Global Iced Tea Market

Market Size in USD Billion

CAGR :

%

USD

57.00 Billion

USD

97.20 Billion

2024

2032

USD

57.00 Billion

USD

97.20 Billion

2024

2032

| 2025 –2032 | |

| USD 57.00 Billion | |

| USD 97.20 Billion | |

|

|

|

|

Iced Tea Market Size

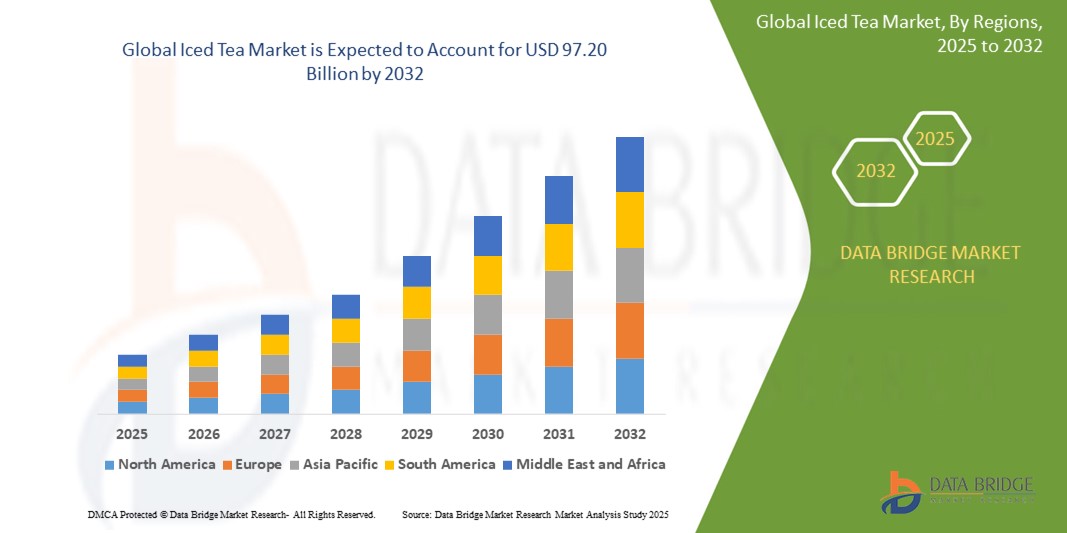

- The global Iced Tea market was valued at USD 57.00 billion in 2024 and is expected to reach USD 97.20 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.90%, primarily driven by the increasing consumer preference for healthy and refreshing beverages

- This growth is driven by factors such as the rising awareness about the health benefits of iced tea, particularly its antioxidants and low-calorie content

Iced Tea Market Analysis

- The global iced tea market is experiencing significant growth as consumer preferences shift toward healthier beverage options. With an increasing awareness of health and wellness, many consumers are opting for iced tea as a refreshing, low-calorie alternative to sugary sodas and energy drinks

- The market is seeing an expansion of product varieties, including organic iced tea, flavored options, and those infused with functional ingredients such as antioxidants and vitamins. This diversification appeals to a broader range of consumers, including those seeking specialized beverages that offer added health benefits

- There is a growing demand for ready-to-drink iced tea, driven by the convenience factor. Busy lifestyles and the need for quick, healthy refreshments have boosted the popularity of pre-packaged iced tea drinks, especially among younger generations and working professionals

- Sustainability is becoming an important factor in the iced tea market. Brands are increasingly focusing on eco-friendly packaging, sustainable sourcing of ingredients such as tea leaves, and reducing their carbon footprint. This trend resonates with environmentally conscious consumers who prioritize sustainability in their purchasing decisions

- For instance, major iced tea brands such as Lipton have launched new products aimed at capturing the health-conscious consumer segment. They have introduced iced teas with reduced sugar and added functional benefits, tapping into the growing demand for health-focused beverages

Report Scope and Iced Tea Market Segmentation

|

Attributes |

Iced Tea Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Iced Tea Market Trends

