Global Hot Water Dispensers Market

Market Size in USD Billion

CAGR :

%

USD

1.58 Billion

USD

2.93 Billion

2024

2032

USD

1.58 Billion

USD

2.93 Billion

2024

2032

| 2025 –2032 | |

| USD 1.58 Billion | |

| USD 2.93 Billion | |

|

|

|

|

What is the Global Hot Water Dispensers Market Size and Growth Rate?

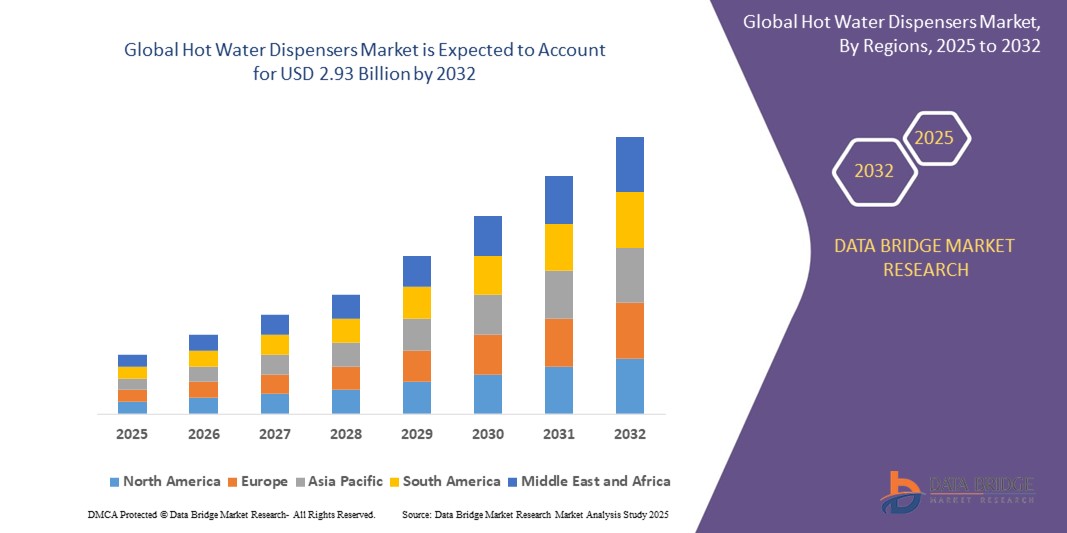

- The global hot water dispensers market size was valued at USD 1.58 billion in 2024 and is expected to reach USD 2.93 billion by 2032, at a CAGR of 8.0% during the forecast period

- Rising disposable incomes have a profound impact on the hot water dispensers market, as they enable a larger number of consumers to purchase and integrate these appliances into their homes and workplaces

- With increased financial capacity, there is a heightened tendency among consumers to invest in technologies that enhance convenience and streamline daily routines, such as providing instant access to hot water for beverages, cooking, and other applications

- This trend drives higher adoption rates and encourages manufacturers to innovate with advanced features such as energy efficiency and water filtration, appealing to a broader customer base

What are the Major Takeaways of Hot Water Dispensers Market?

- The increasing demand for convenience is a significant driver of the hot water dispensers market. Consumers today value efficiency and time-saving solutions in their daily routines, making instant hot water dispensers highly appealing. These appliances streamline the process of heating water for beverages, cooking, and other purposes, eliminating the need to wait for water to boil on traditional stovetops or kettles

- As lifestyles become busier and more fast-paced, there is a growing preference for appliances that provide quick, reliable access to hot water at the touch of a button. This trend is particularly pronounced in urban areas where space is limited and efficient use of kitchen appliances is crucial

- North America dominated the hot water dispensers market with the largest revenue share of 34.01% in 2024, driven by the increasing demand for energy-efficient appliances, rising consumer preference for smart kitchen solutions, and strong presence of leading brands in the region

- Asia-Pacific region is expected to witness the fastest CAGR of 7.5% from 2025 to 2032, attributed to increasing urbanization, rapid lifestyle changes, and growing awareness of water hygiene across major countries like China, India, and Japan

- The Hot Water Tank Dispensers segment dominated the market with the largest revenue share of 38.6% in 2024, owing to its wide usage across residential and commercial settings for delivering instant hot water

Report Scope and Hot Water Dispensers Market Segmentation

|

Attributes |

Hot Water Dispensers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Hot Water Dispensers Market?

