Global Human Identification Market

Market Size in USD Billion

CAGR :

%

USD

2.05 Billion

USD

4.80 Billion

2024

2032

USD

2.05 Billion

USD

4.80 Billion

2024

2032

| 2025 –2032 | |

| USD 2.05 Billion | |

| USD 4.80 Billion | |

|

|

|

|

Human Identification Market Size

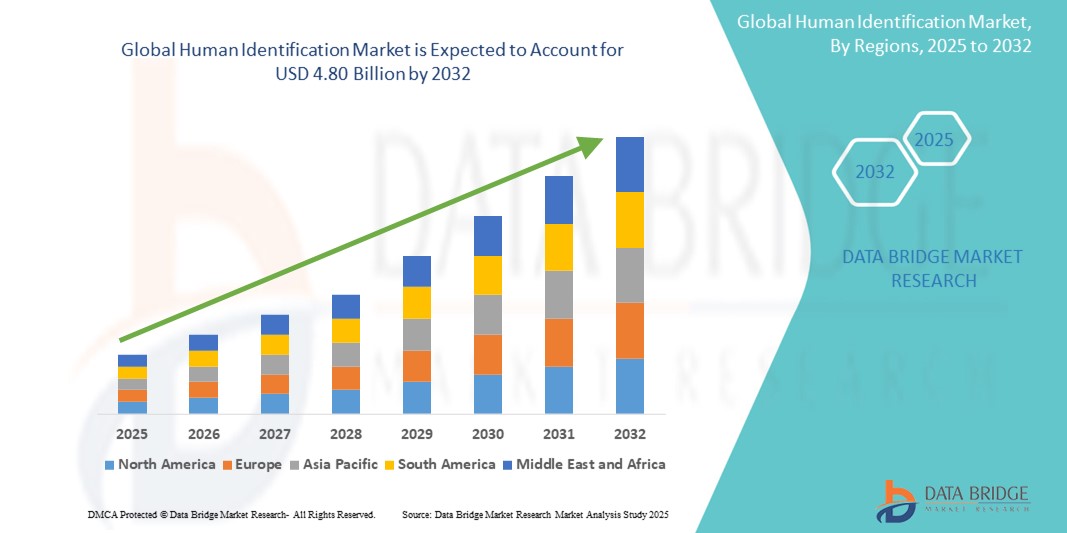

- The global human identification market size was valued at USD 2.05 billion in 2024 and is expected to reach USD 4.80 billion by 2032, at a CAGR of 11.20% during the forecast period

- This growth is driven by factors such as the increasing crime rates, and technological advancements in DNA fingerprinting

Human Identification Market Analysis

- Human identification technologies are essential tools in forensic science, enabling the precise identification of individuals through DNA analysis, fingerprinting, and biometric systems. These technologies play a critical role in criminal investigations, disaster victim identification, and missing person cases

- The demand for human identification solutions is significantly driven by increasing crime rates, advancements in DNA sequencing, and the growing need for accurate forensic analysis in law enforcement and legal proceedings

- North America is expected to dominate the human identification market, with a market share of 37.4%, driven by advanced healthcare infrastructure, high adoption of cutting-edge forensic technologies, and the strong presence of key market players

- Asia-Pacific is expected to be the fastest growing region in the human identification market, with a projected CAGR of 11.12%, driven by rapid expansion in forensic infrastructure, increasing crime rates, and rising investments in law enforcement technologies

- The consumables segment is expected to dominate the market with a market share of 44.5%, driven by its critical role in reliable and accurate DNA profiling. The continuous demand for high-quality consumables, including reagents, primers, buffers, and kits, along with the rising volume of forensic cases and growing need for rapid DNA analysis, further contribute to its market dominance.