Increasing Demand for Functional and Health-Focused Iced Tea

- Consumers are becoming more aware of the health benefits associated with ingredients such as antioxidants, vitamins, and minerals found in iced tea, leading to a greater focus on functional beverages

- Tea varieties such as green tea, black tea, and herbal teas are particularly popular due to their perceived health benefits, including improved metabolism, heart health, and stress reduction

- Brands are responding to this trend by introducing iced tea products with added functional ingredients such as vitamins, electrolytes, and adaptogens aimed at boosting immunity or enhancing energy levels

- For instance, Honest Tea, a brand owned by Coca-Cola, has expanded its range of organic iced teas to include options infused with superfoods such as turmeric, ginger, and hibiscus to cater to the growing demand for functional beverages

- For Instance, Celestial Seasonings which launched a line of iced tea blends with added probiotics and herbs for digestive health, tapping into the increasing interest in gut health and wellness

- As consumers prioritize health and wellness, the trend toward functional iced teas is expected to continue, with new innovations likely to emerge, such as iced teas infused with plant-based protein or CBD, further propelling market growth

Iced Tea Market Dynamics

Driver

Increasing Health Consciousness Among Consumers

- One of the key drivers of the global iced tea market is the growing shift towards health-conscious beverage choices

- As consumers become more aware of the negative health impacts of sugary sodas and other high-calorie drinks, they are opting for healthier alternatives such as iced tea

- Iced tea is often seen as a low-calorie option that can provide health benefits such as antioxidants, vitamins, and hydration

- For Instance, green tea-based iced tea is widely regarded for its antioxidants and potential to improve metabolism, which attracts health-conscious individuals

- Brands are capitalizing on this trend by introducing iced tea products with no added sugars or artificial ingredients. The rise of organic iced teas is also a reflection of this health trend, as more consumers seek out products with natural ingredients that promote wellness

- For Instance, major brands such as Lipton and Tetley are expanding their iced tea portfolios to include healthier options, such as low-sugar and herbal varieties, to meet the increasing demand from health-conscious consumers

- As more people focus on their wellness and making better dietary choices, the demand for iced tea, particularly those with functional benefits, continues to grow, driving the market forward

Opportunity

Rising Popularity of Ready-to-Drink Iced Tea

- With busy lifestyles, many consumers prefer convenience in their food and beverage choices, and RTD iced tea provides a quick and healthy alternative to traditional sugary soft drinks

- RTD iced tea is available in a wide variety of flavors, catering to diverse tastes and preferences. This versatility presents an opportunity for manufacturers to target various consumer segments, from young adults to health-conscious individuals seeking refreshing options

- The convenience factor is driving increased consumption in both developed and emerging markets, especially among busy professionals and students. Brands are investing in innovative packaging and distribution channels to ensure easy access to RTD iced tea, which further fuels market growth

- For instance, brands such as Coca-Cola and PepsiCo have expanded their iced tea portfolios with ready-to-drink variants under brands such as Honest Tea and Lipton, making these products easily accessible to consumers through convenience stores, supermarkets, and online platforms

- As consumer demand for on-the-go beverages increases, there is significant potential for growth in the RTD iced tea segment, making it a key area for investment in the coming years

Restraint/Challenge

Intense Competition and Price Sensitivity

- One of the main challenges faced by the global iced tea market is the intense competition among brands, which often leads to price wars and margin pressures

- The market is highly fragmented, with numerous local, regional, and international brands competing for market share. This competition makes it difficult for companies to differentiate their products, particularly in the mass-market category, where price sensitivity is high

- Consumers are increasingly looking for affordable options, and many of them opt for cheaper alternatives, which impacts the profitability of premium iced tea brands that focus on quality and health benefits

- For instance, while premium brands such as Honest Tea or AriZona Iced Tea offer organic and health-focused options, their pricing might be higher compared to mainstream iced tea products, making them less attractive to price-conscious consumers

