 40.50 billion in 2024 and is expected to reach USD 65.68 billion by 2032, at a CAGR of 6.23% during the forecast period

- This growth is driven by factors such as the rising global shortage of healthcare professionals, increasing demand for specialized medical services, and the growing elderly population requiring continuous care

Hospital Staffing Market Analysis

- Hospital staffing includes the recruitment and management of healthcare professionals such as physicians, nurses, and allied health workers, essential for ensuring quality patient care and operational efficiency in hospitals

- The demand for hospital staffing services is driven by the global shortage of healthcare professionals, rising patient volumes, and increased focus on improving patient outcomes and reducing burnout among existing staff

- North America is expected to dominate the hospital staffing market with a market share of 57.95%, due by advanced healthcare infrastructure, high demand for specialized medical staff, and the presence of key staffing agencies

- Asia-Pacific is expected to be the fastest growing region in the hospital staffing market with a market share of 15.62%, during the forecast period due to rapid expansion in healthcare infrastructure, increasing demand for healthcare services, and a rising middle-class population

- Travel Nurse segment is expected to dominate the market with a market share of 46.5% due to its flexibility, rapid deployment capabilities, and ability to fill critical staffing gaps, especially in high-demand or rural areas

Report Scope and Hospital Staffing Market Segmentation

|

Attributes |

Hospital Staffing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hospital Staffing Market Trends

“Technological Integration and AI-Driven Workforce Management”

- One prominent trend in the global hospital staffing market is the growing integration of artificial intelligence (AI) and workforce management software to optimize staff scheduling and improve operational efficiency

- These innovations help hospitals address staffing shortages by forecasting demand, automating shift allocations, and reducing administrative burdens, thereby ensuring better coverage and minimizing staff burnout

- For instance, AI-powered platforms such as Kronos and ShiftWizard allow real-time analytics and predictive scheduling, enabling hospital administrators to dynamically allocate resources based on patient acuity and peak hours

- This digital transformation is revolutionizing hospital staffing, improving staff satisfaction, reducing turnover, and enhancing overall patient care delivery through more agile and efficient workforce management systems

Hospital Staffing Market Dynamics

Driver

“Rising Demand Due to Healthcare Workforce Shortages”

- A significant driver in the global hospital staffing market is the persistent shortage of qualified healthcare professionals, including nurses, physicians, and allied health workers

- This shortage is exacerbated by an aging global population, growing chronic disease burden, and the increasing complexity of healthcare needs, which collectively put pressure on hospitals to maintain adequate staffing levels

- As healthcare systems strive to meet rising patient volumes and regulatory standards for quality care, the demand for temporary, travel, and locum tenens staffing services continues to grow to fill these gaps

For instance,

- According to a 2023 report by the World Health Organization, the global shortage of healthcare workers is projected to reach 10 million by 2030, with low- and middle-income countries being the most affected. This shortfall directly impacts hospital operations, emphasizing the need for flexible and scalable staffing solutions

- As a result of the ongoing global workforce shortage, hospitals increasingly rely on staffing agencies and digital workforce platforms to ensure consistent, high-quality patient care and operational continuity

Opportunity

“Leveraging Digital Platforms and AI for Efficient Workforce Management”

- The integration of AI and digital platforms into hospital staffing operations presents a major opportunity to optimize workforce management, reduce costs, and enhance patient care delivery

- AI-driven staffing tools can analyze workforce data, predict staffing shortages, and automate shift scheduling, ensuring the right professionals are available at the right time while minimizing staff fatigue and burnout

- In addition, digital staffing platforms enable hospitals to access a broader pool of healthcare professionals, including travel nurses and locum tenens, through real-time job matching, credential verification, and onboarding tools

For instance,

- In October 2023, AMN Healthcare highlighted the growing adoption of AI-based scheduling platforms that use predictive analytics to anticipate patient volume and recommend optimal staffing levels. These systems help improve resource allocation, reduce overtime costs, and maintain staff satisfaction by offering greater schedule flexibility

- By leveraging AI and digital tools, hospitals can increase staffing efficiency, improve healthcare worker retention, and enhance care quality, particularly in times of high demand or crisis, creating a more resilient and adaptive healthcare system

Restraint/Challenge

“Rising Labor Costs and Budget Constraints in Healthcare Facilities”

- The increasing cost of healthcare labor is a major challenge facing the global hospital staffing market, placing financial strain on hospitals and healthcare systems, particularly in regions with limited healthcare budgets

- Wage inflation, demand for overtime pay, and reliance on expensive temporary or travel staff significantly increase operational expenses, reducing the profit margins of healthcare providers