“Smart Integration and Touchless Convenience in Water Dispensing”

- A key trend reshaping the hot water dispensers market is the growing adoption of smart dispensing technology, including sensor-based, touchless, and app-controlled systems. This trend is driven by rising hygiene awareness and demand for user-friendly appliances across homes and workplaces

- For example, Panasonic and Midea have launched intelligent hot water dispensers with motion detection, temperature customization, and smartphone app integration, enabling users to control and monitor the device remotely

- Smart dispensers now feature programmable schedules, child safety locks, and energy-saving modes, all integrated with voice assistants like Amazon Alexa or Google Assistant for hands-free operation

- These innovations are especially prominent in residential kitchens, modern offices, and healthcare facilities, where cleanliness, safety, and ease of use are prioritized

- Furthermore, the emergence of IoT-enabled dispensers allows real-time monitoring of water usage, energy consumption, and filter status—beneficial for eco-conscious consumers and institutions managing large-scale water supply systems

- The increasing preference for automated, AI-integrated water dispensers is expected to redefine consumer expectations for both convenience and efficiency, driving the premiumization of the segment in the coming years

What are the Key Drivers of Hot Water Dispensers Market?

- The rising demand for instant, energy-efficient water heating solutions, particularly in urban households, offices, and hospitality environments, is a major factor driving market growth

- In May 2024, Whirlpool Corporation launched a new line of energy-efficient hot water dispensers with digital temperature presets and safety locks tailored for both domestic and commercial use, highlighting the push toward convenience and safety

- Increasing awareness of hygiene, health benefits of hot water consumption, and the need for time-saving kitchen appliances is encouraging consumers to invest in hot water dispensers

- Growing adoption of modular kitchen appliances and smart kitchen ecosystems further supports the integration of connected water dispensers, especially in developed economies

- The availability of multi-functional models that combine hot, cold, and ambient water dispensing with filtration systems enhances their appeal among health-conscious consumers

- Moreover, demand from sectors such as corporate offices, hotels, hospitals, and cafes is accelerating, fueled by the need for quick hot water access and efficient beverage preparation

Which Factor is challenging the Growth of the Hot Water Dispensers Market?

- One major challenge in the hot water dispensers market is the relatively high cost of smart or commercial-grade dispensers, which may hinder adoption in price-sensitive markets

- For instance, multi-temperature touchless dispensers with IoT or UV sterilization features are priced significantly higher than traditional manual models, limiting accessibility for low-income users or smaller businesses

- Additionally, concerns over maintenance costs, filter replacements, and energy consumption persist, especially among consumers unfamiliar with modern dispenser technologies

- Consumer skepticism regarding the long-term durability of digital components and fears of malfunctions or overheating may also slow adoption, particularly in rural or less tech-savvy regions

- Furthermore, in developing economies, irregular electricity supply and water quality issues can hinder the proper functioning of advanced dispensers, affecting performance and user satisfaction

- Addressing these concerns through affordable product lines, public education campaigns, and durable, energy-efficient solutions tailored to local needs will be essential to expand market penetration globally

How is the Hot Water Dispensers Market Segmented?

The market is segmented on the basis of type and application.

• By Type

On the basis of type, the hot water dispensers market is segmented into Hot Water Tank Dispensers, Bottom Load Water Dispensers, Electric Kettle Hot Water Dispensers, and Others. The hot water tank Dispensers segment dominated the market with the largest revenue share of 38.6% in 2024, owing to its wide usage across residential and commercial settings for delivering instant hot water. These systems are preferred for their energy efficiency, high-volume output, and ability to maintain consistent water temperatures, making them ideal for tea/coffee stations, kitchens, and break rooms.

The Electric Kettle Hot Water Dispensers segment is projected to witness the fastest CAGR from 2025 to 2032, driven by their increasing adoption in households due to their compact size, rapid heating capability, and affordability. Technological advancements such as temperature presets, auto shut-off, and smart connectivity features are further enhancing their appeal among consumers seeking convenience and safety.

• By Application

On the basis of application, the hot water dispensers market is segmented into Industrial, Residential, Commercial, and Others. The Residential segment accounted for the largest revenue share of 41.3% in 2024, propelled by the growing trend of smart kitchens, rising energy efficiency awareness, and increasing consumer preference for easy-to-use appliances. The demand for compact, aesthetically pleasing, and feature-rich dispensers is high in households globally.

The Commercial segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rapid installation across offices, restaurants, hotels, and public areas. Commercial users seek dispensers with higher durability, fast flow rate, and hygiene-focused features such as touchless dispensing and in-built filtration systems to cater to frequent use.

Which Region Holds the Largest Share of the Hot Water Dispensers Market?

- North America dominated the hot water dispensers market with the largest revenue share of 34.01% in 2024, driven by the increasing demand for energy-efficient appliances, rising consumer preference for smart kitchen solutions, and strong presence of leading brands in the region

- Consumers across the U.S. and Canada are prioritizing kitchen convenience and sustainability, contributing to widespread adoption of hot water dispensers in residential and commercial spaces such as offices, restaurants, and cafés

- The region's mature infrastructure, higher disposable incomes, and growing demand for touchless, hygienic dispensing systems have positioned North America as the global leader in this market

U.S. Hot Water Dispensers Market Insight

The U.S. market dominated the North American revenue share in 2024, led by a strong appetite for smart and connected kitchen appliances. Consumer preferences are shifting toward instant, high-capacity hot water dispensing systems that save time and energy. Integration with smart assistants and filtration systems further enhances product appeal, especially in tech-forward households and fast-paced commercial environments.