- Additionally, private label iced tea products from retailers such as Walmart and Costco further intensify the competition, as these products are often sold at lower prices but offer similar taste and quality

- Companies need to find ways to balance pricing strategies with product innovation and differentiation to stay competitive, as the market becomes increasingly price-sensitive while demand for healthier options continues to rise

Iced Tea Market Scope

The market is segmented on the basis of product type, form, application, nature, and sales channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Form |

|

|

By Application |

|

|

By Nature |

|

|

By Sales Channel |

|

Iced Tea Market Regional Analysis

North America is the Dominant Region in the Iced Tea Market

- North America holds the largest share of the global iced tea market, primarily driven by the high consumption rates in the U.S.

- The U.S. has a strong preference for both ready-to-drink and flavored iced tea, further bolstered by the popularity of organic and functional beverages

- The market is characterized by a high level of product innovation, with brands introducing low-sugar and health-enhancing options to cater to the growing demand for healthier beverage

- The dominance is supported by the strong distribution networks of major brands, alongside widespread retail availability through supermarkets, convenience stores, and online platforms

Asia-Pacific is Projected to Register the Highest Growth Rate

- The Asia-Pacific region is expected to witness the fastest growth during the forecast period

- Countries such as China and India are seeing a surge in demand due to an increasing inclination toward health-conscious products and iced beverages

- In addition, the rise in disposable income and urbanization in these regions has contributed to the popularity of ready-to-drink iced tea products

- The market is also benefitting from a growing focus on premium products and the introduction of local tea variants to cater to regional preferences surgical setups. The expanding presence of global medical device manufacturers and improving accessibility to advanced ophthalmic care further contribute to market growth

Iced Tea Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- The Coffee Bean & Tea Leaf (U.S.)

- Unilever (U.K.)

- Gourmesso (U.S.)

- Harney & Sons Fine Teas (U.S.)

- Dualit (U.K.)

- Nestlé SA (Switzerland)

- Dilmah Ceylon Tea Company PLC (Sri Lanka)

- Ippodo Tea Co. Ltd. (Japan)

- Tranquini (U.S.)

- Som Sleep (U.S.)

- Phi Drinks, Inc.(U.S.)

- BevNet.com (U.S.)

Latest Developments in Global Iced Tea Market

- In April 2025, Honest Tea launched a new range of iced teas with added electrolytes and vitamin C for immunity support, catering to the growing health-conscious consumer base. Similarly, brands are experimenting with CBD-infused iced teas to target consumers seeking relaxation benefits

- In August 2023, lipton brand launched 330ml cans of its classic lemon and peach flavor ice teas into the united kingdom market with six-pack multipack variants

- In April 2023, unilever plc brand lipton expanded its iced tea business by launching new iced tea products. The iced teas have different flavors, including lemon, peach, and lychee

- In April 2023, molson coors and coca-cola added a new beverage through their partnership with the launch of peace hard tea. According to the company's claim, peace hard tea is available in single-serve 24 oz cans in three different flavors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ICED TEA MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ICED TEA MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL ICED TEA MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 SUPPLY CHAIN ANALYSIS