Report Scope and Human Identification Market Segmentation

|

Attributes |

Human Identification Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Human Identification Market Trends

“Advancements in DNA Sequencing and Biometric Technologies for Human Identification”

- One prominent trend in the human identification market is the rapid advancement in DNA sequencing technologies and biometric systems, which are enhancing the speed, accuracy, and reliability of human identification processes

- These innovations allow forensic laboratories and law enforcement agencies to analyze smaller and more degraded DNA samples, improve data processing efficiency, and increase the precision of identity verification in criminal investigations and disaster victim identification

- For instance, next-generation sequencing (NGS) has significantly improved the ability to analyze complex genetic markers, enabling rapid DNA profiling, while advanced biometric technologies such as facial recognition, iris scanning, and fingerprint analysis offer highly accurate, real-time identification capabilities

- These advancements are transforming forensic science, improving case resolution times, enhancing public safety, and driving the demand for cutting-edge human identification technologies globally

Human Identification Market Dynamics

Driver

“Rising Demand for Forensic Testing and Criminal Investigations”

- The growing need for accurate human identification in forensic science and criminal investigations is a significant driver for the global human identification market

- Increasing crime rates, terrorism, and natural disasters have led to a greater demand for rapid, precise, and reliable identification technologies

- As law enforcement agencies and forensic laboratories strive to improve their capabilities, the demand for advanced DNA analysis, fingerprinting, and biometric identification technologies has surged

For instance,

- In December 2024, according to an article published by the National Forensic Science Technology Center (NFSTC), the adoption of rapid DNA analysis technology has significantly improved crime scene investigations, enabling law enforcement agencies to identify suspects within hours, enhancing public safety and reducing investigation times

- As a result, advancements in forensic technologies, including next-generation sequencing (NGS) and rapid DNA analysis, are expected to drive the growth of the human identification market

Opportunity

“Integration of Artificial Intelligence and Machine Learning in Identification Systems”

- The integration of AI and machine learning in human identification systems is emerging as a major opportunity, enabling faster and more accurate identification processes

- AI-powered systems can enhance biometric analysis, automate fingerprint matching, and improve DNA data processing, significantly reducing turnaround times in forensic laboratories

- These technologies also help detect patterns and anomalies in large data sets, aiding in criminal investigations and disaster victim identification

For instance,

- In January 2025, according to an article published in the Journal of Forensic Sciences, AI algorithms are being developed to automate the analysis of complex DNA profiles, significantly improving the accuracy of human identification and reducing the risk of human error

- The integration of AI in human identification technologies is expected to transform the industry, improving the efficiency of forensic investigations and expanding the scope of applications beyond traditional law enforcement

Restraint/Challenge

“High Costs and Technical Complexity of Advanced Identification Systems”

- The high costs associated with advanced human identification systems, including next-generation DNA sequencers and biometric scanners, pose a significant challenge to market growth

- These technologies often require substantial investments in infrastructure, specialized training, and ongoing maintenance, making them less accessible to smaller forensic laboratories and law enforcement agencies. In addition, the technical complexity of these systems can create operational challenges, particularly in regions with limited technical expertise and resources

For instance,

- In November 2024, according to a report by the International Association for Identification (IAI), the high cost of implementing advanced DNA analysis technologies is a major barrier for smaller forensic labs, limiting their ability to adopt cutting-edge tools and technologies

- As a result, the high costs and technical demands associated with advanced human identification systems may hinder market penetration, particularly in developing regions

Human Identification Market Scope

The market is segmented on the basis of product and services, technology, application and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product and Services |

|

|

By Technology |

|

|

By Application |

|

|

By End User

|

|

In 2025, the consumables segment is projected to dominate the market with a largest share in products and services segment

The consumables segment is expected to dominate the global human identification market, holding the largest share of 44.5% in 2025. This dominance is driven by the critical role of consumables, including reagents, primers, buffers, and kits, in reliable and accurate DNA profiling. The continuous need for high-quality consumables, coupled with the increasing volume of forensic cases and the rising demand for rapid DNA analysis, further contribute to the growth of this segment.

The forensic application is expected to account for the largest share during the forecast period in application market

In 2025, the forensic applications segment is expected to dominate the global human identification market, holding the largest market share of 36.40%. This dominance is driven by the widespread adoption of advanced DNA profiling technologies such as next-generation sequencing (NGS), rapid DNA analysis, and PCR, which offer faster and more accurate results. The rising number of crime cases globally and the need for robust evidence in court proceedings further contribute to its market dominance.