- Smaller hospitals and rural healthcare facilities, in particular, may struggle to compete with larger institutions in attracting and retaining skilled healthcare workers due to financial constraints

For instance,

- In a 2023 report by the American Hospital Association (AHA), labor costs accounted for over 50% of total hospital expenses, with travel nurse pay rates doubling compared to pre-pandemic levels. These financial pressures are forcing hospitals to reassess staffing models, often leading to reduced hiring or staff burnout due to inadequate coverage

- Consequently, rising labor costs and budgetary limitations hinder the ability of healthcare providers to maintain optimal staffing levels, which can negatively impact patient care quality, staff satisfaction, and overall hospital efficiency

Hospital Staffing Market Scope

The market is segmented on the basis of staffing service and service

|

Segmentation |

Sub-Segmentation |

|

By Staffing Service |

|

|

By Service |

|

In 2025, travel nurse is projected to dominate the market with a largest share in staffing service segment

The travel nurse segment is expected to dominate the hospital staffing market with the largest share of 46.5% in 2025 due to its flexibility, rapid deployment capabilities, and ability to fill critical staffing gaps, especially in high-demand or rural areas. Hospitals increasingly rely on travel nurses to address workforce shortages and manage fluctuating patient volumes. In addition, the appeal of higher wages and flexible work arrangements has led to a growing supply of professionals entering the travel nurse workforce

The hospitals is expected to account for the largest share during the forecast period in service market

In 2025, the hospitals segment is expected to dominate the market with the largest market share of 42.5% due to the central role hospitals play in delivering healthcare services, especially in treating complex conditions and emergencies. Hospitals continue to have the highest demand for diverse healthcare staff, including nurses, physicians, and allied health professionals. As patient volumes increase, hospitals are increasingly relying on staffing services to maintain high-quality care and meet staffing requirements efficiently

Hospital Staffing Market Regional Analysis

“North America Holds the Largest Share in the Hospital Staffing Market”

- North America dominates the hospital staffing market with a market share of estimated 57.95%, driven, by advanced healthcare infrastructure, high demand for specialized medical staff, and the presence of key staffing agencies

- U.S. holds a market share of 65.5%, due to its large, aging population, which requires continuous healthcare services, as well as the country’s robust healthcare system that drives demand for diverse healthcare workers, including nurses, physicians, and allied health professionals

- The well-established healthcare reimbursement policies and significant investments in healthcare technology further bolster the demand for qualified hospital staff

- In addition, the increasing prevalence of chronic diseases, along with a growing preference for travel nurses and locum tenens professionals, continues to drive market growth in the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Hospital Staffing Market”

- Asia-Pacific is expected to witness the highest growth rate in the hospital staffing market with a market share of 15.62%, driven by rapid expansion in healthcare infrastructure, increasing demand for healthcare services, and a rising middle-class population

- Countries such as China, India, and Japan are emerging as key markets due to their growing aging populations and rising healthcare needs

- Japan, with its advanced healthcare system and well-established staffing agencies, continues to be a major market for hospital staffing services, as it strives to meet the needs of its aging population

- India is projected to register the highest CAGR in the hospital staffing market, driven by expanding healthcare facilities, a high incidence of chronic diseases, and growing investment in healthcare workforce development

Hospital Staffing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- AdeccoGroup (Switzerland)

- CHG Management, Inc. (U.S.)

- Maxim Healthcare Services (U.S.)

- Supplemental Health Care (U.S.)

- Jackson Healthcare (U.S.)

- TeamHealth (U.S.)

- Medical Solutions (U.S.)

- Aya Healthcare, Inc. (U.S.)

- Favorite Healthcare Staffing Inc. (U.S.)

- InGenesis, Inc. (U.S.)

- MedPro Healthcare Staffing (U.S.)

- TactStaff (U.S.)

- Insight Global (U.S.)

- Clive Henry Group (U.K.)

- Weatherby Healthcare (U.S.)

- All Medical Personnel (U.S.)

- AMN Healthcare (U.S.)

- Cross Country Healthcare, Inc. (U.S.)

Latest Developments in Global Hospital Staffing Market

- In December 2024, nursing homes in Connecticut faced critical staffing shortages, leading to facility closures and a greater reliance on temporary staffing agencies. This trend reflects a larger issue of workforce instability across the healthcare sector

- In November 2024, AI-powered staffing platforms are transforming recruitment and workforce management by automating scheduling, improving staff placement, and offering predictive analytics to ensure optimal staffing levels across hospitals

- In October 2024, government spending cuts in the UK led to significant impacts on the healthcare staffing sector, with NHS trusts cutting clinical positions to address financial pressures. This created a workforce gap that staffing agencies are striving to fill, further driving the reliance on temporary staff

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.