5.2 FACTORS INFLUENCING PURCHASING DECISION

5.3 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

5.4 GROWTH STRATEGIES ADOPTED BY KEY PLAYERS

5.5 SHOPPING BEHAVIOUR AND DYNAMICS

5.5.1 RECOMMENDATION FROM FAMILY & FRIENDS

5.5.2 RESEARCH

5.5.3 IMPULSIVE

5.5.4 ADVERTISEMENT

5.5.4.1. TELEVISION ADVERTISEMENT

5.5.4.2. ONLINE ADVERTISEMENT

5.5.4.3. IN-STORE ADVERTISEMENT

5.5.4.4. OUTDOOR ADVERTISEMENT

5.6 PRIVATE LABEL VS BRAND ANALYSIS

5.7 PROMOTIONAL ACTIVITIES

5.8 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

5.9 NEW PRODUCT LAUNCH STRATEGY

5.9.1 NUMBER OF NEW PRODUCT LAUNCH

5.9.1.1. LINE EXTENSTION

5.9.1.2. NEW PACKAGING

5.9.1.3. RE-LAUNCHED

5.9.1.4. NEW FORMULATION

5.1 CONSUMER LEVEL TRENDS

5.11 MEETING CONSUMER REQUIREMENT

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING ANALYSIS

9 BRAND OUTLOOK

9.1 COMPARATIVE BRAND ANALYSIS

9.2 PRODUCT VS BRAND OVERVIEW

10 GLOBAL ICED TEA MARKET, BY TEA TYPE

10.1 OVERVIEW

10.2 BLACK TEA

10.3 GREEN TEA

10.4 OOLONG TEA

10.5 MATCHA TEA

10.6 OTHERS

11 GLOBAL ICED TEA MARKET, BY FLAVOR TYPE

11.1 OVERVIEW

11.2 CINNAMON TEA

11.3 DANDELION TEA

11.4 CHAMOMILE TEA

11.5 ROSEMARY TEA

11.6 PEPPERMINT TEA

11.7 FRUIT TEA

11.7.1 FRUIT, BY TYPE

11.7.1.1. LEMON TEA

11.7.1.2. LIME TEA

11.7.1.3. PASSION FRUIT TEA

11.7.1.4. MANGO TEA

11.7.1.5. MIX FRUIT TEA

11.7.1.6. OTHERS

11.8 OTHERS

12 GLOBAL ICED TEA MARKET MARKET , BY FORM

12.1 OVERVIEW

12.2 POWDER/PREMIX

12.3 LIQUID/READY-TO-DRINK

12.4 OTEHRS (IF ANY)

13 GLOBAL ICED TEA MARKET MARKET , BY CATEGORY

13.1 OVERVIEW

13.2 CONVENTIONAL

13.3 ORGANIC

14 GLOBAL ICED TEA MARKET MARKET , BY BRAND CATEGORY

14.1 OVERVIEW

14.2 BRANDED

14.3 PRIVATE LABEL

15 GLOBAL ICED TEA MARKET MARKET , BY PACKAGING TYPE

15.1 OVERVIEW

15.2 POUCHES

15.2.1 BY POUCH TYPE

15.2.1.1. PLASTIC

15.2.1.2. PAPER

15.3 CANS & CARTONS

15.4 BOTTLES

15.4.1 BOTTLES & JAR, BY TYPE

15.4.1.1. PLASTIC

15.4.1.2. GLASS

15.5 OTHERS

16 GLOBAL ICED TEA MARKET MARKET , BY PACKAGING SIZE

16.1 OVERVIEW

16.2 LESS THAN 100 ML

16.3 100-250 ML

16.4 251-500 ML

16.5 501-1000 ML

16.6 MORE THAN 1000 ML

17 GLOBAL ICED TEA MARKET MARKET , BY DISTRIBUTION CHANNEL

17.1 OVERVIEW

17.2 STORE-BASED RETAILING

17.2.1 SUPERMARKETS/HYPERMARKETS

17.2.2 CONVENIENCE STORES

17.2.3 GROCERY STORES

17.2.4 WHOLESALERS

17.2.5 OTHERS

17.3 NON-STORE RETAILING

17.3.1 E-COMMERCE RETAILER

17.3.2 COMPANY WEBSITES