Human Identification Market Regional Analysis

“North America Holds the Largest Share in the Human Identification Market”

- North America dominates the human identification market, with 37.4% market share, driven by advanced healthcare infrastructure, high adoption of cutting-edge forensic technologies, and the strong presence of key market players

- U.S., which represents the largest market within this region, holds a significant share of 31.3%, due to increased demand for advanced DNA analysis solutions, rising crime rates, and continuous advancements in forensic technologies

- The availability of well-established forensic labs, supportive government policies, and significant investments in research & development further strengthen the market in this region

- In addition, the increasing use of DNA databases for criminal investigations, coupled with ongoing advancements in rapid DNA analysis technologies, is expected to drive further market growth

“Asia-Pacific is Projected to Register the Highest CAGR in the Human Identification Market”

- Asia-Pacific is expected to witness the highest growth rate in the human identification market, with a projected CAGR of 11.12%, driven by rapid expansion in forensic infrastructure, increasing crime rates, and rising investments in law enforcement technologies

- Countries such as China, India, and Japan are emerging as key markets due to the growing adoption of forensic technologies, government initiatives to improve forensic capabilities, and increasing demand for efficient human identification solutions

- Japan, with its advanced forensic technology and strong focus on criminal investigations, remains a crucial market for human identification technologies. The country continues to lead in the adoption of cutting-edge DNA analysis systems to enhance precision and efficiency in forensic applications

- India is projected to register the highest CAGR in the human identification market with a market share of 3.4%, driven by significant improvements in forensic infrastructure, rising crime rates, and increased government support for modernizing forensic laboratories

Human Identification Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Cytiva (U.S.)

- PerkinElmer Inc. (U.S.)

- BioTek Instruments, Inc. (U.S.)

- Tecan Trading AG (Switzerland)

- Abbott (U.S.)

- Thermo Fisher Scientific, Inc. (US)

- BD (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Merck KGaA (Germany)

- Agilent Technologies, Inc. (U.S.)

- Illumina, Inc. (U.S.)

- General Electric Company (U.S.)

- Siemens Healthineers AG (Germany)

- Hitachi Ltd. (Japan)

- Verogen, Inc. (U.S.)

- QIAGEN (Germany)

- Eurofins Scientific (Luxembourg)

- Ciro Manufacturing Corporation (U.S.)

- Hamilton Company (U.S.)

- Sorenson Forensics (U.S.)

- INNOGENOMICS TECHNOLOGIES, LLC (U.S.)

- Genex Diagnostics Inc. (U.S.)

- LGC Limited (U.K.)

- NMS Labs (U.S)

Latest Developments in Global Human Identification Market

- In January 2025, Promega Corporation announced the commercial launch of its PowerPlex 35GY System, the first 8-color STR kit approved by the FBI for use in the National DNA Index System (NDIS). This system enhances forensic DNA analysis by offering expanded loci coverage, including Y-STRs, and is optimized for use with Spectrum CE Systems, improving the efficiency and reliability of forensic DNA testing

- In October 2024, Interpol's Innovation Centre in Singapore enhanced its digital forensics capabilities by integrating advanced technologies such as AI-assisted digital forensics equipment and tools for data extraction from damaged devices. The center also employs robotic K9s and drones to enhance field operations, reflecting a commitment to leveraging cutting-edge tools in combating modern crime

- In September 2024, Promega Corporation unveiled its 8-Dye STR Multiplex Technology, including the Spectrum CE System and PowerPlex 35GY System. These tools support complex forensic analyses by providing more complete information, streamlining forensic DNA testing, and enhancing efficiency and reliability in solving difficult case

- In August 2024, the Denver Office of the Medical Examiner received a federal grant to procure a rapid DNA processor. This technology enables swift generation of genetic test results, significantly expediting the identification of victims in mass casualty incidents and aiding in the identification of family members of unidentified bodies

- In June 2024, BGI Group announced plans to make genome sequencing more affordable, aiming to break the USD 100 barrier for the first time. This significant cost reduction is facilitated by innovative technologies and automation processes, making DNA analysis more accessible to laboratories of all sizes and enabling wider adoption of human identification technologies

- In May 2024, forensic laboratories worldwide increasingly adopted ISO 18385 certification for human DNA testing products, ensuring minimal contamination risks and maintaining high-quality standards. The industry also shifted toward automated workflows and integrated systems to reduce human error and increase processing efficiency, addressing the growing backlog of forensic cases

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.