Europe Hot Water Dispensers Market Insight

The Europe market is projected to expand steadily during the forecast period, supported by growing environmental consciousness and stricter energy efficiency regulations. Hot water dispensers are increasingly being adopted in eco-friendly buildings, educational institutions, and offices. European consumers value long-term durability, energy savings, and safety features, which is prompting manufacturers to innovate across functionality and design.

U.K. Hot Water Dispensers Market Insight

The U.K. market is witnessing strong growth, fueled by increased investment in smart home appliances and heightened consumer awareness about boiling water safety. Compact, built-in, and wall-mounted dispensers are gaining popularity due to space constraints in urban homes. The expansion of e-commerce and home renovation trends further accelerates market adoption.

Germany Hot Water Dispensers Market Insight

Germany’s market growth is driven by innovation and sustainability, where consumers prioritize low-energy consumption, quality engineering, and integrated water filtration. Government incentives for energy-efficient home improvements and the rise in multifunctional appliances are supporting growth across both residential and commercial segments.

Which Region is the Fastest Growing in the Hot Water Dispensers Market?

Asia-Pacific region is expected to witness the fastest CAGR of 7.5% from 2025 to 2032, attributed to increasing urbanization, rapid lifestyle changes, and growing awareness of water hygiene across major countries like China, India, and Japan. Rising middle-class income, growing hospitality and food service sectors, and government initiatives for modern infrastructure are key growth enablers in the region. Additionally, the emergence of domestic manufacturers offering affordable and technologically advanced products is driving wider adoption among both households and businesses.

China Hot Water Dispensers Market Insight

China leads the Asia-Pacific market, backed by a robust manufacturing ecosystem, large-scale distribution channels, and rising urban demand for compact and fast-heating kitchen appliances. Consumers favor smart dispensers equipped with temperature control, sterilization features, and energy-efficient modes, especially in urban apartments and shared living spaces.

India Hot Water Dispensers Market Insight

India is expected to grow at the highest rate within the region, owing to rising health consciousness, increasing demand for hot beverages, and improved access to energy infrastructure. Both residential and small business segments are investing in electric and bottom-load dispensers, with a preference for affordable, low-maintenance models.

Japan Hot Water Dispensers Market Insight

Japan’s market is advancing through innovation and automation, with a focus on compact, high-tech appliances that cater to elderly-friendly households and space-efficient living. Hot water dispensers with precision temperature controls, voice activation, and eco-modes are gaining momentum in both home and office applications.

Which are the Top Companies in Hot Water Dispensers Market?

The hot water dispensers industry is primarily led by well-established companies, including:

- Blue Star Limited (India)

- CELLI SPA (Italy)

- Culligan Water (U.S.)

- Haier Group (China)

- Honeywell International Inc. (U.S.)

- Panasonic Corporation (Japan)

- Pentair (U.K.)

- Voltas Ltd. (India)

- Waterlogic Holdings Ltd. (U.K.)

- Breville Site (Australia)

- Midea (China)

- BUYDEEM Official (China)

- Waste King (U.S.)

- Kohler Co. (U.S.)

- Whirlpool Corporation (U.S.)

- Clover Co. Ltd. (Japan)

- Oasis International Inc. (U.S.)

- Primo Water Corporation (U.S.)

- Emerson Electric Co. (U.S.)

- AvantiProducts (U.S.)

What are the Recent Developments in Global Hot Water Dispensers Market?

- In September 2022, Google launched its second-generation wired Nest Doorbell, which is significantly smaller than its predecessors by nearly 30%. This advancement in size enhances its aesthetic appeal and integration potential within homes, showcasing Google's commitment to refining its smart home offerings through compact, advanced technology

- In December 2021, Hikvision announced a collaboration with Irida Labs, a Europe AI vision solution provider. This collaboration aims to enhance AI-driven vision solutions tailored for logistics and manufacturing sectors. The focus is on real-time management in plants and warehouses, highlighting Hikvision's strategic move to leverage AI for operational efficiency and automation in industrial settings

- In November 2021, Latch, Inc. collaborated with Marks USA, Town Steel, Inc., and announced an upcoming collaboration with dormakaba Holding AG. These partnerships expand the adoption of LatchOS among guests, residents, and property managers. The alliances signify Latch's strategy to integrate its smart access technology more deeply into the hospitality and property management sectors, enhancing convenience and security

- In July 2021, Vivint Smart Home, Inc. entered into a strategic collaboration with Freedom Forever to offer consumers integrated smart homes capable of generating their own energy needs. This initiative aligns with the growing trend towards sustainable living and energy independence, positioning Vivint as a leader in combining smart home technology with renewable energy solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.