18 GLOBAL ICED TEA MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.3 COMPANY SHARE ANALYSIS: EUROPE

18.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

18.5 MERGERS & ACQUISITIONS

18.6 NEW PRODUCT DEVELOPMENT & APPROVALS

18.7 EXPANSIONS & PARTNERSHIP

18.8 REGULATORY CHANGES

19 GLOBAL ICED TEA MARKET, BY GEOGRAPHY

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

19.1 NORTH AMERICA

19.1.1 U.S.

19.1.2 CANADA

19.1.3 MEXICO

19.2 EUROPE

19.2.1 GERMANY

19.2.2 U.K.

19.2.3 ITALY

19.2.4 FRANCE

19.2.5 SPAIN

19.2.6 SWITZERLAND

19.2.7 RUSSIA

19.2.8 TURKEY

19.2.9 BELGIUM

19.2.10 NETHERLANDS

19.2.11 SWITZERLAND

19.2.12 DENMARK

19.2.13 NORWAY

19.2.14 FINLAND

19.2.15 SWEDEN

19.2.16 REST OF EUROPE

19.3 ASIA-PACIFIC

19.3.1 JAPAN

19.3.2 CHINA

19.3.3 SOUTH KOREA

19.3.4 INDIA

19.3.5 SINGAPORE

19.3.6 THAILAND

19.3.7 INDONESIA

19.3.8 MALAYSIA

19.3.9 PHILIPPINES

19.3.10 AUSTRALIA

19.3.11 NEW ZEALAND

19.3.12 HONG KONG

19.3.13 TAIWAN

19.3.14 REST OF ASIA-PACIFIC

19.4 SOUTH AMERICA

19.4.1 BRAZIL

19.4.2 ARGENTINA

19.4.3 REST OF SOUTH AMERICA

19.5 MIDDLE EAST AND AFRICA

19.5.1 SOUTH AFRICA

19.5.2 EGYPT

19.5.3 SAUDI ARABIA

19.5.4 UNITED ARAB EMIRATES

19.5.5 ISRAEL

19.5.6 BAHRAIN

19.5.7 KUWAIT

19.5.8 OMAN

19.5.9 QATAR

19.5.10 REST OF MIDDLE EAST AND AFRICA

20 GLOBAL ICED TEA MARKET, SWOT & DBMR ANALYSIS

21 GLOBAL ICED TEA MARKET, COMPANY PROFILE

21.1 UNILEVER

21.1.1 COMPANY OVERVIEW

21.1.2 REVENUE ANALYSIS

21.1.3 PRODUCT PORTFOLIO

21.1.4 GEOGRAPHIC PRESENCE

21.1.5 RECENT DEVELOPMENTS

21.2 ARIZONA BEVERAGES USA

21.2.1 COMPANY OVERVIEW

21.2.2 REVENUE ANALYSIS

21.2.3 PRODUCT PORTFOLIO

21.2.4 GEOGRAPHIC PRESENCE

21.2.5 RECENT DEVELOPMENTS

21.3 TETLEY USA INC.

21.3.1 COMPANY OVERVIEW

21.3.2 REVENUE ANALYSIS

21.3.3 PRODUCT PORTFOLIO

21.3.4 GEOGRAPHIC PRESENCE

21.3.5 RECENT DEVELOPMENTS

21.4 PEPSICO, INC

21.4.1 COMPANY OVERVIEW

21.4.2 PRODUCT PORTFOLIO

21.4.3 GEOGRAPHIC PRESENCE

21.4.4 RECENT DEVELOPMENTS

21.5 THE COCA-COLA COMPANY

21.5.1 COMPANY OVERVIEW

21.5.2 REVENUE ANALYSIS

21.5.3 PRODUCT PORTFOLIO

21.5.4 GEOGRAPHIC PRESENCE

21.5.5 RECENT DEVELOPMENTS

21.6 SNAPPLE BEVERAGE CORP.

21.6.1 COMPANY OVERVIEW

21.6.2 REVENUE ANALYSIS

21.6.3 PRODUCT PORTFOLIO

21.6.4 GEOGRAPHIC PRESENCE

21.6.5 RECENT DEVELOPMENTS

21.7 TURKEY HILL DAIRY

21.7.1 COMPANY OVERVIEW

21.7.2 REVENUE ANALYSIS

21.7.3 PRODUCT PORTFOLIO

21.7.4 GEOGRAPHIC PRESENCE

21.7.5 RECENT DEVELOPMENTS

21.8 DILMAH CEYLON TEA COMPANY PLC

21.8.1 COMPANY OVERVIEW

21.8.2 REVENUE ANALYSIS

21.8.3 PRODUCT PORTFOLIO

21.8.4 GEOGRAPHIC PRESENCE

21.8.5 RECENT DEVELOPMENTS

21.9 STARBUCKS COFFEE COMPANY

21.9.1 COMPANY OVERVIEW

21.9.2 REVENUE ANALYSIS

21.9.3 PRODUCT PORTFOLIO

21.9.4 GEOGRAPHIC PRESENCE

21.9.5 RECENT DEVELOPMENTS

21.1 RED DIAMOND INC.

21.10.1 COMPANY OVERVIEW

21.10.2 REVENUE ANALYSIS

21.10.3 PRODUCT PORTFOLIO

21.10.4 GEOGRAPHIC PRESENCE

21.10.5 RECENT DEVELOPMENTS

21.11 PUREEARTH BEVERAGES PVT. LTD.

21.11.1 COMPANY OVERVIEW

21.11.2 REVENUE ANALYSIS

21.11.3 PRODUCT PORTFOLIO

21.11.4 GEOGRAPHIC PRESENCE

21.11.5 RECENT DEVELOPMENTS

21.12 TAZO

21.12.1 COMPANY OVERVIEW

21.12.2 REVENUE ANALYSIS

21.12.3 PRODUCT PORTFOLIO

21.12.4 GEOGRAPHIC PRESENCE

21.12.5 RECENT DEVELOPMENTS

21.13 ADAGIO TEAS

21.13.1 COMPANY OVERVIEW

21.13.2 REVENUE ANALYSIS

21.13.3 PRODUCT PORTFOLIO

21.13.4 GEOGRAPHIC PRESENCE

21.13.5 RECENT DEVELOPMENTS

21.14 HARNEY & SONS FINE TEAS

21.14.1 COMPANY OVERVIEW

21.14.2 REVENUE ANALYSIS

21.14.3 PRODUCT PORTFOLIO

21.14.4 GEOGRAPHIC PRESENCE

21.14.5 RECENT DEVELOPMENTS

21.15 BOS BRANDS

21.15.1 COMPANY OVERVIEW

21.15.2 REVENUE ANALYSIS

21.15.3 PRODUCT PORTFOLIO

21.15.4 GEOGRAPHIC PRESENCE

21.15.5 RECENT DEVELOPMENTS

21.16 4C FOODS

21.16.1 COMPANY OVERVIEW

21.16.2 REVENUE ANALYSIS

21.16.3 PRODUCT PORTFOLIO

21.16.4 GEOGRAPHIC PRESENCE

21.16.5 RECENT DEVELOPMENTS

21.17 TEATULIA

21.17.1 COMPANY OVERVIEW

21.17.2 REVENUE ANALYSIS

21.17.3 PRODUCT PORTFOLIO

21.17.4 GEOGRAPHIC PRESENCE

21.17.5 RECENT DEVELOPMENTS

21.18 TEJAVA

21.18.1 COMPANY OVERVIEW

21.18.2 REVENUE ANALYSIS

21.18.3 PRODUCT PORTFOLIO

21.18.4 GEOGRAPHIC PRESENCE

21.18.5 RECENT DEVELOPMENTS

21.19 LONG ISLAND ICED TEA

21.19.1 COMPANY OVERVIEW

21.19.2 REVENUE ANALYSIS

21.19.3 PRODUCT PORTFOLIO

21.19.4 GEOGRAPHIC PRESENCE

21.19.5 RECENT DEVELOPMENTS

21.2 VAHDAM® INDIA

21.20.1 COMPANY OVERVIEW

21.20.2 REVENUE ANALYSIS

21.20.3 GEOGRAPHICAL PRESENCE

21.20.4 PRODUCT PORTFOLIO

21.20.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

22 RELATED REPORTS

23 CONCLUSION

24 QUESTIONNAIRE

25 ABOUT DATA BRIDGE MARKET RESEARCH

Global Iced Tea Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Iced Tea Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Iced Tea Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.